Mint Ventures: Concerns about MakerDao go beyond RWA exposure

Mint Ventures: Concerns about MakerDao extend beyond RWA exposure.This issue of Clips focuses on the RWA leader and DeFi blue-chip project MakerDao, which has recently gained popularity. The author attempts to analyze the internal and external factors behind the rise of MKR, and evaluate its advantages, challenges, and long-term hidden risks from the perspective of Maker’s business.

The following article represents the author’s phased view as of the time of publication, and may contain factual errors and biases. It is for discussion purposes only, and we also look forward to corrections from other investment research peers.

1. The rebound in MKR price: The result of the resonance of many factors

Recently, the secondary market prices of old DeFi have rebounded significantly, with Compound and MakerDao showing the most significant increase. Although the big rise of Compound has the background of the founder Robert Leshner’s second entrepreneurship in the RWA track, this event has limited impact on the fundamental impact of Compound, and the rise of Comp belongs more to “uprooting”, which is not of much analytical value.

The rise of MKR is driven by a combination of internal and external factors, including the logic of fundamental business reversal and the long-term vision of the Endgame plan.

- Introduction to Words3, the Full-Chain Game: A Word Chain Game Developed Based on MUD.

- Arbitrum and the Dawn of a New Era: Exploring Ethereum’s Cancun Upgrade and the Future of $ARB

- Founder of Folius Ventures: 8 Insights on the Development of the Cryptocurrency Field

Specifically, the driving forces behind the recent rise of MKR include:

1. The monthly expenses of the protocol have decreased, and the monthly expenses have fallen from the previous 5 or 6 million US dollars to around 2 million in June.

Maker’s token transfer payment statistics, image source: https://makerburn.com/#/expenses/accounting

2. Changing the collateral from interest-free stablecoins to national debt or stablecoin financial management has significantly improved the financial income expectations and is reflected in the decline of PE. According to makerburn’s statistics, MakerDao’s predicted annualized income from RWA alone is as high as nearly 71 million US dollars.

Maker’s RWA asset list, image source: https://makerburn.com/#/rundown

3. The founder Rune has sold other tokens such as LDO in the secondary market and continuously repurchased MKR for many months, giving the market confidence.

4. By governing, the threshold for repurchasing the project surplus pool (System surplus) funds has been lowered from 250 million US dollars to 50 million US dollars. Currently, the available funds in the surplus pool are 70.25 million US dollars, with about 20 million in repurchase funds. However, according to Maker’s current repurchase mechanism, it has been changed from repurchase and destruction to “repurchase market making”, so the actual amount of repurchased MKR is 2000/2, and the remaining 10 million Dai will be used to provide liquidity with MKR on Uniswap v2 in LP form as a treasury asset.

The system surplus data of Maker, image source: https://makerburn.com/#/system-surplus

In addition, since Rune Christensen, the founder of Maker, proposed the Endgame Maker transformation plan last year, its grand narrative has also made many investors believe in and buy in after the performance and coin price of MKR rebounded.

The ultimate goal of MakerDao’s Endgame is to realize its vision of a “world fair and stable currency” by optimizing governance structure, funding sub-projects.

In addition, the recent narrative of RWA seems to be quite popular in the market, although there are not many projects that have launched tokens around this business, but the discussion has clearly increased, and it has been favored by many investment institutions.

In summary, the recent rise of MKR is the result of a combination of internal and external factors, with internal factors being the main driving force. As for the promotion of the RWA narrative, the author is more inclined to believe that it is MakerDao’s practice and the phased good results of the RWA business that have promoted the development of the encryption market’s RWA narrative, rather than the other way around, where causality is reversed.

2. The essence of MakerDao’s business

So, how should we view the long-term impact of these positive factors on MakerDao? Can these positive factors push Maker to the next level and achieve its grand vision of creating a “world fair and stable currency”?

The author thinks it is difficult, and this has to do with the essence of MakerDao’s business.

The core business of MakerDao has never changed and is essentially the same as projects such as USDT, USDC, and BUSD, which is to promote its own stable currency and obtain “seigniorage income” from the issuance and operation of stable currencies.

The so-called seigniorage tax can be broadly understood as the income that the currency issuer obtains by issuing currency. Different stable currency projects have different ways of obtaining seigniorage income. For example, another decentralized stable currency project Liquity charges users a fee of 0.5% when they mint its stable currency Lusd. For Tether users, they need to pay 0.1% or $1,000 when depositing or withdrawing dollars.

In addition, Tether will actively allocate the US dollars deposited by users to purchase more liquid government bonds, repurchase agreements, or currency funds to earn financial income on the asset side.

One of Dai’s main sources of revenue was previously from users obtaining Dai through collateralized debt and paying borrowing interest (stability fees) during the period. Later, a similar approach to Tether was adopted, in which the stablecoins such as USDC in its PSM module were collateralized and exchanged for yield-generating assets such as government bonds or held in Coinbase’s USDC current account.

However, the core of stablecoin business lies in the expansion of the demand side of stablecoins. Stablecoins can only maintain a high issuance scale and obtain sufficient collateral assets to achieve financial income by using adjustable assets.

In addition, the main difference between Dai and USDT and USDC lies in its decentralized positioning. The most important differentiation value of Dai is that “Dai has stronger anti-auditability and smaller regulatory exposure than USDT and USDC.” However, replacing a large amount of Dai’s collateral with RWA assets that can be seized by centralized forces essentially dissolves the difference between Dai and USDC and USDT.

Of course, Dai is still the largest decentralized stablecoin, with a market value of 4.3 billion, which is much higher than Frax (nominal market value of 1 billion) and LUSD (market value of 290 million).

3. Sources of Dai’s Competitive Advantage

In addition to the positive attempt to approach RWA on the asset side, in recent years, Maker’s overall operation of Dai has been lackluster. Its competitive advantage in firmly holding the first trading position of decentralized stablecoins lies in two aspects:

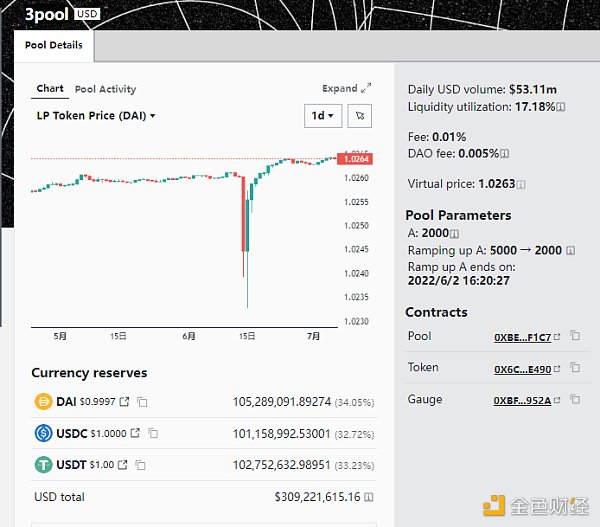

1. The legitimacy and brand of “the first decentralized stablecoin”: this allowed Dai to be integrated and adopted by many head DeFi and Cex much earlier, greatly reducing its liquidity and business PR costs. Taking Curve as an example, Dai, as one of the currencies of the base pool 3 pool, the longest stablecoin liquidity base pool in Curve’s history, is defaulted by Curve as the base stablecoin, which means that Maker, as the issuer of Dai, does not need to spend a penny on the liquidity of Dai on Curve. Moreover, Dai also enjoys indirect subsidies provided by other liquidity bribery parties (when these projects purchase their own tokens and pair them with 3 pool liquidity).

Curve’s 3 pool stablecoin pool, source: https://curve.fi/#/ethereum/pools/3pool/deposit

2. Network Effects of Stablecoins: People tend to use the stablecoin with the largest network scale, the most users and scenarios, and the one they are most familiar with. In the decentralized stablecoin category, Dai still leads in terms of network scale.

However, Dai’s main competitor is not Frax and Lusd (they are also in a difficult situation). When users and project parties choose to use and cooperate with stablecoins, they often compare them with USDT\USDC. Compared to them, Dai is at a clear network disadvantage.

4. MakerDao’s real challenge

Although MakerDao’s short-term benefits are intensive, the author still holds a pessimistic attitude towards its future development. After discussing the business essence of Maker’s stable

Secondly, and also the focus of Endgame, is the subDAO project incubated by Maker, which will develop around Dai through community development. On the one hand, the subDAO will undertake the governance and coordination work currently centralized on the MakerDao mainline, turning centralized governance into segmented and project-based governance. On the other hand, the subDAO can establish separate business projects to explore new sources of revenue and provide new demand scenarios for Dai. However, this is also the second major challenge facing Maker.

Question 2: How can subDAO projects succeed in starting a business while receiving blood transfusions of MKR and Dai?

In the future, many subDAOs incubated by Maker will use their own new tokens to incentivize Dai liquidity mining to enhance the use of Dai. At the same time, MakerDao will provide low or 0 interest rate Dai loans to subDAO business projects to help them complete early-stage startups. In addition to low-interest financial support, subDAO also inherits MakerDao’s brand credit and community, and the endorsement of this credit and the introduction of seed users are important for the launch period of DeFi. Compared with hoping to improve the adoption of Dai by introducing environmental protection projects, the subDAO scheme sounds more executable and has a precedent in the DeFi field. For example, Frax has developed its own Fraxlend, which supports borrowing Frax with various collateral to provide usage scenarios for Frax.

Fraxlend asset lending list, source: https://facts.frax.finance/fraxlend

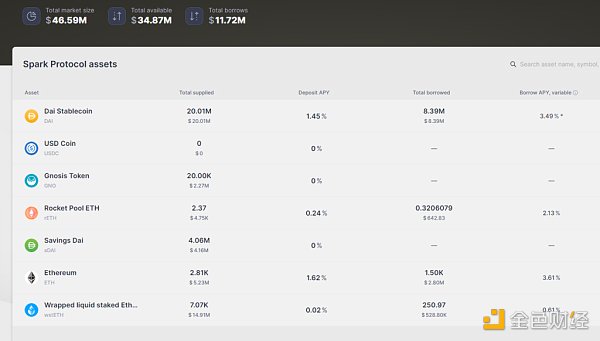

However, the problem is that in the context of the “low-hanging fruit” in the DeFi field has already been picked by entrepreneurs, it is not easy to develop a subDAO project that adapts to market demand. More importantly, these subDAOs also need to shoulder the responsibility of delivering value to Dai and MKR while developing projects, because they need to allocate additional project tokens to Dai, ETHD (the LST token repackaged version planned in Endgame, used as Dai collateral) and MKR as incentives. With such a “tribute task” in mind, completing the task of meeting user needs and defeating competitors with a product is difficult to imagine. Among them, SBlockingrk, a loan product incubated and launched by MakerDao, currently has an actual TVL of only more than 20 million after deducting the 20 million Dai directly minted and provided by MakerDao.

Image source: https://app.sBlockingrkprotocol.io/markets/

5. Other hidden concerns of MakerDao

In addition to the two challenges mentioned above, MakerDao also faces other hidden concerns.

First of all, the stable coins on MakerDao’s account that can be used to continue buying RWA are running low, making it difficult to continue buying US bonds.

According to Makerburn’s statistics, the stable coins held in its PSM are currently only around 912 million US dollars (USDC+GUSD). Among them, 500 million US dollars of GUSD are already enjoying a 2% annualized income subsidy from Gemini, although it is much lower than the interest rates of other RWAs, due to various complex factors (such as the fact that the GUSD held by Makerdao PSM accounts for 89% of the total issuance, and if it is forcibly liquidated and sold for US dollars, there will be a relatively large price loss), this part of the funds will not change much in the short term.

Image source: https://makerburn.com/#/rundown

Therefore, Maker’s flexible cash that can be used to continue buying income-generating assets is only the 4.12 billion USDC in the PSM at the moment, at the worst, it is to exchange the 500 million USDC in Coinbase with an annualized rate of 2.6% for US bonds. Therefore, the amount of funds that Maker can use to buy US bonds will only be around 900 million at most, and in fact, to cope with the redemption of PSM, the amount of funds that Maker can use to buy US bonds will not be too much. Otherwise, once users redeem USDC with a large amount of Dai, Maker will need to sell its US bond assets to accept them, and the transaction wear and bond price fluctuations will actually cause Maker to suffer losses. Moreover, if the market capitalization of Dai continues to decline, the size of Maker’s investable assets will be further forced to decline.

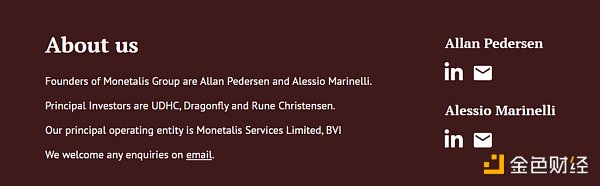

Secondly, I doubt whether Makerdao’s cost control can continue to be maintained. According to Endgame’s current plan, although it tries to distribute the governance process and power of DAO from “Maker center” to various subDAOs, complex roles, organizations, and arbitration departments are also set up in the governance units of subDAOs, making the entire collaboration chain the most complicated among all projects I have ever known, and it is a real “governance maze”. Interested readers can visit Endgame’s V3 complete version for a brain-burning reading experience. In addition, the intersection of DeFi and traditional offline financial entities caused by the introduction of RWA business, the generation of a large number of high-paying outsourcing jobs, and the currently very serious problem of governance centralization (in October 2022, 70% of the votes in favor of the Endgame plan came from the voting group related to Maker founder Rune), have made MakerDao’s interest delivery problem the elephant in the room. For example, the largest RWA investment management fund of Maker is managed by a small institution called Monetalis Clydesdale, but it is in charge of 1.25 billion US dollars of Maker funds, responsible for allocating funds to national debt assets and contacting other traditional financial institutions. The company charges nearly 1.9 million US dollars/year in service fees, and Maker was its only client at the time, and Maker’s founder Rune Christensen is the major shareholder of the company.

Rune is the main investor of Monetalis, source: https://monetalis.io/

Another example is that Maker pays its risk management service provider Block Analitica a service fee of nearly 5 million US dollars/year (Dai + MKR). More bizarrely, Block Analitica is not only a provider of risk management services, but also an evaluator of risk management services. This double identity of athlete and referee has made Maker’s risk control services a lucrative monopoly business. The remaining issue is probably how Block Analitica and the interest group that monopolizes the MKR governance rights share the rich benefits obtained from Maker’s treasury. Similar events, coupled with the grand plan of Endgame that even makes A16Z shake its head, the future roundabout loss of the treasury funds may be further exacerbated. However, with the decentralization and delegation of organizations, the means for interest groups to empty the treasury and split accounts may become more hidden and circuitous.

Source: coindesk

In addition, the stability fee of Dai has recently been raised from 1% + to more than 3%, which further reduces the demand for users to borrow and lend through MakerDao, which is not conducive to the maintenance of Dai’s scale.

Finally, from Endgame to large-scale purchase of national debt and RWA, to the founder’s high-profile secondary market repurchase, and to the initiation of voting to significantly reduce the threshold for withdrawing repurchase funds from the treasury, a series of combinations have made the market value of MKR have obvious short-term gains, but also left many hidden dangers:

1. Insufficient retention of treasury surplus reserves reduces the ability to cope with bad debt risks.

2. Aggressively increasing exposure to RWA has greatly increased the risk of assets being held by centralized institutions, and further increased the fragility of Dai.

3. The huge and complicated, continuously modified Endgame plan has caused serious community divisions. In the Endgame stage roadmap released by Rune Christensen in May, there are also “AI governance”, stablecoins and governance tokens that “launch new brands” (retaining the original Dai and MKR), and MakerDao’s own chain, etc. “Fantastic ideas.”

6. Endgame is not the end

In the comments section of the Endgame roadmap (The 5 phases of Endgame) published by Rune Christensen in May, in addition to common praise and other governance-related questions, two users’ comments stand out:

“(We) have wasted precious money and energy on funding useless people and garbage, without investing in creating value for MKR and expanding the scale of Dai. All funds and research should be used to figure out how to make Dai and MKR run autonomously! Remove bloated personnel and complicated governance, this is the right way.”

“Why do we think a globally pre-planned ‘endgame plan’ would be better than solving current problems and gradually improving? This plan always has a very specific content about ‘what we do’ except for the blockchain part, and very little about ‘why we do it’.”

No one replied to them.

For Web 3 projects based on blockchain, we should make good use of the efficiency brought by transparency and low trust costs, rather than building new walls and generating new fog, seeking rent behind the wall and in the fog.

Endgame is not the end that DeFi should have, it is only the wall and fog of MakerDao.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LD Capital: Summary of NFT Lending Platform Updates

- Decoding Ambient Finance: An Efficient Two-Way AMM Protocol Combining CEX and DEX Advantages

- Interpreting Entangle Protocol: Convert any asset into LSD to solve the liquidity problem across the chain

- Viewpoint: Why is it not a good idea to bet 100% on Ethereum, using Lens and dYdX as examples?

- Some thoughts about NFTFi: NFTs, as a more easily understandable trading asset and a carrier for more attributes in SocialFi and GameFi, will continue to exist.

- Meta is offering a million-dollar annual salary to recruit people. What high-paying jobs are available in the metaverse?

- What are some other innovative DEXs worth paying attention to besides Uniswap V4?