Many ministries and commissions support the application of blockchain, and Korea, Commission, and Ancient promote the issuance of government cryptocurrency | July policy

Currently, there have been more than a month since the launch of the Libra project, but discussions around the project and digital currency are continuing. In July, the two houses of the US Congress conducted four hearings around the digital currency.

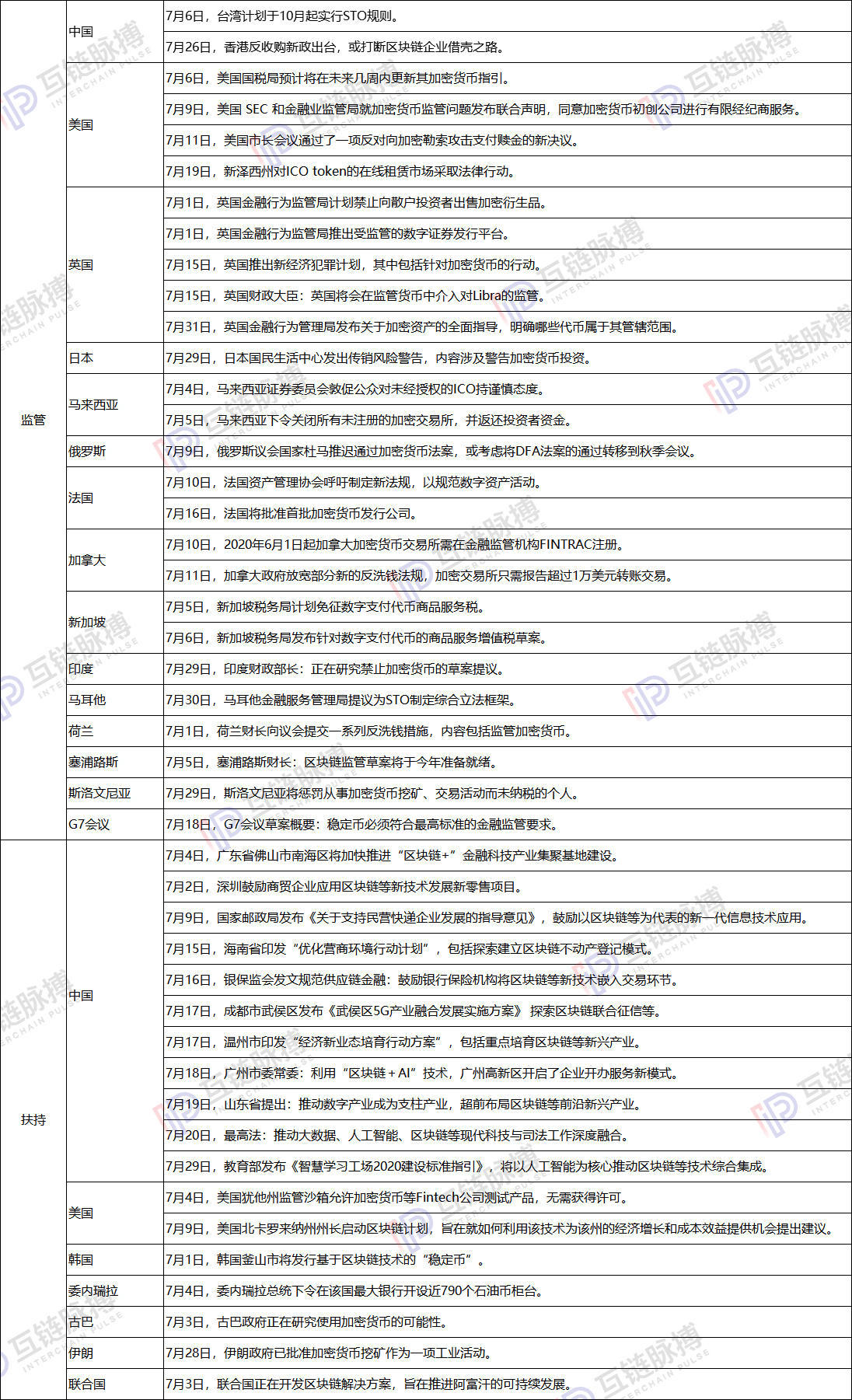

Mutual chain pulse observations of blockchain policy information in various countries, many of which are also affected by Libra. In terms of blockchain regulation, on July 18th, the G7 meeting released a draft summary stating that the stable currency must meet the highest standards of financial regulatory requirements and must address the regulatory divide.

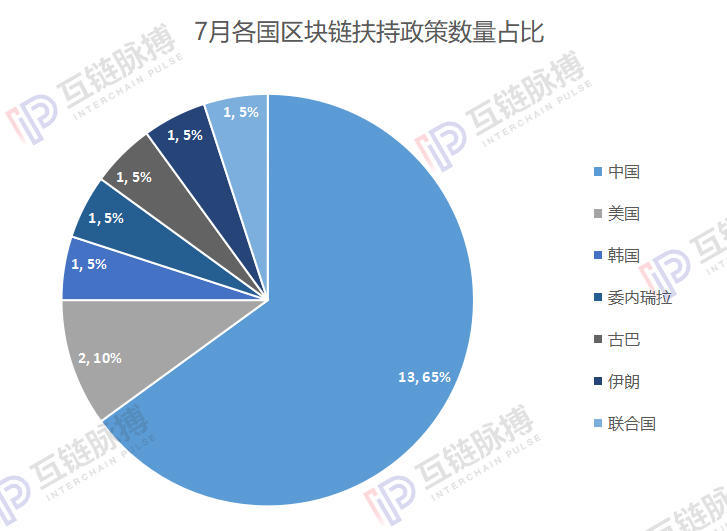

In terms of blockchain support, the focus of attention in Korea, Venezuela and Cuba has fallen on the government's cryptocurrency. Busan, South Korea, will issue “stabilized coins” based on blockchain technology; the Cuban government is studying the possibility of using cryptocurrencies; the Venezuelan president has ordered nearly 790 oil coin counters in the country’s largest bank.

In addition to Libra's influence on the policies of various countries, China's blockchain policy information also has certain changes. The central ministries and commissions are further promoting the application of blockchain technology, while the Hong Kong and Taiwan regions are more heavily regulated.

- BTC alone rose back to 10,000 US dollars, facing the daily resistance level

- Blockchain financing forced the "coin mountain"

- Fight for economic freedom! Coinbase released a ten-year development vision on a tall

Domestic blockchain policy: RTHK strengthens supervision of central ministries and promotes blockchain application

According to the incomplete statistics of inter-chain pulse, in July, there were two policy information related to blockchain supervision in China, which were announced by Taiwan and Hong Kong. According to statistics reported by regulationasia on July 2, Taiwan Province plans to implement the STO rules in October. The funds raised through STOs will not exceed 300 million Taiwan dollars, and individual investors can purchase up to 300,000 Taiwan dollars. On July 26, the Hong Kong Stock Exchange issued a heavy regulatory document, “Consultation Summary on Backdoor Listings and Other Shell Stock Activities.” The new policy introduced this time is likely to interrupt the backdoor listing of some blockchain companies.

Compared with the amount of information related to supervision, the inter-chain pulse statistics, the number of information on domestic blockchain support is more, there are 11 in total. Among them, the central ministries and commissions and Guangdong Province accounted for a large proportion, and 4 and 3 respectively supported related policy information.

The information on the support policies announced by the central ministries and commissions mainly focuses on the actual work of various departments and promotes the application of blockchains in the fields of postal, banking insurance, justice, and education.

On July 9, the State Post Bureau encouraged a new generation of information technology applications represented by blockchains; on July 16, the China Insurance Regulatory Commission issued a document encouraging bank insurance institutions to embed new technologies such as blockchains into trading links; July 20 The Supreme Law: promote the integration of modern technology and judicial work such as big data, artificial intelligence, blockchain, etc. On July 29, the Ministry of Education said that it will promote the integration of blockchain and other technologies with artificial intelligence as the core.

Foshan City, Shenzhen City and Guangzhou City in Guangdong Province are also promoting the application of blockchain technology in finance and government affairs.

On July 2, the “Procedures for the Shenzhen Municipal Bureau of Commerce's Industrial Development Special Funds Consumption Promotion Support Program” was issued. It pointed out that Shenzhen encourages commercial and trade enterprises to apply new technologies such as the Internet and blockchain to develop new retail projects, and will meet the requirements. The project was funded; on July 4th, the "Development Action Plan for the "Tengyun Plan" in Nanhai District of Foshan City" was issued, and it was mentioned in the outline to accelerate the construction of the "blockchain +" financial technology industry cluster base; July 18 On the day, the implementation plan of the Guangzhou High-tech Zone Construction of the Guangdong Province Business Environment Reform and Innovation Experimental Zone was officially approved. After that, we can use the "blockchain + AI" technology to open a new service model for enterprises that are "all-weather, zero-face, one-click".

In addition, Hainan Province, Sichuan Province, Zhejiang Province, and Shandong Province each have one blockchain support information release.

On July 15, Hainan Province issued the “Optimization of Business Environment Action Plan”, which included exploring the establishment of a blockchain real estate registration model; on July 17, Chengdu Wuhou District issued the “Fuji District 5G Industry Integration Development Implementation Plan”. 》, said that it will explore solutions such as blockchain joint credit reporting; also on July 17, Wenzhou City issued the “Economic New Business Development Action Plan”, including focusing on cultivating blockchain and other emerging industries, attracting blockchain and other industries. On July 19th, the deputy director of the Shandong Provincial Bureau of Big Data introduced at the press conference that it is necessary to promote the digital industry to become a pillar industry, and to advance the frontier emerging industries such as the blockchain.

Foreign blockchain policy: or promote the development of government cryptocurrencies by Libra

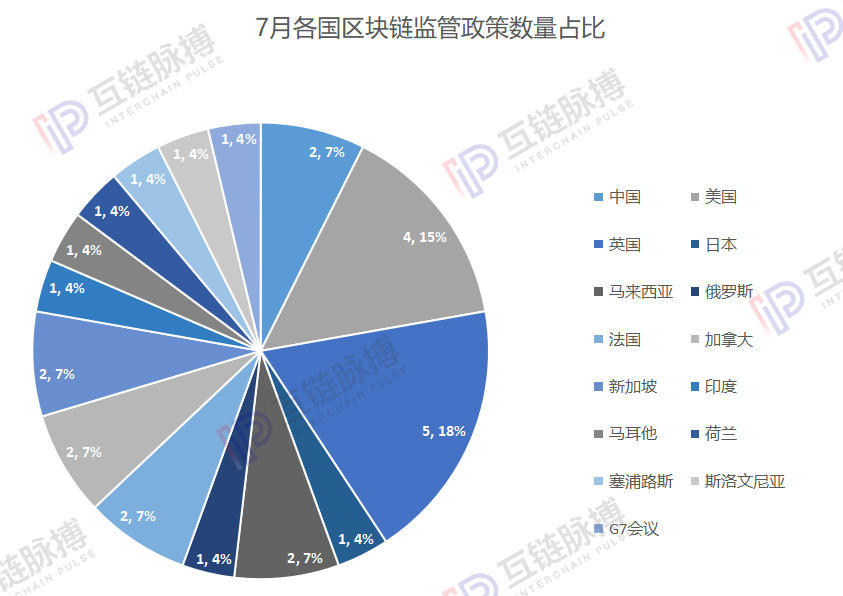

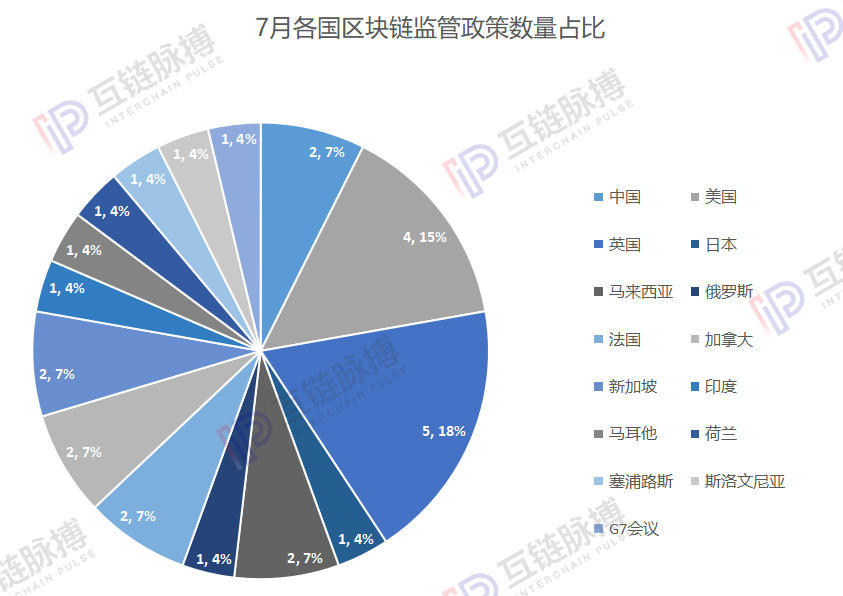

According to the incomplete statistics of inter-chain pulse, in July, there were 25 relevant information on foreign blockchain supervision policies. For the first time, the United Kingdom surpassed the United States to become the country with the most regulatory information.

This month, there were five regulatory-related information in the UK: In early July, the UK Financial Conduct Authority issued an official document indicating that it was preparing to introduce a ban on the sale of crypto-derivatives to retail investors; Globacap, a fully regulated digital securities and management platform.

In mid-July, the UK launched a new economic crime plan that included actions against cryptocurrencies to ensure that these programs were not used for money laundering and other illegal activities. The British Chancellor of the Exchequer also said in mid-July that the UK will intervene in Libra regulation in the regulatory currency.

At the end of July, the UK Financial Conduct Authority finalized its Guide to Encrypted Assets to determine which tokens belonged to its jurisdiction.

The four regulatory information introduced by the United States are different. The IRS is expected to update its cryptocurrency guidelines; New Jersey has taken legal action against the ICO token online rental market.

In addition to the United Kingdom and the United States, Malaysia, France, Canada, and Singapore have announced two policy information related to blockchain regulation.

At the beginning of the month, two messages from Malaysia revealed their tough attitude towards cryptocurrency exchanges. On the 4th, the Malaysian Securities Commission urged the public to be cautious about the unauthorized ICO; on the 5th, the Malaysian financial regulator ordered the closure of all exchanges in the country except the three registered exchanges. The Malaysian Capital Markets Authority warned that all unregistered cryptographic exchanges operating in the country ceased operations and returned investor funds.

Canada is also the focus of the exchange, the official announcement on July 10, from June 1, 2020, the Canadian cryptocurrency exchange will be legally required to register at the Canadian Financial Transaction and Reporting Analysis Center.

At the same time, it is worth noting that after the launch of Libra for one month, on July 18th, the draft G7 meeting was released. It is pointed out that the stable currency must meet the highest standards of financial regulatory requirements and must address the regulatory divide. Stabilizing coins like Facebook's cryptocurrency Libra trigger "serious regulatory and systemic concerns" that must be resolved before similar plans are implemented. And this is also the attitude that national regulators want to show during this time.

Inter-chain pulse statistics, there are only 7 policy information related to foreign blockchain support, and there are 2 in the United States, which are experimental plans for blockchain technology in Utah and North Carolina. On the 4th, the U.S. Utah regulatory sandbox allowed Fintech to test products such as cryptocurrency without obtaining permission; on the 9th, the governor of North Carolina of the United States launched a blockchain program aimed at how to use the technology for the state’s economic growth and Cost-effectiveness provides opportunities to make recommendations.

The focus of South Korea, Venezuela, and Cuba is the government's cryptocurrency behavior. On the 1st, Busan City, South Korea will issue a “stabilized currency” based on blockchain technology; on the 3rd, the Cuban government is studying the possibility of using cryptocurrency; on the 4th, the Venezuelan president ordered nearly 790 oil in the country’s largest bank. Currency counter.

Interchain Pulse Statistics of Blockchain Policy for July 2019:

Text: Golden car

This article is [inter-chain pulse] original, please indicate the source!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin bifurcation for two years: Why do you want to fork in the year?

- Bitcoin's IPO to the US is coming soon, raising more than $1 billion: core financial data exposure

- Interview with Babbitt | Matrixport, Trading, Lending and Hosting, How to build a bank in the digital currency world?

- Which platform is strong for the platform? Babbitt strips twitching and finds the truth for you

- Brazilian citizens will report encrypted transactions to the IRS

- The small BM slipped faster than the BM, and the ENU founder “killed” the project and called for the 砸

- The blockchain business of the fire coin and the OK port company began to take shape, and the forward holding group involved in the debt lending business.