Ren Zeping: Tencent Ali should be encouraged to join Libra to promote the inclusion of RMB in Libra's reserve assets

Guide

On June 18th, Facebook's global digital cryptocurrency Libra official website was officially launched, and the Libra white paper has also been released. According to the white paper, Libra will build a simple, borderless currency that will serve the financial infrastructure of billions of people. Libra has received wide attention as soon as it was launched. On the one hand, it has pushed digital currency to a new round of climax, and on the other hand, it has raised concerns among regulators in various countries. What is Libra? What are the advantages of Bitcoin? What impact will it bring?

Summary

Libra is a blockchain-encrypted digital currency issued by Facebook. Its main features include: In terms of organizational structure, Libra's release management is implemented by non-profit, decentralized associations, which cover a variety of industries such as payment, telecommunications, and blockchain; in terms of technology, with other digital currencies In contrast, Libra's three core technologies (Move programming language, BFT consensus mechanism, Merkel tree data structure) make it more secure and reliable; in terms of currency characteristics, Libra reserves 100% linked to a basket of bank deposits and short-term Treasury bonds have the advantages of stability, low inflation, universal acceptance and interchangeability.

- The UK FCA publishes the final guide to cryptocurrency regulation, and multiple types of cryptographic assets are clearly defined

- Interpretation of the market | The US market is completely open, will 400 million people buy BTC?

- Many ministries and commissions support the application of blockchain, and Korea, Commission, and Ancient promote the issuance of government cryptocurrency | July policy

Libra's advantages and challenges coexist, and national regulation is currently the main obstacle. On the one hand, Libra combines blockchain technology and bitcoin advantages, upgrade technology and distribution mechanism to achieve inclusive finance. Compared with USDT, Libra has significant advantages in terms of subject credit, organizational structure, currency stability and ecological construction. It is expected that Libra will become the most mainstream stable currency, providing equal financial services for underdeveloped regions and significantly reducing cross-border payment costs. On the other hand, issuers and national regulatory risks pose challenges to Libra's promotion. 1) Issuer risk As a currency, Libra naturally faces similar risks to commercial banks, including over-issuance and privacy exposure risks. 2) National regulatory risk, Libra will weaken the monetary sovereignty of each country, impact the existing monetary system, and the regulatory and international organizations of all countries generally hold a neutral and cautious attitude towards Libra, and do not rule out the possibility that some countries will ban Libra in the future.

Libra or impact currency systems, banking systems, capital markets and other digital currencies.

Impact on the monetary system: The prototype of the Libra super-sovereign currency appears. First, the Libra Association is not trying to create a super-sovereign currency, but Libra naturally evolves into a super-sovereign currency. From the perspective of the globalization of the US dollar, asset collateral and rich ecology have made Libra a prototype of super-sovereign currency, and the gradual expansion of circulation may make Libra naturally evolve into a super-sovereign currency. It is expected that Libra will first circulate in a small country with relatively backward financial infrastructure. The impact on the sovereign currency of the big country is relatively limited in the early stage. Libra's circulation in small countries is the vane of its ability to become a super-sovereign currency. Second, Libra will impact national currency sovereignty, affect the implementation of monetary and fiscal policies, or hinder the internationalization of the RMB. In terms of monetary policy, the anonymity and peer-to-peer trading characteristics make Libra a new channel for cross-border capital flows. The capital flow control of central banks is more difficult. Some commodities may be priced using Libra, and some small countries' currencies may even be completely replaced. Monetary policy will be invalid. In terms of fiscal policy, the government is unable to levy a “coinage tax” and loses the deficit monetization tool. The fiscal revenue shrinks and the risk of debt default increases.

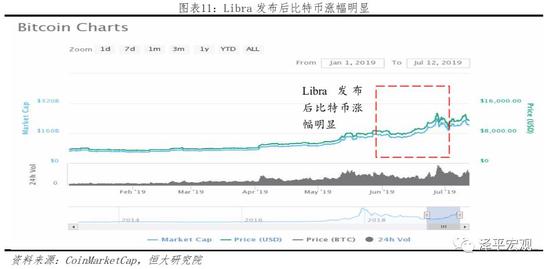

Impact on other digital currencies: Libra cannot replace Bitcoin and does not constitute direct competition. Libra is positioned as a payment method, and its design concept overcomes the three shortcomings of Bitcoin and is a better payment medium. And because Bitcoin differs in terms of credit risk and function positioning, the two will not constitute a direct competitive relationship. In fact, as a digital currency, the promotion and popularization of Libra will make Bitcoin more accepted and recognized by more people.

Impact on the banking system: bank loans and cross-border payment business are under pressure. Cross-border payment services are the main application scenarios of Libra, which will impact the cross-border payment business of traditional commercial banks. At the same time, Libra is likely to carry out credit expansion in the future, which will impact the commercial bank loan business. Impact on the capital market: Enterprises are financing in disguised form through ICO, and development opportunities and potential risks coexist. In the future, companies can raise funds through “Libra+ICO”. The low investment threshold and no need for approval make it easy for enterprises to quickly find partners, but maliciously speculating on tokens or undermining the normal financial order may even lead to systemic financial risks.

In the face of Libra, China should embrace innovation and challenges, encourage the Chinese central bank to promote digital currency research and development, and encourage Chinese Internet companies to strengthen cooperation with Libra. In the long run, instead of responding passively, it is better to take the initiative to attack. China should pay attention to the new opportunities for technological change brought about by digital currency and blockchain technology. The Chinese government, Tencent Ali, and important financial institutions will join the world and related companies to launch the world. Sexual digital currency Globra, China is ahead of the US in the field of Internet finance and mobile payment, which is of strategic significance for enhancing the convenience of the world's people, China's Internet technology strength, mobile payment strength, RMB internationalization, and the establishment of a global financial center. . First, we should delve into the nature of Libra and focus on development and strategic direction, paying close attention to the development of other emerging global digital currencies. Second, efforts were made to integrate Libra and other digital currencies into the existing regulatory system while building its own digital currency system. Third, China’s regulation of digital currency should not be “one size fits all”. On the one hand, it is necessary to speed up the establishment of a legal system for the issuance and trading of digital currencies. On the other hand, the risk of cross-border capital flows should be prevented through the foreign exchange control system to ensure the stability of China's financial market. In the long run, Internet companies should be encouraged to expand overseas business and cross-border payments, and enhance the international competitiveness of China's financial services industry.

Risk warning: Libra's development is less than expected, countries are strictly forbidden, etc.

table of Contents

1 What is Libra?

1.1 The driving force of birth: Facebook enters the payment business

1.2 Management model: non-profit, decentralized association governance

1.3 Core technology: Move programming language, BFT consensus mechanism, Merkel tree data structure

1.4 Currency characteristics: 100% linked to a basket of bank deposits and short-term government bonds

2 Advantages and challenges coexist, national regulation is currently the main obstacle

2.1 Advantages: Technology upgrade, stable currency and inclusive finance

2.1.1 Technology upgrade based on blockchain

2.1.2 Linking a basket of mortgage assets to create a better stable currency

2.1.3 Create a more inclusive financial system that significantly reduces cross-border payment costs

2.2 Challenge: Issuer Risk and National Regulatory Challenges

2.2.1 Issuer Risk: Excessive Currency, Liquidity Pressure and Privacy Disclosure

2.2.2 National regulatory challenges: countries generally hold a neutral cautious view

3 Libra's influence appears, or impacts on the monetary system, banking system and capital market

3.1 Impact on the monetary system: the emergence of Libra super-sovereign currency

3.1.1 Looking at the prospect of Libra's super sovereign currency from the globalization of the US dollar

3.1.2 Libra affects the implementation of monetary policy and fiscal policy in various countries, or hinders the internationalization of the RMB

3.2 Impact on other digital currencies: Libra is a better payment medium, but it cannot replace Bitcoin

3.3 Impact on banking institutions: bank loans and cross-border payment services are under pressure

3.4 Impact on the capital market: companies are financing through ICO disguised

4 Financial supervision and how Chinese companies respond

4.1 Responding to Libra: objective analysis, embracing competition

4.2 Attitude towards digital currency: financial supervision should not be across the board

4.3 Chinese Internet companies should be encouraged to expand overseas business and cross-border payments

text

1 What is Libra?

On June 18, 2019, Facebook released the Libra white paper, proposing the establishment of a simple, borderless currency that would serve the financial infrastructure of billions of people. Libra is a cryptographic digital currency based on blockchain technology and managed by a dedicated association. Specifically, Libra consists of three parts:

1) Based on a secure, scalable and reliable blockchain;

2) Backed by an asset reserve that gives intrinsic value, 100% linked to a basket of currencies;

3) Governed by an independent Libra Association whose mission is to promote the development of this financial ecosystem.

Through the combination of the above three, Libra aims to create a more inclusive financial system.

1.1 The driving force of birth: Facebook enters the payment business

The birth of Libra was not a one-off, but a product of Facebook's use of precipitation data to make multiple attempts to broaden its business structure and find new profit growth points.

First, Facebook's business structure is single, and it has repeatedly exploded data security and privacy issues, and there is doubt about sustainable development. Facebook has about 2.7 billion users, covering developed countries such as the United States and Europe, and developing countries such as India and Mexico. However, Facebook's business model is dominated by advertising. In the first quarter of 2019, advertising revenue accounted for 98.9% of total revenue. In addition, Facebook frequently suffers media criticism and regulatory penalties for privacy breaches and data abuse. In 2016, Cambridge Analytica used about 87 million Facebook user information to influence the US election. In July 2019, German regulators believed that Facebook had insufficient information in reporting illegal content on the platform. , a fine of 2 million euros for Facebook. With the awakening of people's awareness of Internet privacy protection and the gradual improvement of national legal systems, in the future, personal behavior data such as content browsing will be applied to advertising intelligent distribution or limited, and Facebook's “traffic + advertising” business model is doubtful.

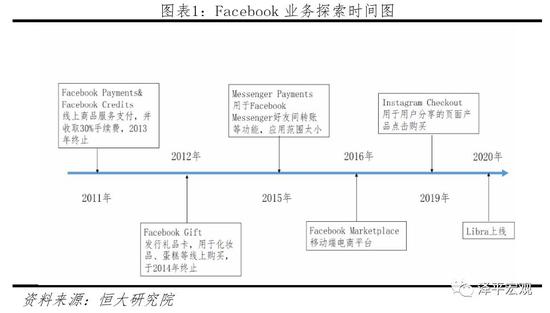

Second, in order to improve the value of data and change the business structure, Facebook has repeatedly explored the field of payment and e-commerce, and has the foundation and understanding of the field. As early as 2011, Facebook began to set foot in the payment industry, set up Facebook Payments to undertake the payment function in the platform. In 2012, Facebook entered the e-commerce field and launched the gift card Facebook Gifts. Since then, it has launched payment methods such as Credits and Messenger Payments, Facebook Marketplace, Checkout and other e-commerce services. However, Facebook users are widely dispersed, and competitors such as Apple iTunes/Store and Amazon have strong market annihilation capabilities, and Facebook's payment and e-commerce business has been unable to open the market.

Third, the blockchain can solve the development problems facing Facebook and enhance its voice in the lifeline of the new economy. Blockchain technology has the advantages of openness, equality, mutual trust and transparency, which has brought revolutionary changes to the payment industry. With Libra, Libra once again cut into the payment field, and based on massive data, it is expected to become a financial technology service provider, creating an ecological closed loop of “social + payment”.

1.2 Management model: non-profit, decentralized association governance

Although Libra cryptocurrency is initiated by Facebook, its distribution management is carried out by a non-profit, decentralized association based in Geneva, Switzerland.

The Libra Association currently consists of 28 members covering a wide range of industries including payments, telecommunications, and blockchain. The Libra Association is sponsored by Facebook and consists of organizations from various industries covering the payment industry, technology trading platform, telecommunications industry, and blockchain industry. According to the white paper plan, the number of founding members of the Lirba Association will reach 100 or so in 2020.

Members of the Libra Association have equal rights and obligations, and individual founders have a maximum voting power. The Libra Association is governed by a board of directors whose role includes ensuring that the verifier node meets trading needs, issues Libra and manages reserve assets. All decisions of the association will be made through the board of directors, and two-thirds of the members will vote for the major policy or technical decision. In order to prevent voting rights from being held in one hand, no matter how many Libra members hold, a single founder, including Facebook, can only represent 1 vote in the board or 1% of the total votes, whichever is the greater.

1.3 Core technology: Move programming language, BFT consensus mechanism, Merkel tree data structure

Libra's core technology involves three aspects: the Move programming language, the Byzantine Consensus Algorithm (BFT), and the blockchain data structure. Libra can be easily understood as a coalition chain using the Byzantine consensus algorithm.

1) Libra designs and uses a more reliable and safe Move programming language. Move has the following characteristics: 1) each resource has only a single owner, designed to prevent digital assets from being copied; 2) automatically verify that the transaction satisfies the conditions, ensuring blockchain security; 3) executable against Libra currency and verifier Node management reduces the difficulty of developing key transaction codes.

2) Adopt a BFT mechanism based on the LibraBFT consensus protocol. The consensus mechanism is designed to ensure the consistency and irreversibility of transaction information across distributed nodes. Libra uses the BFT mechanism to ensure that the network is up and running even if one-third of the nodes fail.

3) Use the data storage structure of the Merkel tree to ensure the security of the stored transaction data. The Merkel tree is a widely used data structure in blockchains (such as Bitcoin) that efficiently and quickly summarizes and verifies large-scale data integrity, as long as any node in the tree is tampered with verification failures.

1.4 Currency characteristics: 100% linked to a basket of bank deposits and short-term government bonds

The Libra blockchain is fundamentally a digital currency using blockchain technology. By comparing with French, Bitcoin, other stable and Q coins, we understand the characteristics of Libra as a currency.

1) In terms of the issuance mechanism, Libra is centralized, that is, the Libra Association has established management and issuance rules, which are different from digital currencies such as Bitcoin and USDT, but similar to the French dollar and Q ratio.

2) In terms of credit endorsement, Libra is similar to the stable USDT, which is backed by asset reserves. Libra is 100% linked to a basket of bank deposits and short-term government bonds to further stabilize the currency and increase credit. Bitcoin has no credit endorsement, and French and Q coins rely on national credit.

3) Libra has no issue limit in terms of the number of issues, similar to the legal currency, stable currency USDT and Q currency, but Bitcoin has a regulatory limit of 21 million.

4) In terms of circulation, Libra is gradually expanding its circulation based on Facebook's 2.7 billion users worldwide. The legal currency except the US dollar can only be circulated in one economy. The stable currency USDT is mainly used to purchase other digital currencies. The circulation of Q coins is limited to the purchase of Tencent services.

2 Advantages and challenges coexist, national regulation is currently the main obstacle

Libra's launch is a major historic breakthrough in digital currency, and understanding Libra's strengths and challenges is key to its future. On the one hand, Libra combines blockchain technology and bitcoin advantages, upgrade technology and distribution mechanism to achieve inclusive finance. On the other hand, issuers and national regulatory risks pose challenges to Libra's promotion. In particular, Libra's impact on the monetary system will weaken the monetary sovereignty of countries, and does not rule out the possibility that some countries will ban Libra in the future.

2.1 Advantages: Technology upgrade, stable currency and inclusive finance

2.1.1 Technology upgrade based on blockchain

Based on blockchain technology, Bitcoin enables the ability to open an account without the need for intermediaries, anonymity, peer-to-peer transactions and Internet access, thus attracting many followers. Libra uses the blockchain as the underlying technology, which not only absorbs the advantages of Bitcoin, but also further technical optimization in terms of programming language and platform architecture.

1) Designed the Move programming language, taking into account both security and development difficulty. The Move language not only provides a convenient development environment for ecological participants, but also ensures the security of smart contract development through the design of digital assets.

2) Adopt the framework of “union chain + centralization” to meet the needs of national regulatory authorities to combat illegal activities. Unlike Bitcoin's decentralized architecture, Libra uses a centralized architecture where all transactions are initiated by a central authority to generate permanent records containing information about the time, place, and method of the transaction, thus supporting regulators against violations such as money laundering and tax avoidance.

2.1.2 Linking a basket of mortgage assets to create a better stable currency

The market has a strong demand for stable coins, and Libra has significant advantages in issuing subject credit, organizational structure and currency stability.

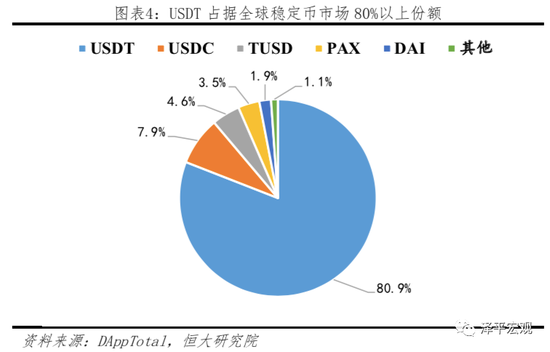

In December 2018, the total market value of the stable currency USDT jumped to the fifth place in the global digital currency, surpassing the well-known digital currencies such as Litecoin and EOS, indicating that the market has strong demand for stable coins. At present, USDT occupies more than 80% of the stable currency market. USDT is issued by Tether and is pegged to USD 1:1.

Libra has significant advantages over USDT:

1) Libra issuers can interact with each other to provide internal oversight for the issuance and circulation of digital currencies. The USDT is a highly centralized stable currency and Tether has all the power to issue or destroy the USDT. In the absence of regulation, Tether has had many scandals involving opaque and random issuance of US dollar reserves. Libra adopts a coalition chain, which is issued by many well-known enterprise nodes such as Facebook. It is a multi-centered stable currency, and mutual restraint between members can enhance the market's trust in Libra.

2) Libra is linked to a basket of currencies, which weakens the impact of price changes in the single currency on the stability of the currency. The USDT anchors the US dollar, but in recent years it still has sharp price fluctuations; Libra is linked to a basket of French currency and will regularly adjust a basket of French currency to maintain a stable currency.

2.1.3 Create a more inclusive financial system that significantly reduces cross-border payment costs

Libra reduces the cost of operating financial services. Traditional financial services are based on third-party financial institutions such as banks, with complex processes and long service chains, and high financial services costs. Libra uses decentralized blockchain technology, and peer-to-peer trading weakens the role of financial institutions, and process simplification reduces the cost of operating financial services.

Libra's low operating costs not only create a more inclusive financial system, but also significantly reduce cross-border payment costs.

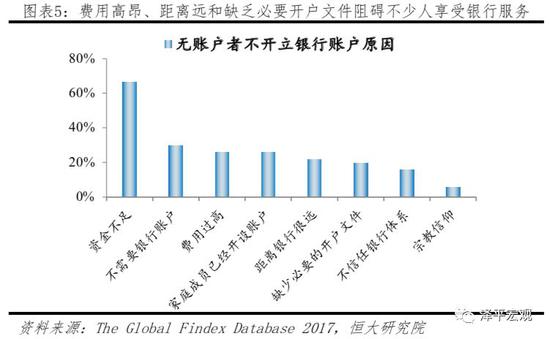

1) Provide equal financial services to underdeveloped regions. Affected by cost, reliability and fluency of remittances, financial needs in underdeveloped regions cannot be met. According to World Bank data, high costs, long distances, and lack of formalities prevent people from opening bank accounts. With Internet and blockchain technology, Libra can effectively alleviate these obstacles and provide low-cost banking services to underdeveloped people. Pratt & Whitney's financial services promote local trade and business development, improve capital allocation efficiency, and provide endogenous incentives for economic growth in underdeveloped regions. In addition, Libra is also expected to address long-standing extensive poverty alleviation assistance through financial big data and online banking channels. International aid funds can reach the poor precisely, reducing the financial losses and bureaucratic corruption in the poverty assistance process.

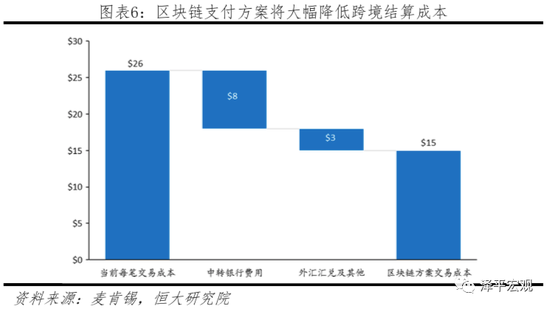

2) Significantly reduce cross-border payment costs. Traditional cross-border payment settlements are long and costly, and third-party intermediaries are required to perform complex processes to complete the liquidation procedures in each country. Libra's peer-to-peer payment method bypasses the banking system and enables 24/7 payment and fast transactions. According to the McKinsey report, the blockchain applied to B2B cross-border payment and settlement can reduce the cost per transaction from about $26 to about $15.

2.2 Challenge: Issuer Risk and National Regulatory Challenges

2.2.1 Issuer Risk: Excessive Currency, Liquidity Pressure and Privacy Disclosure

As a currency, Libra naturally faces similar risks to commercial banks, including over-issuance and privacy exposure risks.

1) Over-risk. The white paper does not specify the specific ways and channels for the conversion of legal currency to Libra, but it is expected that members of the association will act as a middle layer between the hosting company and the user, ie members of the association will send money to the hosting company and release Libra. This model has higher requirements for the governance and supervision mechanism of the association. Once the members of the association release Libra "out of thin air", Libra will not carry out the asset reserve according to the 1:1 ratio, which will lead to Libra's over-issue and reduced purchasing power.

2) Liquidity risk. Once a node member and asset custodian bankrupt, global Libra holders may panic and trigger a large-scale "Libra-French currency" exchange. Although Libor uses liquid assets such as bank deposits and short-term government bonds as distribution reserves, short-term, large-scale exchanges will still put Libra with liquidity pressure.

3) Privacy risk. Libra circulates and scales, and the Libra Association will need to manage billions of accounts around the world, covering multidimensional data such as cross-border payments, clearing and e-commerce. Facebook frequently explodes scandals of user privacy leaks, and the risk of user data leakage cannot be ignored.

2.2.2 National regulatory challenges: countries generally hold a neutral cautious view

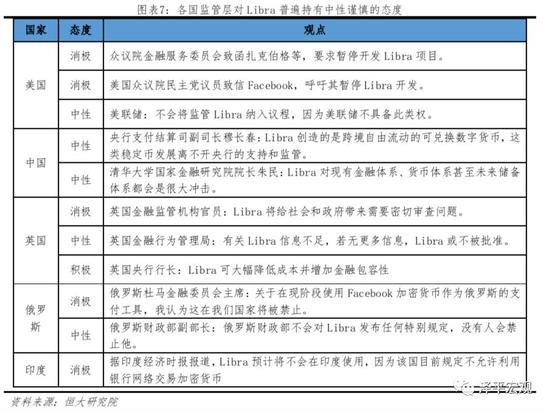

Blockchain technology, Facebook's lead and a bundle of currencies have made Libra widely watched as soon as it is launched, and is even seen as a potential competitor for future super-sovereign currencies. However, as a blockchain-based digital currency, it is likely to impact the existing monetary system: First, Libra or substituting some national sovereign currencies, the economies of small and medium-sized countries are relatively limited, and the credit currency they issue is far from the quality. Less than Libra, and Libra preempted the local government to build a sound financial infrastructure, so that the country's sovereign currency is gradually squeezed out. Second, the difficulty of foreign exchange control in various countries has increased. Libra has provided indirect exchange channels (such as RMB-Libra-US dollars) to people in various countries, which poses challenges to foreign exchange control of various countries. Third, the implementation of monetary policy in various countries has become more difficult, and asset prices may be separated from central bank control. The fourth is to increase the difficulty of anti-money laundering and counter-terrorism. Digital currency information is concealed, easy to trade, and widely circulated. It is often used by criminals to carry out extortion or money laundering. For example, the WannaCry ransom virus that broke out earlier requires bitcoin to be used for ransom. Although Libra permanently records detailed transaction information, national regulatory systems need to be optimized or even refactored, and regulatory loopholes are exploited by offenders.

For the above reasons, national regulators and international organizations generally hold a neutral and cautious attitude towards Libra, and some countries are strictly prohibited from Libra. The US House of Representatives Service Committee and some Democrats asked Facebook to ban the development of the Libra project. The US Senate Bank, Housing and Urban Affairs Committee and the House Financial Services Committee held separate hearings on Libra; the Chairman of the Russian Duma Financial Committee explicitly prohibited Libra from acting in Russia. Means of payment. In terms of international organizations, the Bank for International Settlements (BIS) stated that technology finance projects such as Libra go beyond traditional financial regulation or pose challenges to the global banking system. If Libra is unable to obtain approval and support from national regulators, its cross-border remittance business will be difficult to carry out smoothly, and the scope and application scenarios will be greatly reduced.

3 Libra's influence appears, or impacts on the monetary system, banking system and capital market

3.1 Impact on the monetary system: the emergence of Libra super-sovereign currency

3.1.1 Looking at the prospect of Libra's super sovereign currency from the globalization of the US dollar

Libra is a stable currency collateralized by a basket of currencies, superimposed on Facebook's large user base and the rich ecology of the Libra Association, which makes Libra likely to become a super-sovereign currency. In fact, the cautious supervision of Libra by national regulators stems mainly from concerns about monetary sovereignty.

In the existing global monetary system, cross-border transactions are mainly settled in dollars, and the dollar plays a global currency role. We look at the prospect of Libra's development as a super-sovereign currency from the globalization of the US dollar.

After the Second World War, the globalization of the dollar went through the following process:

1) The establishment of the Bretton Woods system: During the First World War II, the United States made war money. At the end of World War II, US industrial manufactured goods and foreign trade accounted for 1/2 and 1/3 of the world respectively, and the US$20.08 billion gold reserves accounted for the world. 59% of the gold reserve. With strong national strength, the United States promotes a “double-linked” currency reserve system: the US dollar is linked to gold, and the currencies of various countries are linked to the US dollar. The US dollar thus becomes the international settlement currency, with $35 convertible to one ounce, and national currencies linked to the US dollar at a fixed exchange rate.

2) The formation of the oil dollar system: In the 1960s, with the decline of the US economic share, the Bretton Woods system was disintegrated, and the United States began to rely on oil to support the dollar. Specifically, after World War II, oil was the most important energy consumer product in developed countries (in 1965, oil accounted for 39.4% of energy consumption and 0.4% of coal), and it was also a strategic energy source for various countries. In 1974, the United States successively signed agreements with Saudi Arabia and other Middle Eastern countries to require the US dollar as the crude oil settlement currency, and in 1983 launched the world's first crude oil futures on the New York Mercantile Exchange, and the oil dollar system was formed.

3) The status of the US dollar after the financial crisis has been questioned: the global monetary status of the US dollar has caused the US government to over-finance, and the depreciation of the US dollar has devalued the wealth of creditor countries holding US dollar assets, and the status of the US dollar has been challenged. In 2009, Zhou Xiaochuan, the former president of China's central bank, proposed to create an international reserve currency that “decouples from sovereign countries and maintains long-term currency stability” to avoid the shortcomings of the US dollar as an international reserve currency. The production of Bitcoin is due to the distrust of the French currency. Nakamoto has left a sentence in the Bitcoin Creation Zone: "On January 3, 2009, the Chancellor of the Exchequer was in the process of implementing the second round of bank emergency. The edge of bailout."

From the globalization of the US dollar, we get the logic of the development of currency globalization: in the early stage, the currency must support the value through the mortgage assets (such as the dollar linked to gold) to establish the trust and acceptance of the currency by each country and its people; Money needs to have a circulation scenario (such as trading oil in US dollars), stimulating network effects, making currency use an endogenous habit; in addition, the monetary authorities need to maintain a stable currency, once the value of the currency depreciates or appreciates, it will trigger "good money to drive out bad money." (If the dollar status is questioned after the financial crisis).

Asset collateral and rich ecology make Libra a super-sovereign currency prototype, but it has no advantage over the big country currency. Libra is similar to the US dollar after World War II. It uses mortgage assets to support its intrinsic value. It is linked to a basket of currencies and is accepted and trusted by the public. The value of the currency is also more stable. In addition, the Libra Association includes commercial entities such as Visa (179.17, 1.17, 0.66%), PayPal, eBay and Uber, which means that Libra already includes payment scenarios and usage ecology, which already has a global currency prototype. However, compared with the sovereign currency of the big country, Libra has no advantage. On the one hand, Libra holders cannot obtain interest income, on the other hand, the financial infrastructure of the big countries is relatively perfect. In addition, as a commercial project, Facebook aims to cut into the payment field in underdeveloped regions. We expect the Libra Association to cooperate with the big country supervision instead of trying to replace the sovereign currency of the big country.

Therefore, we believe that the Libra Association is not trying to create a super-sovereign currency, but asset collateral and rich ecology make Libra a super-sovereign currency prototype. As the scope of circulation expands, Libra may naturally evolve into a super-sovereign currency. It is expected that Libra will first circulate in a small country with relatively backward financial infrastructure. The impact on the sovereign currency of the big country is relatively limited in the early stage (the association will also cooperate with the major powers). Whether it can evolve into a super-sovereign currency can closely pay attention to Libra's circulation in small countries.

3.1.2 Libra affects the implementation of monetary policy and fiscal policy in various countries, or hinders the internationalization of the RMB

National monetary sovereignty is the embodiment of national sovereignty on the currency issue. Once the sovereign currency is completely or partially replaced, it will affect the government's function of managing society. The national monetary sovereignty is reflected in the issuance of an independent currency and the independent determination of the number of issuance, purchasing power and exchange rate system. Once the sovereign currency is partially or completely replaced, the country’s ability to implement monetary and fiscal policies will be affected.

1) Libra will impact the implementation of monetary policy in various countries

Once Libra is in large-scale circulation, the monetary authorities of various countries have significantly increased the difficulty of implementing monetary policy, and even completely lost the ability to implement monetary policy.

First, the difficulty of capital flow control has increased dramatically. According to the impossible triangle of Mundell, the independence of monetary policy, the fixed exchange rate and the free flow of capital cannot be fully realized. The late-developing countries usually suppress the exchange rate to stimulate exports, and monetary policy is also an important means for countries to iron the economic cycle, so most countries The central bank will appropriately limit the cross-border flow of capital. Libra provides a new channel for capital flow, and the application of blockchain technology makes Libra anonymity, peer-to-peer trading characteristics, and the central bank's difficulty in regulating capital flows has increased significantly. In the case of Bitcoin, Bitcoin does not require intermediation, peer-to-peer transactions, Internet access, and anonymity. This makes it difficult to fully incorporate central bank supervision. A large amount of capital that cannot be flowed out through normal channels can flow out of Bitcoin. For example, in domestic transactions, RMB purchases bitcoin, sells to foreign platforms to sell dollars, or holders leave the country to sell through 32-digit password characters.

Second, some commodities may be priced in Libra. In extreme cases, some small countries' currencies are completely replaced, and monetary policy will be invalid. The traditional monetary policy starts with Fisher's equation MV=PQ. When the economy is overheated or declining, the central bank regulates the quantity M by quantity or price instrument. After being included in Libra, since Libra's circulation range clearly exceeds sovereign currency, some commodities may be converted to Libra, and Fisher's equation evolved into M local currency V local currency + MLibraVLibra = P local currency Q local currency + PLibraQLibra, on the one hand the currency definition will be changed, the currency Supply M0, M1 and M2 require new measurement standards, and macro-control becomes more complicated. On the other hand, the central bank cannot regulate Libra's supply and reduce the implementation effect of monetary policy. For some small countries and local currency collapse countries, Libra is likely to completely replace the local currency (such as Panama and El Salvador in US dollars as the currency of circulation), these countries will completely lose the ability to implement monetary policy, such as the euro zone by the European Central Bank to develop monetary policy, countries The ability to implement monetary policy.

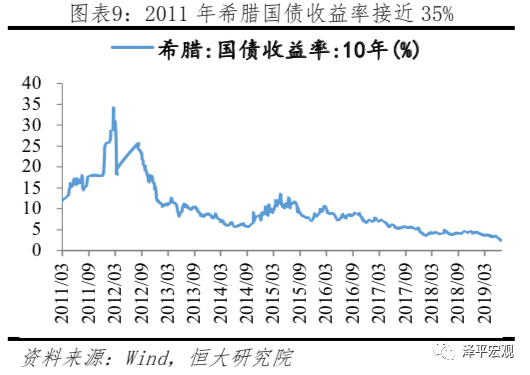

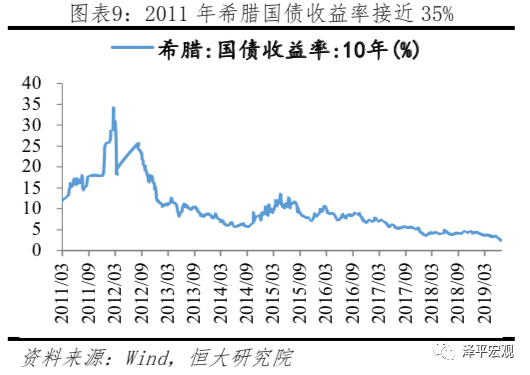

2) Libra weakens the financial capacity of countries and fosters a new “European debt crisis” for a long time.

As a global currency, Libra reduces the cost of cross-border transactions, but it will weaken the financial capacity of countries, and the separation of monetary policy and fiscal policy will make the “European debt crisis” reappear.

First, the government is unable to levy a "cold tax" and the government's fiscal revenue has shrunk. In addition to statutory taxes such as value-added tax, corporate income tax and personal income tax, the government also imposes invisible taxation in the form of “coinage tax”. The coinage tax is the benefit of the government's monopoly of currency distribution rights. It mainly reduces the wealth of the holders through currency depreciation and increases the wealth of the issuer. Governments around the world have already imposed the seigniorage tax as a fiscal revenue. According to Fisher (1982) and Click (1998), the coinage tax accounts for about 6%-10% of the total government revenue. Once Libra partially or even completely replaces fiat money, the government will lose some or all of its currency distribution rights, and thus it will not be able to dilute government debt through currency oversupply, and the government's fiscal revenue will shrink sharply.

Second, the government is unable to implement the monetization of the fiscal deficit and the government's financing capacity has declined. In response to fiscal deficits, the government can pay by issuing claims, increasing taxes, or printing banknotes. Once Libra replaces sovereign currency, the government will lose the means of monetizing the fiscal deficit. Not only will the government's financing capacity decline significantly, but the stock debt risk will increase dramatically.

Third, the government is over-reliant on fiscal policy, monetary policy and fiscal policy are not unified or trigger a new "European debt crisis." Libra's replacement of sovereign currency means that the government loses its currency distribution rights and monetary policy tools, so that the government has to borrow foreign debts to implement fiscal policies. Over-reliance on fiscal policies will make government debts high and debt risks intensified. On the other hand, the circulation of global currency means the inconsistency between monetary policy and fiscal policy. The inconsistency of the pace of economic cycles in various countries is likely to induce a new “European debt crisis”. In the case of the Eurozone, the European Central Bank implements a unified monetary policy, but the fiscal policy is controlled by the governments themselves. Among them, the Greek government has high debts and the economic downturn makes it unable to pay the due bonds. However, Greece, which is deeply in debt crisis, cannot depreciate by its currency or Lowering interest rates to deal with the crisis, and the lack of fiscal transfer between countries, the debt crisis gradually spread from Greece to Ireland, Portugal and Spain, and evolved into a European debt crisis.

3) Libra or the road to hinder the internationalization of the renminbi

Libra's mortgage assets may become a national reserve currency, and the internationalization of the RMB will be blocked.

According to the Libra white paper, Libra will use a basket of currencies as an asset collateral to support Libra's value. Although the Libra Association has not disclosed the specific mortgage currency and its weight, the media generally predicts that the association will select the US dollar, the euro, the British pound and the Japanese yen, and the RMB is not included. If Libra is widely circulated around the world, central banks will reserve collateral currencies to cope with exchange rate shocks caused by Libra exchange demand. In other words, once the renminbi is not included in the Libra collateral currency, the central bank’s renminbi reserve demand will decrease and the internationalization of the renminbi will be blocked.

SDR (Special Drawing Rights) is highly similar to Libra, and we can see Libra's impact on RMB internationalization from SDR. The SDR is also composed of a basket of currencies. The SDR can be used to pay off the domestic deficit and the IMF arrears. The only difference with Libra is that the SDR is only used for trade and debt settlement between countries, and cannot be used as a payment method for enterprises and individuals. . On October 1, 2016, the RMB officially joined the SDR, with a weight of 8.09%. From October 2016, the IMF began to disclose the total amount of the RMB in the global currency reserve, after the RMB was only included in other currency subjects. In October 2016, the proportion of RMB in the global currency reserve was 0.84%. As of March 2019, the ratio had reached 1.84%, while in June 2015, the other currencies including RMB accounted for only 1.89%. In fact, SDR accounts for a very low share of the global central bank's monetary reserve. At the end of 2014, it accounted for only 2.9%. However, the inclusion of the RMB in the SDR has driven the demand for RMB reserves, and the internationalization of the RMB has obviously accelerated. The inclusion of SDR in the RMB can infer Libra's impact on the internationalization of the RMB. If Libra does not include the RMB in the mortgage currency and Libra is circulated globally, the internationalization of the RMB will be blocked, and vice versa will boost the internationalization of the RMB.

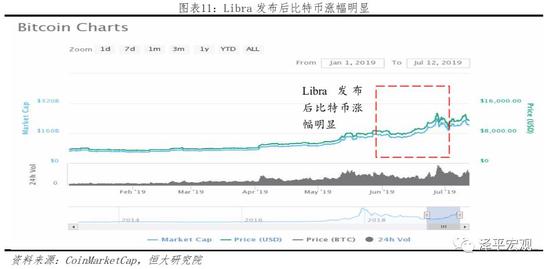

3.2 Impact on other digital currencies: Libra is a better payment medium, but it cannot replace Bitcoin

According to Nakamoto's conception, Bitcoin is “a decentralized P2P electronic cash payment system”, but in the past decade, Bitcoin has not become a widely used payment method. The main reasons include: 1) large currency fluctuations, speculative attributes Strong; 2) Block size is limited, the time required to obtain consensus is too long, resulting in slow payment confirmation; 3) high threshold for use, difficult to trade frequently.

Libra's design concept overcomes the three shortcomings of Bitcoin and is a better payment medium, which is expected to become a global electronic cash. However, we believe Bitcoin will not be replaced by Libra:

1) Credit risk is different. Libra is issued by the node companies in the alliance chain, the offline assets are Libra for credit endorsement, and the members of the association can guarantee the consistency of interests for a long time; while Bitcoin is a completely decentralized public chain, no individual or institution can tamper with the data. .

2) Different function positioning. Bitcoin has a total amount of restrictions and cannot be added at will. This feature has gradually evolved into speculative and safe-haven assets (against central bank currency oversupply), which is similar in function to “digital gold”; Libra mainly meets user demand for payment.

Therefore Libra and Bitcoin do not constitute a direct competitive relationship. In fact, as a digital currency, the promotion and popularization of Libra will make Bitcoin more accepted and recognized by more people. Bitcoin has seen significant gains since the Libra white paper was released on June 18.

3.3 Impact on banking institutions: bank loans and cross-border payment services are under pressure

Cross-border payment services are the main application scenarios of Libra, which will impact the cross-border payment business of traditional commercial banks. For example, Ripple with similar functions requires traditional cross-border settlement and payment to pass through the SWIFT network for a longer period of time, about 3-5 days. The cost is higher, including bank transfer fee (1 bank for Bank of China) and SWIFT telecommunications fee ( Bank of China 150 yuan). With the Ripple network, you can quickly remit money at low prices (including bank charges and 0.00001 Ripple coins) in a matter of minutes. Libra's number of users and alliance forces surpass Ripple, and cross-border payment services of traditional commercial banks will be under pressure.

Once Libra made a credit expansion, the traditional bank's loan business was hit. Libra currently anchors a basket of currencies in a 1:1 ratio to enhance its credit. As Libra is gradually accepted by the market, the credit of Facebook and affiliates will gradually increase, and the asset mortgage rate can be lowered. When Libra expands its credit, Libra can be created out of thin air. At this point, the Libra Association began to play the role of a bank to create deposits through loans, which is bound to challenge the monopoly of traditional commercial banks in indirect financing. In addition, as the world's leading online social application company, Facebook has accumulated a large amount of personal data, which will provide data support for the risk pricing of Libra loan business. The synergy between businesses means that Libra Association can cut into the loan business at any time.

3.4 Impact on the capital market: companies are financing through ICO disguised

ICO is the first issue of the blockchain project to issue tokens, that is, raising common currency such as Bitcoin and Ethereum for project crowdfunding. Future companies may finance through Libra+ICO.

In May 2017, the scale of ICO financing showed explosive growth. The monthly financing amount increased from about 800 million US dollars to 1.3 billion US dollars in half a year. ICO has the following advantages: 1) low investment threshold, financing for start-up blockchain companies that have difficulty obtaining bank loans; 2) financing companies do not need to dilute equity, investors only get project equity; 3) simple process, no regulatory department required Review.

In the future, companies will be financing through “Libra+ICO”, and development opportunities and potential risks will coexist. This aspect has lowered the financing threshold, improved the efficiency of global capital allocation, and helped the project to quickly raise partners to jointly develop the ecology; on the other hand, it is outside the supervision, making the project mixed, uneven, adverse selection and moral hazard or undermining the normal financial order, malicious Hype tokens can even trigger systemic financial risks.

4 Financial supervision and how Chinese companies respond

In the face of Libra, China should embrace innovation and challenges, encourage the Chinese central bank to promote digital currency research and development, and encourage Chinese Internet companies to strengthen cooperation with Libra. In the long run, instead of responding passively, it is better to take the initiative to attack. China should pay attention to the new opportunities for technological change brought about by digital currency and blockchain technology. The Chinese government, Tencent Ali, and important financial institutions will join the world and related companies to launch the world. Sexual digital currency Globra, China is ahead of the US in the field of Internet finance and mobile payment, which is of strategic significance for enhancing the convenience of the world's people, China's Internet technology strength, mobile payment strength, nationalization of the renminbi, and establishment of a global financial center. .

4.1 Responding to Libra: objective analysis, embracing competition

One is to embrace Libra after seeing the governance system. Regulators should delve into the nature of Libra and pay close attention to its development and strategic direction. After the official release of Libra in 2020, regulators need to pay close attention to their development and operation, the composition of the board of directors and founders of the association, the composition and proportion of the anchor currency, and analyze its true influence and strategic direction. Simply rejecting is not only equivalent to the convenience of abandoning new technologies, but also leads to the disorderly development of the market.

The second is to accelerate the process of issuing digital currency by the central bank and establish a new monetary system symmetrical with Libra. Central banks are poised for research and development in the central bank's digital currency. In February 2018, the Royal Mint introduced the digital currency "Royal Mint Gold (RMG)"; in October 2018, Dubai introduced the cryptocurrency "emCash" for government and non-government services. At the National Monetary and Gold Work Conference in 2019, China's central bank proposed that China will further promote the research and development of the central bank's digital currency in 2019. The central bank's issuance of digital currency has the following advantages: first, saving the issuance and circulation costs of paper currency; second, helping to improve the efficiency of monetary policy; third, improving the efficiency of the payment system; fourth, compared to digital currency such as Libra The financial risk of the central bank's digital currency is relatively low.

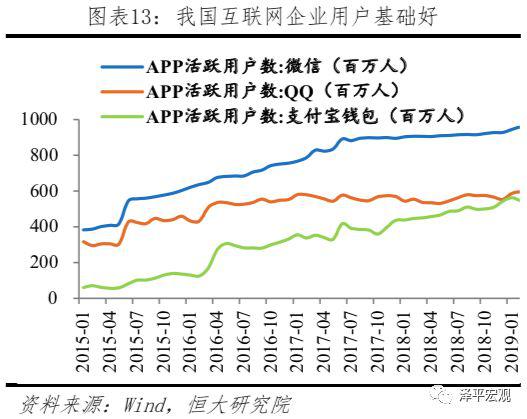

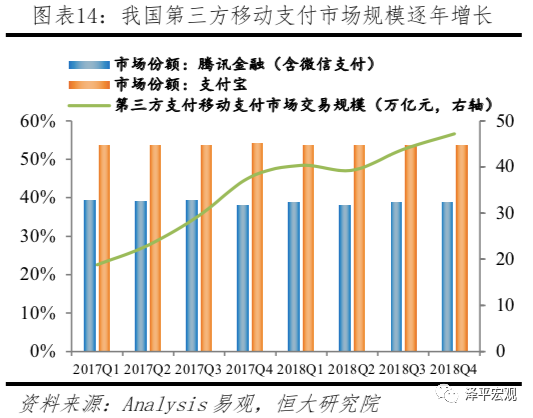

The third is to encourage Internet companies to issue money, encourage companies to join Libra, and promote the inclusion of RMB in Libra's reserve assets. China's Internet industry giants Tencent and Alibaba have developed in the field of blockchain technology, and Internet users have a good user base and huge potential for legal currency. Whether or not to conduct digital currency research and development in the future depends on the attitude of the regulatory authorities. In addition, China's Internet companies can be encouraged to become Libra partners, actively participate in the Libra Association Board of Directors, participate in voting on major policy or technical decisions, and promote the entry of RMB into Libra reserve assets.

4.2 Attitude towards digital currency: financial supervision should not be across the board

The emergence of Libra further promotes the deep integration of information technology and traditional finance. The financial supervision of the Chinese government must not adhere to the “one size fits all” attitude in the past, but should establish a financially inclusive and prudent regulatory system.

First, we must accelerate the establishment of a legal system for the issuance and trading of digital currencies, clarify the legal status of digital currencies, regulatory bodies, regulatory systems, and responsibility commitments. On the basis of comprehensive measurement of risks, we should raise the level of legislation and implement continuous and precise supervision.

The second is to improve the foreign exchange control system and avoid using digital currency to trade foreign exchange in disguise. Libra provides users with convenient cross-border payments and two-way exchanges with French currency, such as holders purchasing Libra in US dollars and Libra in exchange for RMB. Regulators should be alert to the digital currency as a channel to evade foreign exchange controls.

The third is to prevent the impact of China's foreign exchange management and RMB internationalization. Libra will accelerate the cross-border circulation of funds and put pressure on the management of RMB local and foreign currency cross-border funds. In the new round of global digital currency disputes, if China can seize the opportunity and form a stronger position in the renminbi, it will be conducive to the advancement of the renminbi internationalization goal. Faced with the challenge of Libra's digital currency, China's financial regulatory agencies should take precautions and propose forward-looking prevention and response measures to prevent hot money from entering and exiting.

4.3 Chinese Internet companies should be encouraged to expand overseas business and cross-border payments

Looking at Libra's development, Facebook's international influence is the focus. Therefore, China should encourage Chinese Internet companies to actively expand overseas business and application scenarios, enhance national soft power, and lay a solid foundation for the internationalization of the RMB. First, the domestic Internet payment platform can target Chinese overseas travel groups and establish cooperative relationships with overseas tourism. With the expansion of overseas tourism groups of Chinese residents, overseas tourism consumption will become an important way for domestic payment platforms to open overseas markets. Secondly, the domestic payment platform can implement the technology sea-going strategy, promote financial services by establishing strategic partnerships, buying shares, merging or forming joint ventures, and enhance the international influence and competitiveness of the domestic digital currency platform. Finally, the domestic payment platform can target countries with close proximity to China or countries with weak financial strength, and seize the opportunity of the Belt and Road strategy to promote the overseas application of China's payment platform.

Source: Zeping Macro

Author: Hengda Institute Ren Zeping Gan source even one seat Liu Chen Shi Lingling Xie Jiaqi

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- BTC alone rose back to 10,000 US dollars, facing the daily resistance level

- Blockchain financing forced the "coin mountain"

- Fight for economic freedom! Coinbase released a ten-year development vision on a tall

- Bitcoin bifurcation for two years: Why do you want to fork in the year?

- Bitcoin's IPO to the US is coming soon, raising more than $1 billion: core financial data exposure

- Interview with Babbitt | Matrixport, Trading, Lending and Hosting, How to build a bank in the digital currency world?

- Which platform is strong for the platform? Babbitt strips twitching and finds the truth for you