MakerDAO's MCD: What changes have you brought?

In the field of DeFi, MakerDAO is an influential project. It generates a stable currency Dai by decentralization. Dai is by far the most widely used decentralized stable currency in DeFi.

Dai has been generated by ETH over-collateralization. On November 18, 2019, MakerDAO will release Dai (Multi-Collateral Dai), which is the MCD in the title. This will be a major event in the history of MakerDAO development. What changes will it bring?

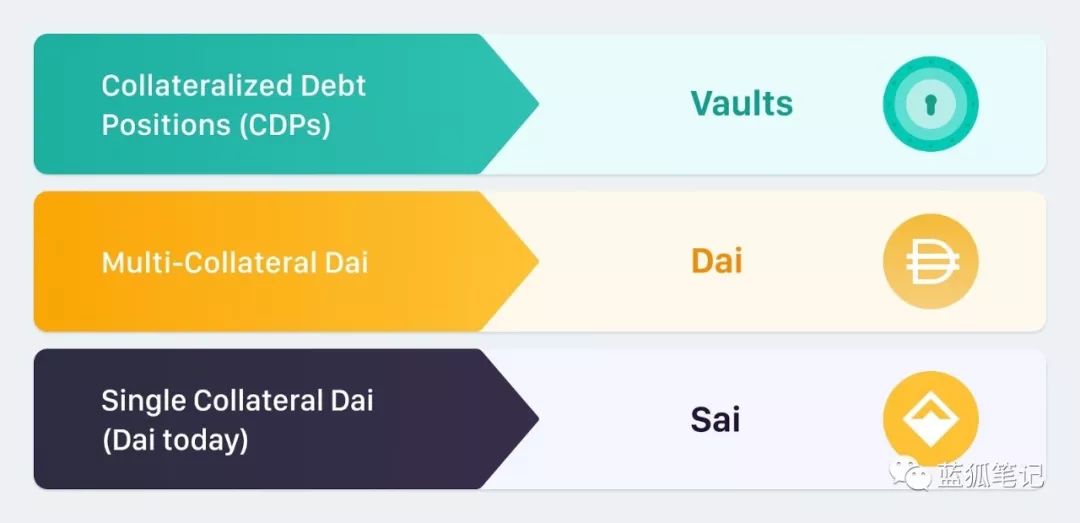

Terminology changes on MakerDAO

For MakerDAO users, you need to learn some new terms to avoid confusion when using them.

The MakerDAO project had an important term for CDP (Collateralized Debt Position), which is the mortgage debt position. Some community users believe that “mortgage” can be confusing and reminiscent of traditional financial products that are not related. In the latest version, CDP will be replaced by "Vault", which can be called a small vault, vault. This term sounds like a sense of security.

- CCTV video: What can the “blockchain” of the competition layout do?

- Viewpoint | How cryptography provides guarantees for solvency

- Discussion: Will blockchain technology be a fake terminator?

The existing Dai is generated by ETH over-collateralization, but after the new version, this part of Dai will be called Sai (Single-Collateral Dai), while the Dai generated by multi-asset mortgage is still called Dai.

As shown below:

Note that in addition to the change in terminology, the icons for Dai and Sai are different.

Sai upgrade to Dai

On the day the MCD version is released, users can upgrade their Sai to Dai. At some point after the upgrade (the specific time will be determined by the community through governance), Maker will adopt emergency shutdown measures, the current MakerDao agreement may be closed, and the existing Sai and CDP will be settled. The upgrade will also bring the benefits of the latest version to the user, such as more collateral asset selection, and DSR (Dai Savings Rate), which means that after upgrading Sai to Dai, you can earn money through DSR deposits.

Before Sai is over, it means there are two stable coins (Sai and Dai), two stability fees, that is, two systems are in operation.

Different main body upgrade methods, such as Sai holders, CDP holders, centralized exchanges or managed wallets, decentralized exchanges and unmanaged wallets, Keeper, Market Maker, loan agreements, dApp, CDP integrators, etc. Need to upgrade. To the Sai holder (that is, the holder of the existing Dai), first enter the migrate.makerdao.com, then log in with the wallet, click "Continue" on the "Single Collateral Dai redeemer" tab, enter the number of Sai, Submit the transaction and receive the upgraded Dai in your wallet. The specific upgrade process is subject to the official MakerDAO project process.

Since Dai is a multi-asset mortgage, what new mortgage assets will there be?

The Maker community is evaluating the first batch of new cryptocurrency assets:

· Augur (REP)

· Basic Attention Token (BAT)

· DigixDAO (DGD)

· Ether (ETH)

· Golem (GNT)

· OmiseGo (OMG)

· 0x (ZRX)

To become a mortgaged asset of MCD, it needs to go through the process of community governance. First proposed, then debate and feedback, and the community collects formal feedback from the proposal. After that, multiple community surveys will be conducted to conduct a sentimental survey of voters for each proposal. Finally, a formal vote is made. Voting will determine whether to activate the mortgaged asset and its parameters. In other words, as long as the governance of the community can be agreed, more mortgage assets can be added in the future.

In a single-asset-backed Dai system, the stabilizing fee is paid by MKR, while in the multi-asset mortgage system, the Vault holder will use Dai to pay the stabilizing fee.

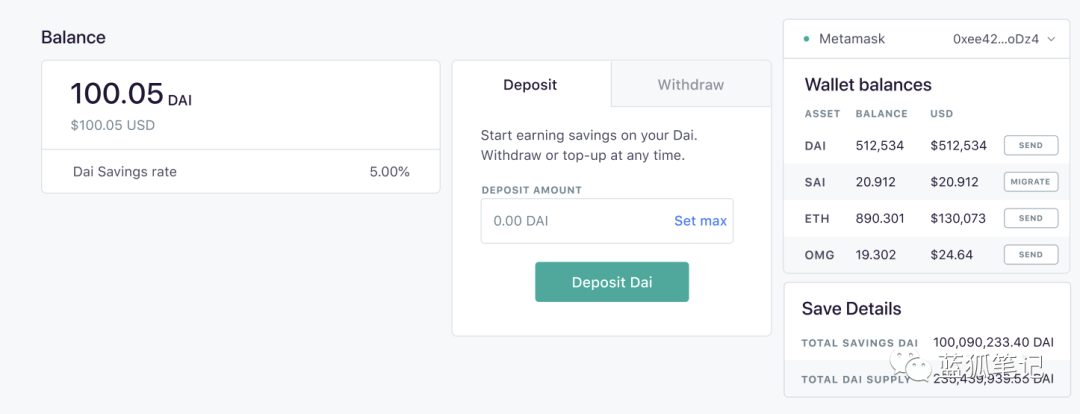

What is DSR?

DSR (Dai Savings Rate) is a new feature of MCD that Dai holders can use to earn revenue. Anyone with Dai can participate, it can participate and quit at any time, is a flexible deposit.

In addition, it is a smart contract for the Maker protocol, which is combinable. That is, other decentralized applications (dApps) can use it.

Why launch DSR? This is related to the appeal of the Marker agreement. The core of the Maker protocol is to maintain Dai's stability (with the dollar anchor). DSR can be a mechanism for maintaining Dai stability. In the current mechanism, stability is mainly regulated by the stabilization fee. If the Dai price is too low, Maker Governance will propose to increase the stability fee, which will stimulate CDP holders to repay Dai, reduce Dai supply, and cause Dai prices to rise. If the price of Dai is too high, Maker Governance will propose to reduce the stability fee, promote more Dai production, increase demand, and cause Dai prices to fall.

The DSR also affects the behavior of the Dai holder through its rate. When Dai's price is too low, DSR will increase the rate, motivate users to buy and deposit more Dai, so Dai's demand will rise and the price will rise. When Dai's price is too high, DSR will lower the rate, reduce the need to deposit into Dai, and take Dai out, increase the supply of Dai, and reduce the price of Dai.

If you deposit Dai through DSR, the annual income is 5%. Which one of them is paid by Dai? It is paid for by the stability fee required to produce Dai. That is, it is paid by Dai's borrower.

Thus, the stabilization fee actually bears two parts of the cost: one is the risk premium of the specific mortgage asset, the value transfer from the CDP holder to the MKR holder; the second is the DSR rate adjustment from the CDP holder. Transfer to the value of the Dai holder. The DSR rate is determined by the MKR holder.

In the DeFi ecosystem, there are also many gains from depositing in Dai. However, DSR is different from a centralized deposit platform. These platforms have counterparty risk and require the counterparty to borrow storage to generate interest. The proceeds from the DSR deposit into Dai are generated programmatically and are guaranteed by MKR dilution. In other words, although the benefits of depositing Dai on other platforms are higher, the risks may be higher.

Maker governance

The ultimate governance decision of the Maker Agreement is the holder of MKR. MKR holders must ensure that the system is stable and transparent, and MKR is also the beneficiary of system growth. It captures the value of system growth, but at the same time bears the ultimate risk of the system.

The latest vote was about a proposal to reduce the stability fee from 5.5% to 5% and raise the debt ceiling to 120 million Dai.

One-stop DeFi platform Oasis changes

Maker's Oasis platform will launch a lending business where users can generate Dai by locking their mortgage assets (such as ETH and BAT) in the vault. The Dai here is the new Dai. In addition to lending, Oasis also offers DSR services, which users can deposit into Dai to earn more Dai. The previous Oasis trading business will stop the Sai transaction and open the Dai transaction.

Conclusion

The MCD release of the MakerDAO project will bring Dai, a multi-asset mortgage, to bring DSR. This is a major change in the history of Maker and Dai development. How will it affect the DeFi ecosystem? What does it mean for Dai and MKR holders? Welcome to discuss the message.

Risk Warning: All articles in Blue Fox Notes can not be used as investment suggestions or recommendations. Investment is risky. Investment should consider individual risk tolerance. It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Jiang Guofei, vice president of Ant Financial Services: Blockchain has fully participated in Tmall Double 11

- Double eleven shopping to send bitcoin, this app did

- The United States is beginning to worry? Billionaire Michael Novogratz says China's digital currency revolution will weaken US financial status

- Notes | About the scrutiny of the verifier 100% Slash, a16z talk about open source movement

- Briefly describe the three stages of the combination of blockchain and industrial economy

- The main force continues to wash, ETH or brewing changes

- Everyone only pays attention to the next halving of Bitcoin, but ignores this information.