Viewpoint: Why is it not a good idea to bet 100% on Ethereum, using Lens and dYdX as examples?

Why you shouldn't bet everything on Ethereum, illustrated by Lens and dYdX.Author: Ann; Translation: Baize Research Institute

Recently, the crypto community has been strange, with Ethereum maximalists showing a self-righteous attitude that is only comparable to that of Bitcoin maximalists when it comes to being annoying.

I get it. This started with the Multichain vulnerability, and unfortunately, it had the biggest impact on the Fantom blockchain. I don’t know why this would make Ethereum maxis feel superior to others, because similar vulnerabilities could also happen on Ethereum.

Saying Goodbye to Web3 Socials

Yes, Zack is carving up the big social media cake.

- Some thoughts about NFTFi: NFTs, as a more easily understandable trading asset and a carrier for more attributes in SocialFi and GameFi, will continue to exist.

- Meta is offering a million-dollar annual salary to recruit people. What high-paying jobs are available in the metaverse?

- What are some other innovative DEXs worth paying attention to besides Uniswap V4?

But what does this mean exactly? What is the impact of Meta CEO Mark Zuckerberg’s “Twitter competitor” Threads on the cryptocurrency industry, especially Ethereum? Will it have a more noticeable impact than Elon Musk’s Twitter?

The real victim is not Twitter, but Lens Protocol – the champions of our Web3 social media future.

I have been following the development of Lens. It has been over a year since it launched, but frustratingly, they still limit their service to invitees only, with access control.

Musk has messed up Twitter several times, and competitors have taken advantage. First it was Mastodon, Nostr, and then Threads. Opportunities have arisen time and time again, but Lens Protocol has missed out every time. This time is no exception.

To make matters worse, Meta also plans to make Threads exactly what crypto enthusiasts imagine: you can move your profile and data to any other service or platform.

If Meta can really solve this problem, then we can say goodbye to the slow Lens Protocol altogether.

As to why Lens development hasn’t been as fast as we’d hoped, I have a theory that I’ll explore later in this article.

dYdX Launches Cosmos-based App Chain

Recently, dYdX finally released its v4 app chain testnet based on Cosmos. It just so happens that some Ethereum maxis were labeling Cosmos as having no applications on it.

These people easily forget the fact that dYdX’s decision to transition from L2 solution StarkWare to Cosmos is considered one of Ethereum’s biggest backlashes. What’s wrong with Ethereum that mature protocols like dYdX decided to split paths?

The reasons why dYdX chose to abandon the L2 solution are the same reasons why you shouldn’t bet 100% on Ethereum.

Ironically, one of Ethereum’s biggest problems for other L1s is that it is too focused on infrastructure (do we need more new dApps to crash and significantly increase Gas fees on Ethereum mainnet when traffic is high?), so Ethereum actually doesn’t build much for large-scale adoption. (Gas costs are still high).

Some believe that consumer-oriented applications will be built on L2 and rollups, but the latter are mostly in continuous development.

So it can be said with certainty that if you take cryptocurrency as a whole, any development aimed at large-scale adoption has been stagnant. Ethereum seems to have built many new dApps, but if you look closely, they may only be new derivative trading platforms, NFTs, etc. – many of which are not the applications we need to promote large-scale adoption.

“An intelligent contract platform with the largest number of dApps” may be a sufficient reason in some cases, but it certainly cannot be used as a reason for Ethereum maxi to downgrade competitors.

Ethereum may be the best choice for investment or application development at present. It is relatively stable to some extent because it is a native asset (no bridging risk) with a high pledge rate (stable liquidity), and it also provides decent returns for pledgers. The pledge is currently at an all-time high, and a new narrative of “re-pledging” is brewing.

But is it really wise to bet 100% on Ethereum?

Excluding complexity-User experience is the key to large-scale adoption

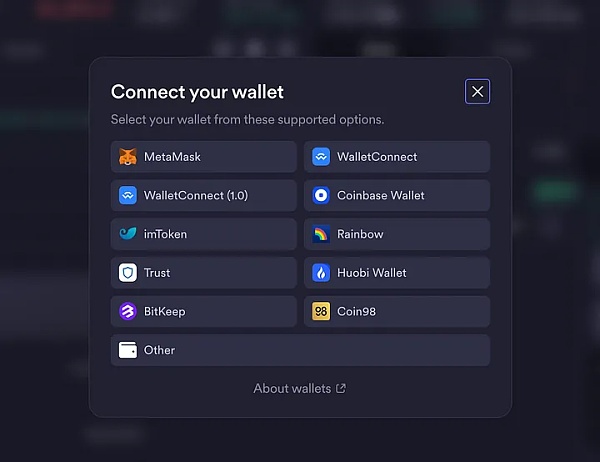

In the DeFi user experience, “simplicity” is always the preferred choice, especially from the perspective of Web2 users who are not developers. Users must face the problem of inefficient capital efficiency by distributing ETH to various L2 solutions, and this is only to save Gas fees.

We often think from the perspective of DeFi old users. Personally, I have also fallen into this bias. As an old hand in DeFi, I completely forgot that I once complained that Ethereum was too complicated to use. As a crypto researcher, exploring various blockchain ecosystems is my job, and slight discomfort is not important to me.

But most people – the potential new users that the crypto industry is trying to attract – are not like that. Complexity is still a huge barrier.

Deploying dApps on a large L1 chain, or just wandering in an Ethereum L2, will be much less troublesome. Users of DeFi, SocialFi, GameFi, and NFT projects can experience seamlessly and economically through “single deposit”. Never need to bridge to other chains.

Developer’s access threshold is more important

We can say that one day, when the user experience is smoother, people will not be able to distinguish whether they are using L1 or L2, L3 or Rollup, then the concerns for the above views will become outdated.

For example, dYdX V4 has done a good job in supporting ETH wallets, even though it is based on the Cosmos protocol.

At the same time, seamless user experience is also the goal of account abstraction. With some encryption technologies, the wallet will manage everything for the user. Deposit once and you can do anything anywhere without worrying about what happens behind the scenes (on the chain).

However, I think it is still difficult to implement account abstraction wallets. Similar to creating a button for the frontend of a traditional application is never simple, developers must build wallets that work for the various ecosystems they intend to support (different languages, tools, and standards).

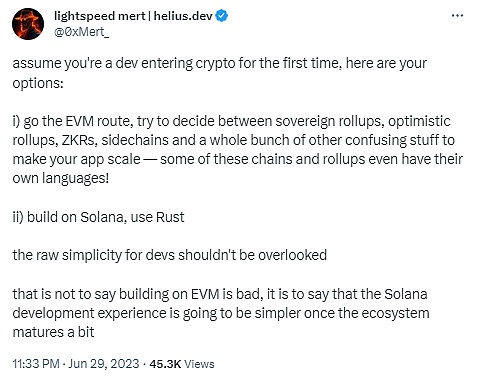

For example, Starkware uses a programming language called Cairo, while if you build it based on the privacy-centric Aztec, you must use Noir. Some developers are starting to advocate using Rust to provide more secure code.

For an industry with a total developer population of only one-third of Meta employees, this is especially frustrating.

While EVM-compatible solutions such as Optimism, Arbitrum, or zkSync may reposition themselves as “if a dApp can be built on Ethereum, it can also be directly plugged into L2 at a cost that is only a small part of Ethereum” or “Deploy without too many changes to the code”, but more complex workflows may further distance you from reliability.

Choosing between L1 and L2 is confusing. Why do you choose one blockchain over another when building your dApp? Which one is not only the best right now but is also future-oriented as the blockchain technology advances rapidly and market demand evolves?

This decision is critical.

Now let’s talk about Lens Protocol again.

I have my own hypothesis for why they always miss being a Twitter competitor. This is because they are built on Polygon. I don’t know what their reason is (besides having Polygon Ventures as a venture capital), but it has been shown to be a bad choice.

It is well known that Polygon runs slowly. I don’t think it has the ability to support social media applications with potentially millions of users. In addition, it is now planning to upgrade to Polygon 2.0, which puts existing dApps built on it in an uncertain state. Can they migrate seamlessly? Is it still worth staying on Polygon when there is a better blockchain?

Building a dApp in the fast-paced crypto industry itself is a risky business, as a wrong move can cause real financial losses.

Developers need to choose the best construction site. Some serious developers with strict technical requirements often end up choosing the Ethereum mainnet. This is what happened with Blur (a professional NFT trading platform) and the recently launched EigenLayer. There is a reason why any project that is heavily advertised eventually ends up on the Ethereum mainnet. I wouldn’t say it’s “innovative,” more like “closed innovation,” because few users are able to play on the Ethereum mainnet on a regular basis. We can’t just meet the needs of whales.

Conclusion

The complexity itself is enough reason to seek alternative solutions, and dYdX leaving Ethereum L2 is a good example of this. After all, the practice of “never put all your eggs in one basket” is wise.

Whether you are an investor or a developer, if you are still hesitant, rest assured that even the most ardent Ethereum supporters are secretly funding other L1 solutions, as I mentioned in my previous article (the author hinted that Ethereum maximalist Cobie invested in the new L1 Monad this year). I bet there are many of these people.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Circle has frozen the approximately 63 million USDC leaked from Multichain.

- New rules for persuading withdrawals or selling shells for revenue? OSL reportedly withdraws from the Hong Kong Web3 “gold rush”.

- What can users do when the cross-chain bridge in the header goes wrong?

- Self-proclaimed equal Web3 wanderer stops at seeking immortals and asking the way.

- FTX shatters Taylor Swift’s crypto dream, $100 million collaboration also falls through.

- Vertex: A rising star in the derivatives DEX market, with a daily trading volume market share of around 10%.

- Multichain, the cross-chain bridge, is once again caught in controversy