MEME Coin: From Internet Meme to a Market Cap of Over One Billion, What’s Behind the Power?

MEME Coin: How an Internet Meme Became a Billion-Dollar Cryptocurrency

Author: Daniel Li, CoinVoice

As digital technologies and applications continue to emerge and change people’s lifestyles and ways of thinking, new cultural forms and modes of communication are also being born. Among them, meme culture, characterized by derivation, resonance, and viral replication, has gradually emerged in this context. Initially, memes were just Internet jokes or memes, but with the integration of memes and the crypto world, MEME coins, as a new type of crypto asset, are rapidly emerging. From “meme” to a market value of over 100 million, MEME coins once again demonstrate the unlimited potential of the crypto market, and also arouse people’s exploration and reflection on the power behind MEME coins. So, what is driving the rise of MEME coins? This article will delve into the background, development history, and power behind MEME coins, revealing the mystery behind this phenomenon.

From Internet Culture to Crypto Market: The Development History of MEME Coins

The origins of MEME coins can be traced back to 2013 when an anonymous developer created a crypto asset based on Bitcoin blockchain technology called MEME. Its name comes from “Internet Meme” and aims to combine Internet culture with crypto assets. MEME’s original goal was to become a fun digital currency that uses Internet elements such as memes and emojis to attract more people to participate in the crypto asset market. With the rise of social media, memes have attracted more and more attention, and MEME coins have gradually moved from Internet culture to the crypto market. Today, MEME coins have become an important force in the crypto market, and the development of MEME coins can be roughly divided into the following stages:

Starting phase (2009-2013): In this period, some of the earliest MEME coins, such as Catcoin and Coino, did not have specific goals or purposes. They mainly relied on social media promotion to attract users and did not attract widespread attention in the entire crypto market. It wasn’t until the emergence of DOGE coins that MEME coins truly gained recognition in the crypto market. DOGE coins were initially just a joke, but because of their cute dog image and the tenacious mode of Internet culture, they quickly became popular on the social platform Reddit. As DOGE coins gradually gained acceptance, a large number of MEME coins with dogs as elements also emerged, further demonstrating the characteristics of meme viral replication. In this period, the MEME coin community was very active, and through the spread of Internet social channels, MEME coins began to gradually rise in the crypto industry.

- When AI meets blockchain: ushering in a new era of human-machine integration

- What are the recent movements of Crypto VCs? 7 tools to help you easily track

- a16z partner jonlai: the most successful application is the packaged game

Development Stage (2013-2017): With the development of the cryptocurrency market, more and more MEME tokens began to emerge. In addition to DOGE coins with dogs as the theme, other MEME coins with different themes appeared on the market, such as Pepe Cash with Pepe the Frog as the theme, Nyancoin with cats as the theme, and BlockingndaCoin with pandas as the theme. These tokens are usually promoted through social media to attract users and have become part of internet culture to some extent. During this period, MEME tokens began to gradually receive market attention. In addition, the emergence of some innovative market mechanisms, such as decentralized exchanges and airdrops, also provided assistance to the development of the MEME market.

Maturity Stage (2017-2020): The maturity stage is an important stage in the development of MEMEs. In this period, the capitalization level of the MEME market has been significantly improved, and some MEME coins with high market values have gradually become star tokens on the market, such as DOGE coins and Pepe Cash. In addition, some MEME coins can also obtain huge financing through ICOs, such as BAT (Basic Attention Token) and GNT (Golem Network Token). In this stage, MEME tokens began to explore community governance models to better manage projects and attract more users. At the same time, some tokens also began to establish their own ecosystems and application scenarios to promote token usage and appreciation.

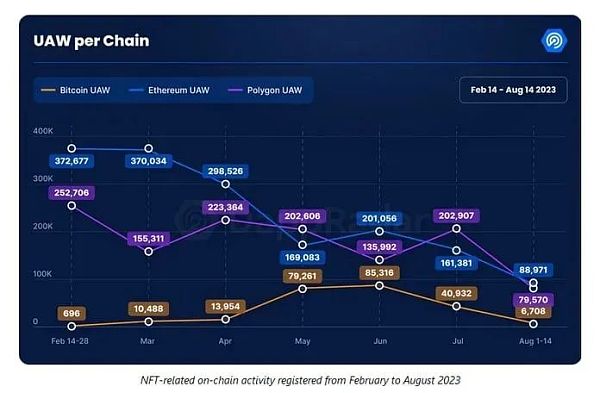

Boom Stage (2020-2023): Thanks to the promotion of MEME community members and the gradual maturity of the MEME market, the market value of MEME tokens has also created new highs. Among them, DOGE, as a representative of MEME coins, reached an all-time high price of $0.74 in April 2021, with a total market value of nearly $50 billion. At the same time, in this period, MEME coins began to explore new fields and application directions, such as NFT-based games and art collections, and the use of blockchain technology to solve social problems, such as decentralized management and identity verification. These new ideas and gameplay have brought new development directions and ideas to the entire cryptocurrency asset industry.

New round of hype period (after 2023): The current MEME coin market is experiencing a new round of hype. As the biggest dark horse this year, PEPE coin has gained a market value of $1 billion and 107,000 holders in just 23 days, breaking the record previously held by DOGE and SHIB coins and becoming the fastest-growing MEME token in the history of cryptocurrency assets. In addition, this round of MEME coin hype has also expanded to the Bitcoin market for the first time. ORDI, the first BRC-20 token established on the Bitcoin blockchain, quickly reached a market value of nearly $1 billion after listing on mainstream exchanges. BRC-20 is a replaceable token standard established on the Bitcoin blockchain, and it has been used to mint 8,500 different tokens, most of which are MEME coins. It can be foreseen that the next MEME season may occur in the Bitcoin market.

From internet culture to celebrity coins, the rise of MEME

Whether it’s the early DOOGE or the recent hot Pepe and Aidoge, these MEME coins that can break through have common characteristics, and these characteristics are the fundamental reasons why the currency circle can continue to emerge MEME coins that are on fire.

Fair distribution

In the early stages of the MEME project, most tokens were distributed for free through community activities and creative mining. This distribution model is fair and attractive. It attracts more users to join, forming a large and active community, and also improves the liquidity of tokens. Because more people hold tokens, the supply on the market has also increased, which promotes the increase in trading volume and price. For the initial MEME project, this free and fair distribution model can also increase visibility and promotion, attracting more investors to enter the market.

In addition, MEME coins also use concepts similar to “miners”, such as “AI miners” in AIDOGO coins and “Frog Miners” in Pepe coins. These miners can receive rewards based on their contributions, encouraging users to actively participate in the project. This reward mechanism can effectively stimulate the behavior of community members, increase their investment and support for the project.

Extremely low investment price and super high expected returns

Compared with mainstream value coins, the price of MEME is very low, and the vast majority are below $1. The extremely low price allows users to buy billions of MEME tokens for very little money. For those who want to try cryptocurrency investment but have limited funds, MEME coins are a very attractive choice.

The price of MEME coins fluctuates greatly, often rising or falling ten times due to a hot event. Therefore, for most MEME coin users who hold a small amount of funds, the probability of achieving small bets with MEME coins is much higher than that of traditional mainstream value coins. Even if they fail, they will only lose a few hundred or a few thousand dollars, but once they succeed, they are very likely to achieve financial freedom. This is why even though there are a large number of scattered users who are harvested every time MEME coins are on fire, they cannot stop their enthusiasm for investment. For most crypto speculation users, MEME coins are like a lottery in the crypto industry. No one can refuse the opportunity to pay a small price for a chance of high returns, even though this opportunity is very small.

Powerful Narrative

MEME coin is a typical case of narrative-driven finance, and its success is largely attributed to the power of narrative. The narrative mode of MEME coin includes: derivative narrative, related narrative and counter-narrative, and the innovation and application of these modes have provided crucial support for the rapid spread and popularity of MEME coin.

Derivative narrative refers to the narrative of MEME coin originating from existing cultural or media materials, creating new MEME images and stories through secondary creation and adaptation of these materials. This narrative mode mainly relies on acute grasping of popular culture and network culture and creative adaptation ability. For example, Dogecoin’s image comes from the widely circulated funny dog head expression package on the Internet, and the creator applies this image to digital currency and promotes it on social media, making Dogecoin quickly popular on social media.

Related narrative refers to the narrative of MEME coin associated with a specific event or theme, creating unique MEME images and stories by humorous, humorous or satirical interpretation and expression of this event or theme. This narrative mode mainly depends on the creator’s insight and creative expression ability for the event or theme. For example, ArbDoge AI (AIDOGE) uses the hottest topic in the current market, combining “AI” and “Doge” to create a digital currency image with interesting and creative features, and through social media promotion, AIDOGE quickly attracts a large number of users’ attention.

Counter-narrative refers to the narrative of MEME coin creating MEME images and stories with strong social criticism significance through irony or criticism of a phenomenon or event. This narrative mode mainly depends on the creator’s deep observation of social phenomena and human weaknesses and critical spirit. For example, PepeCoin is created by secondary creation and adaptation of the common “Pepe the Frog” image in Internet culture, creating a digital currency image with irony and criticism color, aiming to deeply reflect and criticize some problems in modern society.

Community Promotion and Creative Marketing

Community promotion can not only increase community interaction and participation, but also improve token liquidity and value. The creators and community members of MEME coin attract more users to join the community and expand the user base and token liquidity through various online and offline activities, such as airdrops, social media interaction, and mining. For example, mining mechanisms such as “AI Miners” in AIDOGO coin and “Frog Miners” in Pepe coin can reward users based on their contributions, encouraging community members to actively participate in the project and increase their investment and support. This mechanism of encouraging community participation can effectively increase community activity and cohesion, thereby enhancing the value of the token.

In addition, MEME coin is also very creative in design and marketing. For example, by combining popular elements with cryptocurrencies, it has attracted the interest and attention of more young people and social media users. These design and marketing strategies have made MEME coin a fun investment choice, attracting more investors to participate. For example, Punk Comics (PUNK) is an NFT-based digital collectible game. The project combines pixel art, comics, and games to design a series of unique pixel characters and comic characters. These pixel characters and comic characters represent different superheroes and villains, such as Spider-Man, Iron Man, and Hulk. The marketing approach of PUNK, which combines the most popular cultural elements and art, has quickly gained high topicality and investment attractiveness in the market.

The Problems Exposed by the Fading Meme Craze

Under the Meme craze led by PEPE, the Meme market has presented a hot scene this year. The prices of many Meme coins have risen by more than 1000% in just one day, but this wave of enthusiasm has quickly faded away. In just one week, the price of PEPE has fallen by nearly 65%. This short-lived frenzy and rapid decline reveal many problems that the current Meme market is facing. Although Meme coins have attracted the attention of mainstream institutions and investors, there is still a large gap compared to mainstream value coins.

First, the biggest challenge for the development of MeMe coin is the bubble risk. Taking PEPE as an example, its rapid rise and fall in a very short time exposed the bubble risk of the current MeMe market. Driven by investors’ FOMO emotions, excessive speculation may lead to overpricing. In addition, some bad actors manipulate the MeMe coin market to manipulate prices, further exacerbating the bubble risk. Therefore, MeMe coins need to take measures to prevent excessive price fluctuations, such as strengthening supervision, increasing transparency of exchanges, etc., to regulate market order.

Secondly, the lack of practical application scenarios is also an important challenge for the development of the MeMe market. Currently, the application scenarios of MeMe coins in real life are relatively few, which limits their actual market value and makes it difficult to attract more users. In contrast, mainstream value coins have been widely used in various fields, such as cross-border payments, international trade, financial investment, etc., with a stable market foundation and high market recognition. Since MEME coins lack actual application scenarios, their value is difficult to be quantified, making them extremely susceptible to market sentiment when there are fluctuations in the cryptocurrency market.

In addition, compared with mainstream value coins, MeMe coins have not yet gained enough recognition and trust. The issuance mechanism, governance structure, and transparency of exchanges of MeMe coins still need to be improved. In order to gain wider recognition, MeMe coins need to establish a connection with mainstream cryptocurrencies (such as Bitcoin, Ethereum, etc.) and achieve interoperability through cross-chain technology. At the same time, MeMe coins also need to create their own unique brand and Internet culture connotation to distinguish themselves from other cryptocurrencies.

In summary, although the MeMe market was once booming in the short term, with the decline of the trend, the problems exposed by the market have become more and more obvious. Bubble risk, lack of application scenarios, and insufficient recognition pose challenges to the development of the MeMe market. To achieve sustainable and stable development, MeMe coins need to continuously improve themselves, strengthen their connection with mainstream value coins, and play a greater role in actual application scenarios.

Summary

In the MEME coin frenzy, people’s awareness and demand for cryptocurrency have been fully demonstrated. Although the value of MEME coins stems from their unique social culture and network effects, their success also reflects people’s widespread recognition of cryptocurrency. Although there are many imperfections in the current MEME coin, new and interesting MEME coins continue to emerge, providing new possibilities and innovative directions for the application of blockchain. As the saying goes, “no progress without change,” future MEME coins need to go through continuous innovation, shock, and fluctuation to stand firm. We look forward to MEME coins becoming an open digital economy that integrates technology, culture, economy, and other elements in the near future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How Blockchain Is Impacting Online Poker

- Blockchain in the annual report of listed companies: a comparative analysis of six state-owned banks

- More than 60 organizations in Europe and the United States jointly developed: Rehabilitation Certificate for New Coronavirus Patients Based on Blockchain

- Blockchain war "epidemic" action (1): big data application

- Observation | Is the open source of the blockchain the biggest flaw in the business model or the strongest defense?

- Video: Blockchain opens a new chapter in medical health (Part 1)

- Video: Blockchain opens a new chapter in medical health (Part 2)