MEV vs. Flashbots: A Story of Natural Rivals and the Delicate Balance of Building DeFi Systems

MEV vs. Flashbots: A Tale of Rivals and Delicate DeFi SystemsOriginal article: “MEV and Flashbots: The Uniquely DeFi Tale” by 0xFishylosopher

Translation by Deep Tide TechFlow

Introduction

MEV, or Maximum Extractable Value, is a byproduct of blockchain design and a unique DeFi phenomenon.

- From Wealth Effect to Organic Growth: Revealing the Secrets to the Success of High-Quality Cryptocurrency Projects

- HyperCycle: An innovative blockchain architecture for AI algorithm data

- Project Research | Canvas: Focused on DeFi, Layer2 Protocol Based on StareWare ZK Rollups

Essentially, MEV is just an example of profit-maximizing behavior, where validators operating on the blockchain seek to maximize their profit on validating transaction tasks. Although some argue that MEV can be beneficial by increasing capital efficiency, it significantly affects the user experience of using decentralized applications, including higher gas fees, slippage, and risks of validator collusion and centralization.

In this article, 0xFishylosopher will first explore MEV as a theoretical concept and the systemic risks it poses to the ecosystem. Following that, using Flashbots as a case study, we will discuss how the DeFi community is attempting to address all these negative externalities of MEV.

The “Flash Boys” Club

MEV is a feature of blockchain technology, not a bug. In a given blockchain network, validators (or miners in the traditional PoW model) decide which data to put on the chain. Specifically, they can control the order in which data is put on the chain. It turns out that certain transactions give validators enormous profits. Therefore, as rational economic agents, validators will arrange transactions in a way that maximizes transaction fees.

The concept of MEV was first articulated in detail by smart contract researcher Phil Dainan in an important paper called “Flash Boys 2.0,” in which the researchers emphasized the existence of a large number of robots and arbitrage agents attempting to “predict and exploit” DEX transactions of ordinary users, similar to high-frequency traders in traditional finance aggressively optimizing trading latency. To understand the scale of this phenomenon, in just the past 24 hours of writing this article, 2578 ETH, or approximately $4.9 million at current prices, were profitably extracted through MEV operations.

While MEV is a catch-all term that includes many different arbitrage methods and scenarios, several key features underpin many MEV opportunities in DeFi. First, many MEV is achieved through the process of “Priority Gas Auctions” (PGA), where users can pay higher transaction (gas) fees to have their transactions run first. Since many arbitrage robots rely on having their transactions run first to make a profit, these robots will participate in gas bidding wars, continually driving up prices to have their transactions run by validators, resulting in severe network congestion that prevents ordinary users from running their transactions unless they also pay exorbitant transaction fees.

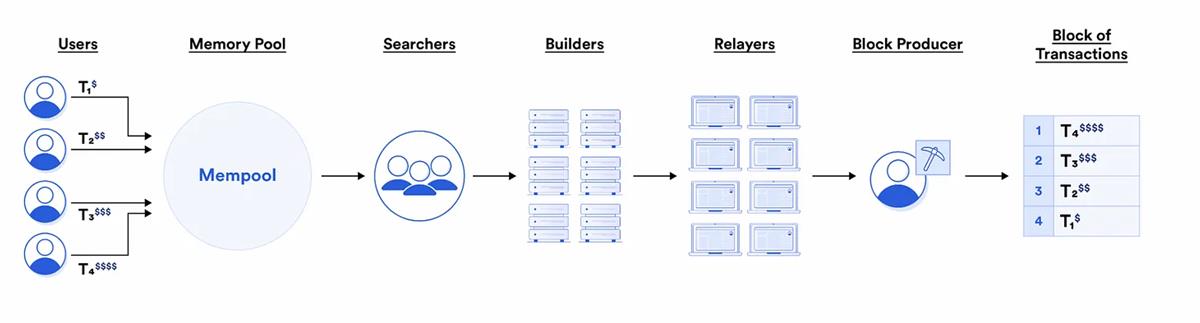

On the other hand, validators are one of the main beneficiaries of this situation. In fact, the more power, the more profit: because validators (at least in theory) have the power to decide which transactions to run, they can earn “ordering optimization” fees by determining which transactions bring them the most cash. However, in practice, it is too cumbersome to let validators complete the entire MEV search, packaging, and execution process. Therefore, most of the “ordering optimization” is outsourced to specialized searchers, builders, and relays, who can be thought of as validators’ “secretaries” who simplify the MEV process to get a share of the profit. Specifically, searchers will look for MEV opportunities, builders will bundle these opportunities into complete “blocks,” and relays will send these complete “blocks” to validators or actual block builders. Therefore, the overall situation of the modern MEV ecosystem is as follows:

As we mentioned earlier, while the arbitrage enabled by MEV can bring some benefits, including higher capital efficiency and ensuring price consistency across different exchanges, there may be significant negative externalities for end users, such as higher transaction fees, slower execution speeds, and higher slippage (such as sandwich attacks). However, this is not the greatest risk that MEV poses to blockchains — especially if validators collude, MEV may actually undermine the security of the blockchain consensus layer.

This security issue stems from the problem of incentive adjustment — among all these profitable MEV opportunities, miners can earn more profit by optimizing transaction fees rather than sticking to a constant block reward subsidy. As Dainan wrote:

Therefore, miners can fork a high-fee block, retaining some fees to attract other miners to build on that fork. In extreme cases, deviations from the protocol’s incentives can lead to strategic confusion among economically rational miners, thereby reducing the security provided by block confirmation.

This is called an “undercutting attack,” one of several ways in which MEV may undermine the basic security of blockchains. Other known attacks include “time bandit attacks,” in which validators do not collude to steal profitable transactions from the current block, but rather rewrite MEV opportunities from past history through collusion. In addition, MEV extraction does not even need to be done on-chain, as it can be done through off-chain backdoor transactions, such as those between large traders and validators.

Therefore, we can see that MEV practices face significant risks in the blockchain ecosystem.

Flashbots and the War on MEV

Given the potential serious consequences of unrestricted MEV, several projects and teams have been dedicated to mitigating the negative externalities of this practice. One of the most important teams in this field is Flashbots, a project dedicated to re-aligning MEV incentives in a way that both adequately rewards validators for building the chain honestly and mitigates the worst impacts for regular users.

To this end, Flashbots attempts to take three distinct steps: (1) shining a light on the “dark forest” of MEV, (2) democratizing MEV extraction, and (3) re-allocating the benefits back to the ecosystem. To achieve the first goal, Flashbots has a dedicated product called MEV-inspect, which aims to “shine a light” on the “dark forest” of MEV, quantify the negative externalities caused by MEV, and highlight the scale of the problem.

The goals of democratizing MEV extraction and re-allocating benefits, on the other hand, are more complex and involve a whole suite of products that are gradually developed as the problem scope and focus changes. In some ways, it could be said that Flashbots’ product development history over the past two years is itself a timeline of Ethereum growth and development.

The first significant product release from Flashbots was the MEV-Geth client, a modified version of Ethereum Golang that better prevents MEV manipulation by routing it to a private transaction pool. On top of this new client, a MEV auction market was built using the “first-price sealed-bid” method (also known as “blind bidding”), where each participant is only allowed to submit one price, and auction participants do not know the price of the other participants’ bids. Through this design, Flashbots mitigated the “price bidding” war discussed earlier.

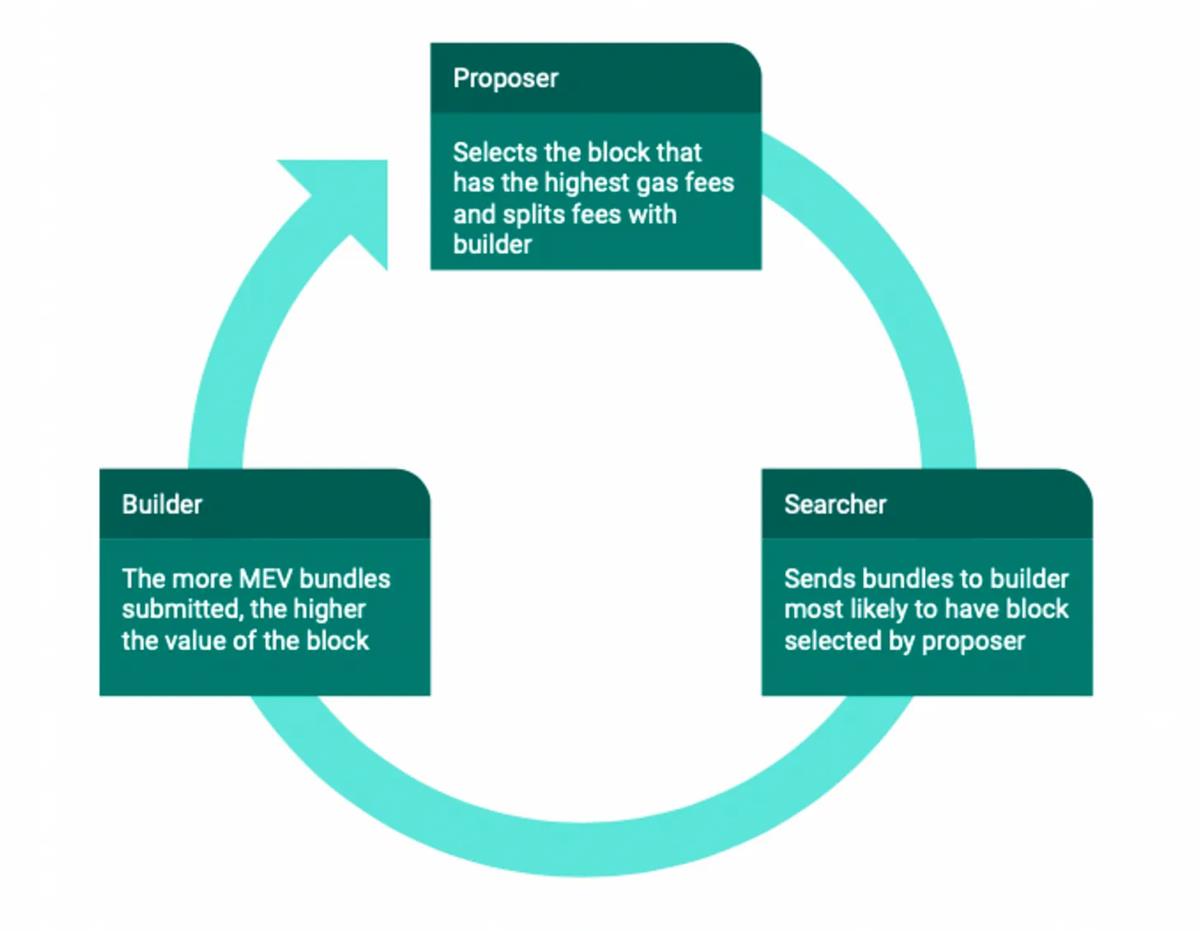

The guiding principle behind the creation of MEV-Geth and the MEV market is to disperse the power and responsibility of validators building blocks themselves through an incentive realignment process called “proposer-builder separation.” Validators using the MEV auction do not have to go through the complex process of MEV search and transaction packaging, but can simply look at the MEV market to find which transactions will provide them with the highest MEV and place a single bid that reflects their actual preference. Additionally, to prevent validators from including their own transactions and profiting from front-running user transactions, actual transaction details (buy orders, sell orders, settlements, etc.) are not disclosed until after block construction is complete.

So why would validators use this algorithm and give up the profitable MEV opportunities mentioned earlier? This is because the Flashbots algorithm only needs to select MEV transactions from the market, which is easier and cheaper for validators. As more and more high-quality MEV transactions pass through this market rather than directly on-chain, validators who stick with Flashbots can get higher returns. The result is impressive: shortly after the release of MEV-Geth, over 90% of Ethereum validators began using this solution, demonstrating the importance and effectiveness of incentive realignment in addressing potential issues. However, as the Ethereum ecosystem evolves and transitions from a Proof of Work (PoW) model to a Proof of Stake (PoS) model starting in September 2022, the change of this concept based on “proposer-builder separation” also becomes inevitable.

The main reason why PoS is more efficient than PoW is that in PoW, each node must build and propose blocks from scratch, while in PoS, only a few validators act as primary block proposers to append data to the blockchain. While this is good for the environment and computational efficiency, it may create additional centralization risks due to the attractive nature of MEV, especially if validators (“proposers”) collude with critical “builders” on the sell side of the market. Even the private transaction pool run by Flashbots themselves may be tempted by collusion, and of course, placing trust in a single entity (such as Flashbots) goes against the decentralized ideal.

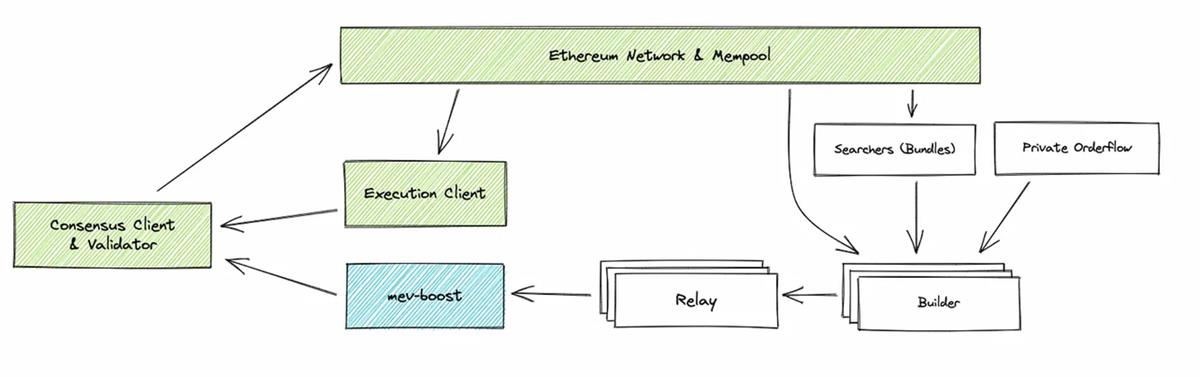

The release of MEV-boost decentralizes the “supply side” of this MEV market. MEV-boost not only includes transactions in the Flashbots private transaction pool (effectively a monopoly), but also allows any builder running this software to submit transactions to all participating validators. For validators, this makes them earn more income as more builders participate in building all these different blocks, and balances which validators can access which transactions, building a stronger and more secure ecosystem. Like MEV-Geth, this novel design realigns incentives from multiple parties to avoid centralization risks and has been hugely successful, with over 85% of the network adopting this design, of which Flashbots only passes 34% of the transactions.

Flashbots SUAVE

So far, the task of mitigating all centralized risks to make decentralized finance immune to the most harmful effects of MEV has not been completed. By implementing proposer-builder separation, Flashbots’ solution has already decentralized or redirected the critical powers and responsibilities of validators to “builders,” introducing these “builders” as entities distinct from validators who select transactions. However, there are significant builder economies of scale in practice, which in turn lead to centralization risks for the builder role.

So what do builder economies of scale look like? Recall that searchers, builders, and relayers all play different roles, with searchers searching for MEV opportunities and then sending them to builders, who then send full blocks to relayers. This means that searchers must choose who to send results to. To maximize their return, they will choose the highest quality builders, whose transactions are most often selected by validators. As more and more high-quality transactions flow to top builders, a centralization effect is created, where top builders will always receive the highest quality MEV transactions from searchers, thereby solidifying their position.

Empirical evidence shows that this builder centralization effect exists. In the past 24 hours as of writing this article, the top 5 builders proposed about 90% of the total MEV-Boosted blocks. As this centralization intensifies, these oligarchs may begin to use their dominant position to manipulate transactions, including colluding and reviewing certain transactions, which could once again jeopardize the security of the underlying blockchain. This is the motivation behind Flashbots’ latest project: a single unified auction for expressing value, which aims to dissolve the block-building process from any single blockchain and outsource it to a separate network, decentralizing the role of block builders.

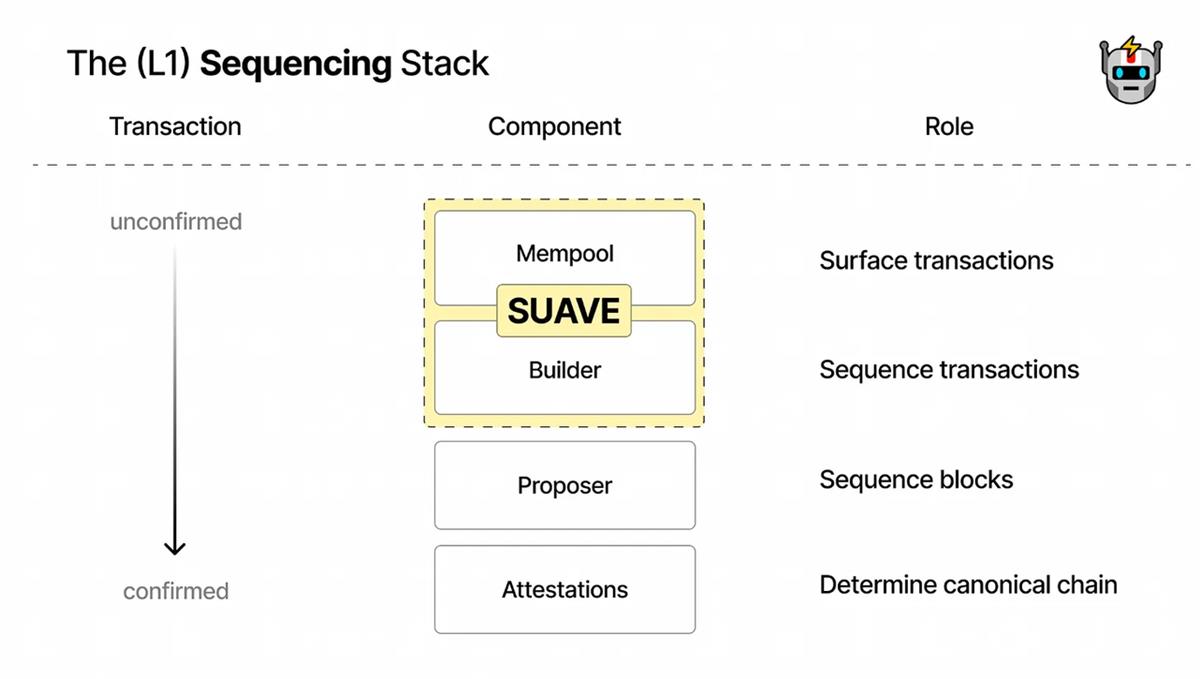

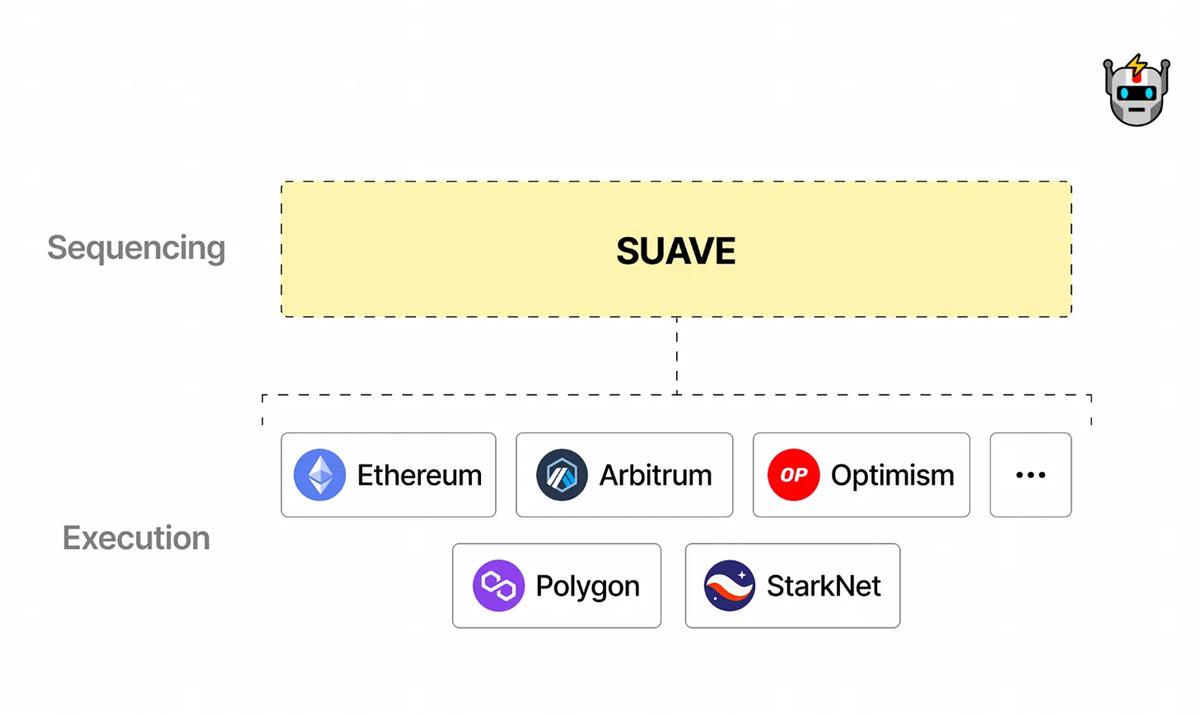

SUAVE is actually a standalone, dedicated block ordering chain that will be responsible for the transaction memory pool and the builder role, while the native chain’s validators (such as Ethereum) will be responsible for the proposer and proof roles. As we have seen, SUAVE is a natural extension of the proposer-builder separation principle, where we put proposers and builders on two completely independent chains so that they are both sufficiently decentralized and separated from each other. In addition, the vision for SUAVE is that it will serve as a universal ordering layer for many different chains, so that whether you are a validator for Ethereum, Arbitrum, Polygon, or any other EVM chain, you can use SUAVE to find the best MEV opportunities not only for your native chain, but also for cross-chain MEV trades that can only be obtained by looking at the transaction memory pool of that chain.

Despite SUAVE’s grand vision of ultimately benefiting all parties involved and making the Ethereum ecosystem more decentralized, there are still some key design issues that need to be addressed in the six months since its founding in November 2022. One core issue is whether to build SUAVE as a standalone L1 chain (similar to Chainlink), use a Rollup solution, or “borrow” Ethereum validators’ re-staking services like Eigenlayer. Each solution has its unique trade-offs in terms of implementation convenience, validator retention, security, and flexibility, which we will not discuss in detail here.

Another core issue is whether SUAVE will release its own token. Although the SUAVE forum currently denies that it will “temporarily” launch its own token and continues to use ETH as its native token on-chain, there are several questions, namely whether Flashbots will insist on this, especially since in the long run, launching a SUAVE token seems to be the most economical choice for Flashbots as a private company. Additionally, it can be fairly argued that Flashbots’ belief that it can raise a unicorn valuation of $1 billion in a bear market is due to the implicit promise of future SUAVE token releases.

So, what is stopping Flashbots from announcing that it is launching a SUAVE token? As it turns out, launching a token brings several headache-inducing design decisions. For example, is this token useful for certain transactions, or is it just “another token used for governance”? If this token will have utility, what will that utility look like? How to incentivize Flashbots’ different stakeholders (such as different chains, end-users, builders on Flashbots, etc.) to use and trust this new token instead of more mature tokens like ETH or L2 tokens like ARB? In any case, a complex incentive alignment process needs to be addressed, so the Flashbots team is entirely justified in temporarily avoiding this issue.

Beyond Flashbots: The Big Picture of DeFi’s Future

While it is still too early to tell what form SUAVE will ultimately take and whether this brand new sortition chain will be able to achieve its initial goals and adjust incentives in a truly mitigating way to MEV’s negative externalities, I believe that MEV and Flashbots represent typical images of the trade-offs, problems, and principles involved in designing truly decentralized financial systems.

First, as previously mentioned, MEV is a feature of blockchain technology, not a bug. These arbitrage opportunities and validator profit incentives stem from the instant accessibility of the blockchain and ensure capital efficiency in DeFi. The negative impacts of MEV, including network congestion, gas wars, and end-user slippage, are merely byproducts and negative externalities of this process.

By definition, negative externalities do not affect the agents who engage in negative behavior. In this case, causing network congestion and slippage for end-users does not harm validators or arbitrage bots engaging in this profitable behavior. In traditional economics, purely market-based systems do not deal well with all these externalities. Traditionally, governments or other regulatory bodies intervene to correct market dynamics and minimize the impact of negative externalities (e.g. taxing tobacco and alcohol).

On the other hand, DeFi is essentially trustless and opposed to any form of human government enforcement. Its closest “enforcement agency” achieves determinism and transparency through coding rules and regulations (e.g. via smart contracts). Therefore, as demonstrated by the story of Flashbots, reducing the negative externalities of MEV always depends on a complex process of incentive redesign and alignment. After all, like Wall Street quant traders, DeFi arbitrage bots are not known for high ethical standards and good intentions.

Using incentive redesign to reduce the negative externalities of MEV is not just an internal feature of the Flashbots team. In addition to Flashbots, many other teams are trying to readjust incentives and develop protocols to reduce the impact of MEV. For example, Chainlink’s Fair Sequencing Service (FSS) uses its decentralized oracle network to outsource the “transaction ordering” process to validators, achieving a similar goal to the SUAVE network. Another example is the “Coincidence of Wants” (CoW) mechanism on the CoW protocol (formerly Gnosis Chain), which automatically glues transactions together based on whether they are complementary (e.g. I want to swap 1500 USDC for 1 ETH, and you want to swap 1 ETH for 1500 USDC) and uses solver algorithms to ensure that everyone trades at the optimal price.

However, redesigning incentives in a trustless, decentralized setting where no single party is trusted can be a very difficult task, as fundamentally, you’re trying to counteract economies of scale. For example, in the case of Flashbots’ Builder Centralization, builders who have already “proved their worth” are more likely to be “trusted” by searchers, who will give them more high-quality trades and cement their position as market leaders. Identifying, addressing, and implementing decentralized alternatives through incentive realignment is essentially playing a game of “whack-a-mole” – you never know what centralized vulnerabilities and hidden economies of scale might be lurking in any newly introduced incentive system, all of which only make sense in hindsight.

Furthermore, in a complex system with many different stakeholders and agents, such as a blockchain, it is virtually impossible to avoid externalities, as there will almost certainly be a corner where one stakeholder’s actions spill over and affect another stakeholder’s actions. As shown by Dainan in “Flash Boys v2.0,” many of these externalities may constitute a real threat, undermining the stability of the entire system. As a result, any decentralized system – even those with well-designed game theory – will always have this inherent complexity, subtlety, and fragility, where an unexpected loophole could threaten its existence.

Compared with centralized systems, decentralized systems do not contain any obvious “single point of failure” – but it is precisely this that sometimes makes decentralized systems more powerful than their centralized counterparts. If there is a flaw in the system design, every node has the potential to become a “single point of failure.”

Finally, the story of MEV and Flashbots tells us that maintaining the health of decentralized systems always requires continuous, arduous efforts – continuous participation in the “whack-a-mole” game. Trust diffusion in decentralized systems requires responsible and vigilant diffusion, especially because there are so many economic incentives at stake: whether good or bad, MEV always exists.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Neutron: A new cross-chain DeFi blockchain on Cosmos

- Standing at the forefront of the Meme trend, how did Ben become a cryptocurrency legend from an unknown person?

- 4.5BTC night market quote video analysis

- What is the problem with the current peak game of players less than 3 ‰ of Steam?

- Axie Infinity, a cute blockchain game

- Can 2020 games become a solution to the blockchain game?

- Blockchain + football: is grass or leeks on the green field?