One article compares the degree of centralization of governance on the chain: MakerDAO, Decred, Tezos

Author: Nate Maddrey and Coin Metrics team

Translator: Barley

Source: Satoshi Shinmoto

Editor's Note: The original title was "Original Title: Comparing the Centralization of Sanxiong on the Chain: MakerDAO, Decred, Tezos"

- Ethereum Foundation: A Quick Look at Eth1.x Research

- A brief history of crypto exchanges: a glimpse into the evolution of the most powerful organization in the blockchain industry

- Crypto Industry Watch | There is no guide to bear markets, success is not limited to the present

Coin Metrics explored the topic of "on-chain and off-chain governance" in the 29th Network Watch, introduced three mainstream projects using on-chain governance: MakerDAO, Decred, Tezos, and analyzed their token distribution and network centralization Degree of relationship. Before that, I first borrowed a blog from district0x to introduce "governance", "on-chain governance" and "off-chain governance".

What is governance?

district0x states: "Blockchain governance refers to the mechanism by which a decentralized network adapts and changes over time." Although the design of the blockchain network should be intelligent, after the protocol is publicly tested, it will inevitably find some new unconsidered factors.

In the face of competition (or controversy), problems often arise. If users start to advocate for other features that they feel are more advanced, should the network change to meet these needs? Some characteristics of the network, such as the issue rate, privacy, and consensus mechanism, have been controversial, and it can only be iterated after practical applications.

Fred Ehrsam wrote an article that explains very well why the evolution and upgrade capabilities of the blockchain network in continuous development will become the key factor in whether it can survive the competition of interests it controls.

Blockchain governance is rooted in the fact that when the stakeholders of the network interact with the network and generate value from the network, their interests change.

Stakeholders naturally start from their own interests, and their main goal is to make the network serve them. Therefore, if these systems are to survive, these differences need to be eliminated through related processes.

On-chain governance and off-chain governance

Blockchain governance is generally divided into two modes: on-chain governance and off-chain governance.

On-chain governance refers to the process by which protocol upgrades occur automatically in response to token voting.

In these systems, token holders directly use the network's intrinsic tokens to vote on corresponding measures. The agreement will calculate the vote directly, and the subsequent results will be carried out automatically. This relationship between token voting and code changes is often referred to as "tight coupling."

These processes are interesting because they try to digitize the decisions of the community, which is a potential step to gradually improve functionality from the status quo.

In the digital world, stakeholders can coordinate at a very low cost, and the plasticity of software systems opens the door to faster experiments. Models can be tested and inefficiencies can be easily fixed.

On the other hand, off-chain governance (most blockchain projects use off-chain governance) refers to informal coordination among network stakeholders to determine how to handle network upgrades.

The most common process looks like this: Developers submit changes through formal improvement proposals, network stakeholders coordinate through community channels (subreddits, email forums, and social media), protocol developers integrate new features, and node operators indicate Support or disagree with the change, and the miner decides which chain to maintain.

There are advantages and disadvantages to on-chain and off-chain governance.For example, on-chain governance is questioned and opaque, off-chain governance is accused of low voter turnout, so it is important to weigh the two.

The following two articles will help us better understand the differences and advantages and disadvantages of the two:

- Blockchain governance, welcoming the future with programming: https://ethfans.org/posts/blockchain-governance-programming-our-future

- Vlad: Against on-chain governance: https://ethfans.org/posts/against-on-chain-governance

MakerDAO

MakerDAO is a distributed financial platform based on Ethereum (users can mortgage assets to generate stable currency DAI, which is currently the highest market value and ETH locked application in the DeFi concept). MakerDAO uses polls and binding on-chain voting management Stablecoin DAI.

MakerDAO polls are "symbolized polls used to investigate the community's views on a particular model or data source." The Maker Foundation uses polls to gauge the community's views on different issues, such as adjusting the stable currency DAI's stable fee rate. MakerDAO also has Executive Votes, which are binding decisions. Once the voting is over, the winning option will take effect.

At present, the number of votes for MakerDAO is directly proportional to the amount of Stake. When a poll or administrative vote is turned on, users pledge their MKR to participate in voting. After the voting period ends, the party with the highest number of MKR pledges wins. In administrative voting, the voting process will continue until "the number of votes exceeds the number of votes in favour of the last administrative vote".

On December 6, MakerDAO held an administrative vote that enabled the community to adjust the DAI debt ceiling and the SAI stabilization rate. A total of 51,910 MKR support votes were passed and passed. According to data from mkrgov.science, two of these addresses accounted for 66% + of total MKR pledges. In several other votes, the weight of a single address accounted for 90% + of the total votes of the winner, including a vote in October, and a single address contributed 94% + of the votes of the winner.

Therefore, when analyzing MakerDAO governance, the supply distribution of tokens is an important factor. Holders with a large number of MKRs can have a huge impact on votes.

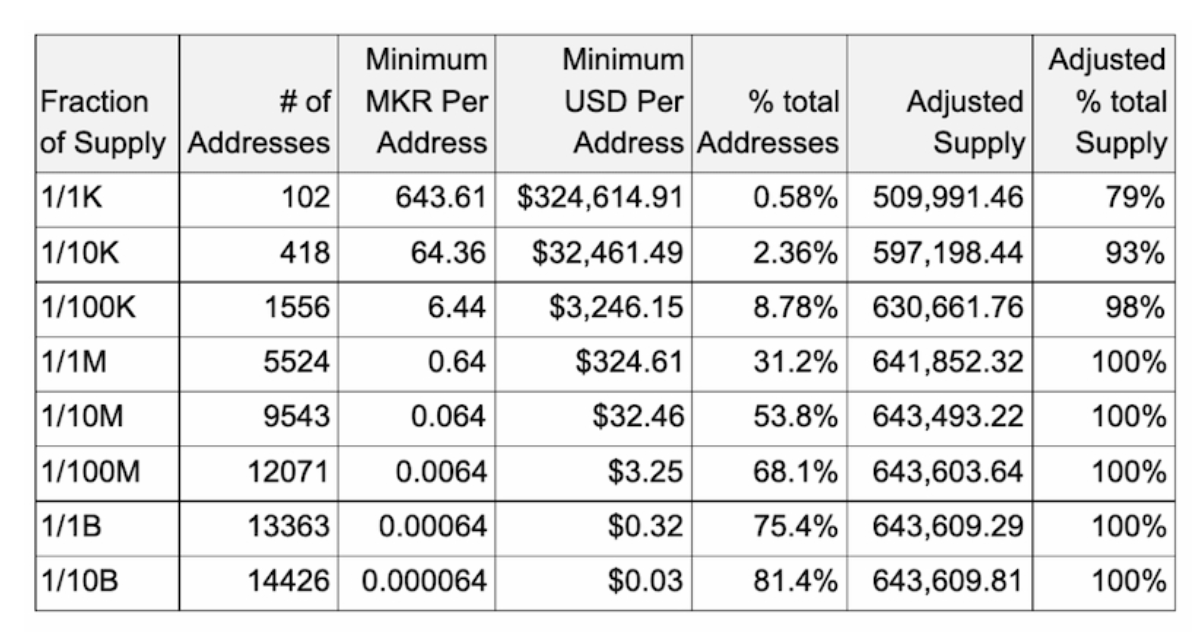

To analyze the distribution of token supply, CM looked at addresses that accounted for more than a certain percentage of the total supply, ranging from one thousandth to one billionth of the total supply.

However, the distribution of MKR is somewhat uneven because there are several MKR addresses that pool a large number of pledged tokens. Specifically, the "Maker MultiSig" contract and the "Maker Governance" contract hold 219,296 and 137,084 MKR, respectively. Therefore, CM removed these two addresses for analysis, and the adjusted total supply of MKR decreased from 999,999 to 643,609.

After adjustment, one thousandth of the total supply of MKR is 643.61 MKR (about 324,000 $ at current prices), and one billion is 0.000064 MKR (about 0.03 $).

The following table shows statistics for addresses that hold at least 1 / X of the total MKR supply, where X ranges from one thousand to one billion.

Among them, 102 addresses hold at least one thousandth of the total MKR (ie 643.61+ MKR). These 102 addresses accounted for only 0.58% of the total number of addresses, but held a total of 509,991 MKR, accounting for 79% of total supply +. Given that recent voting requires 51,910 MKR, it is possible to control MakerDAO voting if these top 0.58% of addresses cooperate.

Note: As shown in the figure below, the supply of MKR has been adjusted to remove the two Maker Foundation contracts.

Over time, the number of addresses holding a small amount of MKR has been steadily increasing. However, the number of addresses holding at least one hundred thousandth of the total MKR supply (that is, at least 6.44 MKR) has remained relatively stable. As a result, for most of MakerDAO's history, most voting rights were concentrated on relatively few addresses.

Decred

Decred's on-chain voting system also uses pledges, but the number of pledges is not proportional to the number of votes. On the contrary, users pledge DCR in exchange for tickets that can be voted for, which gives them the opportunity to vote and verify the previous block.

When verifying each block, the system will randomly select five tickets to vote to verify the validity of the previous block. The pledged DCR will be locked until the selection ticket is selected for voting and then returned to the owner along with the PoS reward.

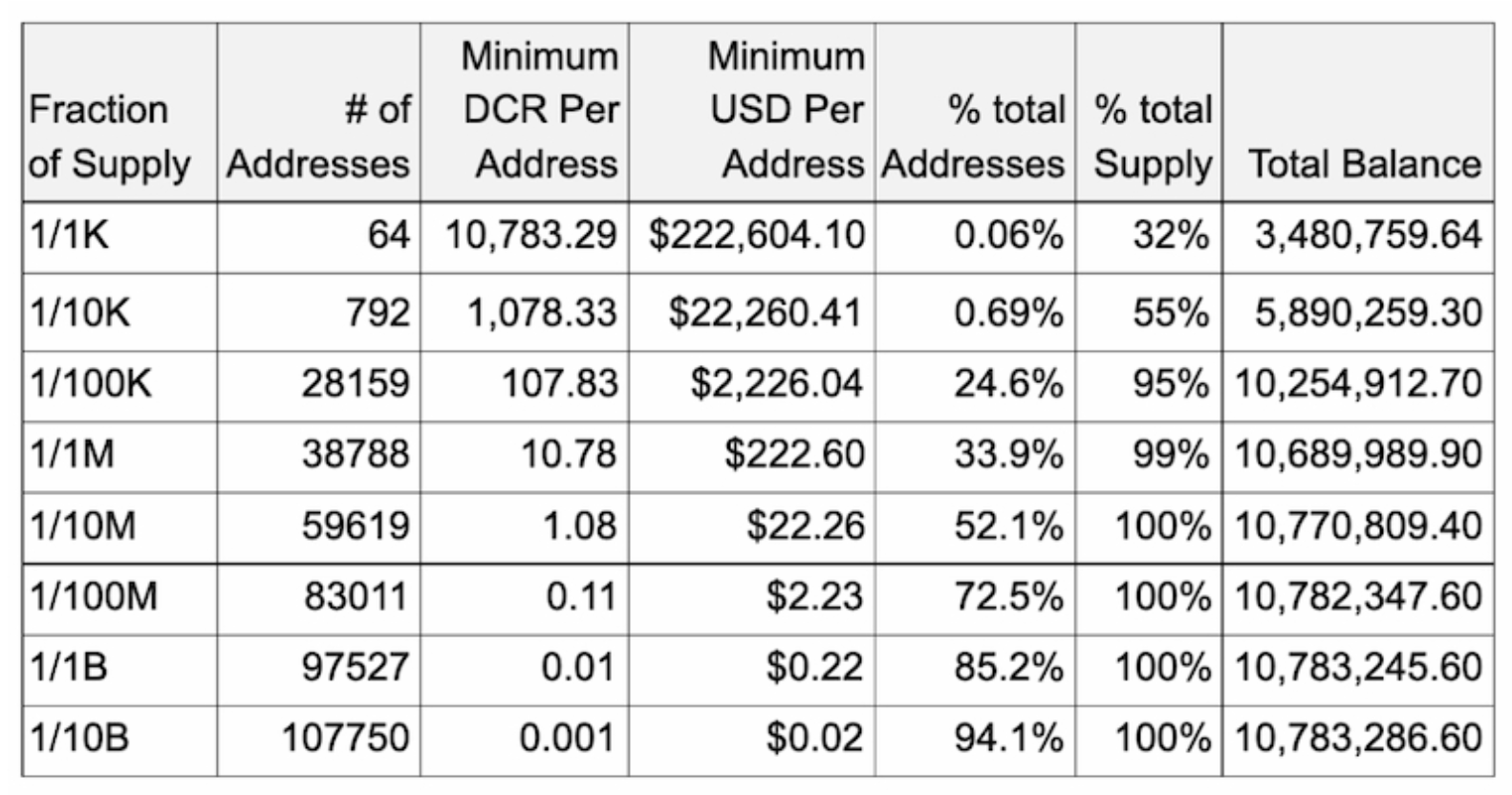

Although the number of votes is not directly proportional to the number of pledged DCRs, it is still advantageous to have a relatively large number of DCRs. The current price of each Decred note is 144.71 DCR, and the discount contract is 2,980 $. There are currently 28,158 addresses with at least 107.83 DCRs (approximately 24% of the total DCR supply), which is slightly lower than the price of existing notes.

To the next level, there are 792 addresses with at least one ten-thousandth of the total supply of DCR (that is, holding at least 1,078 DCR), at the current price of approximately 22,260 $. These 792 addresses account for 55% + of total DCR supply. Given that this group of addresses has more than 50% of the supply, it is conceivable that if the owners of this group of addresses cooperate, they can control Decred's voting.

However, Decred's voting system is more difficult to do than MakerDAO, because Decred's voting tickets are randomly selected, so a single user cannot directly enter and vote immediately.

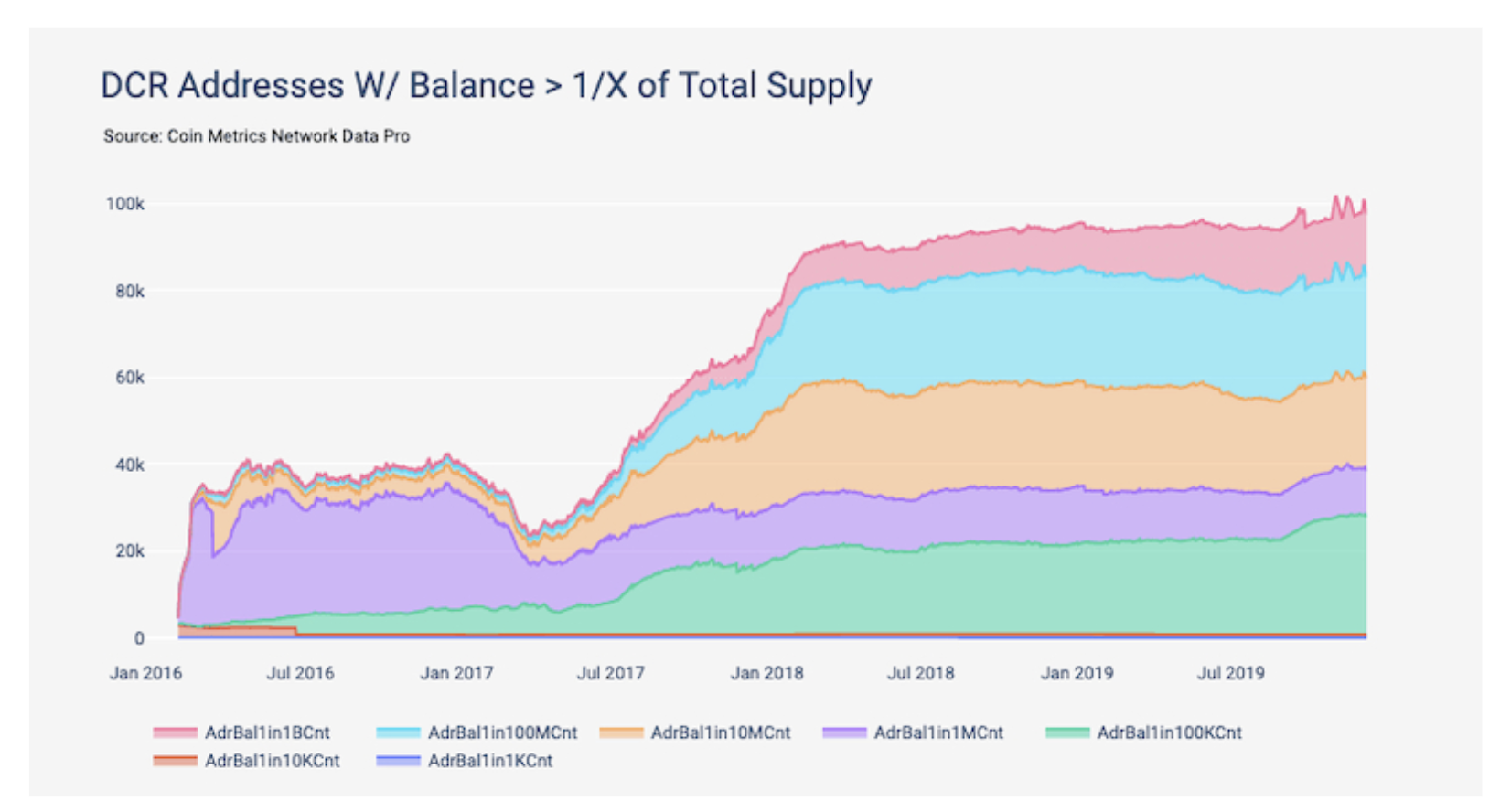

In the past year, the number of addresses with more than one hundred thousandth of the total DCR (ie holding at least 107.83 DCR) has almost doubled. Similarly, the number of addresses holding a small amount of DCR is also increasing. In the past year, the number of addresses with more than 10,783 DCRs has decreased (one thousandth of the total supply), from 73 to 64.

Tezos

Tezos' governance mechanism is more similar to Decred than MakerDAO. Tezos bakers (Tezos miners) vote with their tokens. In addition to voting on governance issues, Bakers also validated the blocks, but in this analysis, CM only focused on their voting responsibilities.

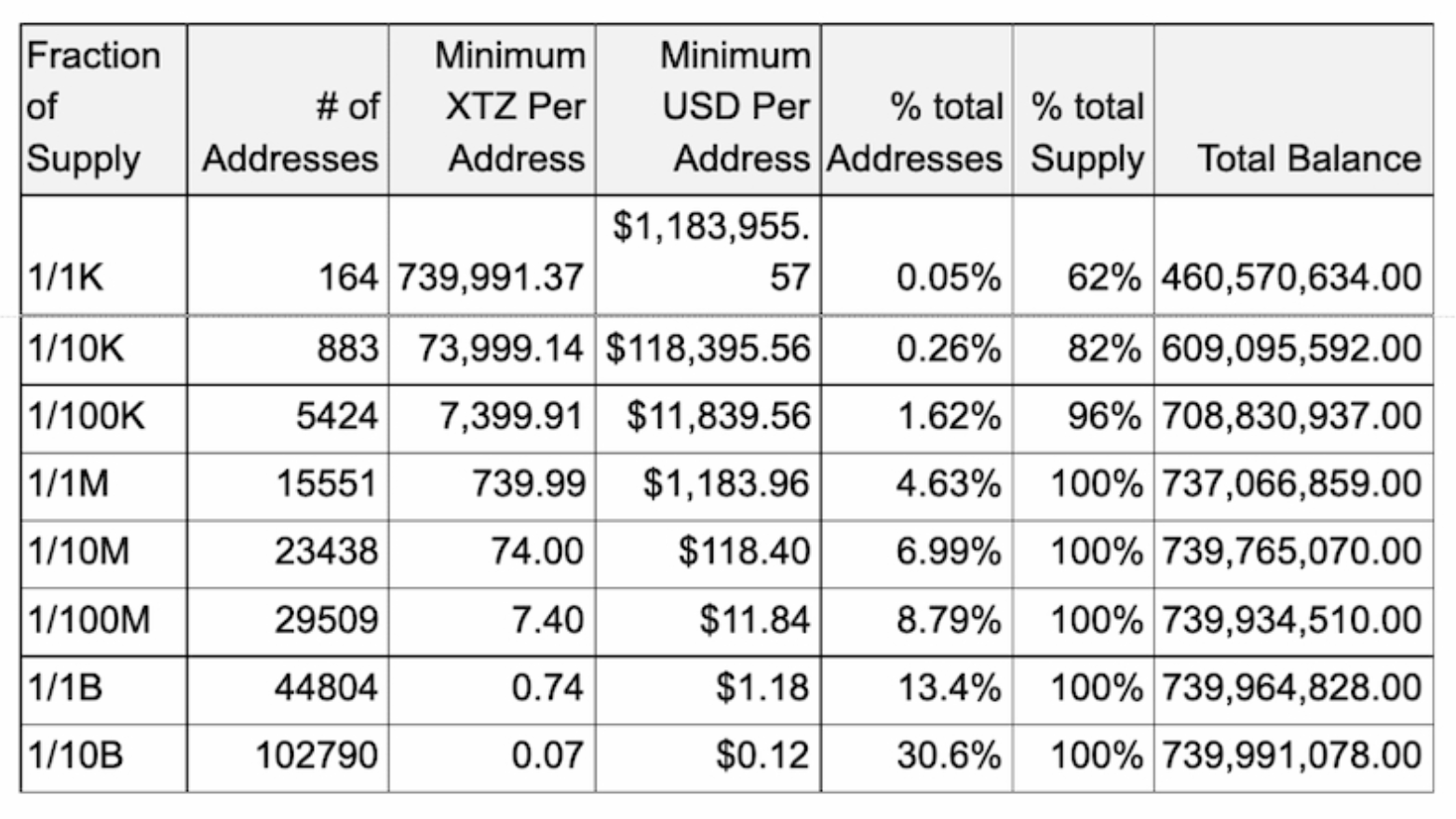

In addition, Tezos users can delegate their tokens to the roaster, allowing the roaster to vote on behalf of the user, which allows users with less than 8,000 XTZ to still participate in the baking process (indirectly).

In order to qualify as a baker, Tezos users must pledge a certain amount of XTZ, or "rolls". The more rolls a baker has, the higher the chance of being selected as a block validation node. Tezos rolls is currently priced at 8,000 XTZ.

There are currently 5,424 Tezos addresses with at least 7,399 XTZ (that is, one hundred thousandth of the total). These 5,424 addresses together account for 96% of Tezos' total supply. In addition, there are 883 addresses with at least one ten-thousandth of the total supply of tokens (73,999 XTZ, valued at about $ 118,000). The total number of tokens for these 883 addresses accounts for 82% of the total supply.

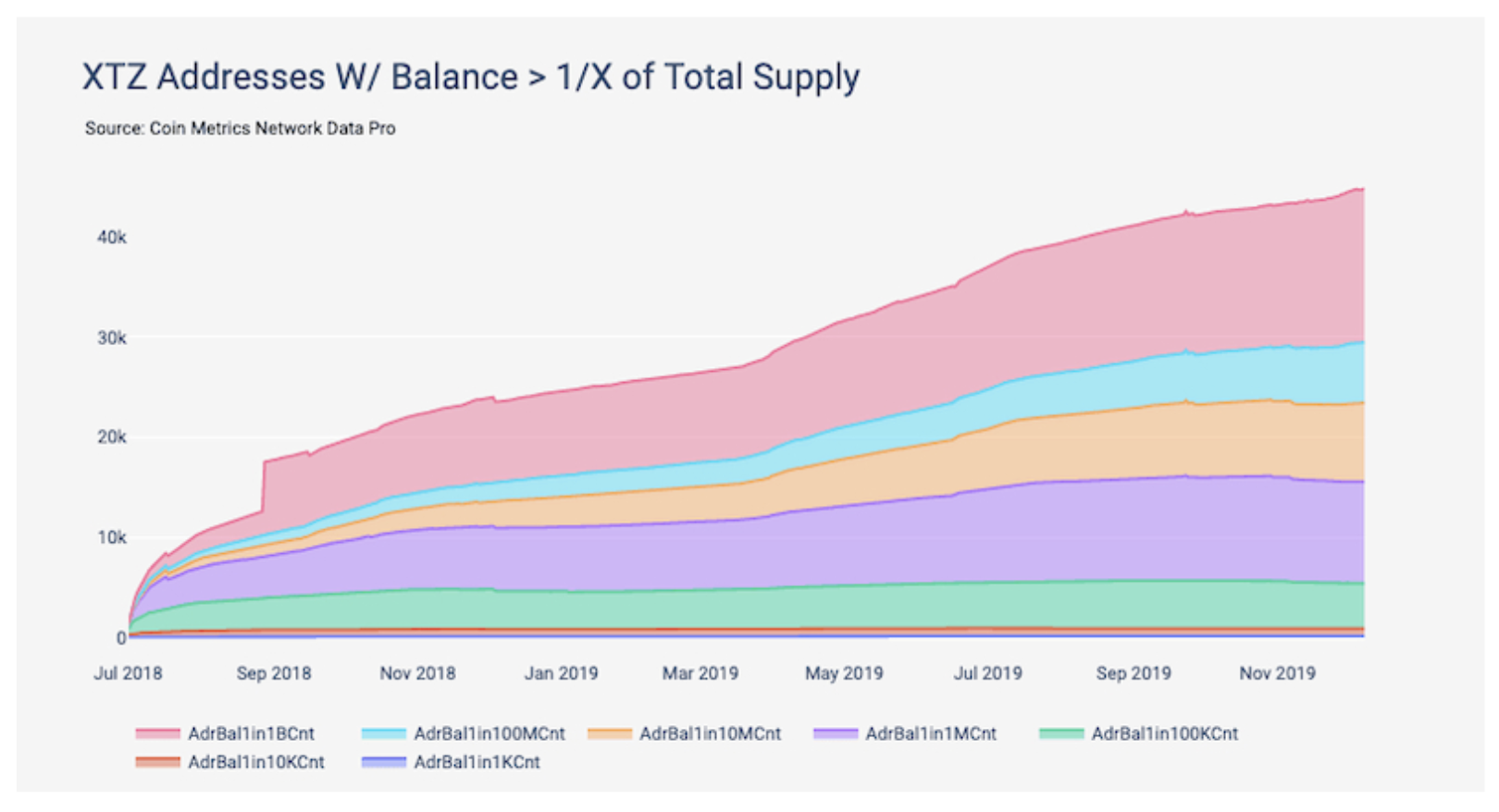

The number of addresses with more than one hundred thousandth of the total supply of XTZ (ie at least 7,399 XTZ) is growing more slowly than the DCR, from 4,625 at the beginning of the year to 5,424 today. The number of addresses with one-billionth of XTZ total supply (ie, at least 0.74 XTZ) has grown significantly faster, jumping from 24,556 on January 1 to 44,000.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Miners must read: 8 tips to help you achieve long-term mining profitability

- Zhongxiang Bit is strict: no blockchain technology team can make it without 50 people

- Science | What is the valid balance of validators in Ethereum 2.0

- Babbitt Interview | Jamie Burke, Founder of Outlier Ventures: We have been in the industry blockchain for 6 years

- The vision of Twitter CEO's social network: Decentralized network is the original intention, and the advent of blockchain rekindled the "hope" in my heart

- Fidelity Digital Assets: UTXO Model Leads to Overvaluation of Bitcoin's Real Trading Volume

- Blockchain startup Upvest secures $ 7.8 million in Series A funding, targeting "10 trillion euros" alternative investment asset class