Graphic: Why is cryptocurrency investment diversified?

Source: Medium

Translation: First Class (First.VIP)

Is it the best choice to buy bitcoin in a unified investment?

- Bitcoin Core 0.19.0 official version released, what new changes?

- Sidechains and status channels that are confusing concepts: What is the difference, who is better?

- Implementing cross-chaining between Fabric, Quorum, and Corda, the integration framework for superbooks is like this

What is an effective way to diversify a portfolio of cryptocurrency assets? Can crypto assets be diversified? This is a question that many HODLers have been asking. The fall in bitcoin and other cryptocurrencies has been challenging HODLer's endurance. Although the current price of Bitcoin still maintains a 112% increase compared to the beginning of the year, the recent price adjustment has put tremendous pressure on the latecomers.

This article will examine the possibility of diversifying crypto portfolios from the perspective of HODLer, which means that funds are allocated to various cryptographic assets through a long-term strategy. We will also discuss how to balance the portfolio of altcoin and stable coins.

Why is investment diversified?

In the traditional financial world, the performance of different assets under different market conditions may vary. For example, in a volatile market, real estate investment trusts (REITs) may perform better than average stocks, and when risk tolerance increases, the yield of defensive stocks may disappoint investors. This is a diversified investment in time. The main purpose of investing in different asset classes is to balance the risks and returns in the portfolio.

In the field of cryptocurrencies, diversification is also one of the ways to manage risk. Although some would say that the cryptocurrency portfolio cannot be diversified, the main altcoin is highly correlated with Bitcoin. However, after careful study, you can still choose the “Autumn Star” with independent market and the “stable fund” with less fluctuation. Investors can participate in the market more effectively under the control of the risk.

Centralization and diversification

In some cases, focusing on only one type of investment asset can maximize profitability, but at the same time maximize risk exposure. Most importantly, under a highly concentrated investment strategy, investors must be free from any analytical errors and ensure that they are not overly exposed to unnecessary risks.

However, excessively diversified investment can also hurt the return on investment. Some investors believe that the more assets they have, the higher the return, which is not true. This investment strategy may increase investment costs and increase unnecessary investigations, resulting in risk-adjusted returns below average.

Market performance overview

Before we start diversifying our portfolio, let's quickly review the performance of the main cryptocurrency.

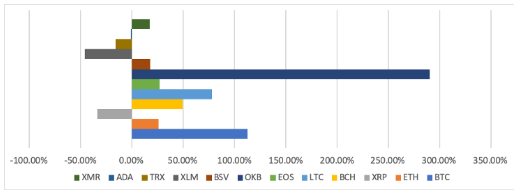

As shown in the following figure, this again shows that the performance of various crypto assets can be very different, which highlights the importance of balancing risks and rewards.

Asset allocation

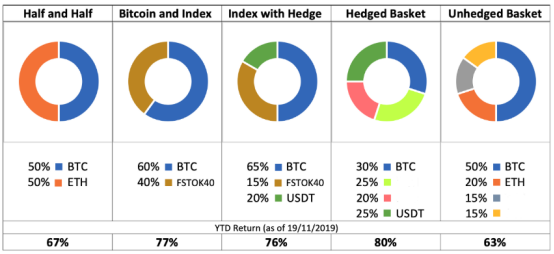

A balanced portfolio of coin and token can help HODLer balance risk and return. We use BTC to compare with other major altcoins. The Fundstrat Crypto 40 Index (a weighted index that tracks the market capitalization and liquidity of the 11th to 50th cryptocurrencies) provides some combinations. As a result, the annual yields are not very different, so some Investors will still put all their eggs in one basket.

Despite the recent adjustment in bitcoin prices, bitcoin has maintained a 112% increase so far this year, which has kept many bitcoin-based portfolios strong. However, we found that the portfolio only contained BTC and ETH underperforming (Figure 1).

At the same time, stable assets such as USDT have a hedging nature. Reducing the exposure of the altcoin has slightly increased the holdings of the BTC, which is less risky to a certain extent, but the effect of increasing the USDT in the portfolio is not significant (Figure 2 vs. Figure 3).

(First class note: The currency of the altcoin in the above picture has been blurred.)

In addition, in a portfolio of coins and tokens with high volatility, stabilizing coins are especially important and need to hedge baskets. The portfolio includes a altcoin and a platform of stable currencies, which are 290%+ and 46%, respectively. Despite this, the combination has achieved nearly 80% annual revenue so far, and the USDT held is part of the reason for this gain.

In addition, experienced traders and HODLer will be able to adjust their portfolios by adding derivatives based on only a long portfolio. For example, if a HODLer is bullish on a coin for a short period of time, he can increase the leverage on the project by adding futures or permanent long positions. Structural products can also be used as hedging tools in times of market downturn.

to sum up

Diversification of cryptocurrency investments has been one of the most debated topics in the industry. So far this year, the value of Bitcoin has been able to maintain a 112% increase, thanks to the large-scale bull market in the second quarter and the recent rise in China.

Although some people will say that 100% bitcoin configuration may still generate considerable returns this year. However, a single BTC portfolio can never capture the opportunity for greater profit, but it also assumes less risk.

Disclaimer: This material should not be used as a basis for investment decisions, nor as a recommendation for investment transactions. Trading digital assets involves significant risks that may result in investment losses. Please fully understand the risks involved, and take into account your level of investment experience, investment objectives and seek professional financial advice when needed.

original:

Https://medium.com/altcoin-magazine/crypto-asset-diversification-e346a7f4ca89

Source (translation): https://first.vip/shareNews?id=2499&uid=1

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Chain Weekly reported that Shanghai, Shenzhen and other places have increased the fight against cryptocurrency transactions; the ecological development of the blockchain industry is still in full swing.

- Six indicators to explore the clues of the cryptocurrency market

- Depth | Jia Nan Technology: the first share of the global mining machine, industry extension to see AI

- QKL123 market analysis | megatrend has gone bad, miners are on the verge of loss (1125)

- Analysis: Why people don’t use Bitcoin to pay in their daily lives

- US SEC "Encryption Mom": The cryptocurrency regulatory framework needs to be adjusted, and the SEC has forgotten that "change can also be beneficial"

- Blockchain game studio Mythical Games completed $19 million in financing, with total financing of $35 million