The central bank released the 2018 annual report: four times mentioned the digital currency, saying that "the stage has progressed" (PDF full text)

This article is intended to convey more market information and does not constitute any investment advice.

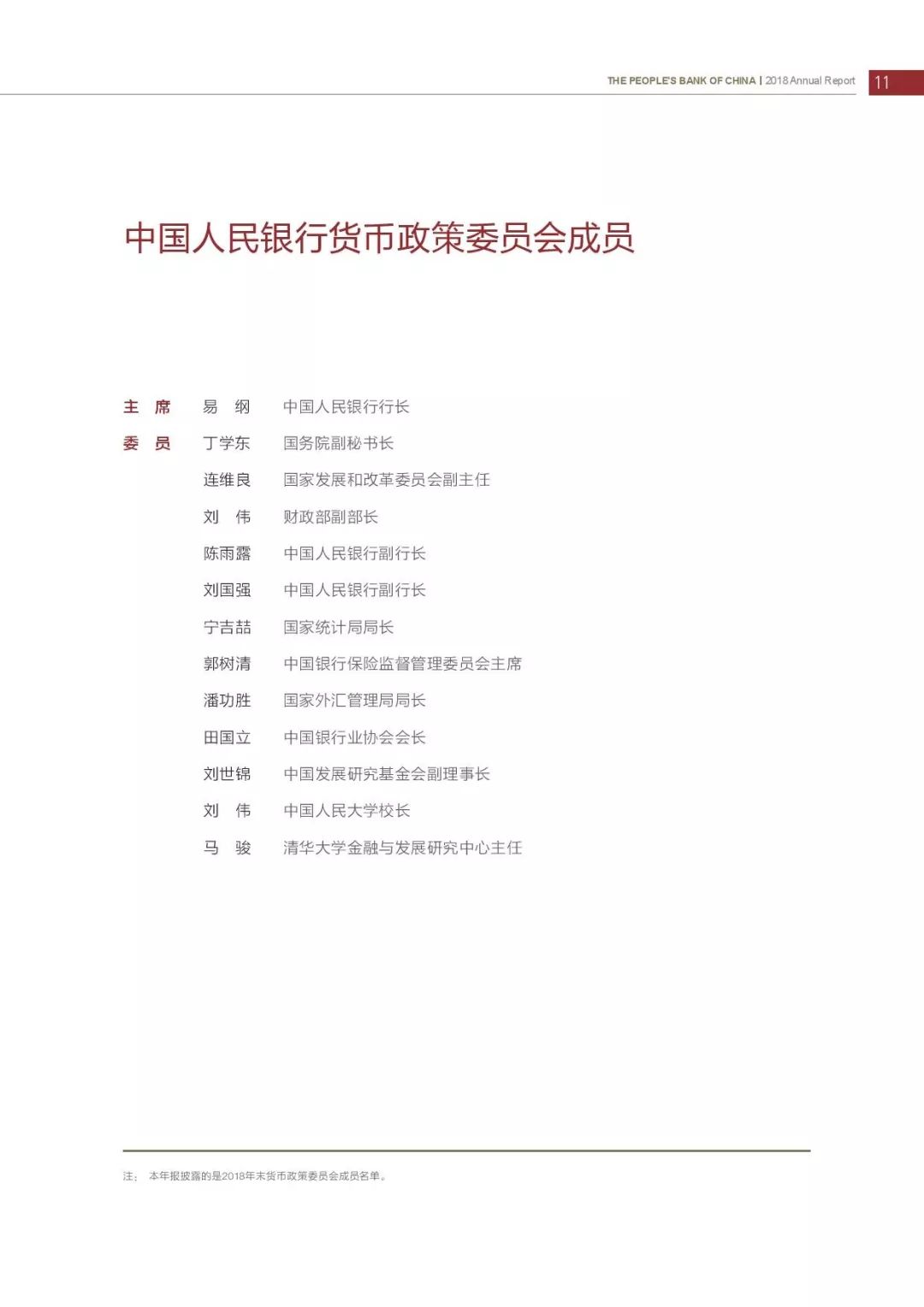

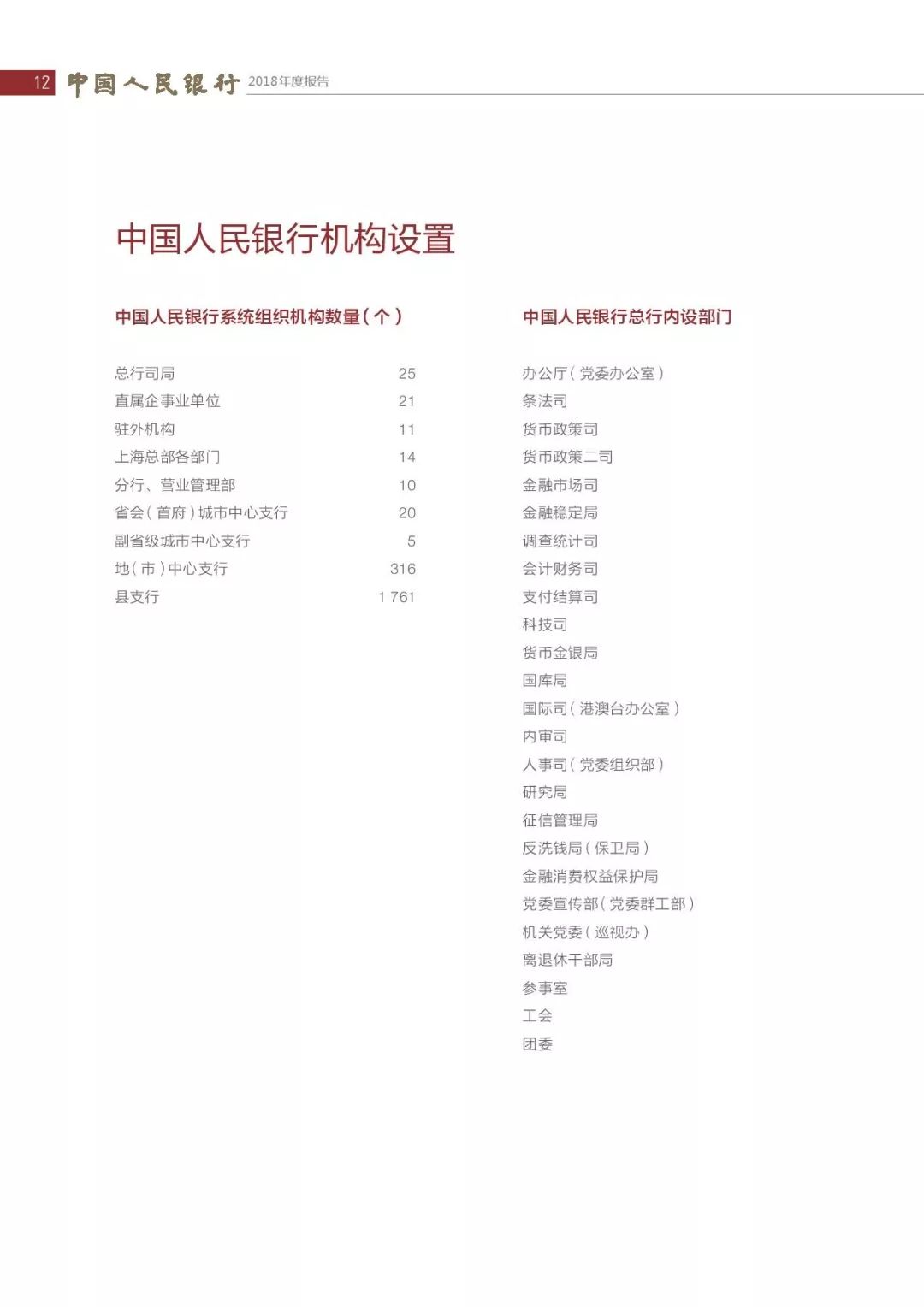

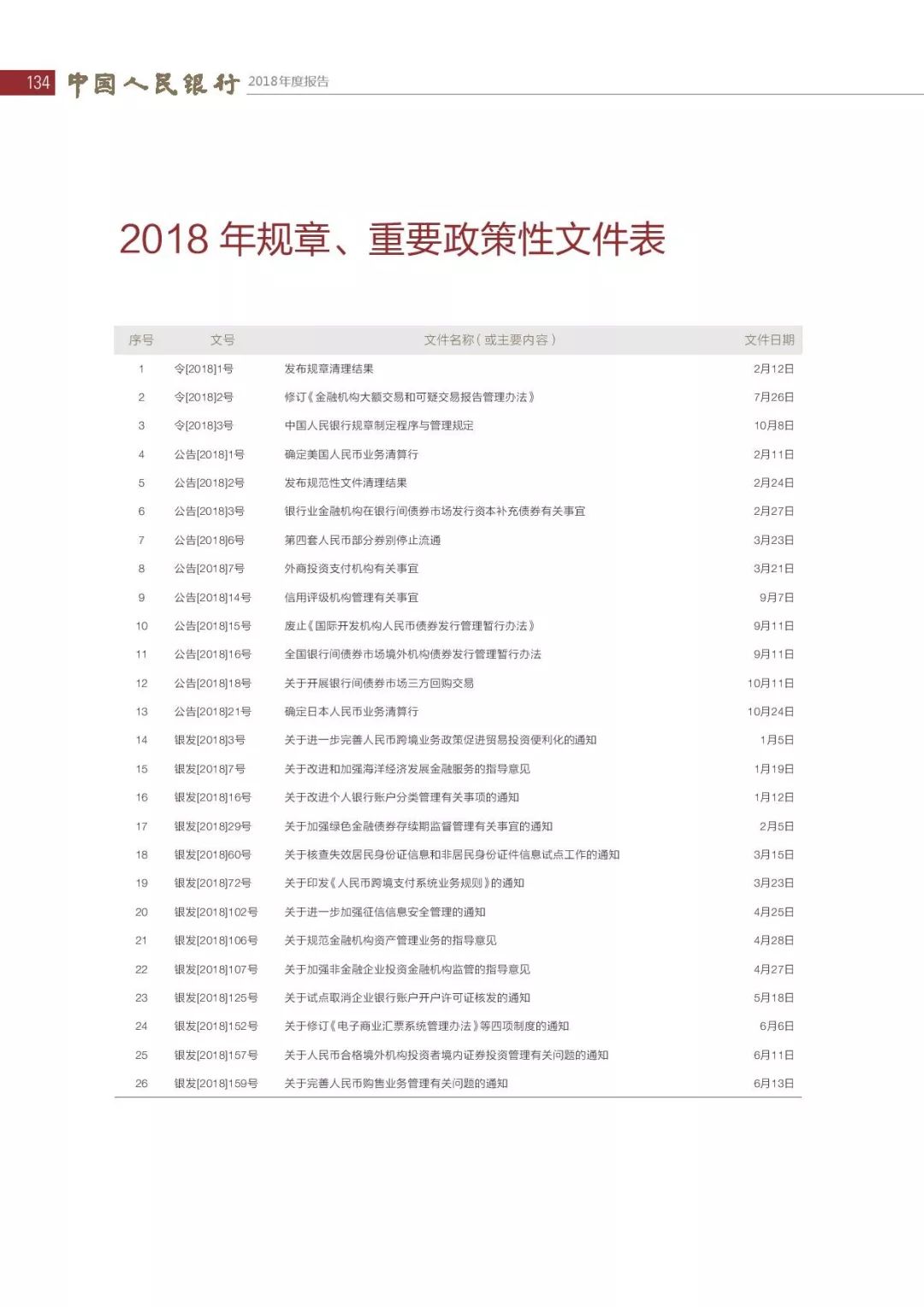

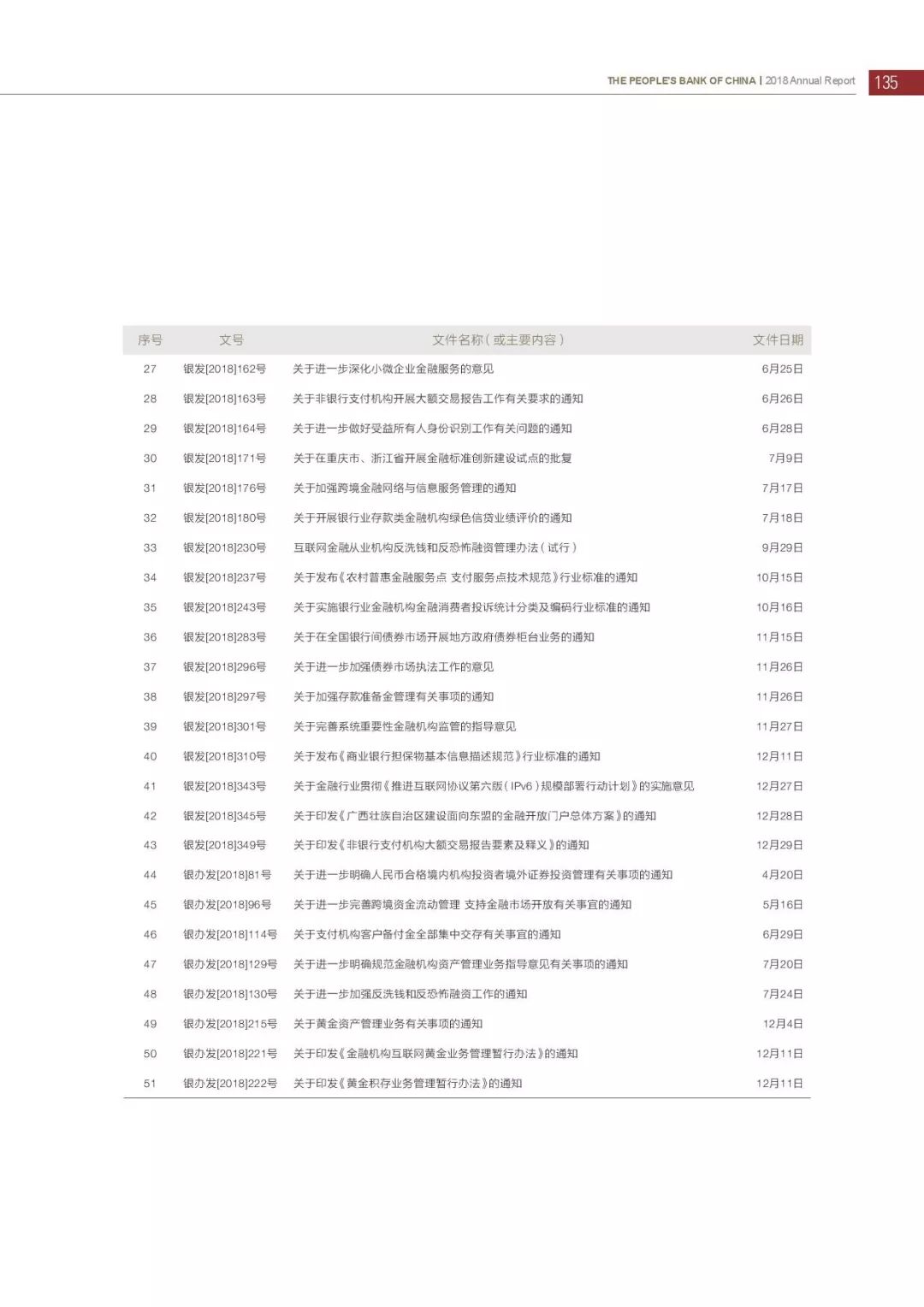

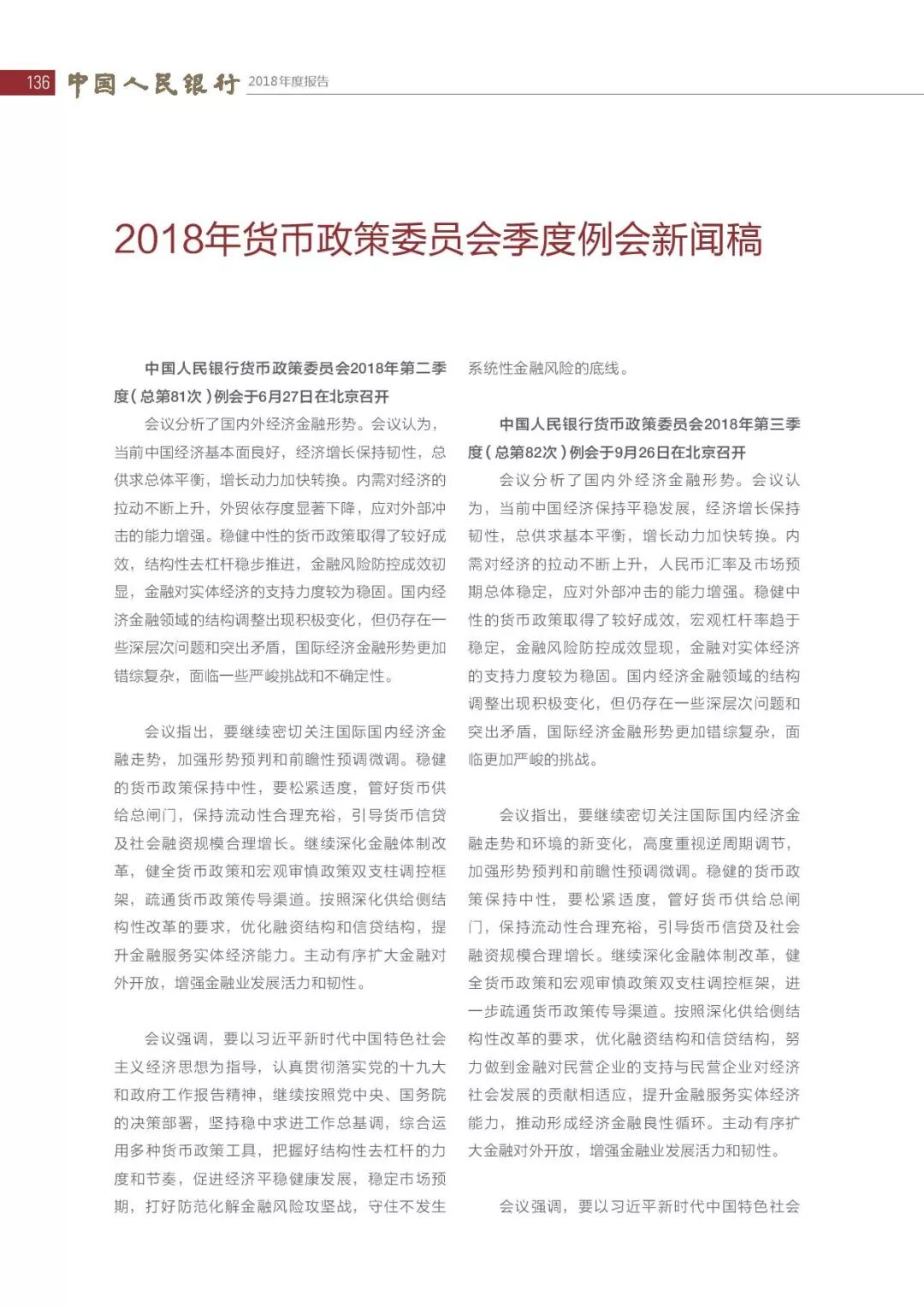

The central bank released its 2018 annual work report on August 6th: "People's Bank of China Annual Report 2018". The report contains 137 pages, of which 4 are digital currency.

On page 53 of the report, the central bank said that in 2018, the organization of commercial organizations to jointly develop digital payment instruments (DC/EP) with digital currency characteristics, "has made progress."

In the section “Strengthening Financial Information Technology Planning and Standardization Construction” on page 63 of the report, the central bank said that in 2018, special working groups such as quorum currency, green finance and financial IT infrastructure will be established to promote the preparation of financial standards in related fields.

- QKL123 market analysis | Bitcoin is multi-empty, the altcoin is relatively strong (0823)

- The sky is really a pie! Many exchanges traded abnormally, and more than 40 bitcoins were sold for 0.3 dollars.

- Babbitt column | Cai Weide: How do foreign countries see China's response to Libra, how is it laid out abroad?

For the central bank's digital currency, the central bank has paid great attention to it, and publicly mentioned the digital currency four times in the past month:

- On August 2, the central bank said at the video conference in the second half of 2019 that in the second half of the year, it is necessary to speed up the pace of research and development of legal digital currency and track the development trend of domestic and foreign virtual currencies;

- On August 10th, the Deputy Director of the Central Bank's Payment and Settlement Department, Mu Changchun, said that the central bank's digital currency will adopt a “two-tier operation system”, and the research and development aspect will adopt a “horse race” mechanism, with several established operating organizations adopting different technical routes for research and development. . At present, the central bank’s digital currency has been “out of the box”;

- On August 18th, the CPC Central Committee and the State Council issued opinions on supporting Shenzhen to build a pioneering demonstration zone for socialism with Chinese characteristics, and mentioned support for innovative applications such as digital currency research in Shenzhen;

-

On August 21st, the central bank’s official WeChat public account pushed two articles, namely, the article “On the central bank’s digital currency” published by Fan Yifei, the deputy governor of the central bank, in January 2018, and the Deputy Director of the Payments Department, Mu Changchun. The original speech of the speech on August 10, 2019 at the third China Finance Forum for the Forty People. On the same day, the People’s Daily published an article entitled “Digital Renminbi”, saying that the central bank’s launch of digital currency “is neither a popular e-wallet or online payment, nor a complete “reinventing” to replace Some renminbi systems are new cryptocurrency systems that have a certain alternative to circulating cash."

The central bank also gave huge support to the financial technology behind the digital currency. On August 22, the central bank issued the “FinTech Development Plan (2019-2021)” to determine the key tasks of the six aspects of financial technology in the next three years, namely:

- First, strengthen the strategic deployment of financial technology , strengthen top-level design from a long-term perspective, grasp the development trend of financial science and technology, and do a good job in overall planning, system and mechanism optimization, and talent team building;

- The second is to strengthen the rational application of financial technology , focus on breakthroughs to drive overall development, standardize the selection, capacity building, application scenarios and safety control of key common technologies, comprehensively improve the application level of financial technology, and build financial technology into a high-quality financial development. New engine";

- The third is to enhance the quality and efficiency of financial services, rationally use financial technology to enrich service channels, improve product supply, reduce service costs, optimize financing services, improve the quality and efficiency of financial services, and make financial technology innovations better benefit the people's livelihood. Promote the healthy and sustainable development of the real economy;

- The fourth is to strengthen the financial risk prevention and control capabilities , correctly handle the relationship between security and development, use financial technology to enhance the identification, early warning and disposal capabilities of cross-market, cross-industry and cross-regional financial risks, and strengthen network security risk management and financial information protection. Good new technology application risk prevention, and resolutely hold the bottom line without systemic financial risks;

- The fifth is to strengthen financial science and technology supervision , establish and improve the basic rules system for supervision, accelerate the formulation of basic rules for supervision, monitor analysis and evaluation, explore the management mechanism of financial science and technology innovation, serve the comprehensive statistics of the financial industry, and enhance the professionalism and unity of financial supervision. Penetration

- The sixth is to strengthen the foundation of financial science and technology , continuously improve the ecology of financial technology industry, optimize the industrial governance system, and support the healthy and orderly development of financial technology from the aspects of technological research, legal construction, credit services, standardization, and consumer protection;

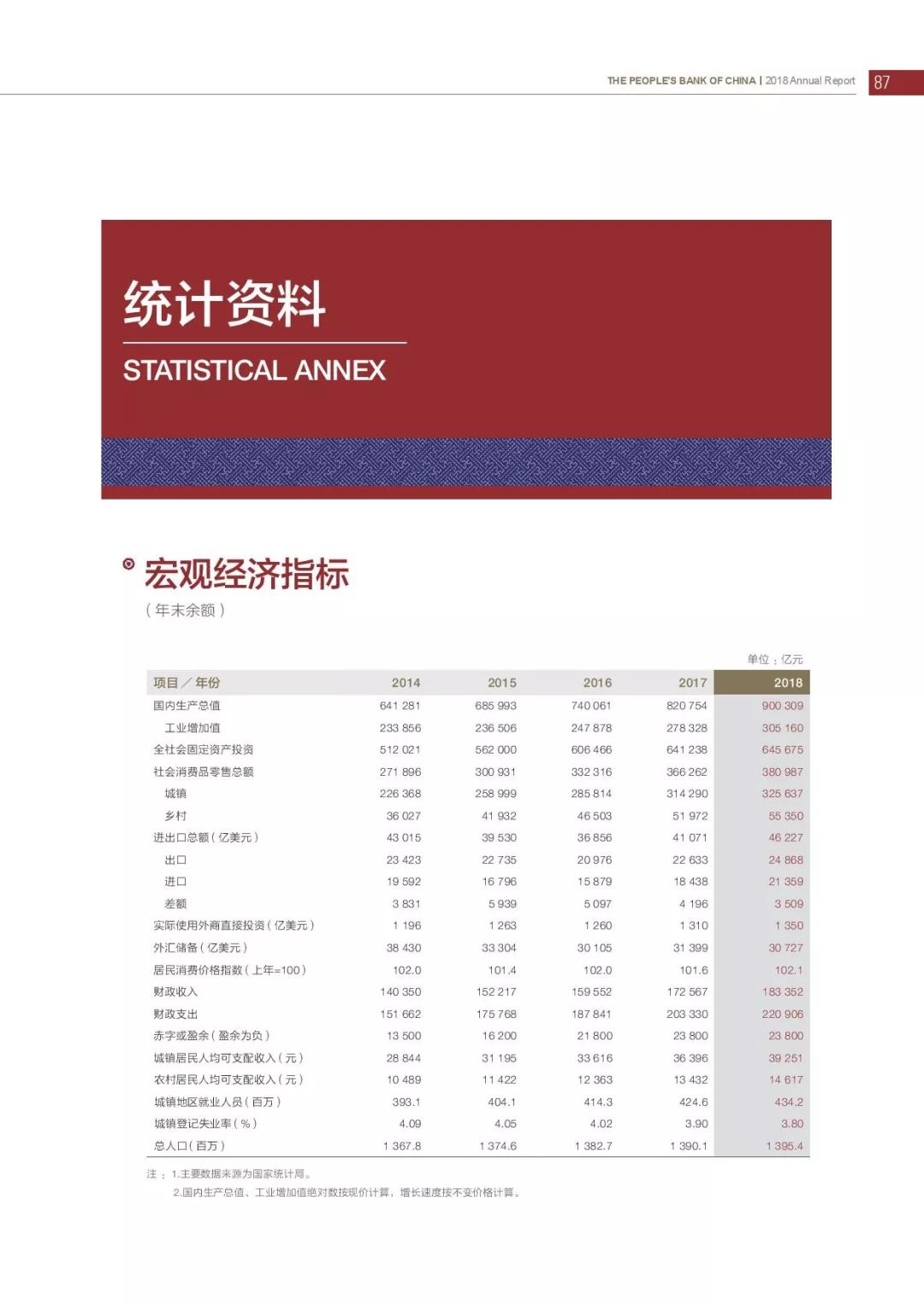

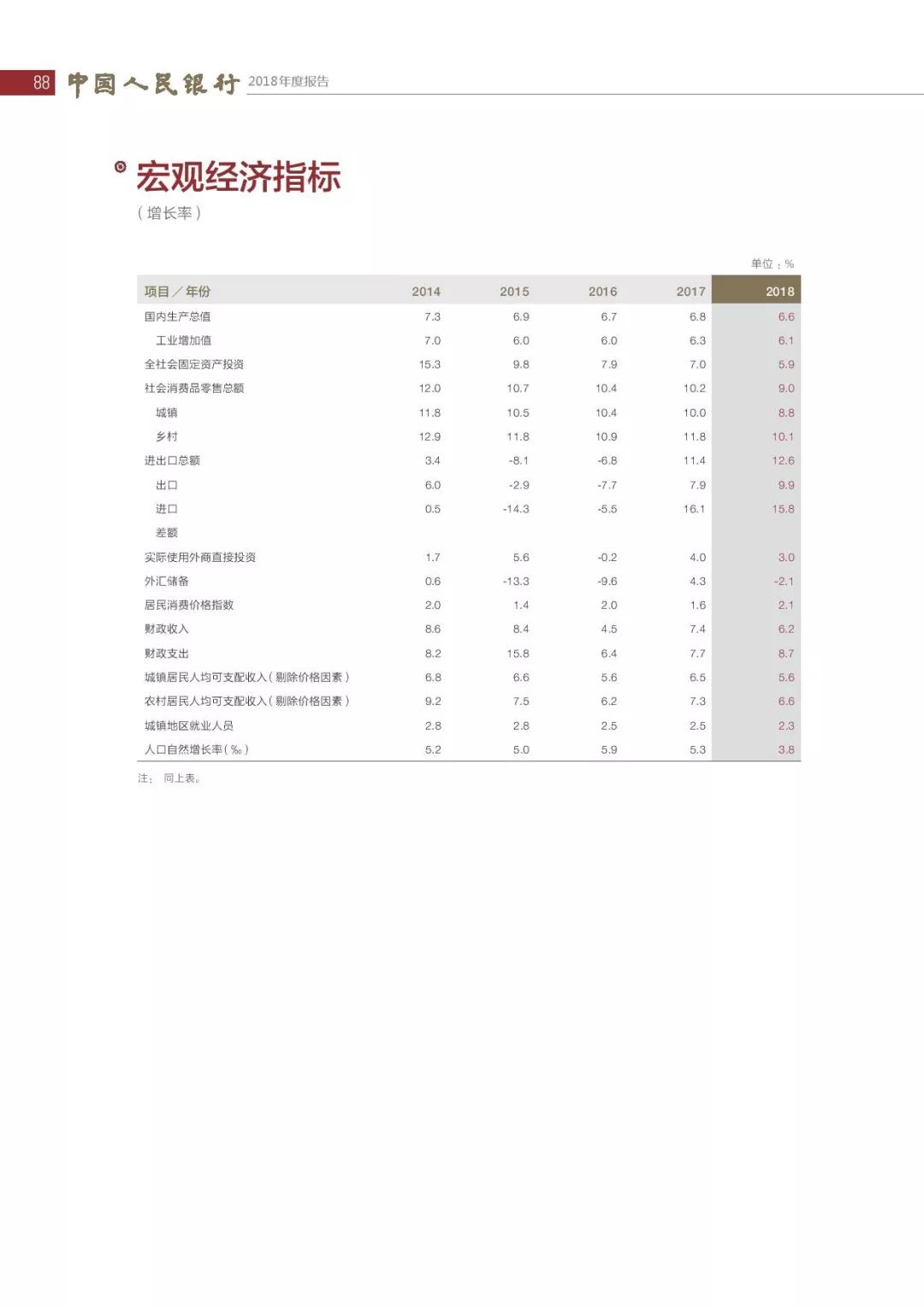

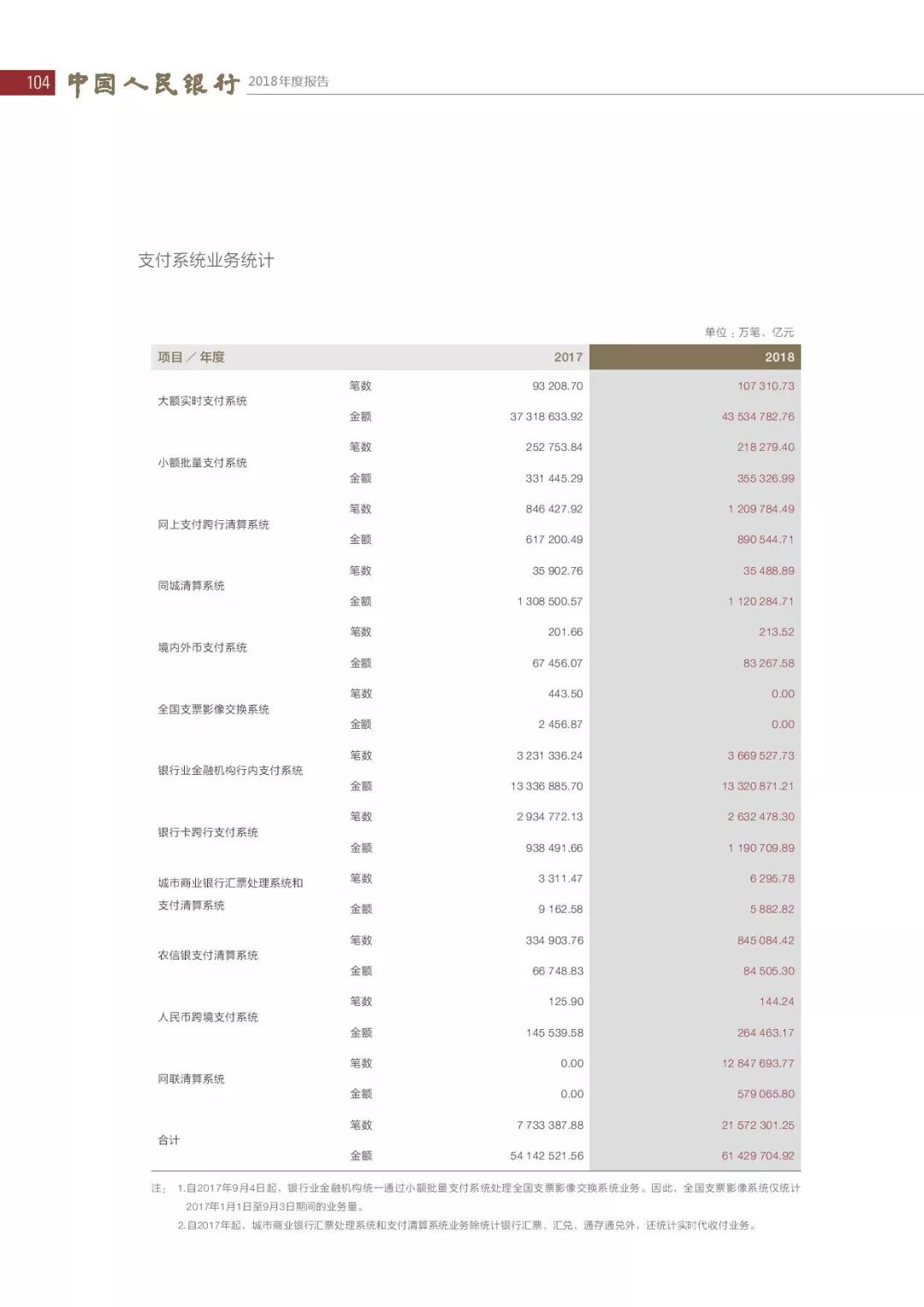

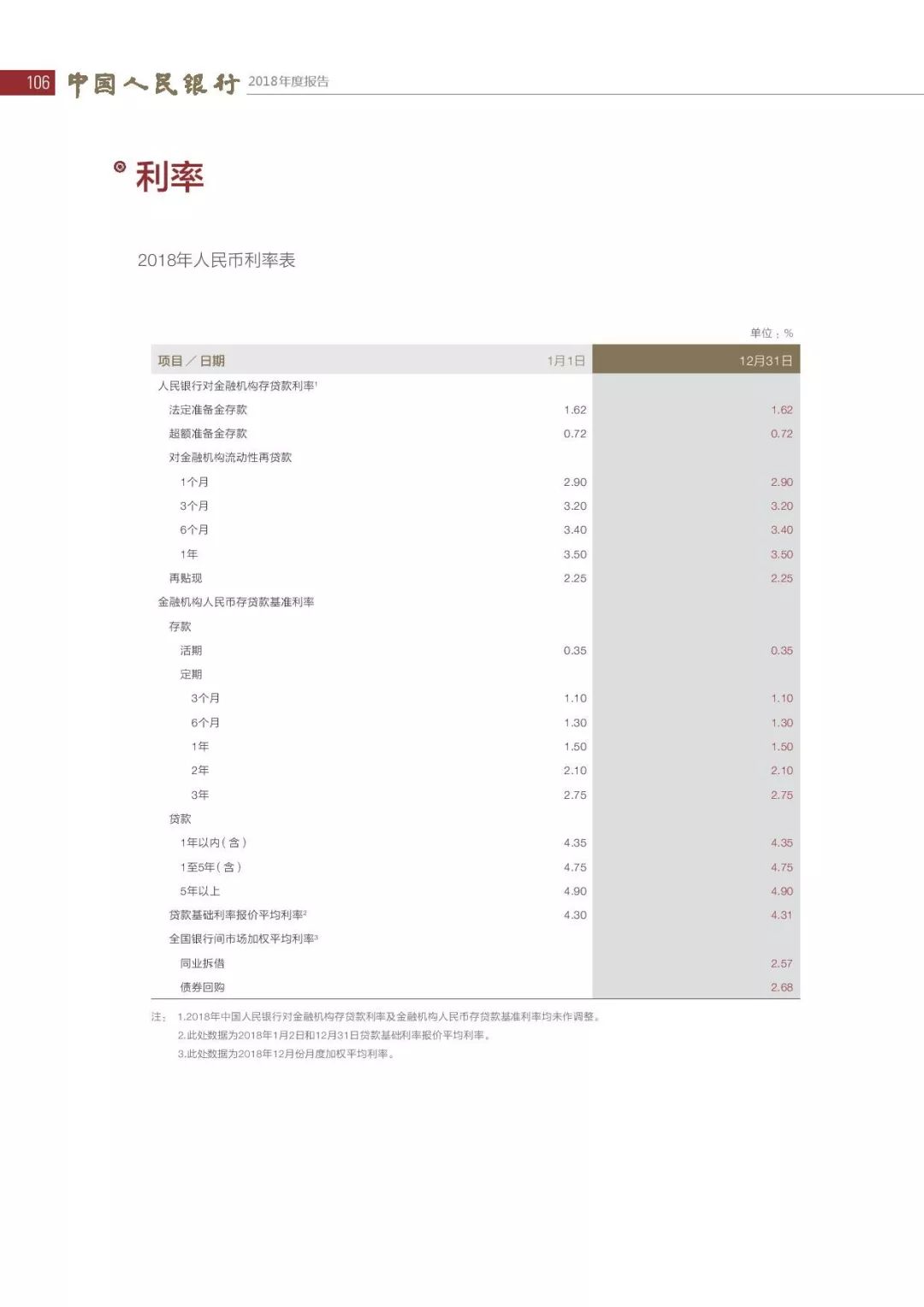

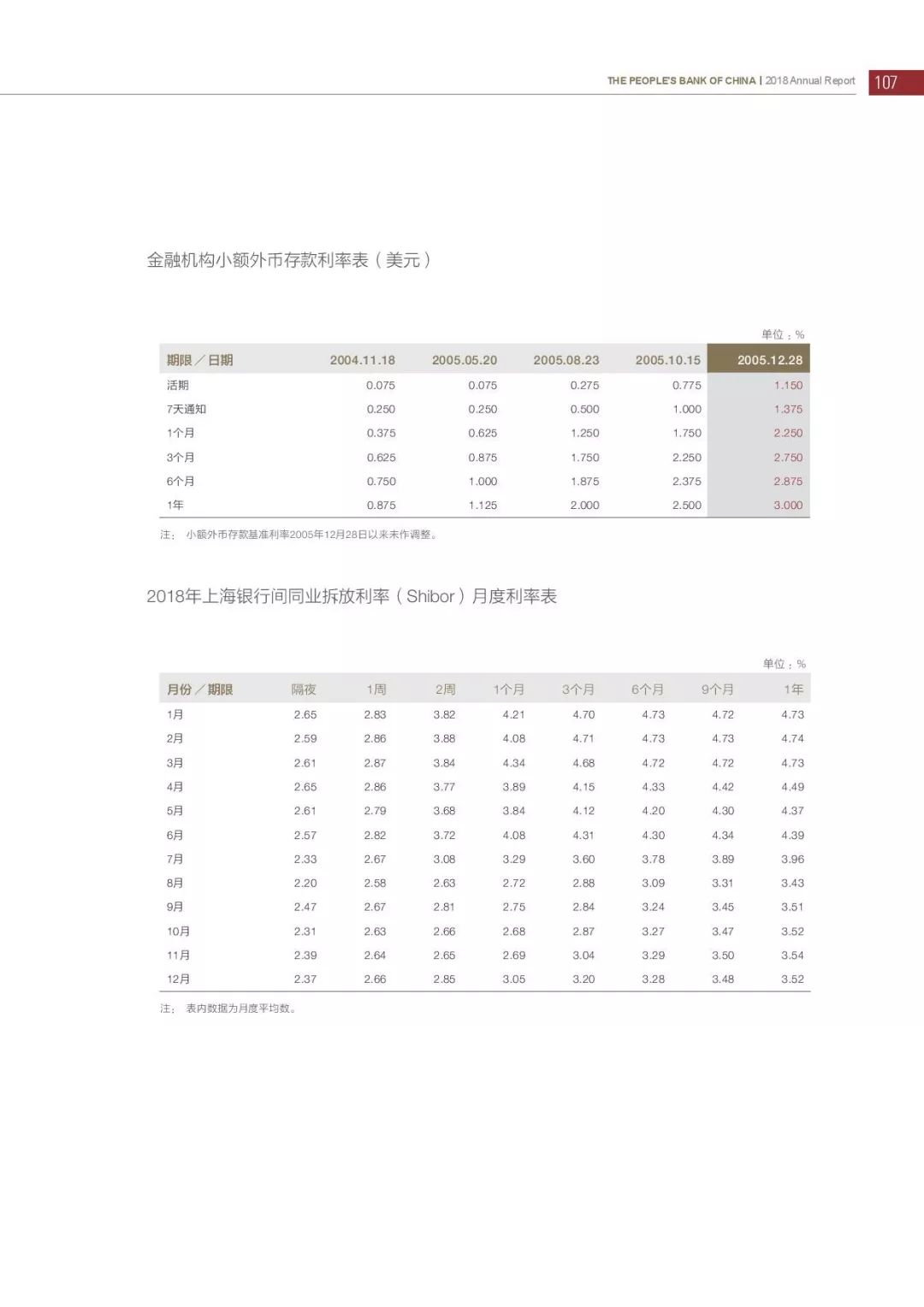

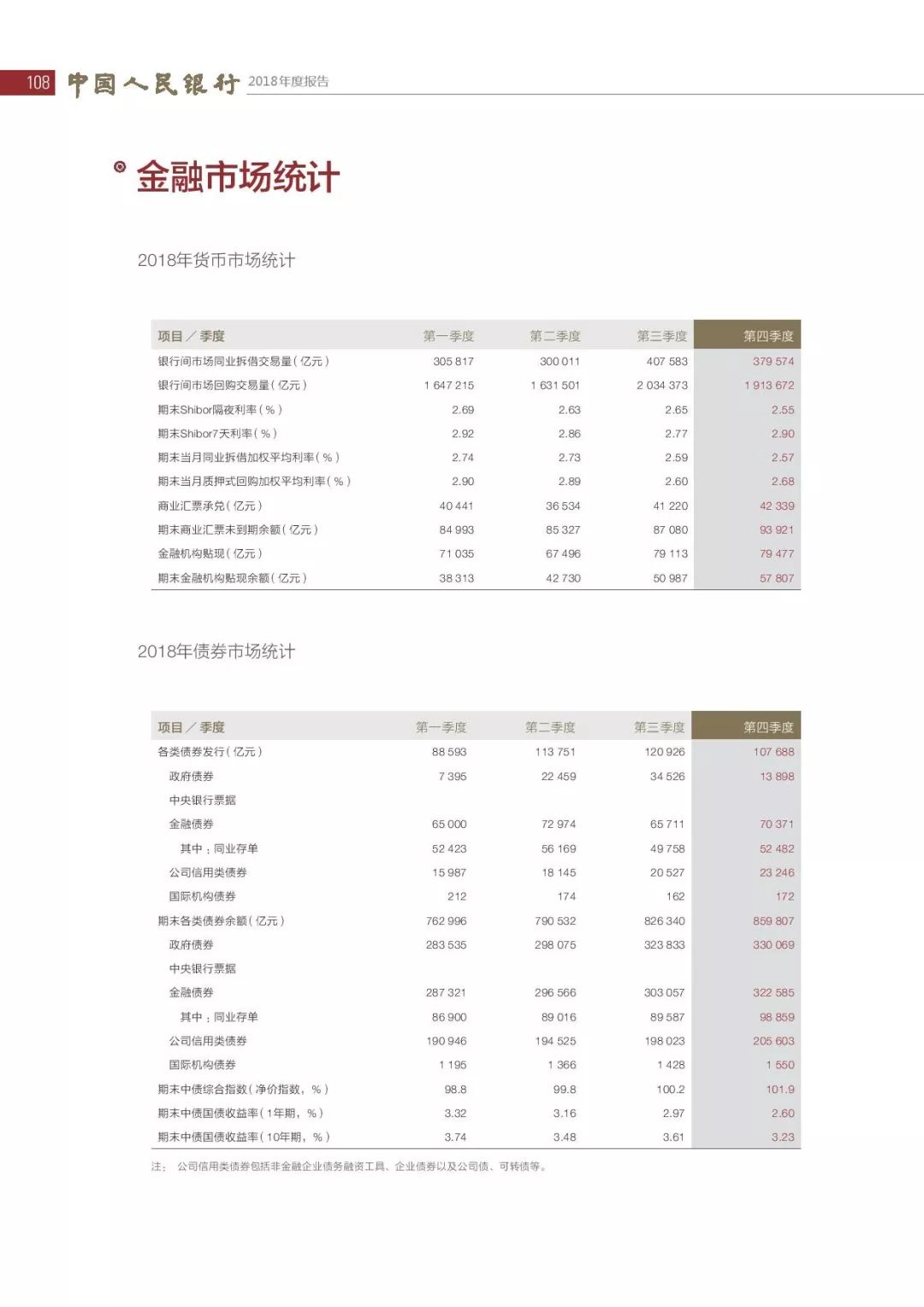

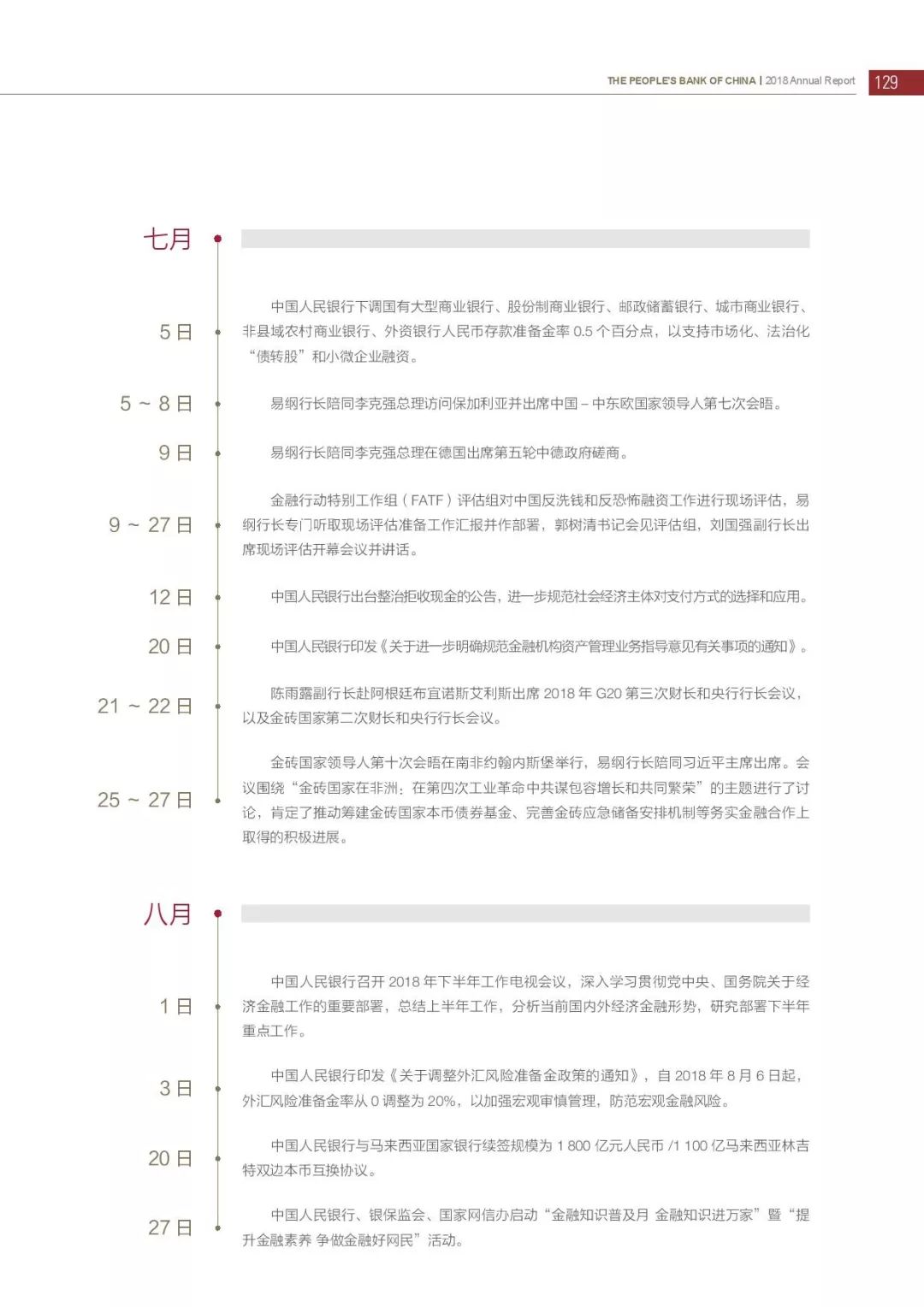

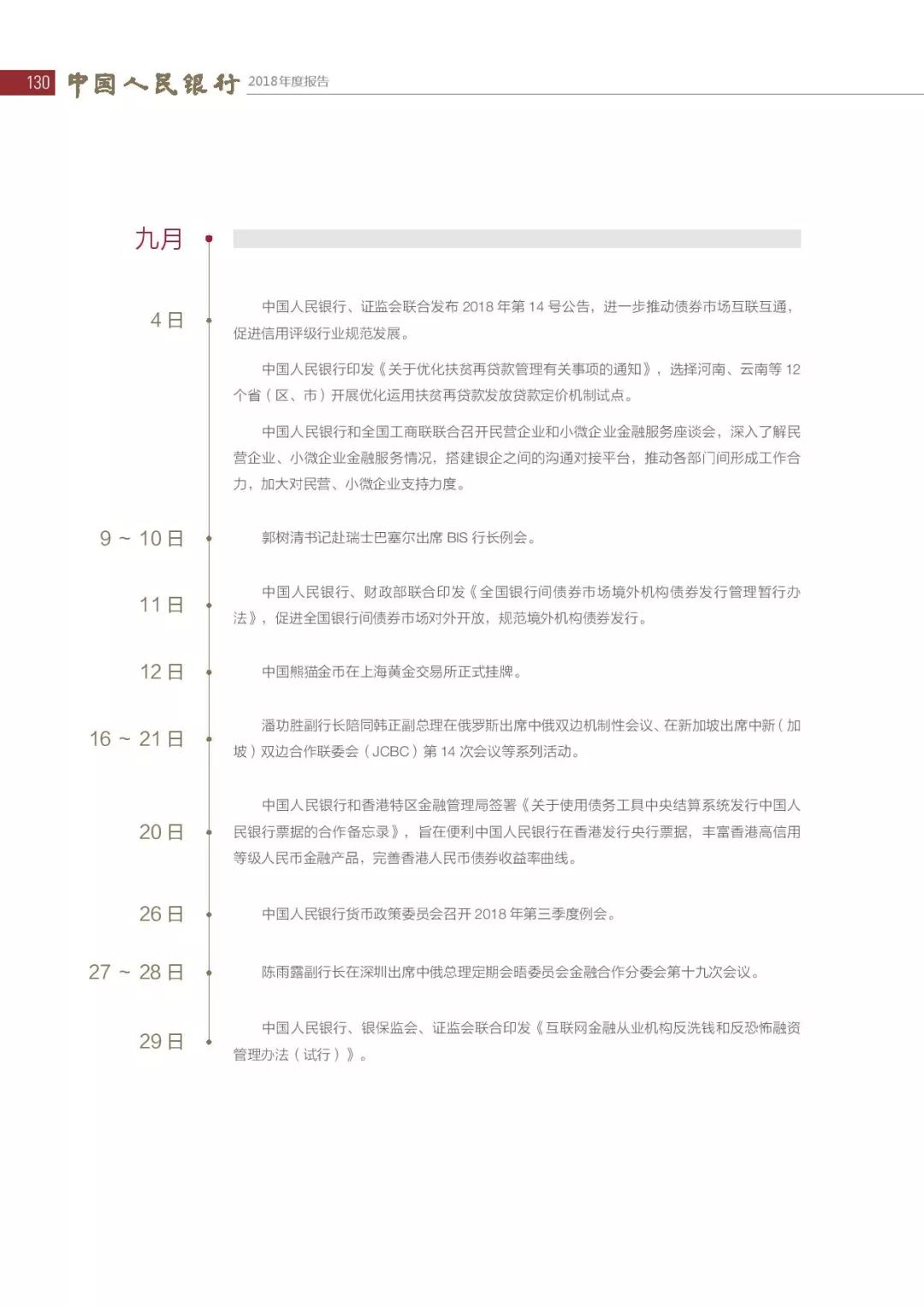

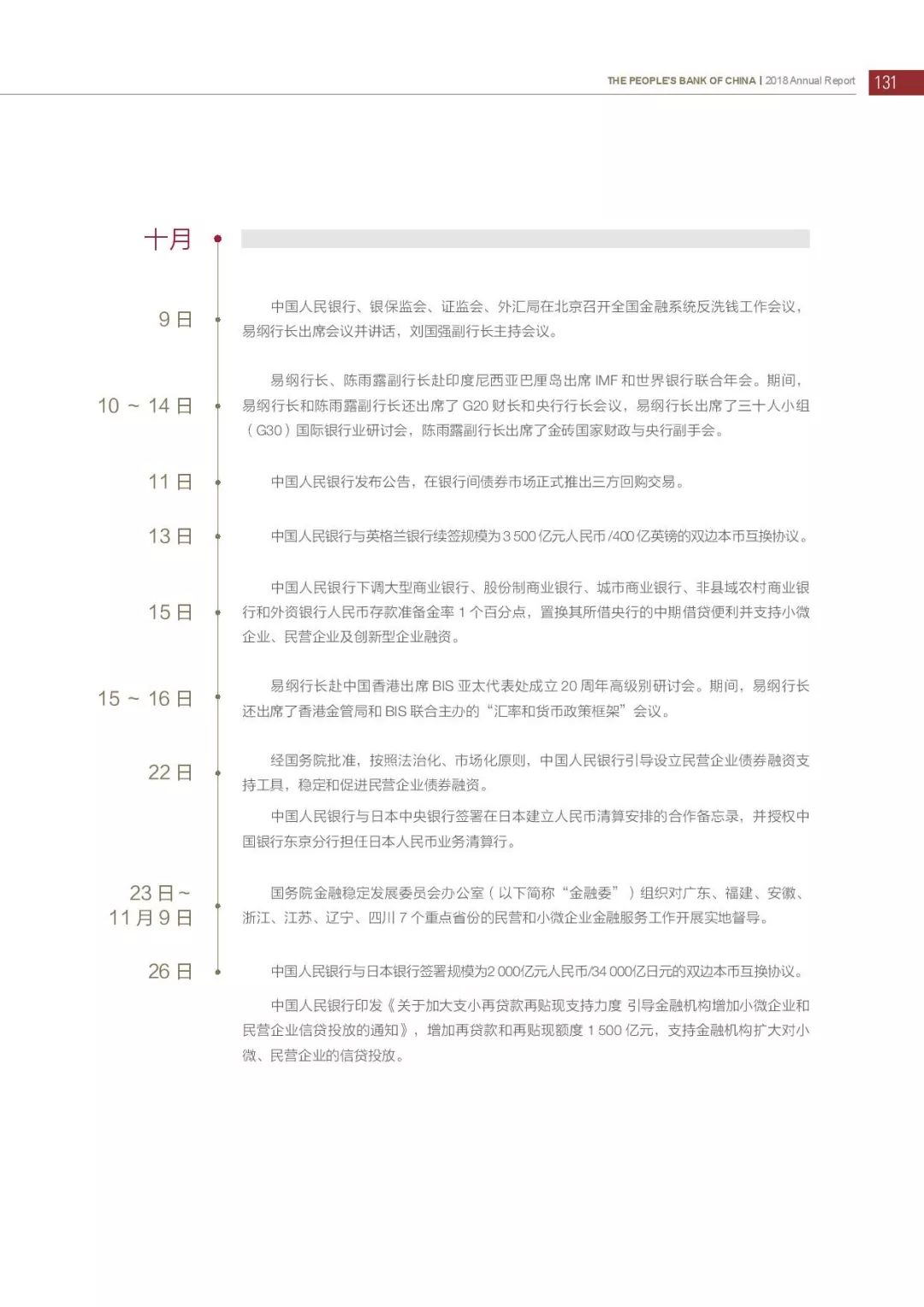

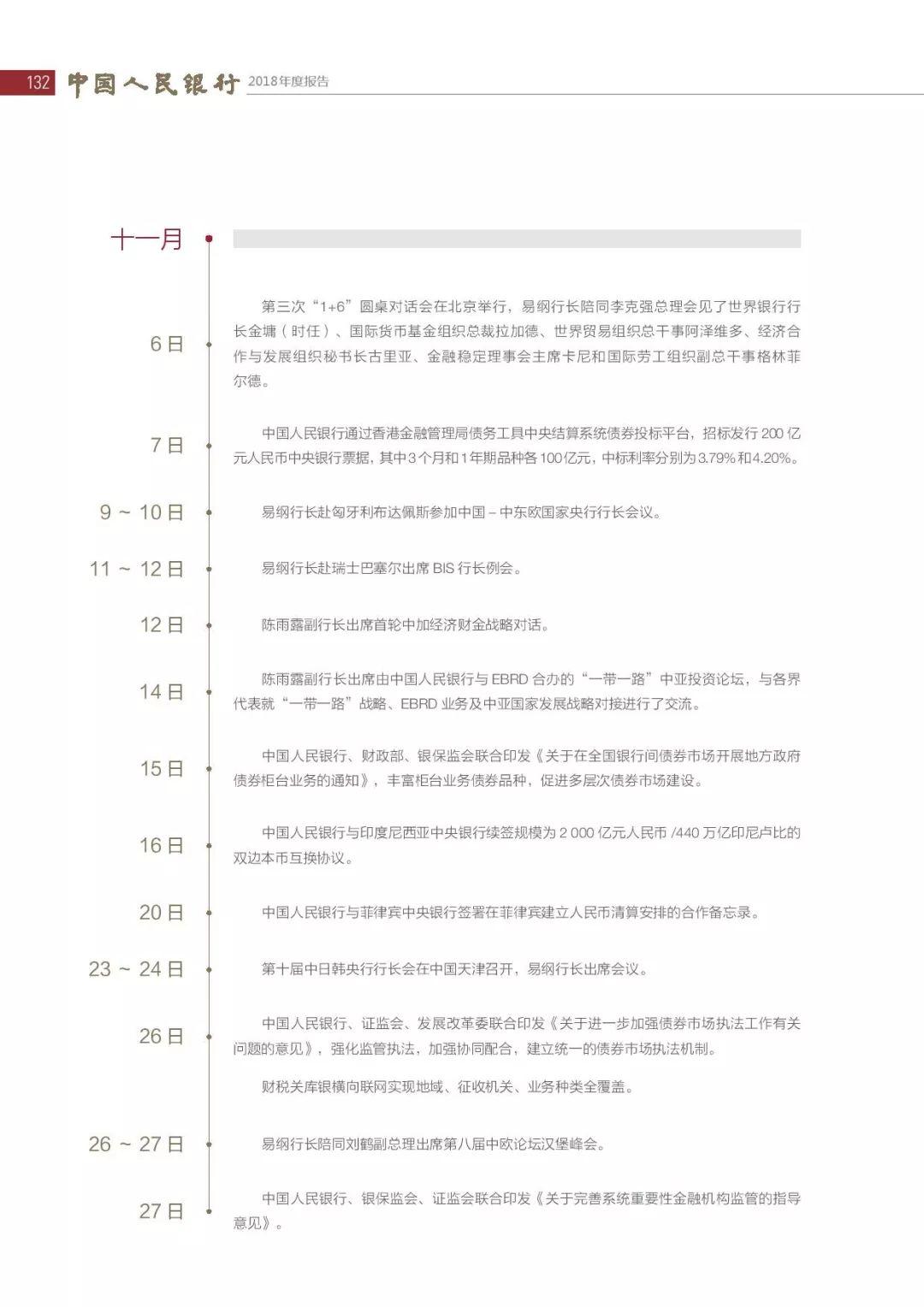

The following is the full text of "People's Bank of China Annual Report 2018":

Interactive moments:

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinions | Whether it is PoW or PoS, it will eventually become centralized

- Confusion in the era of digital economy: What happens to digital heritage after people die?

- Viewpoint | Is decentralization technology really better than traditional technology?

- Exchanges are temporarily withdrawing cash, data is garbled, or the Amazon server failure in Tokyo

- Ethereum will become the first public chain of the Hyperledger Alliance

- Sudden! Multiple platforms BTC and ETH were pinned, but some people were unexpectedly rich.

- Read the consensus mechanism of blockchain in one article