Vertex: A rising star in the derivatives DEX market, with a daily trading volume market share of around 10%.

Vertex: A rising star in the derivatives DEX market, with around 10% daily trading volume market share. Author: duoduo, LD Capital

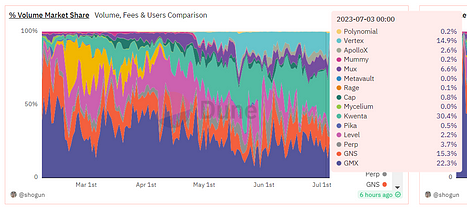

Author: duoduo, LD CapitalThe competition in the derivative DEX field is fierce, with GMX, DYDX, and SNX in the lead and Gains, MUX, Level, and ApolloX as the secondary players. There are also constantly emerging new protocols being launched.

Vertex is a derivative DEX protocol with recent good performance. Since its launch at the end of April 2023, its recent daily trading volume accounts for 10% to 15% of the capital pool model derivative DEX market, and it received strategic investment from Wintermute in June 2023.

Source: dune

Source: duneNote: DYDX data is not included in this chart, which compares capital pool model derivative DEX.

1. Business Data

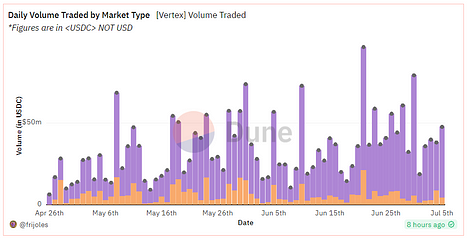

l Trading Volume : Mainly through trading incentive measures, it has created high trading volume, with a daily average trading volume of about $40 million in the last 7 days. The purple part is derivatives, and the yellow part is spot, with derivatives trading as the main part.

- Multichain, the cross-chain bridge, is once again caught in controversy

- Some thoughts on heavy collateralization: What are the opportunities and challenges?

- Analysis of the Massive Abnormal Outflow of Multichain Tokens: Not Simply a Hack, Nor Loss of Complete Control due to Uncontrollable Factors

The daily trading volume is lower than the leading derivative DEX (DYDX/GMX/SNX), and the daily trading volume of the secondary derivative DEX is equivalent. Based on the recent 7-day trading volume, Vertex has entered the top ten.

Source: dune

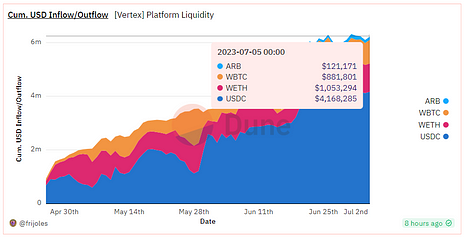

Source: dunel TVL : $6.22 million, the scale is still relatively small, including four tokens, the specific composition is as follows:

Source: dune

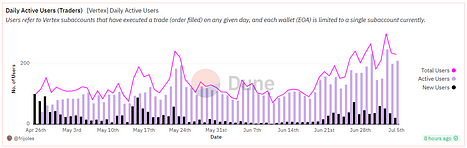

Source: dunel DAU : Accumulated users are 1842, and the number of daily active users in the recent 7 days is about 200. By comparison, GMX has more than 1,000 daily active users, DYDX has around 700, and SNX has about 500.

Source: dune

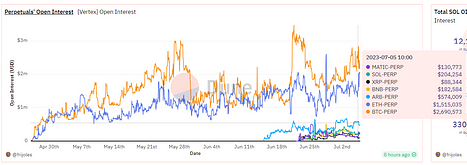

Source: dunel Open Interest : There are a total of 7 trading pairs, with BTC and ETH occupying the main share, and the current position is about $5.37 million. The position amount is also relatively low.

DYDX holds about $300 million in position, GMX holds between $150 million and $200 million, Gain Network is between $30 million and $50 million, and Mux is between $20 million and $50 million.

Source: dune

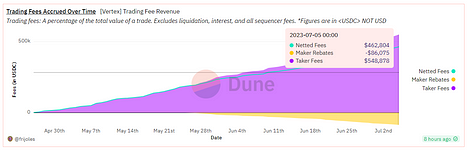

Source: duneFee: The cumulative gross income is about 540,000 US dollars, deducting the commission of 86,000 US dollars given to the maker, the net income is 460,000 US dollars.

Source: dune

Source: duneII. Team and Investors

Co-founder Darius is mainly responsible for external marketing activities.

Co-founder Alwin Peng previously worked at Jump trading and is a blockchain engineer.

In June 2023, Vertex received strategic investment from Wintermute Ventures, the venture capital department of cryptocurrency market maker Wintermute. Wintermute provides market-making services for many well-known projects such as Arb, OP, and Blur.

When announcing the investment in Vertex, Wintermute stated: “Vertex is led by a strong team of traders and engineers with a good track record in the TradFi and DeFi markets and is at the forefront of smart contract and market innovation.”

Previously, in April 2022, Vertex received a seed investment of US$8.5 million, led by Hack VC and Dexterity Capital, and followed by Collab+Currency, GSR, Jane St., Hudson River Trading, Huobi, JST Capital, Big Brain, and Lunatic Capital. Early investors received 8.5% of the tokens, which means that Vertex’s seed round valuation was US$100 million.

Vertex was originally a project built on Terra, but after Terra’s collapse, the protocol migrated to Arbitrum.

III. Product

Provide one-stop DeFi services, including spot, futures, and lending markets, mainly around futures markets. Most of the trading is perpetual contract trading, and spot and lending are more for futures services, so they are classified as derivative DEX.

Liquidity supply mode: Hybrid order book-AMM model

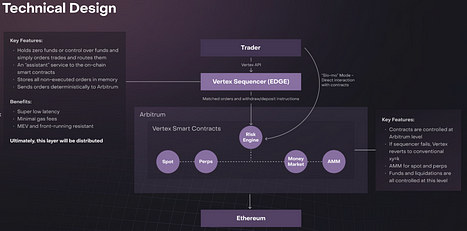

The liquidity supply mode is the main difference between Vertex and other derivative DEXs. Vertex believes that the off-chain order book can reduce MEV attacks and improve transaction execution speed through FIFO processing. On-chain AMM provides permissionless liquidity support, and traders can be forced to trade. When the liquidity of the order book is insufficient, it can ensure the effective conduct of transactions.

Vertex achieves a hybrid order book-AMM model through the following components:

- On-chain trading venue (AMM);

- On-chain risk engine for fast liquidation;

- Off-chain sorter for order matching; and

- Diagram: Vertex Core Component Architecture

Source: Vertex

Source: VertexThis means that there are two types of liquidity coexisting in the Vertex trading platform: one is order book liquidity provided by market makers via API, and the other is LP funds provided by smart contracts.

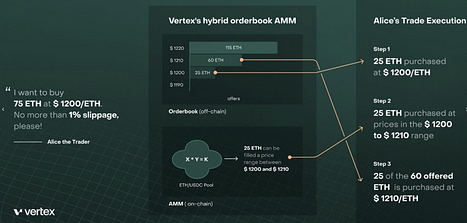

The two types of liquidity are combined by the sorter, and what is seen on the front end is a unified liquidity for trading at the best available price. The following figure shows how the sorter uses order book liquidity and LP liquidity to complete trades.

Source: Vertex

Source: VertexSource: Vertex

Process analysis:

The trading price of the ETH-USDC currency pair is $1,200.

Alice wants to buy 75 ETH on the market and sets the maximum slippage to 1%.

There is an order on the order book worth 25 ETH at a price of $1,200, so one-third of the trade is executed at $1,200.

The next sell order on the order book (60 ETH in total) is at $1,210.

However, there is an LP position of 25 ETH with a price range between $1,200 and $1,210. Therefore, the next one-third of the trade is purchased from the LP position at a price between $1,200 and $1,210.

The final one-third of the trade is executed at a price of $1,210.

Fund efficiency: Universal Cross Margin expands margin range

Vertex seeks to improve the efficiency of fund utilization and proposes the concept of “Universal Cross Margin,” primarily by expanding the margin range.

Currently, there are two common margin models in derivatives trading. One is the isolated margin model, where a trading pair is an independent isolated account. Only the currency of the trading pair can be deposited, held, and borrowed in a specific isolated account. Each isolated account has an independent risk rate, which is calculated independently based on the assets and liabilities held under the trading pair. The risk isolation of each isolated account has no impact on other isolated accounts in the event of liquidation risk.

There are two margin modes: Isolated Margin and Cross Margin. Generally, a user only has one Cross Margin account on the platform and can trade all supported currencies. The assets in the account are cross-collateralized and shared, and the risk rate is calculated based on all assets and liabilities in the Cross Margin account. Once a liquidation occurs, all assets in the account will be liquidated.

It can be seen that the fund utilization efficiency of Cross Margin is higher than that of Isolated Margin. On this basis, Vertex has proposed Universal Cross Margin.

Users can use all their funds (deposits, positions, and investment profits and losses) as margin on the platform, including open positions in spot, perpetual contracts, and currency markets. For example, users can provide liquidity to the spot fund pool, which can earn fees and also be used as margin for contract trading. This increases the efficiency of fund utilization.

Universal Cross Margin also allows for portfolio margining, where unrealized profits can be used to offset unrealized losses or as margin for existing or new positions.

To help users better manage the risk of their accounts, Vertex also provides account risk level prompts, which can show the health of the account directly on the page.

Accounts can be divided into two states: Initial and Maintenance. In the Initial state, they can also be classified into three risk levels: low, medium, and high, based on the ratio of margin to liabilities. The Maintenance state means that the initial margin usage has exceeded 100%, new positions cannot be opened, and margin needs to be replenished as soon as possible, otherwise liquidation may occur.

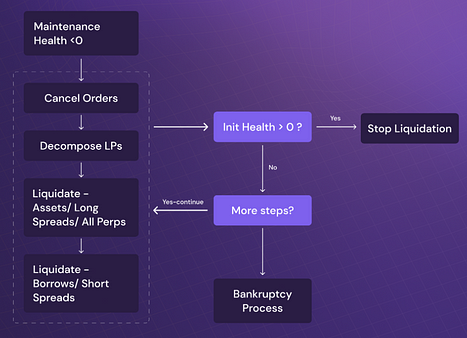

Due to Universal Cross Margin, liquidation is also in Cross Margin mode, and will be liquidated in the following order:

Orders are canceled, and the funds are released;

LP assets are released and sold;

Assets are liquidated (i.e. spot balance/contract position);

Liabilities are liquidated (borrowing).

If the initial health status of the account recovers to above 0 during the liquidation process, the liquidation will stop.

Source: Vertex

Source: VertexLower trading fees

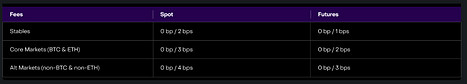

The trading fees of Vertex are relatively low. Whether in spot or contract, the maker fee is currently 0, and the taker fee is 0.01%-0.04%.

Source: Vertex

Source: VertexTo encourage maker trading, rebates are available for makers whose trading volume exceeds 0.25% of the total trading volume for a specific period (28 days, or one epoch). The rebate rates are as follows:

Source: Vertex

Source: VertexCompared to several major derivative DEX markets, GMX has higher transaction fees, with opening and closing fees both at 0.1%. DYDX’s trading fees range from 0.02% to 0.05% and decrease as trading volume increases. Kwenta’s trading fees range from 0.02% to 0.06%.

IV. Token Economics

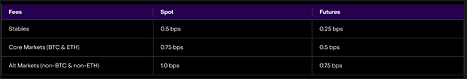

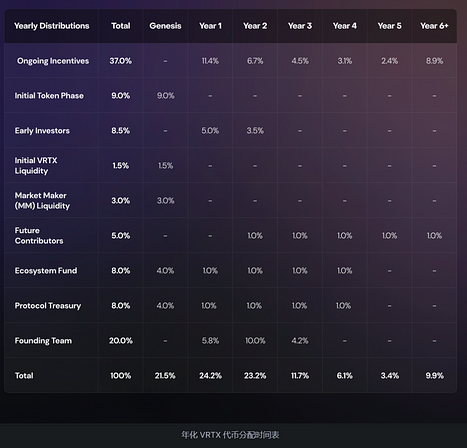

VRTX is the governance token of the Vertex Protocol, with a total supply of 1 billion tokens, of which 90.08% will be distributed within 5 years.

Token distribution is as shown in the following figure, with 46% used for community incentives, including 9% for initial token incentives and 37% for ongoing incentives; 41% is allocated to the team, treasury, ecosystem fund, and future contributors; 8.5% is allocated to early investors; and 4.5% is allocated to liquidity. It should be noted that this distribution chart was disclosed to the public in early June 2022 and does not include the Wintermute investment portion. In general, it may be allocated to new investors from the treasury.

Source: Vertex

Source: VertexVertex tokens will be distributed six months after the mainnet launch, which is expected to be in October 2023. The token release schedule is as follows:

Source: Vertex

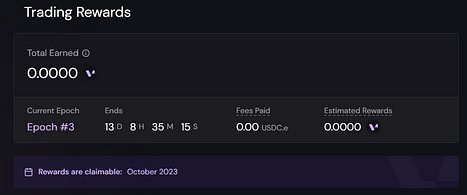

Source: VertexThe Initial token phase will use part of the tokens for pre-issuance trading incentives. Users can track related incentives on the Rewards page of the Vertex application, and the official website specifies that the incentives can be claimed in October 2023.

Source: Vertex

Source: VertexThere are six epochs in the Initial token phase, each lasting 28 days and offering 15 million tokens as rewards, with the current epoch being the third. The proportion of trading incentive tokens is mainly based on the weight of trading fees. In addition, different trading pairs have different rewards, as shown in the following figure:

Source: Vertex

Source: VertexVertex protocol tokens have not been issued yet, and due to the existence of trading incentives, it is impossible to avoid the behavior of trading with inflated volume. Currently, the launch of derivative DEX protocols all rely on trading incentives. For example, Vela implemented trading incentives in its beta version to stimulate the growth of trading volume. Most protocols still maintain trading incentives after going online, such as DYDX and Kwenta. The fact that Vertex is being widely adopted at this stage shows that funds have a positive view of the protocol tokens.

V. Conclusion

The competition among derivative DEXs is already a red ocean. A large number of projects follow the pattern of GMX, deploying on new public chains or layer-2 solutions, offering high APR to attract funds and earn profits. In comparison, Vertex offers some innovative mechanisms to create better liquidity and higher efficiency of fund utilization, which is worth paying attention to.The risk to be aware of is that while Universal Cross Margin increases the efficiency of fund utilization, it also increases the risk exposure of user assets, so traders need to do corresponding risk control.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- A glimpse of the emerging new use cases for ZK: zkML, ZK Games, ZK ID

- Decoding the DEX newcomer Vertex: average daily trading volume of about 40 million US dollars in the past 7 days, with a daily trading volume market share of about 10%.

- Can ERC’s Finalize establish its orthodox status?

- Inverse Finance: A Rebirth from the Brink of Death?

- “The Three Pain Points” of Digital Asset Trading

- Multichain crisis reappears as over $130 million in token liquidity is withdrawn

- Why Frax Finance is worth watching: Three investment themes, five catalysts