Perspective | 2020: The turning point for bulls and bears and the opportunity for blockchain to empower traditional industries

Failing to seize the opportunity of token investment from the end of 2017 to the beginning of 2018, and not paying attention to the secondary market in the middle and later years of 2018 is also a huge loss. The platform currency vent that was missed at the beginning of 2019 was at the end of the year and missed the investment in good projects with low valuations. Miss the huge wave of integration of blockchain technology with traditional industries in 2020.

Looking back, insights 2020

Day and night alternate, spring plough and autumn harvest. Everything in the world has rules and nodes. Although we have encountered unprecedented challenges since the beginning of 2020, it is also a huge turning point for the market environment. This is a turning point in life and death in many industries, and it will also be an opportunity for countless ordinary companies in various industries to counterattack.

We walk along the historical tunnel and look forward to the crisis in 2020.

- Reflecting on the dispute between the Steem community and Sun Yuchen, should DPoS be the one to blame?

- Indian crypto exchange lifts ban: trading volume soars 6-fold, is it global buy?

- Equity and debt double kills, the Fed cut interest rates sharply, can Bitcoin take over the "hot money" that escaped Wall Street?

Time back to the stage where I invested in blockchain projects. In 2017, I participated in many projects, such as QKC, QLC and other well-known projects. As a partner of JRR Crypto in 2018, I don't think it can be like many other Token Found Similarly, future opportunities will only depend on 1CO, which was very hot at the time. Therefore, I designed a water seller investment strategy focusing on the blockchain ecology in different ways and at the time, which seemed to be avant-garde .

Entering 2019, as the market continues to develop, I have stated in many speeches that M & A in the second half of the year will be a golden opportunity. As many of the projects raised in 2018 have achieved certain commercial value, but still suffer from no income model and stable income continues to exist, it may be underestimated to buy. This once again proved correct, as Binance, Bibox and many other companies announced many acquisitions at the end of 2019. These also proved that my judgment is correct.

Based on previous successful predictions of market trends, many people ask me what is the next trend in 2020?

In my opinion, 2020 is an important year for blockchain companies to establish a stable relationship with traditional industries, regardless of whether blockchain companies or traditional industry companies want to seize this opportunity, provided that they need to rethink the interactive business model.

As this trend moves forward, China will be a force to be reckoned with in the entire industry.

The main judgment factors are as follows:

First, after so many years, the blockchain technology has become more and more mature;

Second, China is the second largest economy in the world;

Third, China has 70% of the world's mining rights;

Fourth, China has one of the most powerful retail markets;

Fifth, China announced DECP.

Especially after the blockchain was positioned as a national strategic layout on October 24, 2019, the global blockchain market will face a new development direction in 2020.

Now 2020, due to the strong attention of the traditional market, the blockchain and the physical industry should take this opportunity to come together to create stronger business value. In order to have a sustainable impact between traditional companies and blockchain companies, both parties should reconsider their mutual, basic business models and business structures.

Several possible new business models and business structures for future companies

Based on my more than ten years of experience in traditional industries and investment experience, the following shows the basic concepts, but can flexibly adapt to various situations according to market segmentation.

Basic relationship:

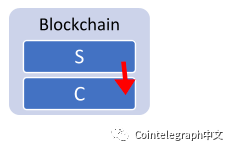

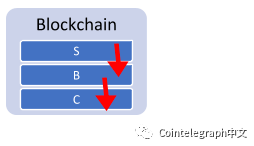

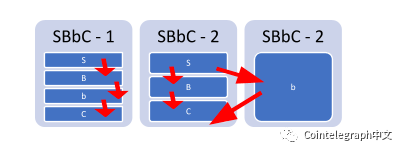

o Treat the company itself as S

o Business partner as B

o Use smaller business partners as b

o C is the end user / consumer

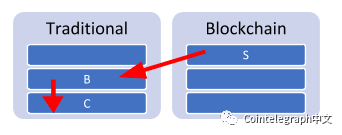

-After simple combination

o S to C:

- This mode is not recommended due to expensive maintenance and low loyalty

o S to B to C:

- As a sustainable model, when B's role is a token exchange, the token of item S is listed; or S is a protocol layer, and B is a DApp

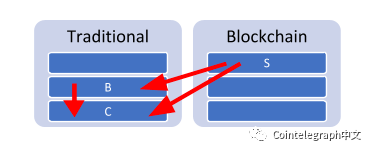

o S to B to b to C

For example: S is the protocol layer, B is the DAPP, b is the cross-chain project, and C is the user.

- This is a more sustainable, more promising and attractive model, but the challenge is how to share costs and profits. What makes it attractive is that this model has more involved roles and can create interactive structures rather than unidirectional structures.

The reason why most blockchain projects fail is because they fail to create a sustainable model, or even if they do not bring real economic value, which amounts to a lack of revenue models.

Therefore, in 2020, with the recognition of traditional industries, blockchain companies will show baby boomer growth and find ways to enter traditional industries.

Interaction with other industries:

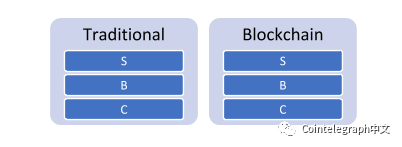

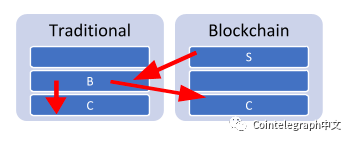

-The most simplified comparison of blockchain to other traditional industries:

Example of one-way interaction in the industry:

-BaaS: Provides blockchain technology for traditional industries, such as supply chain or many other industries, but consumers still cannot feel the application of blockchain technology.

-Payment system : Provide blockchain technology and tokens to support cross-border transfers and transactions. Consumers will feel the difference and therefore create greater value.

Example of two-way industry interaction:

-Credit system: Provides blockchain technology services for credit on-chain to the traditional industry, so that the credit can be used at the same time in the original traditional industry or in token transactions, as the return arrow of the blockchain industry, increasing its circulation utilization rate.

"When the blockchain has more interactive paths with traditional industries, the closer the binding relationship is, and the stronger the integration value is created, it is necessary to try to find the most cross paths."

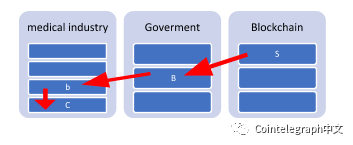

Once these concepts are understood, the elements of the traditional industry can be divided in more detail:

(There are unique architectures that can be built in each area. Here is a basic example.)

Miss the past, don't miss 2020

Failing to seize the opportunity of token investment from the end of 2017 to the beginning of 2018, and not paying attention to the secondary market in the middle and later years of 2018 is also a huge loss. The platform currency vent that was missed at the beginning of 2019 was at the end of the year and missed the investment in good projects with low valuation. Miss the huge wave of integration of blockchain technology with traditional industries in 2020.

The developing enterprises need to adjust the layout, which will inevitably cause pain and discomfort, but this is also a rare opportunity for many enterprises and individuals. 2020 will be a key year for blockchain companies to create stronger value for themselves and the industry. This wave of groundbreaking design architecture will produce companies at the same level as Internet giants Ali or Tencent. I hope that friends in the industry can develop a more innovative interaction mode, want to compare with the public test, dare to call the sun and the moon for a new day.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- South Korea officially legalizes cryptocurrency transactions, Bitcoin stands at $ 9,000

- Only less than 10,000 blocks left! Will the Bitcoin halving effect come as expected?

- Amazon, Tesla and Bitcoin

- Can't you have both privacy and utility? Privacy protection opens up new horizons for business

- Million-sold hardware wallet, can Ledger NanoX shake the throne of the previous "machine emperor"

- South Korea officially passes amendments to the special financial law! Cryptocurrency Institutionalization Goes Next

- LingTing · Blockchain General Knowledge Lecture 70: Make the blockchain "understand"