The road to DeFi on Bitcoin

Source: Blue Fox Notes

Author: Mohamed Fouda

Translation: ZT

Foreword: To implement DeFi products on the public chain, in addition to the scene itself, there are several key points, the value of the public chain's native assets, the throughput of the public chain, and smart contracts. From these perspectives, Bitcoin has an overwhelming advantage in the value of native assets, but its shortcomings in terms of transaction throughput and smart contracts are very obvious. This leads to a natural disadvantage of implementing DeFi on Bitcoin. So, in this case, is it possible to achieve rich DeFi based on Bitcoin?

- Opinion | Beyond BTC halving in 2020, these three major events will happen in the mining industry

- In 2020, the blockchain will scale from trials to large-scale applications in insurance, trade, notarization and other industry scenarios.

- Global FinTech Financing Report 2019: Blockchain Financing Amount Leads Above 261.9 Billion

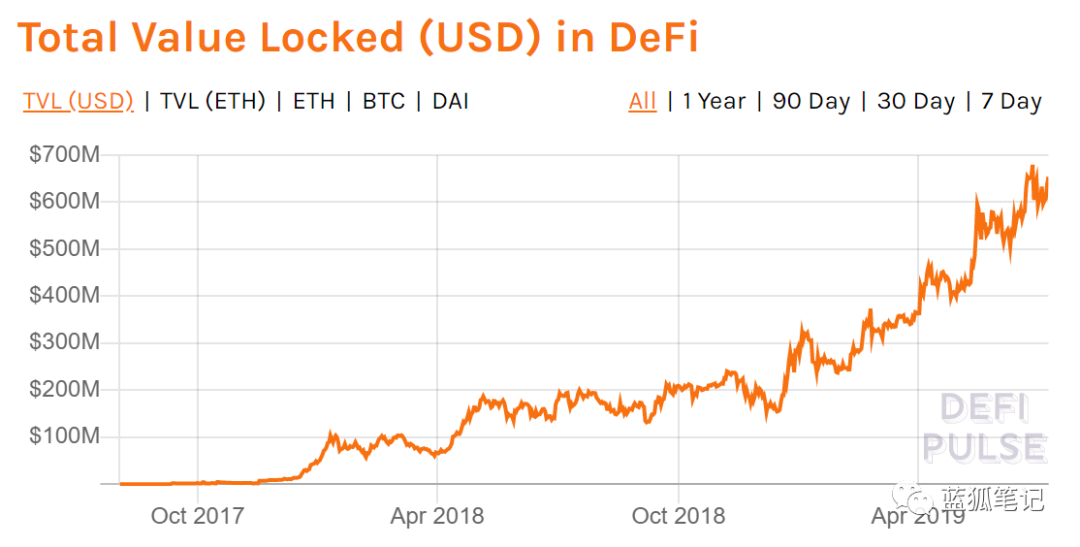

For many cryptocurrency investors and enthusiasts, DeFi has always been a popular narrative. DeFi's vision is as follows: As intermediaries shrink or disappear completely, critical financial services will become cheaper and more efficient. In theory, DeFi makes online financial services more inclusive because it can overcome some artificial obstacles, such as national borders or judicial restrictions.

DeFi products and protocols are made possible by allowing us to encode the rules of financial interaction into a blockchain that does not require permission. Therefore, it is natural that most of the current DeFi projects are built on Ethereum to take advantage of the functions of its smart contracts.

However, Bitcoin is still the most liquid, best-known, decentralized cryptocurrency in the world (at the time of writing, its market capitalization exceeds 60% of the total cryptocurrency market capitalization. Blue Fox Note: currently 66%) . Obviously, this makes Bitcoin a strong opponent of DeFi products that benefit from trust and decentralization. But obviously it doesn't mean it's easy.

Bitcoin believers want to retain Bitcoin's "hardness" at all costs, and are unwilling to make fundamental changes in monetary policy, for whatever reason, whether it is DeFi or not. Despite the existence of sidechain solutions like RSK, it is almost impossible to add smart contract functions to the underlying layer of the Bitcoin protocol to implement DeFi products.

However, this does not mean that Bitcoin DeFi will never happen.

From centralized to almost completely decentralized financial products, many individuals and teams are struggling to use the current structure of Bitcoin. This article will explore how Bitcoin DeFi will become possible, and different technical methods will be explained with different cases.

First, what exactly is DeFi?

Decentralized finance, or DeFi, is a comprehensive concept that includes all financial services that can operate without intermediary organizations, or the mechanisms that control financial products are implemented between different entities. DeFi products include decentralized lending, decentralized transactions, decentralized derivatives, or even decentralized stablecoins.

Many people also think that decentralized payment is also a DeFi product, and I also support this view. From this perspective, Bitcoin is the most widely used cryptocurrency by businesses. Services like BTCPay even allow merchants to receive BTC directly without going through a third-party payment processor. Therefore, this article focuses on how Bitcoin can extend its DeFi footprint beyond decentralized payments.

Overview of Bitcoin's centralized financial products

Before delving into the development path of Bitcoin's DeFi, let's start with some of the "centralized" financial services that currently use Bitcoin. Once DeFi can be effectively executed on Bitcoin, this will be the main goal of decentralization.

- Bitcoin lending

One of the most popular financial services based on Bitcoin is lending. We can divide companies in this area into two categories. The first is to allow investors to borrow Bitcoin and some other cryptocurrencies for trading or market making; the most well-known company in this regard is Genesis Capital. Genesis Capital reportedly processed $ 1.1 billion in crypto loans in 2018, 75% of which were Bitcoin.

The second category is companies that provide BTC mortgages, such as BlockFi and Unchained Capital. In order to prevent fluctuations in the value of collateral, these companies only issue excess mortgage loans. The value ratio of loans and collateral is 20% -50%. (Blue Fox Note: In other words, if you mortgage 100BTC, you can only lend 20-50BTC).

- Margin lending

Margin borrowing is a special case of collateral borrowing and is used for leveraged transactions. In such a scenario, loan funds are not allowed to leave the lending platform. Conversely, if the transaction loss is equal to or lower than the value of the collateral, the margin position is liquidated and the funds are returned to the lender.

BitMex, Kraken, Bitfinex, Poloniex and other exchanges are the main players in the field of margin trading. However, due to regulatory uncertainty, most of these products are not available to US customers.

- Stablecoin

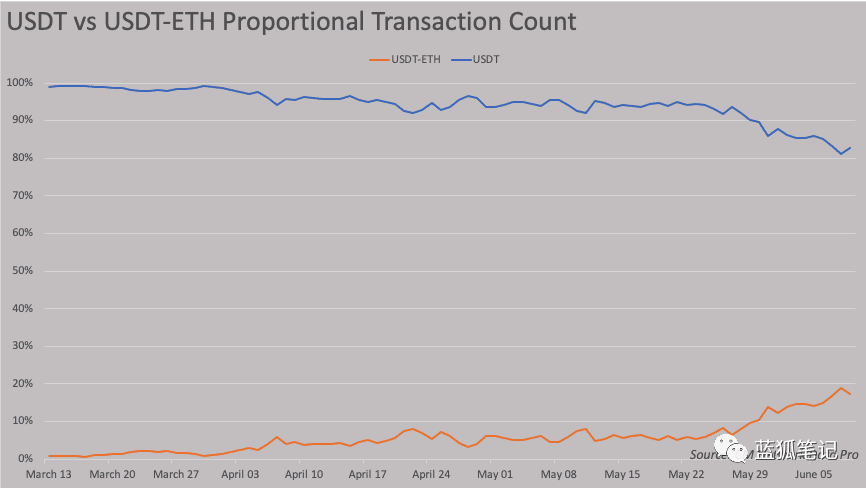

Stablecoins are easy to transfer and have low rates. Traders are particularly interested in this. They want to benefit from volatility and maintain value stability when they are not actively trading. USDT was one of the first stablecoins to solve this problem. It is built entirely on Bitcoin using the OmniLayer protocol. OmniLayer allows the creation and transfer of assets using the Bitcoin transaction opcode space.

USDT is a stable dollar anchored in USD. It promises that the USDT token will be minted only when the corresponding USD is deposited in Tether, and the corresponding USDT will be destroyed when the USDT token redeems USD. Although Tether can be traded in a decentralized way, the most important part of it is still centralized: reserve and control. Tether holds and controls the USD reserves of all issued USDTs in its bank accounts, which often puts them in legal trouble.

Tether began issuing USDT in other blockchain networks, such as Ethereum and EOS, which attracted activity on the original Bitcoin blockchain, thereby reducing its dependence on the Bitcoin network.

Decentralized Finance in Bitcoin

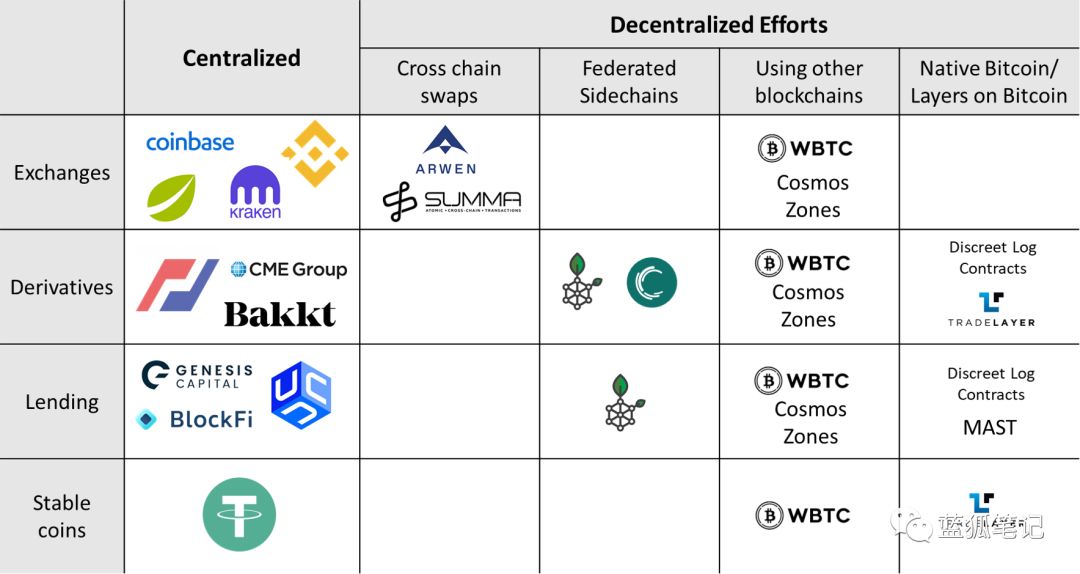

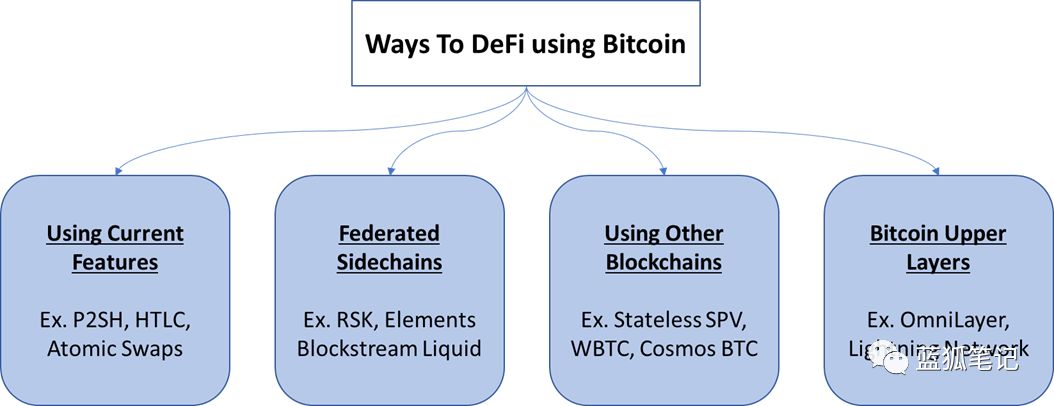

Now let's take a look at how DeFi products can use Bitcoin. We will list some use cases and projects to illustrate. Possible use cases include decentralized exchanges, decentralized lending, decentralized stablecoins, and decentralized derivatives. The technical methods of implementing Bitcoin DeFi include:

* Leverage Bitcoin's existing capabilities such as Hash Time Locked Contracts (HTLC) to facilitate direct cross-chain atomic transactions to build decentralized exchanges with other cryptocurrencies.

* Bitcoin's affiliate sidechains, such as Blockstream's Liquid network. These sidechains use two-way anchoring to the Bitcoin blockchain and allow the use of anchoring to Bitcoin in various financial activities.

* Use Bitcoin in other protocols, such as Ethereum or Cosmos, to enable interaction with DeFi products;

* Using layers based on the Bitcoin blockchain, such as OmniLayer or Lightning Network. These technologies differ in terms of features and the range of DeFi applications they support. In addition, most of these technologies are under development. Next, let's explore these technologies and their target use cases.

Cross-chain transactions on decentralized exchanges

The simple premise of a decentralized exchange is to perform transactions between Bitcoin and fiat or Bitcoin and other cryptocurrencies, meanwhile, keep your tokens until the transaction is complete. In other words, you don't need to deposit your bitcoin into the wallet of a centralized exchange to trade, and you do not need to bear the security risks of the exchange.

Although platforms such as LocalBitcoins and OpenBazaar can complete such transactions, these platforms are only suitable for those who occasionally trade, not fast and frequent transactions that allow efficient price discovery. For these people, a centralized order book that can settle transactions quickly is very useful.

Realistically speaking, building a truly decentralized exchange is one of the most difficult challenges for DeFi. As long as there is a centralized server that provides and displays the order book, you still have centralized components. However, what we are focusing on here is how to hold our own currency before the transaction is completed. In this area, we believe that some companies are working hard to develop technology to achieve this goal. Arwen and Summa are leaders we know.

Arwen uses the concepts of trustless on-chain custody and cross-chain atomic transactions, allowing access to the order book of a centralized exchange without the need to host tokens. In this case, you can efficiently trade on a centralized order book while holding your own tokens until the transaction is executed. At present, this product only supports bitcoin series of cryptocurrencies (Blue Fox Note: tokens using the same code base as Bitcoin), such as LTC, BCH. Arwen is working to achieve cross-chain atomic transactions between Bitcoin and Ethereum and ERC-20 tokens.

Summa invented Stateless SPV technology, which can provide trustless financial services for Bitcoin and other blockchains. Stateless SPV allows the use of Ethereum smart contracts to verify Bitcoin transactions, making it possible to perform various financial transactions using Bitcoin. Using this technology, the Summa team conducted an auction to use Bitcoin to bid for tokens issued on Ethereum. The team is studying universal cross-chain transactions between Bitcoin and Ethereum and ERC20 tokens.

Bitcoin DeFi using alliance sidechain

Bitcoin sidechain is a concept proposed by Blockstream in 2014, which aims to introduce some new features to Bitcoin without changing the underlying layer of the protocol. Since then, the concept has evolved significantly. The simple idea of a side chain is to create a separate chain that is run by a small group of validators (known as a consortium) and uses a token on the chain that anchors Bitcoin through two-way anchoring. Its benefits include faster transaction confirmation or execution of potentially controversial functions such as private transactions, tokenization of other assets, or smart contracts.

The main drawback of a sidechain is that it needs to trust a small alliance to execute the sidechain and keep it running. In addition, there is a risk of losing property using the sidechain. For whatever reason, if the sidechain verifier decides to abandon this sidechain, in this case, the anchored property will be abandoned in this sidechain. Bitcoin cannot be redeemed.

RSK is a well-known sidechain that is committed to bringing smart contract functionality to the Bitcoin network. It supports smart contracts in Solidity language, which makes it easy to migrate the DeFi protocol on Ethereum to RSK. In addition to RSK, Blockstream also released its commercial Liquid sidechain products in 2018. However, Blockstream's original idea focused on asset tokenization and faster transaction speeds, but this concept can also be used to support DeFi applications.

Decentralized derivatives using the Bitcoin layer

The third way to implement a Bitcoin DeFi product is to use an intermediate layer built on top of Bitcoin, such as the Lightning Network and OmniLayer. Since the Lightning Network is a relatively new Bitcoin development, building complex DeFi products on top of the Lightning Network is still under study. The most notable effort comes from Discreet Log Contract, which we will talk about at the end of the article.

Another option is to use OmniLayer, one of the interesting projects is Tradelayer. This project attempts to implement a decentralized derivatives market on Bitcoin. It aims to extend the OmniLayer protocol through multi-signature channels to allow the use of Bitcoin or other tokens issued on Bits as collateral for peer-to-peer derivatives transactions.

One possible scenario is to place the trader's protection funds at a multi-signature address and jointly sign the transaction and transaction update to achieve the settlement of derivative transactions. In this scenario, users can achieve local utilization and get fast execution by co-signing transaction transactions. Using the same method, another possible use case is to use Bitcoin collateral to issue stablecoins in the same way that MakerDAO uses Ether as collateral to generate stablecoin DAI.

Leverage external help to achieve Bitcoin DeFi

- Wrapped BTC on Ethereum

A completely different approach to using Bitcoin in DeFi is to take advantage of other networks, such as Ethereum or Cosmos. Since most DeFi projects now run on Ethereum, it seems logical to find a way to use BTC on Ethereum.

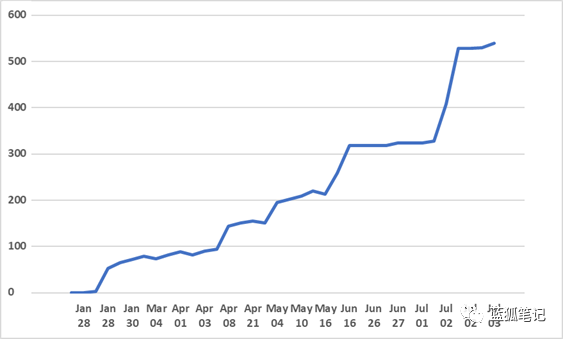

The easiest way is to issue Bitcoin-based ERC20 tokens (WBTC), which can be used on Ethereum's DeFi project or traded on Ethereum's decentralized exchange. The BTC used to issue the WBTC needs to be placed in the multi-signature wallet of the project hosting provider. As of July 2019, 540 WBTCs have been issued, accounting for only a very, very small portion of BTC's circulating supply.

Although WBTC may facilitate the use of BTC in DeFi, it still has some important shortcomings. First and foremost is counterparty risk. BTC used for pledge needs to be kept by a centralized institution, and it will face hacking. Secondly, the introduction of intermediaries to keep BTC to some extent does not conform to the concept of DeFi. Finally, to use BTC / WBTC on DeFi, users need to pay with ETH, which is not what many Bitcoin fans are willing to do.

- Using Cosmos

Cross-chain projects such as Cosmos bring new opportunities to introduce DeFi for crypto assets such as Bitcoin. For example, the Cosmos protocol defines an anchoring area, where assets (issued in Cosmos) can be anchored to other blockchain assets such as Bitcoin. In these areas, it is possible to add smart contract functionality to anchored assets and benefit from faster finality.

This method is also supported by some hardcore Bitcoin supporters: In this way, Bitcoin can still maintain native tokens to pay fees and use anchor zones. Bitcoin supporters can pledge their anchored BTC in the anchor zone to process transactions in the zone and claim transaction fees in the zone. In this sense, the Bitcoin network will benefit from this new technology without having to rely on other assets. This is in sharp contrast to WBTC, which needs to use ETH to pay fees or interact with other DeFi protocols.

It is worth mentioning that the use of Cosmos's zone to implement Bitcoin DeFi is still under development, and there are a series of secret projects under construction. It is currently uncertain whether this two-way anchoring between Bitcoin and Cosmos will succeed, and Cosmos's inter-chain communication has not yet been completed. If this two-way anchoring requires a hosting service like WBTC or some validator to perform anchoring like the alliance sidechain, then the Bitcoin area on Cosmos will not be much different from other solutions .

In addition to projects that are building such systems for Bitcoin, we are also seeing a strong interest in using Cosmos to bring DeFi to other assets, such as Kava Labs. If these efforts succeed, the barriers to using BTC in DeFi will be greatly reduced. This success can bring enough liquidity to the anchoring zone and maintain a reasonable level of decentralization by attracting enough validators.

Research on Expansion of Bitcoin DeFi Function

- MAST (Merkelized Abstract Syntax Trees)

In the current Bitcoin network, due to the programming language Script, smart contracts are very limited. Scripting languages are not Turing-complete languages, meaning they cannot be used to write general-purpose programs. However, it can still be used to implement some smart contract functions. This is achieved through P2SH and SegWit addresses. With both, a transaction will only be spent if certain conditions are met. The problem is that complex transactions with multiple conditions make the space very, very large, which makes them expensive to use.

For these reasons, it has been proposed to implement the MAST protocol in Bitcoin. MAST is an extension of the P2SH function, which will make it cheaper and more feasible to conduct Bitcoin transactions under complex conditions.

MAST has obvious benefits, it improves the scalability of the Bitcoin network by saving block space, and the less obvious benefit is that it can achieve some Bitcoin DeFi use cases. For example, if we assume that a decentralized price prediction machine can work, then MAST can achieve decentralized lending using BTC as collateral, and even decentralized stablecoin issuance.

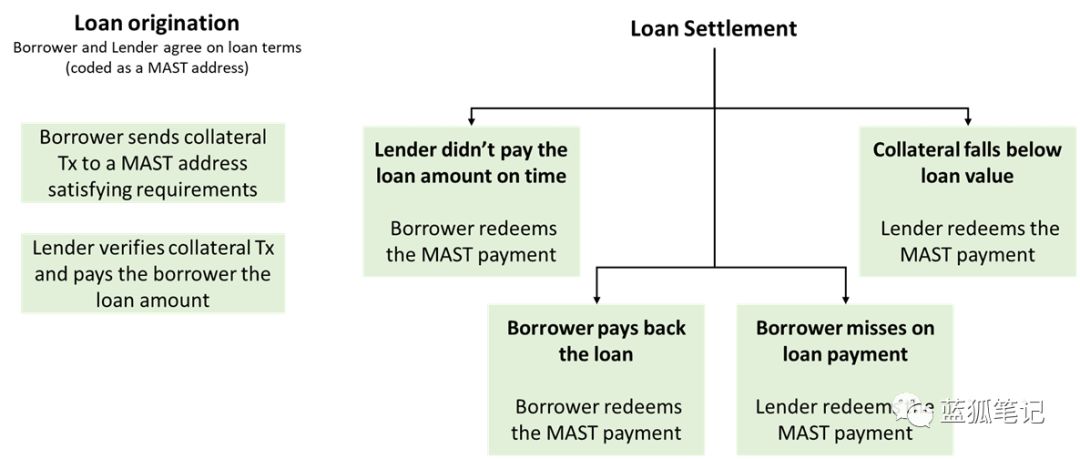

The diagram below shows a possible decision tree for a decentralized lending scenario using MAST. A series of conditions required for loan settlement can be coded into a redemption script and hashed to MAST. The MAST address can guarantee the fair execution of the loan, and if the lender does not repay the loan on time, or the value of the collateral is lower than the principal and interest of the loan, the lender will get the collateral.

- DLCs (Discreet Log Contracts)

Another research idea to expand the DeFi capabilities of the Bitcoin network is Discreet Log Contracts (DLCs), which was initiated by Tadge Dryja of MIT's DCI (Blue Fox Note: DCI is the Digital Currency Initiative). Regarding Discreet Log Contracts, a simple explanation is a way for both parties to create a futures contract, which is just a bet on the future price of the asset.

The DLC requires both parties to choose one or more oracles to publicly broadcast asset prices before they create a contract. When the contract is determined, either party to the transaction can use the public broadcast information signed by the oracle to settle the contract and claim its revenue. DLCs use Schnorr signatures to hide contract details, which guarantees that the oracle cannot manipulate the results of the contract. DLCs utilize technologies similar to Lightning Network, and it is possible to integrate DCLs into Lightning Network channels.

in conclusion

Since 2018, much discussion has occurred on the DeFi protocol. Although Ethereum is considered the leader of DeFi, as the most liquid cryptocurrency, developers and investors have set their sights on the potential of Bitcoin DeFi.

The huge benefits are driving many development teams to try to find the best implementation. Although this will bring more competition between many smart contract platforms such as Bitcoin and Ethereum, such competition is very necessary, and it is conducive to progress and the realization of the vision of a decentralized financial system.

Risk Warning: All articles of Blue Fox Notes can not be used as investment advice or recommendations. Investment is risky. Investment should consider personal risk tolerance. It is recommended to conduct in-depth inspection of the project and make good investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Watch | Policies continue to assist, Bitcoin options go public, this week is a lot better

- DeFi weekly selection 丨 the total value of the lock position exceeds 1.1 billion US dollars, the DeFi era of sailing is beginning

- Observation | Blockchain accelerates the digital transformation of commercial banks

- Xiao Yan: What is the legal boundary of blockchain technology and its application?

- Featured | Examining various centralized and decentralized crypto lending platforms

- Money laundering, stolen money, murder, Malta's bad crypto dream

- Can the central bank digital currency replace the US dollar in the future?