Opinion | Beyond BTC halving in 2020, these three major events will happen in the mining industry

Text | Huang Xueyi Operation | Gai Yao Edit | Mandy 王 梦蝶

Production | Odaily Planet Daily (ID: o-daily)

At the beginning of the year, the price of the currency unexpectedly rose and the price of the mining machine doubled. In April, Bitmain and Shenma released new generation mining machines. After the arrival of the network, the computing power of the entire network went straight up, doubling this year and breaking through the 100E mark.

In the second half of the year, the price of the currency fluctuated downwards, in sharp contrast to the computing power curve. The first-generation machine emperor S9 was dying several times. In addition, the 2020 reward halving node was approaching. Will it be re-injected or backtracked? Confused; At the same time, Bitmain and Shenma successively experienced personnel shocks in which Wu Jihan “exiled” Zhan Ketuan and Yang Zuoxing were detained; on the other side, the first mining company, Jia Nan Yunzhi, finally successfully listed, raising funds, investing The film is expected by many people.

- In 2020, the blockchain will scale from trials to large-scale applications in insurance, trade, notarization and other industry scenarios.

- Global FinTech Financing Report 2019: Blockchain Financing Amount Leads Above 261.9 Billion

- Watch | Policies continue to assist, Bitcoin options go public, this week is a lot better

In 2020, these outstanding stories will usher in a new climax.

Bitcoin halving affects the whole body. How did the rise and fall of the currency price affect mining profits at that time, and how should miners choose now? When the new year begins, Odaily Planet Daily launches its annual planning report "Hello 2020" looking forward to the future series. This issue is a mining article, hoping to provide some reference for practitioners.

Mining 2019: hashrate soars, miners end by year

The picture below is the 2019 mining yearbook compiled by Odaily Planet Daily. Among them, the two major events that affect the development of the industry are the big changes in computing power and major changes in miners. Let us focus on the analysis below.

- The hashrate soared 1.4 times, and the new generation of mining machines contributed 3/4 of the hashrate

According to BTC.com data, in 2019, the average hashrate of Bitcoin increased by 1.45 times, from 40.16 EH / s at the beginning of the year to 98.67 EH / s at the end of the year.

In this nearly one hundred E computing power, many industry veterans judge that 50E is from the old miner at the level of 15 TH / s (represented by the ant S9), and the remaining 50E is the new from the 50 TH / s level. Mining machine (represented by the Shenma M20S).

The basis of this estimation is that in October 2018, the peak value of Bitcoin's entire network computing power reached 53 EH / s, but since then, as the currency price plummeted, the mining machine continued to shut down and was removed from the shelves; by the next year, the market conditions improved, and the floods It was only at the end of May that it rose to 53 EH / s.

In addition, the earliest new generation of mining machine ants S17 series has arrived since the end of May, so the increased computing power after June can be considered to be mainly brought by the new mining machine (44.69 EH / s), accounting for about The annual increase in computing power is 76%, or three-quarters.

For the computing power of 2019, the founder of BTC.com Zhuang Zhong also said an interesting phenomenon.

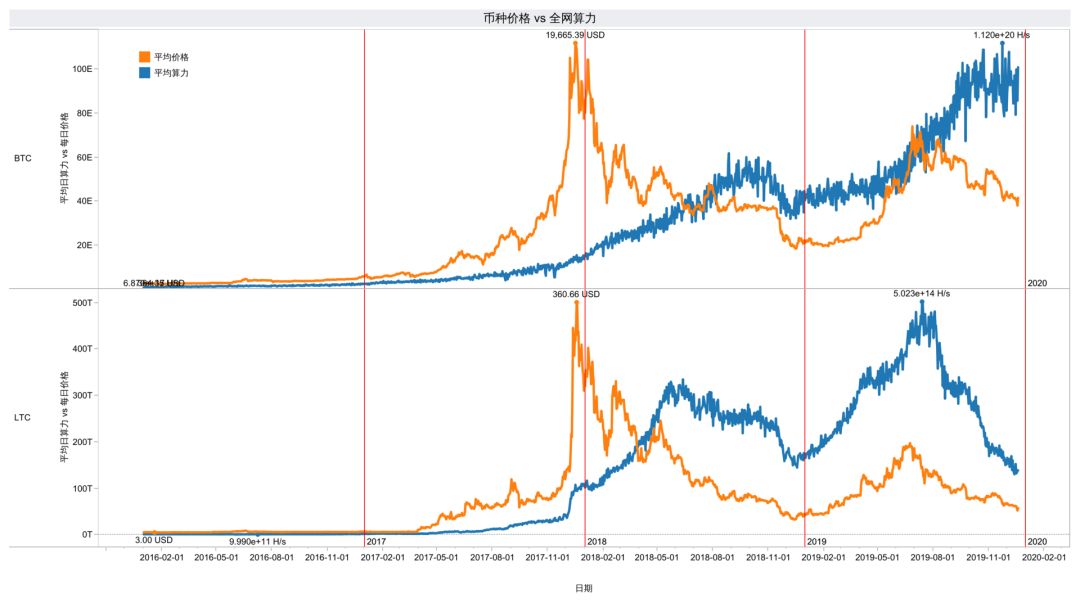

The following figure shows the comparison of the price of Bitcoin and Litecoin and the computing power of the entire network (blue).

Picture from BTC.com

Pay attention to the change curve of the computing power of the two this year. Litecoin's computing power goes with the price of the currency, rising first and then falling; Bitcoin has broken out of the endless currency price in the second half of the year and has been rising to the present.

This is also different from its historical performance. At the end of 2018, the entire network's hashrate plummeted after following the currency price. Moreover, that decline took the entire network's computing power to restore the "primordial god" for a full 7 months.

As Zhuang emphasized, the reason for this year's "abnormality" is that during the period of rising market prices, the response of the mining industry lags behind the currency price. In addition, the industry has come to the node of the upgrading of mining machines.

"The market situation at the beginning of the year brought relatively good expectations to the mining industry. In the short term, the mining machine market has a large shipment, so the computing power is still rising when the Mavericks pass. Of course, this decision is also because of the new mining machine mining There is indeed a lot of room for profit, which is also the safest option for halving next year. "Solemnly said.

- Canaan goes public in the US, Shenma successfully breaks through, and the mainland is turbulent

Speaking of the mining machine manufacturers in 2018, one manifestation that everyone can think of is that they went public to Hong Kong for listing. Beginning in May of 2018, Jia Nan Yunzhi, Yibang International, and Bitmain, the top three market sharers, have submitted prospectuses, but after six months, they all ended in "overdue".

In 2019, Jia Nan Yunzhi, who has been running for 4 years, finally achieved his wish, but at the same time, the "spoiler" Shenma also succeeded in quickly attacking the market in terms of market share.

In October 2019, Jianan Yunzhi formally submitted a prospectus and successfully landed on Nasdaq the next month, raising US $ 90 million with a valuation of 1.33 billion. Although the valuation and financing amount are far less than the trend of going to Hong Kong to seek an IPO in 2018, it has also become the "first share" of China's mining industry and even the blockchain.

Almost at the same time, at the end of September, Yang Zuoxing, the founder of Shenma Mining Machinery, expressed his anger at the Coin-India Mining Summit and announced that in the third quarter from July to September, its latest generation of mining machines M20S / M21S has shipped 100,000+ units. It is estimated that 200,000+ units will be delivered by the end of the month.

This is a dazzling achievement: Q3 delivered an average of 70,000 units per month, with a monthly output of up to 100,000 units. A single unit is calculated at 55 T. In 3 months, Shenma contributed about 10 to the entire network. E computing power, accounting for about 27.6% of the new computing power, and its market share ranks among the top three.

But just one month later, with Yang Zuoxing's surging horses, he was suddenly "lost."

On November 3, the media "Wu Said Blockchain" announced that according to various parties' verification, Yang Zuoxing had been taken away by the police for investigation or was related to the violation of Bitmain's commercial secrets. No release has been reported so far.

This flight of disaster is really "planned for a long time." A number of people close to Bitmain told Odaily Planet Daily that Bitmain has never given up using all kinds of formal and informal means to chase down rivals.

At the time of the incident, Bitmain had just encountered Wu Jihan's "seizure of power." Therefore, "reporting a god horse" was also understood to be one of the actions of "Waiwai Annai."

On October 29, business information showed that Wu Jihan replaced the Jenke regiment and became a legal person in Beijing Bitmain. Immediately, Wu Jihan released an internal e-mail, announcing the dismissal of all positions of the Jenke regiment in Bitmain. At the same time, a large number of "Zhanpai" employees in the dismissed group.

The Zhanke regiment that was "dismissed" launched a series of counterattacks in the follow-up, including freezing related assets of Bitmain's subsidiaries, and hiring lawyers from various places to file lawsuits in Cayman. But so far it has not been effective.

After clearing the "political opponents", Wu Jihan started a series of internal adjustments. In terms of personnel, all employees were raised first after a large number of layoffs. In terms of business, the focus was on the Bitcoin mining machine business, and the AI server team and small currency were cut. Part of research and development.

Miners who have experienced these changes, returning to the main point of mining machine R & D and production, Bitmain and Jianan Yunzhi continue to invest in 5 nm mining machine chip tapes. On the other hand, Bitmain and Shenma's latest mining machine M30S And Ant S19 has been competing on advanced performance of 30-40 W / T.

According to Wu's blockchain news, the price per T of the Shenma M30S will be less than 200 yuan, which looks very cost-effective; at the same time, relevant sources have revealed that the Antminer S19 is confident to have an economic advantage.

The competition of miners to reduce prices really reflects the current sluggish sales of mining machines. All this is due to the uncertain currency price and the block rewards that have worried the mining industry in half.

Mining 2020: halving = mine disaster?

As Shenyu, the founder of F2Pool Yuchi said, "This year, we basically went through a complete mining cycle, from the beginning of the disillusionment period to the rapid rise period, and now it has entered a confused period. Everyone should be here Think, what will happen in the future? What should we do to deal with it? "

Mining depends on two factors, the currency price and the difficulty of the entire network. To be precise, the currency price is the root cause, and the difficulty of the entire network is mostly linked to the currency price. We still have to seriously consider whether the "halving market" that has been digested by people one year in advance will come.

Let's start with the "optimist" point of view.

Asked what would happen after halving, ViaBTC founder Jiang Zhuoer answered this question differently from most people.

"Mining is more profitable after halving." His tone seemed unquestionable.

"A lot of mining unions were close to the enemy before the halving. In fact, later they found that after halving, they made more money in fiat currency (everyone)."

Why do you believe that the halving market will come? Jiang Zhuoer explained from the perspective of supply and demand.

It said that the halving of digital currency to the supply and demand balance is very direct. Even if bitcoin is about to be halved for the third time, but this year's halving, this still means that 900 BTC are being produced every day. What is this concept? Based on the current price of bitcoin (about 50,000 yuan), it is equivalent to someone buying 45 million bitcoin every day, and it is a continuous net purchase.

From the perspective of supply and demand, some people need to hoard or use digital assets. This long-term demand will not change in a short time. After the supply is halved, the price must double to restore the supply and demand balance. But after the price rises, many people know that Bitcoin has risen through the news, and then come in to buy, causing the price to rise, and finally forming a positive cycle.

Yuan Yuan, the founder and veteran miner of Yaohui.com, agrees with this view from the perspective of miners' psychology. "Half the halving also means that the cost of acquiring Bitcoin in the future may be higher, so capable miners are more inclined to hoard coins, thereby accelerating deflation."

Of course, there are also many miners who believe that this expectation has been over-digested, and what people think will happen, but will not happen.

"If there are fewer people watching history, history will be easier to repeat; if there are more people watching history, history may change." As one person in the industry said.

The price of the currency is difficult to determine, but production decisions are before us. In fact, we can make a simple model to prepare for the upcoming halving.

If the price is halved at the moment, then the situation may be as expected by many people. Those old miners with low energy efficiency and high electricity costs will face batch shutdowns.

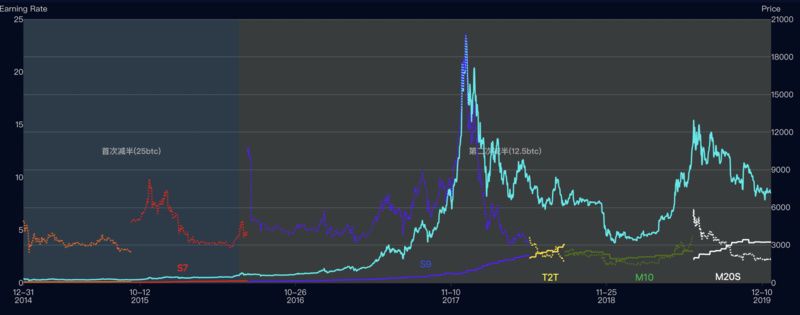

Godfish divides the bitcoin miners in the current market into three gears. The first gear is the latest generation of mining machines with an energy efficiency ratio of 40-50 W / T, and the number is small. The second gear is based on the core motion T2T and Shenma. M10 represents the miner with an energy efficiency ratio of 50-60 W / T; the third gear is the Ant S9 with an energy efficiency ratio of 100 W / T. After frequency reduction and modification, the energy efficiency ratio can be reduced to 80-90 W / T .

If the price is still the same when halved next year, then miners with energy efficiency ratios above 60 W / T will face a high risk of shutdown. As shown in the figure, at the current general electricity price of 0.38 yuan / kWh for miners of 60 W / T and above, the daily net income of a single unit is more than 20 yuan. After the reward is halved, the revenue will be halved. Will face shutdown.

Data from: F2Pool

However, Shenyu said that after halving 20 days, the mining area came to the flood season at the end of May and early June. If the policy is good and the electricity price is as cheap as last year, the mining machine with an energy efficiency ratio of 60 W / T or more may also be re-started. Start up, "and in this waiting process, there will be a relatively difficult stage in 20 days."

If the price of the currency cannot be maintained after the halving and the U-turn is down, such as falling to 5000-6000 USD, then a mining disaster may occur at this time.

"It may lead to mining machines above 50 W / T, and only 2-3% of the entire network is left." Shenyu judged. "The miners that are shut down will gradually migrate to low-power areas abroad."

Of course, if the price rises, such as by 50%, then the current level can be maintained. If it is soaring, the limited production capacity of mining machines may cause extreme shortages of mining machines, thereby stimulating the prosperity of mining machine production and distribution markets. Owners of mining work can also profit from it.

"This year may be two extremes, either great joy or great sadness." Shenyu concluded.

In order to encourage the miners to laugh at this confused period, Shenyu brought a bowl of chicken soup to each miner at the annual customer appreciation banquet held at the beginning of the month.

He said that the development of mining cannot be separated from those hard times. The following figure is the mining pain index produced by Yuchi, which is a profit margin for mining.

Data from: F2Pool

It can be seen from the figure that from the end of 2015 to 2016, the mining industry has fallen into a very difficult period, with the index at about 4. "But those hard times also forced everyone from the earliest industrial parks or home-based mining to large-scale mining of hydropower. Miners have come to Sichuan from places such as the Northeast to dig cheaper electricity. Resources, the entire mining industry has also been able to undergo a major upgrade, resulting in everyone present and so many large-scale mines. "Shenyu said.

Jiang Zhuoer put forward a more aggressive strategy based on the judgment that the halving market is bound to come.

"Now it is quite good to buy a mining machine. After half a year of decline, the price of the mining machine has been relatively low, and the miners have also used various methods to raise money, so they can actually invest in mining. Moreover, they should try to dig out after mining. For example, if you have 1 million coins, do n’t use them to buy mining machines, and reserve a certain amount of money to store coins. This will accumulate coins more quickly, and you can better step on the halving market. ”Jiang Zhuoer Means.

Beyond halving, 3 big predictions for 2020

1.Accelerated penetration of mining finance

Since the second half of 2018, people of insight have been calling for mining finance. By 2019, finance will fully occupy all aspects of mining.

From the mining machine recently launched by the joint lender to the mining machine mortgage 0 yuan purchase and installment purchase, to the mining machine dealer when the large amount of capital turnover is in urgent need to seek a loan from the service provider, and then to the miner who has a certain understanding through the purchase of options and other products To lock in the mining revenue, etc., finance has a self-evident role in the strong relationship, heavy investment, and long-term business of mining.

At present, the most common products and services in mining finance are hedging (also known as hedging and locking mining proceeds in advance) and mortgage lending (mortgage of bitcoin to obtain working capital to pay for mining costs). The former provides risk aversion Exposure, which provides the cash flow needed for production.

In terms of product form, there are relatively few products designed to provide hedging services for the mining industry. Most miners hedge mainly through exchanges. Relatively speaking, the shape and scale of lending products are more intuitive.

Digital lenders told Odaily Planet Daily that "conservative estimates indicate that domestic digital currency centralized lending has a loan size of $ 400-500 million, and about half of them are miners."

However, from the perspective of penetration rate, the combination of finance and mining as a "blockchain entity industry" is only preliminary, and the market explosion will take 2020 or even longer to complete. The reason is that the factors such as the miner's perception and the cost of use have prevented the popularization of such a conventional but complex tool as options.

Making miners realize the role of these tools may be the first step for service providers.

In this regard, solemnity is quite "bitter."

"I know that a lot of old miners are more 'faith fans'. Everyone's strategy is relatively simple. I just dig coins and then I do n’t sell them. But this idea is definitely a problem. If you die and hoard coins, you lose In fiat currency, your machine will always be so many. In the end, it may be that someone else has set a high price to buy a new machine, and then the computing power is more than you. So I think miners should have some growth in how to use financial tools to leverage mining revenue planning."

2. The business boundary of mining enterprises disappeared, and competition became increasingly fierce.

In 2019, one of the most intuitive feelings of everyone is "a good multi-cloud computing platform came out this year". The reason behind this is that there are actually many companies that originally specialized in mines, mining machine distribution and even mining pools, and have begun to transform into a comprehensive platform that integrates mining machine trading, hosting, cloud computing power, and financial services.

Among them, there are many players who come in for gold from the currency circle and even the traditional industry, but more of them are dominated or supported by players in the industry. These players rely on a single business and make full use of industrial resources for vertical and in-depth expansion.

Hidden behind this is that players who have been rushing into the sand in 2018 or waiting for the opportunity to enter the industry during the cooling-off period of 2019 are becoming more institutionalized and professional. At the same time, the industry's decline in the second half of the year is also extremely diluting mining profits. In order to seek diversified sources of income, mining companies that want to become larger and stronger have to turn into "treasure boxes", combine multi-party resources, and provide one-stop services .

For example, miners such as Bitmain and Jianan Yunzhi cooperated with professional lenders such as MatrixPort and PayPal to “destock” and launched mining machine mortgage 0 yuan purchases and installments; etc. Hero posts, recruiting mines to "joint mining"; and currency printing, after the brand was formed, cut into the industrial chain of OEM, mining machine maintenance and other industries, opening up a "one-stop" "post-service market".

In the market of mining service providers, the industry structure is far from being formed, and today professional players have been in place. If the market is not too bad, this year will be a year of crazy horse racing for these players.

3. Chip capacity is tightening, and Jianan's favorable listing highlights

Production capacity has always been a hard top for computing power growth. By 2020, it will be even more severe.

This year, the viewpoint of 5G chip mining machine chip production capacity has almost reached consensus. It is inferred from this that the support of chip manufacturers (that is, TSMC and Samsung) will largely determine the victory and defeat of miners in the market.

In 2019, Bitmain's new mining machine shipments are slightly inferior to the enemy, and one of the most important reasons is that the chip capacity / yield is limited. By 2020, this situation may be even worse.

Moreover, in addition to 5G chip grabbing capacity, there is also competition among miners. It turned out that Bitmain's chip foundry is TSMC, Shenma, Core Motion and Wingbit are Samsung, and Jianan Yunzhi has two major suppliers at the same time.

"Swinging between TSMC and Samsung will allow Jianan Yunzhi to get rid of its excessive reliance on a single supplier." Some insiders believe.

"Jianan Yunzhi will gain more trust at the supply chain level after its successful listing." "Wu said" Blockchain quoted relevant sources. It is reported that when Bitmain's 5nm test chip is successfully returned, Jia Nan Yunzhi will also follow up with TSMC's 5nm process.

The new US $ 90 million fund raised by Jianan Yunzhi IPO can also help it invest in research and development and increase production capacity. "After listing, we can also gain more trust and support in financing and sales channels." Shenyu said so.

Now that chip production capacity is becoming tighter, Jia Nan Yunzhi seems to have touched a few good cards.

Finally, Odaily Planet Daily borrowed a blessing from Godfish to send it to miners' friends, "Still seek stability next year, and invest in what you can afford, you may get unexpected gains."

References:

"Mining Research Report 2019", TokenInsight, January 2020

THE BITCOIN MINING NETWORK , CoinShares Research, December 2019

Original articles, reprinting / content cooperation / seeking reports, please contact [email protected]; unauthorized reprinting is strictly prohibited, and illegal reprinting must be investigated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- DeFi weekly selection 丨 the total value of the lock position exceeds 1.1 billion US dollars, the DeFi era of sailing is beginning

- Observation | Blockchain accelerates the digital transformation of commercial banks

- Xiao Yan: What is the legal boundary of blockchain technology and its application?

- Featured | Examining various centralized and decentralized crypto lending platforms

- Money laundering, stolen money, murder, Malta's bad crypto dream

- Can the central bank digital currency replace the US dollar in the future?

- Promote the progress of digital currencies in various countries. Will stable currencies such as Libra still have huge development potential in the future?