Online for only 2 months, with a total TVL of $333 million, has zkSync Era become the fertile ground for DeFi innovation?

Is zkSync Era, which has only been online for 2 months and has a total TVL of $333 million, the breeding ground for DeFi innovation?Author: Haotian

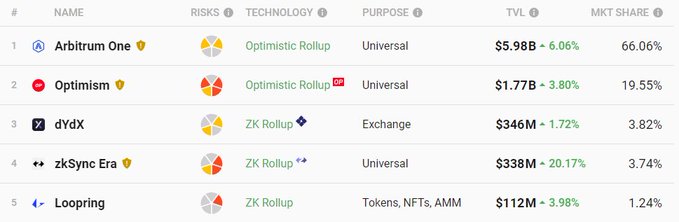

After only 2 months online, zkSync ERA independent wallet addresses have exceeded 680,000 and the total TVL of the ecosystem has reached $338M, ranking fourth in layer2 Rank. Although there is still a considerable gap compared to Arbitrum, the growth rate of its various Metrics data indicates that this airdrop war will definitely be rolled out to the sky. But how is the zkSync ecosystem progressing? What unknown variables still exist in the decentralization process? In the following Thread, you must carefully consider it.

At present, the data volume is still unable to highlight the advantages of zk-rollup, and the user experience is barely satisfactory. For example, problems such as high gas fees, transaction failures, and unstable slippage are frequently criticized. In short, the mechanism of proofing each transaction of zk circuit is inherently expensive, and a certain amount of ecological data is required to achieve a balance of transaction speed, GAS cost, silky experience, etc. This is a process of quantitative change to qualitative change, and we need to watch as we go.

- Banking industry bets on the “metaverse” track: fleeting trend or breakthrough ahead?

- Future of Cryptocurrencies: From Seeking Mass Adoption to the Turning Point in 2026

- Analysis of Beijing Internet 3.0 White Paper (with full text): Distinguishing from Web3, Focusing on Artificial Intelligence and Metaverse

zk-Rollup may aim to be the first after Mass Adpotion, but in reality, we must consider how to keep up with Arbitrum, which is reflected in: 1) The ability of head projects to attract funds needs to be strengthened. Head DEX, Lending, and Derivative projects such as SyncSwap, ReactorFusion, and Onchain Trade need to further improve their lock-up value and yield rate, just like the GMX growth engine has a driving effect on Arbitrum;

2) The innovative advantages of zk technology at the bottom need to be released. Theoretically, compared with Arbitrum, zk-rollup can achieve millions of TPS of transaction volume, and the decentralization is more extreme, but at present, due to the complexity of the zkSync PlONK circuit algorithm and the prominent development compatibility problems, it poses severe challenges to the ecological expansion. This greatly lags behind the time when zkSync exploded. Currently, iZUMi Finance DL-AMM innovative mechanism needs to be observed; (related reading: “iZiSwap & Discrete Liquidity Model: Revealing the Future Trend of AMM”)

3) The zkSync ecosystem’s diversity and innovation are not enough; how much potential an ecosystem has depends on its performance in categories such as Derivative products, Lending, Yield Aggregator machine gun pools, etc., but currently zkSync is focused on DEX interaction? Digital domain names? Meme? Obviously, these projects can attract popularity, but the continuous siphon effect is far less efficient than the Farming Pool. Let’s observe whether zkHoldstation APY can stabilize;

Overall, the development of the zkSync ecosystem is impressive, but it is still in the alpha stage. Obviously, the market sentiment is too high. Here are a few potential unknown variables (risks) that I have observed. In short, calm down!

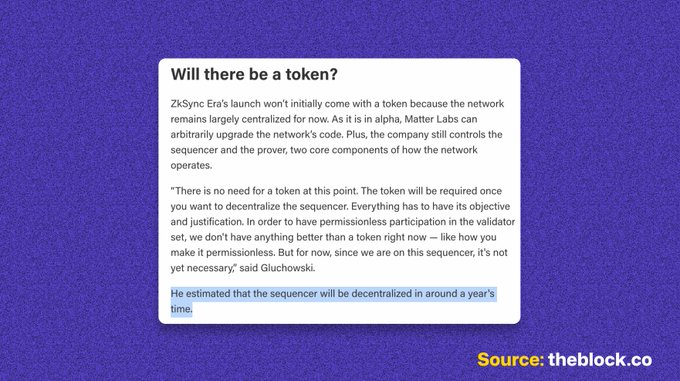

Simply put: the issue of Sequencer’s POS privilege control in the future; decentralized Validators are still excessively controlled by MatterLabs; unstable underlying dynamic fees, Plonk contract open source issues, etc.

Previously criticized for the centralization of Sequencer in op-rollup, zkSync’s Sequencer is currently also a centralized component operated by MatterLabs. In the future, it will achieve decentralization based on POS mechanism and authorization methods (there are privileges, but not extreme). However, zkSync’s Sequencer cannot change the order, because once the transaction is changed, the zk-SNARK proof is also invalidated, so even if it cannot achieve extreme decentralization, it cannot be malicious.

Validators are responsible for generating SNARK proofs for transactions submitted by Sequencer under the chain and adding them to the Rollup chain of new blocks after cross-validation is correct. Although in the final state, Validators (including zkPorter) must be absolutely decentralized, most of the verification nodes are still controlled and operated by the Matter Labs team in the immature market stage, and they will gradually decentralize and self-govern according to the roadmap.

What does this mean? Will these highly controlled validator nodes of Matter Labs quietly collect user IP addresses? Technically, there is no possibility of “malicious nodes” tracking transactions and collecting user IP addresses. Especially in this black box before it is completely decentralized, if individual verification nodes collect IP and other information in the name of anti-witch attack to optimize airdrop strategies, it seems to make sense logically.

Of course, as a leader in the zk ecosystem’s privacy transactions, I think zkSync will not do such a rebellious thing. However, facing the current frenzy of zkSync’s hair-raising, it is difficult not to make such inferences and hidden worries. Here we only discuss the technical logic that can be achieved in theory. As an observer of the zk ecosystem industry, I tend to remain optimistic. Please judge and respond to the viewers who have multiple accounts to rake in.

Finally, let’s talk about the zkSync fee issue that makes everyone extremely confused, especially the differences in interaction fees and failure rates of different projects. This is essentially a compatibility issue between smart contracts and the underlying zk. If the contract code logic is complicated, and the data structure and Plonk’s circuit algorithm optimization are not in place, there will be unstable issues. This is bound to become an obstacle for developers to enter the ecosystem, and it may take time to digest.

It is not difficult to understand why Matterlabs CEO Gluchowski said in an interview that there is no need to issue coins now and that decentralization will be implemented within a year. On the one hand, this will give enough time for decentralization issues such as Sequencer, zkPorter Validators, etc. On the other hand, this will give enough time for excellent projects to grasp and develop innovative zk projects to expand the ecology, and of course, it will also give the opportunity for many investors to accumulate blessings.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How can AI integrate with cryptography to drive the next wave of innovation and growth in Web3?

- Weekly Preview | Hong Kong to Implement Virtual Asset Regulations Starting June 1; OP, 1inch Unlock Tokens Worth Millions of Dollars

- Variant Partner: Web3 social networks will succeed by adopting asset-first approach

- Deep Panda DAO’s new way out: Closing down is more profitable than struggling to survive

- Xiyou Cong: Have you prepared for the next wave of hype narrative after Brc20?

- a16z Crypto CTO: Protocol Design is More Important than Token Economics

- One year after the Terra-Luna reset: Rebuilding Trust, centralized exchanges will continue to exist