Insights | Pan Chao: Theory and Practice of DeFi

Editor's Note: This article is a speech by Pan Chao, the head of the MakerDAO Chinese community, at the “Defi” event, “The Insights”. In this article, Pan Chao is extremely refined to summarize the definition of DeFi, the characteristics of different DeFi projects in the market, and finally point out the ultimate pursuit of decentralized finance. The simple introduction implies a sense of order, and the clear conclusion also gives people the imagination, this is his Insight.

Hello everyone, the topic shared today is DeFi: Theory and Practice. I will introduce DeFi definition, kernel and practice in specific areas. Finally, talk about the definition and direction of DeFi.

DeFi definition and kernel

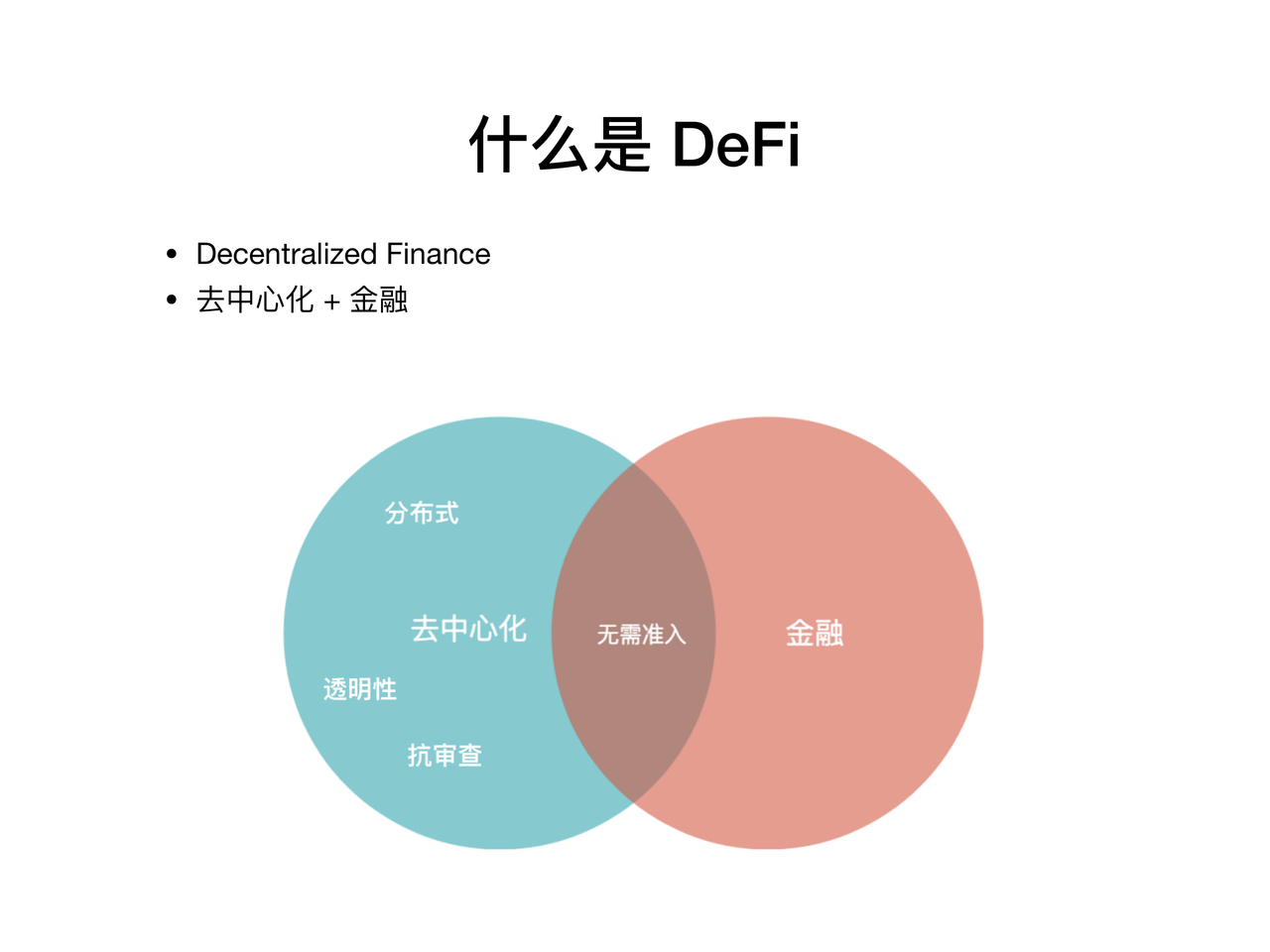

First let's talk about the definition of DeFi. The full name of DeFi is Decentralized Finance – Decentralized Finance.

- Ethereum PoS test network released, this autumn can be effectively halved ETH

- Blockchain information filing: What is the reference value? How to treat it rationally?

- Depth | Big data killing era, privacy coins will be your life-saving straw

The concept of finance is generally understood, then decentralized? We often think of the following concepts: distributed, transparent, anti-censorship, non-changeable, and so on. In my opinion, these are not the core and advantages of decentralized finance. Distributed is not unique to the blockchain. Transparency, anti-censorship and unchangeability are difficult to be compatible with the financial industry. The core and advantage of decentralized finance is that no access is required .

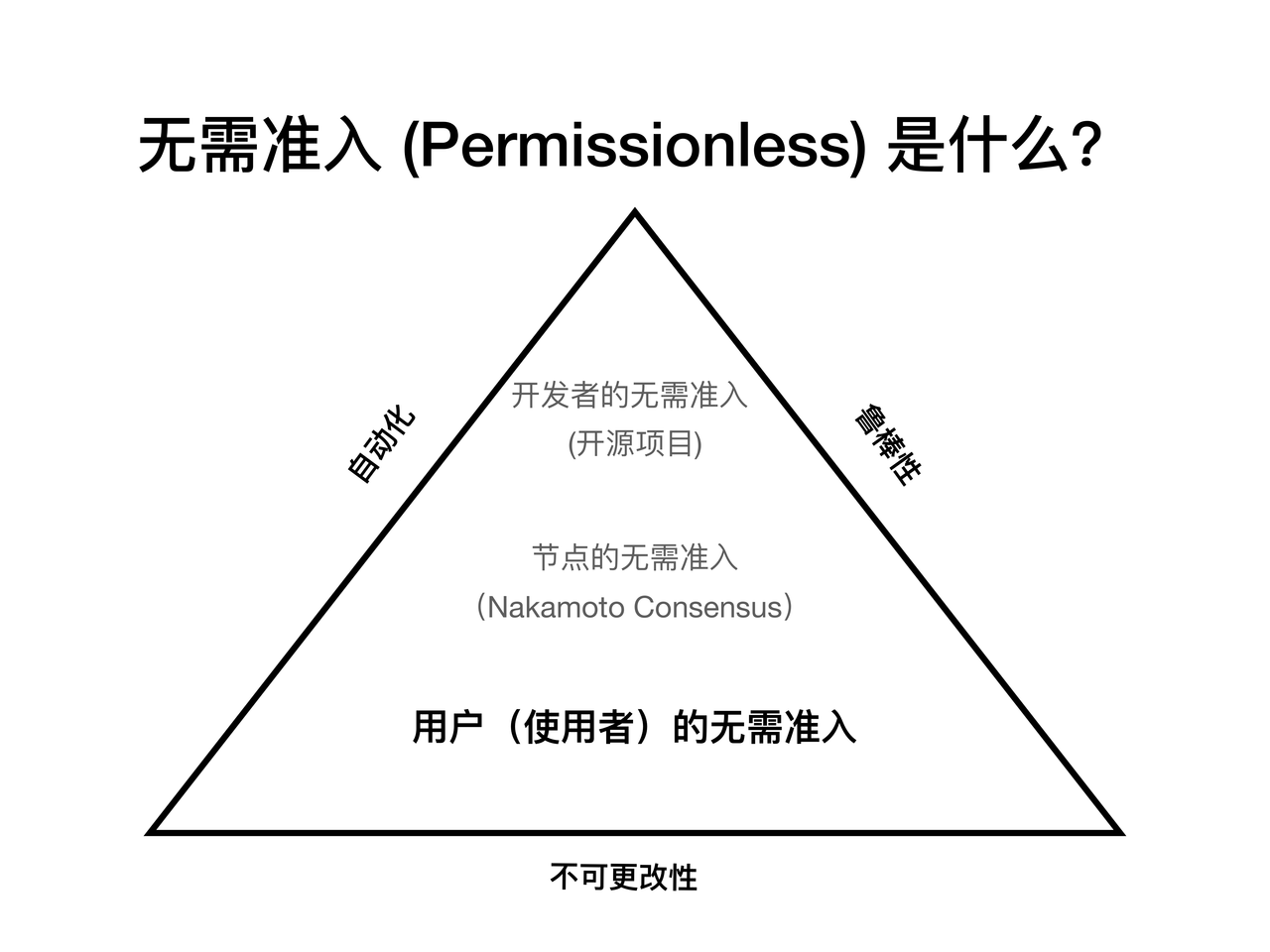

What is the need for no access? There are three levels of no entry required: no access for developers, no access for nodes, and no access for users .

- The developer's lack of access means that the project's code is open source, and any developer can participate in the code and protocol update in the form of Pull Request. An example is Ethereum.

- No access to the node means that any node can act as a miner or verifier, meaning that anyone can act as a biller. This often refers to Nakamoto Consensus's global consensus mechanism, such as proof of work or proof of equity.

- The user's non-accessibility means that anyone can use the network to interact with the network, including creating accounts, transferring funds, contract interactions, and more.

Personally, financial projects that only need to meet the needs of users can be classified as decentralized finance, and developers and nodes do not need to be allowed to trade in efficiency, security and decentralization .

Around the need for access, there are also "impossible triangles" features: automation, robustness and non-changeability. A fully automated, unalterable network is like rocket engineering, and it is nearly as difficult to maintain system robustness (Robustness) under abnormal failures, malicious attacks, and mistakes. Especially in the early decentralized financial projects, it is inevitable to choose.

Decentralization in the financial sector

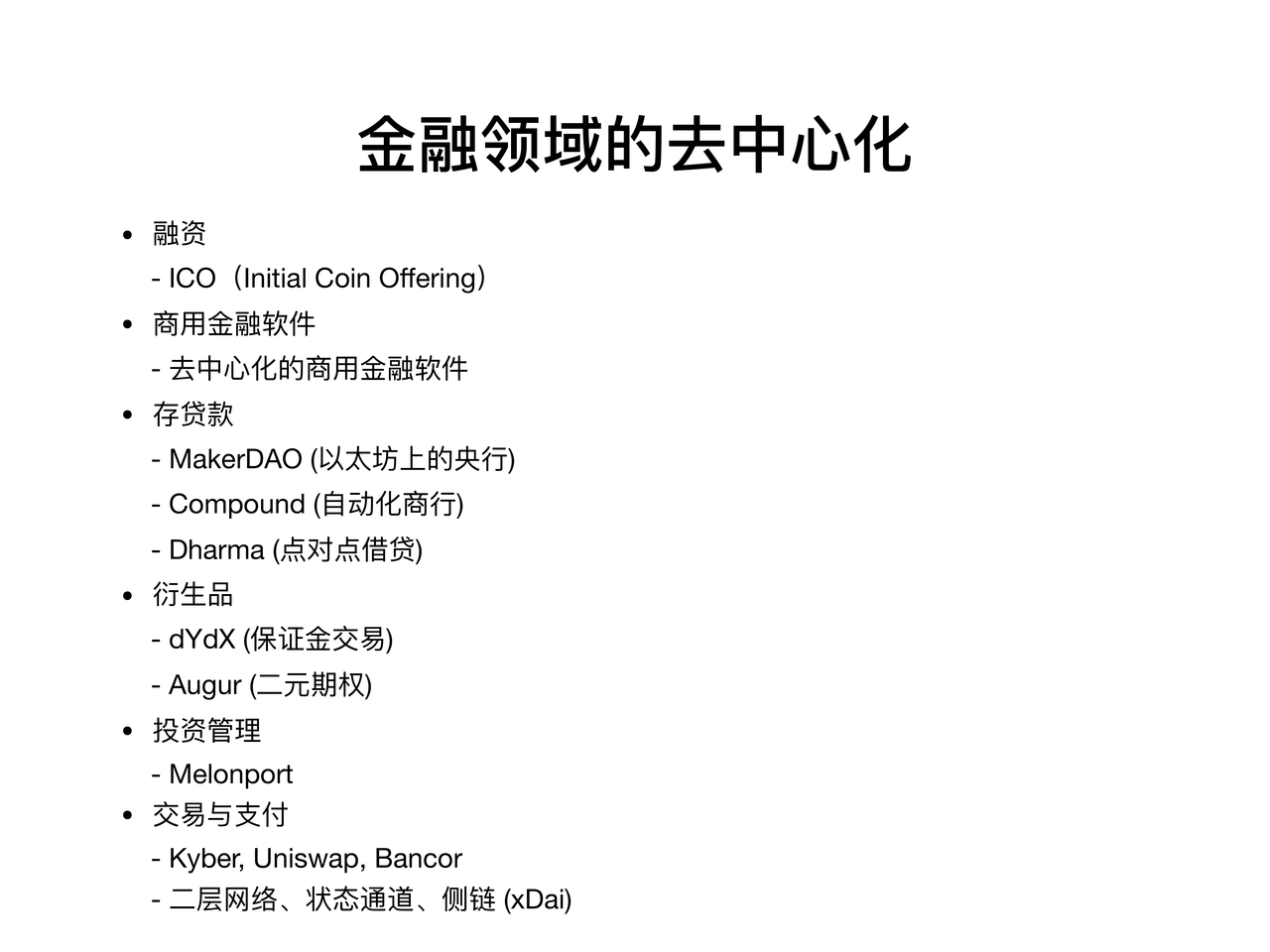

When we talk about decentralized finance, we tend to decentralize (blockchain) as the main body, and then discuss and design applications and protocols with financial attributes. But to understand decentralized finance more comprehensively and systematically, I prefer to use finance as a body to think about which areas can be decentralized. In my opinion, there are several aspects and examples:

Financing

Financing refers to the project raising funds to the outside world, and the financing without access is a crowdfunding in the full sense. Traditional crowdfunding (Crowdfunding) raises funds in return for products and services. In the blockchain, the financing is based on the token, and the token or legal currency is raised, which is the ICO (the first token issuance).

Despite the controversy, ICO can be said to be the first application with financial attributes on the blockchain. The earliest first token issue was Mastercoin, which attempted to develop financial protocols based on the Bitcoin network. Although Mastercoin itself failed, it raised 500 bitcoins through ICO and later transformed into the well-known Tether network – Omni.

After Mastercoin, we saw large ICOs including Ethereum, especially after the ERC20 standard, the first token release became easier and more popular.

Commercial financial software

However, the software facilities of the early blockchain project financing were very primitive and even simple. Investors need to use the command line and master the basic programming knowledge to participate. This is a big threshold.

With the continuous development of (decentralized and centralized) commercial software, financial services on the blockchain continue to be easily accessible to ordinary people. For example, the web-side wallet (Metamask), the mobile terminal imToken and the transaction and payment DApp.

### Deposit and loan

With external funds and easy-to-use software, decentralized finance can have large-scale adoption and core functions related to finance – deposits and loans based on stable currencies.

MakerDAO is a project started in 2015, and its stable currency Dai has become the base currency and loan engine on Ethereum. If Ethereum is seen as a gold reserve, then Dai is the central bank currency issued under the excess “Ethereum Standard” reserve.

– Exploring MakerDAO in depth

In the context of Dai's “high-energy currency”, there are derivatives in the market that are issued with other assets as reserves. For example, a "commercial bank" Compound that does not require a pool of funds and automatically adjusts interest rates according to supply and demand.

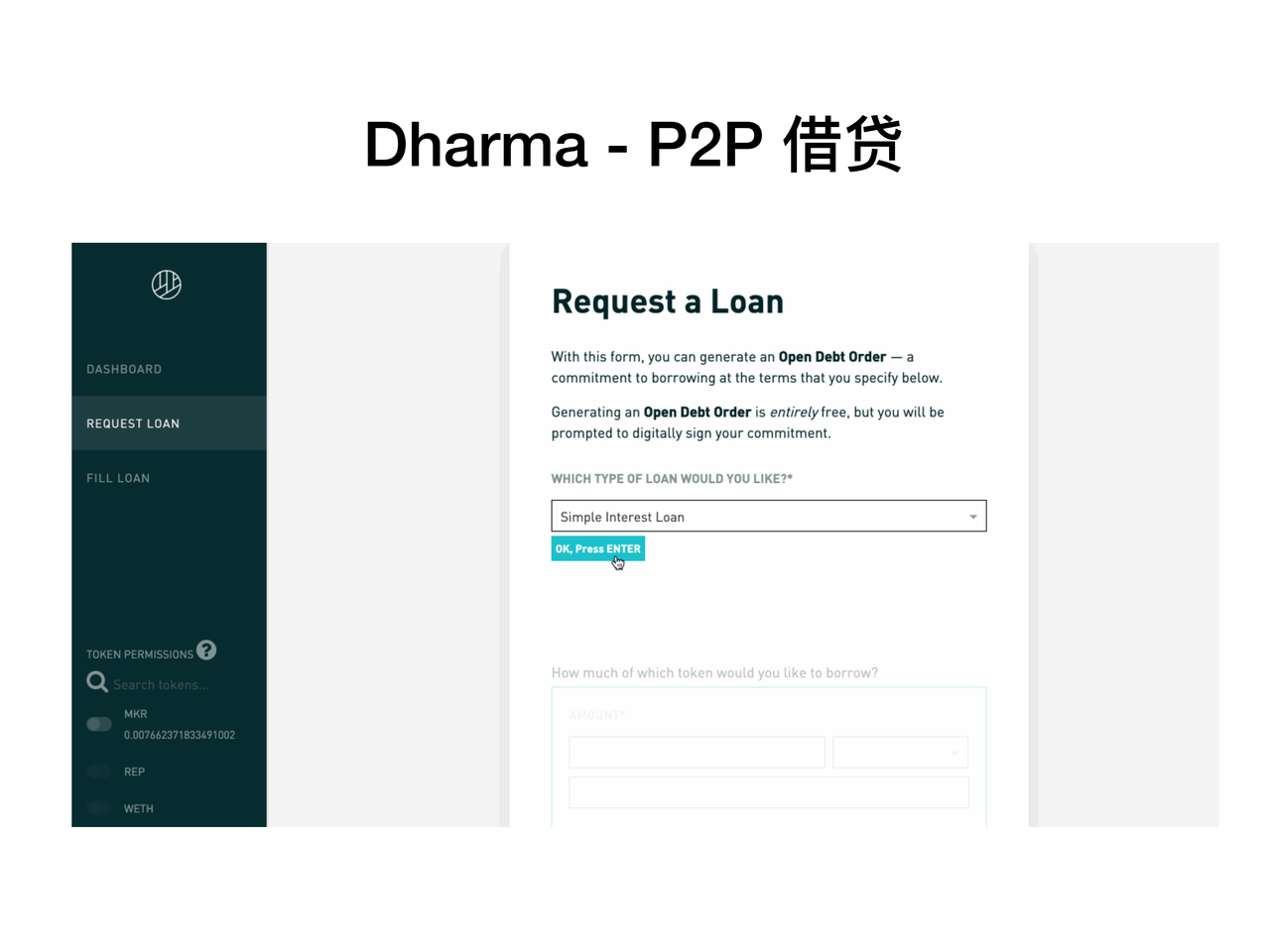

The lending agreement in the form of peer-to-peer is also represented by Dharma et al.

Derivatives

In addition to the base currency and loans, derivatives have naturally emerged in this ecosystem, such as margin trading (dYdX) and binary options (Augur).

In a centralized margin trading market, the capital allocation is limited to the purchase of the underlying asset (ie, the counterparty is required) and will only be settled when the position is closed. Derivatives based on public chains do not require a counterparty and are freely circulated.

Predicting the market is a form of binary options. Because it only needs to provide recognized results at the time of settlement, the transparency of blockchain books and the automatic execution and settlement of smart contracts are natural advantages.

There are also many financial synthetics that sneak traditional assets into the chain, such as the US stock index, allowing ordinary people to participate in previously unrecognized derivatives investments without restrictions and low cost .

Investment management

After having a relatively rich financial product, investment management is another area that can be decentralized. Blocks based on blockchains (such as Melonport) can distribute cakes that used to belong only to securities companies to professional independent investors through auto-executed contracts and networks that do not require access.

Transaction and payment

Finally, let's take a look at the transaction and payment fields. Decentralized exchanges are believed to be no strangers to everyone. It is often overlooked that financial applications in the blockchain can provide faster and safer settlements without the need for hosted decentralized transactions. fluidity.

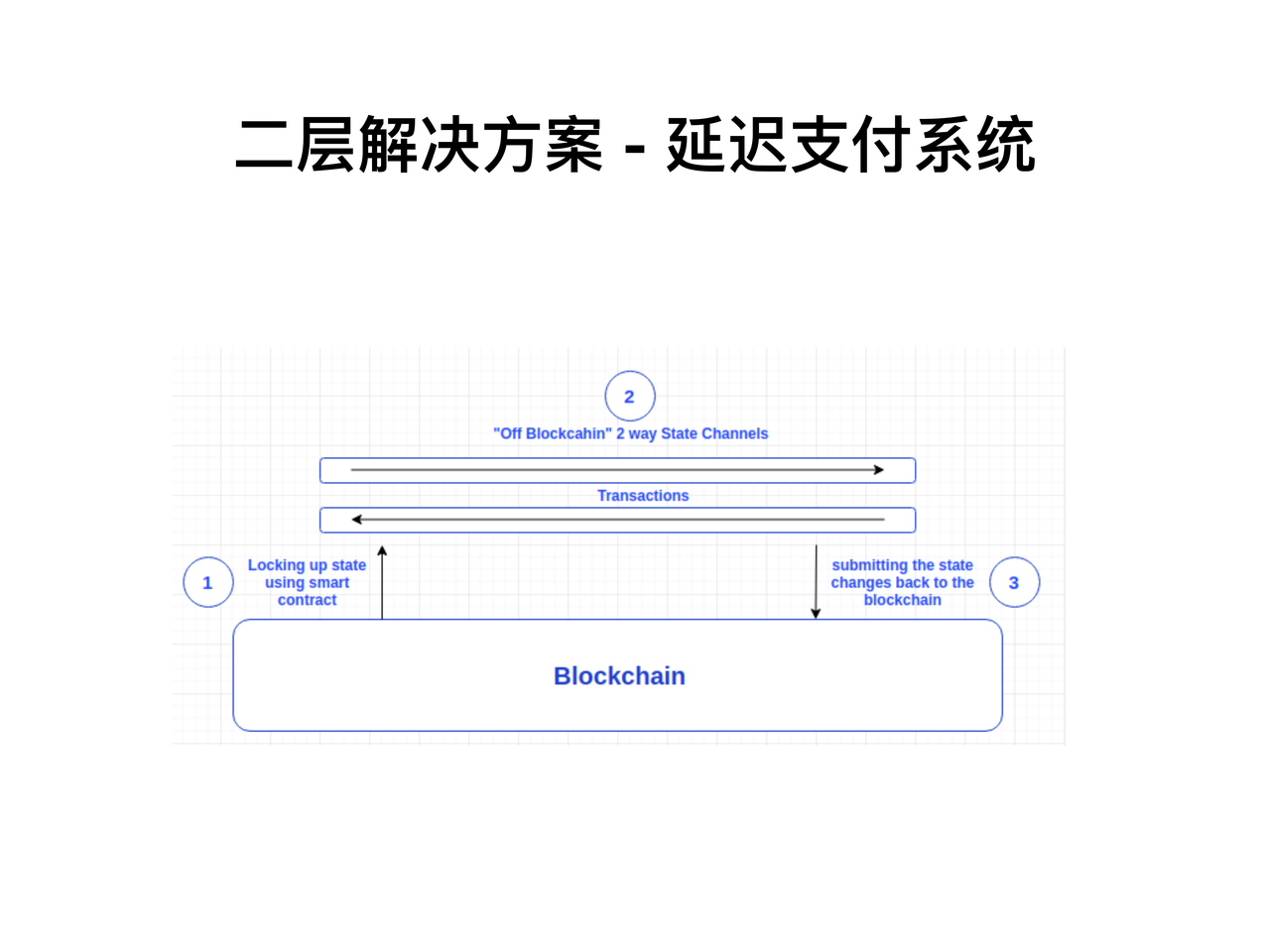

In terms of payment, a second-tier or even multi-layer network , that is, by pledging assets or state channels, puts a part of the speed-seeking transactions under the chain, and puts transactions that require transaction security and finality in the main chain. Mature . We have seen some decentralized payment solutions that are close to mainstream payment tools.

Redefinition and direction of decentralized finance

With these examples back to the original discussion, we see that the core of DeFi is around no need to enter, low threshold. The goal of decentralized finance is not to decentralize itself, but to be more open and fair.

This Open Banking is very close. Only Open Banking gives third-party access only to readable APIs, and DeFi gives ordinary users read, control, and even the power of the biller.

The difference between DeFi and traditional FinTech is that the latter is based on data and machine learning algorithms for more accurate credit evaluation and prediction, while DeFi treats all participants equally, which is the original intention, but has to admit that identity and credit systems It is currently a missing link in DeFi.

It is foreseeable that decentralized finance will coexist with traditional finance, and decentralized finance will complement the payment, loans and credit of centralized institutions in cross-border areas, niche markets and areas lacking financial infrastructure.

Bank the unbanked, Serve the underserved.

Decentralized Finance The better name should be Open Finance.

(This article is from the EthFans of Ethereum fans, and it is strictly forbidden to reprint without the permission of the author.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- When does Bitcoin reach $150,000? Analyst said that it is in the next cycle

- Doubt blockchain chain 23 | 9012 years, the side chain is still a dead and alive Schrödinger cat?

- Application and Research of Blockchain Technology in Cross-Border Payment

- Indian regulators have procrastination? The cryptocurrency ban has not been lifted, and the people took to the streets four times to protest

- Sound | The Treasure of the Crossing of the Bulls

- Babbitt column | Blockchain + Medical: A bridge to restore trust? (under)

- Project Ubin: Singapore's central bank's attempt to apply DLT in clearing settlements (Part 2)