In-depth analysis of MakerDAO’s RWA layout: How does the DeFi protocol integrate real-world assets?

Analysis of MakerDAO's RWA integration in DeFi.MakerDAO, one of the largest DeFi projects, is currently the best example of combining Tradfi and DeFi. In the future, we expect to see more protocols and projects incorporating RWA into their balance sheets for diversified asset allocation. Compliant asset issuers will be indispensable, and better on-chain/off-chain governance structures will gradually be discovered and explored.

TLDR

Fixed-income products were the first to break out in Web3, driven by treasury management of DAOs and Web3 companies. The RWA track currently occupies the top spot in TVL, with tokenized national debt projects leading the way. Combining RWA allows DAO organizations to retain highly liquid assets while generating stable, low-correlation returns to diversify risk and achieve higher quality income. The governance and operation of DAOs is not more efficient than that of traditional corporate structures. MakerDAO had to use a complex trust structure to buy national debt ETFs through its DAO, at a high cost. By contrast, it is more efficient and feasible for professional/compliant asset issuers to tokenize RWA and have DAO organizations purchase them.

RWA Enters Crypto Mainstream

Against the backdrop of the crypto winter and US dollar interest rate hikes, a new round of DeFi innovation is coming. Native DeFi protocol returns have plummeted, with stable returns even lower than US bond yields – the so-called “risk-free rate”. Many DeFi projects are turning their attention to real-world assets (RWA) outside the crypto world. MakerDAO was the first major DeFi protocol to enter the RWA race. As early as 2020, MakerDAO built an RWA vault using 6s capital, a real estate development collateralized loan project, and worked with RWA-based lending platform Centrifuge to tokenize collateral. MakerDAO lists this token as one of the collateral for the stablecoin Dai, achieving diversification of collateral composition. MakerDAO’s Endgame plan, released in May 2022, emphasizes that one of the key parts of MakerDAO’s construction of a decentralized stable currency is to use RWA as collateral.

Recently, major DeFi protocols have been laying out in the RWA track. In June 2023, Compound founder Robert Leshner founded a new company called Superstate and submitted an application to the SEC to create a short-term US bond fund on Ethereum. MakerDAO’s MIP65 (MakerDAO Improvement Proposal, “MIP”, MIP65 proposes to deploy part of MakerDAO’s funds to invest in short-term bond ETFs) was approved in May of this year, increasing the cap of the vault from $500 million to $1.25 billion and purchasing the corresponding amount of bond ETFs in the coming months. In addition, many traditional financial giants, including Goldman Sachs and Citigroup, have expressed a keen interest in the RWA track, and many have already entered the field.

- After launching an upgraded application, OKX Hong Kong has recorded over 10,000 new user registrations within a month.

- A Guide to Flashbots Protect Upgrade: How to Speed Up Private Transactions

- Layer1 Protocol Galactica Network Introduction: Can it fundamentally solve the witch attack problem?

Why now?

As early as 2018, STOs (Security Token Offerings) as a subset of RWA once caused a craze in the market, but it ended fruitlessly. Today, RWA narratives are gradually heating up. Why is this the time? What is driving the development of the track?

-

Infrastructure perspective: DeFi infrastructure is gradually improving. Relevant token standards, oracles, and peripheral development tools are more complete and have the ability to connect on-chain and off-chain;

-

Asset and income perspective: Web3-native assets have reached a bottleneck, and assets are basically homogenized; in the bear market, on-chain activities are sluggish, and there is a lack of native Web3 stable sources of income;

-

Narrative perspective: After the collapse of CeFi, investors pay more attention to risk control and compliance; the traditional financial field is highly compliant, and RWA assets provide investors with more protection than Web3-native assets;

-

Regulatory and regulatory perspective: Regulation is constantly expanding its boundaries, and cryptocurrency-related laws and regulations are gradually improving;

In the previous round of the market, RWA platforms with similar models took shape, such as Maple Finance, Clearpool, TrueFi, etc. The basic model of these platforms is to open a lending fund pool for some institutions through community governance, and users invest in the fund pool to obtain a pre-agreed rate of return. The institution can use the funds for relevant investment operations and issue interest and principal according to the agreement. However, early RWA platforms lacked compliance processes and risk management. After the Luna and FTX crashes, some borrowers went bankrupt, resulting in serious losses to investors.

Figure 1: Active borrowing amount of RWA lending agreement, source: rwa.xyz, data as of 2023.07.06

As can be seen from the above figure, before the Luna crash in 2022, the borrowing amount reached its peak, and the borrowing volume plummeted thereafter. In the second half of 2022, due to the Luna and FTX incidents, Clearpool and TPS Capital suffered the most severe losses, both of which had major mistakes in compliance processes.

TPS Capital and Clearpool started cooperation in the second quarter of 2022, establishing a lending fund pool on Clearpool. TPS Capital claimed to be independent of Three Arrows Capital (which went bankrupt after the Luna incident). But the court documents prepared by the liquidator of Three Arrows Capital show that the relationship between the two is quite close and complex, and Three Arrows Capital is actually the guarantor of TPS Capital, providing guarantees for the loans that TPS Capital defaulted on later.

In June 2022, Clearpool removed the lending pool of TPS Capital, and X-Margin, Clearpool’s data partner, downgraded TPS Capital’s rating to B and reduced the borrowing limit to $0. Clearpool and X-Margin announced that they would work together to ensure that TPS Capital repays its borrowed funds and to ensure that users do not suffer losses.

Before the avalanche, the world was silent until the last snowflake fell. The loss of tens of millions of dollars is a tragic lesson, and it makes developers who want to participate in the RWA track pay more attention to risk control, compliance processes, and legal frameworks.

What is RWA?

RWA refers to assets that exist outside of the blockchain but can be tokenized and combined with existing DeFi protocols in a certain way. Currently, the main types of RWA projects are focused on the following:

-

Bonds, including private bonds, corporate bonds, and government bonds

-

Equity

-

Real estate

-

High-value collectibles

-

Carbon credit points

We believe that bond-type products, including government and corporate bonds, will be the first to enter DeFi, with demand mainly from DeFi protocols’ adoption of RWA and Web3 protocol treasury management. According to DefiLlama data, the top two RWA projects by TVL are the US bond tokenization platforms (OpenEden and MatrixDock), followed by real estate-related RWA platforms (Tangible and RealT). However, with a total volume of billions of dollars, it is still relatively small compared to the entire Tradfi field and even the DeFi field, and there is huge room for growth.

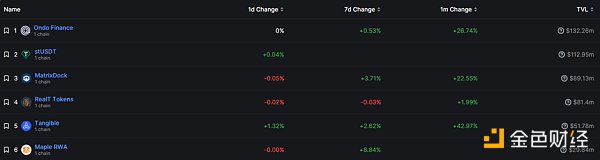

Figure 2: RWA project TVL, source: DefiLlama, data as of 2023.07.10

The driving force behind RWA

Overall, existing DeFi protocols mainly apply RWA assets in three ways: 1) treasury fund management, with some of MakerDAO’s RWA demand coming from this; 2) used as collateral, such as MakerDAO and Solana’s stablecoin protocol UXD Protocol; 3) introducing new asset types for DeFi scenarios, such as Curve (MatrixDock STBT) and Flux Finance (Ondo Finance OUSG).

DeFi protocols introduce RWA assets from a variety of sources, including:

-

On-chain asset management demand

-

On-chain asset management seeks stable returns and good liquidity. Real-world products such as government bonds are widely recognized investment targets with relatively stable returns and very good liquidity, belonging to the category of assets with a market value of trillions of dollars.

-

Alternative sources of income

-

On-chain native income mainly comes from Staking/Trading/Lending. When the crypto market is highly volatile, a downturn in on-chain financial activity will lead to a decline in returns. For example, under current market conditions, mainstream on-chain platform returns are even lower than US government bonds. If seeking alternative income with low correlation to on-chain native assets, introducing RWA-related assets is undoubtedly a good choice.

-

Diversified investment portfolio

-

On-chain assets are relatively single and have high correlation and high volatility. Introducing more stable RWA assets with low correlation to on-chain native assets can achieve hedging purposes and form more diversified and effective investment portfolio strategies.

-

Introducing diversified collateral

-

The high correlation of on-chain assets makes lending protocols prone to runs or large-scale liquidation, further exacerbating market volatility. Introducing RWA assets with low correlation to on-chain assets can effectively alleviate such problems.

Let’s take MakerDAO as an example to analyze in detail how DeFi protocols apply RWA (as collateral).

Deep Analysis of MakerDAO RWA Application

MakerDAO is a decentralized autonomous organization (DAO) that aims to create and manage the Ethereum-based stablecoin Dai. Users lock Ethereum (ETH) as collateral to generate Dai stablecoins. The goal of Dai is to maintain a 1:1 anchor relationship with the US dollar and stabilize its value through smart contracts and algorithms. Due to the high volatility of the cryptocurrency market, a single collateral can easily lead to large-scale liquidation, so MakerDAO has been trying to diversify its collateral, and introducing RWA is an important means, even written into the Endgame plan proposed by MakerDAO Co-founder Rune Christensen.

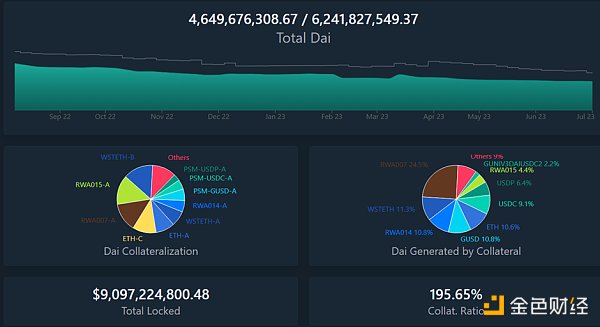

Figure 3: Current state of Dai, source: daistats.com, data as of July 10, 2023. The figure shows the current total amount of Dai (about 4.65 billion), and the upper limit set by MakerDAO is 6.2 billion. Currently, the collateral composition of Dai has achieved relatively diversified, including some RWA and various stablecoins.

Risk of single collateral

On March 12, 2020, the financial crisis caused by the epidemic led to the collapse of the financial market, and the US stock market has been continuously suspended. As a marginal subdivision market of the financial market, the cryptocurrency market has plummeted rapidly, and MakerDAO, as one of the top DeFi protocols on the Ethereum chain, has also been greatly impacted. On the one hand, due to the limited capacity of the Ethereum network and network congestion, liquidators are unable to liquidate risk accounts in a timely manner; on the other hand, some borrowers of stablecoin Dai need to purchase Dai to repay their debts and withdraw collateral assets, resulting in an increase in market demand for Dai, further increasing the difficulty of liquidation. Under multiple factors, MakerDAO had bad debts of up to 5.67 million US dollars. Finally, MakerDAO had to raise 5.3 million US dollars by issuing 20,980 MKR tokens in late March 2020 to make up for the bad debts.

MakerDAO Endgame Plan

After experiencing such events, MakerDAO has continuously tried to diversify its collateral. The goal of the MakerDAO system is to gradually establish a decentralized stable currency, and to build a currency system, it is necessary to use assets currently having consensus as collateral and borrow their credit. Native cryptocurrency is naturally an important part of collateral, but essentially native cryptocurrency assets are highly correlated, and it is difficult to achieve collateral diversification only through cryptocurrency assets. To diversify the risks of the current cryptocurrency market, MakerDAO introduced some RWA assets as collateral for the stablecoin Dai.

MakerDAO Endgame is a series of future visions and plans for MakerDAO proposed by MakerDAO co-founder Rune Christensen in May 2022, which includes planning the path to build a decentralized stable currency. This ultimately requires two types of collateral: decentralized assets that can physically guarantee fairness and real-world assets that can provide reliable liquidity and stability. It also shows the benefits that DeFi, Maker, and Dai stablecoins can bring to the world, gradually integrating the world economic system with DeFi and adopting Dai as a payment and settlement tool.

The Endgame plan is divided into three stages, and the three stages are divided based on the composition of collateral, ultimately creating Dai as a stable currency:

-

Dovish (current state): There are no restrictions on RWA as collateral, and the Dai stablecoin is anchored to the US dollar.

-

Hawkish: The target interest rate of Dai is negative, and it floats freely.

-

Phoenix: There are no other types of RWA in the collateral of the Dai stablecoin except for RWA with physical elasticity.

Specific plans have been designed for each stage corresponding to the specific ratio of collateral, which can be referred to in the original text and will not be repeated here.

Current components of MakerDAO RWA:

Throughout the history of currency, the currencies adopted by humans have evolved from commodity money in the early days, using scarce resources that form a consensus as an equivalent, such as shells and gold, to later issuing paper money with scarce resources that have reached a consensus as collateral, such as issuing paper gold with reserve gold, and later developing credit currencies based on military power, such as the US dollar. Although Dai of MakerDAO has a volume of tens of billions, it is still a drop in the ocean from a larger perspective. It needs to borrow the credit of other assets and highlight its own advantages to gradually consolidate its position. In the Endgame plan proposed by the co-founder of MakerDAO, RWA is also introduced as a transition: in a world of encrypted assets that is not yet solid enough, real-world assets are needed as anchors. According to MakerBurn’s data, there are currently a total of 11 RWA projects, with $2.12 billion in assets as collateral for MakerDAO.

MIP65, named Monetalis Clydesdale, was proposed by Allan Pedersen, the founder of Monetalis, in January 2022, and was passed and implemented in October 2022. The goal is to invest a portion of the stablecoin held by MakerDAO in high-liquidity, low-risk bond ETFs. The initial debt ceiling is $500 million, and the ceiling will be raised to $1.25 billion through subsequent proposals in May 2023.

In MIP13 proposed in February 2022, the community discussed that about 60% of MakerDAO’s balance sheet assets were various stablecoins (to ensure the value stability of Dai through the Peg Stability Module (“PSM”) mechanism, with USDC as the main reserve), and over the past 18 months, more than 50% of the assets were stablecoins, but they did not generate profits for MakerDAO. The counterparty risk mainly comes from Circle (the issuer of USDC). The community hopes to invest stablecoins in some way to generate profits and diversify risks, including the idea of investing in short-term US Treasury bonds.

Later, among the MKR token holders who participated in the voting of MIP65 proposal, 71.19% supported the proposal, and it was finally passed. MIP65 will launch an RWA-related treasury, and the funds in MakerDAO’s PSM mechanism will be invested in high-liquidity bond strategies through trust.

Monetalis is a consulting company founded by Allan Pedersen and Alessio Marinelli, providing consulting services and solutions for traditional finance and DeFi institutions. Both founders have extensive experience in traditional finance, consulting, and venture capital institutions. Monetalis’ investors include UDHC, Dragonfly, and MakerDAO co-founder Rune Christensen.

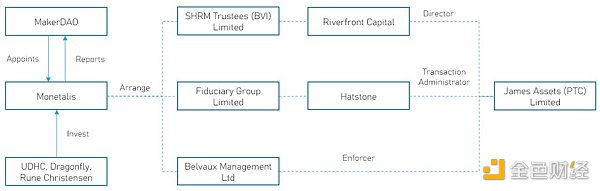

The overall business architecture of the proposal is as follows:

-

MakerDAO delegates Monetalis to design the overall architecture through voting, and Monetalis needs to periodically report to MakerDAO.

-

Monetalis is the project planner and executor, designing the overall trust architecture, including:

-

Riverfront Capital (SHRM Trustee (BVI) Limited) is the only director.

-

Hatstone (Fiduciary Group Limited) serves as the transaction manager, and the trust transactions need to be approved by the company.

-

Belvaux Management Ltd serves as the trust executor to ensure that the trust operates according to its objectives.

-

MakerDAO MKR token holders are the overall beneficiaries and can instruct the purchase and disposal of trust assets through governance.

-

James Asset (PTC) Limited (“JAL”) is the trustee;

-

Coinbase provides exchange services for USDC and USD.

-

Sygnum Bank provides trading and custody of trust assets and sets up an account for trust operating expenses.

-

The funds are used to invest in two types of ETF products, namely, Blackrock’s iShares US$ Treasury Bond 0-1 yr UCITS ETF and Blackrock’s iShares US$ Treasury Bond 1-3 yr UCITS ETF.

Where:

-

JAL is a shell company that holds the trust, and is a newly established company in the BVI.

-

Riverfront Capital (SHRM Trustee (BVI) Limited) is a company established in the 1990s that provides professional trust services.

-

Hatstone (Fiduciary Group Limited) has over USD 1 billion in total assets and provides fund management, corporate services, and fund investment services.

-

Monetalis, as the project manager under MakerDAO’s delegation, sets up the overall architecture. Monetalis’ situation will not affect MakerDAO’s assets. Monetalis receives a management fee of 0.15% per year, payable quarterly.

-

Sygnum Bank is the world’s first regulated digital asset bank and a global digital asset expert headquartered in Switzerland and Singapore. Its products include regulated cryptocurrency transactions. With Sygnum Bank AG’s banking license in Switzerland and Sygnum Pte Ltd’s capital market services (CMS) license in Singapore, Sygnum enables institutional investors, qualified private investors, corporations, banks, and other financial institutions to invest in the digital asset economy with full confidence.

Figure 8: Monetalis project trust architecture, source: DigiFT Research

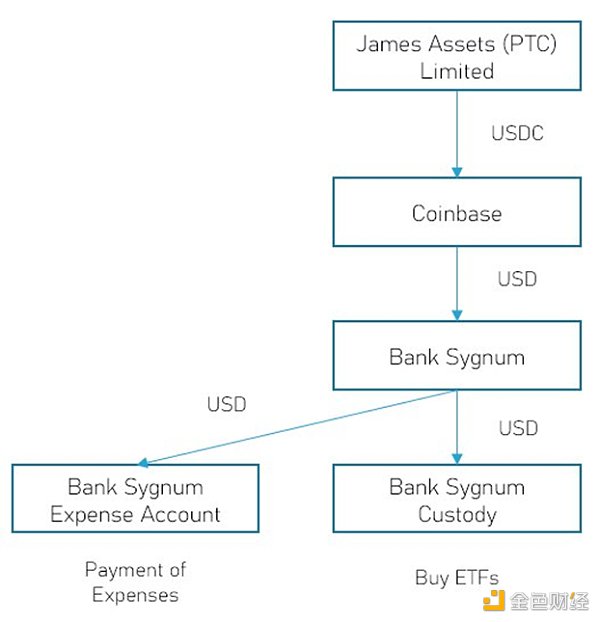

The purchase process is shown below:

Figure 9: Trust operation process diagram, source: DigiFT Research

JAL is the holder of various bank accounts. Each transaction is initiated online and requires approval from Riverfront Capital (JAL’s sole director) and Hatstone (JAL’s transaction manager). With this legal framework design, MakerDAOMIP65 can achieve the following goals:

-

Third parties or Monetalis cannot change the legal terms and conditions or access related funds.

-

MakerDAO MKR holders can trigger liquidation through community voting and governance via the trust.

-

No single third party can hinder MakerDAO’s governance of the trust or modify the terms and conditions.

-

There must not be any obvious weaknesses or special circumstances that would allow funds to be misappropriated.

-

The trust structure must be defined to purchase only specified types and amounts of assets.

To achieve DAO-held RWA, MakerDAO has designed a complex trust structure and new legal regulations, which come with high costs, including an initial $950,000 for various expenses and ongoing payments to Monetalis, the trustee and project manager for the trust.

Additionally, in the latest community proposal from MakerDAO, Project Andromeda was proposed by community members at the end of May. BlockTower would act as project manager, purchasing short-term US Treasury bonds with a debt ceiling of $1.28 billion in Dai to further increase MakerDAO’s investment in RWA. BlockTower has collaborated multiple times with Centrifuge and MakerDAO, and the team has extensive experience in traditional finance. With the process run by Monetalis in place, if the MakerDAO community wishes to increase its investment in RWA alone, this proposal is likely to be approved.

Tokenized Assets Included in DeFi Protocol – MakerDAO <> Centrifuge

Centrifuge is a decentralized lending platform that provides a series of smart contracts to create a transparent market for RWA assets without unnecessary intermediaries, enabling decentralized financing for RWA assets on the chain. The ultimate goal of the protocol is to reduce borrowing costs for companies while providing a stable source of collateralized revenue for DeFi users.

Figure 10: Centrifuge Fund Flow, Source: Centrifuge Documents

Actually, the process of issuing assets on Centrifuge is similar to the process of issuing Asset-Backed Securities (ABS). The fund flow process is as follows:

-

The asset originator (such as BlockTower) creates a special purpose entity (SPV) as the issuer for each fund pool, which serves as an independent legal entity for each fund pool. Centrifuge’s contract creates the corresponding fund pool on Ethereum and associates it with the corresponding SPV.

-

Borrowers decide to use some real-world assets as collateral for financing, such as invoices or real estate.

-

The asset originator issues RWA tokens corresponding to the collateral, verifies them, and mints corresponding NFTs as on-chain collateral.

-

Borrowers and SPVs agree on financing terms. The asset originator locks the NFTs in the Centrifuge fund pool associated with the SPV and extracts Dai from the pool’s reserves. Dai can be transferred directly to the borrower’s wallet or converted by the SPV into dollars and transferred to the borrower’s corresponding bank account.

-

Borrowers repay the financing amount and fees on the NFT maturity date, choosing to repay directly in Dai on-chain or through bank transfer, which is then converted by the SPV into Dai and paid to the Centrifuge fund pool. Once all NFTs are fully repaid, they are unlocked and returned to the asset originator and can be destroyed.

SPV is created by the asset sponsor, and the borrower is generally business-related to the asset sponsor.

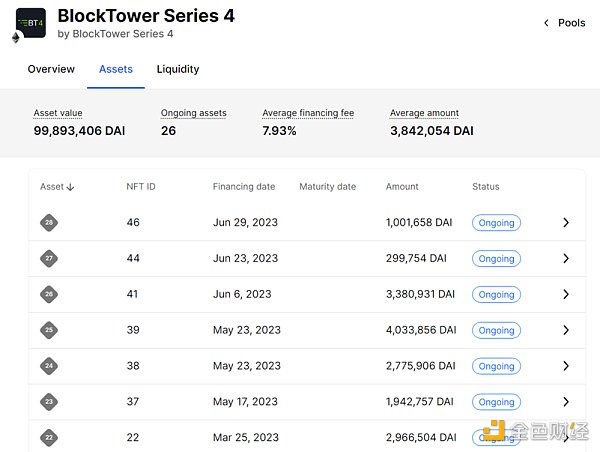

Figure 11: Centrifuge BlockTower series 4 parts assets, source: Centrifuge

The figure shows a screenshot of the Centrifuge App page, BlockTower Series 4, with a list of NFTs that serve as on-chain collateral. Each NFT corresponds to a verified off-chain real-world asset by an asset sponsor, in this case, a structured loan.

Centrifuge provides a tool and marketplace for projects/users who need to purchase RWA directly, embedding assets in the DeFi world, and providing higher yields than the general market. However, it also carries some risks from borrowers, who are counterparties.

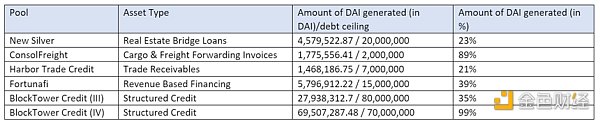

Data: The type and quantity of Centrifuge platform assets purchased by MakerDAO, and the number of Dai issued using them as collateral, source: Daistats, data as of July 10, 2023.

Currently, MakerDAO has adopted several borrowing data from Centrifuge, and compared to national bond projects, RWA tokenized through Centrifuge is relatively small in size, with the largest BlockTower as a whole just reaching tens of millions of dollars. The advantage of this program over MakerDAO’s direct purchase of national bonds is its simple process and the absence of complex legal structures. In recent community discussions, Centrifuge will charge a fee of 0.4% to help these projects obtain loans, and MakerDAO does not need to bear any additional costs. However, these projects have a higher default risk than national bonds, resulting in greater counterparty risk overall.

Conclusion

As one of the largest DeFi projects, MakerDAO has tried two forms of RWA-related community operations in recent years: direct purchase and holding of assets through DAO + trust (MIP65), and purchasing tokenized RWA (through Centrifuge), which is currently the best case of combining Tradfi and DeFi.

Compared to smaller DeFi protocols, MakerDAO has enough financial strength to achieve direct purchase of national bonds by DAO, but the cost is high. MakerDAO has set up an innovative legal structure through a complex trust structure to ensure the safety of MakerDAO’s community assets and bring RWA income to Dai and MKR token holders. For this purpose, MakerDAO paid $950,000 in advance, and Monetalis charges 0.15% of the total amount as project management fees every year, and the other three companies involved in the trust also have corresponding expenses. According to reports, MakerDAO paid about $2.1 million in expenses in January 2023 to purchase the first phase of $500 million national bond ETF. This cost is too high for ordinary DeFi projects.

The reason for this can be traced back to the fact that the holders of MKR tokens cannot be fully mapped to the legal framework of the real world. Because they are anonymous, do not go through KYC, and belong to different countries and regions (each of which has different laws and regulations), they cannot be compatible with the existing legal framework of the real world, which ensures the security of token holders’ assets (especially off-chain assets). Therefore, such a complex legal framework was designed to achieve the purchase of national debt ETFs. Whether this legal framework will encounter problems remains to be seen.

For most DeFi protocols and project teams, they do not have the energy, resources, and ability to build a complete system. The second way to directly buy tokenized assets will be easier. If there is a compliant asset issuer (traditional financial asset issuance requires holding relevant licenses or permits), only a simple community vote is required. After purchase, the assets are saved on the chain through multi-signature and the address is made public for community supervision. The risk is more on the opposing party risk of the issuer. As mentioned in the previous article “Discussion of RWA Application Cases: 5 Attempts to Chain US Treasuries”, RWA token issuance market opportunities, in the short to medium term, will have relatively high demand for bond-type RWA. The first to emerge are national debt projects, such as OpenEden, MatrixDock, Maple Finance, Ondo Finance, etc., and according to DefiLlama data, the two largest RWA TVL projects are also national debt projects.

As DeFi development encounters bottlenecks, the DeFi community has also begun to further consider asset security issues, from only worrying about smart contract vulnerabilities in the past, to paying attention to compliant assets. Traditional finance is highly compliant. Through asset isolation, governance role allocation and isolation, process standardization, and institutional restrictions, it avoids small loopholes that may cause large-scale system risks.

In the future, we can expect to see more protocols and projects incorporating RWA into their balance sheets, realizing diversified asset allocation. Here, compliant asset issuers will be indispensable, and better governance structures that combine on-chain and off-chain will gradually be discovered and explored. Looking forward to the real-world applications of the crypto world.

References

- Overview – Maker Endgame Documentation

- Endgame Plan v3 complete overview – Legacy / Governance – The Maker Forum

Introduction to MakerDAO Collateral Onboarding – Collateral Onboarding

MIP21: Real World Assets – Off-Chain Asset Backed Lender – Legacy / MIPs Archive – The Maker Forum (makerdao.com)

RWA (Real-World Asset) in MakerDAO – Innovation and Strategy in Fintech – MakerDAO (daogov.info)

[RWA 007] MIP65 Monetalis/Clydesdale Legal Assessment – Legacy / Core Units Strategic Finance – The Maker Forum (makerdao.com)

MIP65: Monetalis Clydesdale: Liquid Bond Strategy & Execution – Legacy / MIPs Archive – The Maker Forum (makerdao.com)

[RWA007] MIP65 Monetalis Clydesdale/CES Domain Team Assessment – Legacy / Collateral Onboarding Domain Work – The Maker Forum (makerdao.com)

Real-World Asset Report – 2023-05 – Maker Core – The Maker Forum (makerdao.com)

RWA Case Study – US T-bill Tokenization | DigiFT

4,646,425,045 – Dai Stats

MakerDAO – MIP65 – Monetalis Clydesdale (dune.com)

MakerDAO – Dashboard (dune.com)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ribbon Finance Governance Proposal: Consolidating Ribbon Finance and Aevo

- Messari: Solana’s Q2 2023 Performance

- In-depth analysis of MakerDAO RWA layout, how DeFi protocols integrate real world assets

- AltLayer: How to perform decentralized Rollup state verification using Beacon Layer?

- An Overview of Decentralized Stablecoin Platform Reserve: How is Decentralized Currency Creation Achieved?

- Starbucks has been exploring Web3 for half a year. What has the Odyssey Plan done so far?

- Full Text: US announces first criminal case involving attack on DEX smart contract