Is the encryption market really a rational market?

Every time the market is turbulent, people are constantly getting on and off. Whether it is based on short-term interests or risk considerations, is artificial man-made short-term operation really doing useful work?

Periodic law

In the short run, the benefits are doubled every month, 20% a week, and some people are satisfied, but what is the investment is so fascinating. As the assets skyrocketed, the mood went up and down, forming a cycle.

There are three laws in the cycle:

The first law, the market never goes straight, it must take the curve. As we often say, the future is bright and the road is tortuous. It is impossible for any thing to develop a straight line, including the personal life track. The market will have a big drop after the big rise. The investor’s attention to the current fluctuations does not see the causal relationship. The rising process accumulates the falling energy and eventually leads to the fall; the falling process accumulates the rising Energy, the end result is inevitable rise, not doubtful.

- Rereading the "fat agreement", why the domestic blockchain team is going in the wrong direction

- Advertising, traceability, deposit, and blockchain are all false propositions?

- Investing in cryptocurrency with artificial intelligence thinking

The second law, history will be repeated but not the same. History never repeats the details of the past, but history repeats a similar process.

The third law is to go to the extremes in the middle: the market is surrounded by the basic trend line or the average online fluctuation. After the market reaches an extreme, there will always be a central point return. However, after the market returns to the central point, it will not make too many stops, but will continue to move in the other direction.

A slightly rational person feels uncomfortable in the currency circle, soaring and plunging every day, so that an ordinary news is interpreted by the market as positive, or simply bad, the market is never a rational market, the market is an irrational market. If you use a rational concept to interpret the market situation, it will be very painful. It is clear that a certain garbage coin is worthless. It is also sought after by countless people. Once the price rises rapidly, it will attract follow-up people to take over.

Pendulum clock theory

The psychology of investors is like a pendulum. The left and right fluctuate greatly and they are not willing to stay at the center. Even if they are close to the center, the time will not be too long. The psychological fluctuations will lead to price fluctuations and create market arbitrage space. It is precisely the charm of the market.

Psychological volatility plays a very important role in the investment market, especially in the short term.

Oakwood Capital Howard-Max proposed in 1991 the use of "pendulum theory" such as investor psychological and emotional changes, and now more instructive cryptocurrency market, because the cryptocurrency market 7×24 hours of uninterrupted trading, mood swings, A little psychological change in the market will immediately reflect.

Six factors that swing like a pendulum:

From greed to fear;

2. From optimism to pessimism

3. Endure risk aversion from risk;

4. From trust to doubt;

5. From believing in the value of the future, to insisting on the real price now;

6. From rushing to panic selling.

The core is that psychological changes and behaviors are both polarized and rarely made at a rational level.

Let me look at the annual price change index of Bitcoin in recent years:

According to the bitstamp trading platform:

In November 2010, the price of a single bitcoin on Mt.Gox, the world's largest bitcoin trading platform, exceeded $0.50, an increase of about 167 times over the initial price.

From March 2011 to April 2011, the development history of Bitcoin has once again seen a major turning point – Bitcoin and the British pound, Brazilian currency, Polish currency exchange trading platform online. The mainstream media rushed to report that investors from more countries rushed into the ranks of speculative coins. On June 8, 2011, bitcoin single transaction price reached 31.9 US dollars, creating a record high, about 16,000 than the initial price. Times. Soon after, the bitcoin trading platform Mt.Gox broke out of "hacking incidents". The security of digital currency was questioned by investors. Bitcoin prices continued to fall and fell sharply.

In 2012, in the shadow of Mt.Gox in Bitcoin in February 2012, the single price fell below 2 US dollars, compared with the new high of 31.9 US dollars set in June 2011, the decline reached 1395%.

In March 2013, according to the exchange rate, the global issue of bitcoin totaled more than 1 billion US dollars. Bitcoin has soared since this year. At this time, investors are generally aware of the “decentralization” and “total supervision” of Bitcoin. What is the meaning of the epoch.

In 2014, Bitcoin investors continued to fall, and the bad situation continued until 2015, hitting 900RMB.

It started to rebound in 2016 and broke through $1,000 as of December 2016.

In 2017, with the ICO boom, bitcoin skyrocketed again, hitting a record high of $21,000.

In 2018, the high fell back, all the way to kill, the lowest fell to a low of $ 3,200.

Bitcoin prices were fixed at $5,400 before the deadline for publication in 2019.

From the perspective of the historical cycle, basically every bitcoin price has never been in a rational price every year, or it has skyrocketed or plummeted. In fact, it is contrary to rational investment. From this, we can understand the psychological fluctuations of investors.

The most fundamental reason for the market to fluctuate between greed and fear is that the psychology and emotions of investors swing back and forth between greed and fear. In other words: sometimes people feel particularly good, positive and optimistic, and expect good things to happen. Bitcoin immediately went to the ETF and Nasdaq, greed occupied the psychology of all investors, regardless of all the competition for buying, and with the fall of hope, the expectation became negative, fears occupied the psychology and emotions of investors Investors no longer want to make money, but worry that they will lose money. This leads to a decrease in the number of investors buying. The things that pushed the bitcoin up are gone, the market is not moving, and some people start selling coins. As a result, the price has fallen sharply. In the state of panic, the sentiment of investors has brought a huge reverse force. Even with the multi-military air force, the bear market naturally comes.

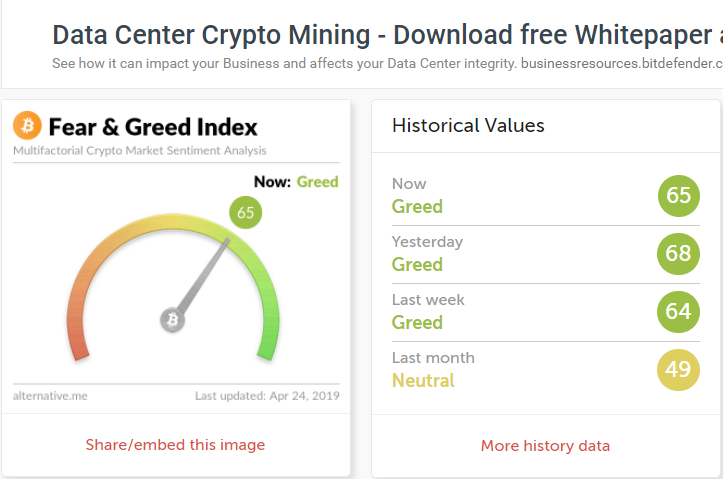

Greed and Fear (FGI) Index

Yes, it is greed and fear to push the price of the currency up and down. It is not good or bad at all.

The most important indicator for observing the changes in the entire market is the FGI fear and greed index, and the reference significance of price volatility is really small.

In 1999, the US technology stock market bull market was a combination of greed and fear, when greed dominated the entire market. Those who did not participate in this crazy bull market can only be forced to watch others make a fortune. "Cautious investors" dare not buy, empty hands, watching others buy and make big money, it is stupid to feel that they did not buy. The buyer who pushed the market to rise was not feeling a little bit afraid. "This is a new paradigm," the buyer screamed at the horn of the battle. "Hurry up on the boat, or you missed the boat again. By the way, the price I am buying now is definitely not too high, because the market It is always effective.” Everyone finds that the more they buy, the more they buy, the more they buy, the more they form a virtuous circle, and let the technology stocks continue to rise as if it can rise forever.

However, as long as a well-known company announces a problem, or an external factor suddenly interferes. The market price has fallen, and it may fall naturally because the price is too high and the weight is too large. It may also cause the price to fall because the market psychology has not reversed the Northland.

For some reason, the atmosphere of greed in the market quickly evaporated, and fear began to dominate the market. It turns out that everyone is saying, "Hurry to buy, or else you will miss the opportunity." Now everyone's statement has been changed to "Hurry to sell, or else the stock price will fall to zero."

Fear began to prevail. What people worry about is not to miss the opportunity to make money, they are worried about losing money. People turned out to be overly optimistic about irrational exuberance, but now they are overly cautious.

In 1999, listed companies were optimistic that the next decade would be like a big pie in the sky. Investors were enthusiastic and enthusiastic, and they were convinced. After three years, by 2002, the attitude of investors has changed. They are deeply afflicted by corporate scandals and screamed: "I will never trust the management of listed companies!" They yelled "How can I guarantee that the financial data of listed companies are accurate and reliable?" As a result, stock prices have fallen sharply, and bond prices have also fallen sharply. For example, almost no one is willing to buy bonds issued by scandal-listed companies, even if they fall. No one wants cabbage prices.

It is precisely in the market from corruption to fear to the extreme, the market will also show the greatest investment opportunities to make money, just like the 2003 bad debt market. "Poverty and fear" is an obvious continuum of psychology and emotion. One extreme is fear, the other is greed, and the investor's psychology and emotion continually swing back and forth between the two. This clearly Explain a lot of investment issues.

From greed to fear, from trust to suspicion, it has always been a mirror image. As a mature investor, it will not be affected by any negative and favorable market. Especially the gossip, for example, "I have seen, the documents are true", such as catching the wind, the mature investors will not believe at all, and can not block the confusion of newcomers, they are searching for gossip everywhere, trying not to know a few Earn money in the news of the hand, did not want to finally chase after the rise and fall.

At least we have to be calm and treat every message, the emotions are not left and right, balancing the boundaries between greed and fear. The most wrong thing to control the extent of greed and fear is that favorable events have led to excessive market growth, so they have bought, pushed up prices, and thus become more greedy, and further increase the price of the currency. The opposite is also true.

I feel that I have never been a reliable thing. I feel that the price of the currency is going to rise. I feel like a person. I feel that someone in an event is missing. Only the peace of mind can see the essence of things, and mature investors learn to balance. Not dominated by greed and fear.

Author: Bitcoin Caesar

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- "Insurance + blockchain": I have a chain, who is coming to the league?

- Getting started with blockchain | Why does EOS recharge to the trading platform and need to fill in the notes but not present?

- Internet vs blockchain revolution: the origin of the giant company

- The blockchain grew up in the classic "spoken war", who made it? Who makes you sad?

- Want to send coins? Samsung is also coming to join in the fun.

- Blockchain has entered the era of “Hundred Schools of Contention”, here is the judgment of more than ten of the strongest brains.

- Research | IEO is accelerating to the stage of exhaustion?