LianGuai Daily | The contract address of LianGuai Stablecoin PYUSD has been announced; OpenAI has launched the web crawler GPTBot, which can automatically collect information to improve AI models.

LianGuai Daily announces the contract address of LianGuai Stablecoin PYUSD. OpenAI releases GPTBot, a web crawler that enhances AI models by automatically gathering information.Today’s headlines:

Binance obtains Bitcoin and digital asset service licenses in El Salvador

Cathie Wood: The SEC may approve multiple Bitcoin spot ETFs simultaneously

OpenAI launches web crawler GPTBot to automatically collect information to improve AI models

- Building a Virtual World How to Use Blockchain Technology to Record Time for Digital Gods?

- Bitcoin Technology Revival? A Comprehensive Review of the Ordinals Series Protocols

- Reasons for the decline of ICP Independent technology and sparse ecosystem

LianGuaiyLianGuail announces stablecoin PYUSD contract address, with 26.9 million coins issued

Lazarus Group steals $37 million from CoinsLianGuaiid using fake job opportunities

Tether CTO: Over 325 million USDT redeemed today, redemptions must comply with fiat system rules

Sino Global files a claim for around $67 million against FTX/Alameda

L1 Digital raises $152 million for its second cryptocurrency venture capital fund

Regulatory News

Binance obtains Bitcoin and digital asset service licenses in El Salvador

According to The Block, Binance has obtained two licenses in El Salvador, becoming the country’s “first fully licensed” cryptocurrency exchange. The two licenses are the Bitcoin Service Provider (BSP) license issued by the Central Reserve Bank of El Salvador and the first non-temporary Digital Asset Service Provider (DASP) license issued by the National Digital Assets Committee of El Salvador.

With these licenses, Binance has now been approved or registered in 18 markets worldwide, including France, Italy, and Dubai.

NFT

Artificial Intelligence

OpenAI launches web crawler GPTBot to automatically collect information to improve AI models

OpenAI has recently launched the web crawler GPTBot, which can automatically collect data from the entire internet. It is reported that this data will be used to train future AI models such as GPT-4 and GPT-5. According to OpenAI, GPTBot will collect publicly available data from websites while avoiding paid, sensitive, and prohibited content.

It is reported that OpenAI has filed a trademark application for “GPT-5” with the US Patent and Trademark Office on July 18.

Project Updates

LianGuaiyLianGuail announces stablecoin PYUSD contract address, with 26.9 million coins issued

LianGuaiyLianGuail has announced the contract address of the USD stablecoin PYUSD, and on-chain data shows that 26.9 million coins have been issued with 8 holders. The contract address is 0x6c3ea9036406852006290770BEdFcAbA0e23A0e8.

Yesterday, LianGuaiyLianGuail launched the USD stablecoin PYUSD, which is issued by LianGuaixos Trust.

Uniswap integrates Base Network

Uniswap announced on Twitter that it has integrated with Base, allowing users to directly add liquidity or swap tokens on the Base Network through the Uniswap application.

Steadefi has lost approximately $1.1 million in the attack, and the project team states that all funds are at risk.

The automated yield leveraged strategy platform, Steadefi, stated on Twitter: “Steadefi has been attacked, and all funds are currently at risk. On-chain messages have been sent to the attacker’s wallet address for negotiation. Steadefi hopes to discuss the bounty issue with all parties involved in the exploit, offering a 10% reward for the stolen funds.” Steadefi stated that if the attacker returns 90% of the funds by 16:00 on August 10th Beijing time, the remaining 10% will be retained, and there will be no further pursuit. Otherwise, this 10% will be provided to those who can identify their identity and convict them in court.

Steadefi provided an updated summary of the incident in another tweet, stating: “Our protocol deployer wallet (also the owner of all vaults in the protocol) has been compromised. The attacker has transferred ownership of all vaults (lending and strategies) to wallets under their control and continues to perform operations limited to owners, such as allowing any wallet to borrow any available funds from the lending vault. Currently, all available lending capacity on Arbitrum and Avalanche has been depleted by the attacker, and assets have been exchanged for ETH and bridged to Ethereum. Depositors’ vaults have not been depleted (as of now) because the attacker does not have the functionality to withdraw deposits from that vault, which is owned by a single entity. If users deposit funds into the strategy vault, they can still withdraw assets (assuming the attacker has not paused the vault). The attacker has also paused the liquidity mining contract, which means that if you (and most people) have deposited svtoken or ibtoken into the farm, you will also be unable to withdraw them, although the attacker cannot withdraw them either.”

In addition, according to CertiK Alert monitoring, Steadefi has lost approximately $1.1 million in this incident as of 5:50.

Decentralized exchange Cypher hacked, smart contracts frozen

Cypher, a decentralized exchange based on Solana, tweeted that it has been attacked and lost nearly $1 million. The smart contracts have been frozen. The team is conducting an investigation and hopes to engage in dialogue with the hackers to discuss the next steps.

Bitstamp CEO: Negotiating to raise new funds, plans to launch derivatives trading in Europe next year

According to Bloomberg, Jean-Baptiste Graftieaux, the CEO of Bitstamp Global, stated that they are currently negotiating to raise new funds. A spokesperson for the exchange stated that the fundraising process was launched at the end of June, with Galaxy Digital Holdings serving as an advisor. Bitstamp plans to use these funds for operations, including the launch of derivatives trading in Europe next year, as well as expanding its business in the Asian market and the UK. Graftieaux stated in a statement, “Bitstamp is not for sale, and we are not actively seeking to sell the company. Our current priority is to raise funds through strategic investors and accelerate Bitstamp’s growth by providing new products and services to retail and institutional crypto clients.”

Cathie Wood: The U.S. SEC may approve multiple Bitcoin spot ETFs simultaneously

Cathie Wood, CEO of Ark Invest, said in an interview with Bloomberg that the U.S. Securities and Exchange Commission (SEC) may approve multiple Bitcoin spot ETFs simultaneously, which could help create a fair competitive environment. Companies such as BlackRock, Fidelity, WisdomTree, VanEck, and Invesco have all applied to launch Bitcoin spot ETFs. Wood said that due to the similarity of potential funds, the success of each fund will depend on the issuer’s marketing skills. In June of this year, Ark Invest stated that its Bitcoin spot ETF application will be the first to be approved because the investment firm submitted the application to the SEC earlier.

Lazarus Group steals $37 million from CoinsLianGuaiid using fake job opportunities

According to DL News, the hacker group Lazarus Group stole $37 million from CoinsLianGuaiid, an Estonia-based cryptocurrency payment provider, through a six-month social engineering attack.

CoinsLianGuaiid disclosed that in March of this year, engineers at CoinsLianGuaiid received a list of technical infrastructure issues from a so-called “Ukrainian cryptocurrency processing startup.” Between June and July, the engineers received false job invitations. On July 22, an employee, thinking they were interviewing for a lucrative job, downloaded malware as part of a so-called technical test.

The hacker group spent six months learning about CoinsLianGuaiid, including team members, company structure, and all possible details. When the employee downloaded the malicious code, the hackers gained access to CoinsLianGuaiid’s system and then successfully forged authorization requests using software vulnerabilities to extract funds from CoinsLianGuaiid’s hot wallet.

Argent: Users who received prompts need to complete the upgrade before August 21, otherwise there is a risk of asset loss

Starknet wallet Argent tweeted that due to an upgrade in Starknet, some old Starknet accounts also need to be upgraded. The upgrade is scheduled for August 21, and 95% of users will not be affected. However, users who received the update prompt are advised to complete the upgrade before that date to avoid the risk of asset loss.

Tether CTO: Over 325 million USDT has been redeemed today, redemptions must comply with fiat system rules

LianGuaiolo Ardoino, CTO of Tether, tweeted: “Over 325 million USDT has been redeemed today, and many customers have joined and can redeem. There are some FUD about the thoroughness of the Tether onboarding process, such as ‘the process is too difficult,’ ‘users are asked too many questions,’ ‘need to submit many documents.’ In fact, due to Tether’s banking-grade standards, we need basic information such as ‘source of funds.’ Because Tether relies on a strong network of banking partners, it is crucial to ensure proper KYC/AML before attracting customers. If this is not done, all Tether users will face risks.”

Ardoino also stated: “Bitcoin is the only truly decentralized thing. Anything other than Bitcoin, including basically all other cryptocurrencies, is not truly decentralized. Therefore, users are reminded that USDT is not Bitcoin, but a centralized stablecoin that uses a decentralized transmission layer (also known as blockchain). When users redeem USDT, they must comply with the rules of the fiat currency system.”

Forbes: Tether’s failure to disclose Q2 net profit is confusing, as the reported operating profit is significantly lower than the previous quarter’s net profit.

Forbes published an analysis article stating that Tether announced on its website last week that its “operating” profit exceeded $1 billion in the second quarter, a 30% increase from the previous three months. Tether’s first-quarter report stated that its “net profit” was $1.48 billion. Therefore, a 30% increase could bring the quarterly “net profit” for the period ending June 30 to $1.92 billion. However, Tether did not report “net profit” in its latest report. It only reported “operating” profit, which is usually higher than net profit because the company must deduct non-operating expenses, including taxes and interest, to obtain net profit. In this case, Tether’s significantly increased operating profit is clearly nearly $500 million lower than the net profit of the previous quarter. The media accuses Tether of being confusing by not defining operating profit in the announcement and not explaining why it no longer reports net profit as it did in the previous two quarters (net profit was $700 million in the fourth quarter of 2022).

In subsequent comments to Forbes, Tether stated that the operating metrics are “the recurring profit generated by the group’s activities in the second quarter of this year” and “from a financial perspective, the first quarter of 2023 was a very good quarter. The $1.5 billion net profit includes some outstanding performance, such as the revaluation of Bitcoin holdings.” The company was then asked why it changed the reporting metric and how much Bitcoin it owned at the beginning of this year, but the company did not respond.

Warning: Fake tokens related to PYUSD are emerging, investors need to be aware of the risks.

According to Cointelegraph, DexScreener data shows that since the announcement of the new stablecoin PYUSD by LianGuaiyLianGuail yesterday, nearly 30 tokens with the code name “PYUSD” have appeared. These tokens have been minted on various chains such as Binance Smart Chain, Ethereum, and Base. The largest “PYUSD” fake token was minted on Ethereum and was launched a few minutes after the announcement by LianGuaiyLianGuail. Currently, the trading volume of this token has reached $2.6 million.

The media reminds that LianGuaiyLianGuail has explicitly stated that PYUSD can only be sent between verified LianGuaiyLianGuail and other compatible wallets. These fake tokens are likely honeypot scams, which means that once investors purchase these tokens, they will not be able to sell them.

HSBC Hong Kong Responds to “Difficulty Opening Accounts”: Licensed Virtual Asset Operators Can Open Accounts After KYC and AML Review

According to a report by The Standard, in response to the “difficulty faced by technology companies in opening bank accounts,” HSBC Hong Kong’s CEO Diana Cesar said that there may be misunderstandings in communication between operators and banks, but the Hong Kong Monetary Authority and the Securities and Futures Commission have established clear frameworks. If specific conditions are met, licenses can be obtained, and with HSBC’s Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, opening an account with the bank is possible. As for complaints in the market, they should be directed to the operators to see if they comply with regulatory frameworks.

Coinbase Launches Cash Tender Offer for its 2031 Senior Notes, with a Total Purchase Price of up to $150 Million

Coinbase announced that it will commence a cash tender offer (“Tender Offer”) for its 3.625% Senior Notes due 2031, with a total purchase price of up to $150 million (excluding accrued and unpaid interest).

Investors participating in the tender offer and selling their bonds before August 18 will receive $645 for each $1,000 in principal amount (equivalent to $1 per $0.645). This amount includes a $30 special early tender premium. For those selling the bonds after August 18 but before September 1 (the expiration date of the offer), Coinbase will offer $615 for each $1,000 in principal amount (equivalent to $1 per $0.615).

Sino Global Files $67 Million Claim Against FTX/Alameda

According to CoinDesk, Sino Global Capital, represented by Matthew Graham, has filed a $67.3 million claim against FTX Trading Ltd. on behalf of Sino’s Liquid Value fund, which was launched in 2021 in collaboration with Sam Bankman-Fried. The fund aims to raise $200 million, primarily targeting high-net-worth individuals. As of January 2022, the fund has raised $90 million, with FTX being a major investor. The fund focuses on infrastructure and gaming investments.

Investment and Financing

CF Private Equity Plans to Raise at Least $100 Million for its Blockchain Private Equity Fund

According to Blockworks, CF Private Equity (formerly Commonfund Capital), a global private equity investment management company, is preparing to launch its first dedicated blockchain fund, named CF Blockchain Ventures LP, which is designated as a private equity fund rather than a venture capital fund in the filed documents submitted to the SEC in early August. The filing documents indicate an expected fundraising amount of $100 million, but the disclosed figure may only be related to the initial delivery of the fund, and a spokesperson for the company declined to comment.

CF Private Equity is a wholly-owned subsidiary of asset management firm Commonfund. Its business also includes outsourced Chief Investment Officer services, designing custom investment portfolios and funds for institutional investors. Since its inception, CF Private Equity has registered approximately $22 billion in committed capital. According to its website, CF Private Equity has completed over 10 blockchain investments since 2018.

L1 Digital has raised $152 million for its second cryptocurrency venture capital fund.

According to CoinDesk, Zurich-based investment advisor L1 Digital has raised $152 million for its second cryptocurrency venture capital fund. L1D will directly invest 70% of the funds in crypto startups, with the remaining 30% invested in early-stage crypto-focused investment firms. L1D has previously supported renowned industry investors Multicoin Capital, DeFiance Capital, Castle Island Ventures, and 1kx.

Important data

Data: JustLendDAO transferred 200 million USDT, suspected to have been transferred from Sun Yuchen’s personal wallet address to a new address.

According to Whale Alert, 200 million USDT was transferred from JustLendDAO to an unknown address (starting with TT2T17) 45 minutes ago. Adam Cochran, partner at Cinneamhain Ventures, stated that the aforementioned unknown address is Sun Yuchen’s personal wallet, and later the 200 million USDT was transferred to a new address.

Update: According to Coindesk, a spokesperson for Huobi denies that the address starting with “TT2T17” belongs to Sun Yuchen. Coincarp data shows that the address is currently listed as the 8th largest holder of TRX tokens.

Data: DWF Labs transferred 1 million DODO tokens to Binance and still holds 5 million DODO tokens.

According to The Data Nerd, DWF Labs received 6 million unlocked DODO tokens earlier today and, 1 hour ago, during the surge in DODO price, DWF Labs transferred 1 million DODO tokens (equivalent to approximately $172,000) to Binance. Currently, DWF Labs still holds 5 million DODO tokens, equivalent to approximately $810,000.

LianGuaiNews APP Points Mall officially launched

Hardcore prizes for free exchange: imKeyPro hardware wallet, First Class Cabin research report monthly card, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections, first come first served, experience now!

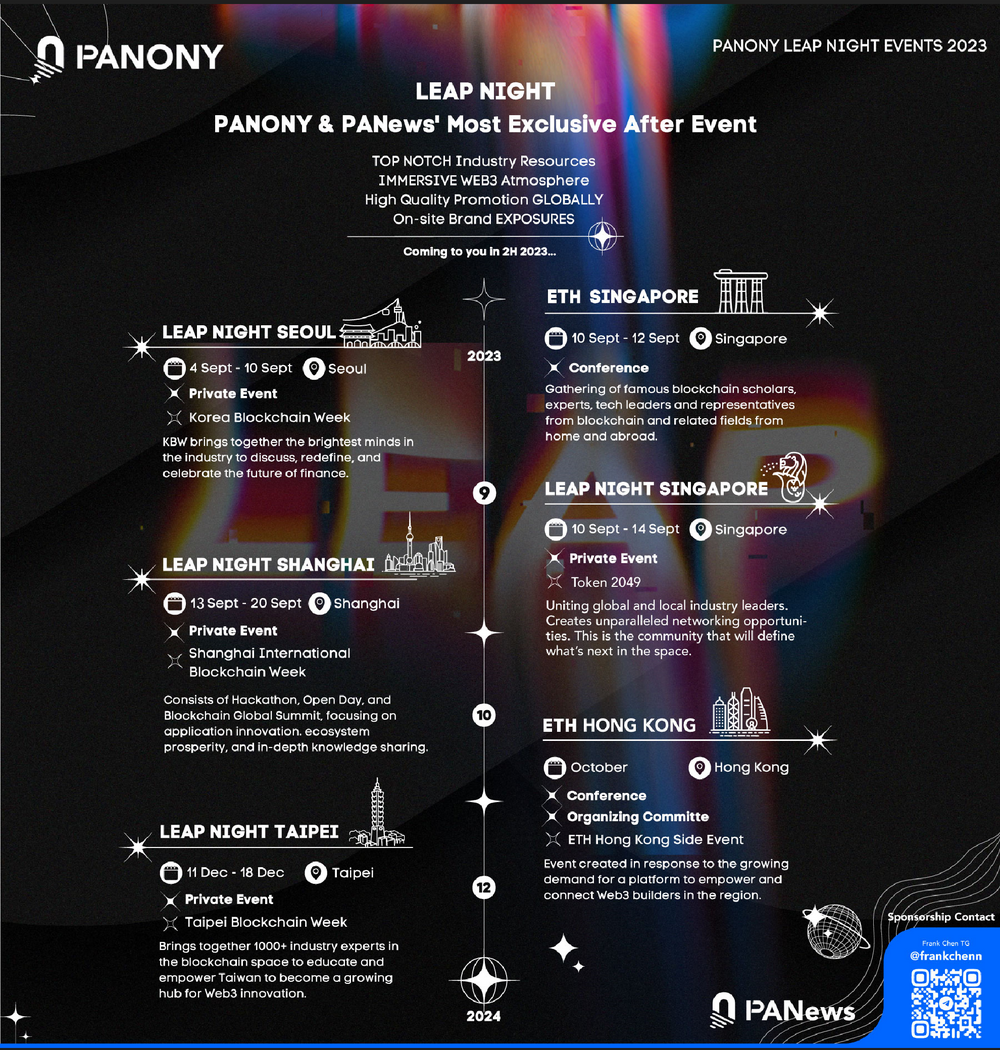

LianGuaiNews launches global LEAP tour!

Korea, Singapore, Shanghai, Taipei, September to December, multiple locations gather to witness a new chapter of globalization!

📥Multiple activities under construction, welcome to communicate!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How will the metaverse truly land? Futureverse raises $54 million to focus on digital infrastructure

- Inventory of 6 projects in ETHGlobal LianGuairis that utilize authentication technology to build voting systems.

- Fit21 Encryption Bill of the Republican Party in the United States Approved for Full Deliberation in the House of Representatives

- From parameter A, examining the technical details and governance philosophy of Curve

- LianGuai Daily | Flashbots raises $60 million in funding; Anthropic, Google, Microsoft, and OpenAI launch cutting-edge model forum.

- Vitalik Buterin Proof of Personhood based on biometric identification is more effective in the short term, but technology based on social graph is more robust in the long term.

- Ethereum Foundation’s 10th AMA Highlights Validator Set, Randomness, DVT, and Technical Direction