Immovable Tencent Blockchain and the Advancing Web3 ‘Goose Factory Gang

Tencent Blockchain and the Web3 'Goose Factory GangOriginal author: Jack, BlockBeats

“Tencent Gang” emerges in Web3.

As a leading internet giant, Tencent was one of the earliest companies to enter the blockchain field in China. In 2021, the news of “Axie Infinity surpassing Honor of Kings in revenue” became a turning point for Tencent internally. Since then, Tencent has actively explored the metaverse and Web3, fostering influential projects and teams, including ZhiXin Chain and Phantom Core, among others.

- Reviewing my journey of making 10 million US dollars in the cryptocurrency market at the age of 22.

- Report Cryptocurrency Rich List Includes 22 Billionaires and 88,000 Millionaires

- Trading volume plummets nearly 97%, is Bitcoin’s ordinal NFT just a flash in the pan?

However, in the past six months, most of the news about “big players entering the industry” in the crypto industry has come from AntChain and Alibaba Cloud. When BlockBeats inquired about the situation at Tencent, it was found that there were almost no Web3-related businesses internally.

On the other hand, Tencent employees are “group entrepreneurship” in Web3, with close social and cooperative connections. The organizational structure and product logic of their projects also have distinct characteristics, and many projects have already made progress in the industry.

Saving GameFi

On Saturday, the 19th of last month, Meta SLianGuaice Cafe in Beijing was particularly lively. A Web3 shooting game called Matr1x Fire held a community offline event here, with more than 100 people gathering to share their game experiences, views on GameFi, and discuss the project’s future roadmap. A 5v5 game battle was also organized on-site, creating a vibrant atmosphere.

In the harsh winter of the crypto industry, few teams in even the sought-after ZK field can organize such community events on their own, let alone Matr1x Fire, a GameFi project from the “outdated track”.

Matr1x Fire event scene

Since StepN fell from grace in April last year, the sustainable development of GameFi seems to have become an unsolvable problem. Due to uneven game quality, lack of player demand, and deficiencies in economic model design, GameFi has left a deep impression of “scam” and “Ponzi scheme” on most Web3 practitioners.

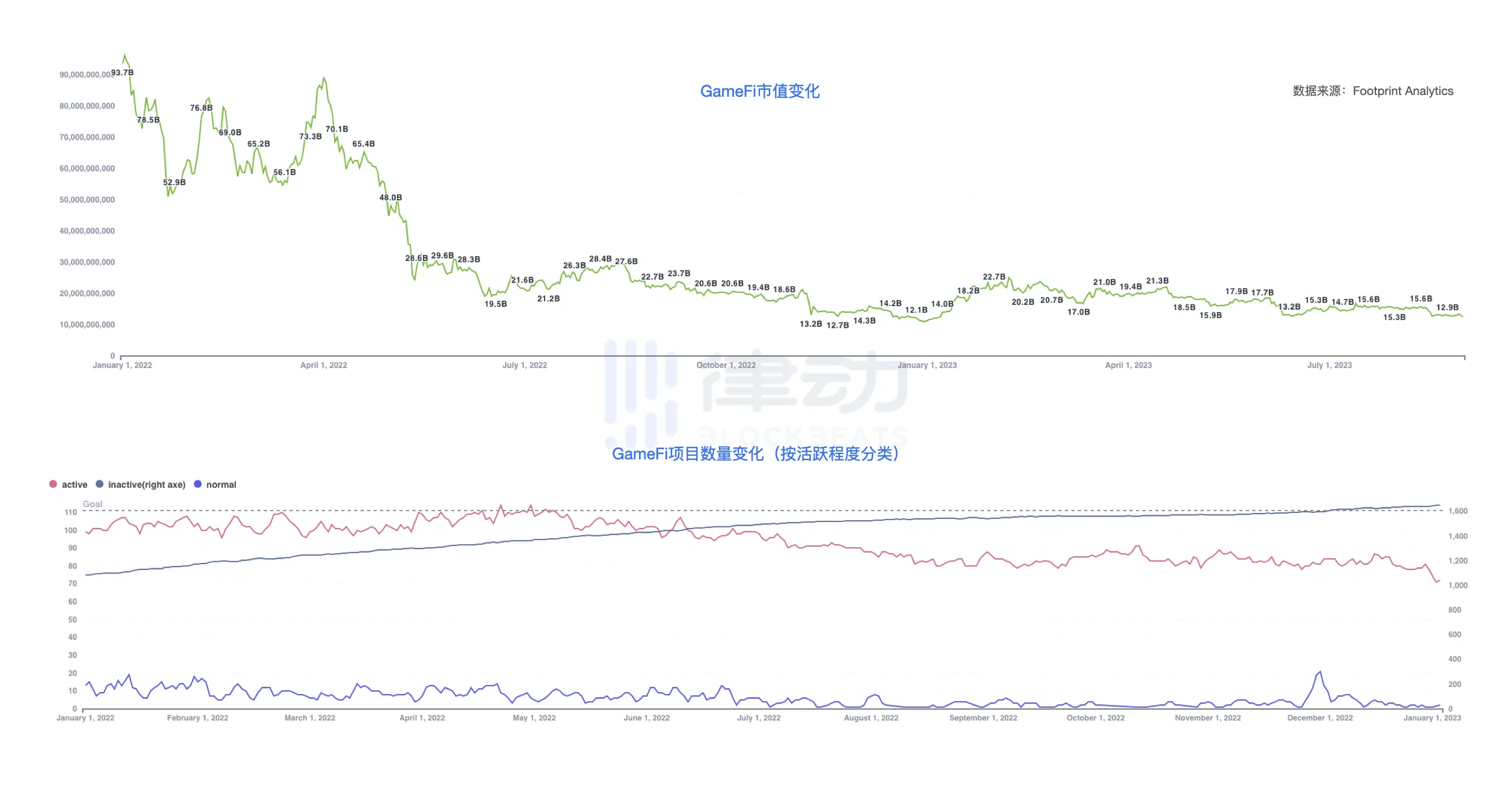

According to Footprint Analytics data, the market value of the GameFi track has shrunk from $93.7 billion at the beginning of 2022 to $13.3 billion. In terms of the number of GameFi projects, there are currently less than 80 active projects, while the number of inactive projects exceeds 1,600, and the gap between the two continues to widen.

Data Source: Footprint Analytics

As the track cools down, investors are starting to shift their focus to new narratives, and discussions about the whole-chain game are gradually becoming more frequent in the crypto VC circle. Fully automatic worlds, on-chain modifications, AI-driven NPCs… Traditional GameFi relying on NFT transactions and token incentives is no longer sexy in the new imagination of the whole-chain game. The era of GameFi seems to be becoming a thing of the past, with difficulties in project financing and slow progress in product roadmaps.

The emergence of Matr1x Fire seems to have interrupted this seemingly irreversible trend.

This is an FPS shooting mobile game, focusing on PVP multiplayer competition and PVE casual gameplay. A few weeks ago, all 3000 BattleLianGuaiss NFTs of this game were sold out in less than 5 hours. In the subsequent open test, Matr1x Fire obtained user data rarely seen in the GameFi field. BlockBeats learned from members of the Matr1x Fire team that the number of registered users on the test day exceeded 200,000, and the game app still maintains tens of thousands of active users.

Matr1x Fire completed a $10 million financing round in September last year, with participation from Korean financial giant Hana Financial Investments, HashKey, Amber, and other institutions. Alpha testing and promotion work did not begin until August of this year. According to team members who disclosed to BlockBeats, the team has spent nearly 100 million yuan on game development so far, and during the development process of nearly a year and a half, a lot of time has been spent on polishing the product details.

True FPS players or professional players pay a lot of attention to the overall hunting experience of the game. “For example, FPS involves issues such as time delay, synchronization of opponent’s shooting time, matchmaking of players from different regions, TTK (Time To Kill), shooting feel, etc. These are very complex issues. Many players of Matr1x have provided feedback that they think the game’s experience, such as recoil feel, is done very well,” said H, a founding member of Matr1x, to BlockBeats.

Matr1x Fire game screen

In addition to Matr1x Fire, another Web3 mahjong game called Mahjong Meta has also attracted a lot of attention recently.

On August 3, this Ethereum-based game announced the completion of a $12 million financing round in the GameFi winter, with Dragonfly, Folius Ventures, and StepN’s parent company Find Satoshi Labs all on the list of participants. According to the team’s data, Mahjong launched beta testing in May this year and attracted over 15,000 players in the following two months, completing over 490,000 matches. Its game NFT achieved a total trading volume of nearly 500 ETH on Opensea.

After the official launch in early August, the Mahjong team is still very busy. “There are still quite a few recent milestones, including some detailed functions and optimizations that we want to achieve in version 1.0, as well as apps and various new gameplay. We are a product-oriented team, so most of our time is spent on development,” said Brice, co-founder of Mahjong, to BlockBeats.

Unlike shooting esports games like Mahjong and Matr1x, they belong to the broader category of board game entertainment and are more suitable for long-term users. “For example, if a player starts playing cards at the age of 25, they are likely to continue playing until they are 60 or even 70 years old. Combined with some esports mechanisms, it is very suitable for long-term operation, improving the overall game experience through new seasons.”

The team has already completed the CV recording with well-known Japanese voice actors such as Nao Kobayashi, and has also invited many artists from China and abroad to create and select scenes and BGM for the game. During the beta testing phase, many Japanese players have contacted the team to inquire about the names and composers of the game’s background music. “It is these details of the experience that many players are very sensitive to, so I personally took care of many fragmented aspects. We hope that the game presented to players is a complete narrative closed loop that is self-consistent in all aspects.”

Against the backdrop of the booming full-chain games and the declining narrative of GameFi, Mahjong and Matr1x Fire have rekindled the industry’s attention and thinking about Web3 games. In addition to a deep understanding of game development, strict control of product details, and mature considerations in choosing the track, these two projects also share an important common point: they are both created by former Tencent employees.

In September 2021, a series of articles titled “Axie Infinity surpasses King of Glory in revenue” circulated online. According to official data released by the game that month, Axie Infinity had over 2 million players logging into the game daily, with transaction volume exceeding 334 million USD in the past month, surpassing King of Glory’s 231 million USD. Although the actual revenue earned by the project through a 4.25% transaction fee is far less than 334 million USD, the phrase “surpasses King of Glory in revenue” was enough to attract attention from within Tencent.

“Actually, our group of people have been exposed to Web3 very early on, but we were still very surprised when we discovered that Axie Infinity’s revenue surpassed King of Glory. So many people from within Tencent started paying attention to this direction.” Before founding Mahjong, Brice worked in Tencent’s game investment department for many years, leveraging Tencent’s comprehensive investment tools and resources in the game industry. He voluntarily took on the responsibility of exploring the Web3 game field for the team.

In just a few months, Brice has talked to hundreds of GameFi teams and investors. “But internally at Tencent, you are more of an observer to discover and support other people’s dreams. But this is completely different from the experience of coming out and focusing on developing a product.” So in the fall of 2022, Brice decided to “leave the factory” and start a Web3 venture with his partners.

Unlike Brice, H comes from Tencent Financial Technology, which is the business line within Tencent that was the earliest to be exposed to the blockchain and cryptocurrency field. The Tencent Blockchain Team under it is the core engine driving the exploration of blockchain technology within the company, incubating many well-known projects such as Weiqilian and Zhixinlian. However, not long ago, its leader also left Tencent and joined Web3 entrepreneurship.

The Disappearance of Tencent Blockchain

In May of this year, Cai Yige, the person in charge of Tencent Blockchain, gave an interview to 36Kr reporters, revealing for the first time the reasons for leaving Tencent and starting a Web3 business.

Cai Yige is a true “Tencent veteran”. After graduating from university, he joined Tencent. In his own words, the most precious ten years of his life have been spent growing with Tencent. Since joining Tencent’s financial technology business line in 2017, Cai Yige has served as the General Manager of Tencent Blockchain, responsible for exploring the commercial applications of blockchain technology.

When asked why he chose to start a Web3 business, Cai Yige said that he and his partners had been pondering Web3 entrepreneurship opportunities for almost a year. After seeing the Hong Kong Web3 industry policies being gradually introduced, he firmly decided to leave Tencent. “While I still have ideas and enthusiasm, I want to give it a try. Otherwise, I might regret not doing it in the future.”

After the interview article was published, Tencent employees forwarded it one after another and wrote on their social media: “Go for it, Brother Cai.”

“Brother Cai” is a key figure in Tencent Blockchain. Under his leadership, the team has successively incubated Weiqilian, a blockchain supply chain financial platform, and Zhixinlian, which is applied in the field of judicial certification. The latter has provided underlying technical support for multiple digital collectible platforms such as Huancore from 2021 to 2022. When Tencent’s blockchain business first entered the public’s view, Cai Yige often acted as the team’s “official spokesperson”.

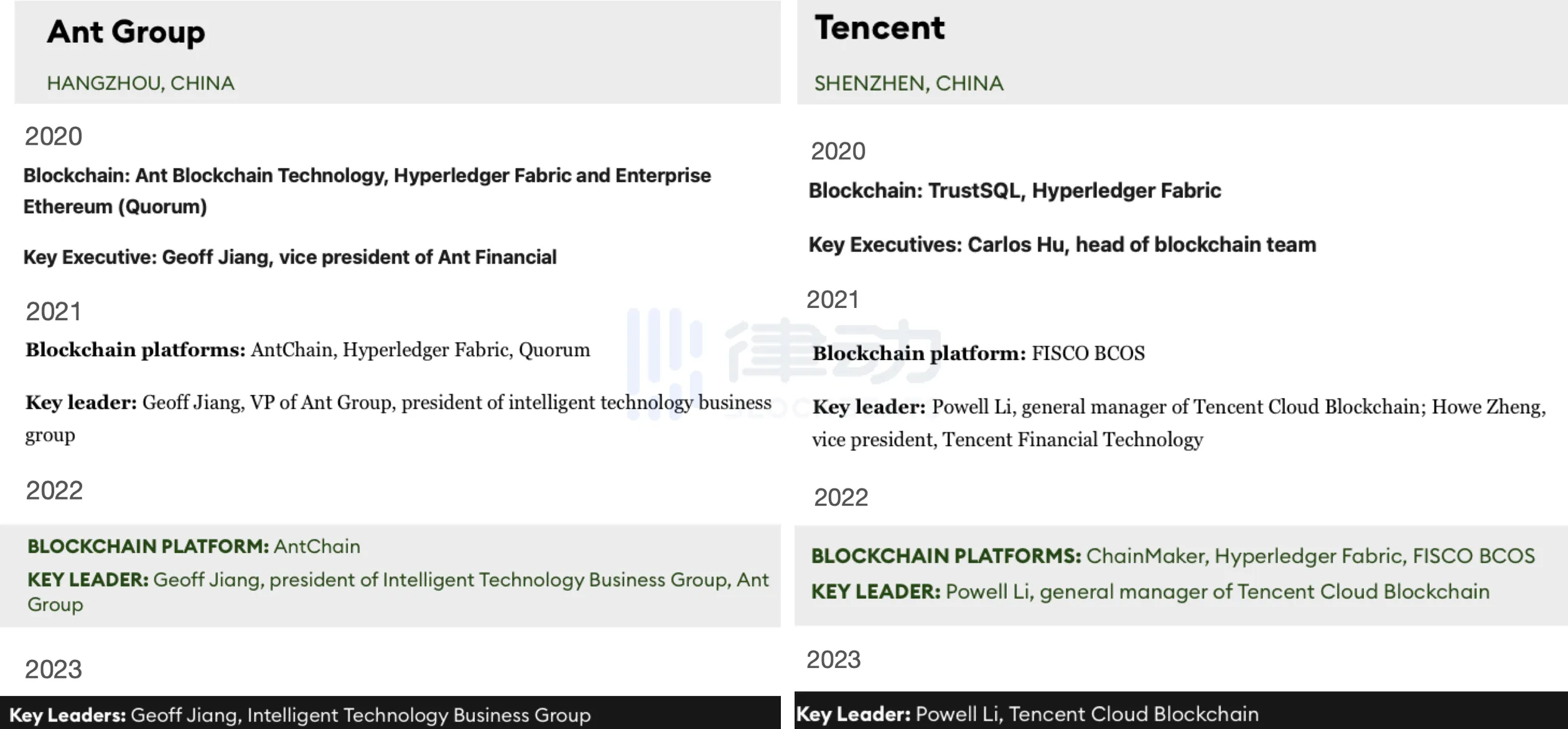

In February of this year, Tencent announced that it had been selected for the Forbes Blockchain 50 list for the fourth consecutive year. However, the representative of Tencent’s blockchain business on the list was not “Brother Cai”, but Li Li, the person in charge of Tencent Cloud Blockchain.

In fact, since Forbes launched its Global Blockchain 50 list in 2020, Cai Yige’s name has never appeared on it. In 2020, Hu Mingli, the current Vice President of Tencent Cloud, made it onto the list as the “leader of the blockchain team”, representing the TrustSQL project developed by Tencent’s blockchain research and development. In 2021, Li Li, the person in charge of Tencent Cloud Blockchain, and Zheng Hao, the Vice President of Tencent Financial Technology, were both selected, representing the FISCO BCOS (Golden Chain Alliance) launched by WeBank. From 2022 to 2023, Li Li was selected again, and Chang’an Chain, incubated by Tencent Cloud Blockchain, was also included as a representative project in the 2022 list.

In the past four years, Tencent’s blockchain research and development and incubation technology has only appeared on the list once, and Tencent’s most well-known blockchain project, TrustSQL, has never been selected.

2020 to 2023 Forbes Global Top 50 Blockchain Companies (Tencent vs. Alibaba)

Lagging behind Alibaba

Compared to Tencent, Alibaba’s blockchain is much more stable in terms of organizational structure and business. In the past four years, the selected project on the list has always been AntChain and its leader, Jiang Guofei.

Many people familiar with AntChain’s business told BlockBeats that Alibaba’s blockchain business is driven from top to bottom. In 2015, Ant Financial established a blockchain interest group and researched and verified the feasibility of blockchain in various application scenarios during an internal hackathon. In the same year, shortly after its establishment, Alipay publicly stated its focus on blockchain and other technologies that address trust issues. Subsequently, the group decided to find a leader to formally initiate the blockchain business.

At first, Ant Financial invited Xu Yiji, co-founder of AntShares (later Nebulas), to join. Xu Yiji was originally a Google engineer and a fervent “public chain enthusiast”. After joining Alibaba and Alipay, he vigorously promoted his ideals of public chains, driving the entire Alibaba blockchain business towards the direction of public chains. He even boasted about replacing Alipay with blockchain.

However, after China tightened its policies in 2017, Alibaba no longer recognized Xu Yiji’s business ideas and replaced him with Jiang Guofei as the head of the blockchain business.

Jiang Guofei is also a technical genius who has developed numerous products and solutions in the fields of the Internet of Things, big data analysis, and artificial intelligence, and has won multiple industry innovation awards. Because his English name (Geoff) sounds similar, everyone in the company is used to calling him “brother-in-law”, but like Cai Yige, Jiang Guofei is also the “big brother” of Alibaba’s blockchain.

In February 2017, Jiang Guofei joined Ant Financial as Vice President and President of the Financial Technology Business Unit, in charge of Ant Blockchain. Insiders told BlockBeats that after Jiang Guofei joined Ant Financial, there were more than 500 people within the Alibaba group working on blockchain-related businesses at one point. In September 2019, Jiang Guofei became the President of Ant Group’s Intelligent Technology Business Group and became the core person in charge of Ant’s blockchain platform.

At the end of 2019, there were rumors of Ant’s IPO. In December, Ant announced a comprehensive acceleration of its globalization, domestic demand, and technology strategies, and began to accelerate the process of “de-financialization” and transform into a technology-based company. Shortly afterwards, Jiang Guofei led the team to launch the blockchain technology platform Trusple, and stated that “blockchain technology makes Trusple better suited to meet the needs of international trade trust.”

In June of the following year, Ant Financial officially changed its name to Ant Technology Group Co., Ltd. In July, Ant Group upgraded its Ant Blockchain brand to “AntChain” and disclosed its daily active user data of over 100 million for the first time. In September, under the guidance of the Shanghai Municipal Government, the first Global High-level Financial Technology Conference hosted by Alipay and Ant Group was held on the Bund. Ant Group comprehensively showcased the technology of AntChain at the conference, announced the launch of an open alliance chain for small and medium-sized enterprises, and released integrated hardware and software for on-chain applications.

In June 2021, AntChain held its first developer conference, where Jiang Guofei elaborated on the development philosophy of AntChain. In January 2022, Jiang Guofei took on the role of President of Ant Group’s Digital Technology Business Group and also became responsible for Ant Group’s technology business sector. Since taking over Ant Blockchain in 2017, Jiang Guofei’s Alibaba-based blockchain has consistently held the top position in global patents in this field. Today, when you visit the official website of AntChain OpenLab, you will find solutions such as smart contract security, multi-party computation, zero-knowledge proof (ZKP), fully homomorphic encryption (FHE), and other cutting-edge technologies in the encryption industry, all of which AntChain has been researching.

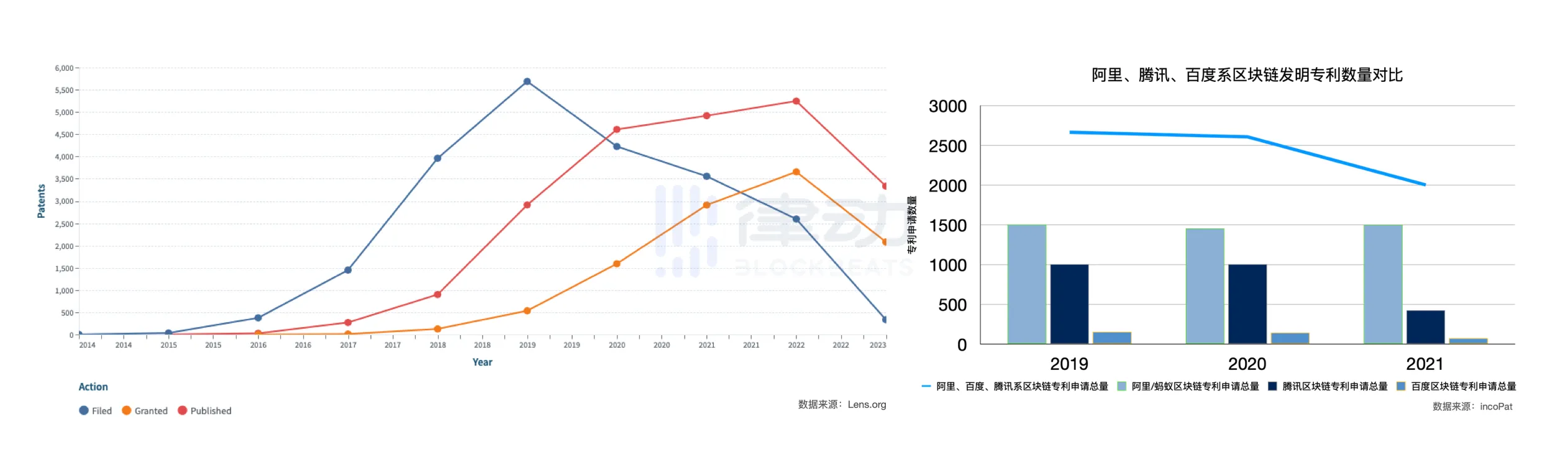

In contrast, Tencent’s blockchain business has shown a clear and rapid decline. Since 2015, China has been the global engine for blockchain patent inventions, with major contributors including Alibaba, Baidu, Tencent, and other internet giants. In terms of quantity, the number of global patent applications for blockchain inventions reached its peak in 2019 and rapidly declined in the following two years. In the competition for patent applications, Tencent is the only major player in China that can compete with the Alibaba group. However, since 2021, Tencent has started to completely decline, with the number of patent applications dropping from 1,006 in the previous year to 427, while the number of Alibaba group’s patent applications has remained basically unchanged.

The left chart shows the trend of global blockchain patent applications, while the right chart shows the trend of blockchain patent applications from Alibaba, Tencent, and Baidu.

In terms of organizational structure, the Alibaba group has also shown a clearer division of business responsibilities. The blockchain business of the Alibaba group is mainly undertaken by AntChain and Alibaba Cloud. AntChain is responsible for the development of underlying technologies, while Alibaba Cloud provides enterprise services through its BaaS (Blockchain as a Service) platform. Among them, AntChain is the main executor of the Alibaba group’s blockchain strategy, and most of the Alibaba group’s blockchain applications are based on AntChain.

The organizational structure of Tencent’s blockchain business appears to be chaotic. First, there was the Golden Chain Alliance led by WeBank, and then there were Tencent Blockchain and Tencent Cloud Blockchain. Each business line has its own research and development in underlying technology and top-level applications, fully demonstrating Tencent’s consistent “horse racing mechanism”. Since 2022, Tencent’s progress in the field of blockchain has been almost nonexistent. Interestingly, in June of this year, the first national standard for blockchain technology was released, and both Tencent Blockchain and Tencent Cloud Blockchain published articles on their official accounts at the first time, stating that they participated in drafting the national standard.

Content of articles on Tencent Blockchain and Tencent Cloud Blockchain official accounts

During the period from 2015 to 2022, Tencent and Alibaba have had a very obvious competitive relationship in the research and development of blockchain technology and the promotion of business. Insiders told BlockBeats that Tencent once delved into Alibaba’s strategy in the blockchain field, and even had accurate knowledge of its annual pricing, KPI completion quantity, and the planning and situation of each business department.

However, after that, Tencent Blockchain suddenly collapsed in the competition and disappeared from the domestic blockchain landscape.

The Rise and Fall of Tencent Blockchain

From the launch time of Tencent Blockchain White Paper, underlying technology platform TrustSQL, and Tencent Cloud Blockchain TBaaS, Tencent’s blockchain business was on par with Alibaba’s in the early stages of competition, and even took the lead at one point.

Tencent also started to lay out the blockchain industry in 2015. At that time, an important strategic goal for Tencent in its business was to launch a surprise attack on Alipay and Alibaba’s financial business through Tenpay (now Tencent Financial Technology) behind WeChat Pay. In terms of extension business, WeBank, in which Tencent invested, took on the task of exploring blockchain finance first.

In May 2016, WeBank and Tencent Enterprise initiated the Golden Chain Alliance (Shenzhen Financial Blockchain Development Promotion Association), started independent research and development of blockchain underlying technology, and released the first financial consortium chain cloud service BaaS in June. In 2017, WeBank, together with institutions such as Onchain and Matrix Element, launched the financial-grade blockchain underlying platform FISCO BCOS, which was applied in government affairs, finance, supply chain, and other fields. Insiders told BlockBeats that many technical members in WeBank came from Tencent, but there were also a large number of members from Ping An, and there were some upheavals internally, with many people leaving at different times.

However, WeBank is ultimately an extension business invested by Tencent. Within the Tencent system, the team of the financial technology business line was the first to explore the blockchain field.

Tencent Financial Technology (referred to as Tencent FiT) belongs to the Corporate Development Group (CDG) and is the middle and back office behind financial products such as WeChat Pay and QQ Wallet. Around 2016, some experts in Silicon Valley sent Tencent FiT a lot of research on the blockchain field. At that time, Tencent was also looking at related technologies such as Bitcoin internally. Therefore, the team responsible for the backend of WeChat red envelopes started to lead the research and built the Tencent blockchain system.

In January 2017, Tencent WeGold was launched, which was the first application scenario based on the landing of Tencent’s blockchain technology. In April of the same year, Tencent FiT and Tencent Research Institute jointly released the “Tencent Blockchain Solution White Paper”, becoming the first company in China to release a blockchain white paper. The white paper disclosed the underlying platform TrustSQL independently developed by Tencent Blockchain. At this time, there were still two years before Ant Group launched its benchmark blockchain technology platform Trusple.

Also in 2017, Tencent Cloud, which was then under the Social Network Group (SNG), also began to explore blockchain business. Insiders told BlockBeats that at that time, the Tencent Financial Cloud team was often asked by bank or financial institution customers whether there was a BaaS (Blockchain as a Service) service. They then approached Tencent Blockchain to understand the related technology. However, the team later decided to develop their own blockchain cloud service technology, thus giving birth to Tencent Cloud Blockchain. In December of the same year, Tencent launched the blockchain infrastructure platform TBaaS and started to explore blockchain+ solutions for various industries.

In March 2018, Pony Ma mentioned blockchain for the first time at the National People’s Congress, stating that Tencent was laying out electronic bill business and using blockchain invoices as a major focus. In August, Tencent Blockchain and the Shenzhen Taxation Bureau of the State Taxation Administration jointly launched the Tax Chain and issued the first blockchain electronic invoice in the country, which was regarded by many industry insiders as an important milestone event in the blockchain industry.

On September 30, 2018, Tencent went through the 9.30 transformation and established the Content Business Group (PCG) and the Cloud and Smart Industries Group (CSIG), raising Tencent Cloud’s strategic position in the Tencent ecosystem. In October, the Trusted Blockchain Summit hosted by China Academy of Information and Communications Technology was held in Beijing. The summit selected and announced more than 20 companies that passed the first round of functional testing and performance testing, and Tencent Technology Co., Ltd. and Tencent Cloud Computing Co., Ltd., both subsidiaries of Tencent, were selected at the same time.

In April 2019, the blockchain game “Let’s Catch Monsters” spanning three major business groups, IEG, TEG, and CSIG, officially launched its non-deleted closed beta testing. There were over 12 million users registered on the same day, and the game reached the top of the App Store’s free chart within hours of its release. However, the market response to the game was not as expected.

"Let's Catch Monsters" launch scene

In August 2019, Tencent officially launched its evidence preservation service platform, Zhi Xin Chain. Zhi Xin Chain was initially initiated by Tencent’s Smart Legal Affairs team to solve judicial evidence preservation problems. Zhi Xin Chain was originally intended to solve the technical upgrade of copyright protection scenarios, and later expanded to financial evidence preservation scenarios. It successively connected to several domestic internet court evidence preservation platforms. At the same time, Ant Chain undertook the judicial chain for the circulation of internal network case files of the Supreme People’s Court, Guangzhou Internet began the “Wang Tong Fa Lian,” and the Beijing Internet Court comprehensively developed connections with the judicial chain and the judicial evidence preservation scenarios.

In January 2021, Tencent Cloud, Beijing Microchip Research Institute, China Construction Bank, and the Digital Currency Research Institute of the People’s Bank of China jointly established the Chang’an Chain Ecological Alliance. As a result, the underlying technology of Zhi Xin Chain was upgraded from Tencent Cloud’s blockchain to Chang’an Chain.

In August, under the wave of the metaverse, PCG internally incubated the digital collectibles platform, Huan Core, which quickly ignited the domestic digital collectibles market after its launch. At the same time, Tencent Cloud revealed that Zhi Xin Chain has supported the landing of more than ten digital collectibles platform projects such as QQ Music, KuGou, Yuewen Group, and Xiaohongshu.

At the end of the year, there was a rumor that Zhang Xiaolong, the President of WXG, made a speech at the Tencent Employee Conference, stating that “Web3 may be a false carnival, but the Chinese Web2 has left behind real disappointments.” Although it was confirmed to be a rumor, three months after the rumor appeared, Tencent’s venture capital participated in the $200 million financing of NFT game company Immutable, completing its “Web3 first investment.”

Tencent’s blockchain business reached its climax. However, this momentum quickly began to decline and directly plummeted to the bottom.

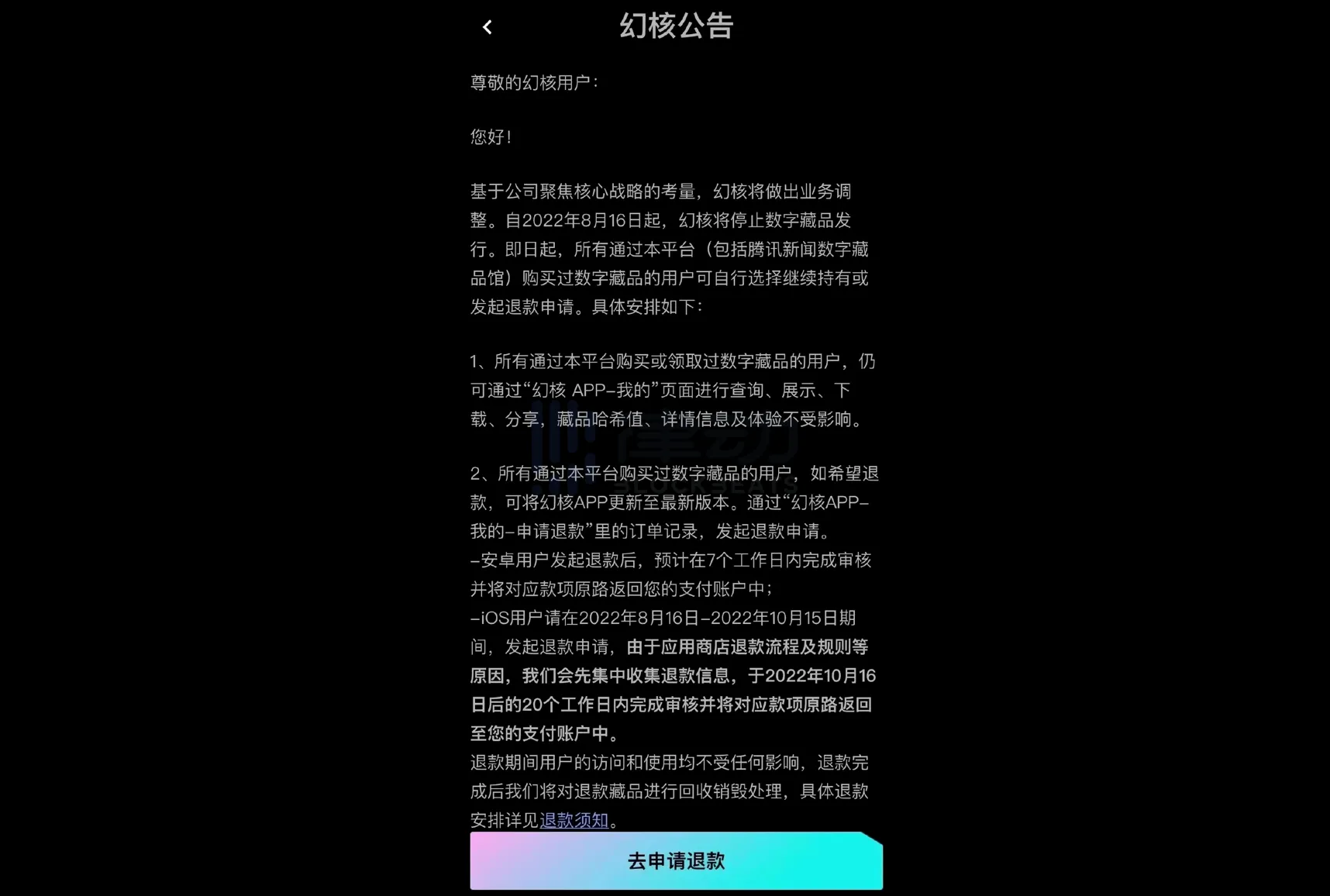

In May 2022, Wang Shimu, the former General Manager of Tencent News, suddenly transferred to the PCG Social Platform and Application Business Unit, responsible for innovative businesses such as Huan Core. Shortly after in August, Huan Core announced the suspension of digital collectibles issuance and reminded users to initiate refund applications. In September, Wang Shimu resigned. In March of the following year, Huan Core officially announced its shutdown.

The shutdown of Huan Core is not only a landmark event marking the end of the domestic digital collectibles craze but also a critical turning point for Tencent’s blockchain business from prosperity to decline.

Since August 2022, Tencent’s internal blockchain-related business has basically come to a standstill. Tencent’s official blockchain public account has almost stopped updating content, and Tencent Cloud’s blockchain official account only has news updates related to Changan Chain business. ZhiXin Chain, which was in the spotlight before the Chinese New Year, has been put on hold. When BlockBeats asked ZhiXin Chain about the ongoing business, the reply was only four simple words – electronic invoices.

Updates of Tencent Blockchain and Tencent Cloud Blockchain official accounts after the shutdown of Huancore

Tencent Can’t Afford Dreams

Whether it is blockchain, metaverse, or Web3, there is strong interest and active exploration within the Tencent ecosystem. This includes top-level managers. During the cryptocurrency boom in 2017 and 2021, Tencent’s blockchain business also achieved rapid growth. In 2022, after Tianfeng Securities reviewed Tencent’s investments in related areas, it stated that Tencent has the “most comprehensive metaverse layout.”

However, Tencent’s exploration of blockchain and Web3 business is not driven from top to bottom. The organizational structure is too chaotic and loose, lacking a true strategic backbone. Under the dual pressures of cost reduction and top-level decision-making, Tencent’s blockchain business was eventually cut. Now, in the new Web3 and virtual asset field, Tencent has completely retreated and lost the ability to compete with the Alibaba ecosystem.

Rabbit Hole Adventure

H, a founding member of Matr1x Fire, came into contact with Bitcoin during the cryptocurrency bull market from 2016 to 2017. During that time, he read whitepapers of Bitcoin and other blockchain projects day and night, often studying until three or four in the morning. “At that time, there was no concept of ‘Web3’, but once you enter this rabbit hole, you can never get out.” At that time, there were also many ideas about blockchain within Tencent, especially in the financial technology business line closest to the financial sector within Tencent, many of these ideas came directly from its leaders.

In addition to WeBank, Tencent also has a small presence in exploring blockchain and virtual assets in Hong Kong, namely Fusion Bank. The president of Fusion Bank is Lai Zhi Ming, who also has a more well-known title – former vice president of Tencent.

Tencent’s official evaluation of Lai Zhi Ming is: Lai Zhi Ming has made significant strategic contributions to Tencent in building payment infrastructure and financial open ecology… He has laid a solid foundation for mobile payment overtaking on the bend and seizing the industry high ground, and successfully established a diversified financial ecosystem covering fields such as finance, securities, banking, and blockchain with payment as the entry point.

Rai Zhiming is a Hong Konger who graduated from MIT in 1995 and returned to the mainland. He joined Tencent in 2009. In September 2012, Rai Zhiming became the General Manager of Tenpay. Three years later, Tenpay was upgraded to Tencent’s Financial Technology Business Unit, with Rai Zhiming as the head. During his tenure, he showed a strong interest in blockchain.

In January 2019, Rai Zhiming, as a member of the Guangdong Provincial Political Consultative Conference, proposed to further promote the pilot application of blockchain electronic invoices in Guangdong Province. In October 2020, Rai Zhiming, along with Yao Qian, the former director of the Science and Technology Regulatory Bureau of the China Securities Regulatory Commission, and others, appeared as a participating author in the book “Blockchain and Asset Securitization” published by Wanxiang Holdings Executive Director Xiao Feng. According to sources familiar with the matter, around 2016, Cai Yige was starting a fintech startup, and it was Rai Zhiming who brought him back to Tencent to serve as the head of Tencent’s blockchain.

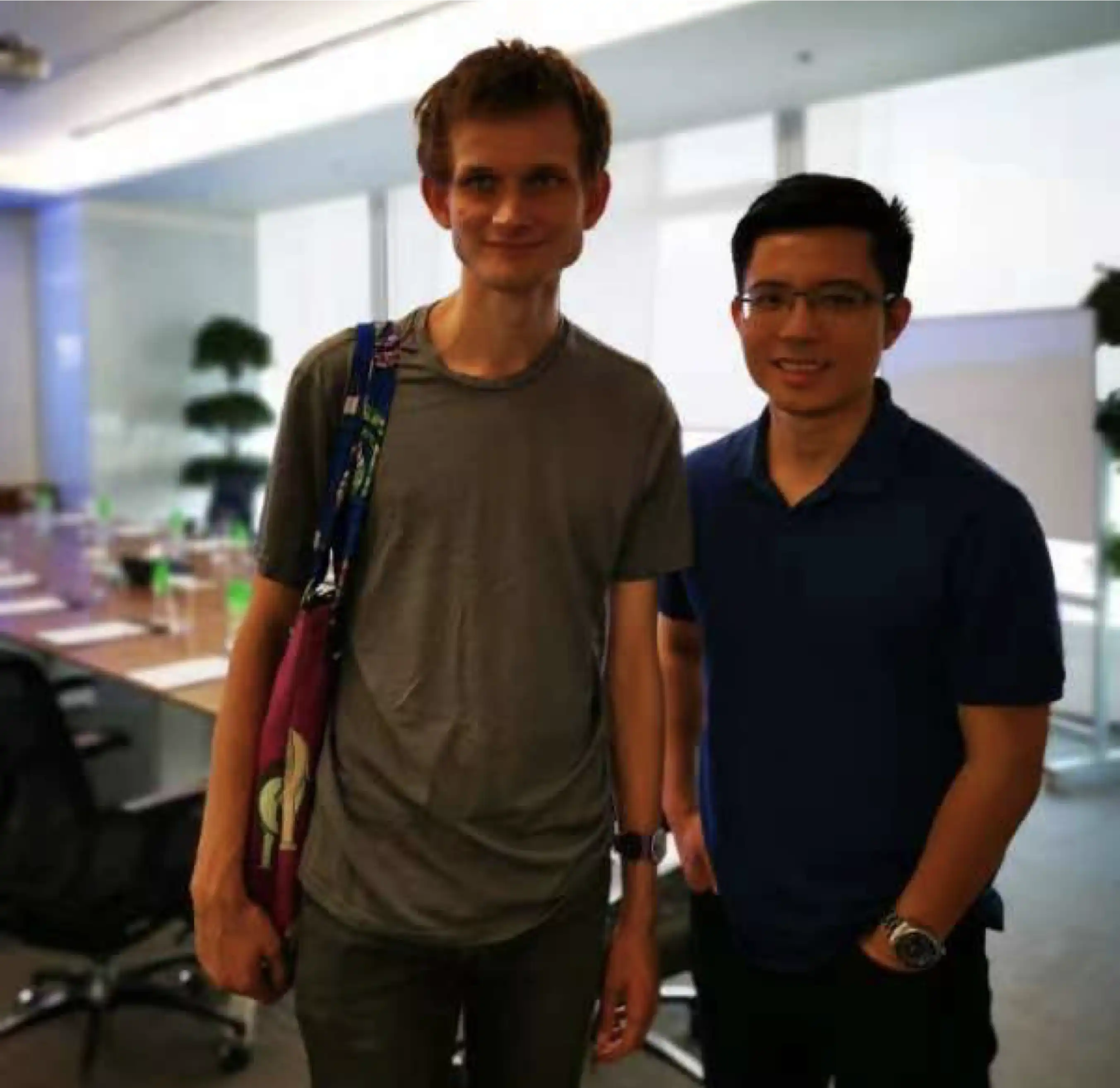

In 2019, Ethereum founder Vitalik visited Tencent. At that time, the cryptocurrency market was chaotic, and Cai Yige did not want his team to get involved in these gray areas. Instead, he focused on thinking about the scenario-based value of blockchain technology. After exchanging ideas with Vitalik, Cai Yige felt that Ethereum’s narrative as a “world machine that provides trust” was an interesting and exciting direction.

Vitalik and Cai Yige

In June 2019, Rai Zhiming stepped down as the head of Tencent FiT and became the Chairman of Tencent’s virtual bank, Infinium Limited. In November, Cai Yige officially became the General Manager of the blockchain division of Tencent’s virtual bank and participated in the preparation of Fusion Bank, starting to explore blockchain finance and digital asset scenarios.

Regarding the specific business exploration of Fusion Bank, Cai Yige said, “Hong Kong has very strict requirements, and it takes a long time to launch new businesses.” Insiders told BlockBeats that Fusion Bank had proposed many concepts in the early stages, but most of them did not materialize. For example, Fusion Bank once considered issuing its own STO tokens and digital gold. During the 2020 Tokyo Olympics, the team also tried to do blockchain cross-border remittance settlements with Japanese banks. However, these businesses were halted due to regulatory policies in Hong Kong.

In 2022, the operating data showed that the eight banks in Hong Kong collectively incurred a loss of more than HKD 3.7 billion, with Fusion Bank’s loss exceeding HKD 533 million. In June, Tencent announced that Rai Zhiming would no longer serve as Vice President of Tencent and would focus on his role as Chairman of Fusion Bank. The “behind-the-scenes mastermind” of Tencent’s blockchain business was officially expelled. The following year, Cai Yige also left Tencent.

Within Tencent, there is a strong exploration of the metaverse and Web3.

In April 2021, Tencent announced a new round of organizational restructuring to save QQ. Yao Xiaoguang, the president of TiMi Studios and vice president of Tencent, took over as the head of PCG’s social platform business, replacing Liang Zhu.

During his time at IEG (Interactive Entertainment Group), Yao Xiaoguang’s “Honor of Kings” was Tencent’s “cash cow”. After taking on the role of head of the social platform business, Yao Xiaoguang immediately began a series of explorations into “social + gaming” business. In August 2021, PCG launched an internal test of a game social product called NokNok, which aimed to compete with Discord. In September, TiMi Studios released a recruitment poster to establish the ZPLAN project, with a team size reportedly exceeding a thousand people. Several months later, the Super QQ Show was launched, which many people regarded as Tencent’s ambitious metaverse project.

Also related to QQ, in November 2021, Tencent distributed a 23rd anniversary commemorative edition NFT to its employees.

This series of NFTs was created by the Fantom Core team incubated by PCG, based on the QQ penguin image with a total of 72,000 pieces and 58 elements included. They were divided into three levels: high-quality, rare, and epic, based on their appearance probability. There were also 1,000 special egg-shaped NFTs. After the release of the NFT series, a “trading frenzy” quickly swept through the company, and some even built a rudimentary “trading market” using spreadsheet software. The popular hidden “Chang’e” edition once sold for 50,000 yuan, making “buying and selling penguins” the new social trend within Tencent.

QQ penguin NFT, and its "trading market"

“At that time, the atmosphere within Tencent was particularly good, and we had our own ‘exchange U groups’ to facilitate transactions. Because we were all colleagues and could see real names on the enterprise WeChat, everyone felt very reassured.” A former Tencent employee told BlockBeats that this WeChat group for deposits and withdrawals was established after a Tencent blockchain conference.

In the first half of 2021, the popularity of NFTs soared, and there were many people within the company who wanted to understand, learn, and participate in this trend. At that time, ZhiXin Chain happened to be the earliest team within Tencent dedicated to researching this field. Taking this opportunity, the leader of ZhiXin Chain organized a conference within Tencent with the aim of promoting the on-chain assets of internal businesses. According to Tencent employees’ recollections, this conference was particularly lively. “Normally, when Tencent holds a public event, the participation is not particularly high, even a few dozen people is considered remarkable. But at that conference, there were nearly 500 participants, and afterwards, we created Discord and WeChat groups to discuss these topics.”

After the ZhiXin Chain Conference, many teams within Tencent, such as QQ Music and Yuewen Group, have started to establish business relationships with ZhiXin Chain, including the Fantom Core team of PCG.

The Fantom Core team is located in an innovative product incubator under PCG, and Little Goose Pinpin was incubated from here. At that time, the team also developed a domestic alternative to Discord, but after the success of the Nao Nao community in the QQ business line, they began to shift their focus to exploring the Web3 and metaverse fields.

Former members of the Fantom Core team told BlockBeats that the main considerations for the Fantom Core project were twofold: first, there are a large number of IPs within PCG that do not have a good way to commercialize them; second, NFT can serve as an economic system that connects to the metaverse, linking Tencent’s gaming and entertainment content businesses in the future.

At that time, QQ Music had already been cooperating with ZhiXin Chain for some time. However, the Fantom Core project progressed very quickly and went online in just over a month after it was approved. With the concept of being the “first NFT platform of Tencent,” Fantom Core became popular overnight, and many subsequent actions of the team had a significant impact on similar domestic products such as Whale Scout and iBox.

Initially, Fantom Core targeted overseas NFT trading platforms like OpenSea, but later shifted to platforms like Nifty Gateway that experimented with 3D. Interestingly, the concept of “digital collectibles” was also first proposed by Fantom Core. Before that, many platforms in China were using the term “non-fungible token,” which was originally a temporary transitional concept. However, after we completed our project, all of our competitors changed to this name and never changed it again,” said a former member of the Fantom Core team.

In addition to NFTs, the department where Fantom Core was located at the time also worked on many other projects in the Web3 field. “We also attempted GameFi. The product was already completed, but it was not launched in the end because Tencent has relatively high compliance requirements internally. If you want to launch overseas, you need to isolate yourself from the company,” a former member of the Fantom Core team told BlockBeats.

Fantom Core once planned to launch an overseas version, but it did not go online in the end due to unfavorable timing and trading volume. “Tencent attaches great importance to a project’s ability to generate revenue on its own, not only in terms of user growth, but also whether the project can sustain itself. It may not have been a concern in the past, but revenue has become the most critical measure in the past two years,” said the former member of the Fantom Core team.

Cost Reduction and Efficiency Improvement

At Tencent’s year-end employee conference in 2021, Ma Huateng mentioned “wintering” for the first time. He emphasized that Tencent now needs to strengthen internal collaboration and reduce costs while improving efficiency.

In March of the following year, Tencent released its 2021 annual financial report, with a net profit of 123.788 billion yuan, a year-on-year increase of 1%, marking the lowest net profit growth rate in nearly ten years. The net profit of Tencent in the fourth quarter was 24.88 billion yuan, a 25% decrease compared to the third quarter. Subsequently, Tencent’s stock price fell below HKD 300, with a decline of more than 12% for the year.

Ma Huateng at Tencent's employee conference

The tightening of the capital market and the squeeze of the dual reduction policy have greatly affected Tencent’s revenue from online education… According to 36Kr, Tencent has been reducing personnel in multiple business groups since the end of 2021, with the largest action taken in the PCG and CSIG business groups, with a layoff rate of over 20%, while the IEG business group where Tencent Games is located has had little action.

As one of the most affected business groups, nearly half of the 9 products that Tencent suspended in the previous months came from PCG. Its products such as Tencent News and Tencent Sports also face tremendous pressure. According to feedback from Tencent employees, the turning point of this round of layoffs was the organizational restructuring across PCG and IEG in April 2021.

After nearly a year of contraction, Tencent’s sales expenses in the first three quarters of 2022 decreased by 20%. At the year-end employee conference, Ma Huateng still emphasized the theme of reducing costs and increasing efficiency, saying that reducing costs and increasing efficiency “should become a habit”, and the businesses that are cut should not be nostalgic. One strong signal from the meeting is that there is not much time left for the PCG business group, with Tencent News at the forefront. Ma Huateng mentioned that if the team does not have strong changes, “the entire (Tencent News) can be cut off.”

Phantom Core is also part of PCG, but the project’s revenue and income have been good all along, but these numbers cannot be compared to the scale of the gaming and live streaming businesses. Therefore, in reality, the closure of Phantom Core does not have much impact on Tencent’s revenue. “Because the overall scale and budget of the product launch are not large, and the income has to be handed over to the company, so whether this innovative business can survive is not based on ROI or cost, but mainly on the company’s level of attention to it,” a former member of the Phantom Core team told BlockBeats.

The signal of changes in Phantom Core’s business started from a personnel change in PCG in May 2022.

In August 2021, Wang Shimu, the former vice president of NetEase Cloud Music, joined Tencent News as the new head. However, in May of the following year, Wang Shimu was transferred to PCG’s social platform and application line responsible for Phantom Core and other innovative businesses. Then in August, Phantom Core announced its cessation of operations, and a month later, Wang Shimu resigned.

Internal sources told BlockBeats that the decision to close Phantom Core and other businesses came directly from Tencent’s top management. “At that time, Pony (Ma Huateng) made the decision that these consumer-oriented businesses will gradually be discontinued.” Multiple Tencent employees have confirmed the rumors that “Ma Huateng doesn’t like Wang Shimu,” but they also believe that the reasons for the closure of Phantom Core are not only limited to this. Tencent has always been very cautious about financial innovation, and the strong speculative sentiment in the secondary market for digital collectibles means that this business faces regulatory risks far greater than its returns.

“Tencent is a very conservative and ‘well-behaved’ company. It will not test the bottom line and boundaries like Alibaba does, and it rarely makes risky money, which is not much for Tencent.” Former member of the Metaverse team told BlockBeats that the issuance of digital collectibles by Metaverse will be divided with the cooperating IP. The entire project is losing money after refunding users. After Metaverse was shut down, Tencent was required to shut down all its digital collectibles businesses, including QQ Music and Tencent News.

The situation at CSIG is also not optimistic.

In the fourth quarter of 2021, the revenue of the financial technology and enterprise services sector increased by 25% year-on-year to 47.958 billion yuan, surpassing online games for the first time to become the largest revenue-contributing business sector of Tencent. However, despite the revenue exceeding the game business, the financial technology and enterprise services sector is also the fastest-growing sector in terms of cost input for Tencent, with a large gap in net profit compared to the game business.

In March 2022, Tencent President Liu Chiping stated in a conference call that Tencent will continue to focus on international games and SaaS businesses in the future, while strengthening cost control for cloud and long video businesses to maintain healthier growth.

In the layoffs that began at the end of 2021, CSIG also became a heavily affected area. In addition to the 20% reduction in staff, the remaining employees were informed that CSIG would focus on profitability as the key indicator of business development, which directly affected Tencent Cloud’s previous business model. In the cloud service market where growth is bottlenecked, Tencent Cloud often sells at a loss through methods such as “one yuan bid” and “total package subcontracting” in order to compete for market share with Alibaba Cloud and Huawei Cloud.

However, the shift towards profitability will render these sales methods ineffective. A middle-level employee at CSIG said in an interview with 36Kr, “The bosses don’t have so much patience anymore. They hope that CSIG can run out quickly instead of constantly losing money.”

Tencent Cloud’s blockchain business, which is under the Tencent Cloud business, has also been greatly affected by this wave of layoffs. Insiders told BlockBeats that in the past two years, Tencent Cloud has held web3-themed salons almost every week internally to discuss how to replicate new technologies in the web3 field onto consortium chains and combine them with the domestic environment for innovation. “But Tencent’s internal web3 efforts are not doing well, and they haven’t really achieved anything. Many of these departments were also cut during the layoffs.”

Tencent Cloud's related online salon on blockchain

However, not all of Tencent Cloud’s blockchain business has been shut down.

In February of this year, Tencent Cloud held the first Web3 Global Summit, “Tencent Cloud Web3 Building Day,” in Singapore. Well-known native crypto projects such as Scroll, Avalanche, and Sui attended this event. The theme of the conference was “Accelerating Web3 Success.” Yang Baoshu, Senior Vice President of Tencent Cloud International, said at the event that Web3 is the new iteration of the Internet, and Tencent Cloud sees its future and has already established partnerships with Ankr, Avalanche, Scroll, and Sui.

During this period, Tencent Cloud announced its support for the development of the global Web3 ecosystem and launched the Web3 one-stop solution “Metaverse-in-a-Box”, mainly targeting the development of on-chain metaverse. However, according to insiders familiar with Tencent Cloud’s Web3.0 business, Tencent Cloud is also difficult to compete with Alibaba Cloud in the field of Web3. “The so-called ‘Metaverse-in-a-Box’ is Tencent Cloud providing you with a set of Web2 tools, and everything else needs to be built by yourself. In addition, it also has gaps in performance and usable enterprise scenarios.”

Despite the growth bottleneck, Alibaba Cloud still holds a strategic position within the Alibaba ecosystem. In March of this year, Alibaba Group Chairman and CEO Zhang Yong took on the role of Chairman and CEO of Alibaba Cloud Intelligence Group. It is rare for a group chairman to also serve as the CEO of a business unit, not only for Alibaba, but also in the entire history of development of Internet giants.

In contrast, Tencent Cloud’s strategic position within the Tencent architecture is far less important than Tencent Games, which can be seen from the significant difference in market share between Tencent Cloud and Alibaba Cloud. “Most Web3 projects are willing to cooperate with Tencent, but what they are actually interested in is Tencent Games, and there is a huge difference between Tencent Cloud and games. However, Alibaba is much better. It has the largest number of enterprises in Asia, and the business it touches and the “toys” it provides are more abundant.”

Take Avalanche as an example. Although it announced a partnership with Tencent Cloud in February, the team’s activities in the following months were mostly carried out in collaboration with Alibaba Cloud. In May, Avalanche also collaborated with Alibaba Cloud to launch the competitive product “Cloudverse in-a-Box”.

By paying attention, one will notice that domestic cloud service providers entering the Web3 field has become a new trend. This year, Huawei Cloud held Web3-related summits in February and August respectively, announcing the provision of technical services for Web3 projects. Insiders told BlockBeats that the main consideration of these giants is still to “use small resources to leverage large profits in overseas markets”.

Cloudverse promotional poster

In addition to PCG and CSIG, Tencent’s investments are also shrinking.

“Around 2020, when Bitmain, led by Wu Jihan, went public on the US stock market, Tencent approached me, hoping to help me go public,” a senior industry practitioner in the mining circle told BlockBeats. Around 2020, “mining stocks” were very hot, and Tencent’s investments could often be seen in the mining circle. “Including the later investment by Tencent in Shanda Games, one of its data centers mainly focused on mining.”

However, Tencent’s investment layout in Web3 has been shrinking since last year. Apart from the $200 million financing of Immutable in March, Tencent’s investment team has not announced any investments in the Web3 field. BlockBeats has learned from multiple sources that Tencent Games and Tencent Cloud’s investment teams still look at some Web3 projects, but rarely take action. The investment entities associated with Tencent are the same.

Insiders told BlockBeats that there are many investment companies of Tencent executives in Nanshan, Shenzhen. In the past, they actively sought projects, but recently they have rarely discussed Web3 and instead focused on the AI field. “These companies’ funds come from Pony (Ma Huateng) and are controlled by Tencent executives.” In the context of global liquidity tightening, many USD funds are having a hard time. It is difficult for financing in all industries, not only in Web3 and AI. “Of course, we cannot assume that they are not investing in Web3 at all, because for compliance reasons, sometimes even if they invest, they will not disclose it.”

In addition to Tencent Cloud, Photon Web3 Research is also one of the few departments within Tencent that still pays attention to Web3. Insiders told BlockBeats that this department mainly focuses on infrastructure, but its business is mostly in the research stage, waiting to slowly layout when allowed by the company and policies.

In the eyes of many former employees, Tencent’s current cost-effectiveness in Web3 is not high. One reason is that the market is not large enough, the second is that the regulatory direction is unclear, and the third is that the labor costs in the industry are not low enough. “Large companies usually do not actively innovate but only become followers and then use their resources to enter together. When this industry has a benchmark product, I believe that many traditional manufacturers and large companies will enter.”

“Tencent is very conservative about Web3, and this conservatism is mainly manifested in the top decision-makers’ qualitative assessment and alignment with domestic policies. Tencent is content to follow in this matter.” At the Tencent Employee Conference in 2021, Ma Huateng mentioned that he wants to “lose weight and gain muscles, and use bullets in critical battles”, brewing the next trend or campaign.

In Ma Huateng’s view, Web3 will not be Tencent’s next trend.

Goose Factory People Don’t Want to Wait

In June of this year, SLianGuairkle announced the completion of a pre-seed round of financing led by Folius Ventures, and was subsequently selected for the sixth phase of the Binance accelerator. This is a Web3 astrology application with built-in GameFi and SocialFi elements. In August, the project released the first batch of free Genesis NFTs using the ERC-6551 protocol, and the trading volume on the first day surged to second place on the OpenSea trading list.

The founding members of SLianGuairkle were former Tencent employees who participated in the incubation of Huanker from scratch. “After the closure of Huanker’s business, everyone started their own entrepreneurial journey one after another. I know of 5 teams that emerged from Huanker, including those working on virtual characters, SocialFi, and those in the financing stage.” Insiders told BlockBeats that Wang Shimu, the former head of the department where Huanker was located, also started a Web3 venture.

With the wave of layoffs at Tencent PCG, CSIG, and many other internet giants, Web3 has seen many Web2 teams joining since the end of last year. During the Web3 event in Hong Kong in April this year, many former Tencent employees discovered that there were more than just familiar faces from their social circles in the Tencent camp of Web3 startups. In many project whitepapers, Tencent employees could be seen, “During that time, projects from big companies were able to secure better financing, and some projects that shouldn’t have received investment based on normal logic also got funding. Investors are betting that they can create the next product like StepN.”

“Tencent Mafia”

BlockBeats discovered that many projects with “Tencent lineage” are combining “fintech + gaming” to start Web3 ventures.

For example, as mentioned earlier, Matr1x Fire has its founding member H from Tencent Fintech, while its co-founders and many development members come from Tencent Gaming. The same combination can also be seen in the project PunkCode, the “number one” blockchain project at Tencent, where Cai Yige previously explored the blockchain field at Tencent Fintech, and his co-founder Guan Zhiyuan was the former head of Tencent’s esports market communications team and a founding member of the King of Glory market team.

As the two business lines within Tencent that have the most frequent contact with blockchain and the metaverse, they also have the most people venturing into Web3. Among them, most of the people from Tencent Gaming are driven by interest and a desire to explore the industry, while those from Tencent Fintech are more due to the compression of space within the business department.

BlockBeats has learned from several knowledgeable sources that there are also many people from the Zilliqa team who have ventured into Web3, with the most well-known being the Web3 equity aggregation platform VIP3. In August, VIP3 announced the completion of a $2 million seed round of financing, with participation from IOBC Capital, Ankr, and other institutions. Currently, VIP3 has established equity partnerships with mainstream crypto platforms such as Binance, HashKey Exchange, and OKX.

Interestingly, the project list that collaborated with VIP3 includes the Web3 game Mahjong founded by Brice. “At that time, the founder of Mahjong, the founder of VIP3, and we had ideas to do some projects during our time at Tencent, and we have been in contact ever since,” a Web3 entrepreneur told BlockBeats.

Some Web3 Tencent startup projects refer to each other as “brother teams” and often organize meetings and exchanges to find feasible cooperation opportunities. There is not just one “Tencent Web3 startup group”, which is used not only to solve deposit and withdrawal problems but also to share recruitment and job-seeking information. “Now it feels like a small alliance, and some friends even joke that we should bring a Tencent out to create a Web3 DAO.”

Tencent Web3 Entrepreneurship Group

In the matter of “establishing a DAO by the departing team,” Alibaba’s projects seem to be keeping up as well. During the upcoming Token2049 event, the Side-Event of A3DAO (A3 Summit) has attracted the participation of many entrepreneurs from large companies and domestic and foreign venture capitalists. The initiator of this DAO organization is several entrepreneurial projects that came out of AntChain, including ZAN, a technology brand supported by AntChain that focuses on compliant Web3 products and services.

According to BlockBeats, many Web3 entrepreneurs in the Alibaba system are former senior executives of Ant Group, and many of them have achieved P10 or higher positions. However, in terms of the number of people, “Alibaba Web3” is not as large as “Tencent Web3.” BlockBeats has learned that the current number of members of A3DAO is about 50 to 60 people, while Tencent’s Web3 Entrepreneurship Group already has more than 500 members.

The Tencent Curse?

It is worth mentioning that many Tencent entrepreneurs in the Web3 field mention a concept similar to the “Tencent Curse” when talking about their entrepreneurial experience. It indicates that some teams may encounter difficulties in adapting to the new environment. “Some teams that transition from Web2 to Web3 are often clueless when first entering the circle and don’t know how to establish connections with users. Eventually, they end up in a state of working in isolation.”

According to BlockBeats, the group of people who left Tencent and entered the Web3 field can be mainly divided into three categories. One category is the post-80s and post-90s who were exposed to Bitcoin and blockchain industries early on. They have a higher level of technical literacy and focus more on infrastructure development. Another category is the younger generation born in the 2000s or even the 2005s. Most of them entered the circle during the bull market in 2021. Although they may not have much professional literacy and work experience, they are often active in various Discord communities and hold moderator positions, so they are well aware of the industry trends. The third category is the teams that transition from Web2 to Web3. They have stronger product capabilities and a sense of ethics and bottom line. They all want to do a good job with their projects but may not have a strong understanding of Crypto Native matters. The group that is most likely to fall into the “Tencent Curse” is the batch of teams that transition from Web2 to Web3.

For Tencent, 2015 was an interesting time. During this period, Alipay, Tenpay, and various companies were just beginning to explore many new businesses, including blockchain. The people who joined Tencent before and after 2015 have significant differences in terms of product thinking and methodology.

During this period, large companies were in an expansion phase, and many new businesses required manpower to explore and develop. Newcomers quickly accumulated a mature set of product methodologies. “For example, at that time, Pony Ma (Ma Huateng) would often say that if you are a product manager, you should collect 1,000 user feedbacks, follow 100 user blogs, and conduct 10 user surveys every month, and so on. These seemingly trivial but essential product research activities involve digging into user pain points and feeding them back into the overall product design.”

Insiders told BlockBeats that product managers who joined Tencent before 2015 had solid basic skills, and many of the hidden champions in the Web3 field were created by these experienced product managers.

However, after 2020, Tencent’s numerous platform products have become very large, with user bases reaching tens of millions or even billions. During this period, product managers who joined Tencent were easily trapped in platform thinking when it came to Web3 entrepreneurship.

Since many scenarios rely on Tencent’s high-traffic platform-level products such as WeChat and QQ Music, most Tencent product managers tend to choose a large market entry point at the beginning of their entrepreneurial journey. They choose a market with a high ceiling and top-tier revenue data. “But Web3 is different from Tencent’s traditional business model. Tencent’s model is more like collecting one yuan from 100 million users, while Web3 is a high-value product model that may only need 1,000 users, each paying 100 yuan,” one practitioner told BlockBeats.

Of course, having a big company’s perspective is not without its benefits. “It means that when you start a business, you won’t be like a pure startup. You will have a framework and be able to avoid many pitfalls. This is a very good advantage because Web3 products themselves lack user experience and design rationality.” It is also for this reason that many teams can quickly make adjustments and get through the adaptation period.

In addition to product methodology, the advantages of Tencent employees in product details control and crisis response capabilities are also gradually emerging. This can be seen from the Matr1x Fire and Mahjong Meta teams mentioned at the beginning of the article. “Everything you can see and can’t see, every detail and micro-operation, has put in a lot of effort. If you don’t have these product capabilities, even if you have good potential, you may not be able to catch it,” H told BlockBeats. On the day of Matr1x’s open testing, the number of registered users exceeded the team’s expectations, and there was a server crash. However, the team resolved the issue within a little over an hour and immediately restarted the server. “If the repair time had exceeded three hours that day, all the new users might have been lost.”

In the current Web3 era, users’ requirements for product details may not be very high, but this is mostly because Web3 is still in the stage where product experience and logic need to be emphasized. In the early stages of the industry, the market tends to be more operation-oriented. “Tencent is not an operation-oriented company, it is a product-oriented company. Web3 is mainly filled with investments, but what is scarce is consumption. To build consumer scenarios, there must first be good projects available,” a senior observer told BlockBeats.

Perhaps, the era of the Web3 “Tencent Mafia” is about to come.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How does the economics community view Bitcoin?

- Tracking Sentiment through Liquidity Pools? – Glassnode’s Latest Research Report

- Can DeFi maintain its usability beyond market narrative fluctuations?

- Glassnode Tracking Market Sentiment through Liquidity Pools

- In the context of high inflation and political unrest, Bitcoin has firmly taken root in Africa.

- Which country has the highest awareness of cryptocurrencies?

- Rollbit on Solana? Breaking down the gaming part of Lamas Finance