Binance Chain L2 pioneering application MEKE to start public testing on July 31st

MEKE, a pioneering application on Binance Chain L2, will begin public testing on July 31st.Only by sowing seeds in winter can we see the saplings of hope in spring. Although the entire cryptocurrency market is still in winter, it is also the best time to sow seeds. During this period of silence in the cryptocurrency market, although the overall market value of cryptocurrencies has not increased significantly, innovative and disruptive blockchain projects have been working hard, waiting for the outbreak when spring comes.

Especially in the L2, DeFi, and RWA fields, some extremely outstanding blockchain applications have emerged. Projects such as Optimism, Arbitrum, and ZKsync in the L2 field have not only greatly improved the operational performance of blockchain, but also brought considerable surprises to early participants. The emergence of Uniswap V4 in the DeFi field, as well as the achievements of Compound, Maker, and others in the RWA field, have also brought great progress to the entire industry.

Speaking of the RWA field again, it is closely related to the DeFi field. Because most projects entering the RWA field are DeFi-related projects, projects such as Compound and Maker, which are related to RWA, are well-established DeFi projects. Because of the characteristics of DeFi such as openness, transparency, and immutability, it can not only be used in the field of encrypted assets, but also serve as an excellent tool to connect encrypted assets with real-world assets, opening the door to RWA.

The maturity of the L2, DeFi, and RWA fields will undoubtedly give birth to disruptive blockchain applications. After years of precipitation,

- Involved in a transaction of 400 billion yuan, how do law enforcement agencies dispose of confiscated cryptocurrencies?

- How will the five market makers improve the liquidity of WLD compared to Zero as a market maker for PEPE?

- Analyzing UNI Long-tail Liquidity Scenarios How Does it Work?

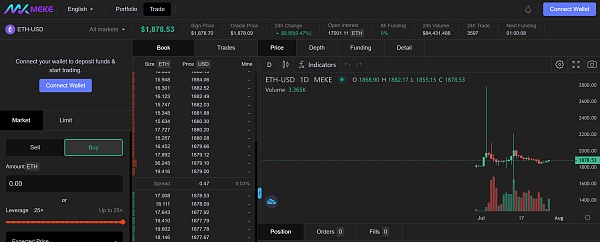

a derivative protocol called MEKE has seen this point. MEKE focuses on derivative trading and combines advantages such as L2 technology and the RWA field. This product not only has a trading experience comparable to centralized perpetual contract exchanges, allowing trading of various mainstream encrypted assets’ perpetual contracts, but also plans to launch on-chain perpetual contracts for real-world assets. Moreover, this product has already been deployed on the OpBNB test network and is the first decentralized derivative trading protocol on the known OPBNB blockchain.

In the entire cryptocurrency financial field, the spot market is clearly saturated. However, the development of the cryptocurrency derivatives trading market is not too deep, harboring enough energy to produce another leading cryptocurrency application.

The MEKE team comes from the United States. At the beginning of its development, with nearly ten years of financial market experience among team members, MEKE strongly recognized that the cryptocurrency derivatives track will be a huge track with a market value far exceeding spot trading.

In the field of cryptocurrency derivatives market, there is an average daily trading volume of nearly hundreds of billions of US dollars, and the trading volume of perpetual contracts has been stable at more than twice that of spot trading in the past two years. However, from the perspective of the overall financial market rules, the derivatives trading market is generally several times to dozens of times that of spot trading. Taking the global oil market with the largest amount of capital as an example, the trading volume of WTI and Brent futures contracts on the ICE and NYMEX exchanges can reach several billion barrels per day, while the global demand for oil is about 100 million barrels per day; the futures trading volume exceeds the daily oil consumption by more than 25 times. It can be imagined that the market potential of currently available cryptocurrency derivatives is only a small fraction of what it could be.

As a decentralized derivatives trading platform, MEKE has unique features that distinguish it from other platforms. Its highlights include the security and transparency of decentralized trading, as well as the smooth experience comparable to centralized exchanges. Even if you are new to cryptocurrency trading, you can quickly get started with MEKE and smoothly engage in cryptocurrency perpetual contract trading. This provides strong momentum for MEKE’s market promotion and is also one of MEKE’s main competitive advantages.

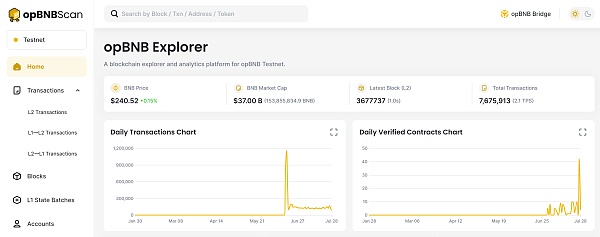

After the birth of opBNB, the Layer 2 network of the Binance Smart Chain, the team decided to deploy MEKE on opBNB. OpBNB is the latest Layer 2 network developed by the core technical team of the Binance ecosystem for the Binance Smart Chain. As the Layer 2 network of the Binance Smart Chain under the Binance ecosystem, this chain has considerable traffic support. Technically, this Layer 2 network can achieve 4500+ TPS and transaction fees as low as $0.005Gas per transaction. MEKE has been successfully deployed on the opBNB testnet and has undergone an audit by CertiK, a leading global blockchain security company. It has been officially confirmed that MEKE will launch its public beta test on July 31st, 7:00 (UTC).

MEKE has prepared multiple rewards for users participating in the public beta test. By participating in the MEKE public beta test, users can not only experience MEKE’s top-notch trading experience early on and learn about the latest global cryptocurrency derivatives trading platform, but also receive MEKE token airdrops, as well as fee dividends and fee reductions after MEKE’s official launch.

Subscribe to the MEKE official community to stay updated on the latest developments and public beta test:

Official website:

https://meke.io

Discord:

https://discord.gg/meke

Telegram:

https://t.me/MEKE_Global

Twitter:

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- African Gold Rush I Help Chinese People with Worldcoin KYC, Earning Up to 20,000 RMB per Day

- Is the concern about Worldcoin groundless?

- Conversation with LianGuai Founder Pan Zhixiong How do Buidlers work?

- Aztec Decentralized Sequencer Solution Analysis Proposal B52 and Proposal Fernet

- Full text of the judgment Bybit payroll officer embezzles public funds, Singapore court determines the property nature of cryptocurrency

- After a massive layoff of 73%, will the 3A blockbuster Star Atlas, which was born in a bull market, still be launched as scheduled?

- Exploring the issue of chain nativity bias Is ZK really suitable for transactions?