Observation | How have Chinese insurance technology giants used blockchain to transform?

Author: He Dayong, Boston Consulting Group (BCG), Managing Director, Global Partner, BCG special financial institution head of China

Despite the general public's trust in blockchain, China's insurance technology industry is far ahead in using blockchain to make changes.

- New Path of International Cooperation for Chinese Enterprises Against Globalization: Blockchain Industry Alliance

- This is the real blockchain! Tens of billions of dollars are put here, 4 industry experts bring you first-line experience

- FBI warning: under the new crown epidemic, beware of four encryption scams

However, in the view of China's leading insurer companies, blockchain is not just a cryptocurrency transaction or an initial currency issuance (ICO), but a reduction in transaction costs, reduced doubts about credibility, and improved transferability Great opportunities for asset and policy liquidity. Moreover, it is not limited to insurance technology companies, universities, government agencies and commercial institutions have invested a lot of resources in research in related fields, aiming to further develop blockchain technology and its extended application in various vertical industries.

Let us understand how insurance technology companies can use blockchain technology to subvert traditional business models and IT architecture through some current cases in today ’s market.

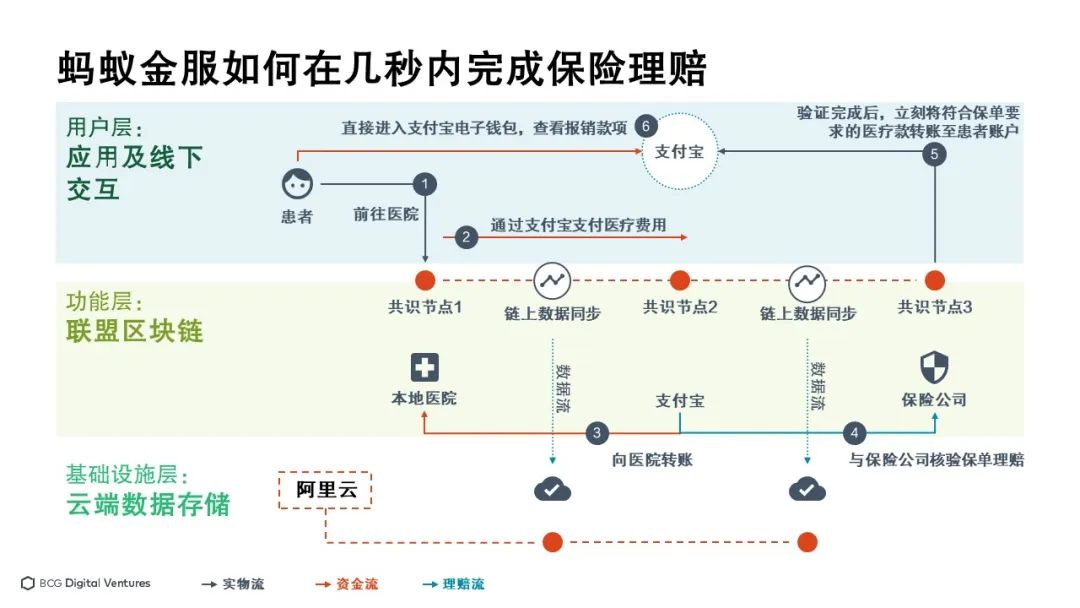

Ant Financial: Blockchain technology will become the foundation of the new health insurance claims structure

With the new system, stakeholders such as hospitals, ant service back-ends, and insurance companies all access the blockchain in the form of "consensus nodes" to synchronize data and information flows in real time. The design of the consensus node is to ensure the high reliability of multiple participants in the network, that is, the basic distributed "unit" in the network, and to reach agreement (or consensus) in accordance with specific protocols or algorithms. As long as the infrastructure supporting the blockchain is running well (ie, signal base stations, Wi-Fi bandwidth, laaS cloud configuration, etc.), insurance claims can be processed and verified in seconds.

With reference to the figure below, we can better understand how Ant Financial achieves this.

From the perspective of the hospital, tamper-proof invoices can be generated and issued directly on the blockchain without worrying about whether the verification process is reliable. The verification result can be accepted by Alipay and can be used by other consensus nodes to synchronize information.

From the perspective of the ant blockchain, this is like an objectively neutral third party on the chain, responsible for verifying and synchronizing the necessary data information and connecting important stakeholders. Relying on the mechanism that the blockchain itself cannot be tampered with, certificate can be stored, and credible circulation, the ant blockchain can fully eliminate the trust concerns of other participants in the ecosystem. For all parties other than Ant Financial, the transaction friction, time and labor costs due to mistrust in the circulation of medical bills can be fully reduced, and the diversity of the ecosystem will be greatly enriched.

From the perspective of an insurance company, the consensus node aims to improve the efficiency of claims settlement. If the traditional offline operation mode is adopted, even if the patient completes the payment through the e-wallet, he still needs to submit many paper claims materials, meet with the claims specialist, or go to the local offline store of the insurance company and wait at least 10 working days In order to obtain compensation, this is only established if the patient provides the materials in accordance with the requirements. Imagine that if you use the blockchain to track and synchronize when invoices are generated, you can replace the cumbersome verification process with efficient automated identification technology. In this way, problems such as over-standard claims, false claims, and invoice fraud can be eliminated from the source, which is why the verification process can be so smooth and rapid. You only need to wait for the patient's consent and the system to respond, and you can immediately transfer the claim funds.

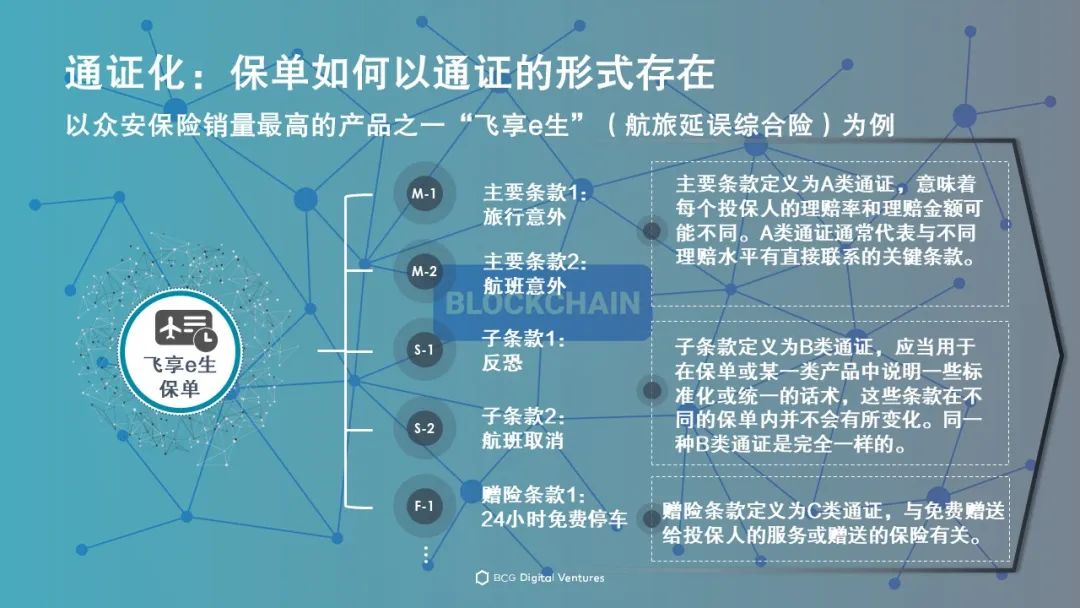

ZhongAn Insurance: Leading Tokenized Insurance Scene

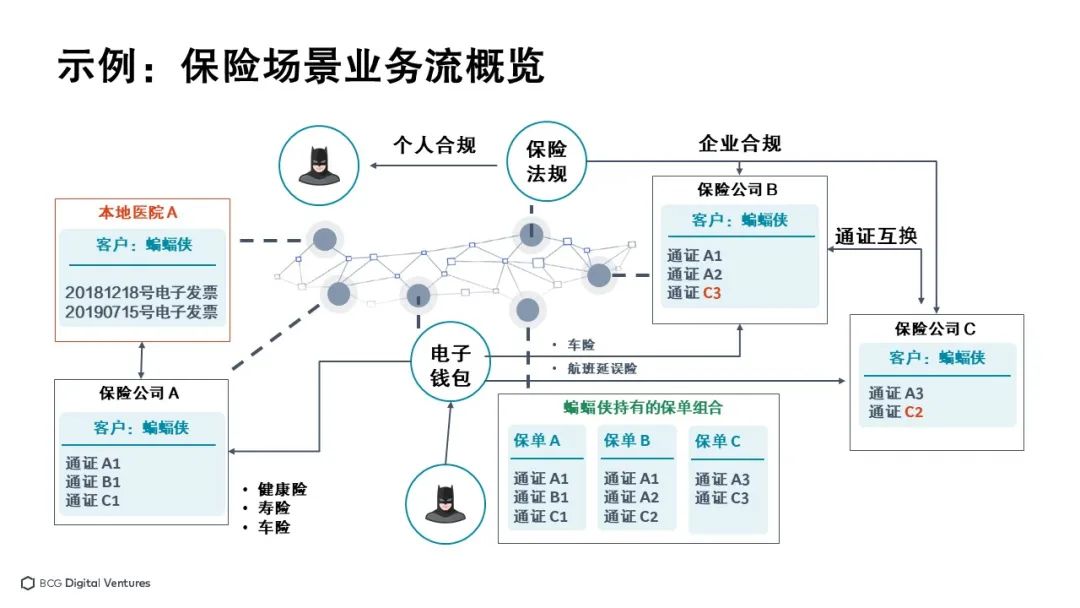

For example, if the policy I am about to receive is almost the same as the policy already stored in the e-wallet, only a few terms are different. Do I (or my insurance company) need to store both policies at the same time? If you use a traditional system, the answer is of course necessary-no matter how high the overlap between the new policy and the previous policy, any policy with new terms must be completely stored. However, with the help of blockchain, we only need to store a policy that is 100% flexible and the terms can be arranged and combined arbitrarily, and each term only needs to be stored once. All the tokens are coded to the greatest extent suitable for the execution of smart contracts, so that they can be copied, reclassified or recombined according to the "demand" of the policy. From the back-end perspective, each individual token is a combination of multiple lines of code. Therefore, the policy can be fully digitized and 100% transferable.

Customers, products, scenarios and regulations are the four important elements that give the insurance business feasibility. With the tokenization on the blockchain, the trust between users will be improved. The product (in this case, the policy) benefits from tokenization, which not only becomes more systematic, but also easier to code. Since enterprises from different industries can smoothly access the blockchain network, the problem of data isolation is also solved. Further agile product upgrades can be carried out separately, and data isolation issues can be resolved by grafting on business scenarios such as reinsurance, digital insurance, medical insurance, and auto insurance, and regulatory nodes can also directly join the blockchain to allow for strong compliance Regulation becomes possible.

Thanks to improved user experience, product innovation, cost reduction, and efficient supervision, ZhongAn is deploying policy tokenization at a faster rate.

Illuminating the future of blockchain

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- QKL123 market analysis | New days of global diagnosis? American Oolong! Data those things (0414)

- WBF founder Bella Fang: no evil + long-termism, the correct position of the encrypted derivatives track 丨 chain node AMA

- Introduction to Blockchain | How Does DeFi Liquidator Work?

- Yao Qian: The new currency war has just begun

- The MOV of Uncle L next door is on fire, but the little bun boss is floating?

- Lightning loan becomes standard? DeFi Saver launches Automation V2 integrated with Lightning Loan

- Crypto analyst: one bitcoin is enough to save a pension