Exclusive Interview with Arbitrum Asia-Pacific Head How Arbitrum is Dealing with the L2 Battle

Interview with Arbitrum's Asia-Pacific Head on L2 BattleAuthor: LianGuaicryptonaitive

If we have to choose a hot and popular encryption track that has been continuously supported by numerous VCs in the past two years, L2 can definitely be selected.

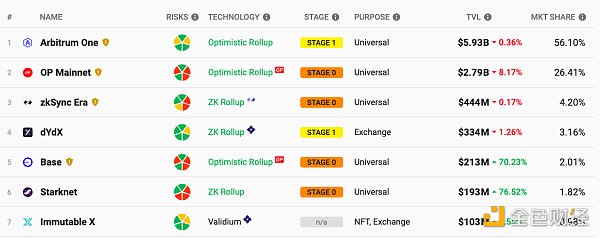

Moreover, the competition in L2 is also extremely intense. There are Optimism, Arbitrum, and Base based on Optimistic Rollup, as well as zkSync, Starknet, and Linea based on zk-Rollup. There are also the zkEVM series L2 that will be launched by the end of 2023 or in 2024, which can be considered as the L2 war.

Although the Arbitrum token was launched after the OP mainnet token, its TVL has always been the first in the L2 track. According to L2beat data, Arbitrum’s TVL currently accounts for 56% of the entire L2 track TVL.

- Interview with Hyper Oracle Programmable zkOracle Building the Supercomputing of the Future World

- Sei’s Ultimate Marketing Rule The King of Rolls in the Post-Airdrop Era

- Insights on the future development of Ethereum How to unlock statelessness?

However, on the other hand, Optimism, which is also in the Optimistic Rollup camp, launched the OP Stack protocol early and attracted well-known projects such as Coinbase’s Base chain, Worldcoin, and BNB to choose OP Stack.

Arbitrum can be said to have strong enemies in front and chasers behind. How will Arbitrum respond to the L2 war? LianGuai recently interviewed Nina Rong, the Asia Pacific head of Arbitrum.

LianGuai: Currently, Arbitrum has several products, including Arbitrum One, Arbitrum Nova, Arbitrum Nitro, and the future Arbitrum Orbit. What are their positions in the Arbitrum ecosystem?

Nina Rong: Arbitrum Nitro is a technology stack. This technology stack was launched in August 2022, one year after Arbitrum One mainnet went live. Since its launch, Arbitrum One, Arbitrum Nova, and Arbitrum Orbit have all been built using the Arbitrum Nitro technology stack.

Arbitrum One is characterized by its strong security, so it is a public chain designed for DeFi and NFT, mainly targeting applications with heavy assets.

Arbitrum Nova is characterized by its low cost, so it is a public chain designed for gaming and socialfi, mainly targeting applications with high TPS and sensitivity to fees.

Arbitrum Orbit allows developers to independently build L3 on Arbitrum One or Arbitrum Nova, serving applications that require completely independent blockchains or have customized requirements for public chains, such as custom gas tokens and custom user permissions.

LianGuai: L2 has been the most active track in the encrypted ecosystem in recent years. Recently, we have observed a trend that they are all moving towards rollup networks or superchains, such as Arbitrum’s Orbit, OP’s OP Stack, Polygon 2.0’s Supernets, zkSync’s hyperchains, StarkWare, and Fractal Scaling. Why are L2s all moving towards superchains and L3s?

Nina Rong: On the one hand, the applications in gaming and socialfi have higher requirements for block space, and on the other hand, more applications hope to build their own ecosystems around their applications.

LianGuai: The competition among L2s is fierce. Currently, Arbitrum’s TVL accounts for more than 50%. On the other hand, Coinbase, Worldcoin, and BNB have chosen OP. Why did they choose OP? How will Arbitrum respond? What are the future developments?

Nina Rong: Arbitrum Orbit is built on top of Arbitrum One or Arbitrum Nova, which means all transaction fees will be returned to Arbitrum One or Arbitrum Nova. We believe this is a more reasonable business model.

LianGuai: What do you think are the main challenges for the future development of L2?

Nina Rong: The challenge lies in improving user experience because L2 itself is not very intuitive for those who are not tech-savvy. Today, when most people still cannot directly interact with Ethereum using MetaMask, we have a lot to do. Hopefully, one day users will be able to use L2 directly when they first encounter blockchain.

LianGuai: Besides L2, what other tracks or narratives do you think are worth paying attention to?

Nina Rong: Due to policy reasons, I believe we should pay more attention to applications in markets outside of the United States and Europe, such as Hong Kong and Japan, where policies are actually very friendly to RWAs.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- MEV Track Overview Have we underestimated its importance?

- SEC is expected to give the green light to Ethereum futures ETF expected to be listed as early as October, with a total of 16 applications pending approval.

- Wood Sister’s Long Push Raising interest rates by the central bank is a more important goal than controlling inflation – bursting the Chinese bubble

- Full text of the speech by Hong Kong Chief Executive Carrie Lam at the 2023 Summit on Innovative Technology and Art Development

- The evolution of the order flow lifecycle What changes does intent-centric bring?

- Exploring the future of Web3 social Building social graphs to solve customer acquisition problem.

- Delphi Digital Researcher UniswapX is Changing the Landscape of DEX