Know stupidity to invest correctly

Imagine a scene: There is a bank that recharges your account for 1440 yuan every day. If you are more greedy and feel that it is not enough, then there is no way, no more than 1440 yuan, once you have not spent 1440 yuan in one day, then The next day will clear all the money of the previous day, and then re-issue your account for 1440 yuan. In this way, maybe you guessed that there is such a bank in the world, its name is: time, giving everyone only 24 hours a day.

In this case, you are faced with a choice, how to use this money effectively?

So, we instantly understood that what we always care about is not money, it is the time that has passed. Our grasp of time is the grasp of money, and the most incisive value of time can be invested.

The investment process is a process of self-recognition. When I first entered the market, I didn’t know what the target of my investment was. I was lucky enough to make some money. I think that IQ has improved a lot, and it’s better than everyone around me. As the bulls and bears change and start to lose money, you must start to doubt yourself. You will blame yourself and hate your ignorance and greed.

- Vitalik Buterin set out to study Monroe and Zcash's privacy agreement, which is expected to add privacy to Ethereum

- Boston Federal Reserve: Planning to design blockchain supervision nodes to monitor capital flows and settlements between different banks

- V God and Joseph Lubin, the two founders of Ethereum, donated 2000ETH, and MolochDAO provided financial support for Ethereum 2.0.

Believe me, it’s not just that you have had this kind of experience. It can be said that every investor is going through the path. Progress is a painful process, a process from stupidity to not stupid. As long as you realize that this is progress, because many people do not admit that they are their own problems. In the process of losing money, they constantly resent others, and believe that the market always fights against oneself.

Many people don't know their stupidity, and even mistakenly think that they are smart. Suppose you realize that you are stupid before entering the market. If you invest in any target, the assumption is not within your ability. Investment, often good things will happen.

Don't feel inferior, because everyone is as stupid as the opportunity, otherwise the market will not be called the Bo silly market. The only difference is that some people know that they are stupid, and some people don't know that they are stupid.

The need to recognize one reality is that your stupidity is not reduced by the appreciation of your assets.

When I entered May 2019, Caesar entered the currency market for nearly three years. From the ignorant entry into the currency circle, I started to earn a little money in the early days of the bull market. I have seen too much human greed and fear, not just It’s your own experience that is more about hearing from others. Some people are ruined because of greed. Some people sing crazy because of fear. Some people insist on it and their assets shrink, but you can't judge whether their choice is right or wrong.

The most common thing to see is that with the arrival of the bull market, many people mistakenly think that their IQs are starting to rise because of their rising assets. They are smarter than in the past. If they fall, they will start to talk nonsense and swear. There are too many scammers, the project side is too junk, smashing other people, and finally stupidly stupid, as if the whole world is right with yourself.

When the bulls and bears are converted, we often derive decisions based on the results. Often the correct decisions you think at the time are not necessarily good. The world is not obligated to give you positive feedback every time, or it will not give you positive feedback right away. You need time to precipitate.

In the world of investment, many people are not talking about facts, but personal opinions.

Most people's failures are always similar, because they get together to discuss their stupid views, as discussed in the rabble, which is what we need to avoid as much as possible.

Just like Bitcoin, it has been running stably for ten years. Some people have seen and believed very early on to change the world. Later, another person saw it and then joined it. Later, it was your turn to see it because the media Propaganda or other channels, you will see other ideas and exchanges in the first place, and then in fact they do not know it is not clear, all investment knowledge only stays on the views of others, The field chased the quilt, doubted the self, and then doubted the world.

The above explains that many people are actually self-contained, without their own investment philosophy, and their views on investment are only on the surface.

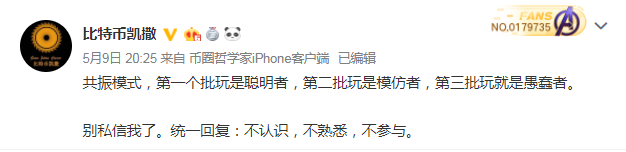

Some time ago, the resonance mode coin was really hot, and Caesar made a paragraph:

Generally speaking, I don’t touch anything I don’t understand. It’s this iron law that has missed a lot of opportunities for riches, but I won’t regret it because the money is not in my knowledge. within.

Once you buy a target that you don't understand, you will face a dilemma: when it falls, you will be afraid, choose to cut the flesh, and vice versa, when it rises, you are more afraid because You don't know how high it is going to rise, and if you don't run, you are likely to be quilted.

In the vicious circle, the company continues to chase and rise, and the last dime is not earned, and it has lost its most precious time.

Caesar made too many mistakes in the 2017 bull market. For example, the BNB is optimistic. The logic at the time was that the currency transaction was the mainstream trading model in the future. After all, the currency transaction was the best in all previous trading experiences. After that, I bought countless sweet coins. Finally, because the amount was too large, shipping became a problem. Later, when the bear market came, it was simply zero.

So am I making progress? Of course, the only advancement is to be more awe-inspiring. At that time, the bull market thought that it understood, and gradually became ignorant, or directly confused, and more eager to see the true face of things, rather than care about the wave of investment sentiment.

When fear occupies its own heart, and fear is the product of the most avoidance in the investment process. Once you have fear in your heart, your actions will be timid and you will not dare to make big moves. Even if you see very good opportunities, you will not enter. Leading to further vacancies and confession will be avoided, because in many cases, the market is short-term manslaughter by the emotions of the rabble.

No one is born to be suitable for investment. Just as no one is born to make money, the setbacks and pains encountered by each person are basically similar, and there is no need to be annoyed. What is important? The important thing is that we have experienced the lessons we have learned. Experience does not guarantee that you will make big money in the future, but you can guarantee that you will lose money.

In the currency market, opportunities are always lacking. Some opportunities belong to you, and some opportunities belong to others.

If you make a poor decision, it doesn't matter, you have the next chance to put your mind right, because there are more opportunities to wait for you to choose, because you have a heart in your heart, not afraid.

There is a misunderstanding in the currency market. Most people think that bitcoin is from zero to nearly 800 billion market value. Some people say that technological progress has led to the rising of bitcoin. However, the fact is that the consensus pulls, that is, more and more people The recognition of Bitcoin as an asset led to an increase in Bitcoin, directly indicating the bitcoin skyrocketing market.

Consensus is very mysterious. You say that the bitcoin value is 1000. Some people think that the bitcoin value is 100w. Only more people think that bitcoin should be more valuable, and it will rise so high. Many people say that bitcoin is so high that it is a bubble. Then I ask you, have you seen a bubble that has been rising for ten years and is still rising?

It is the rising characteristics of Bitcoin that has led to the exposure of different humanities. Some people think that it is a bubble to cash out and never get on the car again. Some people think it is value. Even if it is short-term, it will one day be solved and profitable. . What you think is the difference in investment behavior is actually a question of investment philosophy.

It is doomed that some people make speculative money, and some people earn valuable money. The two can only be distinguished in the long run.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Depth | Coin's stolen 7,000 bitcoins, why did bitcoin rise against the trend and stand out?

- Hu Jiwei, China University of Political Science and Law: When the blockchain encounters notarization, trust becomes simple and reliable.

- 44 "blockchain + AI" application scenario analysis, do you think it can be more complete?

- In the first half of the year, it has risen by 110%. Bitcoin is almost 7,000 dollars. Is the bull market coming?

- Bitcoin rose nearly 100% in five months, and the "out of the box" market is unreliable?

- 88% increase! 2019 Forbes global blockchain top 50 list, you may not understand these 3 details

- US Commodity Fund (USCF) submitted a new cryptocurrency ETF application to the US SEC