I sold the mining machine and I went to the shoes.

After Wu Yifan detonated the fried shoe circle, the banknotes that had been quiet for many days could not stand.

The currency of the old K is quite unbalanced.

"The same speculation industry, seeing the sudden climax of the shoe circle, our calf is dying."

In the envy and can not help but discuss, many exchanges played P Tula, "pretend to trade all shoes can be fried."

- The central bank released the 2018 annual report: four times mentioned the digital currency, saying that "the stage has progressed" (PDF full text)

- QKL123 market analysis | Bitcoin is multi-empty, the altcoin is relatively strong (0823)

- The sky is really a pie! Many exchanges traded abnormally, and more than 40 bitcoins were sold for 0.3 dollars.

The operation of the two exchanges should have been added to the chicken legs

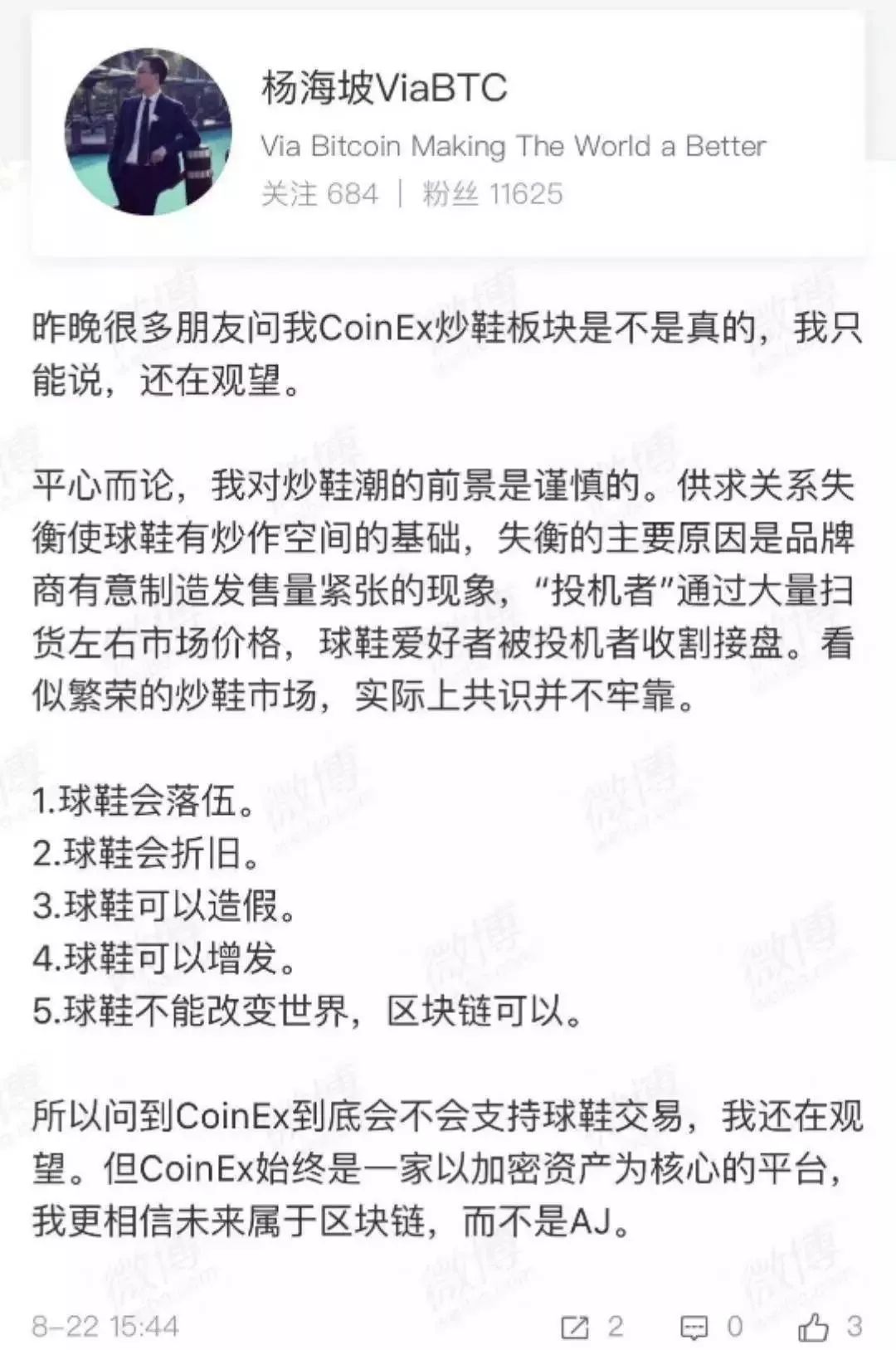

But the shoes and coins are not the same, we have seen a lot of big cockroaches in the currency circle have dissed the shoes into the dust. For example, COO Xiong Yue and ViaBTC founder Yang Haipo analyzed it from multiple dimensions:

To sum up, the two big-eyed views are that, as a value carrier, the fatal flaw in the sneakers is that the "durability" is poor, and the so-called "scarcity" is also deliberate and easily destroyed by the brand. How can it be Compared to Bitcoin, which is a great innovation of "code is law".

Shoes and coins are far apart, and it seems to be comparable to the "mine machine".

Famous shoes, mining machines, speculators everywhere

Famous shoes, mining machines, speculators everywhere

The way young people look at the shoes “rushing” reminds me of the hunger and thirst of the miners when they are on sale at the new mining machine.

With the "shoe head" will find a lot of ways to grab limited edition shoes, if the market is good, when the new mining machine is released, there are already speculators to buy out, the real miners who really want to buy can only buy at a high price.

Obviously, shoes and mining machines have both physical and use value. However, compared with shoes, the mining machine is not close to the public, and it is better than the excavator.

Both have good hype value, but they don't have storage value. Of course, there are very few second-hand shoes.

The hype of shoes includes the same stars. For example, on August 19th, the fried shoes circle was crazy for a photo of “Wu Yifan’s Air Jordan 1 Spider-Man”. Within 1 hour, the same shoes increased at least 5 times. .

Stars on the foot = capital investment in the currency circle, and the star joint name = weight partner platform. Last year, AJ also had a pair of sneakers, from the price of 1299 yuan to more than 8,000 pieces, and this year again rushed to 20,000 to 30,000, this time just because the co-star star Leonard led the Raptors won the championship in the NBA .

In addition, in the winter and the beginning of the school season, it can be said that every day is a day of rushing. In the mining circle, it is necessary to see which mine opportunity suddenly cuts off, or which currency price suddenly takes off, and the corresponding mining opportunity will be sold. For the five months before the Litecoin halved, the price of Litecoin and its mining machines were climbing upwards.

The composition of the two industrial chains is similar. The mining machine manufacturer corresponds to AJ and other brands, and there is a large mine corresponding to the AJ "shoe head", which can be used to shoot millions of coins (possibly tens of millions in the mining circle) to build warehouses; "have mines" followed by It is a "sale" that constantly keeps people from the group and sipping in the circle of friends. Under the toe, it is a "shoe seller" who keeps buying and reselling. Of course, professional shoe vendors will naturally use the private domain traffic of their friends.

As two industries that have barely intersected before, there are many differences between the two, such as the initial release method.

Limited-edition shoes are produced by lottery like a license plate, and it is completely destined to be able to grab it. The process of buying a mining machine has many human factors to intervene. The first one is to almost who will give the full payment first.

Another example is the player's portrait. It is said that after the 00, there are many high school students and college students, these students usually also part-time purchasing or doing micro-business; because many limited edition shoes are issued in North America, so the international students account for a considerable part.

The population of mining machine practitioners, from mining company owners to sales are very different from the two groups. The boss is probably the person who entered the mining industry from 2013 to 2017. He was born in the sales and maintenance of computer accessories, or operated Internet cafes, or a technical house/DIY hardware enthusiast… After the accidental involvement in this industry, he made a fortune. , gather hundreds of millions of funds to do business in the distribution of mining machines. As for the sales people, they compare the general public. Before selling the mining machine, he may have done micro-business and sold various electronic devices, including many young people.

Of course, from the perspective of the circle, the speculative shoes and the investment threshold are lower than the speculum, so they are more close to the people. According to an estimate of “shoes and dogs” before 85, in theory, every person who bought shoes may become a speculator after experiencing soaring prices, so there are at least tens of millions of people in this generalized circle. However, the number of miners is tens of thousands of people (including miners who buy mining machines).

Fake shoes are flooding, mining machine pits

Fake shoes are flooding, mining machine pits

The shoe circle has the harm of the Putian system, and there are also a lot of funds and scammers in the mine ring.

There is a paragraph that says that a certain sneaker is limited to 15 pairs in the world, and 50,000 pairs are sold in China. Like the medical circle, a considerable part of the market for fried shoes has been captured by the Putian system. According to a description of a “shoe dog” (similar to “cat slave”), “Putian has a fairly complete imitation shoe and sales industry chain. After the brand new shoes are on the market, he can quickly produce raw materials and processes similar. Shoes, what level of fidelity can be achieved? You go to the factory to verify, the manufacturer does not have a 100% clear method. Imitation shoes are not as good as real shoes after all, after all, the material is different, may not be a while ""

The mining machine is not imitation, after all, can you dig out the coins, and the performance indicators can be clearly distinguished. But there are also some human problems that plague the mining machinery circle, such as funding.

At the end of 2017, the price of bitcoin was around RMB 120,000. As a necessary tool for obtaining bitcoin, the mining machine has become a very impressive speculation. A S9 with a price of 10,000 can be fired to 30,000. Almost no "limited", orders can be placed up to 3 months later. As a result, the frying machine also attracted the attention of the coil. Moreover, due to the huge amount of mining machines, it is easier to encircle large sums of money. Zhang, who was seized by the police afterwards, spent three months defrauding hundreds of millions of yuan. His routines, like other Ponzi schemes, promise a super high return. When the market price is 30,000 yuan, he sells 10,000 yuan, which attracts many customers and gradually gains trust. In fact, it is paying the difference in the subsidy, and when it is later, it becomes the money of the latter to buy the machine for the former. Finally, one day, he promised to deliver more mining machines than the number of the market, and Zhang was missing.

There are various other scams in the mining machinery circle. Of course, this also has a lack of prudent decision-making factors when the market is overheated.

When the two markets are being sizzled, people are also inclined to lose faith. Chinese ancient language cloud: people do not believe in standing. This was established in the face of making small money, and it seems to be in the face of making big money.

When the market is good, the mining machine is out of stock is an absolute event. As one of the "mines", the founder of Shenma Mining, Yang Zuoxing said, "Until now, the mining capacity is still the bottleneck." The scarcity of the mining machine was revealed. And such a market also means an amazing increase. On April 3, the Zcash (large zero coin) mining machine Z11 was quoted at 9200 yuan. After three days, as the price of the coin rose, the price of the mining machine rose directly by 1,000 yuan, and rose again by 3,000 yuan in a few days. At this time, if you are a dealer, you promised to sell it to the customer for 9,000 yuan a few days ago (delivery within the week). Will you continue this business after the price rises? If the cost of default is 300 yuan per customer, will you put a thousand dollars in the difference and don't earn money to continue to give him low-priced goods? This is when the torture of the soul, of course, in fact, many people can not stand the test.

The same is true for fried shoes. A "shoe dog" recently spoke to the Odaily Planet Daily. Recently, he bought shoes on "poison" (sports and shoes trading platform) and returned it three times after placing the order. "If you want to talk about it, there is no door. (In the industry) This is not to ask, ask is love. The seller will say that this pair likes to stay. Some apps will refund you a one or two hundred vouchers, but The seller of the difference does not care about this money."

Which one is speculative to make money?

Which one is speculative to make money?

Now there is a saying on the market: stocks are not as good as speculation, and speculation is not as good as speculation.

Indeed, it is now the heat of the shoe circle, the currency circle is faint, and the mine circle is deserted. However, the currency circle is in the midst of a shocking market. Once it rises, it will cry for an empty army.

The logic of the two roasted seeds and nuts is similar – it is necessary to judge the wind direction, supply and demand, and seize the opportunity to buy low and sell high.

An old miner who has been admitted since 2013 has broken the cycle of how to use the mine. "At the time of the bear market, a large number of mining machines came out. The cattle came to sell at a high price. When they arrived at the bear market, the miners who waited for the high position couldn’t get back the electricity bill, and the big ones backhanded the low-cost recycling (mine machine)." This rule applies equally to the shoe loop.

As for the shoe market, it is necessary to find the tipping point early. For example, you can also match "Air Jordan 1 Spider-Man" before Wu Yifan goes to the foot.

Naturally, the two circles can't escape the law that prices are affected by supply and demand. In the rushing group, in addition to shouting each other every day, the main focus of the discussion is the actual volume of the sneakers. "Whoever gets closer to the truth can earn money on information asymmetry." Whether the shoes will be replenished or not, how much the shoe has a foot rate (consumption) is the homework that the toe caps have to do every day.

There is no need to say fast-forward and fast-out. The bubble always rises and falls. "A lot of shoes are basically not moving after the end of the game." When the timing is taken, the mirage in the bubble can be turned into a banknote.

Although the road is simple, in practice, people either lack the necessary amount of funds, or lack the sophisticated experience, and judge the mistakes at the critical moments, and the shots are not timely, resulting in losses.

Relatively speaking, fried shoes may be more fortunate than speculative machines. Because, when the mining machine distribution operation is still very primitive, the shoe trading market and its supporting facilities have been built.

The trading platform "poison" and the market tool "Dou Bull DoNew", and many other single KOL evangelistic sermons, plus capital blessing, the industry of speculating shoes is going to the standardization path; while the mining industry, but in the country a paper "ban" Under the "elimination of the industry."

Today Wu Yifan wore 6999, and tomorrow changed back to 1299?

Today Wu Yifan wore 6999, and tomorrow changed back to 1299?

Unlike the mining machine ring, the fried shoes completed the counterattack from the niche to the public in four years. Bitcoin has done it, but the mining machine may never do it.

As competition intensifies, participants need to monopolize the market on a large scale, or even to some extent, to gain a survival advantage. Therefore, the mining industry is also operating in the direction of intensive, large-scale professional institutions. While the shoe loop has an open trading platform and a vast market, retail investors do not seem to be forced to leave so quickly.

Fried shoes start with cultural trends. As a "shoe dog" said, the reason why shoes can be fired is that there are both human factors of brand owners, as well as factors of circle and culture. The slogan of the shoe circle – "Q is love, love is rushing, rushing to finish." Even if the outsiders listen, they will be infected. Coupled with the popular idol blessing, it also adds a layer of fan economy.

The trend may be all the rage, but it is also turning very fast. Today, Wu Yifan wore these shoes, and it soared 5 times to 6999 yuan; tomorrow Wu Yifan could not immediately wear it.

"Small young popular fried shoes, middle-aged and old people fried beeswax, mahogany, antiques, calligraphy, stamps, walnuts, and no one will pick up later." Some people have begun to worry about online, with the aesthetic between generations Changes, once popular investment targets may be more and more unattended.

We can see that after the speculative heat, the sneaker circle is gradually captured by the speculators, and the core of the sneaker culture may also give way to the interests.

"Now the market has gone awry, mass-produced shoes, shoes that were not very valuable before have been fired very expensive. Shoes that can be bought before are now difficult to buy and wear, and the sellers are not shipped." The "shoes and dogs" complained.

Another "shoes and dogs" with self-wearing and part-time fried shoes added that "there is nothing to rush, buy shoes purely for the frying band, and recently are not ready to play."

Imagine how long this circle and the roasting heat can support when the spiritual leaders of these cultures leave.

文| 黄雪姣

Produced | Odaily Planet Daily (ID: o-daily)

Original article, reprint / content cooperation / seeking reports, please contact [email protected]; unauthorized reprint is prohibited, violation of the law will be investigated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt column | Cai Weide: How do foreign countries see China's response to Libra, how is it laid out abroad?

- Opinions | Whether it is PoW or PoS, it will eventually become centralized

- Confusion in the era of digital economy: What happens to digital heritage after people die?

- Viewpoint | Is decentralization technology really better than traditional technology?

- Exchanges are temporarily withdrawing cash, data is garbled, or the Amazon server failure in Tokyo

- Ethereum will become the first public chain of the Hyperledger Alliance

- Sudden! Multiple platforms BTC and ETH were pinned, but some people were unexpectedly rich.