Swing up to 90,000 miles: the five major logics of bitcoin's positive bullishness

Since Bitcoin fell back in June, it has experienced a four-month correction. Bitcoin is the most successful application of blockchain technology. From the upstream mining chips, mines, mining pools, downstream exchanges, wallets, and surrounding media information and data analysis, Bitcoin has been born for ten years. Formed a complete ecology. In the next decade, there may be a process of gradual expansion of the Bitcoin ecosystem. As the core of the entire ecology, will Bitcoin lead the next bull market? This article attempts to analyze from multiple perspectives.

1. Bitcoin computing power and price catch up with each other, and the situation of price lag computing power will not last long.

With the rise of the new power of the mining machine and the influx of computing power, the bitcoin computing power has nearly tripled since the beginning of the year. As the guarantee for maintaining the security of Bitcoin network, the computing power is mutually reinforcing relationship with the Bitcoin system. That is, the more prosperous the bitcoin system is, the more active the data on the chain is, the more the price increases, and the profit-seeking drive the miners to invest in computing power, so the computing power will also Conversely, the more bitcoin computing power is, the more secure the bitcoin system is, the more confidence people have in holding bitcoin, and the stronger the demand for bitcoin networks to store social wealth, the higher the bitcoin price will be. Therefore, from this perspective, the author believes that bitcoin prices and computing power are positively related in the trend, and prices and computing power will lead each other and catch up with each other.

At the end of 2018, bitcoin computing power and price fell simultaneously. Today, bitcoin computing power hit a record high, bitcoin price has entered a rest period, and the current stage is at a price lag behind computing power. It is expected that this situation will not last long. . Because, the person who intends to invest in this market will measure the income of mining and buying coins. A person who intends to invest in bitcoin mining finds that buying coins is more cost-effective than mining. Then he will change to buy coins, and vice versa. The power and bitcoin prices will show a catch-up spiral in the trend.

- On November 7th, the most mysterious dinner in Wuzhen came | Guide to the blockchain conference

- Dry goods | Vitalik: Eth2 segmentation chain simplification proposal

- Bitcoin is 11 years old. Has he grown up?

Source: btc.com

2. Bitcoin halving cycle is approaching

I am not a cycle of believers, but it is undeniable that our world is a cycle of existence, from celestial bodies such as the Earth's rotation, the revolutionary cycle represents one day and one year, the tidal cycle caused by celestial gravity; small to female physiology cycle.

The cyclical phenomenon exists objectively, especially in the "economic cycle theory" that spreads in the capital circle. The longest cycle in the world economic cycle is the Kondratiev cycle, also known as the Kangbo cycle. The Kangbo cycle is divided into four stages: prosperity, recession, depression, and recovery. Economists have racked their brains to explore the reasons for the economic cycle, such as Schumpeter’s theory of innovation cycle, using innovation to explain prosperity and recession, and some economists believe that currency issuance leads to economic cycles, and even to the sun. The sunspot cycle dominates everything, because according to observations, the economic cycle is consistent with the sunspot cycle.

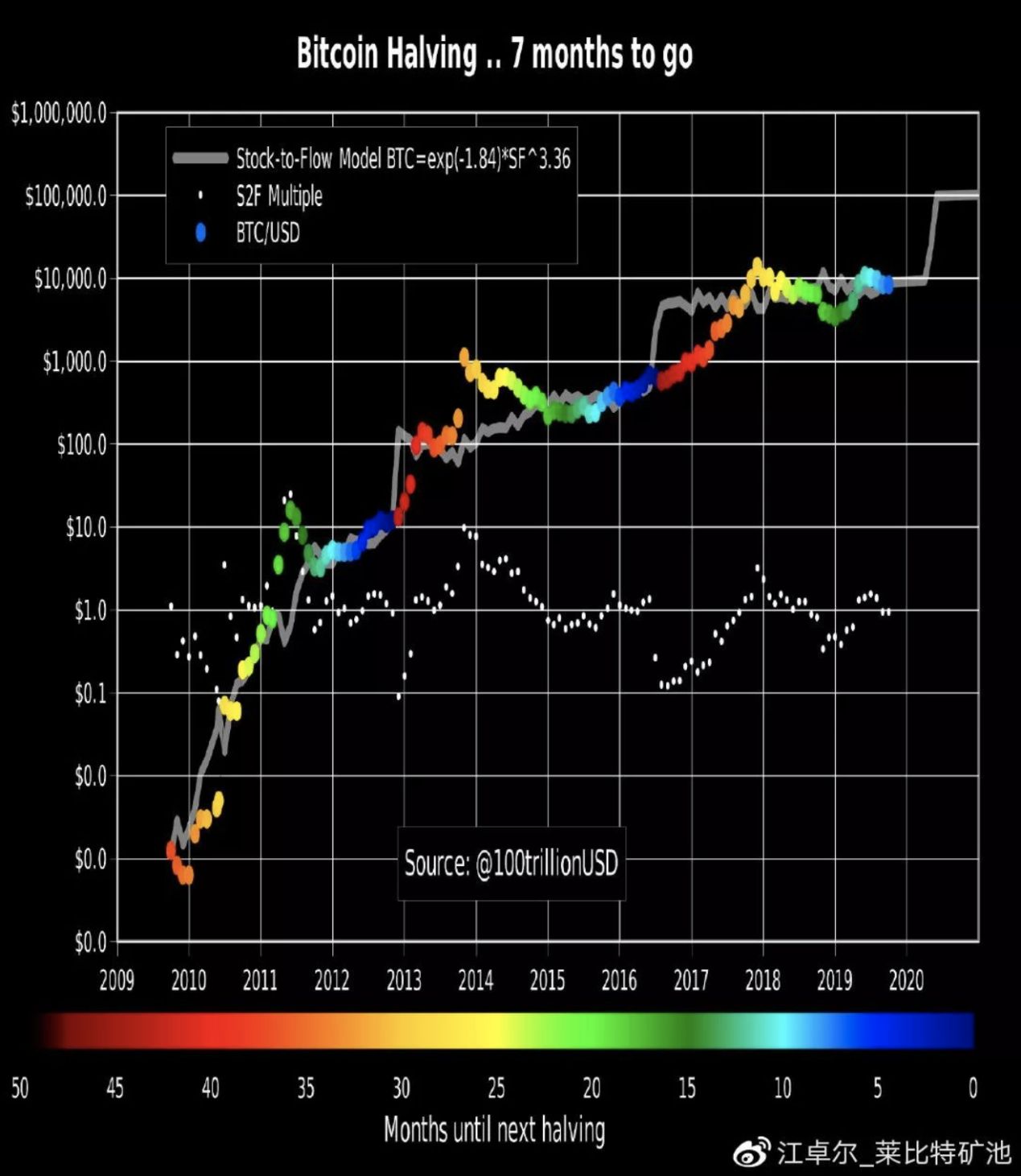

Bitcoin's four-year halving cycle is the main line of bitcoin price increases. Although this argument has not been academically proven, bitcoin is halved, especially after halving, according to the historical halving effect of Bitcoin. There is a round of magnificent rising prices.

From the perspective of supply and demand analysis, we assume that the annual demand for bitcoin is rising moderately. In the first half of the year, bitcoin production begins to halve, while demand remains unchanged. In theory, bitcoin should have a double increase. In fact, the halving period of Bitcoin is often influenced by external factors, such as political events, monetary policy in financial markets, bitcoin technology iterations, bit propagation effects, and the convenience of digital currency transactions. Bitcoin halving cycle and external favorable influence factor superposition may partly explain the phenomenon that Bitcoin halved the price.

According to the historical trend of Bitcoin, it is currently on the way to halving bitcoin, and the price is in a slow climb. Bitcoin is halved, and the phenomenon of bitcoin “hidden” has become more apparent. There are fewer and fewer bitcoins in the market. Therefore, it is conceivable that the sudden halving of bitcoin production will bring about a huge price increase effect.

Source: Jiang Zhuoer Weibo

3. The global low interest rate era is coming, scarce assets are welcoming opportunities for capital allocation

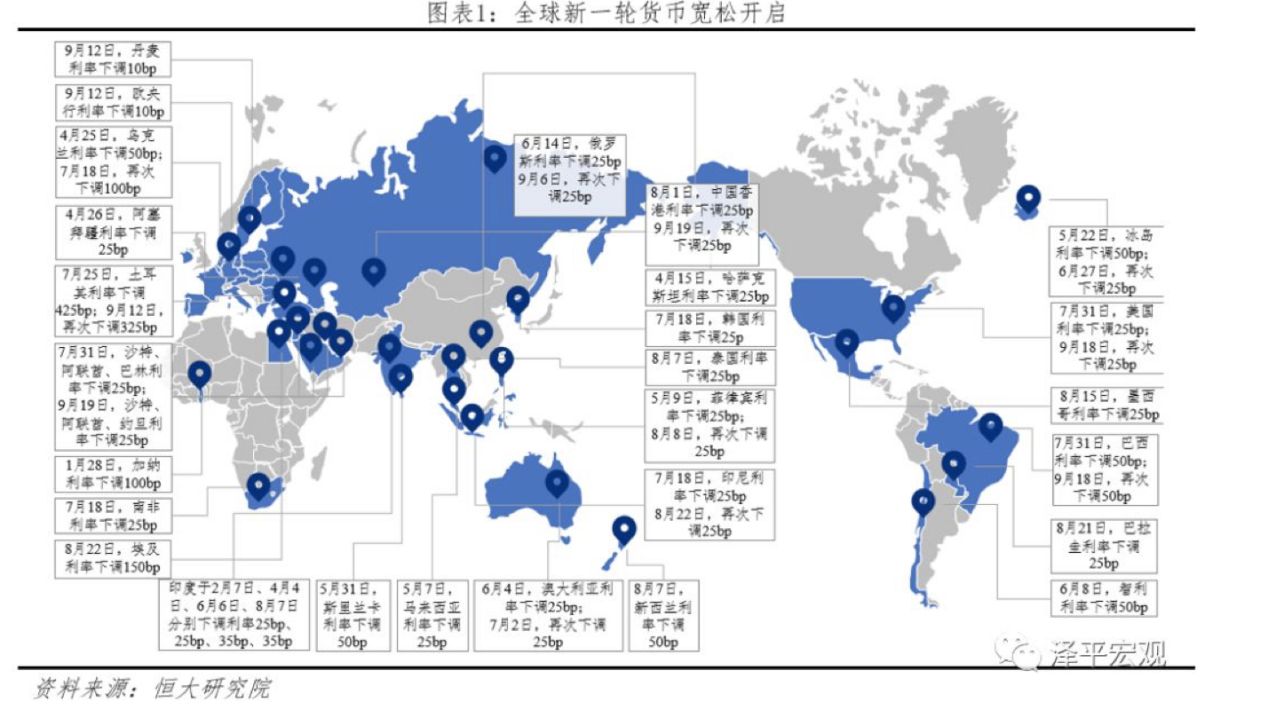

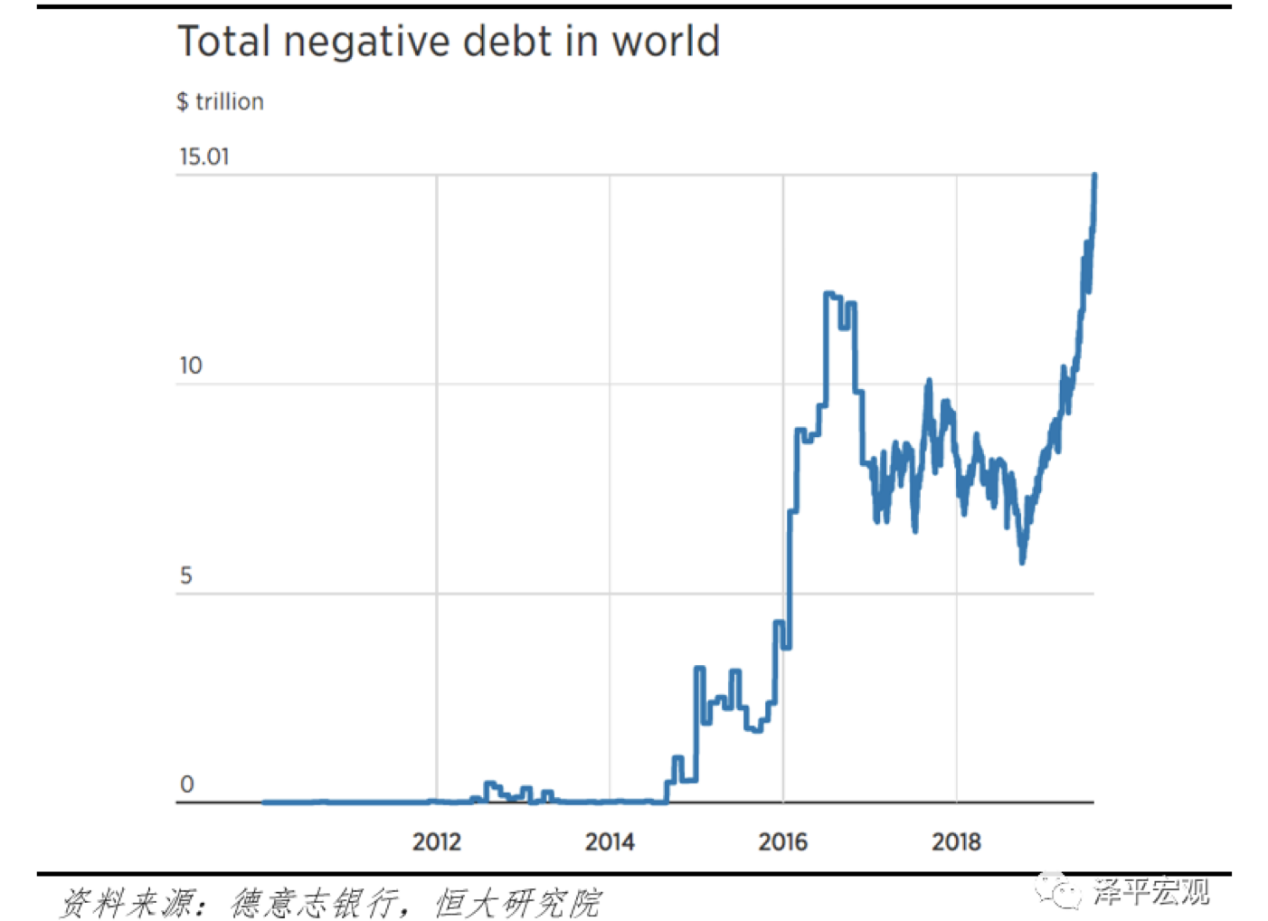

There are still large uncertainties in world economic growth. Since 2019, central banks around the world have joined the ranks of monetary easing, and a new round of low interest rates has come.

At this time, the Fed cut interest rates again last night. This is the third rate cut in the Fed 2019. As a linked exchange rate system in Hong Kong, the United States began to cut interest rates simultaneously. As the faucet of the world economy, the Fed’s every move is driving the direction of global monetary policy. Once again, the world is entering a period of low interest rates (even “negative interest rates”), and asset prices are expected to be revalued.

As a scarce quality asset, it is expected to be sought after by funds in both the traditional capital market and the emerging cryptocurrency field. The core assets of A-shares such as Kweichow Moutai and Hengrui Medicine, the core assets of US stocks such as TSMC, Apple, and Intercontinental Exchange are all at historically high levels.

The cryptocurrency field is an emerging alternative capital market. With the opening of BAKKT, the opening of the currency exchange channel of the big exchanges, and the mining giants successive IPOs (Jia Nan Zhizhi, Bitland has submitted the listing application to the US SEC), the currency security On the Swiss Stock Exchange, BNB ETP and other events, the cryptocurrency market is increasingly connected with the traditional capital market, the bridge is slowly getting through, the real-world monetary policy transmission effect will be saturated into the cryptocurrency market, and bitcoin is used as the cryptocurrency market. The core assets will usher in a historic opportunity for capital allocation.

Source: Evergrande Institute, Zeping Macro Public

4. Increased global tax risks and increased occult demand for assets

The CRS is in force, and the well-known international tax havens such as the Cayman Islands, the British Virgin Islands, and Switzerland are on the list. The era of global tax coordination has come, and the international tax havens in the real world have fallen. At present, about 20 trillion US dollars of wealth is hidden in offshore financial centers such as the Cayman Islands and the British Virgin Islands. With the implementation of CRS, the global rich will gradually be "streaking".

Bitcoin builds a peer-to-peer value transfer system and is a more free and private virtual offshore financial center. Against the real world of Switzerland, the British Virgin Islands, the Cayman Islands…

With the arrival of CRS, the funds of the entity “offshore financial center” will be forced to transfer to the “virtual offshore financial center” constructed by the blockchain. Bitcoin is anonymous (anti-censorship), non-frozen, constant (scarcity), as a non-sovereign asset, Bitcoin is expected to replace the function of the offshore financial center, and is sought after by a large number of users with hidden assets. .

5. Bitcoin has the potential to become a reserve asset, a self-contained cryptocurrency system.

In the traditional financial world, gold has excellent texture, scarcity, and high acceptance of value in the world. Even though gold has withdrawn from the currency sector, it is still an important reserve asset for central banks. In the gold standard period, the circulation of money depends on the amount of gold reserves. As a reserve asset, the author believes that the value of firmness should be ranked first. Throughout history, gold prices have been on the rise.

Bitcoin was born in the 2008 financial crisis and is destined to be a new financial system. As a similar asset of gold, bitcoin is superior to gold even in terms of portability and severability. It is not impossible for the central bank to include bitcoin in reserve assets, but in the short term, we dare not expect it.

Based on Ethereum's Maker DAO project, a stable currency DAI generated through mortgage assets (ETH) was created. In this model, currency creation takes a completely new approach. In the future, we will see a lot of defi project for mortgage bitcoin. As the stable currency gradually penetrates into the real economy, the larger the circulation of stable currency, the more scarce bitcoin as a reserve asset will be.

Although Bitcoin cannot become a reserve asset of the central bank in the short term, it is becoming a reserve asset in the defi field of cryptocurrency, and has formed a self-contained cryptocurrency system, and this system is growing.

In summary: Bitcoin ecology has more and more positive factors, we can't predict the short-term price, but the long-term value of Bitcoin is reflected, blockchain technology also ushered in a historic opportunity, I hope Bitcoin ecology and district Blockchain technology is booming and benefiting mankind!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Genesis Capital's third quarter report analyzes opportunities for cryptocurrency lending

- The domestic public chain Yuanjie DNA released the digital identity application Bitident (Bidden) to help the rise of the digital economy

- The digital currency of Chinese listed companies (below)

- The contract market will add another fierce will explain the currency China strategy

- SpaceX also engages in IEO? Musk is forced

- How to develop a "no coin" public chain?

- QKL123 market analysis | Federal Reserve cut interest rates as scheduled, safe-haven assets fluctuate (1031)