Bitcoin sees a positive start in July, will it reach $40,000 soon?

Will Bitcoin reach $40,000 soon?Author: BlockingBitpushNews Mary Liu

According to data from the Blocking terminal, the price of Bitcoin broke through $31,000 during Monday’s U.S. stock trading session, triggering bullish sentiment among investors and analysts.

For the past week, speculation about applications for physically-backed Bitcoin ETFs and whether they will be approved by the U.S. Securities and Exchange Commission (SEC) has dominated the headlines. Despite a Wall Street Journal report on Friday that the SEC told several ETF filing applicants that their information was incomplete, leading to an instant drop in Bitcoin’s price, the Chicago Board Options Exchange (Cboe) quickly resubmitted the forms that evening and on Monday, Nasdaq also updated its application form on behalf of BlackRock, both designating Coinbase as a partner for the surveillance sharing agreement.

- Bitcoin welcomes a good start in July, and analysts optimistically predict that it is “inevitable” for it to reach $40,000.

- Bernstein: Possibility of US approving Bitcoin ETF is quite high

- Weekly NFT Market Data Review: Total Market Cap / Floor Price Both Significantly Decreased, Azuki Elementals Boosted Trading Volume

Investment firm CoinShares said on Monday that institutional investors are continuing to pour funds into crypto products, with inflows worth $125 million over the past week, most of which were concentrated in Bitcoin-related funds.

Further rebound to $40,000 “is a must”?

Some analysts believe that, given the current market sentiment, Bitcoin may soon break through the $40,000 mark.

Katie Stockton, founder and managing partner of Fairlead Strategies, predicted on CNBC’s “Squawk Box” that Bitcoin could rise from its current trading price to $36,000 and then reach $40,000.

Ivo Georgiev, CEO of Ambire Wallet, told The Block that although people are concerned about further overall risks, the momentum towards $40,000 should be “easily achievable.”

Meanwhile, Antoni Trenchev, co-founder of Nexo, believes that $32,000 is the next resistance level and that Bitcoin could further soar thereafter. He pointed out that July is typically a good month for digital assets. In a tweet, he said: “It’s easy to forget that Bitcoin has been battered ever since FTX went down, but in early July, we saw it rise by over 80%.”

Trenchev compared Bitcoin’s performance to that of most altcoin markets, saying that altcoins still face the risk of being classified as securities and that this issue will last until at least the end of this year.

He said: “Bitcoin has surpassed the high point in April, while the altcoin market is 20% lower than the level in April and 70% lower than the high point in 2021. Bitcoin does not need to worry about issues such as regulation. At the beginning of the new month and quarter, its resilience and influence make it stand out.”

Antoni Trenchev added: “If the SEC does not take the time to approve one of the spot bitcoin ETFs, it will undoubtedly have a significant impact on the cryptocurrency market.”

Cryptocurrency technical analyst Michael Nauss pointed out that since the historical high point in 2021, the BTC/USD monthly closing price has closed above the adjusted volume-weighted average price (AVWAP) for the first time.

AVWAP examines important support and resistance levels based on traders’ behavior. The June closing price breaking through $30,000 marks a two-year recovery unseen.

Cubic Analytics CEO Caleb Franzen retweeted Nauss’s tweet and called on market observers to extend their time preferences. He pointed out, “When the BlackRock ETF application was announced, the price of Bitcoin was about $26,000 and it rose to a new high since the beginning of the year of more than $31,000. Is the current trading price still above $30,000 because people have lost their minds? No, I predict there will be higher highs and higher lows.”

Bitcoin’s Resilience Can Withstand Macroeconomic Headwinds

Uncertain macroeconomic conditions and inflation, coupled with what appears to be a hawkish Federal Reserve, could create short-term resistance.

US government bond yields adjusted for inflation are on the rise, which has some observers worried about potential risk aversion in stocks and broader financial markets. However, cryptocurrency analysts expect bitcoin and digital assets to remain generally resilient.

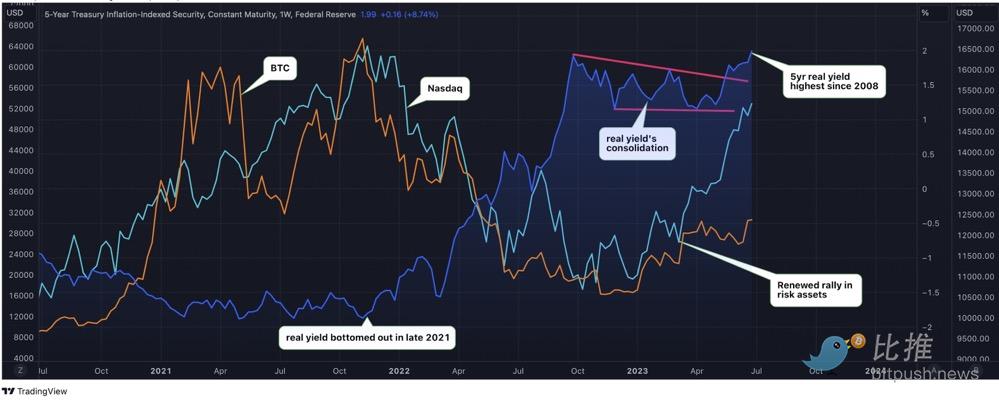

According to data tracked by TradingView, the real yield on 5-year government bonds rose to nearly 2% last week, surpassing the high point of 1.92% in September 2022 and reaching the highest level since the end of 2008. The 10-year Treasury yield is 1.6%, which is very close to the data in 2009. At the same time, the real yield on two-year government bonds has reached 3%, the highest level in at least a decade.

The rise in US bond yields may curb economic growth and reduce the attractiveness of risk assets such as Bitcoin and gold. Bitcoin and the tech-heavy Nasdaq index on Wall Street have historically moved opposite to the direction of US bond yields.

Richard Usher, head of OTC trading at crypto bank BCB Group, believes that the recent surge in US bond yields is a problem for stocks, not digital assets.

Most macro traders who are sensitive to changes in US bond yields left the cryptocurrency market during last year’s crash, leaving “long-term holders” in control of the market. Usher wrote in his article: “US bond yields are now a true substitute for the stock risk market. The question is which type of investor this return is attractive to, typical investors in cryptocurrencies or tech stocks are seeking higher potential returns or are making long-term investments in the industry or asset class. Therefore, I believe that the rise in US bond yields is more of a headache for blue-chip stocks than for markets such as technology or cryptocurrencies, and will not disrupt the mid-term growth narrative.”

Ben Lilly, a cryptocurrency economist at Jarvis Labs, told Coindesk that in the long run, increasing costs could actually bring more capital to production sectors such as blockchain. Lilly said: “This just shows the normal trend of capital costs. When traditional markets become rough, many people tend to focus on the cryptocurrency industry and see it as a way to increase productivity. I expect this to bring more funds to innovative areas such as smart contracts, programmable currencies, and DeFi, which are expected to increase productivity.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis of the Cryptocurrency Market in India: Bitbns Surpasses WazirX to Become the Top Exchange, Total Trading Volume Shrinks by over 80%

- Top 10 events in the cryptocurrency market in the first half of 2023

- Wu’s Weekly Picks: HSBC launches cryptocurrency ETF, US SEC rejects spot ETF application, Azuki criticized by community, and top 10 news (June 24-30)

- US SEC: Applications for Bitcoin spot ETFs submitted by companies such as BlackRock and Fidelity are insufficient.

- Three days after listing, trading volume is lackluster. The first-ever leveraged BTC ETF in the US did not have a good start.

- Everyone asks Vitalik: BCH culture has made progress, MPC wallet has fundamental flaws, and the farthest distance traveled on foot is 113 kilometers.

- High Open and Low Close: Did the first leveraged BTC ETF in the United States disappoint the market?