Libra is accused of being implicated in Bitcoin, and two important intervals determine the future direction of BTC

From the point of view of the downturn, the plunge and the Libra hearing are still strongly related. Although David Marcus, the head of the Libra project, was sufficiently low-key and candid at the congressional hearings, Libra clearly had a lot of doubts from the words of the congressmen, and Facebook’s stains on privately processed data were also Let the lawmakers not want to believe it anymore.

- BTC accelerates, and whether the altcoin should be cleared

- Centralized enterprises have data leakage risk blockchain is the best privacy protection alternative

- Brazil completes its first real estate transaction based on blockchain technology

From Marcus's statement in Congress, we can also feel that Facebook's development of Libra is still in its early stages, and at most it is only a framework idea, but the control of real details may not be clear to them. This may be even more true for the market. Most investors in the market today consider Libra and the cryptocurrency market to be one thing. The US attitude toward Libra also hints at its view of the overall cryptocurrency market. After the hearing last night, the wave of plunge that Bitcoin opened began seems to confirm this view. But what if most people think wrong, if Libra is standing on the opposite side of the cryptocurrency? I didn't think too much about this, just want to trigger investors to think about this issue.

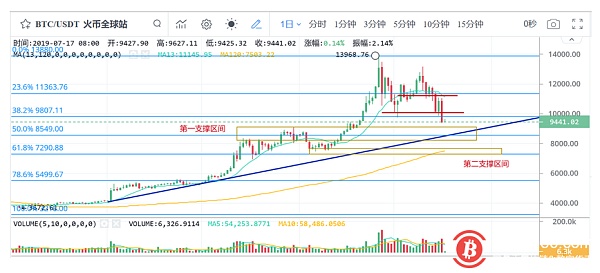

According to general experience, when the market changes, any news may become a catalyst to promote market changes. No matter what the reason for the fall, if you can't recover immediately after falling below the neckline, then the nearby $10,000 will become a strong pressure. In the short term, the price will be back to the neckline, which is an opportunity for investors who are short-term and want to cut meat. The price may then continue downwards, and the 8200-9000 area will constitute the most recent support range. This zone has both a 50% support for the Fibonacci retracement line and an uptrend line formed by the April 2 low line. If this trend line is broken, the 120-day moving average below will become the most recent support. Since the starting point of the 14,000 US dollar sprint since June is also in this area, the possibility of this wave of decline is likely to be around 7500. After that, the price of Bitcoin may stabilize here and begin to develop again.

When Bitcoin fell sharply, the decline in other mainstream currencies was not small. The platform currency was considered to be a relatively resistant variety in the mainstream currency. From a value perspective, platform currency should be an investment choice in a weak market. Since the major trading platforms only act as brokers, as long as the market exists, regardless of whether investors make money or lose money, all major trading platforms are stable. It’s just earning more in the bull market, and earning less when the market is not good. So the value level of the head trade is supported by the currency price. Moreover, each exchange has increased the trading "fuel" attribute of the platform currency. This increases the market demand for platform coins. From this perspective, regardless of the strength of the market, there is always demand for platform coins. This makes the price of the currency always have value support.

Yesterday, Firecoin announced the second quarter repurchase data. According to statistics, the fire coins repurchased a total of 5,366,400 USDT in Q2, an increase of 232% from the previous month. Affected by this, HT has become the most resistant mainstream currency. Moreover, the recent activity of voting on the coins has attracted some investors to hoard HT, but investors also need to be wary of the further downside risks brought by Bitcoin.

BNB has already fallen below the head platform. In the short term, it is no longer suitable for a rebound in the bottom of the game. Waiting patiently for bitcoin to stabilize, there is still a chance behind the head platform. (CoinNess)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Siemens plans to integrate blockchain technology into shared cars

- Xiamen City approved a cross-border financial blockchain service platform pilot

- UK Treasury Secretary: It is up to the regulator to decide how to treat Libra instead of the legislator

- US Treasury Secretary’s blockade of Bitcoin is imminent

- What will happen to Bitcoin in the next financial crisis?

- The Libra hearing will become the key to the success of Bitcoin rebound, and the opportunity to play the short-term game in the cottage currency!

- Large-scale Korean companies such as Samsung and LG will jointly launch a blockchain-based mobile identification system