How to measure the value of Token from the cost?

Compilation: Orange Book

How to value and price a Crypto project has always been a problem, and Placeholder managing partner Joel Monegro believes that from a cost perspective, it may be possible to find a reasonable answer.

He believes that the value of Token lies in its production cost and capital cost. For most projects with tokens, in addition to finding a balance between cost and value, the remaining endings only collapse.

The following is the original compilation, enjoy:

- IOTA co-founder announces retreat and clears all cryptocurrencies

- The People's Liberation Army newspaper article: blockchain boosts military management

- Cosmos's story: How to "turn" $17 million into $104 million

Cost is one of the most common means of measuring value because the market always gives a price near the cost line.

So giving a framework for the "cost structure" of cryptocurrencies will give us a better understanding of the value of cryptocurrencies.

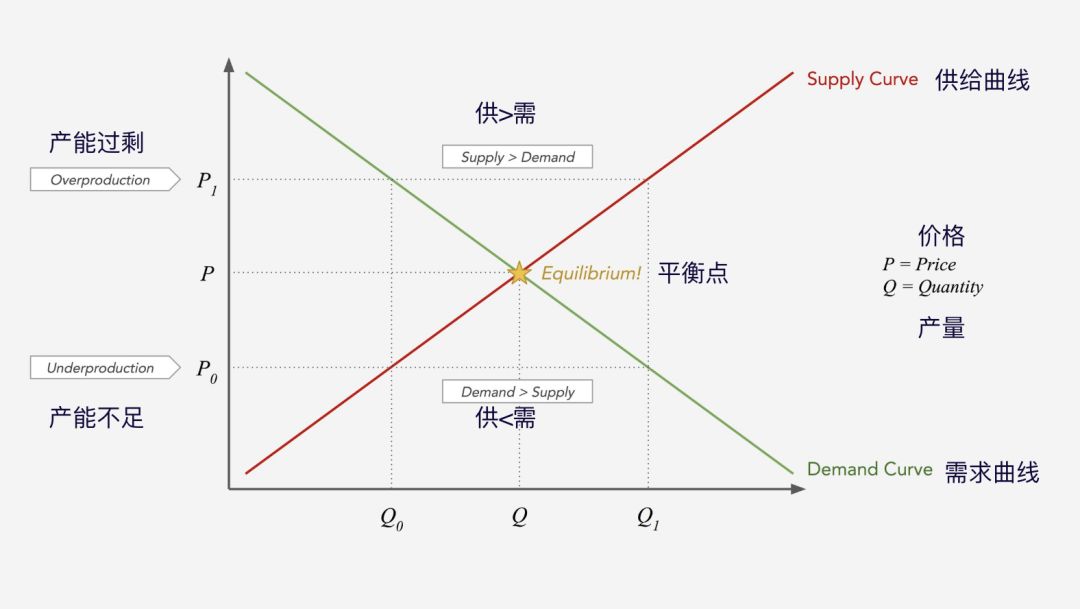

First, let's take a look at the demand supply balance formula that appears in the economics textbook:

P and Q represent price and output respectively, so the product of PQ is the overall economic value. The curve above shows how the price interacts with demand and supply. Of course, the actual slope of the curve will have a lot of actual market conditions and icons. difference.

Usually, a higher price will increase supply, while a lower price will drive demand.

When the supply matches demand, the market is in balance. When the price exceeds this equilibrium point, the supply Q1 is greater than the demand Q0, so the price reduction can make the market reach equilibrium again, and when the price falls to the average level, the production capacity is less than Q0, and the demand is very strong, and the price will be pushed up.

In the short run, the economy is rarely in a state of balance. Under the influence of various factors, the market will shift from insufficient capacity to overcapacity, resulting in high to low price fluctuations.

But in the long run, they tend to be balanced, because over time, some short-term factors are not sustainable and can be replaced, and weak links (failed companies) will disappear.

MB=MC

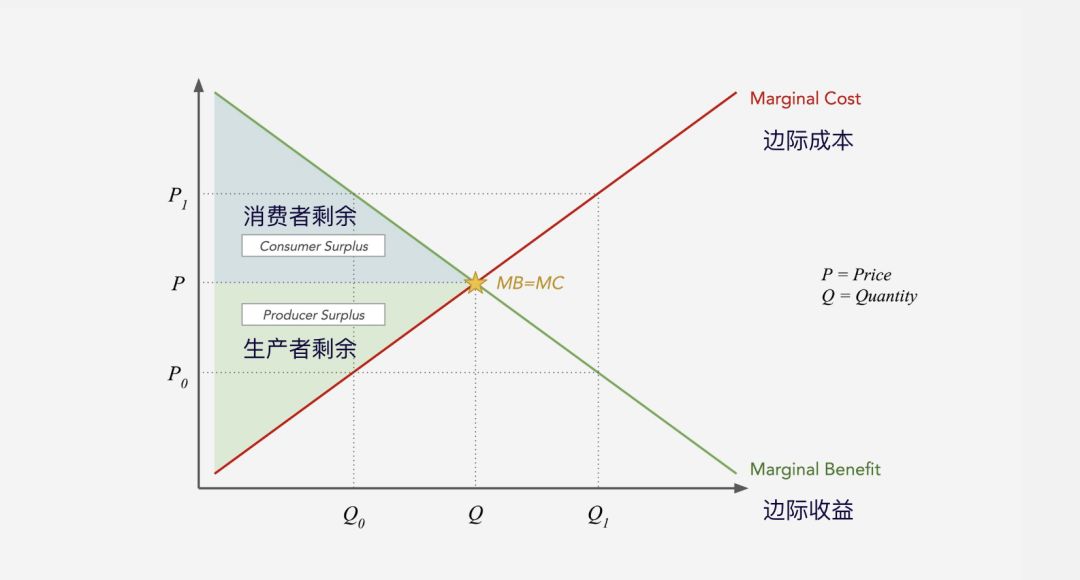

From the micro level, the principle of distribution efficiency determines that in the equilibrium state, the marginal benefit (price) is equal to the marginal cost, that is, the famous MB=MC formula.

The marginal yield curve shows what consumers are willing to pay at different supply levels. In essence, their value is measured by price. The marginal cost curve describes the unit economic cost of each product.

Again, this is a standard curve that will differ from the actual situation, but in general, the MB trend will decline because the richer the commodity, the lower its value in the market. (Refer to the law of diminishing marginal utility), while MC tends to rise because costs increase as production scale increases.

MB=MC is the best price point because it is the moment when the manufacturer recovers all production costs and the consumer pays the lowest price, and it is also the time when the total value of the two parties is the greatest.

For the consumer, it is below the marginal yield curve, above the price (paying the difference between the price and the value), and for the producer, it is above the marginal cost curve, below the price (the difference between the price and the cost) Interval.

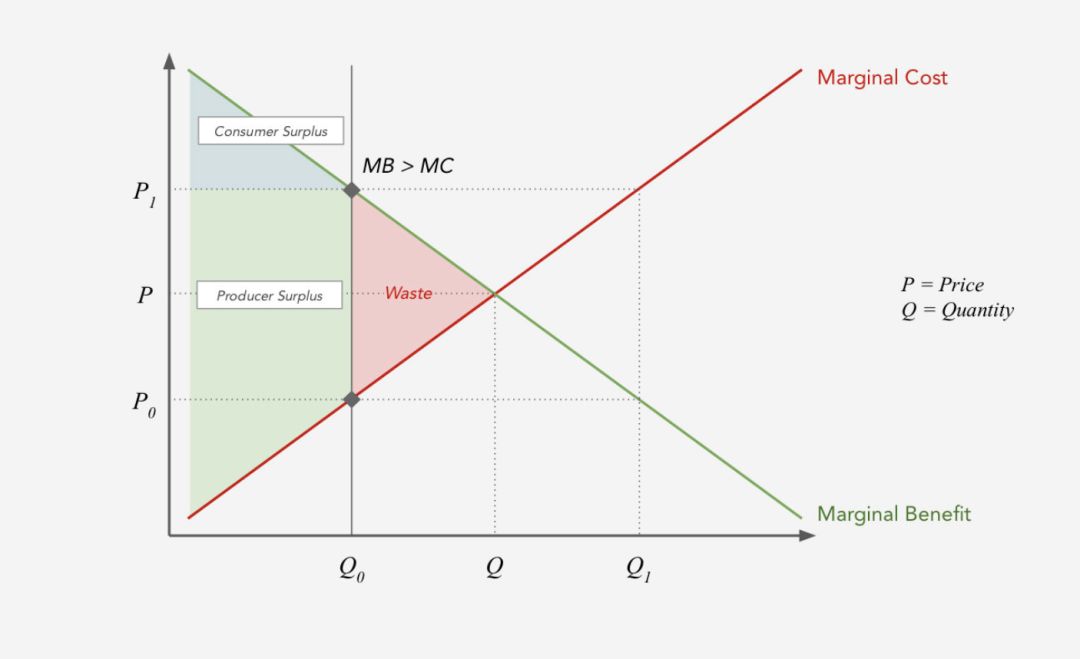

When the marginal benefit is not equal to the marginal cost, the efficiency will be low. For example, MB>MC indicates that the produced product Q0 is less than the best commodity. Since the price determined by the MB (P1) is higher than the production cost (P0) determined by the MC, the producer is in an advantage in the transaction. This market is inefficient and is manifested in “waste” where demand is not fully met:

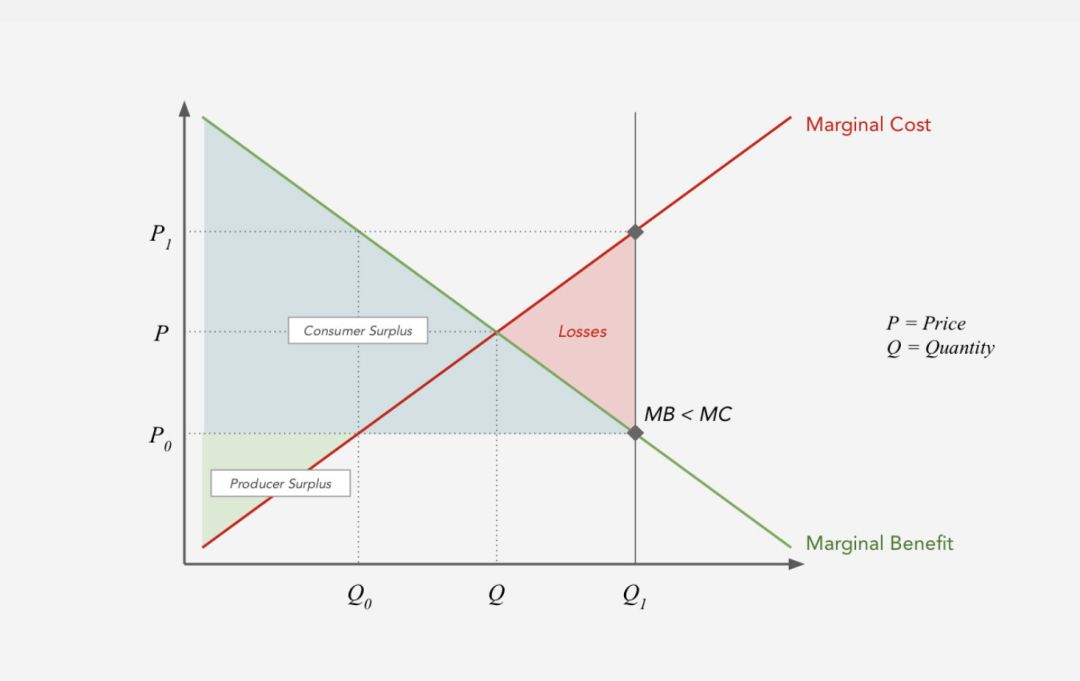

On the other hand, MB<MC, on the contrary, the market price is lower than the production cost, and the consumer is on the favorable side of the transaction, so the “waste” appears in the form of producer losses:

Policy is a common cause of market failures, such as MB>MC may be due to artificial scarcity rules or quantitative easing policies, while MB<MC may be due to price subsidies.

Of course, there may be other reasons, such as market monopoly. At present, large companies restrict data supply through data monopoly is a typical case of MB>MC.

MB=MC means that it is worthwhile, or at least can be priced at its production cost, but it is easier to understand as an alternative cost to the commodity. For example, the replacement cost of widely used goods is much lower than that of the famous artists. Interestingly, this way of measuring value is usually used by tax collectors or insurance appraisers.

In any case, if the price of something is lower than its cost, it is unprofitable for the seller. But if the price is too high, then the market will gradually correct this inefficiency.

But in the case of a company's profitability, the above ideas may seem a bit confusing, but from an economic point of view, costs include all forms of things, such as capital, risk, competition, and so on.

So MB=MC only makes sense when you take all the economic costs into account, not just the “accounting” costs.

For example, VC is a very expensive capital because it has high return requirements and compensation risks, which means that the risk cost of venture capital firms is very high after the risk adjustment. Therefore, a startup company will show an 80% gross profit margin in the accounting sense, but from an economic point of view, the expensive capital cost is not calculated.

In a stable environment, the capital cost of low-risk businesses is relatively low, so the demand for profit margins is low.

TV=TC

From MB=MC we can conclude that the final total value TV is equal to the total cost TC, which is the sum of all marginal revenues and the sum of all marginal costs. When MB=MC, TV=TC.

There is a lot of debate about the accuracy of these basic principles, but the economic model allows us to see more in the absence of information. So, I don't intend to build a specific formula for evaluating something, but to think about value from a more fundamental perspective, which allows us to deduct the return on investment and some other things.

There is one more point about value: value acquisition does not mean return on investment.

We can use this logic to predict the value distribution and capture of the entire market, value, and even within the enterprise, but the value capture is more TAM (potential market) acquisition, and has a certain correlation with the return on investment, but at the same time have their own Internal logic.

Return on investment is a composite function of cost, growth rate, and ownership.

In markets with “captured” high value, you may experience low returns, such as utilities that capture a lot of value in the form of expensive infrastructure and other assets, but it’s hard to get paid, they’re more Used for scale value storage rather than value growth.

On the contrary, you can get higher returns in new markets, but the value of real creation is limited.

Crypto's value measure

For some encrypted networks, equilibrium or direct collapse will be found: so their economic models and policies must facilitate equilibrium. When designing an economic model, the relationship between cost and value distribution should be considered, which means taking into account the supply cost of the supplier, the capital cost of the investor, and the value to the user.

When one side has an excessive advantage, it may directly lead to a collapse. For example, most of the cost is borne by the supplier, and the value is over-allocated to the investor, but the client cannot find value.

Decred is a good example of value distribution, where 60% of the miners (the highest cost) are awarded, and 30% of the tokens are allocated to the POS nodes (they bear the cost of capital to buy and invest in DCR), while 10% Tolen is used to pay for the team's long-term development and network maintenance.

The value of Token is based on its production costs and capital costs: if the token is produced by mining or other means, part of its intrinsic value will be the production cost of the supplier.

For example, if you invest 1 million US dollars to mine, and dig up 10,000 tokens in the middle, then the price of 100 dollars as the token is the lowest price you can accept. It is difficult to sell below this price.

But when it comes to economic costs, you must also consider issues such as the capital costs of other investors.

For example, if you invest 1 million dollars in the same 10,000 tokens, the expected rate of return is 3 times, then the lowest price you can sell may be 300 dollars.

All of these things are affecting prices, but the sum of these parts will get us back to TV=TC, again considering economic costs rather than just accounting costs.

In the short term, we will still see a lot of deviations from equilibrium, especially if the market is still immature.

For example, the smart contract public chain is very much (overcapacity), which means that the market will find a balance at a lower price, it has already happened, it is good or bad, depending on the position of the butt.

The cost of the agreement is higher than the application: the scale effect of the agreement is stronger and requires more investment, so they need more value to maintain equilibrium.

The value of the application is lower because they bear less cost, and in order to get the right size, always consider the total value of a single application and the protocols it uses.

As the market develops, the target of return will change: Today, the protocol layer is still high risk and high return.

In the long run, they may expand the value of trillions of dollars in storage, but growth will slow down steadily, and then there may be fierce competition at the application level.

At this point, although the assets are at the protocol level, the returns are at the application layer. Of course, we are still far from this balance.

Allocating costs to allocate value: If our goal is to design a system that can distribute value more widely, then a deep understanding of the “physical economics” of cost and value is essential. In the long run, the market naturally assigns value to those who bear the costs and risks.

(Finish)

Reference: https://www.placeholder.vc/blog/2019/10/21/how-to-think-about-value

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- QKL123 market analysis | EOS network continues to congest, the fundamentals further deteriorated (1112)

- Beijing will build a “data blockchain” and introduce secure computing to ensure big data security

- Ling listening to Wuzhen site | Do you like a wave or a big river? How to grasp the new opportunities of historical development of blockchain

- Bai Chunli, President of the Chinese Academy of Sciences: Blockchain technology will significantly reduce social operating costs

- Read the simple logic behind the zero-knowledge proof

- Wuzhen Review | Cross-chain ecological stability coin "MOV" released

- Interpretation: Do you really understand decentralized collaboration?