Why are there so many Layer2 chains?

Why are there many Layer2 chains?Author: Leandro Pereira (Sciammarella); Translation: Huohuo/Baihua Blockchain

The second largest cryptocurrency by market capitalization, Ethereum, will undergo a major upgrade to its network by introducing 1 million new Layer 2 scaling solutions.

Layer 2 solutions aim to alleviate the network congestion and high transaction fees that Ethereum has been facing in recent years. This upgrade, called Ethereum Improvement Proposal – EIP 1559, will also introduce a new fee structure that will burn a portion of transaction fees, thereby increasing the value of Ether over time.

The new fee structure will greatly benefit Ether holders. Instead of solely rewarding miners, a portion of the transaction fees will be destroyed, which is expected to reduce the circulating supply of Ether. Over time, this is expected to drive up its value. This new fee structure aims to make transaction fees more stable and predictable, ultimately improving user experience and enabling a broader range of users to use Ethereum.

- LianGuaiWeb3.0 Daily Report | Uniswap has been deployed to the Base network

- LianGuai Morning News | Federal Reserve Launches New Regulatory Program, Banks Participating in Cryptocurrency Face Stricter Scrutiny

- Data Analysis ERC-4337 Adoption The Moment of Breakthrough Arrives?

1. But why do we need so many L2 solutions?

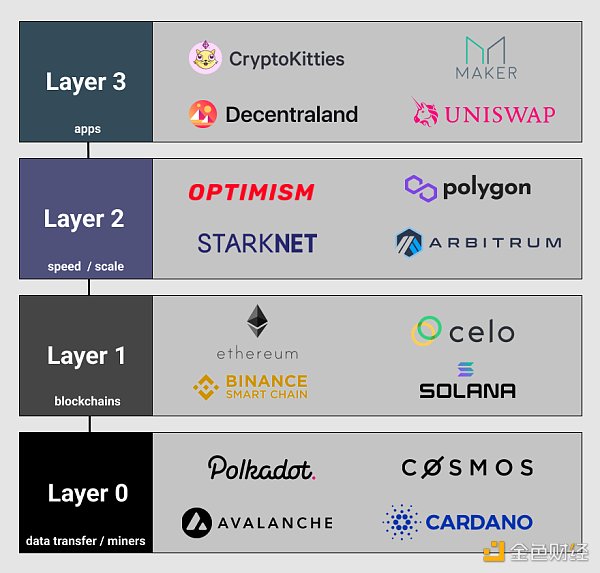

Blockchain is built in layers, each with its specific purpose. The base layer, known as Layer 1, is the foundation of the blockchain network. This is where transactions are processed and recorded on the distributed ledger.

Although secure and decentralized, the first layer blockchain has limitations in scalability and transaction speed due to the consensus mechanism used for verifying transactions. This is where Layer 2 solutions come into play.

Layer 2 refers to auxiliary frameworks or protocols built on top of the base blockchain to enhance transaction speed and scalability. Layer 2 solutions do not directly process transactions on the first layer, but instead handle off-chain transactions before bundling and settling them on the main chain. This helps reduce congestion on the base layer.

Some examples of L2 solutions include state channels, sidechains, and rollups.

-

State channels process off-chain transactions between two parties by opening payment channels.

-

Sidechains are independent blockchains that run in parallel and are linked to the main chain.

-

Rollups batch process off-chain transactions and generate cryptographic proofs to verify transactions on L1.

Blockchain networks such as Cosmos, Polkadot, and Cardano refer to themselves as Layer 0 (L0) because they aim to serve as the foundation for building multiple interconnected blockchains in the network.

These Layer 0 blockchains are specifically optimized to allow different Layer 1 chains and Layer 2 solutions to interact and communicate through the underlying Layer 0 infrastructure.

They also enable developers to create custom L1s for specific use cases, leveraging the shared security and interoperability of the underlying Layer 0. By coordinating cross-chain messaging and transactions, L0 networks can achieve greater overall transaction throughput across the entire blockchain ecosystem.

L0 enables security performance to be obtained from the entire network, rather than each chain having to protect itself in isolation. Therefore, “shared security” can provide stronger guarantees.

Therefore, L0 is not just a single chain, but also the foundation of the blockchain internet.

2. Returning to the advantages of L2…

Some of the main advantages of L2 solutions include:

-

Increased throughput and transaction speed compared to directly conducting transactions on L1. This is crucial for dApp scalability.

-

Lower transaction fees for users compared to paying Gas fees on L1.

-

Enhanced scalability as transaction processing is offloaded from the main chain.

Why is there a proliferation of multiple L2 blockchains instead of a single standardized approach?

What I mean to say is that different use cases – state channels, Plasma, rollups, etc. – each optimize L2 technology for certain types of transactions, assets, or blockchain interactions. There is no one-size-fits-all solution that can fully leverage the best effects.

For example, state channels are best suited for quick microtransactions, e-commerce transactions, and gaming use cases. Some platforms include Raiden Network for Ethereum and Counterfactual for NFT transfers.

Plasma – optimized for more complex smart contracts and applications involving liquidity pools. An example is Polygon Plasma, an Ethereum network scaling solution aimed at improving speed and reducing transaction costs. It works by creating multiple side chains, each capable of independently processing transactions from the main Ethereum blockchain.

Other use cases can include Optimistic Rollups (OR) and ZK-Rollups (ZKR).

Due to the efficiency of bundled transfers, OR is particularly suitable for decentralized exchanges and NFT-focused applications. For example, Synthetix and Loopring utilize Optimistic Rollups. ZKR is well-suited for privacy-focused transactions such as anonymous payments and transfers. Ethereum’s ZKSync 2.0 uses ZK-Rollups for low-cost, private transactions.

Side chains can build faster and more customized blockchains for enterprise use cases. For example, RSK side chains achieve Bitcoin-like functionality through smart contract capabilities, while Validium is suitable for confidential DeFi applications and blockchain interoperability. The privacy protocol Railgun utilizes Validium for anonymity.

As you can see, each type of Layer 2 technology has different purposes. By leveraging methods that are suitable for their target use cases, applications can optimize transaction throughput, costs, and user experience.

By allowing multiple L2 solutions to coexist, there is more room for experimentation, evolution, and customization based on application requirements, avoiding centralized points of failure. If a dominant L2 solution were to fail due to technical issues or hacking attacks, it would severely impact the entire ecosystem. Diversified solutions can help reduce risks.

Applications may need to combine multiple L2s for different parts of their backend or transaction flow. Interoperability achieves this composability.

Different development teams are creating L2 designs simultaneously without a centralized institution enforcing standards. This brings more diversity.

Competition and funding dynamics – each L2 is vying for adoption by dApp developers. This drives innovation as solutions attempt to stand out in the market.

Still in the early stages – blockchain itself is still maturing. Over time, as platforms, technologies, and demands evolve, we are likely to see more integration and standards emerge around L2.

The surge in L2 solutions provides flexibility, reduces systemic risk, and supports customization for this rapidly evolving industry. But in the long run, increasing coordination and interoperability protocols will help bring more structure to this emerging field.

3. There are also challenges

There are some challenges to consider when implementing L2 blockchains:

-

The complexity of design and security considerations increases.

-

Potential security trade-offs and centralization risks depend on L2 design.

-

Fragmentation across multiple L2 solutions instead of a unified ecosystem.

-

Technical barriers for users to adopt new processes for handling transactions.

L2 solutions are crucial for enabling blockchain networks to scale to accommodate greater transaction volume and users. However, integrating L2 in a secure and decentralized manner needs to be considered. In the long run, the right L2 solution can unlock important functionalities and use cases for blockchain.

4. Can we say L1 is consensus and L2 is transactions?

This may be a good way to think about it, but let me provide some additional details:

L1 is where the core consensus mechanism operates, verifying transactions and adding new blocks to the blockchain. It establishes trust and security for the network. However, L1 also handles transactions embedded in the blockchain. The issue is that conducting transactions directly on L1 can be slow and costly due to restrictions like block size and the need to pay high gas fees.

This is where L2 comes in – it first processes transactions off the main blockchain, enabling faster and cheaper transactions.

Therefore, L2 solutions essentially batch many transactions together and settle them using the security of Layer 1, while avoiding its inherent limitations in speed and cost. In this sense, both layers handle transactions, but L2 is optimized for transaction throughput, user experience, and lower costs.

For example, L1 is like the Federal Reserve’s banking settlement system, while L2 is similar to the Visa/Mastercard payment network that interacts with consumers and merchants.

TLDR: Layer 1 handles consensus, security, and some basic level transactions, while Layer 2 specifically addresses transaction scalability. However, they work together to provide the overall utility of blockchain.

5. So, do we need more L2 solutions?

Very simply, my answer is no. In the long run, we may not necessarily need so many L2 solutions to address the surge in the blockchain field. Although diversity and flexibility may be beneficial in the early stages, too many isolated or fragmented Layer 2 protocols could ultimately hinder mainstream adoption.

Ideally, over time, with industry maturity and the emergence of leading practices, there will be more coordination and standardization. This could result in the emergence of mainstream cross-compatible Layer 2 frameworks tailored for certain functionalities such as payments, decentralized trading platforms, NFT applications, etc.

Interoperability standards and modular design will enable these solutions to seamlessly work together. This can provide a good balance between customization, risk reduction, and unified user experience.

All initial Layer 2 experiments may be necessary, but they are not necessarily optimal in the long run. Some standard integration and integration can help unleash the true potential of Layer 2 to extend blockchain technology with flexibility and cohesion across applications.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 3iQ Research Director The stability of LianGuaiyLianGuail stablecoin may trigger competition and force regulatory agencies to take action.

- Is DAI’s 8% excess risk-free rate a Ponzi scheme?

- How will the issuance of the US dollar stablecoin PYUSD by LianGuaiyLianGuail impact the cryptocurrency industry?

- Dialogue with Linea Product Manager How does Linea, backed by ConsenSys, achieve progressive decentralization?

- Interpreting the stablecoin PYUSD issued by LianGuaiyLianGuail which trends are worth paying attention to?

- Impact of Curve Finance Vulnerability on MEV Approximately 6000 ETH Earned

- Milestone Moment, Quick Look at LianGuaiyLianGuail USD Stablecoin