Trading volume plummets nearly 97%, is Bitcoin’s ordinal NFT just a flash in the pan?

Bitcoin's NFT trading volume drops by 97%, is it just a temporary trend?Two weeks ago, a report from DappRadar showed a 97% decrease in sales of Bitcoin ordinal NFTs from May to August, sparking a debate.

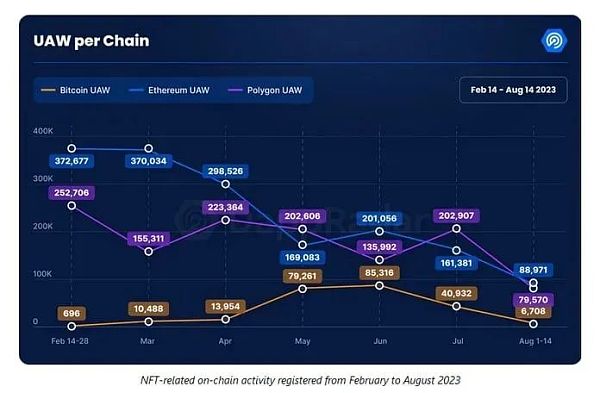

The report from DappRadar indicates a decline in interest in the NFT space, with transaction volumes of independent active wallets on Ethereum and Polygon decreasing by 22% and 60% respectively, with the decline in Bitcoin ordinal NFTs being more pronounced.

Statistical differences spark industry debate

According to DappRadar’s data, as of August 14th, the number of independent active wallets for Ordinals also dropped from a peak of 85,316 in June to 6,708, a decrease of 92%.

- How does the economics community view Bitcoin?

- Tracking Sentiment through Liquidity Pools? – Glassnode’s Latest Research Report

- Can DeFi maintain its usability beyond market narrative fluctuations?

Source/DappRadar

As expected, these numbers have led to speculation that Bitcoin ordinal NFTs are dead, but this has been strongly opposed by some members of the Ordinals community.

Trevor Owens, a Bitcoin entrepreneur and head of Bitcoin Frontier Fund, published a lengthy article on X claiming that DappRadar’s report was an “aggressive article” containing highly inaccurate information.

Data provided by several other on-chain data providers differs from the data published by DappRadar.

For example, Crypto Slam, a multi-chain NFT data provider, reported sales of $195 million in May, which is significantly different from the $452 million reported by DappRadar.

Data from Dune Analytics shows that the sales of Bitcoin ordinal NFTs in May were around $154 million, which is closer to the data from Crypto Slam.

Crypto Slam reported a trading volume of $65 million in July, while DappRadar’s report showed $35 million. Although the trading volume on Dune Analytics was $50 million, the percentage decrease is consistent with the data from Crypto Slam.

Comparing the reports from Crypto Slam and Dune Analytics, both show a sales volume decrease of 67% and 69% respectively from May to July.

This is still a significant decline, but it is greatly different from DappRadar’s 92% figure.

Apart from these numbers, what has caused dissatisfaction among Bitcoin ordinal NFT holders is the comparison between the entire month of May and two weeks in August. For Owens, the 97% decline calculated by DappRadar based on two weeks in August and the entire month of May is the most shocking aspect of the report.

Several other notable Bitcoin ordinal NFT holders have expressed the same view, including Doggfather, the anonymous creator of Frens Protocol.

Jake Gallen, NFT and Strategy Director at Emblem, stated that DappRadar includes BRC-20 transaction volume data in certain regions but not in others. While the transaction volume of Bitcoin ordinal NFTs has decreased, there are still tens of thousands of transactions daily.

Robert Hoogendoorn, Senior Communications Manager at DappRadar, described Bitcoin ordinal NFTs as “peculiar” and in need of unique statistical methods, and he did not characterize the current discussion as controversial.

In a statement prepared by Hoogendoorn for DappRadar, he refuted the strong criticism from members of the Bitcoin ordinal NFT community questioning the credibility of their data and analysis.

The statement stated that their team members are experienced Web3 analysts and editors, and the published data is accurate. However, Hoogendoorn and DappRadar have not addressed the issue of incomplete data reporting in August.

Has the Bitcoin Ordinal NFT cooled down?

However, regardless of which data users trust, for Bitcoin ordinal NFT, it has already entered its “painful period” now.

Bitcoin ordinal NFT caused a frenzy in the community shortly after its launch earlier this year and, more than eight months later, ordinal inscriptions still hold a prominent position in Bitcoin network activities in the past week.

Despite the sharp decline in sales, Bitcoin ordinal NFT is still very active, accounting for 85% of Bitcoin activity in terms of proportion data, indicating that ordinal NFT still has a long way to go before it becomes “cold”.

Critics may think that ordinal NFT is hijacking and exploiting the Bitcoin network, but some industry experts appreciate this growth. Ethereum co-founder Vitalik Buterin recently praised the BRC-20 token standard and said that the increasing prominence of BRC-20 signals his thinking about how to solve the “stagnation” problem that plagues the development of the Bitcoin ecosystem.

Meanwhile, the Ordinals protocol team has introduced a non-profit organization called “Open Ordinals Institute” to provide funding for its open-source development. Based in California, the Open Ordinals Institute is a registered 501(c)(3) public charity aimed at collecting Bitcoin donations by primarily focusing on its core development community to support the development of the protocol.

The program will also focus on creating user-friendly tools that allow users with less technical expertise to easily create Bitcoin digital artifacts. Bitcoin ordinal NFT is a very emerging ecosystem, and its infrastructure is developing rapidly. Therefore, it is necessary to build the most basic components to establish a market with depth and liquidity.

Over the years, Bitcoin has been used by people around the world for many different things. Over time, the popular narrative about Bitcoin’s technical development roadmap and culture has undergone migration and evolution. Recently, especially since 2020, the view that Bitcoin primarily serves as a non-sovereign national currency network has dominated. However, the Bitcoin project continues to evolve in unexpected ways. The emergence of inscriptions once again drives the development of Bitcoin and gives birth to new applications.

Conclusion

According to a report by Galaxy Digital, the Bitcoin NFT market based on inscriptions and ordinals is predicted to reach $4.5 billion by 2025. The rapid development of inscriptions and the already launched market and wallet infrastructure are key factors in predicting that the Bitcoin NFT market will reach a valuation of $4.5 billion within two years.

Using Ordinals to encode NFTs turns Bitcoin into “digital artwork” that is permanently stored within Bitcoin itself. The introduction of Ordinals means that the storage issue has a direct impact on the development of the Bitcoin ecosystem. Integrating Ordinals NFTs imposes higher requirements on data storage and costs for network transactions, and the real trading space will be influenced by Ordinals NFTs. The increase in stored content leads to a several-fold increase in block size. As controversies in the Bitcoin community have discussed, the emergence of ordinal NFTs encroaches on the transactional attributes of Bitcoin itself, but the popularity of Ordinals NFTs has also opened up a whole new dimension of storytelling for Bitcoin.

The rapid rise and subsequent fall of ordinal NFTs in the Bitcoin market highlights the volatile nature of the NFT market. For those who want to follow the trend, the decline of ordinal NFTs serves as a clear reminder of how short-lived speculative excitement can be.

Although Bitcoin NFTs have great theoretical potential, pure speculation may not be enough to sustain the market frenzy. Dappradar researchers suggest that in order to ensure that the setback of Ordinals is seen as a lesson rather than a fatal blow, developers must focus their energy on developing specific applications that truly fulfill the promises of Bitcoin NFTs to the user market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Glassnode Tracking Market Sentiment through Liquidity Pools

- In the context of high inflation and political unrest, Bitcoin has firmly taken root in Africa.

- Which country has the highest awareness of cryptocurrencies?

- Rollbit on Solana? Breaking down the gaming part of Lamas Finance

- Old-timers Leaving the Crypto Circle Some Get Married and Have Children, Some Start New Businesses

- What are the global regulations on the supervision of encrypted assets that the SEC is committed to adopting?

- HashKey Investment Manager The likelihood of the market mainly fluctuating is relatively high, and the market sentiment remains poor.