The Crossroads of GameFi: Continue with P2E or Seek Breakthroughs

GameFi Crossroads: P2E or Breakthroughs?Click to read: GameFi’s Crossroads (Part 2): Innovative Strategies for Two Types of GameFi

Table of Contents

01/ The Birth of GameFi

02/ The Maturity of GameFi

- The true meaning and future expectations of an inverted yield curve

- Exploring Cross-Chain Communication from the Perspective of Rollup

- What is the allure of Sound.xyz, the leader of the music NFT track, with a16z as the lead investor?

03/ Ponzi Structure Is a Double-edged Sword

04/ How GameFi Achieves Good Nash Equilibrium

In the current boom of P2E, we discuss getting rid of this path dependence, not to say that P2E cannot succeed, nor to oppose path dependence – our purpose is to examine the design ideas behind these models, understand their pros and cons, and improve them.

01/ The Birth of GameFi

In 2020, Andre, founder of YFI, proposed on his Twitter that current DeFi is still in the TradeFi stage, that is, trading finance; and with the increasing diversity of smart contracts and economic models, there will be many gamified finance – “GameFi”. This definition is well-created and the prediction for the future is also accurate. GameFi has lived up to the expectations and has developed into an independent track over the past three years, and many GameFi that were once red-hot have appeared.

In fact, GameFi had appeared before this term. The earliest blockchain GameFi is Fomo 3D. The Fomo 3D team does not shy away from reputation – they call themselves Exit-Scam. They believe that the project parties of blockchain are essentially playing a game of hot potato, and the gameplay is very opaque to users. They simply designed a hot potato game that is completely transparent to users – this game can be compared to a lottery on the chain.

The rules of the game are very simple:

-

Users enter the Fomo3D game by buying Keys, which are equivalent to shares. Every round of the game lasts 24 hours, and from the time of buying Keys to the end of a round, users can get continuous dividends; the more Keys they have, the more dividends they will get;

-

Every time a player buys a Key, the remaining time of the game increases by 30 seconds, up to a maximum of 24 hours (the first two mechanisms basically determine that this game is difficult to stop);

-

The unit price of Key will continue to rise as the entry funds increase (the price increase mechanism is written in the smart contract);

-

The ETH used to buy Keys will be allocated to the prize pool, Key holders (dividends), officials, airdrop pools, etc. in different proportions, and the rules for the proportions are divided according to the team chosen when purchasing Keys;

-

There is also a rolling airdrop prize pool, and each purchase can participate in the lottery, with a certain chance (about 1%) to win a reward of 2-5 ETH.

-

The teams are divided into snakes, bulls, bears, and fish. After buying Keys, the ETH allocation rules apply.

The birth of Fomo 3D was short-lived, but it also had a profound impact: it made us realize that blockchain-based games can be so different from traditional ones – blockchain can create more new paradigms and shape new business models. We subconsciously assume that on-chain lotteries are the same as offline ones, just as online lotteries and offline lotteries are not much different. But when we really see it, we realize how different it is. After DeFi Summer, there are countless new paradigms for financial behavior on the chain.

02/ Maturity of GameFi

AXIE: Define Gamification Finance as Play to Earn

Axie and SPTEN both inherit the attribute of breeding from CryptoKitties, and they use the breedable property as a point to attract users to participate. In essence, breedable GameFi is a Tulip Bubble Model. Everyone rushes to buy the rarest tulips to show off and breed rarer ones. Breeding itself is meaningful because it brings new complexity and makes the system rise one step on the complexity ladder – the more complex the system, the further away from fragility. Breeding behavior brings new interest communities and identities, that is, breeders. The game between players has become more complicated, and breeders will not simply buy and sell NFTs based on price fluctuations, they will have their own plans.

Axie Infinity, as one of the most outstanding blockchain games, has opened up the industry paradigm of Play to Earn, and the design of its dual-token economic model has become the mainstream model adopted by subsequent blockchain games.

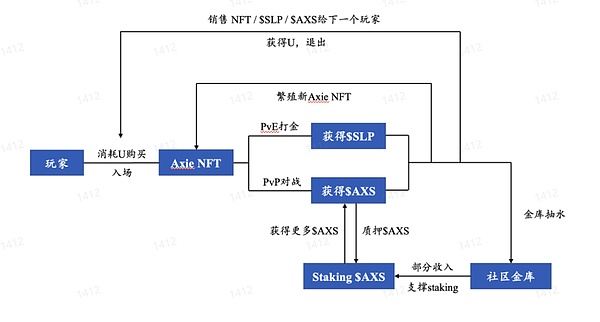

Axie presents the game’s roles (pets named Axie used for fighting) in the form of NFTs. These NFTs are game tickets with different attributes. A player needs to carry three Axies for each battle. Winning the battle will reward players with SLP or AXS tokens. The game has two modes: adventure mode (PvE) battle, and winning players can get SLP rewards; arena (PvP) battle, winning players can get AXS rewards, and players ranked high on the leaderboard can get extra AXS.

Axie inherits the breeding mechanism from CryptoKitties: Axie can breed with each other to cultivate new Axie NFTs. The new Axie is the same NFT asset with the same function, and its attributes are a random combination of the parent NFT attributes; breeding new NFTs requires both AXS and SLP, and a player can breed up to 7 new Axies, and the SLP required for each breeding will increase. The amount of AXS consumed is constant.

In summary, there are three ways to obtain Axie: official pre-sale, secondary market purchase, and breeding with existing NFTs.

Essentially, Axie is a model of dual FT tokens + NFT:

From the perspective of an ordinary player, the player’s path to playing Axie is as follows:

Entry: The player consumes U to purchase the game NFT to enter the game

Game: PvE battles to earn SLP; PvP battles to earn SLP, and high-ranking players win AXS.

Consumption/Reinvestment: Players can use the NFTs purchased initially to breed new NFTs, while consuming a certain amount of SLP and AXS; players can pledge AXS to obtain AXS rewards supported by the treasury income.

Exit: Sell game NFTs, SLP and AXS tokens on the secondary market.

Considering the entire Axie ecosystem as a system, its capital input is the player’s capital input, and new players take over the game assets sold by exiting players and input new capital. The capital output is the capital that players sell assets when they exit, and the community treasury pays capital to the outside world for development.

Based on maximizing personal benefits, the player’s best strategy is to: sell the earned tokens directly when the token is expensive, and then sell the NFT after earning a certain amount of tokens; or take the breeding route, consume tokens to breed NFTs, and use more NFTs to earn more tokens in the future, and then sell NFTs after earning a certain amount of tokens. When NFT is expensive, consume tokens to breed NFTs and sell NFTs directly.

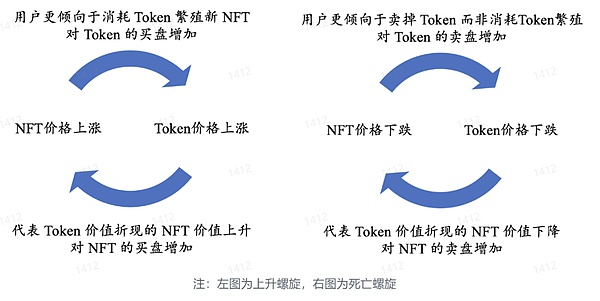

The Axie Ponzi structure is very obvious, manifested in a significant spiral effect – the price trend of the two assets reinforces each other, leading to easy and rapid spiraling up and down of game asset prices.

-

When the growth of game players accelerates, the demand for game assets continues to rise, and the transaction price of game assets for exiting and entering players rises, the game market value correspondingly rises, the gold farming income increases, forming a positive feedback;

-

When the growth of game players slows down, the demand for game assets decreases, and exiting players need to sell assets at a discount, the game market value is pulled down by the transaction price, the gold farming income decreases, the market spirals down, and the game lifecycle is basically declared over.

STEPN: Move to Earn Flourishes Gamification Finance

STEPN is an attempt to extend the gamified decentralized model to other fields. It was originally created on the Solana public chain and won fourth place in the Solana hackathon chain game category, which attracted early attention. The biggest “selling point” of STEPN is that it combines GameFi with offline sports – they call it the Move To Earn mode. After users download the app and register successfully, they create a new in-app wallet, transfer cryptocurrencies SOL or BNB to the wallet, purchase a pair of NFT virtual sports shoes, and start earning money by running outdoors.

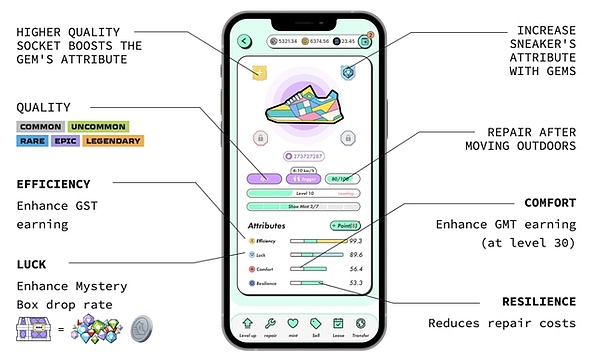

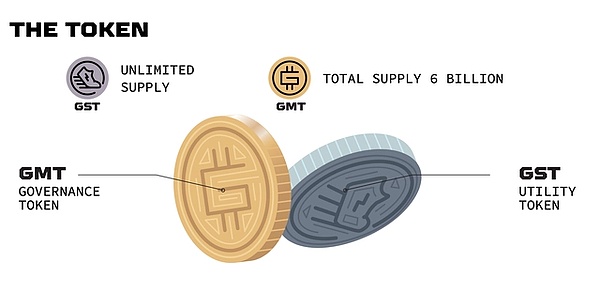

The amount of money earned depends on the user’s exercise and shoe factors . Shoes have different attributes, types, qualities, and levels. Users can earn unlimited issuance of game tokens GST by running within the effective energy time range corresponding to different shoes based on the pace interval. They can be used to upgrade sports shoes and gems, unlock slots, forge new shoes, or directly exchange them for stable coins.

Sneakers include 4 types: Walker, Jogger, Runner, and Trainer, each corresponding to different paces and basic returns. The quality of shoes includes: common, rare, epic, and legendary, and players will use different colors to represent them: gray shoes represent common, green shoes represent rare, blue shoes represent epic… After the shoes reach a certain level, players can unlock corresponding gems and slots to improve the attributes of the shoes, including efficiency, luck, comfort, and elasticity. In addition, the quantity of shoes will also affect the income of GST. Generally, players will adopt the combination of “quantity + quality” of shoes to maximize token income, such as “one green and eight gray”.

STEPN has a breeding mechanism. If you have multiple pairs of shoes, every two pairs can be used to mint new shoeboxes, similar to blind boxes, where new shoes can be opened. The minting process will consume a certain amount of GST. The new shoes can be traded for profit. When a user’s sports shoe level reaches level 30, they are eligible to receive governance token GMT. In addition to upgrading sports shoes, permanently increasing the success rate of gem synthesis, and other functions, GMT can also participate in project voting by pledging and unlock more gameplay. Corresponding to the infinite increase of GST, GMT has a limited issuance and the quantity issued each time decreases. In summary, for ordinary users to play STEPN chain games, the entry ticket is NFT virtual shoes, the real-world application scenario is outdoor running, and the income is GST or GMT. As for how much profit, it depends on the player’s strategic ability.

In terms of gameplay and mechanics, STEPN has two main innovations: the first is that it sets more adjustable parameters to bring the flexibility of Ponzi structures. Whether it is the type of shoes, quality differences, durability and repair mechanisms, or the choice of efficiency, luck, comfort, and elasticity, all allow STEPN to have more macro control over the game. The second is that it raises the threshold for starting mining — GMT, the appreciation currency, can only be mined at level 30, and before that, only GST can be mined. With the same model of dual FT tokens + NFT, this design allows STEPN to crush Axie. The setting of the threshold blurs the player’s calculation of the return cycle and increases the player’s investment, correcting the player’s idea of maximizing “free riding.”

The inspiration brought by STEPN is not only this – it should make us see that a GameFi model can bring new changes to a specific industry. The walking (health) industry has always had no lack of attempts. Broadly speaking, we can also call them zero-coin GameFi. The earliest entrant was WeChat Mini Program Step Treasure. This is a genius design: users earn points by walking, and points can be exchanged for goods in the mall. The clever part is that the goods are zero-cost – because the traffic of this small program is very large, merchants are willing to provide hundreds of small items for a few million people to see their things. What if a user likes it and searches for it on Taobao? After Xiaomi’s balance car was released, it was also hung up immediately. Is there any other way to let tens of millions of people see that Xiaomi has released this new product with the cost of a balance car? Step Treasure once had a daily active user of 30 million, second only to some small programs of very large Internet companies, and was very popular for a while. But the failure of the listing caused Step Treasure to give up its bigger dreams and focus on doing traffic monetization business. Now, the Step Treasure page is full of small advertisements. Later, QuStep began to try to make Step Treasure into a point-based system, and QuStep chose to make an independent APP. But its rough economic model could not support their ambitions, and QuStep was revoked its license a year later.

03/ Ponzi Structure is a Double-Edged Sword

Although it is said that the later generations push the former generations forward, the beach is full of the corpses of the later generation GameFi. After being tested by time, many DeFi economic models have achieved long-term stable operation, successfully achieving incentive compatibility, and even having local optimal solutions – VE architecture; but in contrast, the economic models of GameFi are still in the exploration stage. We have not seen very good models combined with games. At first glance, it is densely written with P2E.

Let’s first look at DeFi, the “predecessor”. In the introduction article “Tokenomics, the Economic Order of the Cryptographic World” about Tokenomics by Buidler DAO, we divided the incentive layer of DeFi, which is the architecture layer that balances the Token cycle between the project party and users, into three categories: governance mode where tokens only have governance functions for the protocol (such as UNI); staking/cash flow mode where tokens can bring continuous cash flow (such as SUSHI); staking tokens to obtain custody tokens veToken, and promote LP earnings through veToken voting custody mode (such as CRV). From the perspective of the time of appearance, the three governance tokens have obvious iterative relationship: the later is the iterative upgrade of the former – gradually becoming more attractive in value capture and incentive effects. From the results, capital is more sensitive to mechanisms than participating parties such as miners and users. Curve’s voting custody mechanism gradually became the most popular model, and a large number of DAO projects, even Buidler DAO itself, adopted the VE architecture. In “In-Depth Analysis of the Mechanism and Innovation of veToken Economic Model with Thousands of Words”, we elaborated on the development history and design formula of the VE architecture in detail.

Turning back to look at the “later generation” GameFi, can GameFi find an optimal solution like DeFi? It is much more difficult. DeFi can be clearly divided into business layer and incentive layer, because DeFi is essentially a usable on-chain tool. The usable attribute of DeFi is the business layer, such as the lending protocol itself, the AMM market-making protocol itself, etc.; while the mechanism that cleverly allows users to choose to stake rather than sell the tokens they hold, and allows the system to enter Nash equilibrium, is the incentive layer.

As long as DeFi is a rigid demand, it does not need to overdraw a large amount of future Tokenomics (or debt) to obtain initial traffic. DeFi can easily stay away from strong Ponzi structures.

Unfortunately, games cannot become a rigid demand. The premise of getting addicted to a game is that you have to play the game first. This is a dead end. How to break the deadlock? Buy traffic. Traditional games roughly have to spend twice the development cost on flow promotion. P2E (Play to Earn, the same below) GameFi takes a different approach. They don’t spend wrong money on flow promotion. Instead, they directly find early players and promise them “Earn” tokens – come and play, play more, earn more.

The promised tokens must be sent to the player’s account, and cannot be an empty promise. They must have value, which means there must be a buying market. The project party and the market must act as the buying market. Who is stronger between the buying and selling market? At the beginning, the buying market is stronger, but gradually, because the distributed tokens will grow into the opposing market, once new users decrease or profits decrease, players will rush to sell game assets and trading volume will exponentially decline. This is what we call a strong Ponzi structure. This is the reason why P2E is short-lived and the cause of the “death spiral” phenomenon encountered by Gamefi in practice.

The Ponzi structure, which is defined in game theory, has two NE (Nash equilibrium): one is that everyone chooses to trust and invest, and the other is that everyone chooses to distrust and squeeze out at the appropriate time. The former is the spiral upward process of Ponzi, and the latter is the inevitable “death spiral” of the Ponzi structure – the “squeeze out” process (this is very common, such as commercial banks facing a run at the end of the credit cycle). I will explain the Ponzi structure in detail in my later article “Ponzi Structure – The First Principle of Economic Models”.

Most GameFi users are speculators, and they are very clear that they are playing a Ponzi game. A very small number of them may choose to hold game assets for a long time because they really like the game, but they are more likely to hold NFTs because they are breeders or gold farmers. When they encounter suitable opportunities or capture dangerous signals, they will not hesitate to choose to sell. Let’s draw a game for users when they encounter opportunities to sell:

04/ How GameFi Achieves a Good Nash Equilibrium

However, what we see in many Web2.0 games is not such a Nash equilibrium.

What we see is that even if skins cannot be traded, League of Legends has an annual revenue of up to $12.4 billion, King of Glory’s monthly profit-making ability is as high as $200 million, surpassing most A-share listed companies; what we see is that NetEase’s “Fantasy Westward Journey” still has tens of thousands of players addicted to it, and those who consume more than tens of thousands are just considered younger brothers, the most expensive equipment can be sold for 10 million yuan; what we see is that Dota2, whose equipment can be traded, has been dominating the e-sports prize money list for years, with a prize pool of $40 million for Ti10 (The International, global finals), and such a prize pool is accumulated only by global players buying “little books” containing skins – Ti Handbooks.

Why does rational gaming fail at the head of Web2.0 games? Because games have always been the “black hole of rational people assumptions”. Classical game theory holds that people who are emotionally hijacked are not rational people, so they are not the subject of game theory research; while the new developments in game theory also regard people’s emotional expressions – as long as they appear stable in the long term – as Nash equilibrium of the game.

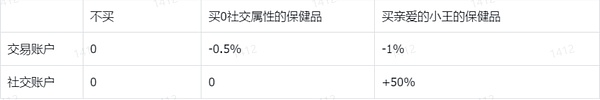

As long as we change the “rational” standards of various strategies from “transaction accounts” to “social accounts”, irrationality disappears. When an old person is coaxed and asked about their health by a young salesperson and buys health products at twice the market price, this seems irrational: not buying health products does not cost money, buying cheap health products costs -500 yuan, buying Xiao Wang’s health products costs -1000 yuan, and the old person chooses the worst strategy. But what if the elderly person is not sensitive to transaction accounts but sensitive to social accounts? What if the elderly person thinks that, as they get older, money is something outside of them, and spending a little money on health products to extend their life is normal? We show the corresponding gains and losses in percentage terms. Suppose an old person has a savings of 100,000 yuan:

The loss of the transaction account for the elderly is only a small part, and this small part is likely to be reserved in their minds to spend; but they gain a lot of social gains. Xiao Wang chats with them and asks about their well-being, and this companionship increases their quality of life by 50%. They are happy, and it is worth it.

Isn’t this also true for luxury goods and live streaming platforms? Nowadays, many people spend their days in the live broadcast room of the famous LOL anchor Da Sima, constantly changing their Douyu ID to reward Da Sima just to hear him read their cleverly designed homophonic ID puns. One hundred yuan for a plane, just to hear him read it once. Under the capitalist system, the way to accumulate wealth is to exploit surplus value. The accumulation of surplus value is non-linear and follows the Matthew effect. The more surplus value is accumulated, the higher the person’s desire to show off, because his trading account has almost no impact on him – I spent 100 yuan to reward the anchor, which is less than 0.001% of my total assets; but I achieved show off and social satisfaction, my social account surged by 70%. Live streaming platforms and luxury goods seem to have no connection, but they both use this kind of show-off psychology.

This is exactly how games should be. When we emphasize the metaverse and Web 3.0, we forget that the excellent games of Web 2.0 have established a strong moat that immerses players. Single-player games on Steam have successfully shaped immersive worlds, extending people’s lives like movies. Online games have made great strides in socializing: League of Legends and Glory of Kings players cannot resist giving their favorite heroes the best-looking skins, even if these skins cannot be traded. You may ask: Since skins cannot be traded, can I get my investment back if I don’t play the game and sell the account later? Although this is true, many years later, even if they don’t play the game anymore, it is rare to see them selling their accounts. They would rather leave them as witness to a memory. This is what the metaverse needs: identity recognition.

Game props are a kind of social currency, a kind of conventional identity recognition. Players either hope that game props can directly help them dominate the game, such as the props in Fantasy Westward Journey; or they hope that when they dominate the game in a fair game, other players will not only be amazed by their skills, but also praise their good-looking appearance. Players feel that game characters are their own mapping, an Avatar.

Our game design should make players addicted and find identity. We should deduct money from their “social account” rather than their “trading account” when they buy game assets. If we can’t do this, then our game is just a financial tool and the relationship between players and the game becomes a game between rational people. Since the structure of the game is obviously a Ponzi structure, the player’s strategy is obvious.

Strong gameplay, players play Game; weak gameplay, players play Game Theory.

From the proposal of the GameFi concept to now, three years have passed. Although three years are not enough to develop AAA-level masterpieces, decent games should have sufficient time to develop. So why hasn’t GameFi in Web3.0 been able to do this?

My answer is that there are many projects that take game development seriously, but very few projects that seriously study economic models. Too many games blindly follow market trends and blindly copy popular economic models. To design an economic model for GameFi, the first step is to clarify which type of GameFi you want to do.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- A Quick Guide to Understanding the EU’s New Concept of Web4

- In-depth analysis of MakerDAO’s RWA layout: How does the DeFi protocol integrate real-world assets?

- After launching an upgraded application, OKX Hong Kong has recorded over 10,000 new user registrations within a month.

- A Guide to Flashbots Protect Upgrade: How to Speed Up Private Transactions

- Layer1 Protocol Galactica Network Introduction: Can it fundamentally solve the witch attack problem?

- Ribbon Finance Governance Proposal: Consolidating Ribbon Finance and Aevo

- Messari: Solana’s Q2 2023 Performance