Comprehensive Research on NFTFi Track: Slow is Fast, NFTfi Drives the Next Bull Market

NFTfi Drives the Next Bull Market with Slow-Fast Research TrackAuthor: 0xLoki

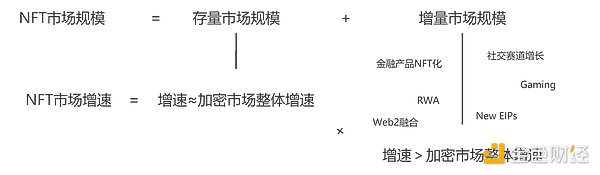

From a holistic perspective, the stock market represented by PFP will be subject to the scale of the homogenized token market, but the incremental market has relative independence and may even exceed the scale of the homogenized token market. NFT or NFTfi does not lack new narratives, and its growth rate is higher than the overall growth rate of the cryptocurrency market, SLOWLY BUT SURELY.

1. We are on the eve of the NFTfi outbreak

First of all, it needs to be clarified that the NFT and NFTfi markets have experienced a clear decline, but this does not mean that the NFT or NFTFi market has lost its growth potential. NFTfi is still one of the markets with the highest potential growth multiples. Following the maturity curve of technology, when a new technology is born, it will climb to the top at the craziest speed, experience possible bubble bursts, and then slowly rise smoothly and enter large-scale adoption. Looking back at the development of the cryptocurrency industry, this development path has been verified many times, from the beginning of BTC, to the PoW craze, and then to the ICO craze and DeFi Summer.

Discussion of the market space of NFT/NFTfi cannot be separated from the two important data mentioned in the previous research report: NFT market capitalization and NFT category proportion. According to the statistics at that time (March 2023), the market value of the high-value and high-liquidity “core market” is only 5.9 billion U.S. dollars, which is about 4.2% of the market value of stablecoins (corresponding to the DeFi track) and 2.7% of the market value of ETH (corresponding to the ETH LSDfi track).

- Online for only 2 months, with a total TVL of $333 million, has zkSync Era become the fertile ground for DeFi innovation?

- Banking industry bets on the “metaverse” track: fleeting trend or breakthrough ahead?

- Future of Cryptocurrencies: From Seeking Mass Adoption to the Turning Point in 2026

Source: Public data compilation

The proportion of NFT categories can explain this phenomenon to a certain extent: PFP, Art, and Collectibles account for more than 75% of the total market value, followed by Utility, Land, and Game categories. Influenced by the characteristics of the categories, most NFTs currently do not have a rigid application scenarios and do not have the ability to generate cash flow. The development cycle faces a binary choice of becoming a blue chip or entering liquidity exhaustion. From the perspective of capital, PFP, Art, and Collectibles mainly represent speculative and social needs, and the strength of demand is related to the overall capital of the market. The change in market size has a positive correlation with the cryptocurrency market, making it difficult to break through the “market capitalization” ceiling and generate excessive excess growth.

Source: NFTGo

However, at the same time, the dominance of PFPs will not continue to exist, and new products are emerging that are worth looking forward to. For example, the identity ecosystem represented by ENS and SBTs, utility NFTs in the gaming/social/education application fields, financial NFTs and RWA opportunities led by SOLV and the ERC-3525 protocol. The structural market growth opportunities brought by these non-PFP category NFTs are far greater than the systematic growth opportunities.

Taking financial NFTs as an example, the average annual financing amount of the cryptocurrency market from 2020 to 2022 is approximately US$30 billion. If 10% of this amount is realized through NFTs or SFTs (semi-fungible tokens) in the future, it will bring a growth of US$6 billion to the NFT market (US$3 billion from fundraising and US$3 billion from investment). 10% of DeFi TVL will bring a growth of US$4.8 billion. These two areas alone can bring a 183% growth to the current NFT market. As shown in the figure below, from an overall perspective, the stock market represented by PFPs will be subject to the scale of the homogeneous token market, but the incremental market has relative independence and may even exceed the scale of the homogeneous token market. NFTs or NFTfi do not lack new narratives and will grow higher than the overall growth rate of the cryptocurrency market, slowly but surely.

II. Sub-track Market Outlook: The Market Space for Trading and Lending is Far More Than This

In the first part of this report (“Panoramic Research on NFTfi Tracks”), the focus was on explaining the current market pattern of NFTfi. Looking at the sub-tracks, NFT trading and NFT lending have initially taken shape, and the future development direction is mainly integration and efficiency improvement. The opinion here remains unchanged: The first and final thing for NFT trading is to improve liquidity. Although we have seen the rapid development of Blur in the past year, personally, Blur is still far, far away from the true end game. In the past few months, I have discussed further improvement measures for NFT trading with many friends (including a large number of team members from related teams). So far, the ideas I can come up with and the ideas I have learned from other friends include:

There are several opportunities in the DeFi market. The first is liquidity provision through the use of veTokens (or time locks), which provides predictable and sustainable liquidity supply (suitable for use with AMM mechanisms). Another opportunity is to establish a specialized clearing protocol (or an oracle with clearing functions) to serve as a counterparty for clearing, improving liquidity on the buy side. Additionally, building an NFT-based options/dual-token financial protocol (theoretically, other types of derivatives may have similar composability) can serve as a counterparty for trading, improving liquidity on the buy side. Other opportunities include partial fragmentation (this approach can also be applied to lending protocols, but I personally don’t like this method), using LSD assets as the underlying liquidity provider to reduce liquidity supply costs, and combining INO+OHM to establish an AMM-like NFT trading pool from the initial issuance. There is also the applicability of vAMM+issuing reverse IL positions or synthetic asset models.

Of course, these are just preliminary ideas, and often when we solve one problem, more problems arise. I welcome further discussion with friends who are interested in this direction.

The second opportunity is lending. Given that NFTfi, Bendao, BlockingrasBlockingce, and Blur have already provided quite a lot of and sufficiently excellent solutions, this field seems slightly crowded. In my opinion, the opportunity lies in short-term yield optimization and long-term aggregation. There are many experiences that can be borrowed for short-term yield optimization, such as p2p matching optimization points for FT pool rates, introducing Yield revenue, asset reuse (LSD&LP), and possible interbank borrowing. In the long term, aggregation is relatively abstract. If we think of our borrowing and lending needs as a scatter plot, point-to-point lending is a scatter plot, while point-to-pool lending is a continuous curve composed of many points (and this curve is dynamically changing), so the next problem is very similar to trading. We need more and denser points or lines. Derived ideas include lending aggregation, expansion of derivatives and composability.

Third, market opportunities in different sub-sectors: 3 growth factors, 2 demands, and 2+N implementation plans for derivatives

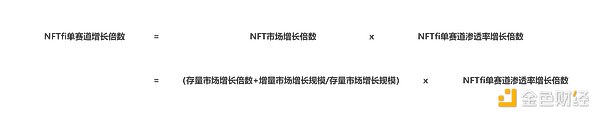

The third opportunity is derivatives. It is mentioned separately because, compared to the first two opportunities, derivatives are a more blue ocean market, as mentioned in previous research reports. Whether it is the number of active accounts on the user side or horizontal comparison with homogeneous tokens, the NFT derivative market has a very low market penetration rate. Based on the breakdown of market size growth shown in the figure below, the NFTfi sector has three growth factors: the growth of the stock NFT market (correlated with the overall cryptocurrency industry), the growth of the incremental market, and the growth of market penetration rate. For derivatives, the third item (market penetration rate) has a higher growth multiple.

It is worth mentioning that non-PFP assets have greater potential for integration with NFTfi. They may have more predictable fluctuations and more reliable value support, such as bill-type and some utility-type NFTs that can generate cash flow (possibly in currency terms), making valuation and trading more efficient. Therefore, the growth of the incremental market will also promote NFTfi in a non-linear way.

The second source of confidence in the NFT derivative track is demand. From past experience in the cryptocurrency market, derivatives often achieve good growth in bear markets, driven by demand. Generally speaking, the demand for derivatives is mainly hedging (or risk swapping) + speculation. The risk aversion characteristics in bear markets and the reduced investment choices under limited capital adequacy will all bring demand for derivatives. In addition, one of the important sources of demand for early cryptocurrency derivatives was the miners of BTC/ETH. Now, Blur, NFT lending, and NFT staking are all bringing yields to NFTs, and the growth of pure hedging demand, as well as the real user and real protocol income brought to NFT derivatives, will also be foreseeable.

The third point that needs to be explained is how to build a good NFT derivative product. Analyzing the entire NFT derivative product requires a very large amount of space, so topics such as index products, options, structured products, etc. may be presented in the form of special research reports in the future. Here, we mainly discuss futures contracts.

First of all, we need to determine the ways in which NFT futures trading can be realized. Due to the scarcity and low order rate of NFTs themselves, delivery-type products are not suitable for constructing NFT futures (perhaps suitable for options). The remaining arsenal that I can think of includes the following five categories. Among them, the order book perpetual contract and vAMM have been implemented, and some other teams are also exploring several other modes.

The next thing to consider is what is the key issue for FT derivatives? I think it is still liquidity, which specifically includes three points: 1) How to price? 2) Who will provide (or act as the trading counterparty) when there is insufficient liquidity? 3) How to liquidate/handle positions that have gone through the margin? From the current situation, NFEX and NFTperp have chosen the perpetual contract and vAMM method to provide preliminary solutions to these three problems. In addition, a feature of the NFT derivative market is that the long-short ratio is extremely unbalanced, and the requirements for funding rates and dynamic opening fees will also be higher, which should also be one of the factors when we compare products.

Source: Compiled by 0xLoki

In comparison, NFEX and NFTperp are relatively similar in terms of data, and each has its own advantages and disadvantages in terms of product solutions. NFEX can provide lower transaction fees and more trading categories (as well as faster trading pair launch speeds), while NFTperp provides a non-custodial solution. However, due to the imbalance of long and short positions, the trading price itself has a large deviation. Although NFTperp has set up Funding Rate+additional tx fee to solve this problem, it is obviously not enough (long positions need to pay a three-digit annualized funding rate).

Source: NETperp Docs

IV. Conclusion: Make Hay While the Sun Shines

Overall, my judgment is as follows: In the medium and long term, the growth rate of the NFT market will far exceed the growth rate of the cryptocurrency market, while the growth rate of the NFTfi market will far exceed the overall growth rate of the NFT market, and the market growth rate of NFT derivatives will far exceed the growth rate of NFTfi.

The tide of the race comes from the tide of the market. When there is enough liquidity, it will inevitably bring about excessive investment. The market has sufficient funds to subsidize and support high valuations. However, in the long run, whether it is a primary or secondary market, pure burning/market speculation will eventually pass. It is also at this stage that protocols that can achieve a complete business closed loop and create real income/value will continue to survive and emerge from the valley of death, and the market will return to [technology-driven] and [demand-driven]. It is worth mentioning that although it is not a good time to issue coins now, among the top NFTfi protocols, Bendao and Blur have already issued coins, and NFTFi may not issue coins in the end. The remaining Opensea (which has already issued NFT), BlockingrasBlockingce, NFEX, and NFTperp are likely to issue coins, which is worth looking forward to.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis of Beijing Internet 3.0 White Paper (with full text): Distinguishing from Web3, Focusing on Artificial Intelligence and Metaverse

- How can AI integrate with cryptography to drive the next wave of innovation and growth in Web3?

- Weekly Preview | Hong Kong to Implement Virtual Asset Regulations Starting June 1; OP, 1inch Unlock Tokens Worth Millions of Dollars

- Variant Partner: Web3 social networks will succeed by adopting asset-first approach

- Deep Panda DAO’s new way out: Closing down is more profitable than struggling to survive

- Xiyou Cong: Have you prepared for the next wave of hype narrative after Brc20?

- a16z Crypto CTO: Protocol Design is More Important than Token Economics