Libra hearings are full of gunpowder: it is difficult for regulators to trust Facebook

Today, after Zuckerberg was “rounded up” by US lawmakers on the data abuse problem exposed by Facebook and Cambridge Analytica, Facebook was “called” today.

This time, Libra digital currency and data privacy issues became the subject of the hearing.

On June 18th, as Facebook released the Libra white paper, the most heavyweight players in the currency circle came into play. Such a big move naturally escapes the vigilance of US regulators. On July 2, after Maxine Waters, the US House of Representatives and Chairman of the House Financial Services Committee, called for a moratorium on Facebook's Libra, other members of Congress joined her.

At 10 am on July 16th, the "Father of Libra" David Marcus answered the series of sharp questions from the US Senate Banking Committee in more than two hours.

- Senior Republican Party: Centralized companies have data leakage risks, blockchain is the best alternative to privacy protection

- Quotes Daily: BTC fell below the $10,000 mark, and the short-selling force gradually fermented

- Facebook hearings 丨 yesterday, today, Libra's road to tomorrow is even harder

(David Marcus at the hearing, from TechCrunch)

Hearing site: full of firepower and tense

The atmosphere at the hearing can be described as "tough". Members of the US Senate Banking Committee publicly expressed that " Facebook is dangerous ", " No one likes Zuckerberg ", " No one here is willing to trust you again ", "Facebook Entering the payment is to make a company that is already too strong stronger." The words have appeared again and again. The main issues that parliamentarians have raised with Marcus include:

- In view of Facebook’s previous “history” of manipulating user privacy data, disregarding news professionalism, and manipulating user sentiment to sell advertisements, we are now asking you to continue to trust you when you are doing the most financial payment you need to trust. ? In the past, what kind of problems did you promise to solve? Which one really solved? If you trust Libra, are you personally willing to put all your assets and salary on it?

- Why put Libra headquarters in Switzerland instead of the US? How does Libra effectively protect consumer data and how to deal with money laundering and terrorist financing, fraud and misappropriation? In particular, Libra is cross-border. If the scammer is from Spain, the result of the fraud is in another country. Which country's laws do you need to protect users? Which legal department does the user have to call?

- Will Facebook allow other digital wallets to be used on the platform? How to deal with competitors?

- What is Libra's business model? Who is responsible for the committee?

Faced with one question, Marcus's overall tone of response continued in the testimony published the day before the hearing: Libra will comply with all US regulations and will not issue coins until the concerns of US legislators are resolved. The specific answers are as follows:

Trust issue . People don't have to trust Facebook because it's just one of the 28 Libra Foundation members and may be just one of 100 or more board members in the future. Facebook has only one vote, Libra is built on an open source system, and Facebook doesn't want or control it.

(28 members of the existing Libra Foundation)

Not only that, Marcus also said that he is willing to put his personal assets and salary on Libra to show his trust in the system.

In addition, Marcus repeated repeatedly from beginning to end, the other reasons that should trust Facebook to do this are:

“Facebook chose to do this not only because it has the resources and the ability to do it, but also because it thinks Libra can be good for the world. Imagine a daughter in another country wanting to send money to her mother, and now she has to pay a high transfer fee. It's been a long time. Libra allows people to transfer money quickly, safely and at low cost, no matter where they are."

Marcus also believes that digital currency is already a big trend. The United States has fallen behind in the real-time payment field. If the United States no longer actively participates and responds, it will risk falling behind in blockchain technology competition. Other countries will As the rise rises, the United States will continue to fall behind.

Not only is Libra's benefits, but Marcus also believes that Libra "can better help more than 90 million business users on Facebook's existing platform reduce payment costs and create more jobs."

Regulatory and User Data Protection | “The Libra Foundation chose to have its headquarters in Switzerland absolutely not to evade any responsibility, and not to evade US regulations… although it is indeed registered in Switzerland, it is also in FinCEN (Financial Crime Enforcement Network) Registered under the management."

As for why you want to register in Switzerland? Marcus' answer is because of Switzerland's "international advantages in the field of international finance… The WTO and the Bank for International Settlements are all in Switzerland.

At the same time, Marcus also stressed that Libra will not be released before the concerns of US regulatory authorities are resolved. The United States should lead the rules of the world's digital currency.

Will it be used for illegal activities such as money laundering and even drug trafficking | "Libra is not an anonymous digital currency, users are not anonymous, to use its digital wallet service, users need to upload real-life identification documents supported by the government, Libra is working with FinCEN (Financial Crime Enforcement Network) work together to solve this problem."

The Libra Association does not have access to consumer users. The Libra system itself has a high standard of security coding, and financial education and consensus principles on how to use digital currency are also embedded in Libra. Libra Encrypted Wallet Calibra direct sales or direct monetization of user data is not “intentional” and if it cooperates with other financial institutions to provide additional financial services, the user will be required to agree to use the data for this purpose.

Business model and monopoly | Libra's revenue will mainly come from two aspects: First, the payment chain of more than 90 million business users on the existing platform on Facebook is faster and lower, and the platform benefits; Second, cooperation with other financial institutions Provide the benefits of additional financial services.

Libra Encrypted Wallet Calibra, while competing with other wallets, will offer users a variety of payment options, including credit cards and bank cards. Calibra will be interoperable so users can send money back and forth with other wallets, and the data will be portable so users can switch to their competitors altogether.

But Marcus also said that in Messenger and Whatsapp, Facebook will only choose to integrate its own Calibra cryptocurrency wallet and refuse to embed a competitive wallet in it. Given the huge user base of Facebook's various applications, this exclusivity can make Calibra more advantageous than banks, PayPal, Coinbase or any other potential wallet developer.

Is Facebook still worth trusting again?

Silicon Valley Insights The deepest feeling after the entire hearing was that members of the US Senate Banking Committee repeatedly turned around in the “we can't trust Facebook again”.

CoinDesk, the authoritative media of the US blockchain, said that the questions raised by the hearing members about Facebook itself are obviously more, and there are few questions about encryption technology and blockchain technology itself. The author believes that this may reflect The distrust of Facebook by lawmakers outweighs the distrust of blockchain technology itself.

Sherrod Brown, who has repeatedly criticized the issue, also admitted in an interview with reporters that it is difficult for Americans to trust a giant company. "Americans don't trust Wall Street, and they now list these big technology companies as "contaminating."

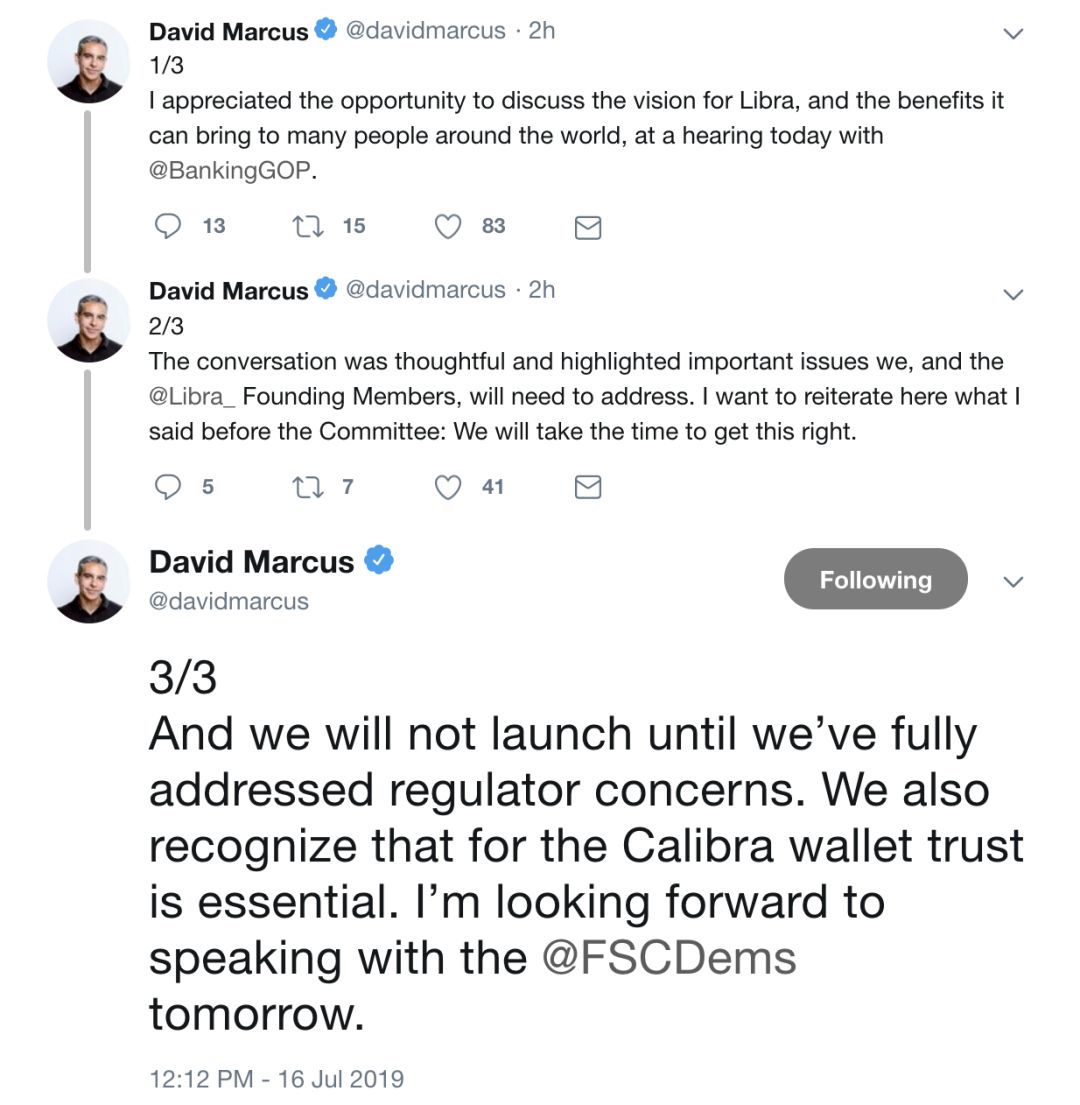

Marcus also sent Twitter after the hearing to re-emphasize: " We will not start Libra until we completely solve the problem of the regulator. We also recognize that trust is crucial for the Calibra wallet. "

Interestingly, regarding Libra's regulation, Marcus mentioned that since the Libra Foundation is registered in Switzerland, questions about user data privacy will naturally be regulated by the Swiss Federal Data Protection and Information Committee (FDPIC).

However, FDPIC spokesperson Hugo Wyler said in an interview with US media CNBC: "Until today, we have not communicated with Libra's sponsors. We hope that Facebook or other Libra promoters will provide us with specific opportunities when the time is right. Real information. Only then can we check the extent of our legal advice and supervision capabilities."

Silicon Valley Insights on the hot spots of the Libra hearings, consulted some of the blockchain practitioners in Silicon Valley.

A friend who is doing blockchain node operation services mentioned that from a technical point of view, Libra uses a PoS consensus mechanism that will bring a decentralized network. The realization of decentralization is that different types of nodes will be motivated by their financial rewards for participating in maintaining the network and confirming transactions. As for how the rate of return is set, whether the rules are decided by all members of the foundation or by the giants led by Facebook is still unknown.

Another industry source suggests that Libra's future compliance costs will only be higher. Because any transfer of funds to a US server must be regulated – even if both parties are outside the US, unless Libra does not have a node in the US, the data is isolated from all data centers in the United States.

However, if Libra does not charge a high fee in the future, it seems that it can only rely on “selling data” to realize the operation of the support system, which will return to the question that they are most questioned by the society and law enforcement.

Libra VS China: The global challenge of digital currency?

At this hearing, Marcus’s view that “the United States is lagging behind in real-time payments, if the United States does not take the initiative to do so, is likely to fall behind”, is easily reminiscent of the domestically ubiquitous mobile phone. Mobile payment.

Facebook's Libra's profit model through the convenience of service platform merchants and the cooperation with third-party financial institutions to provide more services is similar to domestic WeChat and Alipay. In terms of real-time payment, WeChat is a successful example of “social + payment”, but after all, WeChat is only dominated by domestic users. In the end, it is “pay only, not cross-border”, and global socialization is Facebook's best advantage.

So, will Libra enter China?

It is possible, but the possibility is very low. The biggest possibility of having enough volume in China to compete with it is WeChat. Although not international enough, the user base is not half of the total number of Facebook, but the application scenario of WeChat penetration is very powerful. However, all payments on WeChat must rely on the bank and directly use the legal currency. The banking system undertakes the two major businesses of identity authentication and transfer settlement for WeChat payment.

It seems that WeChat's socialization is so powerful that it has not yet shaken the traditional financial model, and Libra poses a direct threat to banks.

Are you optimistic about Libra? What do you think of this Libra hearing? Welcome to leave a message!

Thanks to Silicon Valley Insight Special Author Jin Xia, Susan Wu, and industry figures Xiaohan Zhu and Emily Xu for their contributions to this article.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Six pictures analyze the status quo of stable coins

- Xiao Lei: The renminbi is absent from the libra currency basket, and the purpose of the United States has been achieved.

- Vitalik: Ethereum 2.0 has no unresolved research challenges

- French digital currency regulations will be approved at the end of the month to approve the first batch of legitimate enterprises

- IMF Report: The Rise of Digital Currency

- Bitcoin fluctuates frequently, does it hold money (HODL) or trade?

- Bitcoin fluctuated within a narrow range, and the market once again adjusted back. How did the follow-up market develop?