How to identify “smart money” and track them?

How to identify and track "smart money"?The original author: CoinGecko – Joel Agbo Original Compilation: BlockTurbo

Tracking cryptocurrency wallets mainly involves discovering wallets, collecting in-depth data on transactions on the wallet chain, and translating the data obtained from the first two steps into useful information. Through this, investors can understand the actions of “smart” investors and may use clues from significant wallets to predict market trends.

Key Points

-

Tracking cryptocurrency wallets involves closely monitoring the wallet’s transactions and noting its significant transactions over a period of time or involving specific assets;

-

Wallet tracking provides investors with asset movement information based on tracking the trades of major holders, which can be used to speculate on market trends;

- Another strong contender has arrived in the Ethereum L2 game: produced by the parent company of the Fox Wallet, zkSync is one of the strongest competitors.

- zkSync’s Road to Mass Adoption: The Ecosystem is Still in its Early Stages with Many Variables in the Future

- Opinion: Exploring the Development Potential of the Ordinals Ecosystem from ORDI to OXBT

-

Blockchain browsers or special applications can be used to filter or track selected wallets;

-

Specialized wallet trackers are designed to provide clearer information about wallet movements and notify investors.

How to Track Cryptocurrency Wallets

Tracking cryptocurrency wallets mainly involves discovering wallets, collecting in-depth data on transactions on the wallet chain, and translating the data obtained from the first two steps into useful information. Through this, investors can understand the actions of “smart” investors and may use clues from significant wallets to predict market trends.

What other traders are buying, who the buyers are, and how well they understand the market? If they seem to have a better understanding of the market, what are they investing in now and what might they invest in next? On a larger scale, how does the behavior of such people affect the market?

If you are curious about these questions and how to apply them, read on to learn more about tracking cryptocurrency wallets!

What is Wallet Tracking

Wallet tracking focuses on studying the wallet movements of whales or famous traders to obtain data to guide potential trading decisions.

A cryptocurrency wallet tracker is designed to make it easier for individuals to track wallets of interest, such as sending alerts every time a transaction occurs. These trackers allow you to track the activity of selected wallets in real time. Cryptocurrency wallet trackers connect to third-party APIs and access various on-chain cryptocurrency data sources for information about transactions; they then package this information and present it to users in a more useful form.

Cryptocurrency wallet trackers are designed with customizable features, such as push notifications that alert users whenever the tracked wallet executes a transaction. Depending on the design, cryptocurrency wallet trackers can display basic information about transactions (such as transaction type and amounts involved) as instant alerts on messaging apps like Telegram. This allows users to quickly react without having to search for transaction details using a blockchain wallet explorer like Etherscan.

How to Find Wallets to Track

What should you look for before tracking a wallet? The answer largely depends on the purpose of your wallet tracking, but here are a few things investors often look at when tracking wallets:

Past Investments

When considering adding a smart wallet to your wallet tracker, you can check its investment records to see what assets they sold in the past and how they managed those assets. Check the purchase time and sale time as well as the gains or losses obtained from them. This is a good way to evaluate whether a wallet is a “smart money.” If the wallet has made significant profits in most of its previous transactions, then they may be worth some attention.

Profit/Loss Ratio

When looking for a smart wallet to replicate trades, it’s important to consider their profit/loss ratio, which measures the average profit from winning trades versus the average loss from losing trades over a period of time. Research the assets they hold and their values, track transactions related to assets in the wallet to determine whether the wallet is profitable or not. If a wallet is making a profit with the assets it manages, you may want to track its trades.

Transaction Flow

Where does the wallet’s fund come from and where does it go? If a wallet frequently receives deposits of varying sizes from different wallets, it may be an exchange wallet. Blockchain explorers attempt to label these transactions and wallets, but in some cases, they may be missed. Vesting wallets can also be identified by the labels on their transactions. Personal wallets should have lower transaction frequencies and fewer wallets owned.

Interoperability

Personal wallets generally interact with a few exchanges and other individuals. Team and project wallets are more likely to interact with more professional protocols and execute transactions such as staking, large-scale distribution, and staking reward allocation.

Finding a wallet to track

Choosing a wallet to track depends on your goals and the availability of the wallet. If you just want to track the movements of top holders of smart contract projects you hope to invest in or have already invested in, finding a wallet to track should be relatively easy. However, if you want to track “smart money” investors or other famous figures, the process may be slightly more complicated.

Based on the previous considerations, let’s try to find some wallets to track.

How to use a blockchain explorer to find top holders

You can use a blockchain explorer for the network on which the asset runs to find the wallet of top holders. Older blockchains like Bitcoin and Litecoin usually have a “rich list” feature on their explorer that ranks holders in order of the assets they hold. EVM networks have a similar feature for smart contract tokens.

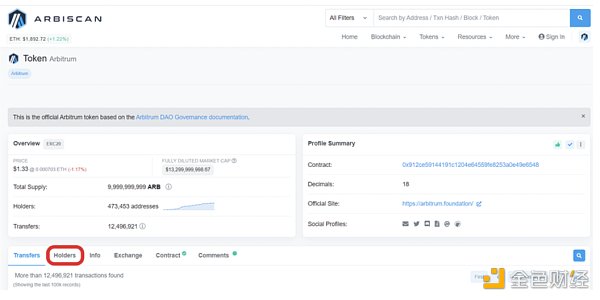

To use the explorer of the network to find the top holders of a smart contract token, you first need to get the smart contract address of the asset and access the explorer for more information. Here, we will use the Arbitrum token on the Arbitrum Layer 2 network as an example.

We copied the smart contract from the asset page of CoinGecko, but you can also get the smart contract address of the asset from the project’s official website and social media profiles.

Visit the Arbitrum Explorer, navigate to the Arbitrum token page, and then to the holders section, where the list of holders is sorted by the amount they hold. Note that the wallet with the highest ranking may be an official wallet or exchange wallet.

Identifying “smart money” investors

To find “smart money” investors, more research may be needed, as well as additional tools to streamline the process and increase its effectiveness.

Using a blockchain explorer

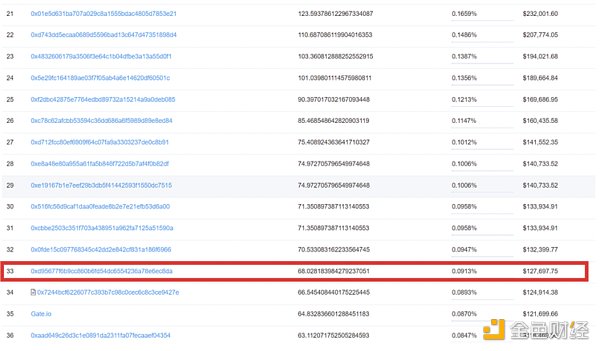

Some top holders of successful smart contract projects are a good starting point for finding “smart money” investors. To illustrate this point, let’s take a look at the Camelot token (GRAIL) on the Arbitrum network, which has been appreciating in value over time:

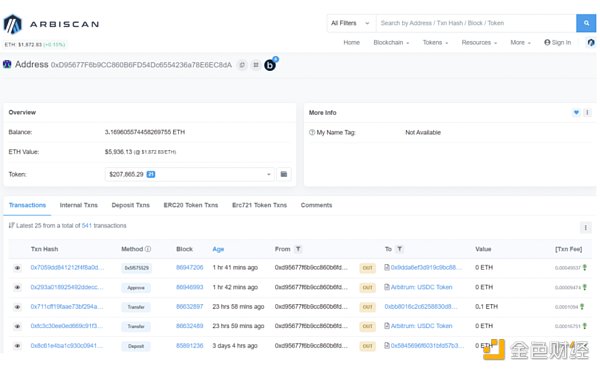

Looking at the top 50 wallets, most of them seem to belong to exchanges, vesting wallets, and possibly institutions related to the project. You can detect this using transaction tags and transaction frequency. Here, the 33rd wallet in the list of holders has been singled out (at the time of writing).

The wallet (0xD956) has about 68 GRAIL tokens under its custody. Among them, 22 tokens were purchased at a price of about $241 each on January 17, 2023. At the time of writing, the trading price of GRAIL was $1899 – yielding profits of over 780%.

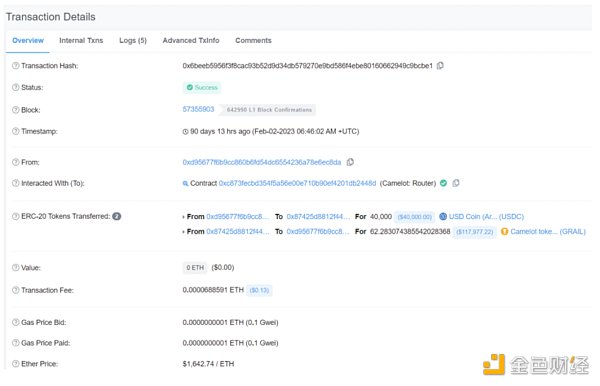

0xD956 also purchased 62 GRAIL at a price of about $550 each on February 2, after selling 15 GRAIL at over $480 from his first purchase, resulting in a profit of around 100%.

At the current value of GRAIL tokens, the February purchase yielded over $70,000 in profits at this time. This is an example of a “smart” trade. This example is for illustration only. Cryptocurrencies are volatile and this is not financial advice.

Social Media

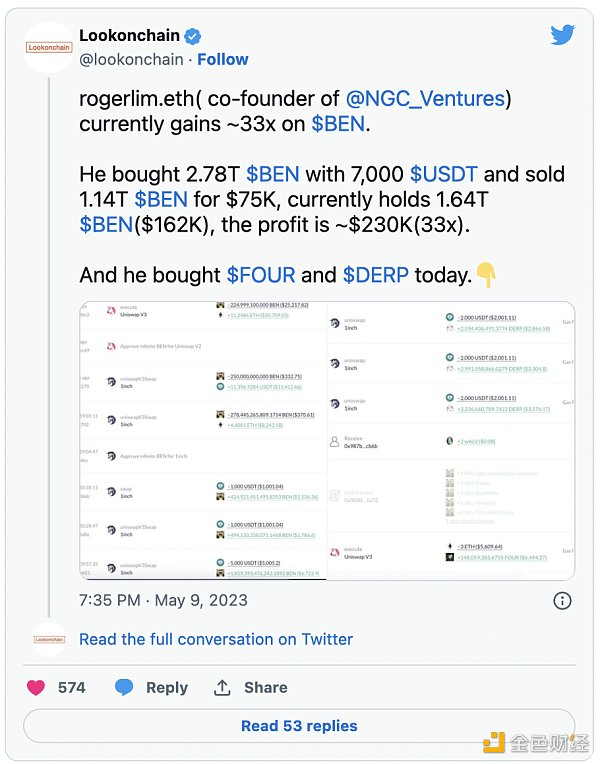

Social media, the internet, and peer-to-peer interactions are also good ways to find wallets to track. One example of such a platform is Lookonchain. Lookonchain tracks “smart money” wallets and displays their findings on their Twitter profile. If these wallets interest you, you can also add them to your tracking list. Again, this is not financial advice.

Indicators to Watch When Tracking Wallets

Now that you’ve found a smart wallet, here are a few things to keep in mind when tracking wallets.

Trading Assets

What assets are your smart investors holding, buying, or selling? Observe these to obtain more data on how smart money investors view the assets. If this asset is popular among smart investors, they may believe that it will appreciate in value in the long or short term. *Note that this is not strong data to rely on, and further research on the asset is recommended.

Transaction Type

Observe if the wallet you are tracking is involved in buying, selling, claiming rewards, or receiving incentives from projects or other well-known institutions. Depending on why you are tracking the wallet, this data can give you insight into financial transactions, their level of involvement in the project, and more.

Transaction Direction

If your wallet is sending focus assets to a centralized exchange, they may be about to take profits. If you are tracking multiple “smart money” investors and their directions align (especially if the asset’s price has already gone up), the most likely answer is profit-taking; if the asset is performing poorly, investors may be exiting the market. If the direction is opposite, “smart money” investors may be buying the asset, which may be worth further research.

Transaction Amount

To evaluate an investor’s belief in an asset or their impact on the overall market, the proportion of an asset in a trader’s portfolio, the percentage of the total supply of assets they hold, and the allocation relative to wallet size are all indicators worth considering. Like the $40,000 purchase above for 0xD956, this is a sign of conviction, especially for individual investors. Depending on the available liquidity at the time of GRAIL’s purchase, such a transaction may have a significant impact on the market.

Transaction Frequency

Your “smart money” wallet may only be trading daily on a decentralized exchange. This could be market manipulation or normal daily trading, but a good detection method is to look at the frequency of it repeating specific trades or trading cycles. If it repeatedly buys and sells a single asset, the trader may be trying to profit from short-term changes in asset value or simply trying to influence the market.

How to Identify Scams

Scam projects attempt to steal investors’ attention by sending their tokens (unsolicited) to some well-known wallets and induce everyone to buy these project tokens or interact with their smart contracts. Filtering out these tokens when tracking smart investors’ wallets is very important. Blockchain explorers attempt to label these types of tokens to protect investors. In the absence of such information, tracking transaction histories is a good way to detect scam tokens in wallets.

Check how the smart wallet obtained the token – were they purchased, claimed, or received from peers? Claim transactions are usually marked on EVM network browsers; another way to identify claim transactions is to track the transactions and verify if the investor paid a fee (claim fee) during the process. There should also be many similar transactions in the “claim wallet.”

If the investor did not purchase this asset on a decentralized or centralized exchange, and it was not sent by another person, then it is likely a token scam that leverages the reputation of the wallet owner. Track the source wallet of this transaction and observe other transactions performed by the wallet. Additionally, check if the smart contract page provides more information about the issuing project and verify all information related to the project if available.

Crypto Whale Tracker

Whales are a unique class of investors. They not only hold a large proportion of circulating assets, but are also often considered the most informed and important group of investors. They are considered “most important” because their activities have a huge impact on the market; they are considered “most informed” because they are thought to be closer to the project team or to have more knowledge about the project than most other investors. Additionally, they are also considered the biggest believers in the project.

Therefore, investors try to track their movements and take these into consideration in their investment strategies. Crypto whale trackers help investors track whales.

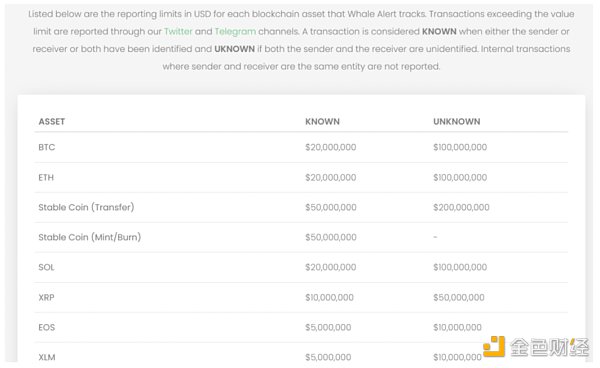

Whale trackers are similar to regular wallet trackers. They work similarly, connecting to aggregated on-chain data via API endpoints, just like wallet trackers. However, a major difference is the information they focus on.

Whale trackers only focus on significant transactions of top holders, and the information presented by whale trackers is usually high-value transactions and transactions from “wealthy” holders. On the other hand, regular wallet trackers present transaction information of wallets chosen by the user. These transactions may be high or low value, any wallet can be tracked, regardless of their position on the owner’s list.

An example of a whale tracker is WhaleAlert.

Portfolio Tracker

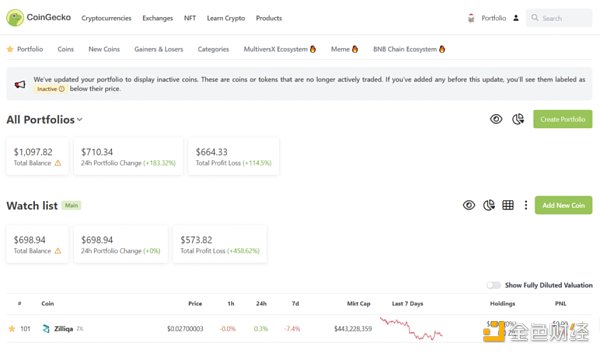

Another related investment tool is the portfolio tracker. Portfolio trackers help investors understand the development of their asset prices. Some portfolio trackers will further aggregate news and additional data about the tracked assets and provide this information to investors. Cryptocurrency portfolio trackers like CoinGecko connect to data sources from cryptocurrency exchanges to obtain cryptocurrency trading data from various exchanges.

Investors can use portfolio tracking features on platforms like CoinGecko, Debank, and Nansen to aggregate their invested crypto assets in one place for easy follow-up on these assets and related developments. Portfolio trackers can also notify investors of significant price changes through push notifications or email notifications.

Cryptocurrency wallet trackers and portfolio trackers use similar technology, but wallet trackers focus on investor behavior while portfolio trackers focus more on asset prices.

Final Thoughts

Always do your own research when investing in cryptocurrencies, and as part of on-chain data research, tracking wallets can help with investment decisions. Wallet tracking may increase the chances of investors obtaining profits, as the goal is to follow “smart” investors with successful track records.

Tracking a wallet can be tricky, especially when investors expect to use the acquired data for larger-scale decisions. This is because decisions like these require not only knowing what assets the wallet holds, but also how long they have held these assets or plan to hold them, and why they hold these assets.

Smart investors may consider certain assets as non-profit-oriented investments and therefore not care about making a profit. However, this means that investors tracking wallets may miss out on opportunities for profit while waiting for signals from “smart” wallets. There is also the possibility of a scam token that attempts to use wallet tracking to promote their token by sending large amounts of these tokens to well-known wallets to pique the interest of investors tracking that wallet.

When it comes to cryptocurrency investing, remember that it is a high-risk investment and you should always do your own research before investing in any project. Also, please note that this article is for educational purposes only and not financial advice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Explaining dYdX Indexer in detail

- Hong Kong’s new anti-money laundering regulations have taken effect. Here are the key compliance points:

- Origin and Development of ZKP: From the 1980s to Present

- 【Exclusive from ChainDD】Analysis of 525-page EU Regulatory Regulations: Step-by-Step Guide to Writing White Papers, Only 3 Types of Cryptocurrencies Approved

- Comprehensive analysis of the .sats domain

- There have been rumors for 2 years that “Grand Theft Auto 6” will introduce cryptocurrency, why won’t it integrate with Web3?

- Hong Kong’s new anti-money laundering regulations take effect, and the compliance requirements are organized comprehensively.