In the first half of the year, it surged 220%, but there are still 60% bitcoin transactions that have not occurred…

Since January this year, the price of Bitcoin has risen by more than 220% , and market sentiment has been rising. And with JPMorgan, Facebook and other giants involved in the blockchain and cryptocurrency field, many people believe that this year may usher in the "second bull market" in the field of cryptocurrency, but for those who hold Bitcoin for a long time. They still remain calm.

According to independent research firm Delphi Digital, Bitcoin's second-quarter performance was eye-catching, actually attracting a steady stream of new sellers into the market. The report shows: " The active part of the bitcoin supply (that is, the bitcoin that generated transactions in the past three months) is starting to increase slightly. In fact, most of the new sellers are individual investors who have held for 3 to 6 months. "

21.5% of circulating Bitcoin has not been traded within 5 years

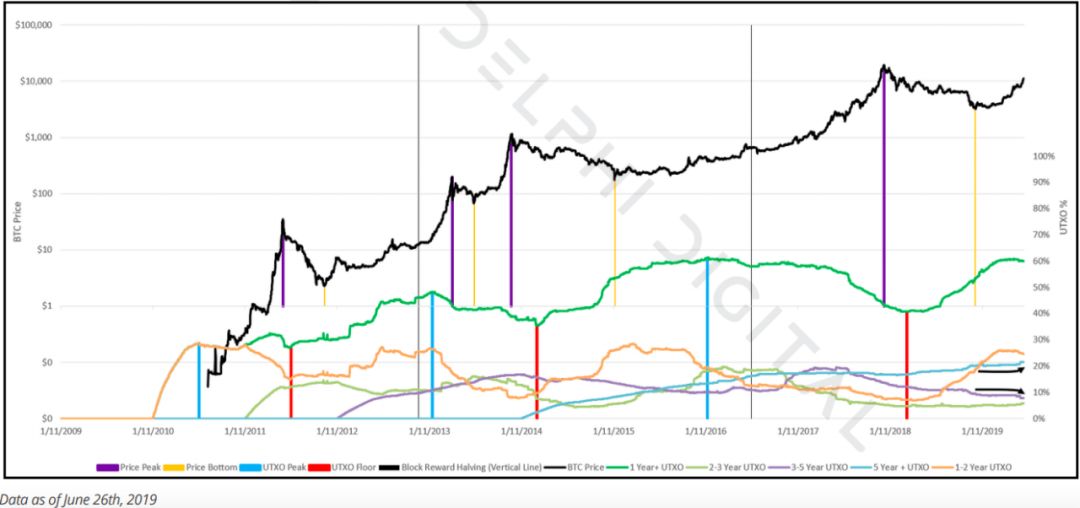

Delphi Digital determines the bitcoin holding time by sorting its "Unspent Transaction Output (UXTO)" data. The time that Bitcoin stays in the market is called "UXTO age."

How to understand UXTO? For example, if you have a 100 yuan, 50 yuan, 20 yuan yuan in your wallet, a total of 170 yuan. The balance of the Bitcoin account is calculated based on the UTXO of the account. When you spend 140 yuan to buy something, you can use 100 yuan and 50 yuan to trade, get a change of 10 yuan. At this time, the previous 100 yuan and 50 yuan is no longer UTXO because it has already been spent, the new 10 yuan to become the new UTXO, plus the previous 20 yuan UTXO, the current balance is 30 yuan.

- Libra wants to cool? Congress stops! After the fever, the rational look can reach the core of value.

- Why is Bitcoin a better stored value tool than gold and Van Gogh?

- 72 hours before the 30 billion MLM crash: Why are investors most panicked about media reports?

The new transaction was recorded on a new block, but did not change the data on the historical block. Bitcoin uses the blockchain linked back and forth to record all transaction records. When the previous UTXO appears in the input of subsequent transactions, it means that the UTXO has been spent, no longer UTXO. If the balances in all bitcoin addresses are calculated step by step from the first block, the balance of each bitcoin account at different times can be calculated.

And the cumulative UXTO age of all Bitcoins tells us how long the entire market has been held. The UXTO age of Bitcoin rose as the holder refused to sell, and declined as more Bitcoin circulation supplies were used for regular trading.

According to Delphi Digital, 60% of Bitcoin's circulation supply has not been traded for at least a year , as shown by the green line in the figure.

The data shows that the number of bitcoins that have not been traded (indicated by light blue lines) has also grown steadily over the past five years, and the number of BTCs exceeding 21.5% has not changed for at least five years.

Delphi Digital said: This naturally makes us want to know who the current market is.

Traders send a lot of bitcoin to Binance

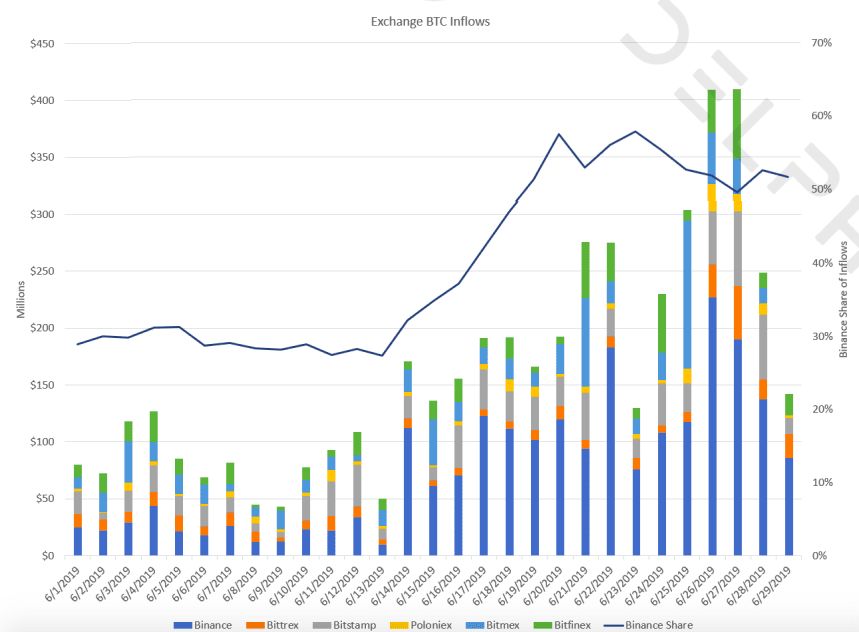

To measure market sentiment, Delphi Digital examined the amount of Bitcoin circulating through major cryptocurrency exchanges such as Binance and Bitfinex.

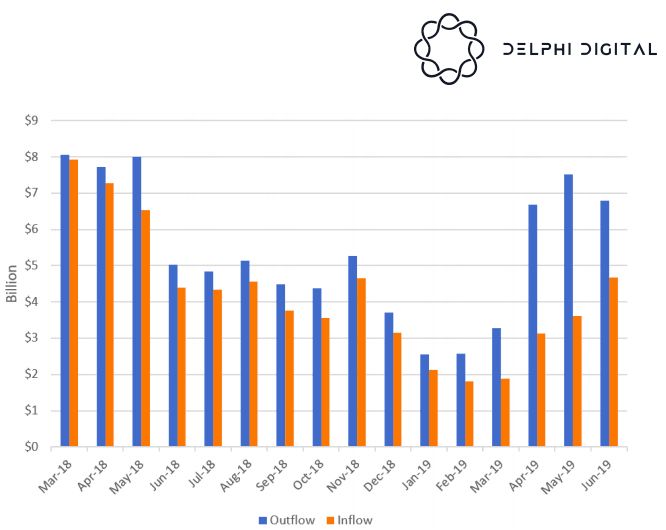

The data shows that since January, the number of bitcoin inflows/outs has increased significantly. In particular, it is worth mentioning that bitcoin has more than doubled in the period from March to April.

According to the research firm, the surge in bitcoin outflows makes sense, as investors who recently bought bitcoin may seek to take their cryptocurrency out of the exchange as a holding asset. At the same time, the increase in BTC outflows is also in line with the price increase in early April.

According to the analysis, Binance seems to be the main choice for Bitcoin holders seeking deposits. Delphi Digital pointed out that Binance accounted for 47% of Bitcoin's inflow last month, up from 24% in the first quarter of 2019.

As for the next trend in the cryptocurrency market, Delphi Digital said that some people may think that the recent breakthrough of $13,000 (and eventually fall back) is an "explosion". Bitcoin price movements may deviate from orbit for some time. This may be "Altseason" creates opportunities. At the same time, transactions of this size and concentration mean selling, but since this is Binance, it leaves the possibility that individual investors are seeking to switch to “cottage coins”.

Delphi Digital warned that "bitcoin is still in a dominant position, and trying to grasp the timing of the rebound of the altcoin may make investors feel like a head start. On the contrary, a more rational and meaningful choice is to give up some of the advantages of the early rise of the altcoin, waiting for the market to Constantly verified."

Author | David Canellis

Compile | expressive

Produced | Blockchain Base Camp (blockchain_camp)

Graphic data source: https://thenextweb.com/hardfork/2019/07/01/bitcoin-60-percent-hasnt-moved-price-bump-2019/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Introduction | Ethereum 2.0 Beacon Chain Verifier

- Is DApp a fake requirement? DeFi is the real use case for Ethereum to live

- Libra's regulatory game: multi-party "gunfire" storm regulation will come

- What does the “finality” of the blockchain mean?

- Dialogue with the Minerals Club Yu Yang: The Rules, Opportunities and Trap of Bitcoin Mining

- TS Run Road Funds Defence Action: Graphic Tracking Asset Transfer Money Laundering (2)

- If Bitcoin can achieve all the plans, is it necessary for most of the competition coins to exist?