Miners must read: 8 tips to help you achieve long-term mining profitability

Source | Hackernoon

Translation | First Class (First.VIP)

Bitcoin and other cryptocurrency mining has always been a volatile industry. Mining profits have been changing, factors such as network difficulty, price fluctuations and halving are constantly changing mining revenues.

To further complicate matters, these factors have different effects on each mining machine. Given that the capital return of the mining industry usually takes 6 months to two years, and mining conditions can change rapidly during this period and may interfere with your calculations, we would like to introduce here the best strategies for profiting.

- Zhongxiang Bit is strict: no blockchain technology team can make it without 50 people

- Science | What is the valid balance of validators in Ethereum 2.0

- Babbitt Interview | Jamie Burke, Founder of Outlier Ventures: We have been in the industry blockchain for 6 years

1. If you can't get cheap electricity, your mining work is at risk

Electricity cost is the most important factor in mining and it has a decisive effect on mining revenue. Many miners face losses every time the price of tokens drops significantly or the difficulty of the network increases.

If your power and maintenance costs are high, you are one of the most vulnerable groups. And those miners with cheap electricity are always in a safe and profitable area.

Now, in China, Russia, Georgia and other countries, many mining electricity can reach $ 0.03- $ 0.04 per kilowatt. If your electricity price is much higher than this number, then you will face a high risk.

2. Constantly upgrade your equipment to more energy efficient equipment

Even in a bull market, Bitcoin's difficulty has almost always grown faster than its price. This means that mining revenues have generally been declining.

The price of Bitcoin jumped from $ 220 in August 2015 to $ 19,500 in December 2017, which is about 89 times.

But surprisingly, the difficulty of the network increased by 120 times during the same period! This means that when the price of Bitcoin is $ 200, the profit from mining is higher than the profit generated at $ 19,500.

Bitcoin price chart vs network difficulty

In order to avoid losing in this marathon, be sure to purchase newer and more energy efficient equipment and use part of the profits to replace the old mining equipment.

3. Buy a mining machine when Bitcoin price pulls back

The price of a mining machine is highly dependent on the price of the cryptocurrency. When Bitcoin reached $ 3,000 at the end of 2018, the price of ASIC miners dropped sharply, even more than Bitcoin, and this was the best time to buy a miner. When Bitcoin jumped from US $ 3,000 to US $ 14,000 in June 2019, the price of mining machines increased by more than six times.

4. Don't ignore BCH and BSV

BCH and BSV mining algorithms are similar to Bitcoin's SHA256. Sometimes mining these coins is more profitable than Bitcoin. For example, at the time of writing, every Terahash can generate $ 0.175 from Bitcoin mining in 24 hours, and mining BSV can generate $ 0.181, an increase of 3.5%. If we deduct electricity bills from mining revenue, we will find that the gap is even larger. Suppose you have an S17 53 Terahash miner with 2400 watts of PSU, and you only pay $ 0.06 per kWh.

Therefore, after deducting electricity costs, if Bitcoin is mined, the miner can generate $ 5.82 per day, while mining BSV can generate $ 6.14 per day, an increase of 5.5%. On older, less efficient devices, this difference is even greater. However, given the fluctuations in the price of these tokens, the most profitable currencies often change.

Some applications will automatically switch the miner to the most profitable token. In addition, some mining pools also support automatic switching of computing power.

5. Pay attention to halving

In May 2020, Bitcoin will be halved for the third time, and mining will be reduced from 12.5 Bitcoins to 6.25 Bitcoins. This will make many miners obsolete. The current profitable mining machine may not be profitable after halving, and the energy-efficient mining machine will suffer less halving losses.

However, some risky miners have invested in cheaper equipment, which consumes more energy and has a shorter payback period. Such miners have acquired original capital before halving and have purchased new energy-saving equipment after halving— — This is a smart and risky action.

6. Digging altcoins may be more profitable, but the risks are also higher

The altcoin is much more volatile than bitcoin, so before you buy a miner, carefully study its prospects. It is best not to invest all your money in one type of altcoin.

The value of some altcoins has fallen 99% in 2018! Some altcoins resisted ASIC miners and tried to invalidate ASIC mining by changing algorithms.

Decreasing or halving the price of altcoins will affect the mining of other altcoins using the same algorithm. For example, Litecoin, Verge, Digibyte, Doge, and several other tokens use the Scrypt algorithm. Litecoin currently has most of the Scrypt computing power.

Litecoin's halving took place in August 2019, and its mining profitability halved will cause miners to switch from Litecoin to other tokens using the Scrypt algorithm, which will greatly increase the difficulty of other networks.

I don't like GPU miners and think they will be as outdated as CPUs.

Although the current profit is not high, GPU mining is usually not as easy as ASIC mining.

7. Develop a sales strategy or convert it into a promising token

To get the most out of mining, you need to develop a clear strategy: determine when and how to sell the mined tokens and pay for maintenance costs. This requires conducting token research, analyzing futures and prices, and obtaining some technical analysis information.

You can choose to hold or convert the token in your hand into a more promising currency and sell it at a higher price at the appropriate time to get more profit from mining.

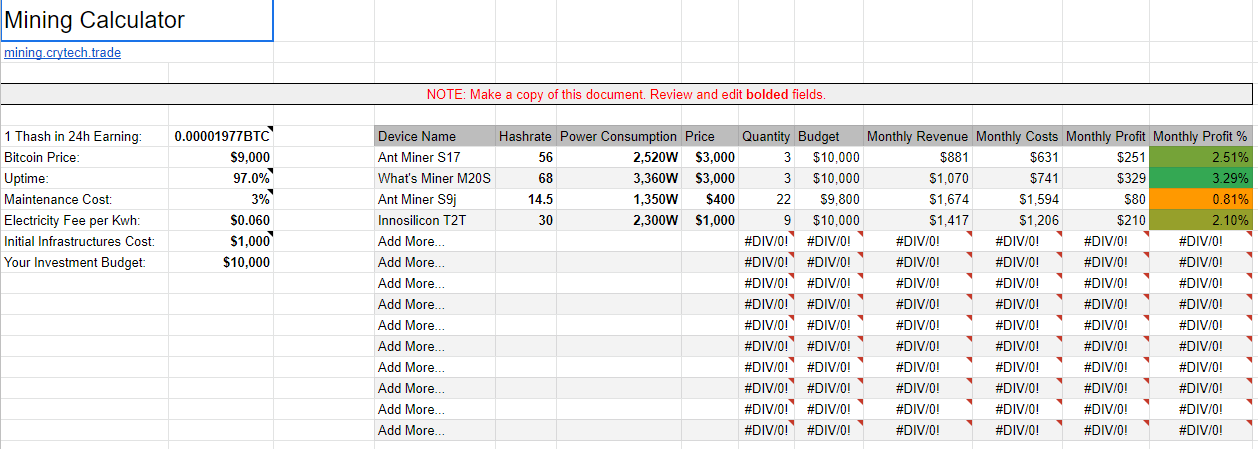

8. Don't be fooled by the mining calculator

Many websites calculate mining profits based on hardware and electricity prices. If you have never mined before, you may be happy to see the numbers provided by these websites and calculators and think, "I will make a fortune!"

However, these sites do not tell you: in addition to the cost of electricity, there may be other current costs, such as maintenance, cooling, rent, labor, etc. Generally, the hash rate and power consumption of the device are slightly different from what the factory says.

This difference is more common in unpopular brands. You can better understand the actual hash rate and actual power consumption by watching the mining machine test video on YouTube. In addition, depending on the distance from the meter to the device and the type of cable used, the power loss from the meter to the device may be as high as 200 watts.

In addition to the cost of the mining machine, preparing the infrastructure also requires paying some initial costs, such as cooling and exhaust, cable wiring and power distribution, shelves, network and monitoring equipment, security measures, etc.

The difficulty of the network is constantly changing and increasing at a significant rate, which directly affects mining revenue. You can check the Bitcoin network difficulty chart to understand its growth rate, but your miner will not always be 100% active.

Due to maintenance, network problems, mining pool problems, power problems, and many other issues, the mining machine may be offline for several hours. I suggest that you consider setting the mining machine uptime to less than 97% when calculating. We have rich mining experience in professional mining pools, and the uptime of these mining machines will not exceed 97-98%.

Create your Excel spreadsheet and consider all the factors that affect mining. Like this:

Conclusion

Profiting from mining is not always easy, but that doesn't mean it's not worth it. If you want or are doing it, you need to be prepared and plan for the future. Enter the market at the right time, buy mining machines at the right time, pay attention to its risks and countermeasures. From a small scale, you may even need to exit on the way, sell equipment and wait for another suitable time to enter again.

Reprinted please retain copyright information.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The vision of Twitter CEO's social network: Decentralized network is the original intention, and the advent of blockchain rekindled the "hope" in my heart

- Fidelity Digital Assets: UTXO Model Leads to Overvaluation of Bitcoin's Real Trading Volume

- Blockchain startup Upvest secures $ 7.8 million in Series A funding, targeting "10 trillion euros" alternative investment asset class

- Theory and Practice of Decentralized Organization (DAO): Conceptualization and Classification of DAO

- China wins two-thirds of Bitcoin's computing power share, with 54% of its computing power in Sichuan

- Science | The total number of Bitcoin private keys is 2 to the power of 256. How big is this number?

- Layer 3 middle layer: a new engine for Web 3.0 development?