Explaining Celestia’s airdrop and economic model, how will the future project’s airdrop method evolve?

How will Celestia's airdrop and economic model evolve in the future?Author: Misty, LianGuaiNews

On the evening of September 26th, modular blockchain Celestia announced an airdrop of 60 million Celestia tokens (TIA), benefiting 7,579 developers and 576,653 active addresses on the chain. Celestia Labs team members and advisors are not eligible to participate in this airdrop distribution. Eligible users must claim the tokens before 20:00 on October 17, 2023.

Looking back at Celestia’s previous funding announcements, both the amount and the institutions involved were among the top in the industry. In 2021, Dutch cryptocurrency investment firm Maven 11 Capital included Celestia in its $40 million closed-end fund portfolio. In July 2022, venture capital firm NFX added $62.61 million to invest in Celestia and Ramp Network through its second fund. In October 2022, Bain Capital and Polychain Capital led a $55 million investment in Celestia, with a post-investment valuation of $1 billion.

From the previous scale of funding, it can be anticipated that the total value of Celestia’s airdrop this time is also considerable. However, in the community, there is no frenzy or cases of overnight wealth accumulation. Compared to previous airdrops, Celestia has taken fairness and real contribution into consideration when designing the airdrop rules. In this article, LianGuaiNews will provide a detailed interpretation of Celestia’s airdrop method, economic model, and a preview of the qualifications for future airdrops of other projects.

- TON Rebirth Technological Advancements and Future Prospects of the Telegram Open Network

- Founder of AltLayer In-depth Technical Discussion on Autonomous World (AW)

- In-depth Analysis and Prospects of Friend.tech Token Model

Celestia Airdrop: Innovative Incentives for Real Contributors and Active Addresses

Celestia will distribute 60 million TIA tokens, with 20 million allocated to research, public products, and early modular ecosystem, 20 million to early adopters of Ethereum rollups, and 20 million to stakers on Cosmos Hub and Osmosis and relay chains on IBC. The specific allocation criteria are as follows.

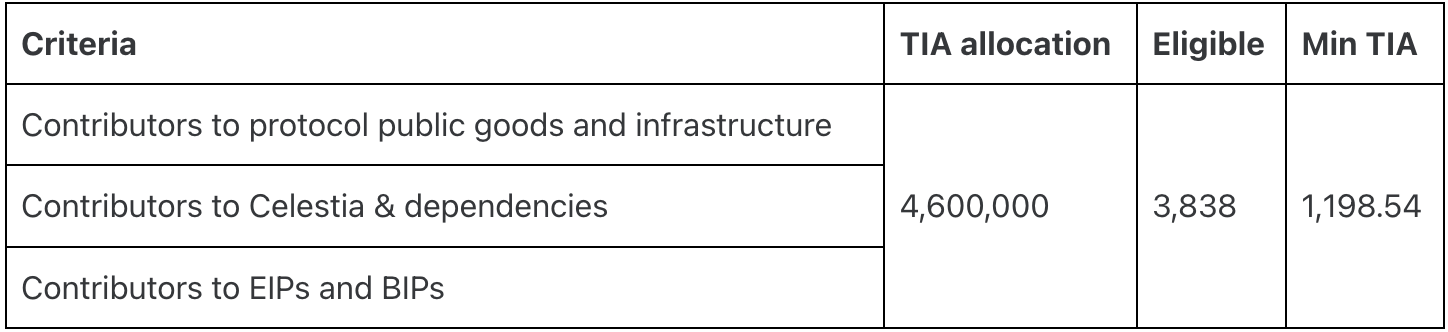

Protocol Public Products and Infrastructure

A total of 4.6 million tokens will be distributed to contributors of protocol public products and infrastructure, with 3,838 eligible users. Each individual can receive a minimum of 1,198 tokens. The specific qualifications include contributors to protocol public products and infrastructure, contributors to Celestia and its dependent projects, and contributors to EIP and BIP.

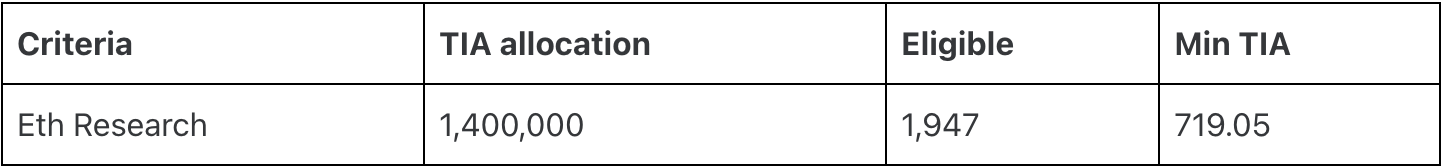

Eth Research

The idea around LazyLedger initially formed in the Ethereum research community. Celestia will airdrop 1.4 million tokens to thank this community for six years of public discussions. The conditions are that forum users of Eth Research who have created at least 1 topic or 1 post before July 5, 2023 are eligible. There are 1,947 eligible users, and each individual can claim a minimum of 719 TIA tokens.

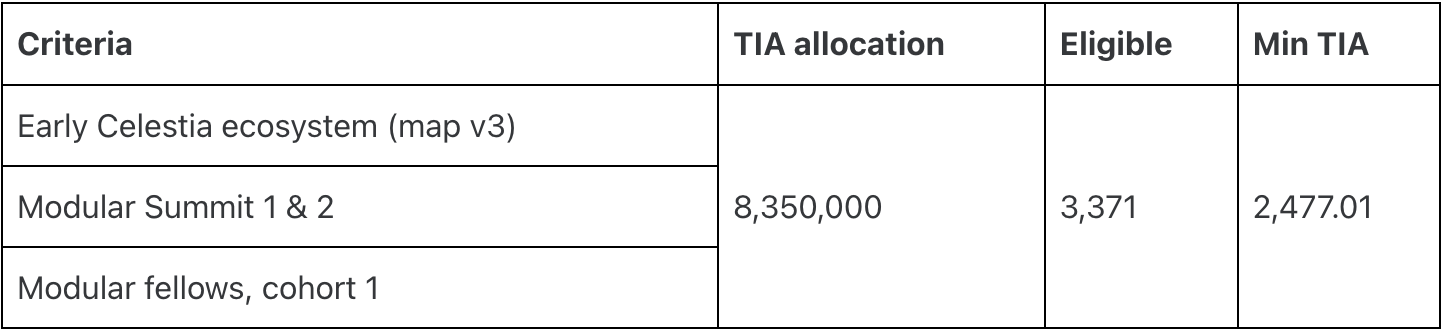

Early Modular Ecosystem

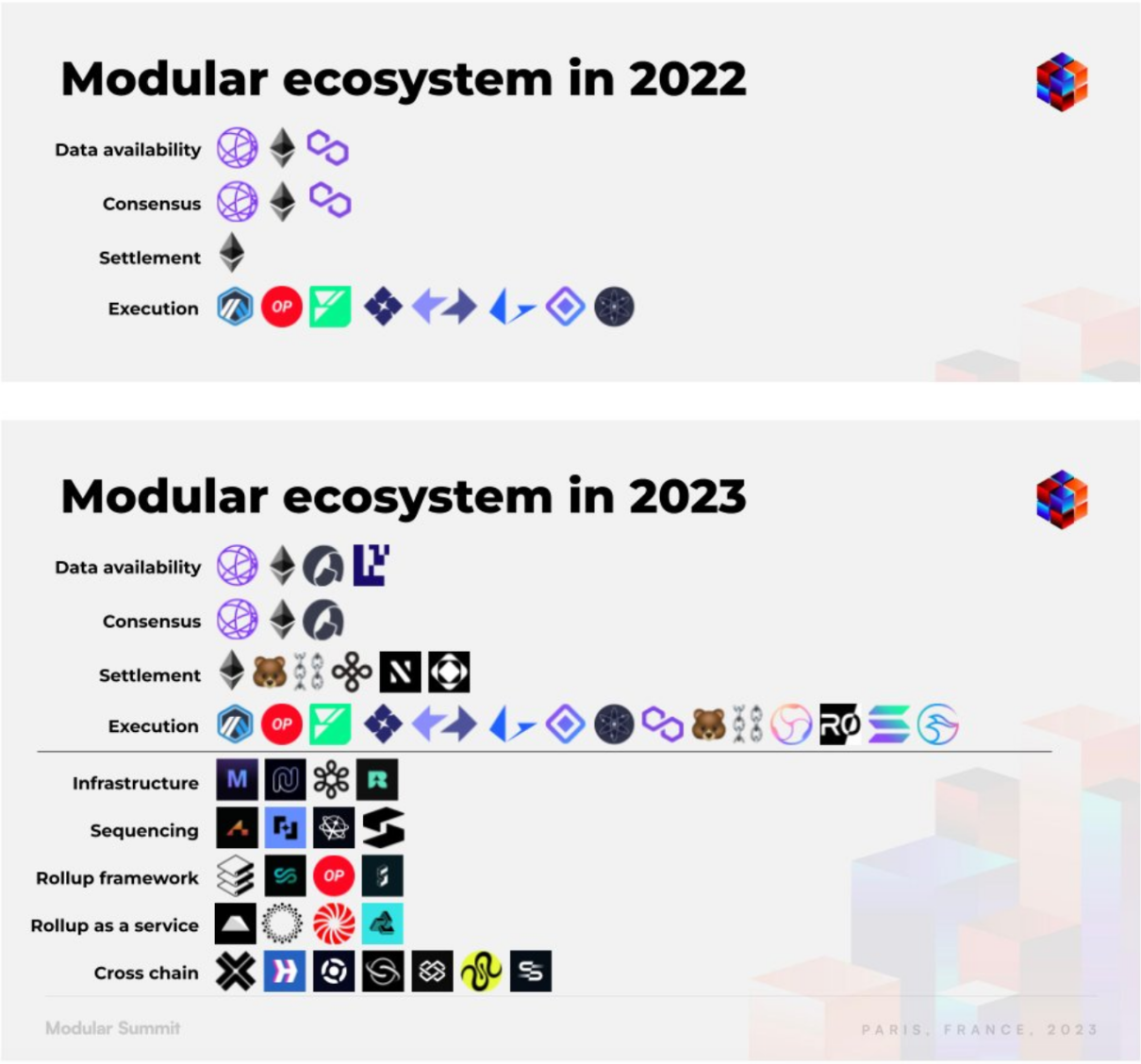

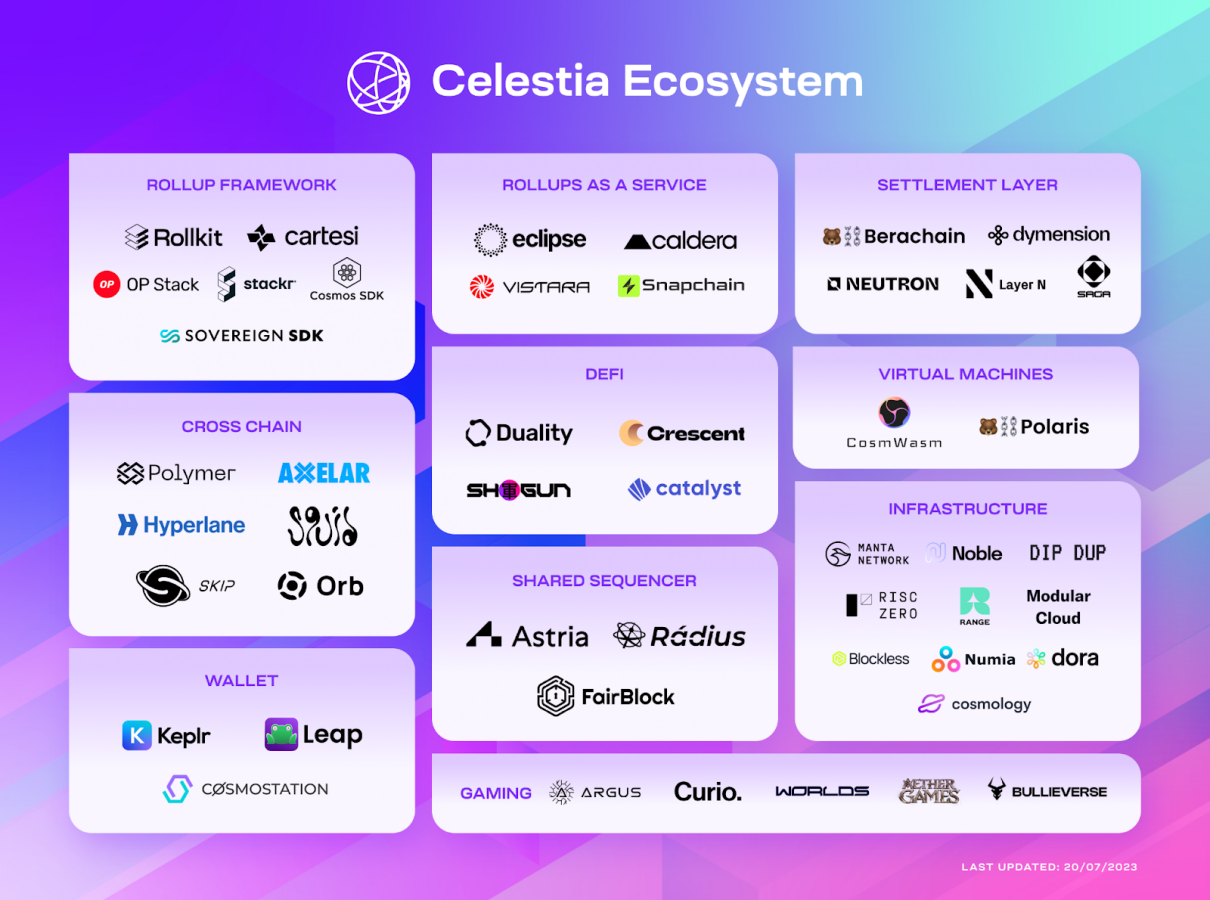

Contributors to the early modular ecosystem can receive 8.35 million TIA tokens, with 3,371 eligible users. Each individual can receive a minimum of 2,477 tokens. The specific allocation groups include the first batch of modular researchers, organizers of Modular Summit 1 (Amsterdam, 2022) and Modular Summit 2 (Paris, 2023), and the Celestia Ecosystem v3 graph released in July 2023.

The qualifications for the first cohort of modular researchers can be found in the official documentation: https://blog.celestia.org/meet-cohort-one-of-modular-fellows/). The modular summit and the V3 ecosystem map are shown in the following figures:

GitHub Super Contributors

Celestia will allocate additional TIA tokens to GitHub contributors who have made at least 4 commits to the above-mentioned eligible repositories, and more tokens to contributors who have made at least 23 commits to research, public products, and early modular ecosystem standards.

According to official data, a total of 1.65 million tokens will be allocated to users who have made at least 4 GitHub contributions, with 1604 eligible contributors. Each contributor will receive at least 1028 TIA tokens. A total of 4 million tokens will be allocated to contributors who have made at least 23 commits, with 1210 eligible contributors. Each contributor will receive at least 3305 tokens.

Early Adopters of Ethereum Rollups

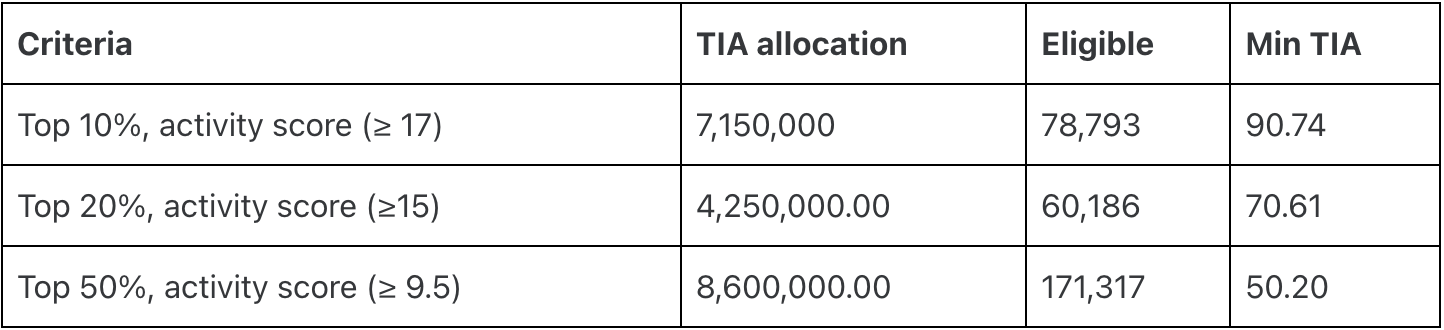

Celestia will allocate 20 million TIA tokens to the top 50% of active users on L2Beat with a wallet balance of at least $50. The wallet addresses will be snapshot on January 1, 2023 (Ethereum block 16308181), and the TVL rankings will be snapshot on April 20, 2023. The activity criteria will be based on users’ behavior on the Ethereum mainnet and other top 10 ranked chains, with 23 points being allocated.

The on-chain behaviors that will affect the point allocation include: the number of interactions with smart contracts on the Ethereum mainnet or Optimism, the number of transactions, the total value of all transactions, ownership of ENS domains, account age, number of active months, Gitcoin donations, ETH gas costs, and the time of the last transaction.

The top 10% of active addresses will receive 7.15 million TIA tokens, with a total of 78,793 addresses eligible. Each address will receive 90 tokens. The top 20% of active addresses will receive 4.25 million tokens, with 60,186 eligible addresses. Each address will receive 70 tokens. The top 50% of active addresses will receive 8.6 million tokens, with over 170,000 addresses eligible. Each address will receive 50 tokens.

Celestia’s point allocation is based on Trusta Labs’ scoring method and excludes identified witch clusters, as well as witch and blacklist addresses from previous airdrops of the HOP protocol and Optimism. It also excludes known addresses related to on-chain vulnerabilities and other compliance standards.

Stakers on Cosmos Hub and Osmosis

Celestia will distribute 18.5 million TIA tokens to validators and delegators who have staked at least $75 on the Cosmos Hub and Osmosis networks. The snapshot was taken on January 1, 2023 (Cosmos Hub block 13482205; Osmosis block 7592794). Similar to the early adopters’ incentive distribution for Ethereum rollups, the airdrop eligibility is divided into three levels based on equity and on-chain activity.

The address activity score refers to Trusta Labs’ media scoring framework, which includes the last transaction time, IBC transaction count, total value of all transactions, account age, transaction count, and gas fees spent.

The top 10% of active addresses will receive 3.25 million TIA tokens, with a total of 29,630 addresses eligible and each address receiving 109 tokens. The top 20% of active addresses will receive 9.25 million tokens, with over 110,000 addresses qualifying and each address receiving 79 tokens. The top 50% of active addresses will receive 6 million tokens, with over 110,000 addresses qualifying and each address receiving 50 tokens.

IBC Relayers

Celestia considers IBC relayers as unsung heroes of Interchain, helping achieve interoperability of modular chains. Therefore, addresses that conducted MsgRecvLianGuaicket transactions prior to the snapshot date will receive 1.5 million TIA tokens. A total of 540 addresses will qualify, with each address receiving 2,777 tokens.

It should be noted that TIA tokens are not currently listed on any decentralized or centralized exchanges. Users should be aware of the risks of phishing links and counterfeit transactions.

Economic Model and Market Value Estimation

TIA has a total supply of 1 billion tokens, with an initial inflation rate of 8% per year decreasing by 10% annually until reaching a long-term inflation rate of 1.5%. TIA tokens can be consumed in the following ways:

1) Payment: To use Celestia for data availability, rollup developers need to submit LianGuaiyForBlobs transactions priced in TIA to pay network fees.

2) Gas fees

3) POS: Celestia is a proof-of-stake blockchain based on CometBFT and Cosmos SDK, supporting delegation within the protocol. By staking TIA as a validator or delegator, users can earn staking rewards from the network. Validators charge fees to delegators and receive a certain percentage of the staking rewards.

4) Decentralized governance: Voting on governance proposals and managing the community pool, which receives 2% of block rewards.

All TIA tokens are allocated to community airdrops, investors, and the team, as follows:

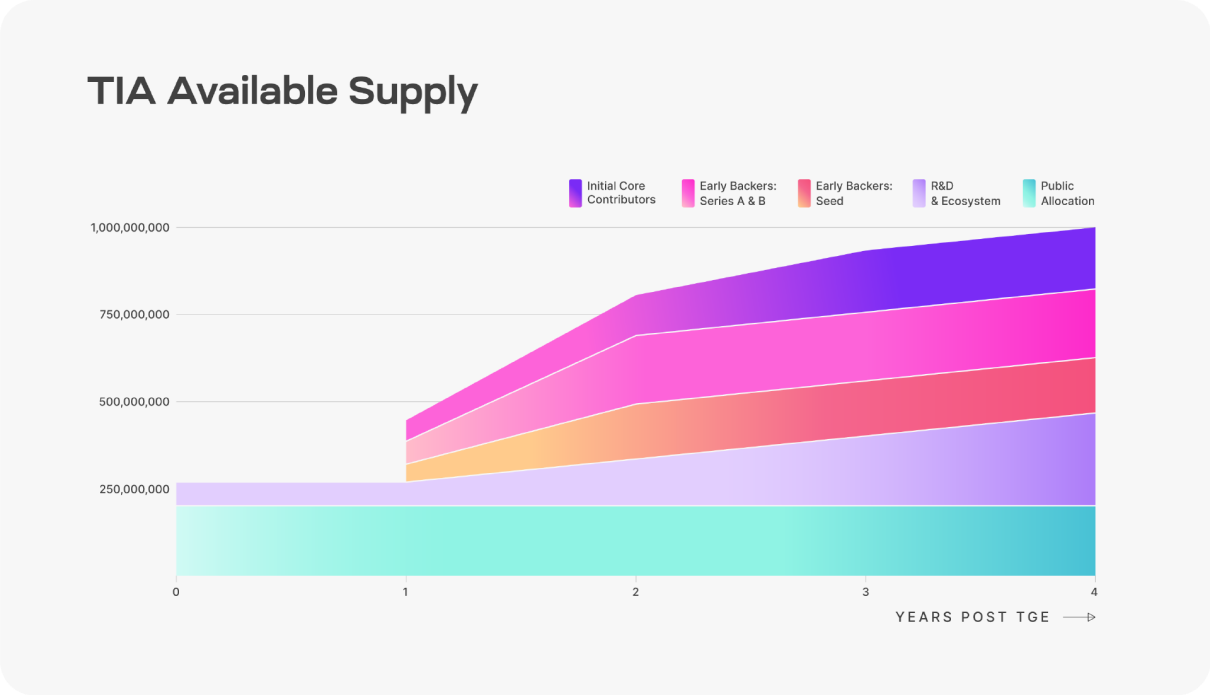

20% allocated to the public community, with 7.4% for Genesis Drop and incentivized testnets, and 12.6% for future plans. This portion will be fully released upon launch.

26.8% allocated to research and ecosystem development, specifically for the Celestia Foundation and core developers to use in research, development, and ecosystem planning, including protocol maintenance and development, as well as plans for rollup developers, infrastructure, and node operators. 25% of this portion will be unlocked upon launch, with the remaining 75% continuously unlocked from year 1 to year 4.

19.7% is allocated to early supporters in rounds A and B, with 33% of this portion being unlocked and released in the first year, and the remaining 67% being unlocked continuously from the first year to the second year.

15.9% is allocated to supporters in the seed round, with 33% of this portion being unlocked and released in the first year, and the remaining 67% being unlocked continuously from the first year to the second year.

17.6% is allocated to early core contributors, including Celestia Labs members and the first core contributors of Celestia. 33% of this portion is unlocked and released in the first year, and the remaining 67% is unlocked continuously from the first year to the third year.

According to the above data, the initial circulation of TIA is 267 million coins, and the opening circulating market value reaches 270 million US dollars, which is comparable to Flare Chain. Its fully circulating market value is 1.1 billion US dollars, ranking 100th. The opening circulating market value reaches 8.6 billion, which is comparable to Cardano. Its fully circulating market value is 11 billion US dollars, ranking 7th. The total circulating market value of the Cosmos chain it adopts is 2.5 billion US dollars, and the total circulating market value of the Polkadot chain in the same sector is 5.4 billion US dollars.

Comparing the operation of various chains and the current market sentiment, TIA token is in a relatively reasonable position between Cosmos and Polkadot in terms of total market value in the early stage of its listing on the secondary market.

The evolution direction of future airdrop methods

With the continuous evolution of airdrop methods, the relationship between project parties and users who seek airdrops has shifted from a mutual benefit stage to a zero-sum game stage. Project parties use the expectation of airdrops and the interaction with users to generate huge transaction fees and other income. For example, projects that are sought after by millions of addresses such as zksync, Layerzero, or StarkNet. Project parties continuously attract users to consume gas or transaction fees through various “PUA” activities.

From the perspective of the project party, users who come over with multiple accounts through PUA do not have the promotional value required for airdrop operations. Just wait for the right time to unload the donkey. Therefore, the project party is more likely to distribute airdrops to users who have made contributions to blockchain technology or concept updates, as well as real users with higher on-chain activity ratings.

In addition, from the perspective of “conspiracy theories”, each airdrop range inevitably contains the project party’s own “rat’s nest”. If other people have already caused a frenzy in on-chain data in order to qualify for and receive more airdrop quantities, it is self-evident whether the project party’s rat’s nest addresses will be mixed together or whether they will create a simpler and more confusing way in rule-making.

Furthermore, in previous Optimism airdrops, airdrops were also distributed to multi-signature addresses, addresses participating in governance voting, and Gitcoin donation addresses in addition to active addresses on the chain. Recently, Sei conducted airdrops targeting cross-chain active addresses. It is worth mentioning that zksync officials have mentioned that airdrop standards may consider the activity of corresponding addresses on the Ethereum main chain.

This time, Celestia’s airdrop incentives are more inclined towards real blockchain technology and project developers, as well as addresses with higher on-chain activity, rather than just targeting addresses on the same chain as the community expected. There are signs that airdrops, as one of the project’s operational activities, are gradually moving away from the previous crude and indiscriminate distribution of tokens, and are all seeking more genuine contributors and active users. Only in this way can the value of the airdrops be maximized.

Summary

Celestia’s airdrop method to some extent innovates the brainless distribution model of airdrops used by previous projects, targeting real development contributors and as many authentic on-chain active addresses as possible. In terms of the distribution of airdrop quantities, Celestia airdrops a minimum of 1000 tokens to individual development contributors, while for active addresses, even users in the top 10% of on-chain activity on the entire network receive only around 100 tokens.

It can be seen that Celestia’s airdrop method is intelligent. On the one hand, it provides more token incentives to absolutely genuine and valuable industry contributors. On the other hand, it targets addresses with relatively high on-chain activity, and the number of such addresses is large enough for their owners to spread the word. This makes them powerful traffic tools with strong advertising effects.

For users with development capabilities who want to qualify for the corresponding airdrop in the future, in addition to contributing to blockchain technology in the past, they also need to have a deep understanding of the project’s development requirements and participate in activities. The majority of users who do not have development capabilities will enter a prisoner’s dilemma, constantly enrich and update the activity of their existing addresses, while adding new addresses. Unable to win with quality, they will seek to maximize their benefits through quantity.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Non-technical personnel’s blockchain account abstraction (AA) study notes

- Interpreting the technical and security factors behind the massive Gas consumption of the Binance Wallet aggregation

- Zero-knowledge proofs from the perspective of non-technical personnel How did it become the third major technological innovation in the history of blockchain development?

- The Third Major Technological Innovation in the History of Blockchain Development – Application of Zero-Knowledge Proof Technology

- Bankless Dialogue with Vitalik The great vision of ETH is to truly create an independent open technology stack.

- Exploring DeFi Economic Models Design and Evolution of Incentive Mechanism

- Layer2 Public Chain Token Valuation Model Analysis