How to get a fixed interest rate on your DAI assets?

Author: Andrey Belyakov

Translation & Proofreading: ViolaH & Min Min

Source: Ethereum enthusiasts

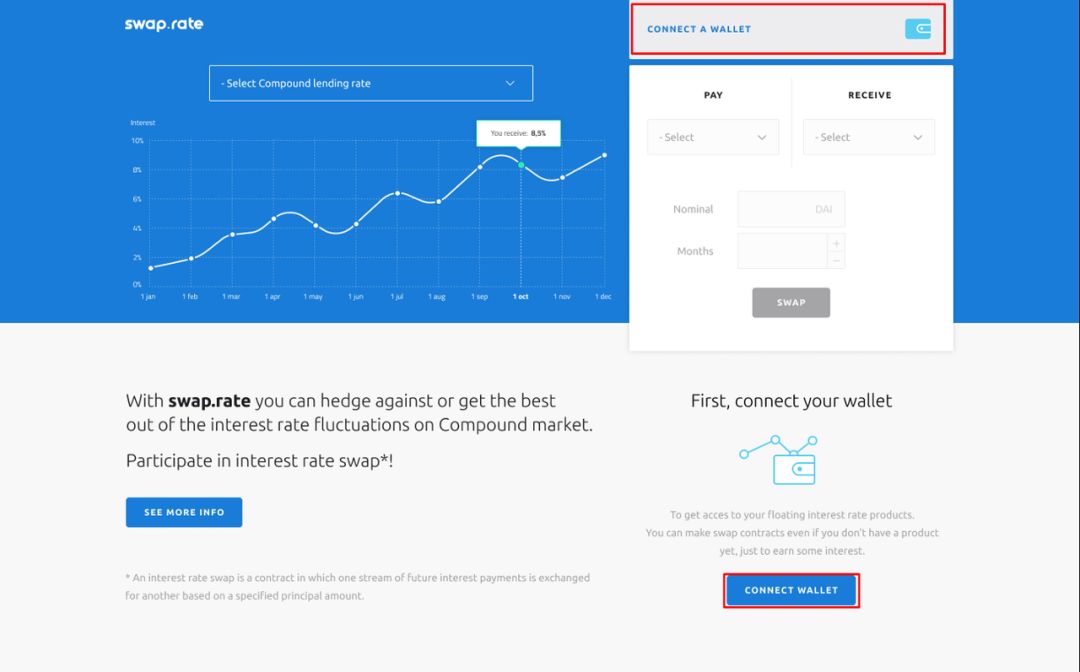

On the SWAP.RATE platform, you can use DeFi loans to hedge or profit from interest rate fluctuations.

- Bakkt's transaction volume exceeded 100 times, can Bitcoin become a mainstream asset?

- EIDOS Creates New Chain Accused of "Mode"

- Which company likes to hire people the most? Which jobs are most popular? 2019 Blockchain Overseas Recruitment List

Simply put, through this platform, you can "insure" your DAI deposits.

Operating principle

You can fix interest rates on previously floating deposits or loans by participating in Interest Rate Swap (IRS) transactions. What is "Interest Swap Trading"? It is equivalent to a special type of insurance contract. When the contract expires, one party will use the cash flow calculated at a fixed interest rate to exchange the other party's cash flow at the current floating interest rate.

For example, on the Compound platform, you can borrow or lend cryptocurrencies at floating rates. Interest rate fluctuations are mixed, this month may be 5%, and next month may become 10%. Suppose SWAP.RATE provides a fixed interest rate of 10% for your deposit on Compound. If you exchange the floating interest rate on hand for a fixed interest rate, you can avoid the risk of interest rate fluctuations. Assuming you have a deposit of 100 DAI on Compound, you only need to indicate on SWAP.RATE how many DAI you are willing to lend at a fixed interest rate and the specific period, for example, three months.

After three months, if the actual interest rate on your deposit on Compound is 7%, you can get another 3% from the IRS. However, if after three months, the effective interest rate on your compound deposit is 12%, the extra 2% will be paid to the IRS. All in all, you end up with 10% interest rates-that's what 10% fixed rates mean.

-Simple emoticons for interest rate swaps-

After signing a contract, SWAP.RATE will freeze a certain amount of margin (usually a borrowed amount or a tenth of the loan amount) according to the contract term to ensure that you or your counterparty will pay as scheduled.

The importance of interest rate swaps

Interest rate swaps are one of the largest and most important financial derivatives markets in the world.

The market for variable (also known as floating or adjustable) interest rates has always been large. Influenced by factors such as supply and demand and bank liquidity needs, most variable interest rates change overnight, and they do so day after day. The overnight interest rate refers to the interest rate used by large banks to lend to each other in the overnight market.

As the name implies, variable interest rates change rapidly, and financial institutions are building related products on the basis of such interest rates. For example, in many countries, people can apply to banks for floating-rate mortgages or deposits. The advantage of floating interest rates is that when the interest rate goes down, the debtor can pay a little less interest. But, of course, lower interest rates also mean less interest on deposits.

Not everyone loves uncertainty, so people start to look bullish or bearish on assets in the market to lock in gains in advance. At the same time, many professional market participants began to sign contracts without direct interest relationships, hoping to make money based on their predictions of interest rates. Admittedly, interest rate swaps are a great tool, and you only need to pledge a small amount of money to fix interest rates. If you can accurately predict future interest rate changes, you can make a lot of money from it.

To give an extreme example-someone is willing to do an interest rate swap with you at a fixed annual interest rate of 30%. You are likely to sign this contract and agree to a floating interest rate in exchange for a fixed interest rate of 30%. You believe that this transaction will definitely make no money. Similarly, in the face of a fixed interest rate of 25% or 20%, you will still be willing to exchange, but if it is a fixed interest rate of 1%, you will not. These are swap rates-they are the overall market expectations for future floating interest rates. Generally speaking, people have different expectations for different delivery periods and different fixed interest rates. The longer the period, the greater the uncertainty, and the higher the expectations of interest rates.

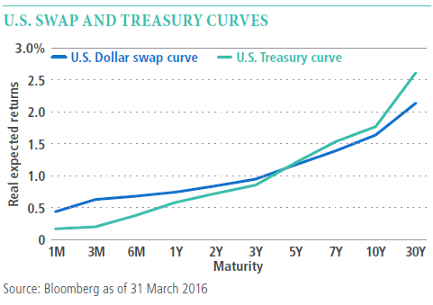

The swap rate curve reflects the 12 delivery periods (the next 12 months) and their corresponding 12 interest rates. These fixed interest rates are publicly provided by market participants, that is, fixed interest rates that market participants are willing to exchange for floating rates in interest rate swap transactions with different delivery periods. Relevant news, events, etc. will change people's expectations of interest rates, so the fixed rates they provide may change in minutes.

Similar to the bond yield curve, through the swap curve, we can see the characteristics of the swap rate over time. As shown above, the y-axis represents the swap rate, and the x-axis represents the maturity date. The swap curve shows the fixed interest rate corresponding to the floating interest rate of different periods (one month, three months, six months, etc.). In short, the swap curve reflects the return that investors in an interest rate swap trade may get based on different maturities.

In the financial market, the swap rate curve is used to determine the fund's interest rate benchmark. Fund rates are used to price fixed income products, such as corporate bonds or mortgage-backed bonds (MBS). Over-the-counter derivatives such as non-vanilla swaps and foreign exchange futures are priced based on information reflected in the swap curve. In addition, the swap curve can be used to measure the overall market perception of fixed income market conditions (ie, expectations).

DeFi status

DeFi has witnessed the stability and maturity of floating rates, and the DiFi ecosystem needs further development. Therefore, our Opium Team is preparing to launch a live swap curve. Users can use their deposits or loans directly through interest rate swap transactions, or make bets by placing bets on rising and falling interest rates.

Now, you can also use SWAP.RATE to short interest rates on Compound.

When you exchange fixed interest rates with Compound's floating interest rate through swap transactions, if the interest rate on Compound falls, you earn.

technical details

SWAP.RATE is a product based on the Opium protocol, and its interface is user-friendly and easy to navigate. Don't underestimate this simple interface. Behind it is a highly developed and extremely powerful mechanism that can best meet user needs. You can initiate or accept an interest rate swap transaction and send a meta-transaction signed by MataMask (or other crypto wallet) to the off-chain repeater of the Opium protocol. The repeater is responsible for matching orders and running 12 order books based on different expiration dates. Once your order is matched, it will be settled on the Ethereum blockchain in the form of an Opium protocol smart contract. At that time, you need to pledge a deposit (10% of the agreement amount). At the maturity date, if the actual floating interest rate is lower than the agreed fixed interest rate, you will be able to get back the margin and get additional interest; if the actual floating interest rate is higher than the agreed fixed interest rate, your margin will be after deducting the interest owed I will return it to you.

Steps for SWAP.RATE

1. Connect to the wallet by signing in your login information. Currently only MetaMask is supported, we will provide more options later.

2. Select a product (lending rate or borrowing rate) in the "Payment" column and set a floating or fixed interest rate, then click "Enable" to have your Opium contract unlock your tokens.

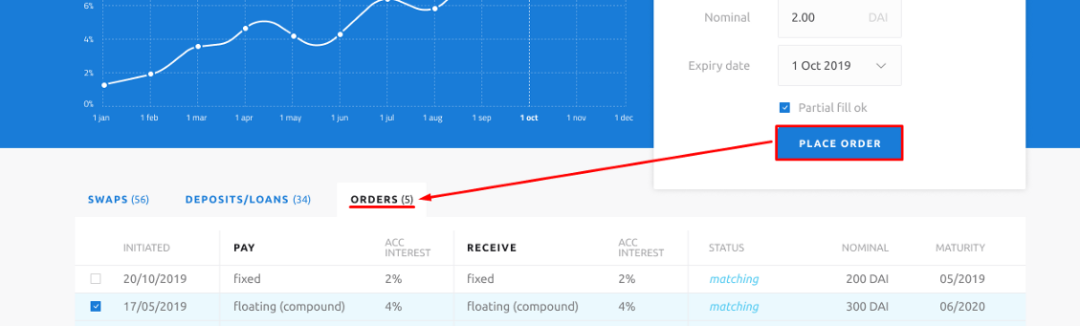

3. Now you just need to specify the amount and due date on SWAP.RATE.

After signing the order information, you can place the order!

All orders are meta transactions that match each other in the off-chain order book and are settled on-chain.

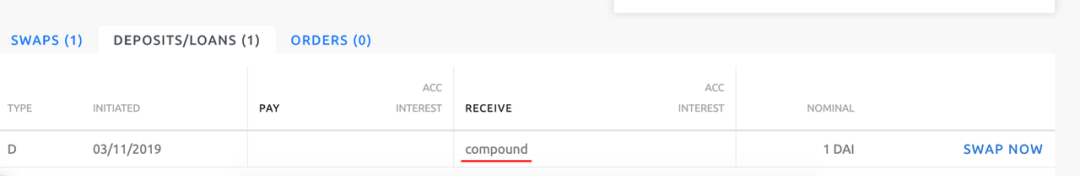

Once the order is created, it will be placed in the order column.

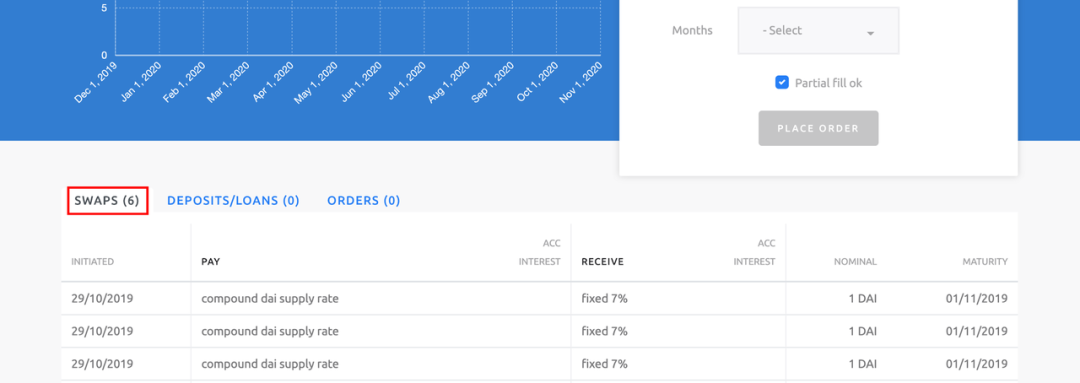

The two matching orders will be placed in the swap column.

If you want to see your current deposit or loan on Compound, you can find it in the Deposit / Loan section.

That's it for platform introduction. Without further ado, we invite you to explore SWAP.RATE together, welcome to share your experience with us! !!

(Finish)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Defective Lightning Network? This research paper says so

- Here are 7 issues currently facing blockchains, each of which is worth 1 billion

- Viewpoint | Blockchain application explosion, but still trial and error

- Does the currencyless blockchain have a wealth password?

- Forbes: 4 reasons China encourages blockchain technology

- Getting Started with Blockchain | Cross-chain: The Future You Want Without It

- IRS strikes again, a storm caused by BTC capital gains tax