Introducing bitcoin futures for physical settlement? LedgerX and CFTC entangled

According to coindesk today, Michael Short, chief communications officer of the CFTC (American Commodity Futures Trading Commission), sent a statement to coindesk indicating that the US bitcoin derivative financial products company LedgerX "has not been approved by the committee" ( Provide bitcoin futures for physical settlement).

However, as early as July 31, LedgerX announced that it had launched the first batch of bitcoin futures contracts settled in kind in the United States.

After the coindesk article was issued, LedgerX CEO Paul Chou subsequently commented on Twitter that the CFTC’s move was “anti-competitive behavior”, accused the CFTC of violating the rules, and this behavior completely deviated from the democratic principles, and will also sue the CFTC. At the same time, Paul Chou said that he had already negotiated with a lawyer.

- Has Dharma plunged too much? Decentralization is not enough, the mode is difficult to sustain is the key

- Twitter Featured: 15% off, cancel the Dutch shoot, Algorand open cuts?

- Algorand announced an early repurchase, Algo rose 45% in a short time

Paul Chou Twitter screenshot

Who is the Oolong incident?

According to The Block, one source said, “There was a disagreement between LedgerX and CFTC. The CFTC asked them to delete posts on the social networking site about the platform to launch physical settlement of bitcoin futures.”

Derivatives expert Thomas G. Thompson also posted a tweet yesterday: "The CFTC official website does not have any officially certified futures contracts."

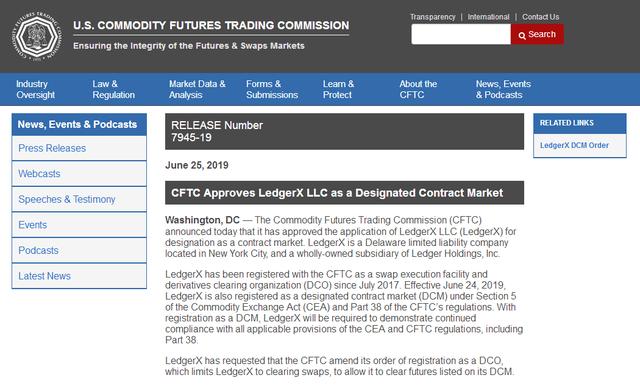

In fact, after 31QU query CFTC official website file, it was found that there is one file related to LedgerX, the file number is 7945-19, which was released on June 25 this year.

The file title is: CFTC approves LedgerX's DCM application. It is understood that in order for financial companies to issue futures, they must obtain two licenses from the regulator: one is the designated contract market (DCM) and the other is the license of the Derivatives Clearing Organization (DCO).

CFTC official website screenshot

The CFTC has now approved the DCM license requested by LedgerX, but has not yet approved any approval for the DCO license.

At the same time, according to the analysis of the coindesk article, according to the regulations of the regulatory body, the CFTC has 180 days to decide whether to apply through LedgerX's DCO. This means that when LedgerX's application is submitted, the regulator has three months to consider whether to approve the application.

However, this is not reasonable, as LethgerX chief operating and risk officer Juthica Chou told coindesk, “We submitted the (DCO) amendment on November 8, 2018, and we received an email letter confirming that no changes are required. Or an extra project. This has been more than 180 days so far, and we don't know why this is happening (CFTC has not yet been approved).

The introduction of physical settlement of bitcoin futures is also "because CFTC has no objection during this period of application, we automatically understand that it has been approved."

But now the denial of the CFTC has made the whole thing confusing. Because LedgerX submitted its application last November, it has been more than half a year now. During this time, the CFTC did not show any indication of approval or opposition.

If the CFTC does not raise an objection within the three-month review period, is it true that LedgerX has obtained a DCO license and can also launch a physical settlement of Bitcoin futures products?

Coindesk interviewed a senior CFTC official who did not want to be named. He said that the CFTC needs clear approval: "The lack of an indication does not mean that it is approval, and the company does not pass the default."

LedgerX is already ready

In fact, although LedgerX was not the first US provider of bitcoin futures (the first is financial services company TD Ameritrade), it was the first to provide physical settlement. And LedgerX has long been eyeing the bitcoin market.

In August 2018, LedgerX announced the launch of the Ledgersavings platform, which provides BTC savings services, allowing users to choose between 3 months, 6 months and 12 months of storage and enjoy different percentages of interest. LedgerX also said that even if the digital currency market does not appreciate, the service will give customers an annual return of about 16%.

The entanglement between LedgerX and CFTC began on April 15, 2019. LedgerX announced on the same day that it has applied to the CFTC for a Designated Contract Market (DCM) license to provide customers with physical settlement of bitcoin futures transactions. The client is not limited to the organization, but retail investors can also trade.

On June 25, 2019, the CFTC official website issued a document announcing the DCO application through LedgerX.

At the same time, according to 31QU's previous report, on July 22nd, the digital currency trading platform Bakkt launched the “Acceptance and Transaction Acceptance Test” for physical settlement of Bitcoin futures products to users. When the official product is released after the test is successful, the product will be listed on the ICE (Intercontinental Exchange of the New York Stock Exchange) and settled at ICE Clear.

How will the follow-up work develop, whether LedgerX will launch a physical settlement of bitcoin futures contracts, and further attention to the CFTC official response.

Source /31QU

Text / small shell

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How to understand the market cycle of cryptocurrency

- QKL123 blockchain list | The overall market heat is reduced, but the media heat is not reduced (201907)

- The most comprehensive analysis tells you: Why LegderX did not launch bitcoin futures trading on time

- The origin, progress and future of Reg A+: Can it be the usual way to market cryptocurrencies?

- Square Q2 Bitcoin sales hit a new high, reaching $125 million, the founder confessed to BTC

- DappReview CEO Niu Fengxuan: 10% of Dapp users account for more than 80% of the transaction volume

- Patent application exposes Wal-Mart digital currency ambitions, or will compete with Libra