Getting started with blockchain | What is blockchain, mining and trusting machines

In order to promote the public's awareness of blockchain technology and promote the research and application of blockchain service technology, the Blockchain and Intelligent Finance Research Center of Sun Yat-sen University launched the I nPlusLab blockchain blackboard newspaper column . This section will introduce blockchain related technologies and knowledge in the form of a series of tweets. This issue focuses on what is blockchain, mining and trusting machines.

First, the blockchain boom

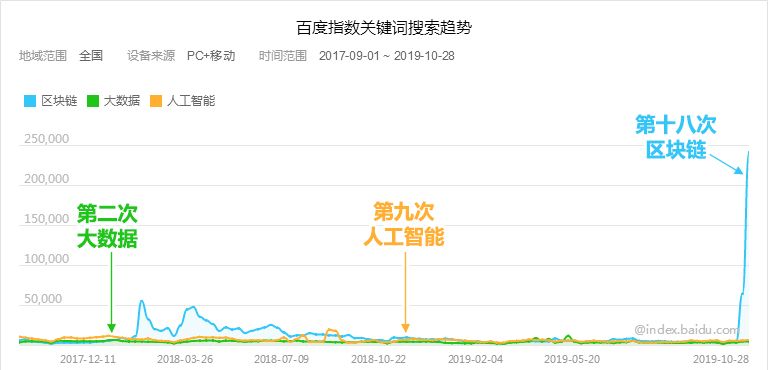

Recently, after the collective learning of blockchain technology in the central government, the blockchain has attracted great attention from all walks of life. From the following picture of the Baidu index keyword search trend, we can see that since the 19th National Congress of the Communist Party of China, in the collective learning of cutting-edge technology, the blockchain has been much more concerned by society than big data and artificial intelligence. What needs to be added is that this is not the first time that the central government has expressed concern about the blockchain. As early as the bicameral academic conference held in May 2018, the blockchain was mentioned, but at this level, the blockchain was collectively Learning is the first time.

- Observation | How Xiong'an integrates “blockchain thinking” into urban genes

- DAG: The next tipping point in the blockchain industry?

- Wuzhen Review: From Defi to MOV

In Gartner's top ten global technology trends forecast, the blockchain has been on the list for four consecutive years in 2017-2020, and the other technologies that have been on the list for four consecutive years are only artificial intelligence. So, what exactly is the blockchain? Why is it so important?

Second, the blockchain definition

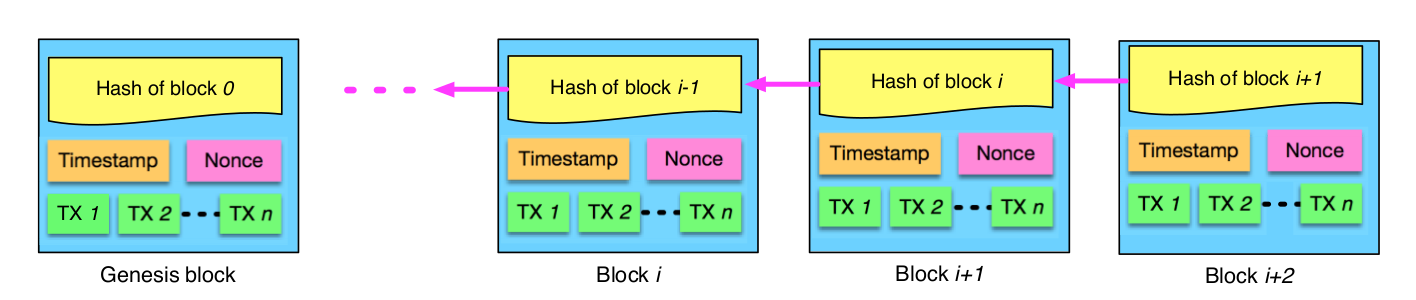

As shown in the above figure, the blockchain forms a chain structure in a chronological order in which the blocks are connected in order. The data stored in each block is data. Taking Bitcoin as an example, each block stores the entire network transfer record of the past 10 minutes of the Bitcoin network. In addition to the transaction information (TX) and time (Timestamp) with digital signature, the block also includes the feature information of the previous block. If the data of the previous block is modified, the feature information will change accordingly, and the value of the current block will not be matched, and it will be easy to be discovered. This structure is "retrospective", and all the trading history of Bitcoin is recorded in this chain, which can not be modified because of the one-stop movement. The Bitcoin network currently has about 9,400 nodes worldwide, and each node stores a complete chain (approximately 200 GB). The advantage of such distributed storage is that the data can't be falsified. A node can change the local data, but it can't be changed by others. Compared with the centralized database, this distributed accounting method makes the data on the chain more credible, and the data is difficult to be tampered with by redundant storage.

Because each account has a copy of the account, privacy is easy to leak. In order to protect the privacy of the data, the account number of Bitcoin is anonymous. Although each node knows how much money is in the account, it is not clear who the account belongs to.

Third, bitcoin mining

The Bitcoin network currently has about 9,400 nodes worldwide, and each time a transfer occurs, it is broadcast to each node. Because each node is billed separately, it is easy to bring data out of sync (such as different order, missing, etc.). Therefore, it is necessary to synchronize the data of each node periodically. Bitcoin is adopted by recommending a node every 10 minutes to package the last 10 minutes of transactions into a block, and then broadcasting the block to other nodes in the network, in this way to ensure the consistency of the data of each node.

There is a key question here. Which node do you choose to package the block? This involves the consensus mechanism of the blockchain (you need to reach a consensus on the nodes that are recommended, if some people approve, some people do not recognize it, then it is a mess) . The easiest way to think of is the lottery, but the Bitcoin network is anonymous, and hackers can easily create large numbers of accounts to increase the likelihood of being drawn. The fundamental reason why the lottery is not feasible is that it has no threshold, and the hacker can create a large number of accounts to destroy without paying the price. The core idea of solving this problem is to raise the evil cost of the bad guys. Bitcoin is solved by means of PoW Proof of Work . As the name implies, if a node wants to get a chance to pack a block, it has to pay a certain amount of work, and this kind of workload can be proved, and it cannot be falsified. For computers, the easiest proof of the workload is to calculate math problems. Analogy to the college entrance examination through the examination to recommend the right person to go to college, Bitcoin by calculating the math problem to recommend a suitable node to be responsible for packing the block. Bitcoin will hold an exam every 10 minutes, and each exam will pick the first place to be responsible for packaging and broadcasting blocks, so as to synchronize the data of different nodes in the whole network. Because this first place is obtained by the true ability, the whole network node is convinced by the winning node, thus reaching a consensus.

The problem-solving process of this math problem is very difficult. It is necessary to try to exhaust the random number. After solving it, it is easy for others to verify whether the solution is correct. In order to improve the efficiency of exhaustive random numbers, many hardware manufacturers choose to write the algorithm into the hardware chip to produce a tool that can solve problems efficiently – mining machine. Mine machines need to consume a lot of electricity, so mines consisting of mining machines are generally built in places where electricity costs are cheap (such as near hydropower stations). At present, the Bitcoin system consumes more electricity per year than the entire country in Denmark.

The node that answers the fastest answer every 10 minutes, because it provides services for the entire system (responsible for packing blocks and broadcasting to other nodes), the system will reward the node with a certain amount of bitcoin. Bitcoin presets a total of only 21 million bitcoins. In the initial system, the reward for a new block was 50 bitcoins. Later, as the remaining bitcoins became less and less, the rewards would gradually decrease. The reward process subtly solves the distribution process of Bitcoin. The system will dynamically adjust the difficulty of the problem, so that each new block will be generated in about 10 minutes. The first block will be rewarded with 50 bitcoins, and each time there will be 210,000 blocks (about 2.1 million). Minutes, about 4 years), the system will halve the rewards for the new block. That is to say, Bitcoin is the rate of issuance is slowly decreasing, and the total amount of final issuance is determined, so Bitcoin can avoid the problem of inflation. The above process of obtaining bitcoin rewards through competitive billing rights (packaging and broadcasting blocks) is commonly referred to as "mining."

Fourth, the blockchain solves the "trust problem"

According to records, 5,000 years ago, both words and currencies appeared in the Mesopotamian plains (Middle East), and the root cause was the pursuit of more efficient means of communication by humans. Words are exchanges at the spiritual level, and money is a communication at the material level. The simultaneous emergence of the two is not accidental. The emergence of money has promoted the trading of goods, and the demand for accounting for goods transactions has promoted the emergence of words. As a method of information transmission, text has experienced an upgrade from language, writing, printing, telegraph and internet in the past 5,000 years. More and more forms of communication have been adopted, and the efficiency of communication has become higher and higher. As a means of value transmission, money has experienced the development of shells, precious metals, paper money, mobile payments, and digital currency for five thousand years. Compared with mobile payment, digital currency is a more efficient means of value transmission. For example, mobile payment transfers need to go through third-party clearing institutions such as banks and Alipay, while bitcoin does not require third parties, which can achieve point-to-point direct payment. In addition, in the cross-border payment scenario, Bitcoin's cross-border transfer efficiency is much more efficient than the traditional banking system.

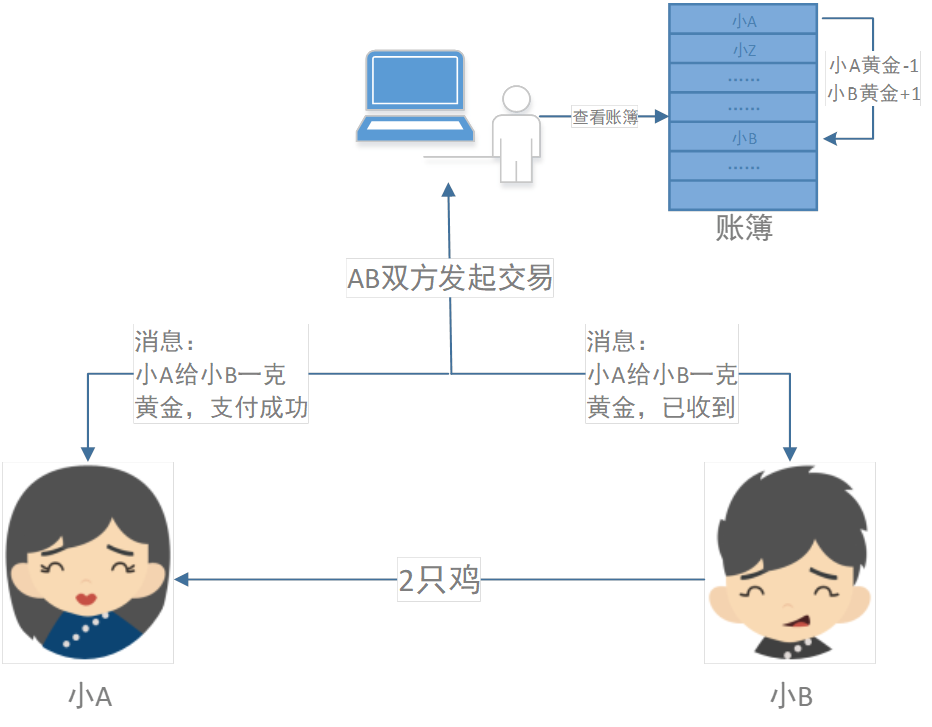

Trust is the foundation of transactions and collaboration, and it is difficult to collaborate without trust. The traditional way for humans to solve the problem of trust is to rely on third parties. For example, the production of Alipay is to solve the problem of mutual distrust between the two sides on the Internet (the buyer calls the money to Alipay, the seller sends the money to the buyer, and the buyer confirms the receipt. After the goods, Alipay pays the seller to the seller. The bank is to help two people who don’t trust each other to transfer money. The stock exchange is to help two people who don’t trust each other to trade stocks. These information/credit intermediaries use the information asymmetry and mutual distrust between the two parties to provide credit endorsement and earn service fees. The emergence of blockchains provides a second option for solving trust problems. It subtly transforms human-to-human trust into human trust in the system through technical means. It turns this trusted third party into many parties (a large number of blockchain nodes). For example, Bitcoin A transfers money to B. This transaction is recorded on the distributed network of 9402 distributed nodes. Although A does not trust B, A trusts the source code of bitcoin and the blockchain's “unable to modify”. A and B can make a transfer transaction, do not need to worry that the other party received the money and said that they did not receive it. Similar to the wedding, by asking a large number of relatives and friends to witness, so the fact of marriage can not be denied. In this way, the blockchain method of distributed accounting can support two or more people who do not trust each other to trade and collaborate, and replace the traditional third-party information/credit intermediary by technical means. Reduce the cost of solving the trust problem.

The InPlusLab blockchain blackboard section will push more blockchain science articles, so stay tuned!

——————————————————————————————————

Sun Yat-sen University InPlusLab (Blockchain and Intelligent Finance Research Center) was founded by Professor Zheng Zibin, with 11 teachers, 8 post-doctors, and more than 150 doctoral/master/undergraduate students. The team published more than 20 blockchain papers, one of which was selected as ESI Highly Cited Paper, and one paper was selected as Top20 Influential Papers in the global blockchain in 2018. The block academic paper cited more than 1,000 Google academic references; The blockchain papers were published in ICCF, WWW, INFOCOM and other CCF Class A international conferences. Four papers were published in the International Journal of the Chinese Academy of Sciences, IEEE IoTJ (influence factor 9.5), and applied for more than 20 patents for blockchain inventions. Opened a blockchain course at Sun Yat-Sen University (more than 500 students), wrote a blockchain textbook, wrote a blockchain for the central office, formed a blockchain club for Zhongshan University, and worked in several top international journals. Hosted a blockchain special issue and held the international blockchain academic flagship conference BlockSys2019.

Professor Zheng Zibin is the director of the Software Engineering Department of the School of Data Science and Computer Science, Sun Yat-Sen University, the winner of the National Outstanding Youth Science Fund, the Young Pearl River Scholar, and the Deputy Director of the National Digital Home Engineering Technology Research Center. IET Fellow, Guangdong Computer Society Blockchain Special Committee deputy director. Published nearly 150 papers, including 3 ESI Highly Cited Papers, Second Prize of Natural Science of the Ministry of Education (1st Completion), Wu Wenjun Second Prize of Artificial Intelligence Natural Science (2nd Completion), CCF Class A Meeting ICSE Best Paper Award, CCF Class B Conference ICWS Best Student Paper Award, 50 Most Influential Blockchain Paper Awards, etc., and more than 8,100 papers cited by Google Scholar.

Welcome to Sun Yat-Sen University's InPlusLab WeChat public account for more information!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Anime coin scuffle: What have you been busy with in each of these two months?

- From "after-the-fact forensics" to "synchronized deposit certificate", the change of procuratorial handling mode brought by blockchain technology

- Zhongan Technology Li Xuefeng: Based on insurance, using blockchain to innovate industrial applications

- Observation|Ternary Paradox: The Dilemma of Current Blockchain

- Viewpoint: Fuzzy of Business Boundary and Evolution of Blockchain Pattern

- Industry Weekly | Last week, 7 new financing projects in the blockchain, and 5 domestic support policies were introduced.

- Wuzhen·Huawei Zhang Xiaojun: Blockchain is to save costs, not to generate revenue