LianGuaiWeb3.0 Daily Report | Uniswap has been deployed to the Base network

LianGuaiWeb3.0 Daily Report Uniswap deployed on Base network.DeFi Data

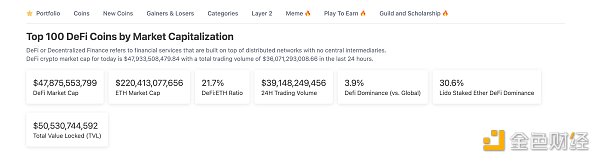

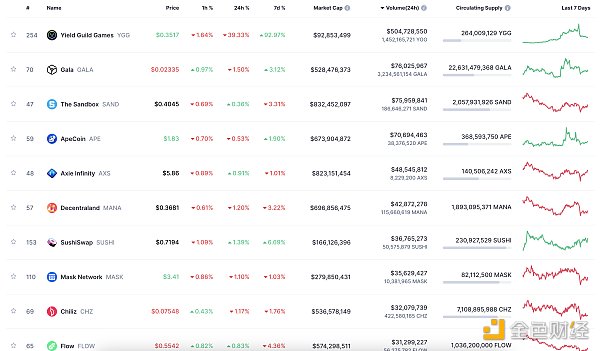

1. Total Market Cap of DeFi Tokens: $47.875 billion

- LianGuai Morning News | Federal Reserve Launches New Regulatory Program, Banks Participating in Cryptocurrency Face Stricter Scrutiny

- Data Analysis ERC-4337 Adoption The Moment of Breakthrough Arrives?

- 3iQ Research Director The stability of LianGuaiyLianGuail stablecoin may trigger competition and force regulatory agencies to take action.

DeFi Total Market Cap and Top 10 Tokens Data Source: Coingecko

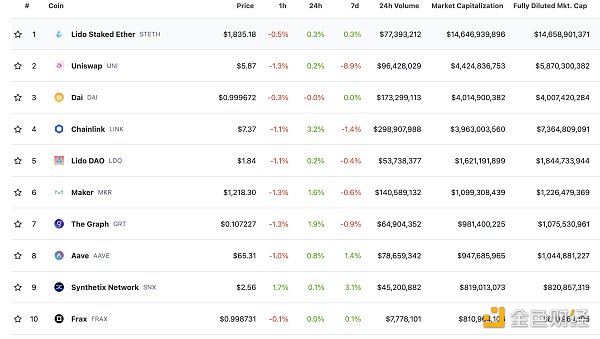

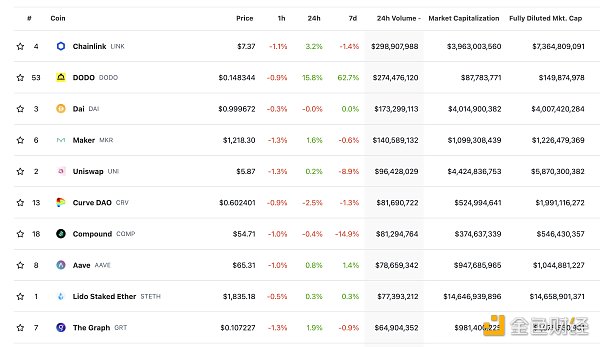

2. Trading Volume of Decentralized Exchanges in the Past 24 Hours: $3.914 billion

Trading Volume of Decentralized Exchanges in the Past 24 Hours Data Source: Coingecko

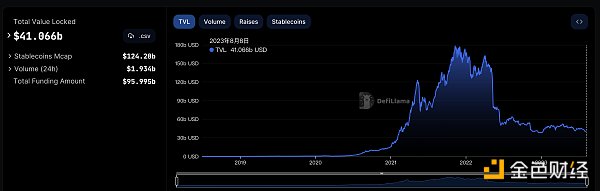

3. Locked Assets in DeFi: $41.066 billion

Data Source: defillama

NFT Data

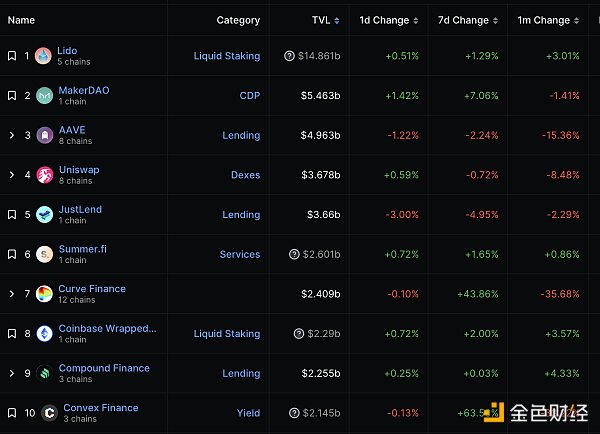

1. Total Market Cap of NFTs: $16.555 billion

Total Market Cap and Top 10 Projects by Market Cap of NFTs Data Source: Coinmarketcap

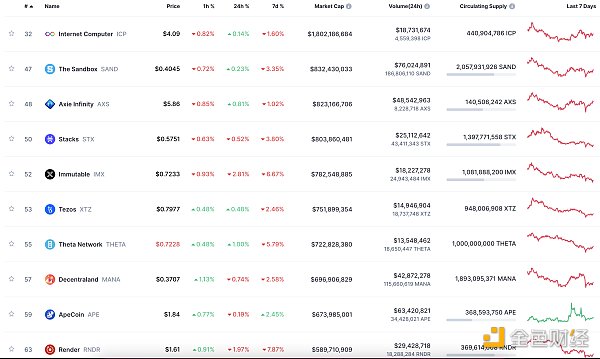

2. 24-hour NFT Trading Volume: $1.581 billion

24-hour NFT Trading Volume and Top 10 Projects by Trading Volume Data Source: Coinmarketcap

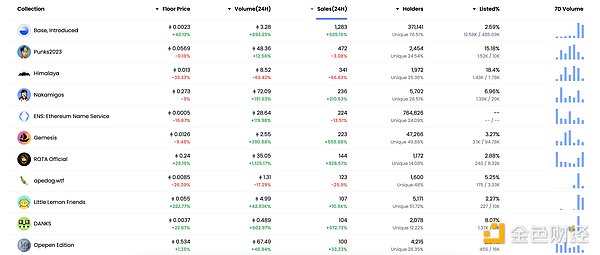

3. Top NFTs in the Past 24 Hours

Top 10 NFTs in Sales in the Past 24 Hours Data Source: NFTGO

Headlines

Uniswap Deployed on Base Network

August 8th news, Uniswap has been deployed on the Coinbase Layer2 network Base, allowing users to directly add liquidity or exchange tokens on the Base network through the Uniswap network application.

NFT/Digital Collectibles Highlights

1. Gala Games Plans to Migrate Existing and Unsold NFT Game Items from Ethereum to GalaChain

LianGuai report, in order to further reduce gas fees on the Ethereum network, blockchain gaming platform Gala Games plans to migrate existing and unsold NFT game items from Ethereum to GalaChain, providing users with a more seamless Web3 gaming experience. As part of this migration activity, Gala Games will also provide players with a batch of NFT blind boxes, each containing three random game items from the Gala Games ecosystem, which can be minted, published, and distributed on GalaChain at no cost.

2. The First Resale of Digital Collectibles Infringement Case in China: “Debt Assignment” Used as Legal Basis for NFT Trading

LianGuai Report: The Sichuan Higher People’s Court has made a final judgment on the dispute over the infringement of the information network dissemination right of works by Hainan Chainbox. This case is considered to be the first time that the People’s Court has responded to the legal nature of NFT resale and whether the resale income belongs to the illegal gains of the infringer. The Sichuan Higher People’s Court believes that the resale of the accused infringing digital collection in this case is not an infringement in the sense of copyright law, and there is no evidence that Chainbox Company has a joint infringement intention with the involved network users in the subsequent transfer of the accused digital collection, or has assisted in the infringement. Therefore, it should not bear the liability for infringement regarding the resale actions of the network users. Analysis believes that the court did not adopt the “digital commodity ownership transfer theory” for the legal nature of NFT transactions, but instead adopted the “debt assignment theory,” which is more in line with the legal essence of NFT transactions. (Zhenjiang Judicial)

3. Income of NFT content creators decreased by 98% from the peak in 2022

LianGuai Report: According to data from Token Terminal, the income of NFT content creators has decreased by 98% from the peak in 2022, and the trading volume of this market has decreased by 95% from January 2022, which was $17 billion. Researchers from Nansen stated that the licensing fees reached a peak of $269 million that month, but in July this year, it was only $4.3 million, because the transaction fees paid for each transaction have dropped from a high of 5% to 0.6%.

Nansen’s data shows that during the boom period from August 2021 to May 2022, the cumulative licensing fees reached $1.5 billion per month, thanks to popular series such as Bored Ape Yacht Club by Yuga Labs Inc. As the NFT market rolls back amidst the decline of stimulus measures in the era of the pandemic, creator expenses have subsequently dropped significantly.

DeFi Highlights

1. Decentralized insurance alternative Nexus Mutual provides insurance for UK shop owners

LianGuai Report: Decentralized startup Nexus Mutual has partnered with mutual insurance organization InShare to bring blockchain-based insurance to real-world risks. Through this collaboration, Nexus will add a portion of its $274 million on-chain capital pool capacity to The Retail Mutual, a mutual organization based in the UK comprising over 5,000 shop owners and small retail businesses.

Nexus provides a total insurance coverage of $2.3 million for risks such as fire, theft, and accidental damage. InShare manages The Retail Mutual and makes all key decisions regarding claims, risk management, and excess coverage. Under the agreement, if The Retail Mutual incurs more than 57% of community donations and a single claim exceeding £200,000 ($255,000) in any given year, Nexus will provide compensation. The Retail Mutual generates an annual income of approximately £2 million ($2.5 million), so if the claim amount exceeds £1.14 million ($1.45 million), Nexus will cover the excess portion.

2. LSD Protocol Puffer Finance Completes $5.5 Million Seed Round Financing

On August 8th, LSD Protocol Puffer Finance completed a $5.5 million seed round financing. The investment was led by Lemniscap and Lightspeed Faction, with participation from Brevan Howard Digital, Bankless Ventures, Animoca Ventures, KuCoin Ventures, DACM, LBK, SNZ, Canonical Crypto, 33DAO, WAGMI33, Concave, and angel investors Lightspeed partner Anand Iyer, Eigen Layer founder Sreeram Kannan, Coinbase Staking Business Manager Frederick Allen, F2pool and Cobo co-founder Godfish, Curve Core Contributor Block Gentleman, President of the North American Blockchain Association Ramble, Eigen Layer Chief Strategy Officer Calvin Liu, Obol Chief Business Officer Richard Malone, and Staking Community Leader Ladislaus von Daniels. The funds raised will be used for further development of Puffer Finance’s open-source project Secure-Signer, which aims to prevent validators from being penalized during the verification process. The project has received a $120,000 grant from the Ethereum Foundation and has core researcher Justin Drake as an advisor.

3. Matter Labs to Make Important Changes to the Behavior of Timestamps, Numbers, and Hashes on the zkSync Era

On August 8th, Antonio, a developer relations engineer at Matter Labs, stated on Github that important changes are being made to the behavior of block.timestamp, block.number, and blockhash on the zkSync Era. Currently, block.timestamp, block.number, and blockhash return the timestamp, number, and hash value of the L1 batch, respectively. After this update, they will return the timestamp, number, and hash value of the L2 block, respectively. Antonio stated that many applications require higher time fidelity, which can be achieved by referencing the L1 batch. With these changes, contracts will be able to time at the L2 block level (generating approximately every few seconds), and this information is already available on the API, but with the new changes, developers will be able to access it directly in smart contracts. We are currently developing this change and will test it internally before moving it to the testnet and the final mainnet.

4. DeBox Releases New Version, Including Introduction of Message List Grouping

LianGuai reported that Web3 instant messaging service provider DeBox has released a major update. The new version includes: fully optimized DApp for enhanced on-chain interaction, providing a seamless experience in the Web3 world; introduction of message list grouping to make it easier for users to manage and filter messages, ensuring a personalized social experience.

5. Base Mainnet TVL Reaches $127 Million, Surpassing Starknet to Enter the Top Five L2

On August 8th, according to L2BEAT data, the Base mainnet TVL reached $127 million, with a growth rate of 55.26% in the past week. It has surpassed Starknet ($110 million) to become the fifth-ranked L2 network in terms of TVL.

Hot Topics in the Gaming Industry

1. CESS Senior Ambassador Andy: DeFi, Gaming, and Content Creator Platforms are the Main Directions for Bringing Web3 Users

During the LianGuai Salon event hosted by LianGuai on August 8th, CESS Senior Ambassador Andy stated in the “Where Will the Next Billion Web3 Users Come From” roundtable conference that there are three main directions for bringing users. First is DeFi. DeFi has two aspects: payments and DEX, which are both essential demands. Stablecoins, especially for cross-border payments, will be very convenient. In the future, trading through DEX is a trend. The second promising track is gaming, as games can integrate well with finance and have a large user base worldwide. The third is content creator platforms. If we look at the apps that can retain customers in Web2.0, such as WeChat, they rely on content to keep users. Therefore, attracting users to Web3.0 will rely on content.

Disclaimer: LianGuai, as a blockchain information platform, publishes articles for informational purposes only and does not constitute actual investment advice. Please establish the correct investment concept and increase risk awareness.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Is DAI’s 8% excess risk-free rate a Ponzi scheme?

- How will the issuance of the US dollar stablecoin PYUSD by LianGuaiyLianGuail impact the cryptocurrency industry?

- Dialogue with Linea Product Manager How does Linea, backed by ConsenSys, achieve progressive decentralization?

- Interpreting the stablecoin PYUSD issued by LianGuaiyLianGuail which trends are worth paying attention to?

- Impact of Curve Finance Vulnerability on MEV Approximately 6000 ETH Earned

- Milestone Moment, Quick Look at LianGuaiyLianGuail USD Stablecoin

- U merchant selling USDT (Tether) got into trouble and was arrested. How to prepare for a criminal defense?