Latest Global Central Bank Digital Currency Guide

Source: 01 Blockchain

1Central Bank Digital Currency: Seven Advantages and Five Challenges

- Perspective | Bitcoin Operating System: What kind of applications will emerge from liberating information and communications?

- Dry goods | Starting from three bottlenecks to solve blockchain scalability issues

- Summary of blockchain security incidents in 2019, global loss exceeds $ 6 billion

(2) Achieving inclusive finance: The digital currency of the central bank can provide the public with a safe and liquid government-backed payment method, without even requiring individuals to hold bank accounts. Some central banks consider this important in the digital age of declining cash use, especially in countries with low bank penetration;

(3) Guaranteeing the stability of payment systems: Some central banks are concerned about the increasing concentration of payment systems in the hands of a few very large companies (some of which are foreign companies). In this context, central banks in these countries see central bank digital currencies as a means to increase the resilience of their payment systems;

(4) Increase market competitiveness and ensure order: Central banks in some countries believe that central bank digital currencies can compete with large companies in the payment industry, and therefore are a means to limit rent-seeking space for these companies;

(5) Dealing with the challenges of new digital currencies: The central banks of some countries believe that issuing central bank digital currencies is a useful and necessary means to compete with privately issued digital currencies (some of which are denominated in foreign currencies). The central banks of these countries believe that central bank digital currencies issued on the basis of government accounting and denominated in domestic bookkeeping units will help reduce or prevent the use of privately issued digital currencies, as privately issued digital currencies may be difficult to regulate;

(6) Support the development of distributed ledger technology (DLT): Central banks in some countries see the advantages of DLT-based central bank digital currencies, which can be used to pay for DLT-based assets. If these assets surge, DLT-based central bank digital currencies will help automate payments when assets are delivered (which can be automated using smart contracts). Central banks in some countries are considering offering central bank digital currencies only to institutional market participants to develop DLT-based asset markets;

(7) Facilitating the implementation of monetary policy: Some scholars believe that digital currency of the central bank is a means to strengthen the transmission of monetary policy. They believe that interest-bearing central bank digital currencies will increase the economy's response to changes in policy rates. In addition, as long as the cost of cash is high, you can use the central bank's digital currency to achieve negative interest rates (thus breaking the "zero interest rate lower limit" constraint) during protracted crises.

(2) “Run risk”: During a crisis, bank customers may convert their deposits into central bank digital currencies, because central bank digital currencies are considered safer and more liquid. It is worth mentioning that in many jurisdictions around the world, deposit insurance is continuously preventing bank runs. In addition, many countries already have safe and relatively liquid assets, such as government bond funds or state-owned banks, and the academic community does not believe that these assets have a systemic run risk during the crisis. Moreover, even if a run occurs, the central bank's digital currency will more easily meet deposit withdrawal requirements than cash. In addition, in many countries in the world, bank runs are usually consistent with currency runs, that is, depositors will seek refuge in foreign currencies whether or not a central bank digital currency is introduced.

(3) Balance sheet and credit allocation of the central bank : If the demand for central bank digital currencies is high, the central bank's balance sheet may expand significantly. In addition, the central bank may need to provide liquidity to banks with a demand for rapid and substantial outflows. The central bank will therefore bear the credit risk and must decide how to allocate funds among the banks, thus opening the door to political intervention.

(4) The international impact of central bank digital currencies requires further research: Central bank digital currencies issued by international reserve currency countries may deepen currency substitution ("dollarization") in countries with high inflation rates and large exchange rate fluctuations. The impact of central bank digital currencies on the international monetary and financial system requires further research.

(5) Costs and risks of central banks: For each country, issuing central bank digital currencies may be very costly and may pose risks to the reputation of central banks. To successfully issue central bank digital currencies, the central bank of a country is required to master the initiative in multiple steps of the payment value chain, including interaction with customers, building front-end wallets, selecting and maintaining technology, monitoring transactions, and responsible for anti-money laundering and anti-terrorism Financing. Technical glitches, cyberattacks or just human error can damage the reputation of the central bank.

2China's central bank digital currency "DCEP"

According to Mu Changchun, director of the Digital Currency Research Institute of the People ’s Bank of China, China ’s central bank digital currency “DCEP” has the following basic characteristics:

1. The digital currency of the People's Bank of China is a digital replacement of paper money (M0 replacement), and its functions and attributes will be exactly the same as paper money, except that the form is digital;

2. The digital currency of the People's Bank of China is a digital payment tool with value characteristics, and does not require an account to realize value transfer;

3. The digital currency of the People's Bank of China is legally compensable, and no one can refuse to accept it as a payment method;

4. The digital currency of the People's Bank of China can realize dual offline payments, and payments can be made without a network;

5. The Chinese central bank's digital currency uses a two-tier operating system.

Although many institutions have interpreted the central bank's digital currency from multiple perspectives, there are still some issues worthy of further discussion. For example, what is the implementation form of dual offline payments? What is the issuing model of central bank digital currency? For another example, in the process of the central bank's digital currency investment and user exchange and withdrawal under a two-tier operating system, did it adopt a simple owner change plan or a destruction plan? (Please refer to the appendix for related information on these three issues)

In 2015 , the People's Bank of China released a series of research reports on digital currencies, and the prototype scheme of fiat digital currencies completed two rounds of revisions.

On January 20, 2016 , the People's Bank of China for the first time proposed the goal of issuing legal digital currencies.

On July 1, 2016 , the People's Bank of China started the research and development of prototypes of digital bill trading platforms based on blockchain and digital currencies.

On January 29, 2017, the Digital Currency Research Institute of the People's Bank of China was established.

On February 1, 2017, the digital bill trading platform based on blockchain and digital currency promoted by the People's Bank of China successfully tested.

On March 1, 2017 , the Central Scientific and Technological Working Conference emphasized the establishment of a central bank innovation platform with digital currency exploration as the leader.

On May 27, 2017, the Digital Currency Research Institute of the People's Bank of China was officially listed.

On June 1, 2017 , the People's Bank of China issued a risk alert on the use of the name of the People's Bank to issue or promote digital currencies.

On March 28, 2018, the People's Bank of China held a 2018 national monetary, gold and silver work video conference call, which stated that it is necessary to "steadily advance the central bank's digital currency research and development".

On September 5, 2018, the Digital Currency Research Institute of the People's Bank of China established "Shenzhen Fintech Co., Ltd." in Shenzhen and participated in the development of trade finance blockchain and other projects.

In May 2019, at the 2019 China International Big Data Industry Expo held in Guiyang, the PBCTFP trade financing blockchain platform developed by the Digital Currency Research Institute of the People's Bank of China appeared.

On July 18, 2019 , the International Telecommunication Union (ITU) held the second meeting of the Focus Group on Legal Digital Currency. Yao Qian, then director of the Digital Currency Research Institute of the People's Bank of China, shared the design and detailed functions of the People's Bank of China's two-tier structure model of fiat digital currencies.

On August 2, 2019 , the People's Bank of China held a working video conference in the second half of the year, pointing out that in the second half of the year, it is necessary to accelerate the development of the legal digital currency "DCEP" and track the development trend of domestic and foreign virtual currencies.

On August 10, 2019, Mu Changchun, then Deputy Director of the Payment and Settlement Department of the People's Bank of China, said at the Third Forty People's Forum in China that the central bank's legal digital currency is ready and a two-tier operation system will be adopted.

On August 21, 2019, the official WeChat public account of the central bank published the full text of Mu Changchun's speech on digital currencies. A simultaneous publication by Fan Yifei, deputy governor of the People's Bank of China, entitled "About The article "Several Considerations of Central Bank Digital Currency" reveals a high degree of consistency between the two, and outlines several important characteristics of central bank digital currency: At this stage, the central bank digital currency is M0 (cash) replacement, not M1, M2 Replacement; the central bank does not issue digital currency directly to the public, and will adopt a two-tier operating system, that is, the People's Bank of China first exchanges digital currency with banks or other operating institutions, and then these institutions exchange with the public. In the process, it insists on centralized management mode.

On August 27, 2019 , Forbes reported that the first batch of China's legal digital currency issuers include Alibaba, Tencent, Industrial and Commercial Bank of China, China Construction Bank, Bank of China, Agricultural Bank of China, and China UnionPay. Launched during the "Eleventh" period, people from the central bank came forward to make rumors.

On September 4, 2019, Mu Changchun, director of the Digital Currency Research Institute of the People's Bank of China, launched an online course "Fintech Frontiers: Libra and Digital Currency Outlook". The last two sections focused on China's legal digital currency.

On September 5, 2019 , China Daily reported that the "closed loop test" of China's legal digital currency has begun. The test will simulate payment schemes involving commercial institutions and non-governmental organizations.

At a series of press conferences to celebrate the 70th anniversary of the founding of the People's Republic of China on September 24, 2019, Yi Gang, President of the People's Bank of China, said that there is currently no timetable for the launch of the central bank's digital currency, and there will be a series of research, testing, pilot, Evaluation and risk prevention processes need to be performed.

On November 4, 2019, Fan Yifei, member of the People's Bank of China Party Committee and Vice President, visited Huawei's Shenzhen headquarters. Vice President Fan Yifei visited the Huawei Park and Huawei's Digital Transformation Exhibition Hall, and witnessed China with Xu Zhijun, Huawei's rotating chairman. The strategic cooperation agreement between the PBC Clearing Center and Huawei was signed, and the cooperation memorandum on financial technology research between the Digital Currency Research Institute of the People's Bank of China and Huawei was signed.

On November 12, 2019 , at the 4th Singapore Fintech Festival "Defining the Future of Digital Currency" sub-forum, Mu Changchun, Deputy Director of the Payment Division of the People's Bank of China and Director of the Digital Currency Research Institute, stated that the Chinese version of the central bank's digital The currency is not aimed at cross-border payments, nor is it used for wholesale capital services like Morgan Coins, but to provide more redundancy for China's already advanced electronic payment system. Mu Changchun pointed out that at present the two giants, Ali and Tencent, have occupied 96% of the domestic mobile payment market. Now Chinese people have gone out without wallets, but payment is the national infrastructure, and regulators must be responsible for any problems that may occur. Prepare for the situation. In addition, China's payment system also has market segmentation and friction. Mu Changchun expressed the hope that through the future central bank digital currency, a more smooth and universal payment method can be established. In addition, it can also cover remote areas and promote financial inclusion.

On November 13, 2019 , the People's Bank of China issued an announcement on the issue or promotion of legal digital currency in the name of the People's Bank of China, reminding the general public to increase their awareness of risk, not to trust and trust, and to prevent damage to their interests.

On November 20, 2019, the Yangtze River Delta Financial Technology Co., Ltd., a subsidiary of the People's Bank of China, recently released job postings and publicly recruited multiple positions such as blockchain technical director, blockchain architect, and blockchain R & D engineer. This time, the Yangtze River Delta Financial Technology Co., Ltd. not only has a large number of positions, but also has very competitive salary. The Yangtze River Delta Financial Technology Co., Ltd. was jointly established by the Digital Currency Research Institute of the Central Bank and relevant units in Suzhou to undertake the construction and stable operation of legal digital currency infrastructure; to undertake key technology research and experimental scenario support, supporting R & D and testing of legal digital currency; Focus on the frontiers of fintech such as blockchain and cryptography.

On November 28, 2019, Fan Yifei, deputy governor of the People's Bank of China, said at the "Eighth China Payment and Clearing Forum" that the central bank's legal digital currency, DCEP, has basically completed the top-level design, standard formulation, function research and development, and joint testing. The next step will be to rationally select the pilot verification area, scene and service scope, and steadily promote the introduction and application of digital form of fiat currency.

On December 9, 2019 , according to media reports, the central bank's statutory digital currency pilot project led by the People's Bank of China, including the four major state-owned commercial banks of Industry, Agriculture, China, and Construction, and China Telecom, China Telecom, and China Unicom The project is expected to land in Shenzhen, Suzhou and other places. The pilot project was led by the Central Bank's Currency, Gold and Silver Bureau, and the Digital Currency Research Institute implemented it. The close to the pilot project team said that the pilot (Shenzhen digital currency currency pilot) plan is divided into two phases. At the end of this year, it is a phase. The pilot will be closed in a small-scale scenario and next year will be the second phase. . If the pilot work progresses smoothly, the central bank's legal digital currency will make substantial progress, which can be said to be a real "coming soon."

3 Global Central Bank Digital Currency Atlas

3.1 Support release or have begun research and development

[France] At a meeting chaired by the French Prudential Regulation and Resolutions Authority (ACPR), the French central bank's governor, François Villeroy de Galhau, said that the central bank will soon begin testing digital currencies and "will launch projects before the end of the first quarter of 2020 call". Villeroy de Galhau stated that France is keen to participate in digital currency innovation, but also warned that France needs to "adequately and methodically" try out new technologies.

[Singapore] MAS has initiated a national project called project ubin since 2016. The development of this project is divided into three stages. In the final stage, their goal is to issue digital currency of the central bank and even expand it. To cooperate with central banks in other countries.

[Sweden] The Central Bank of Sweden said it would sign an agreement with consulting firm Accenture to create a pilot platform for digital currency called e-krona. "The main goal of the pilot project is to expand banks' understanding of the technical possibilities of e-krona," the Bank of Sweden said in a statement. In recent years, Sweden's cash usage has declined rapidly and the Bank of Sweden has been considering whether figures should be issued Currency to promote the development of safe and efficient payment systems, with the goal of digitizing cash by 2021.

[Bahamas] The Bahamas Central Bank reached a formal agreement on the development of a legal digital system on May 30, 2019, and plans to fully adopt digital currencies in 2020.

[Thailand] The Bank of Thailand is promoting a new virtual currency project based on a prototype solution for creating digital currency applications. This solution will allow the central bank to apply virtual currency clearing and trading among its eight banking partners.

[Turkey] Turkish President Recep Tayyip Erdogan instructed that the government should complete the test of the national central bank's digital currency (CBDC) by 2020. According to the 2020 annual presidential plan, the Turkish central bank plans to issue a blockchain-based national digital lira.

[Ukraine] The Central Bank of Ukraine has completed the pilot program of the national digital currency e-hryvnia, but did not specify when it will be officially launched.

[Venezuela] Venezuela took the lead in launching the world's first government crypto endorsement of the sovereign cryptocurrency, Petro. The white paper shows that petroleum coins are anchored with the country's petroleum resources. In theory, each petroleum coin is backed by a barrel of oil reserves in Venezuela.

[Ghana] Ghana, a West African country, plans to issue a national digital currency. Ghana Bank President Ernest Addison announced at the annual banking conference that the central bank will explore digital currency pilot projects and stated that "it is possible to issue an electronic version of Ghana in the near future Fiat currency Cédi E-Cedi ".

[Ecuador] Ecuador was one of the earliest countries to adopt legal digital currency. Ecuador announced its electronic currency Dinero Electronico, referred to as DE for short, in December 2014. DE officially operated in February 2015, using amber beeswax as a value carrier.

[Senegal] Senegal's blockchain-based digital currency is called eCFA and enjoys the same legal status as the country's official currency, the African Franc (CFA Franc). eCFA is completely dependent on the central bank's banking system and can only be issued by authorized financial institutions. Therefore, eCFA is designed to circulate with paper currency as legal tender.

[Marshall Islands] In February 2018, the Marshall Islands , a sovereign country in the South Pacific, has issued a law that will issue the country's legally encrypted digital currency, "Sovereign (SOV)". Since the island country did not have a central bank, it had previously used the US dollar as its official currency. The SOV issued this time will be circulating in the country along with the US dollar.

[Uruguay] In December 2017, the Central Bank of Uruguay announced the launch of a six-month, digital bill issuance project called e-Peso (electronic peso).

[Netherlands Curacao and St. Martin] The Central Banks of Curacao and St. Martin announced in August 2018 that they will explore the possibility of issuing the "Digital Netherlands Antilles Shield" to promote Cura Financial payments within the Moorea and Sint Maarten monetary union systems.

[Organization of Eastern Caribbean States] The Eastern Caribbean Central Bank (ECCB) is conducting a blockchain-based central bank digital currency pilot and is preparing to use it as a fiat currency in 2020.

[Switzerland] The Swiss Federal Council has approved a report examining the opportunities and risks of introducing crypto francs (e-franc), and concluded that the widespread implementation of central bank digital currencies will not currently bring additional benefits to Switzerland. Instead, it will trigger new risks, especially with regard to financial stability. The Federal Council and the Swiss National Bank will continue to closely monitor developments in this area.

[United Kingdom] Mark Carney, Governor of the Bank of England, believes that a similar digital currency should be introduced following Libra to replace the US dollar as an international reserve currency.

[Canada] Timothy Lane, deputy governor of the Bank of Canada, said that there is currently no reason to issue digital currencies, but they may be prepared for this if needed in the future.

[India] The governor of the Bank of India said that it is "too early" to talk about the central bank's digital currency, but the Bank of India is studying this and is also discussing with other governments and central banks.

[Israel] Israel has no intention of becoming the first developed country to issue digital currency. Unless the US Federal Reserve or the European Central Bank and other major institutions take the lead to take action, the Israeli central bank will not take a step forward.

[Lithuania] In a research report released by the Lithuanian Central Bank, the possibility of various types of central bank digital currency (CBDC) with different characteristics, including retail-type CBDC, wholesale-type CBDC and interest-bearing CBDC. According to reports, the Central Bank of Lithuania may issue a blockchain-based digital commemorative coin in the spring of 2020.

[Philippines] The Philippines' ePiso project has been supported by the Philippine Central Bank and has been online for several months under its regulatory framework.

[Tunisia] There have been media reports that Tunisia has launched a digital version of the dinar to promote the reform of the domestic financial system, the country's legal digital currency, and the Tunisian government has denied the authenticity of the report.

[British Virgin Islands] Some media have reported that the British Virgin Islands government announced that it will cooperate with blockchain startup LIFELabs to create BVI ~ LIFE, a stable currency used in British overseas territories. The government later denied this statement.

[Japan] The Bank of Japan is studying the impact of digital currencies on the currency system, but the Bank of Japan Governor Kuroda has said today that there is no need for the Bank of Japan to launch digital currencies.

[Korea] The Bank of Korea said it has no plans to issue government-controlled digital currency or central bank digital currency. An official at the Bank of Korea responsible for digital payments research said: "Because Libra is not yet online, we need to maintain close communication with counterparts in other countries on how to handle this issue. But our position is that the central bank should not rush to issue public digital currencies. We believe , Most South Koreans are not experiencing difficulties using their current payment methods. In this case, we don't have to rush to catch up with the latest trends, and the security and stability of the central bank's digital currency has not been proven. "

[Russia] The governor of the Russian central bank said that Russia does not have a strong reason to launch a central bank digital currency like China, but the Russian central bank is still doing related research. Russia and Venezuela have previously discussed the possibility of bilateral trade settlement between the Russian ruble and Venezuela's "petroleum currency".

[New Zealand] Due to its existing scalability restrictions and long transaction confirmation process, the issuance of cryptocurrencies by the central bank is not stable in financial operations.

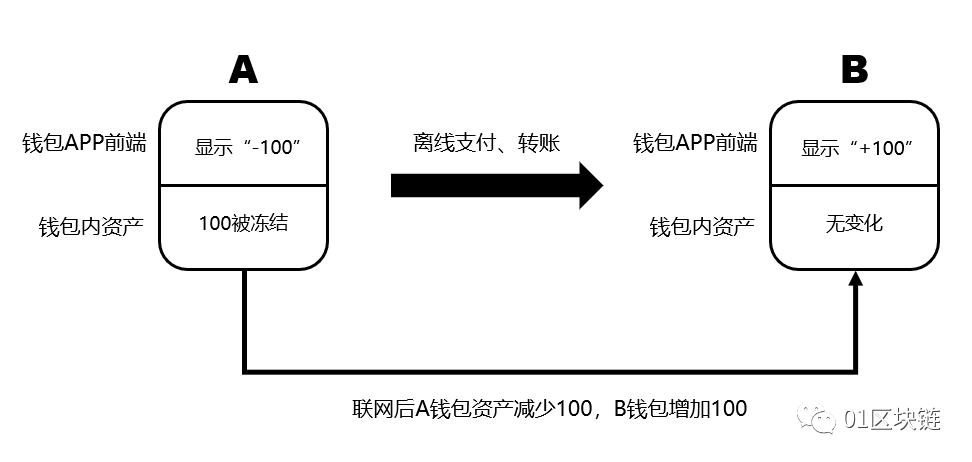

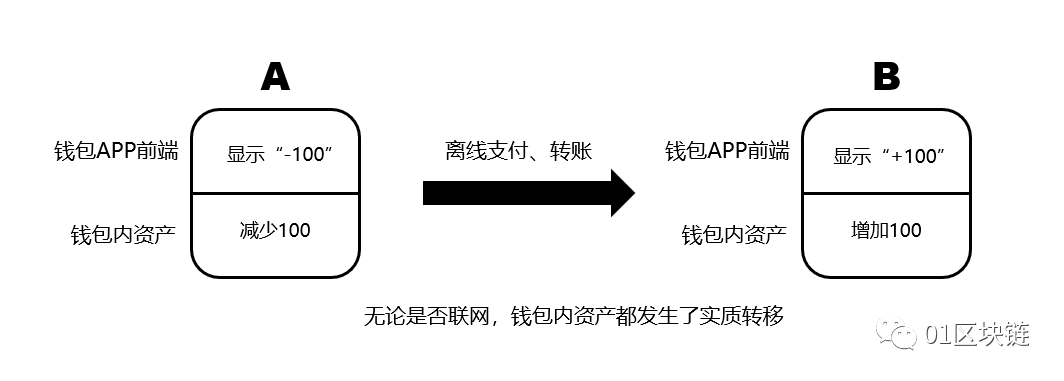

Under the first dual-offline payment implementation scheme, there is only interaction of transaction information between transaction clients and does not involve the actual transfer of digital currency. Operations such as changing and transferring digital currency owners can be completed only after networking. Its basic The principle is shown in the figure below.

(1) Generated at the smallest denomination. For example, if you need to issue 100 yuan of digital currency and the minimum denomination is 1 cent, then the central bank will issue 10,000 legal digital currencies with a denomination of 1 cent;

(2) Issue based on the user's specific withdrawal amount. For example, a user obtained a legal digital currency of 12.34 yuan through a transfer, then the central bank is equivalent to issuing a legal digital currency of 12.34 yuan;

(3) Generated according to the actual denomination of currency in circulation. This is the closest to the way of cash issuance. For example, the central bank issues legal digital currency with denominations of 100, 50, 20, 10, 5, and 1 yuan, so the legal digital currency in the subsequent circulation process is also the above denominations.

However, some studies have found that the entire process is not through changing the ownership relationship, but after the central bank receives the request and verifies it, it will directly destroy the legal digital currency of the commercial bank, and then generate a new legal digital currency. The advantage of this is that as long as the central bank does not publish the transaction flow, it only publishes a digital currency confirmation information, then the external currency can not be linked to the digital currency transfer information, which is in line with anonymity, and meet the central bank's supervision.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- CCTV re-approves blockchain scams: closing big V, online celebrity Weibo, and stepping up efforts

- Fed director: Libra faces "a series of core legal and regulatory challenges", including how to link to underlying assets

- Bitcoin surpasses Ethereum as the mainstay of DeFi? Here are 5 predictions for DeFi in 2020

- Ethereum's six myths: is decentralization really omnipotent?

- Interview with Ms. Bitcoin in Japan's Cryptocurrency Circle: Crazy learning, continuous pursuit, and efforts to build a trusting society | 8 questions

- Bitcoin miner story: Miner's loss of one million yuan sadly exits, "downlord" profit returns 10 million full

- Will Bitcoin's "magic December" bring us another long-term turning point?