Perspective | Bitcoin Operating System: What kind of applications will emerge from liberating information and communications?

Editor's Note: The original title was "Bitcoin Operating System"

Foreword: Humans are good at linear thinking, but difficult to understand the development of non-linear. This leads us to be too optimistic about things in the short term and underestimate the speed of things in the long run, just as people originally estimated the Internet. As a new value storage and exchange medium, Bitcoin naturally has a network effect. Once we break through the tipping point, maybe it will bring us many unexpected surprises. The author is Aleksandar Svetski, translated by "CiQi" from the "Blue Fox Notes" community.

The "economist" … is the blindest of us all.

- Dry goods | Starting from three bottlenecks to solve blockchain scalability issues

- Summary of blockchain security incidents in 2019, global loss exceeds $ 6 billion

- CCTV re-approves blockchain scams: closing big V, online celebrity Weibo, and stepping up efforts

The Internet is another area that is inherently non-human intuition. Throughout human history, we are not very good at predicting the growth of the network; especially those things that have become the public domain, such as electricity, telephones, the Internet, and now Bitcoin.

"When the Paris Exposition is closed (1878), the lights will be turned off and will not appear again." —— Erasmus Wilson, Professor of Oxford University

and also….

"Americans need phones, but we don't need them. We have many messenger boys." — Sir William Preece, Chief Engineer, British Post Office, 1878.

And my favorites are:

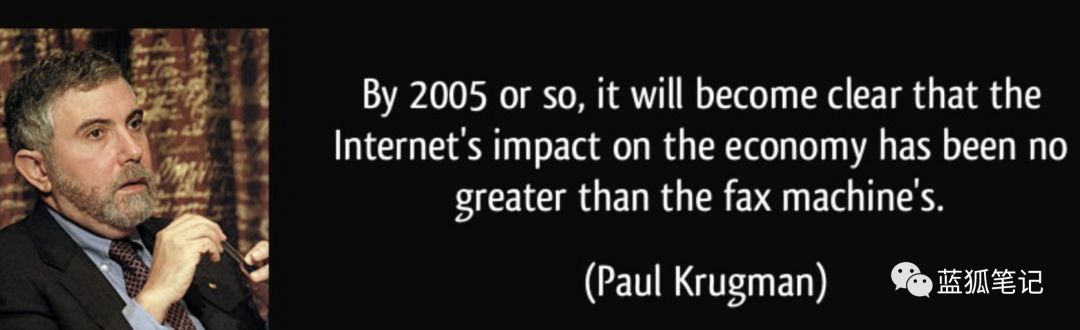

"The development of the Internet will slow sharply, as the flaws in Metcalfe's Law become so obvious: there is nothing to say between most people! It will become very clear that the Internet will not affect the economy more than a fax machine The impact is great. ”—Nobel Laureate in Economics Paul Krugman wrote in 1998.

why?

Why are so-called "experts" so wrong?

There are many reasons; it has a lot to do with prejudice, and it has a lot to do with how we evolve.

Human evolution is mainly as follows:

Humans have always evolved in a world defined by our more linear sensory perception. Grow up in a savanna; in order to steal food and protect your family or run faster than a predator, you must roughly understand how long it takes to run a long distance. Therefore, we humans are very good at estimating how far 30 linear steps are (about 30 meters).

The 30-step index is a completely different concept. It has 1 billion meters, which is a distance that we cannot easily understand. Peter Diamandis and Ray Kurzweil did spread the term and example. (Blue Fox Note: Ray Kurzweil is the author of Singularity Theory)

When we encounter something that changes exponentially or has network effects, it is difficult for us humans to make accurate and intuitive estimates. We usually predict in a linear fashion, whether it is over or underestimated.

Note: Network effects are similar to exponential changes in nature, but not so obvious. The key point is that in the early stages, their progress is difficult to detect. With the initial connectivity foundation established, network growth seems to be changing slowly. However, once it reaches the tipping point, the inflection point, the momentum of continued development is almost irresistible; unless the network itself fails catastrophically.

This inflection point may not be a "point". It is more like a period without the possibility of knowing it behind the scenes; it cannot be measured and therefore cannot be predicted, but it is based on experience or inspiration; you may bet that at this point, people will give up and consider their sustainable development The functional network didn't work because it lacked superficial results; then it took off.

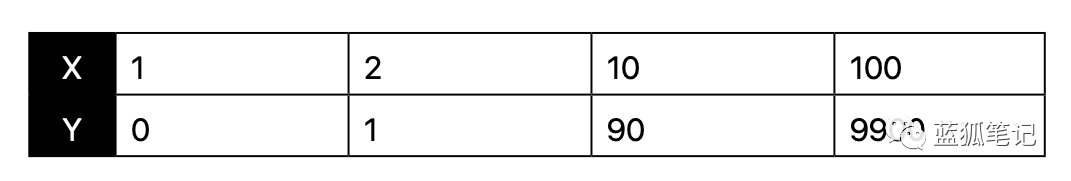

The above figure does not mean mathematically accurate, but to illustrate the following two points:

- We overestimated its short-term impact (such as "Bitcoin will take over the world" remarks)

- We underestimated its long-term impact (such as "Bitcoin is dead … it hasn't worked for ten years")

Note: In the early stages, exponential and quadratic curves look similar, but they are not the same.

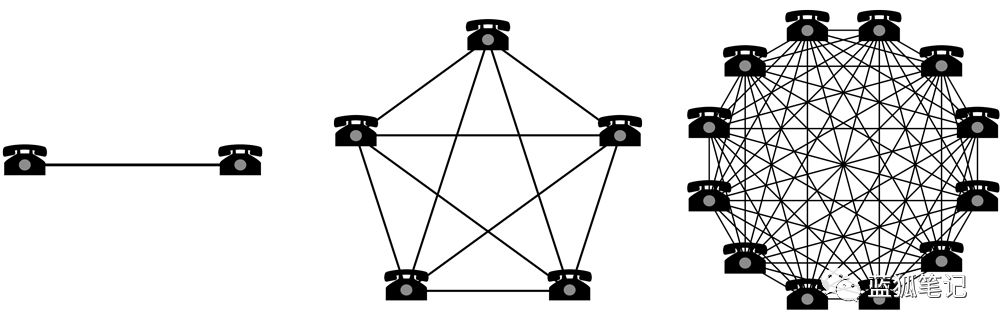

The following figure and example will help you better understand how the network (conic) accelerates beyond a certain point:

The connection is established-when you reach a point between 1000-10000, the network is already working well and will really take off. As shown below:

As of February 18, 2019, Lightning Network has approximately 3,500 visible nodes, and probably the same number (if not more) are private nodes. (Blue Fox Note: the current number of nodes has exceeded 10,000)

There are a few things to consider, especially for opponents.

"Dumb" Vs Smart

Why does the Internet prevail as the main communication network? Why not a private consortium / network like AOL or a telecommunications company that dominated communications infrastructure 100 years ago wins? Here's another reason.

This is because the base layer needs to be "dumb", in other words, the bottom layer and power can make it work best.

The Internet is built on some basic packet switching and routing protocols. Their work is very simple but very good, and it has created the most robust communication network we have never seen before.

As a result, it encourages the rest of the world to build on that foundation. why?

Because when you have a solid and stable foundation, you can abstract any function and provide services that can interact and integrate with other subsequent services. This cumulative effect is another function of the network (such as the Internet, which is now Bitcoin) to accelerate and further strengthen itself and gain a dominant position.

All economic activity will flow to the place where its benefits can be maximized. The more complex and inclusive the basic network you are trying to create (especially broad networks such as communications and currency), the more free market / open innovation space will be. The smaller, and the greater the threat from competing networks. These competing networks develop something more fundamental and robust to become the foundation of construction.

What blockchains do can die because they are either useless or contain unnecessary complexity, especially since private chains cannot build a flat and open foundation for true network effects. (Blue Fox Note: The blockchain understood in this article feels more like a private chain and is debatable.) They have two main selling points; security and immutability are not inherently magical characteristics due to their technical architecture; Or their data isolation.

The only network with this function is an open, common, theoretically sound network, such as Bitcoin; there may be others, despite the significant advantages of Bitcoin, but in this game of the network, when you have a leading and unexpected Start with a few core users who are convinced, and the most basic and talented people can start working on it; other networks are less likely to catch up, let alone keep up with the pace; this possibility declines exponentially . I think it's too late to catch up with Bitcoin. At least this century. It's time to double your bet and don't doubt why you're falling behind. (Blue Fox Note: The premise here is that you do not make mistakes)

For those who think: "No bank will use Bitcoin as a settlement layer" keep in mind:

In the 1990s, every bank said that they would never do any kind of banking on the Internet. Times have changed. You either catch up or lead.

Investment network

Another reason blockchain will fail is its focus on "proprietary technology." There can be no network effect on a private blockchain or DLT. This is called incremental innovation. The real innovation opportunities and innovations are the development of the Internet, such as Airbnb, Uber, App Store, Facebook, and the network that changes the game for everyone: the Internet.

If you look at society, you will find that the foundation on which everything is built is communication, information and language. The first layer based on these is actually money. Most people do not quite understand the important role that currency plays in the evolution of our human race and the ability to build society.

It can be said that currency plays a vital role in the operation of everything in society, and it is also the core of our human cooperation and agreement capabilities. Currently, the only robust, secure and truly rare digital currency medium that resists vulnerability is Bitcoin. Isn't this a network worth investing in or building on?

If you want to be an investor in incremental innovation that will take over the world in the future, you will continue to look for the next best thing. The alternative is to use the methods of Peter Thiel and Red Huffman: look for momentum networks that have a small number of dedicated and stubborn users who continue to grow despite poor news and you will find that 1% has changed the world .

As Mark Anderson said a few years ago: "Software is eating the world," and it is still true today. As an investor, you need to decide whether you want to be part of a very successful world or part of a new world torrent.

As more events occur, innovations that benefit from time and network growth will only become more powerful. Email brings more activities to the Internet. Lightning Network, simple multi-signature, time lock, and "judgment" smart contracts will help further increase the network effect of Bitcoin.

A digital “new” bank is like trying to put lipstick on a pig (Blue Fox Note: This is an attempt to make ugly things better, but essentially just doing things and ca n’t change the substance), and want to change the old infrastructure It's hard to be modern, like trying to make horses and carriages run faster.

It's crazy to mess around with traditional baking, even though we have things like Bitcoin. Bitcoin is the only secure global digital settlement network on which to build a truly new digital bank with greater completeness, complexity, and transparency. Similarly, we do not know what applications will emerge through the liberation of information and communications.

With the help of the Internet, we do not know what scale of change and innovation will emerge when we liberate currency and value exchange in the digital world. It's not overnight. But don't miss it. The world's next Amazon, Google, and Netflix are building on this huge, public, global network of Bitcoin.

Risk warning: All articles of Blue Fox Note can not be used as investment advice or recommendations. Investment is risky. Investment should consider personal risk tolerance. It is recommended to conduct in-depth inspection of the project and make good investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Fed director: Libra faces "a series of core legal and regulatory challenges", including how to link to underlying assets

- Bitcoin surpasses Ethereum as the mainstay of DeFi? Here are 5 predictions for DeFi in 2020

- Ethereum's six myths: is decentralization really omnipotent?

- Interview with Ms. Bitcoin in Japan's Cryptocurrency Circle: Crazy learning, continuous pursuit, and efforts to build a trusting society | 8 questions

- Bitcoin miner story: Miner's loss of one million yuan sadly exits, "downlord" profit returns 10 million full

- Will Bitcoin's "magic December" bring us another long-term turning point?

- Heavy! Wuzhen Lands The First "Blockchain" Theme Pavilion In China