Jianan will be listed, and these 20 A-share “mining concept stocks” will know in advance?

Source | Odaily Planet Daily (ID: o-daily)

文 | 黄雪姣 Edit | Lu Xiaoming

In the past two weeks, the mining industry has two good news. First, Jia Nanzhi, one of the three major mining machine manufacturers in the world, went public in the US; second, the Development and Reform Commission removed “mining” from “eliminating the industry”. In line with the top-level proposal at the end of October to build the blockchain into a strategic emerging industry, the development of the entire industry chain including mining seems to have become the meaning of the title.

- The World Blockchain Conference closed, we discovered these new phenomena

- If the Internet is turned off, how does the blockchain survive?

- How does the blockchain drive the decentralized network and count those blockchain projects that fit into Web 3.0?

The domestic mining industry has heard that they have finally "entered the new era". On the other hand, the stock market, which is sensitive to hotspots and wealth, has also been moved by the wind. The mining-related stocks have been heatedly discussed.

A stockholder is leaving a message in the stock bar

Some analysts believe that the mining-related concept stocks are far more "and start to pay attention to, learn, research, reserve, cooperate, set up, etc." in some blockchain concept stocks, and have more "money scene", so it is good. Investment targets.

To this end, the Odaily Planet Daily has sorted out 20 “Agricultural Concept Shares” listed on the A-share market based on public information, hoping to help investors identify the ways and depths of these companies' “mines”.

Among these companies, we saw that in the early 2018, we were confident in the mine-related business, and the companies that gradually lost their voice in the bear market also had players who rushed into the market at the end of October, and there was a “mine involved” since 2017. "But there have been no progress, companies that have been ignoring the concept stock for two years, and industry partners who have provided business support for large miners for a long time since 2016…

In short, looking at the “mine-related” concept stocks on the market, it is still a small number of mining companies that have long been working in the mining industry. It is difficult for the mining companies with cyclical and high volatility to give these listed companies a promise of drought and flood protection.

Miner concept stock

In the digital currency mining industry, mining machine manufacturers with mining machine design and computing chip research and development capabilities are the most important players in the industry. At present, there are no mining machine manufacturers in the listed companies in China, but there are a lot of “beneficiary stocks” participating in the investment or cooperation with the mining machine manufacturers. Let us call it “miners concept stocks”.

(1) Investment relationship

Zhidu shares (000676)

From June to August last year, Bitcoin conducted three rounds of financing of US$1.7 billion for the IPOs of the Hong Kong stock market. The Zhidu shares were acquired in the mainland. Netease holds a 1.68% stake in Bitco. Optimistically, if its shares are not diluted in subsequent fundraising and the valuation of Bitland has not declined (still $15 billion in August last year), then The stock value of Zhidu shares has reached US$252 million.

Is this really true? Faced with the concern of the stockholders, Zhidu shares replied on the Shenzhen Stock Exchange Interactive Platform that “the company’s investment in Bitland is relatively small and does not meet the disclosure standards.” The company also said that because of the investment in Bitland, 2019 It also won a shareholding in Matrixport created by Wu Jihan, co-founder of Bitland.

Stock options, also known as stock options, refer to the option of granting a holder a certain price (also known as the exercise price) to purchase a certain number of company shares at a certain time in the future. The exercise price has been fixed, which is a financial product that is less risky for the holder (when the stock price is lower than the exercise price), but the potential gain is large.

As the shareholder of the first major miner, Zhidu shares are not too small in the minds of institutional investors in the Zhongzhong blockchain and digital currency.

On October 10th, news of the central bank's recruitment of digital currency researchers revealed that the digital currency sector has risen sharply. In the first nine months of this year, nearly 18% of the Zhixin shares also began to climb step by step. In the month, they reached the Shenzhen Stock Exchange in 12 months, and the stock rose by 114%.

Zhidu stock market chart

Among the 2000 stocks in Shenzhen, only 32 stocks were listed on the Dragon and Tiger List daily, and Zhidu shares were overwhelming for more than 10 days with higher gains and turnover. This shows the welcome of the capital market. It is the most volatile stock in the city, which is dominated by the large amount of funds and targeted institutions.

瀚叶股份(600226) and Futong Xinmao (000836)

The two listed companies have invested in the same fund – Yupu Investment.

In May 2017, on the eve of the bull market climax, Jia Nan Zhizhi completed a round of 300 million US dollars of Series A financing, and simple investment is among the funding agencies. Yupu Investment is the executive partner of Yanhu Investment. Yuye shares indirectly holds 6.83% of the shares of Tiger and Tiger through Shanghai, and Futong Xinmao indirectly holds 3.41% of the shares of Tiger and Tiger through Shanghai Qingyou. .

(2) Initial cooperation

Gaosheng Holdings (000971)

Starting from August 9, 2018, Gaosheng Holdings continued to increase its trading limit for six trading days, and Gaosheng Holdings had to explain the fluctuations. The reason for this is that the Securities Times published an article on the 9th, "Jia Nan Zhi Zhi took the lead in launching 7nm production chip related companies", "the company is involved in the text."

According to the announcement, Gaosheng Holdings signed the “Data Encryption Forward-looking R&D Cooperation Agreement” with Jianan Yuzhi in January 2017. The two parties intend to research and develop data encryption in the practical application field and existing problems.

But unfortunately, this is a concept stock that only "has gotten up early and caught up with a late set". Up to now, no research and development results have been seen from the public information, and no substantial business income has been formed. "In addition to the normal business relationship mentioned above, the company does not have any form of equity relationship with Jianan Zhizhi."

It can be said that Gaosheng Holdings is a typical example of “signing a framework, two years of hot spots”. In the "shares" of Gaosheng Holdings, there are still 25 posts about "Jia Nan Zhizhi" last month, but most of them are their own speeches.

In fact, Gaosheng Holdings has another partner in the industry – the Bitcoin cloud computing power mining platform.

According to the official website, the platform has integrated resources such as IDC (Internet Data Center) and Jianan Minzhi Mining Machinery provided by Gaosheng Holdings to provide cloud mining services for users. The official of Gaosheng Holdings also mentioned (and only once) when answering investors' questions in March 2018, and the related business is still in the process of advancement. However, at present, the official website of Baolibao (https://www.suanlibao.com/) has been unable to open, and Gaosheng Holdings has not mentioned any details of the cooperation with Balibus in the financial report.

Finally, attach a complete chart of miners' concept stocks.

The table also includes Yinjiang (300020), a beneficiary of Yibang Technology, one of the major miners who did not start the introduction, and Keda (600985) and Jingu (002488), which signed the blockchain business with Jianan Zhizhi. ).

The table also includes Yinjiang (300020), a beneficiary of Yibang Technology, one of the major miners who did not start the introduction, and Keda (600985) and Jingu (002488), which signed the blockchain business with Jianan Zhizhi. ).

From the above table, Jianan Zhizhi has more close contacts with listed companies than other miners, and since 2017, it has tried to develop other businesses in the blockchain field. Now, it has set up a joint venture with Jingu Co., Ltd. (49% of Jianan's shares) to personally go into battle, which shows that it is not satisfied with the scope of miners and AI chip companies; and these beneficiary shares can be listed from Jianan Zhizhi to the US. The benefits, as well as the concept of blockchain, are more than one thing.

But like many blockchain technology service providers, it will take some time for Jianan to build from 0 to 1 in this field.

Mining machine manufacturing concept stock

The production process of the mining machine includes wafer manufacturing (wafer is the basic material for manufacturing chips), wafer testing, chip packaging and post-packaging testing, as well as the provision and assembly of electronic components of the whole machine. Let us refer to the listed company involved in the above process as the "mine machine manufacturing concept stock", basically located in the upstream industrial chain of the miners.

(1) Self-developed GPU mining machine

Zhuo Yi Technology (002369)

Zhuoyi Technology itself is a foundry of Xiaomi and Huawei. Its main business includes network communication, consumer electronics and intelligent hardware. Since 2015, Zhuoyi Technology has started to develop and produce shared CDN (Shared Bandwidth and Storage) products for Thunder ODM (Original Design Manufacturer), including Thunder’s “Token Cloud” with the addition of tokens in 2017. ".

It should be noted that many people will call such products "hard disk mining", which is different from the traditional sense of relying on computing power, mainly relying on hard disk space. There is a lack of currency with broad consensus in hard disk mining, so it is also less mainstream.

Closer to home, at the climax of the bull market in early 2017-2018, Zhuo Yi Technology also used GPU mining machines for digging in Ethereum and other currencies.

Zhuoyi Technology once said on the interactive forum that "the company developed a multi-GPU high-performance parallel computing system in early 2017, mainly used for AI and blockchain hashing (commonly known as mining), which has been trial-produced and can be mass-produced. At the same time, it also independently developed a 17-card GPU mining machine. "But the performance is not mentioned, it is known that in the market, in 2018, the mining machine may not be a good business.

Zhongqingbao (300052)

Zhongqingbao's main business includes game and cloud service business, and it is also a dual concept of mine-related and blockchain.

In January of this year, Zhongqingbao said on the interactive forum that the digital currency mining machine independently developed by the controlling shareholder Baode Technology was already selling well in 2018. The company's wholly-owned subsidiary, Proton Internet, plans to combine the remaining bandwidth and computing power with the mining machinery of Baode Technology to make a cloud computing platform.

The blockchain concept allowed it to harvest six daily limit at the end of October and to appear on the Dragon and Tiger charts several times.

On the evening of October 29, Zhongqingbao announced that the company has been involved in the tracing of the blockchain since 2018, and the contract revenues totaled 850,000 yuan, of which the revenue can be included in this year's revenue of 755,700 yuan. The profit was 526,700 yuan.

(2) chip packaging and testing the Big Three

According to the cost structure previously disclosed by Jianan Zhizhi, chip packaging and testing expenses are about 11% of wafer processing expenses. As a result, Haitong Securities estimated in 2018 that the total market for mining and chip testing in 2017 was between RMB 900 million and RMB 1.1 billion. It is predicted that the demand for mining machine chips is strong and is expected to become an emerging driving force in China's packaging and testing industry.

But we have seen the market trends later. In 2018, Bitcoin's total network computing power growth rate was 110%, which is very rapid, but compared with the growth rate of 1100% in 2017, it has actually slowed down a lot. The mining machinery industry has not been able to become the Chinese packaging and testing industry. Growth accelerator.

Over time, this year, the mining machine is hard to find again. Is it a turn for the listed companies in the packaging and testing industry?

When it comes to chip packaging and testing, I have to mention the mainland's three major testers (there are also many large-scale packaging and testing companies in Taiwan) – Changjiang Electronics Technology, Huatian Technology and Tongfu Microelectronics, and all three have A common customer – Bit Continental.

Changjiang Electronics Technology (600584)

Changjiang Electronics Technology Co., Ltd. is the leading boss in the mainland packaging and testing industry. It is also the designated supplier in the Bitcoin prospectus, but unfortunately, from the various announcements of the company, it is difficult for us to find related business. Happening.

Last year, the digital currency market plummeted and “the mining machine was on sale”. Some investors have asked whether the long-term electricity will be affected.

Changhua’s reply is full of enthusiasm, and it also shows that it has sufficient knowledge and sufficient preparation for the digital currency industry. The company said that “the company’s market for virtual currency has long been prejudged and it is considered unsustainable. The company’s arrangement of bitcoin business is entirely an order that uses existing spare capacity. The current virtual currency price has fallen sharply, resulting in a decline in orders. As expected, the company has already prepared for customer restructuring and introduced new large customers to compensate for the vacancies caused by the decline in Bitcoin."

Huatian Technology (002185)

Although it is not a "designated supplier" in the Bitland prospectus, according to various sources, including Huatian Technology itself, it also acknowledges that it is also providing chip packaging and testing services for Bitland.

According to the news of Haitong Securities in January 2018, Huadian Technology said that it began to accept the bit-sea mining machine chip packaging and testing business in 2016. At present, the company's packaging and testing capacity for bitcoin is 30 million pieces/month, which is expected to expand at the end of February 2018. Produced to 60 million pieces / month. Combined with the current bitcoin package to measure the unit price of 1.6 yuan, it is expected that the business will bring more than 1 billion revenue in 2018.

Last year, Huatian Technology's total operating income was 7.2 billion yuan, but the net profit margin was only 6%. The actual revenue generated by the mining machine's sealing and testing business is not mentioned in the annual report.

通富微电(002156)

According to the report of Tongfu Micropower Research (20180514) of Zhongtai Zhengzhengxiang team, “The Chongchuan Plant of Tongfu Microelectronics in 2018 has some bit-continent mining business, which can be done in medium and high-end products, every day (package) 100 – 1.5 million or so, the gross profit margin is relatively high."

In addition, through the acquisition of American AMD (GPU manufacturers, GPU can also use mining) Suzhou and Penang, Tongfu Microelectronics not only improved the sealing and testing technology, but also obtained a large number of orders from the latter. “In domestic terms, before the merger, AMD 50% of the orders are in Penang, Suzhou, 80%-90% after the merger.”

In the first half of 2019, the sales revenue of Tongfu Suzhou and Penang two factories increased by 32% compared with the same period of last year, while the income of the whole company increased by only 3%.

(3) Power supply, electronic components, foundry

Great Wall of China (000066)

The Great Wall of China has a mining power brand called “Dragon”. At the beginning of 2018, it once said on the interactive platform that “the Great Wall kilowatt-class dragon series power supply is the leader, with nearly 80% market share, and it has become the benchmark product of China's digital mining machine high-performance power supply.”

In its stock market, there are also bulls to promote the “Golden Monopoly 80% of the mining power market”. However, according to the analysis of the mining industry, the most commonly used third-party power supply brands (as opposed to the official power supply of the miners) are the power brands such as chain power, and the dragon is only occasionally heard. So this estimate may be wrong or the data is out of date.

China Great Wall also said on the interactive exchange this year that the mining power business accounted for a small proportion of the company's overall revenue and was not disclosed.

Hongyuan Electronics (603267)

Hongyuan Electronics mainly supplies electronic components for Bitland.

According to its announcement this year, in 2019, it has business dealings with Beijing Sanhexing Electronic Technology Co., Ltd., and the cooperative products are electronic components products represented by the company. The product was eventually sold to Century Cloud, a wholly-owned subsidiary of Bitcoin, to provide electronic components for the mining machine.

The 2019 semi-annual report disclosed by Hongyuan Electronics showed that its agency business fell by 11.5% compared with the same period of last year.

Deep Technology (000021)

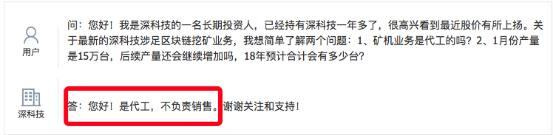

On January 11, 2018, Shen Technology once said that it is one of the well-known bitcoin mining machine manufacturers in China. The company began to introduce this business in November 2017, and the output in January 2018 was around 150,000 units, causing market concern. .

So is there really a deep technology brand bitcoin mining machine on the market?

On January 16th, Shenzhen Technology responded to investors. “The company only works as a foundry of mining machines and is not responsible for sales.”

A stockholder looked at it with sorrow. "What a good answer, the forefoot claims to be a well-known manufacturer, and the hind foot tells everyone that it is actually just a foundry. The difference between a manufacturer and a foundry can be big!"

Mining concept stock

In the upstream, the downstream of the miners is selling ore mining machines, ordering mining machines to mine or operating companies such as cloud computing platforms. We call it the “mining concept stocks”.

Huatie Technology (603300)

On March 9, 2018, Huatie Technology announced that it had invested 70 million yuan (plus registered capital and invested a total of 170 million yuan) into its subsidiary Huatie Hengan to carry out mine construction and mining machine leasing business.

From May to June, Huatie Hengan ordered 36,500 “servers” (mineral machines) from Jianan Zhizhi and Yibang Technology for a price of RMB 4,740 per unit, for a total price of RMB 173 million.

But then, the currency market entered the second half of the bear market, and many miners also cleared the market and the demand for mining machines continued to decline.

Affected by this, Huatie Hengan experienced an operating loss of 110 million yuan in 2018. By January of this year, the unsustainable Huatie Hengan sold at a low price of nearly 60 million yuan.

Zhongying Internet (002464)

The company contributed billions of sales to Yibang Technology in the first half of last year.

Beginning in March 2018, Zhongying Connected Subsidiary Co., Ltd. has paid RMB 400 million to pay for RMB 6 million to purchase 65,000 mining machines. The announcement indicates that this is an agent for overseas company VAST procurement of mining machines, with an agent procurement business income of 22 million yuan. The gross profit margin is 100%.

Internet Online (835727)

Among these mineral-related concept stocks, Internet is probably the most active company. It operates a mining machine called “RHY” + cloud computing platform, and hangs the company's “stock code, service hotline” on the official website, changing the coverless or ambiguous style of other companies. customer.

It claims that the company has opened several mines in several overseas countries, and plans to invest in three phases to build large-scale mines in overseas countries such as Iceland, Georgia and the Middle East, and plans to build 900 MW (MW) substations. After the completion, 600,000 machines can be turned on.

In August of this year, the Odaily Planet Daily Research Institute calculated the yield of each cloud computing platform based on the mining cost model. It was found that the theoretical rate of return of RHY was -14% at the time of the currency price of $10,150, at 10 The second lowest in its class.

Be careful, there are a lot of businesses that are hot and hot.

If the above concept stocks are really involved in the mining industry, the following companies are likely to be just hot spots. Typical examples include Guangdong Junya, Jingjiawei and Inspur Information.

On January 15, 2018, Guangdong Junya said on the interactive forum that digital currency mining machines need to use printed circuit boards. Guangdong Junya has the ability to develop, produce and sell digital currency mining machine circuit boards, attracting investors. interest.

A stockholder went through all the announcements of the company overnight and found no related business.

Being able to do it does not mean that the company will do it. The same is true of Jingjiawei.

The Odaily Planet Daily collected the official announcements and investor interaction information of Jingjiawei, and found no direct or indirect participation in the GPU mining business.

Inspur information is a cloud computing and big data service provider. Although some investors have high voices about mines, they can only say that they are “self-defeating”.

Such "guess" and "suggestion" are good intentions, but some people in the stock market are investors who don't know why. If some people take the eloquent discussion in the stock market seriously, this is not good.

For these mining-related stocks, some investors will carefully look at the earnings and look for value, but some investors do not recommend it too seriously. "Would you like to trade stocks? Do you know what to do? If everyone thinks that he is he will rise, this is A shares! You don't buy others to buy, others make money."

"Emotional hype, seriously lose you. Short-term hype does not talk about value, advanced people eat meat, latecomers pay for it, buy action fast, ask so much?"

For the digital currency, mining concept stocks, such as the period of high volatility, the short-term speculation atmosphere may be inevitable. Perhaps only the mining industry is generally understood and recognized by investors, and there are more long-term value investors.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Dark Net Silk Road drug dealer pleaded guilty about this dark world, how much do you know?

- How far are we from the real DAO?

- From the arguments of NGC Zhu Weiyu and Dovey, talk about Cosmos

- How to measure the value of Token from the cost?

- IOTA co-founder announces retreat and clears all cryptocurrencies

- The People's Liberation Army newspaper article: blockchain boosts military management

- Cosmos's story: How to "turn" $17 million into $104 million