Nigeria Second Largest Bitcoin Adopting Country, the Cradle of Cryptocurrency Growth

Nigeria 2nd Largest Bitcoin Adopting Country, Cryptocurrency Growth HubAuthor: Africa Web3 Ecology Research Institute

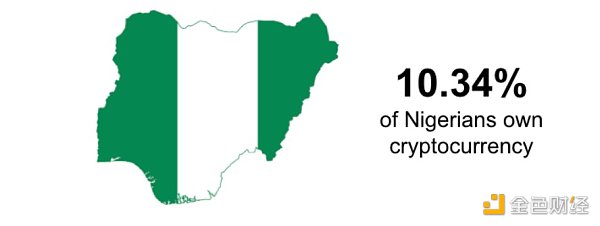

Nigeria is the second largest user of Bitcoin, second only to the United States. The number of cryptocurrency holders in Nigeria has reached 22 million, accounting for 10% of the total population.

As the largest economy in Africa, Nigeria suffers from severe inflation. Foreign exchange controls restrict people from using foreign currency to fight inflation. As a result, residents are turning to cryptocurrencies to bypass regulations and preserve the value of their assets.

The decentralized and global nature of Web3 is highly suitable for the local needs in Nigeria.

- Overseas Web3 Employment Report Remote Work in High Demand, US as the Main Job Market

- Wu’s Weekly Selection Tether becomes the 22nd largest holder of US Treasury bonds globally, Grab adds Web3 wallet and News Top10 (0902-0908).

- Block Earner will launch a loan product backed by Bitcoin as collateral.

Nigeria: Rich Land, Poor People

This is the West Coast! Nigeria is located on the West Coast of Africa and is the largest country in Africa. English is spoken there. Nigerians are not as poor as we imagine, and most of them have mobile phones. It’s not like that.

One out of every six Africans is Nigerian. Nigeria is rich in natural resources such as oil and natural gas, which are abundant in this land. The tropical climate and the Niger River bring abundant water and heat to the country.

Image source: TechCrunch. Therefore, despite overall poverty and weak urban infrastructure, thanks to brands like Transsion offering affordable phones priced at 100-200 RMB, locals can afford them after working hard for a month.

Therefore, mobile internet penetration is still relatively high, with a broadband penetration rate of 41%; there are 102 million internet users, equivalent to the level of China in 2013.

Huge wealth disparity, money flows to the wealthy

Although Nigeria is rich in resources, the income of its residents is not high. According to World Bank data, there are 95.1 million people living in poverty, accounting for half of the country’s population.

However, the combined wealth of the top five richest individuals in Nigeria amounts to $29.9 billion, while the average monthly income of local workers is 18,000 Naira, equivalent to 267.48 RMB.

Image source: United Nations official website

The DApp ecosystem is not prosperous, but cryptocurrency has entered the wallets of 22 million people

Nigeria ranks 11th in the Chainalysis 2022 Global Cryptocurrency Adoption Index and 17th in P2P exchange trading volume (similar to Binance, which is a P2P exchange).

It is estimated that there are currently over 22 million cryptocurrency owners in Nigeria, accounting for 10.3% of the country’s total population. Among the top 10 countries in terms of Bitcoin trading volume in 2020, Nigeria ranks third, after the United States and Russia, with a trading volume of over $400 million.

Image source: News

Thoughts of Overseas Chinese Enter Crypto Accounts with Cryptocurrency

The official language of Nigeria is English, so it is estimated that there are 21.7 million Nigerian citizens living overseas, in order to escape their underdeveloped hometowns. This accounts for one-tenth of the total population of Nigeria.

Therefore, the large number of overseas Chinese has brought about a huge amount of remittances, with remittances from overseas Chinese amounting to $24.31 billion in 2018, $23.81 billion in 2019, and decreasing to $17.21 billion by 2020. The gradual decrease in remittance amounts may be due to the increasing adoption of cryptocurrency by overseas Chinese, as BTC cannot be regulated.

Before the existence of cryptocurrency, the main cross-border remittance service providers for these overseas Chinese were Western Union and MoneyGram.

When a person working overseas sends their annual salary back home, it is often deducted by local capitalists for a month!

Western Union and MoneyGram account for 65% of the offline remittance withdrawal locations, and due to the monopoly position of these two banks, remittance fees often reach 10% and it takes 2-3 days for the remittance to arrive.

Image source: Internet

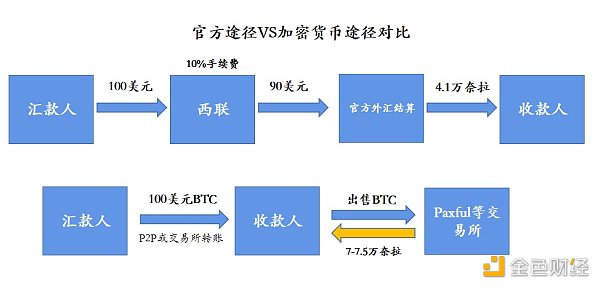

Not only are users affected by the 10% transaction fees, they are also restricted by the local government’s foreign exchange control policies, and the exchange rate is also unreasonable.

The Nigerian government has strict control policies on foreign exchange, with the official exchange rate being 460 naira per US dollar, while the parallel market (black market) exchange rate is 765 naira per US dollar. Therefore, BTC acts as an intermediary for black market currency exchange, allowing the recipient to exchange more naira on the black market.

Image source: Afro-Asian-Latin America 3WW3 Research Institute

Inflation and Currency Devaluation Promote Funds Stored in Cryptocurrencies such as BTC

Every African citizen is troubled by inflation, especially in Nigeria, where the average CPI increase is over 10%, and inflation reached 17% in 2021, with a year-on-year increase of 21% in January 2022.

Usually, along with inflation, there is also a devaluation of the national currency. Since 2013, the naira has depreciated by nearly 70% against the US dollar, falling from $0.0062 to $0.0021. Therefore, people’s enthusiasm for cryptocurrency assets cannot be stopped!

Image source: Google Finance

Although in February 2021, the Central Bank of Nigeria emphasized that cryptocurrency “violates existing laws” and banned commercial banks from engaging in cryptocurrency transactions, it still cannot suppress the enthusiasm of Nigerians for cryptocurrency assets. Millions of Nigerian residents, especially young people, have been converting their naira into Bitcoin and USDT.

Image Source: TED

Banking System Collapse: Moving from Web 2 to Web 3

By the end of 2020, only 64% of Nigerian adults had knowledge of financial services.

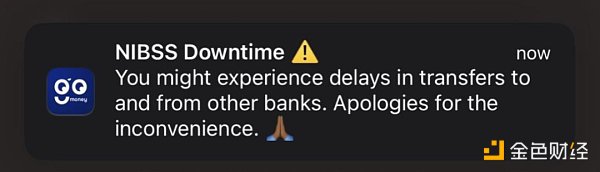

The banking infrastructure in Nigeria is very weak and has come close to collapse. In January 2022, there were errors in the amount of interbank transfers, which later evolved into problems with internal bank transfers.

Many remittances may face the risk of being irretrievable. The direct cause of this banking crisis was the “demonetization order” in Nigeria, where banks were unprepared for new banknotes. At the same time, there was a huge pressure for cash withdrawals due to salary payments and the Nigerian general elections at the end of the month, resulting in the paralysis of bank operations.

Image Source: TED

Image Source: Feedback from local netizens

Such incidents are not occasional. The Nigerian Interbank Settlement System (NIBSS) frequently encounters similar problems, and NIBSS is very outdated, with most cash withdrawal devices being outdated products from Europe and the United States.

Furthermore, the reconciliation systems between banks are outdated. Banks send Excel spreadsheets to the corresponding bank institutions for manual reconciliation, and even a slight error can affect the security of customer funds.

Image Source: Twitter

In addition to the poor banking transfer system, the high non-performing loan ratio and large deposit-lending interest spread also put depositors in an insecure position.

An article published by “Attack Report” on June 10, 2022, revealed that in March, the savings deposit interest rate in Nigeria was 1.28%, while the highest loan interest rate was 26.61%, resulting in a gap of 25.33%. Faced with an inflation rate of 16.8%, this is a serious exploitation of depositors.

At the same time, in 2020, Nigeria’s non-performing loan ratio reached 6%, higher than the global average. During the same period, China’s non-performing loan ratio was 1.92% and the United States’ was 0.96%. It is clearly unfair for depositors to bear such risks in such a low interest rate environment.

Image Source: Twitter

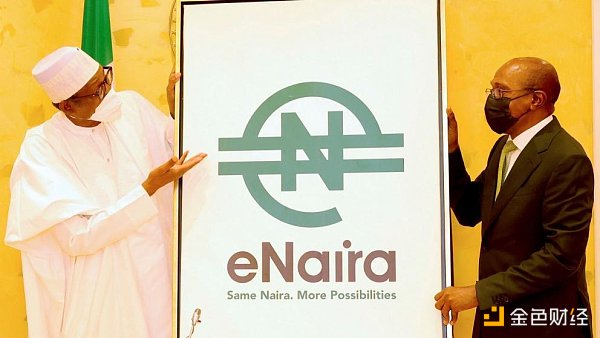

The Nigerian government has made attempts to change this situation through digital currency.

On October 25, 2021, Nigerian President Buhari announced the issuance of the digital currency e-Naira, making Nigeria the first African country to issue a digital currency. However, the centralized Naira stablecoin did not change the financial landscape in Nigeria. After a year of government promotion, the usage rate of e-Naira is only 0.5%, with a total transaction volume of only $9 million.

The biggest problem facing e-Naira is the lack of trust from the public in any government measures. Users prefer to use cryptocurrencies rather than e-Naira.

Image source: NY TIME

Nigerians can only choose Web3. Only Web3 can meet the needs of: enjoying financial services used by global elites as long as they have access to the internet.

For ordinary Nigerians, oil is not theirs, land is not theirs, skyscrapers are not theirs, and the money in the bank may disappear. Only the tokens in their wallets belong to them.

Web3 is changing Africa, and Africa is also changing Web3

If we only focus on the fluctuating prices on the K-line, then Web3 may only be an investment or speculative tool. But if we explore the value of Web3 for the people of Asia, Africa, and Latin America, we will find that Web3 is also a form of “social welfare”.

In this world, Africa with a population of over one billion is overlooked by the mainstream. They generally face problems such as inflation, mobile payments, and employment.

Web3 is an overachiever that can bring solutions. Payments, finance… all of this can be spread through the internet, bypassing governments and geography. And as a result, Web3 will bring significant user growth. While cryptocurrencies have emerged in Europe, America, and the East, perhaps “Africa” is the “cradle” of cryptocurrency growth.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin Price Prediction BTC Falls by 6%, Is the Worst Yet to Come?

- 2023 Bitcoin Mining Industry In-Depth Report Halving Approaching, Miners’ Survival and Preparation

- Immovable Tencent Blockchain and the Advancing Web3 ‘Goose Factory Gang

- Reviewing my journey of making 10 million US dollars in the cryptocurrency market at the age of 22.

- Report Cryptocurrency Rich List Includes 22 Billionaires and 88,000 Millionaires

- Trading volume plummets nearly 97%, is Bitcoin’s ordinal NFT just a flash in the pan?

- How does the economics community view Bitcoin?