If Solana succeeds, does it mean that all the shards are scams?

Author: True Satoshi

The currency circle is a place to encourage innovation. Solana is an example. Its high valuation and high premium are mainly due to its proprietary stack agreement PoH (Proof of History) and its seven technological innovations. On the whole, the fundamentals are better: the underlying technology innovation, the team technical background, the engineering development capability, and the top capital blessing.

Some points worthy of being singled out:

Multicoin support. Solana is the latest favorite of Multicoin. You can take a look at the Solana milk article written by Multicoin, "From the Nakamoto consensus and the trendmint, read the meaning of the separation of time and state." The article as a whole is a popular science popular science text, subjectively published less opinions. I saw it at a glance and was written by Kyle's younger brother. That said the pass…..

- Telegram insists that Gram is not a security, former SEC legal counsel: this is just a struggle

- The first full text! Libra Association calls out the G7: Libra can coexist harmoniously with the central bank's digital currency

- Explore the cemetery of cryptocurrencies: Who killed the altcoin?

The mechanism design of the dual verifier. There are two identities for governance in the Solana system: verifiers and replicators. The former participates in the consensus block, with a revenue of about 10% and high hardware requirements. The latter does not participate in the consensus block, responsible for data distributed storage, the revenue is about 3%.

This is specifically mentioned because in last week's Cosmos AMA, we asked Chjango, as a vision to do the Internet project in the blockchain, compared to Bitcoin and Ethereum's hundreds of thousands of nodes, Cosmos 300 nodes are not a little less. Chjango replied that the future does not rule out more full nodes, but these nodes will not participate in the consensus, just store blockchain data.

This coincides with the idea of Solana's dual verifier. The dual certifier model may be a trend in future PoS networks: a small number of nodes responsible for outbound and verifying the network, and most nodes responsible for storing blockchain data across the network.

If the so-called triangular dilemma is a theorem that cannot be broken, it means that the project that claims to break the triangle dilemma is only a marketing tool, which means that the blockchain project must be the more nodes participating in the consensus, the lower the performance, Then the double verifier is a better compromise solution in the future.

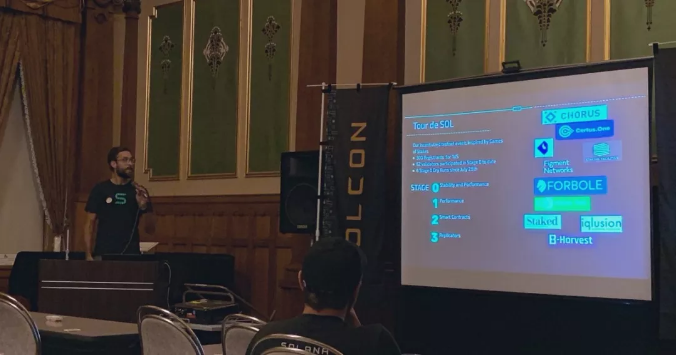

Test the reputation of the network verifier. This is also one of the indicators for judging whether a PoS project has potential. The following picture is a screenshot of Solana's test network offline meeting SOLCON. It can be seen from the figure that all of Solana's verification nodes are foreign professional pledge service providers, and all are Cosmos nodes.

DEX has been in a bottleneck for the past two years : decentralized exchange IDEX has been dubbed the Erc20 garbage coin casino. Although it has maintained the top three positions in the DEX trading volume all the year round, there has been no self-breakthrough, which is an important reason. It only supports the Erc20 token, while the Erc20 has mostly garbage. At the same time, IDEX is essentially a semi-centralized exchange. The degree of decentralization is far from enough. It is technically difficult to self-ititate and update.

Friends who have used the IDEX exchange to buy coins should be able to experience it. It is very stuck when the traffic peaks, and the so-called traffic peak is only about 10,000 people.

DEX still has a long way to go: a technological breakthrough. And the combination of interoperability. The degree of decentralization….

Solana's self-declared focus is on the DEX field, and I want to make a super-performance DEX. This is the place that this project is worth looking forward to. But if Solana didn't hand over a perfect answer in the DEX field, I think investors shouldn't buy it.

Next, talk about the challenges that Solana needs to face:

Because Solana wants to make her own wheels, it is still the common problem of the public chain: network effects, developer ecology, and fierce competition for competing products.

For the time being, we will presume that the underlying technology of Solana and the seven innovative technologies will prove to be feasible and put into practical use in the future. But that doesn't mean developers will migrate to the Solana ecosystem: a high-performance underlying chain that is proven to work doesn't mean capturing the value of the developer's ecology.

Why Ethereum has the most powerful developer ecosystem in the face of bottlenecks in performance. The first is because the peers set off, other public chains are really too much to play. The second is because the bottom layer of Ethereum is time-tested to be very safe. The third point to take the second point is that many subdivisions require higher security than performance, typically DeFi. And DeFi is one of the most promising directions in the future.

So even if Solana is made, it is a low-level public chain that reaches its peak in various performance indicators. That's it. We have passed the era of easy climax for performance and TPS.

But if Solana's innovative technology finally proves to be infeasible. Many people question that its PoH consensus technology is too difficult to do. This kind of questioning is entirely reasonable, because there are many projects that have a glimpse of the past: Cardano and Rchain. The main network of these projects has been delayed. You said that the team is lazy, not working hard to develop? Nor is it. In fact, it was because the bulls had been blown too much before, and it was difficult to achieve them at once. The result was delay in delaying the main network. So the point of doubt about Solana is: Can the main network be on time? Can the performance be as expected after going online? At present, I have to make a big question mark.

Another concern is Solana's future currency approach. I hope that Solana does not pass the IEO way. Although I think this is unlikely.

Yesterday's Launchpad just announced the launch of Kava, a cross-chain Defi project of the Cosmos Ecology. The overall quality of the project is moderately high. Feel the future trend or the quality of the project will choose the IEO online form.

Although IEO has a negative effect on the currency price trend after the online secondary market, it is still a good way to balance the interests of all parties and comprehensively (of course, the side effects are still passed on to the secondary market investors).

Finally, I want to talk about the shards. In the interview with Solana's CEO Anthony in the chain, Anthony said:

"I think sharding is just a very difficult computer science problem. So far, no one really solves this problem. No database can really be considered a shard, and even Vitalik can't solve this problem, which is really very difficult. ”

Someone sent this message to V God. V God answered this question: "We have said how we did the filming for 2 years, the details have changed, and the basic method has not changed. I don't know how to say that the film is a Unresolved issues."

But there is actually a problem here, that is, how to define "solving problems." Because ETH 2.0 has been intensifying development, it is undeniable that it has not yet been made. I don't know if something I haven't made can be called a solved problem, or V God means that the shards have been theoretically solved by them.

And another question about Solana: Solana's claim that "No Sharding" is more of a marketing term: by advertised that it is not a piece to achieve a promotional effect.

Anthony continued to say in an interview with Chain Wen:

“I think we're going to see several different sharding solutions, and the trade-offs of several properties of the web are very different. Yes, we'll see which one really adds value to the use.”

"So from our point of view, it's not that we are against fragmentation, but the sharding is too difficult. Strictly speaking, I don't think the network needs to be extended. Ok, I think we have proved that without it, we can extend the network. Low cost, high throughput and low latency do not require fragmentation."

"We'll see what happens in the future. Many of my friends are working on shards like the Near Protocol. They are only one block from our office. They are very smart and work very hard to solve this problem." Summarize Anthony's point of view:

1. We are not against fragmentation. We suspect that the fragmentation is too annoying and too difficult. We are too lazy to do the piece of the piece. But we have a more powerful solution, PoH history proof mechanism.

2. Although the shards are difficult and cumbersome, I have not completely denied them, so I still support sharding projects like the Near Protocol to explore shards. I am looking forward to seeing if you can make them. Do it out and lose. The last sentence is my own.

About No Sharding. Personal opinion, I think that no matter whether No Sharding is marketing or not, Sharding and PoH are two different solutions. Who can finally make it, can put it into practical application, can meet the theoretical expectation, and then there is an ecological start to build, which program is arrogant, isn't it?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Getting started with blockchain | What is a good digital currency valuation model?

- Building Ethereum 2.0, we have summarized 5 experiences in staking

- Report: Dapp transaction volume dropped by nearly 40%, and the gaming category is still the most popular

- G7 officially released a stable currency report, saying that Libra and other stable coins need to solve the relevant risks to start

- The cryptocurrency exchange "closed tide", running to catch up with P2P

- Bank of Canada considers launching central bank digital currency to deal with cryptocurrency threats

- Technical exploration of cross-chain DEX prototypes: How to trade cross-chain assets within a single DEX?