Human Currency History: From Barter to Bitcoin

Author: Darren Kleine compilation: Cobo wallet

Money keeps human society alive. It has an immeasurable impact on people's daily lives, but we know very little about its operating mechanism and history.

In order to better understand the role of currency and bitcoin as the final monetary form, let us first look at the development of the monetary system and the innovations and challenges in different regions at different times.

In the end, we can see that society is gradually returning to the “real” currency track.

- Insurance giant Marsh has customized a full insurance plan for encrypted custodians, can cryptocurrency traders “sit back and relax”?

- Ethereum was blocked and could not stand it? Miners manually increase the gas ceiling

- Filecoin update roadmap: launch test network in December, main online line or postponed to Q1 next year

Currency before: barter

Despite its simple form, the exchange of objects still has its advantages: when it comes to goods, money becomes unnecessary. Because goods or services can be exchanged directly, no form of intermediate medium is needed to determine whether people can exchange or trade fair or not.

As early as the Phoenician era in 6,000 BC, there was a systematic exchange of goods, and they exchanged goods between different cities in the Mediterranean. In the Far East, the Middle East and Europe, barter exchange has existed for centuries, and the exchange of goods includes spices, silk, salt, fur, perfume and other popular items.

From barter to currency

In the early centuries, there was no clear boundary between exchange goods and currencies such as weapons, fur, silk, spices, and even salt, and some commodities gradually became standard exchanges in areas where objects were directly exchanged. Some even became money, because they have a broad consensus and are used as a measure of value.

British North America is a very interesting example of the transition from barter to monetary economy in modern times. In the 17th century, the fur trade reached its peak, and beaver skin, a high-quality fur made of beaver fur, became the standard unit of measurement for many items. In this way, beaver skin became a currency. In 1795, each beaver skin could buy 8 knives or a kettle. You can buy a gun for 10 beaver skins.

Source: www.furtradestories.ca

It is a successful medium of exchange, promotes trade, plays the role of a unit of value measurement, but it is indivisible, and, only to meet certain standards, beaver skin is irreplaceable.

The manager of the fur trading company was found to be replacing the high quality fur with inferior skin. Therefore, it is not irreplaceable and far less portable and durable than metal coins.

Another big problem with beaver skin as a currency? At the beginning of the 19th century, beavers were basically extinct, leaving only a small number of small beavers to be used in trade.

From our perspective, the obvious solution is to use coins to improve trading efficiency, such as the British shilling. The precondition is that both parties to the transaction can reach a consensus on the value of the coin.

In economic history, the transition from barter to currency has occurred again and again. However, in some cases, property transactions still exist.

What is the currency? What is the difference between currencies?

So, what is money? If beaver skin can be used as currency, is it not a form of currency?

No. There are a few subtle but important differences between currency and currency.

Money is more abstract than currency. Currency is a redemption tool, and currency has intrinsic value and does not require any institution to give it value.

Moreover, the term "hard currency" is always reminiscent of items such as gold and silver, which have intrinsic value because they are difficult to obtain. The currency is usually a piece of paper or other similar promissory notes used to represent value and relatively simple to produce.

If the currency wants to be "real", it must satisfy several qualities:

Money must be an exchange medium. In other words, it must be available for exchange between different goods or services;

Money must be a unit of measure that can be exchanged at a set price with goods or services;

Money must be portable and can be transferred from one user to another in order to complete the transaction;

Money must be durable, and it will not dissipate after a long period of wear and tear;

Money must be divisible and available at different price levels;

Money must be interchangeable, and each unit is the same as the other units. One dollar has the same value as the other dollar.

Value store

Very importantly, the real currency is different from currency, which is a value storage tool in the long run. Currency does not have intrinsic value, but it can be used as a tool to transfer value. The government can continue to print money.

For example, real money can still be valuable for centuries, such as gold. Gold is not printed like a banknote, so it retains its rarity.

In contrast, banknotes change frequently, and value goes on with time, and gold persists. Unlike many currencies, gold can be melted and jewelled, but it won't rot or break, or it will continue to exist in a variety of different forms.

Historical efforts to create money

In order to find out how the currency was born in history, we need to go back to ancient times.

Amber gold is one example: it is a gold-silver alloy, which naturally contains some copper and other metallic elements. It also has many impurities, and the size, quality and density are uneven. However, Amber Gold came in handy in the ancient Egyptian kingdom nearly 5,000 years ago and can be used as an outer layer for pyramids, monuments and drinking utensils.

Amber gold was widely used as currency from the 7th century BC to around 350 BC. This alloy is more durable than pure gold, and alchemicals have not yet formed a standard at the time, so it is more difficult than the next few centuries. The most critical issue with amber gold is that changes in purity make it difficult to become an alternative currency.

Source: www.vcoins.com

As time goes by, the amount of gold in the amber gold coins is gradually reduced. This is because gold has a high intrinsic value. If the ratio of gold to other metals does not change, the coin casting cost will increase accordingly.

Source: en.wikipedia.org

Source: en.wikipedia.org

In different periods in some other civilizations, different forms of currency have emerged in order to meet economic needs. In Africa, China, and India, Zibei has been used as a currency in transactions because it is small, lightweight, and has good texture and texture, making it difficult to forge. At the time when these natural supplies were scarce, Zi Anbei played a big role in the transaction.

Source: www.transmaldivian.com

Source: www.transmaldivian.com

For Aztec people, cocoa beans are a good form of currency for hundreds of years. Just like today's banknotes, no one can produce cocoa beans. To ensure its value, the production of cocoa beans is strictly controlled. This popular area of currency is today's Latin America.

In Japan during the feudal period of the 17th century, rice played the role of money. People can use it to exchange goods, pay taxes, or get paid. Because of its light weight and ease of transportation, rice has been in Japan for several years as a currency. In fact, in the early days of the transition from rice to metal currency, it was once disgusted and suspected. All of these currencies operate on a consensus and supply and demand relationship.

In these societies, people have formed a consensus that gives value to something that is very incomprehensible to outsiders. Since everyone agrees with their value, these currencies are functioning properly and can be used for trade and economic activities.

The principle of supply and demand in the free market is also established here. If the supply of shells is too large, their value will be lower than when they are difficult to obtain. Of course, these currencies have their limitations and cannot be fully used as currency.

Return of money

In the history of the world economy, everything from defective currencies to real money returns is predictable. In Greece in the 7th century BC, gold and silver began to be used for trade, which was also the earliest real form of money.

The original ingredients of these coins were amber gold, but they were gradually refined to satisfy all the qualities of a real currency, which later existed for many centuries. The final development of coins from the form of ingots has been a credible and stable form of currency for nearly 800 years.

Source: en.wikipedia.org

Source: en.wikipedia.org

Gold has maintained its intrinsic value because of its scarcity, so when measured in gold, the salary of people before 2000 was almost the same as today:

"In the time of the Augustus Emperor (27 BC to 14 AD), the salary of a Roman centurion was 15,000 sestertii, considering that a gold Augustus is equivalent to 1000 sestertii, each Augustus contains 8 grams of gold, his salary is about 38.58 ounces of gold. At the current price, about 54,000 dollars a year."

A centurion has 80 men, which is equivalent to the US military commander today. Their salary is about $46,000 a year, very close.

This also shows that gold is a good means of value storage and can be used as a good inflation hedge. In contrast, banknotes are more convenient and easy to use, as can be seen from the history of China's relatively long currency.

"flying money"

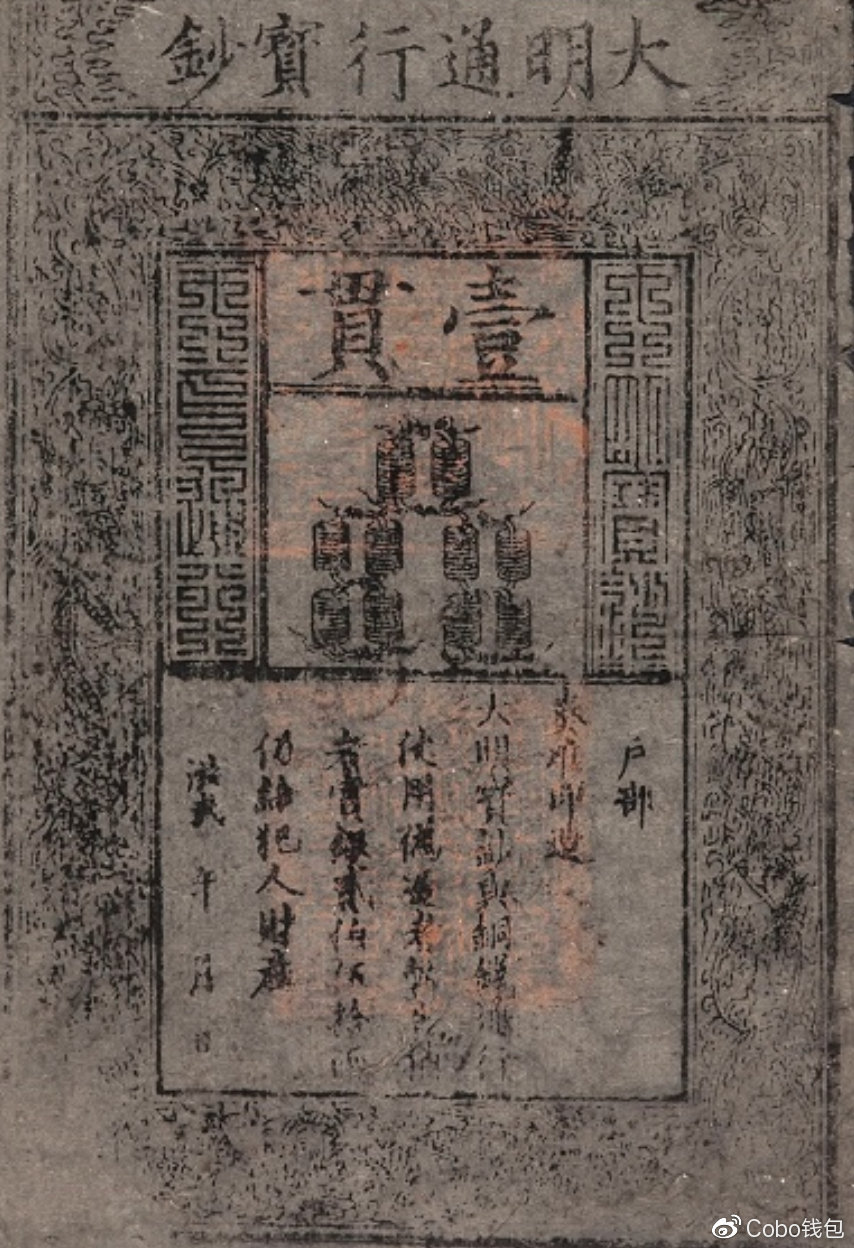

Banknotes first appeared in China's Tang Dynasty. This kind of currency is also called "flying money". Unlike metal currency, this kind of money is easily blown away by the wind.

In 800 AD, the government replaced the copper coins with innovative banknotes. The availability of metal currency is limited and it is not convenient for long-distance transactions between merchants, so banknotes are considered an elegant and innovative solution. The new type of banknotes eliminates the hassle of merchants carrying large amounts of metal currency.

Although banknotes are not strictly legal currency in the strict sense, the original intention is that they can be exchanged for metal currency, but they are popular among merchants because of convenience and portability.

Source: en.wikipedia.org

The banknotes forcibly printed in the first country first appeared in the Song Dynasty. Only the officially issued banknotes of the court can be considered as currency, with the corresponding metal behind it.

Inflation begins to take off

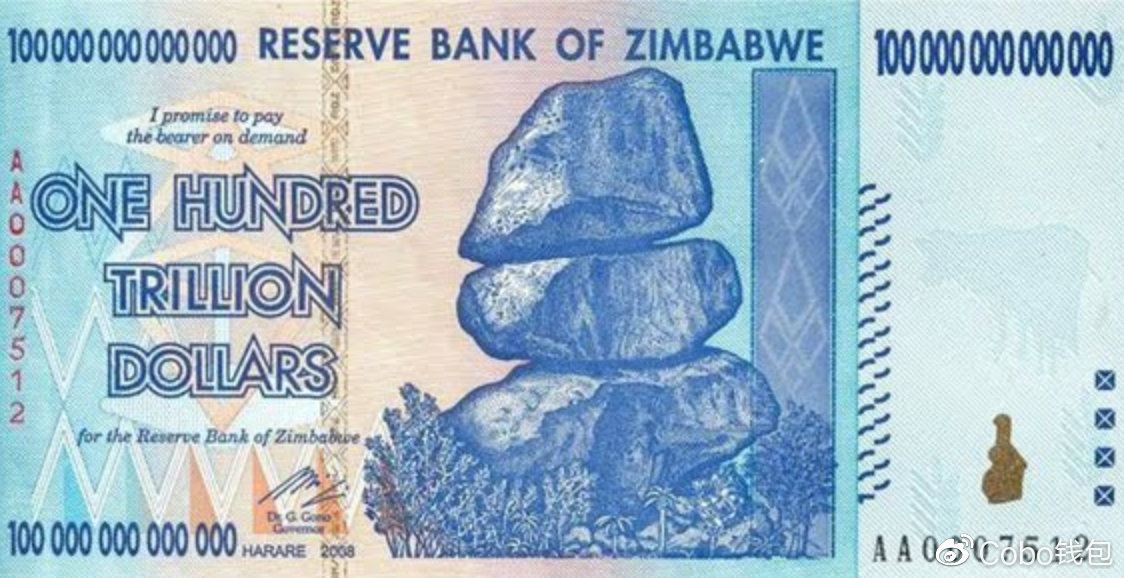

During the Yuan and Qing Dynasties, excessive printing of banknotes without sufficient hard money supported the economy became a victim. In order to maintain currency control, both gold and silver were confiscated by the state. Slowly, in order to boost the economy, excessive printing has led to extreme inflation, which has caused a large depreciation of banknotes.

During the Ming and Qing Dynasties, after experiencing the failure of banknotes, they gradually returned to hard inflation. The innovation of banknotes gradually spread westward to the Middle East and Europe. In 1601, Sweden became the first European country to issue banknotes.

From the long history of China's currency, we can also see that metal as a real hard currency will eventually return, because they will not be destroyed by printing. In various economies around the world, they are gradually moving toward hard currency because they have the advantage of a free market and can resist inflation because of scarcity.

Legal currency in modern society

In the 20th century, extreme bankruptcies were avoided because banknotes around the world required anchoring of gold or silver.

After accepting the lessons of inflation in continental Europe at the end of the 16th century, in order to prevent similar mistakes, the United States turned to another monetary standard – each dollar has gold or silver support behind it to ensure that the currency has a certain intrinsic value. . Since gold is more rare than silver and is not prone to supply surges, it has gradually become the standard support behind US currency and can be exchanged with gold of the same value.

In the war era, countries temporarily abandoned the gold standard, and people began to hoard metal currency to protect assets because banks could not exchange banknotes.

After the Second World War, the Bretton Woods system was established. The currency of many countries in the world was anchored with the US dollar, and the US dollar was the gold standard. This means that the global currency is linked to the value of gold, forming a global currency standard.

Of course, claiming that it has gold support and that there is real gold support is two different things. When more and more countries are no longer willing to exchange with the US dollar, but also want to convert the currency into gold, the problem arises: the demand for gold exchange is far greater than the reserve of gold.

Nixon shock

During his tenure at Nixon, the gold standard came to an end. The US government unilaterally closed the channel for the exchange of dollars into equivalent gold. The move was considered a successful measure to resolve the foreign exchange crisis, and the Dow Jones Index achieved the highest single-day gain in history.

But since then, we have come to the era of floating legal paper money. All this seems to be too familiar, is there any? We turned from the real currency, gold and silver, to banknotes that could be overprinted.

Inflation caused by over-printing has become a problem that continues to plague the world.

Digital Age

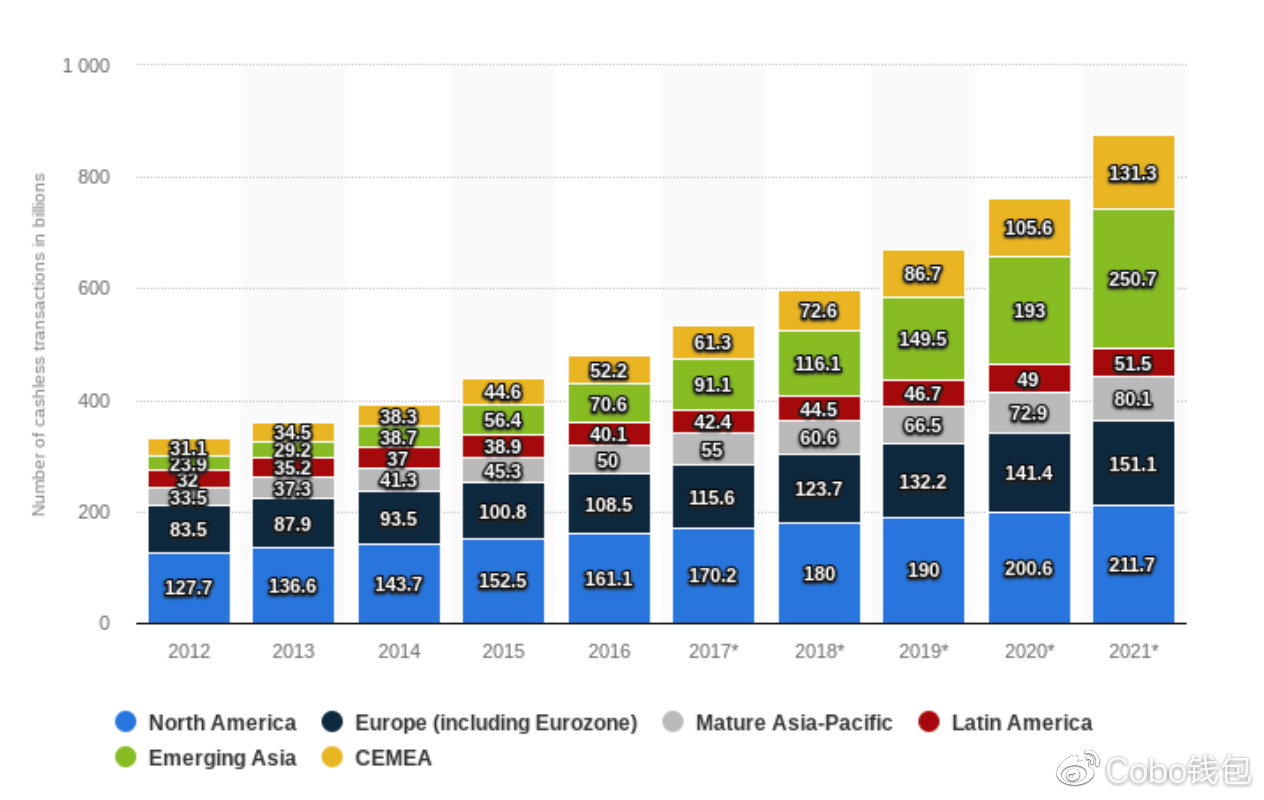

In recent years, the digitalization of currency has risen globally. We are also called “no cash payment”: debit cards, credit cards, and mobile payments that have been popular in recent years, such as Apple Pay, Google Pay, PayPal occupying daily transactions. The vast majority. As of the end of December 2017, WeChat paid more than 800 million card-binding users.

Source: www.statista.com

Like paper money, these electronic forms of payment are not scarce, and even if they bring a lot of convenience to life, they are essentially as flawed as the historical currency.

Today's near-cash-free state reflects a continuing low interest rate and inflation environment. Such electronic currency lacks currency independence and privacy compared to cash and real money.

Future Currency: Bitcoin

In the end, we will also see the return of real money.

- Money must be an exchange medium. In other words, it must be available for exchange between different goods or services;

- Money must be a unit of measure that can be exchanged at a set price with goods or services;

- Money must be portable. Bitcoin can exist in your brain in 12 or 24 words, which is more convenient than any form of currency;

- Money must be durable, and Bitcoin is almost impossible to destroy with the guarantee of powerful hashing power;

- Currency must be divisible. Bitcoin can be divided into 100 million shares. The smallest unit is “Cong”. If necessary, it can be adjusted by changing the agreement.

- Money must be interchangeable, and each unit is the same as the other units.

Like gold and silver, Bitcoin is also scarce, with a total of only 21 million, enough to make it a hard currency that can store value.

Although bitcoin is in electronic form, the nature of blockchain technology guarantees its scarcity. Bitcoin preserves the essence of the era of barter exchange in ancient times. It allows both parties to trade directly, without the intervention of third-party intermediaries.

This is the ultimate monetary form, surpassing any currency we have ever had, even gold and silver.

Original link: https://cryptobriefing.com/why-bitcoin-part-one-the-history-of-money/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis: Can DeFi survive after leaving Ethereum?

- Using data to prove value, the “blockchain value list” will be released in the World Blockchain Conference·Wuzhen

- 72,000 bitcoin bursts, who is the culprit?

- QKL123 market analysis | When the dark moment is coming, when is the Jedi counterattack? (0925)

- Viewpoint | Counter-criticism against two Ethereum criticisms

- Lava Interpretation: All PoC projects are very different

- Research Report | From the Bakkt online to see the way traditional institutions lay out digital assets