Opinion: Bitcoin is not a better Paypal, it is better for the dollar

Understanding bitcoin is difficult. I entered the pit in 2017 and began to have a deeper understanding of it after two years of uninterrupted research.

For most people, Bitcoin is a completely new concept, they have only heard of it occasionally. This is not surprising. If something is not understood enough, the error message can easily spread.

One of the fundamental misconceptions about Bitcoin is that its main use case is payment, which prevents people from understanding the true use of Bitcoin. What do I mean by saying this?

If you ask most people on the street (provided they have heard of Bitcoin), they will tell you that this is a different way of buying coffee or paying for services. Most people who understand Bitcoin like this will dismiss it because it is no better than PayPal, Apple Pay or credit card for everyday transactions.

- Cryptography in Bitcoin: Five characteristics of hash function and mining principle

- At the site | Is Staking suitable for small white users to invest? How does the market turn from bear to cow? Listen to the hot topics in the industry

- Quotes | BTC failed to gain a firm foothold, short-term market regression consolidation

People have heard of the limitations of seven transactions per second, the high cost and the irreversibility of transactions, which makes Bitcoin sound very limited. Most importantly, it was born out of nothing 10 years ago, and prices fluctuate wildly every day, so you know why Bitcoin is so easy to be denied.

From here, it's easy to figure out why Bitcoin doesn't work.

People will ask why not take more measures to increase the trading rate of Bitcoin? If this is not possible, why not switch to another cryptocurrency? (Blue Fox Note: The transaction rate here is tps, the number of transactions processed per second.)

But the problem is that the concept of "bitcoin for payment" is completely wrong. Currently, Bitcoin does not require a very high transaction rate because it does not compete with Paypal or Apple Pay.

For now, Bitcoin's competitor is the US dollar. (Blue Fox Note: The author means that Bitcoin's competitors are not payment companies, such as Paypal, credit card companies, but the US dollar currency itself.)

It is not another form of payment, it is a new form of currency. Let us spend 60 seconds explaining the currency.

What is currency?

Money has existed in various forms in human history – it is one of our oldest technologies.

Beads, shells, fur, stones, livestock, weapons, salt, metal and paper have all been widely used as currency in human history. These items were used as currency, without exception, because they were absolutely scarce in the human environment at the time. It doesn't make sense to use branches or leaves as money, because people don't want them.

On the other hand, hand-made metal daggers, beautiful bead strings or useful animal hides are difficult to produce, so their scarcity gives them value.

Eventually, people began to accept rare items, not to get the item itself, but as a medium of exchange between the other two items.

For example, if I want to buy the deer you just captured, but I only have one axe to trade, the potential difference between the value of these items makes the transaction difficult.

Therefore, portable, easy-to-split third-party value can be used to calculate the value of the deer, which I can also pay for. The items that best suit this purpose need to do three things:

1. They need to be considered valuable by those who use them, and tend to preserve value (value storage) over time.

2. They are used as a medium of communication between the other two items and will not be used up in the process (transactional medium).

3. Because they are used as trading medium, they gradually become the default way to measure value, such as a deer worth 20 gold pieces (accounting unit).

Therefore, by implementing the above three functions, these items become the currency we are familiar with. But what does this have to do with Bitcoin?

As I said before, bitcoin is a new form of currency, like previous beads, shells and metal sheets. After 10 years of being created, people are still talking about it because it is the best form of money we have.

This point of view needs a whole book to explain (Saifedean Ammous made a wonderful exposition in the book "Bitcoin Standards"), but I will summarize it here quickly.

In essence, it can only act as a currency when the user thinks something is valuable. The value of the item is directly related to the ease with which it is produced.

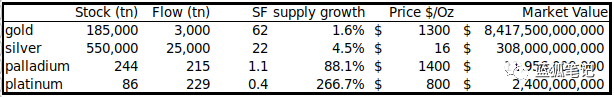

Gold is the most valuable of all metals. In fact, it is largely determined by two things: how much we have dug up (stock), and how much we have dug each year (new amount).

That's it.

The industrial demand for copper, tin, lead, bronze, and silver is greater than gold, but the value of gold is much higher than these metals.

why?

It depends on the ratio of storage to new volume (SF).

The amount of new gold we excavate from the ground every year is about 2% of the existing reserves, which is about 50 SF. (Blue Fox notes: about 2% inflation rate.) Even if gold production doubles (which is very difficult), it only increases the stock from 2% to 4%, which is hardly enough to have a significant impact on gold prices. .

This sustained low supply rate is the fundamental reason why gold has maintained its monetary role in human history. (from Bitcoin Standard)

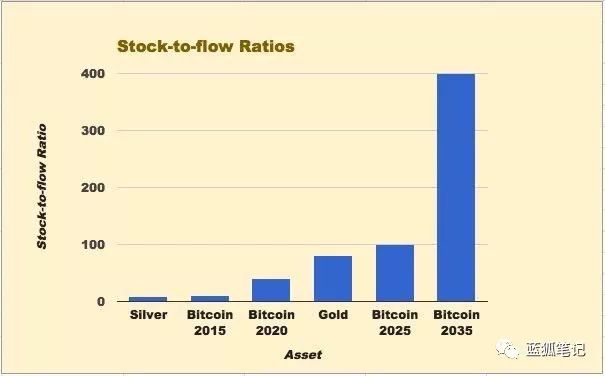

High SF gives you confidence in scarcity, so it satisfies the primary function of money: it becomes a stable means of value storage over time. Throughout history, no other items have the same high level of SF as gold. Until there is bitcoin.

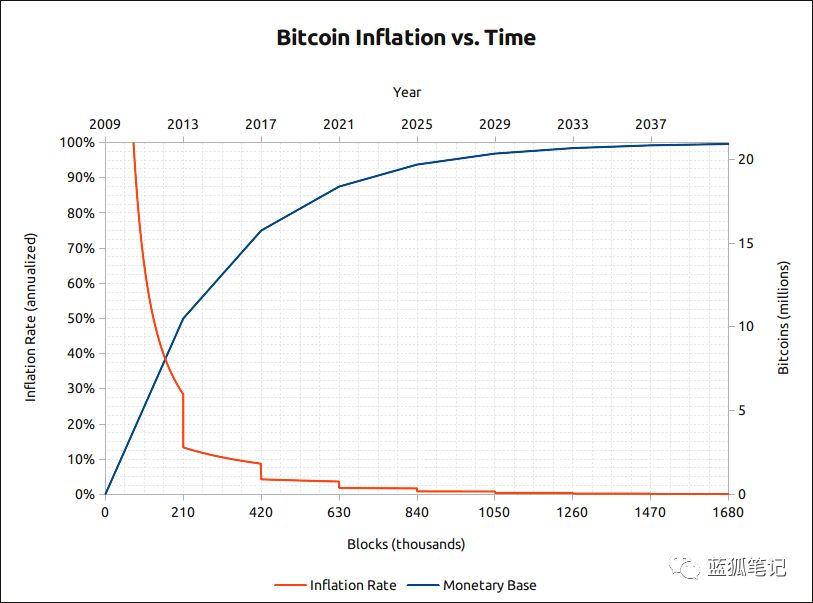

The cap on the total amount of Bitcoin and the decreasing supply plan mean that Bitcoin will be the scarcest product in human history. Currently, 12.5 bitcoins are produced every 10 minutes to reward miners who produce new blocks.

(Bitcoin inflation rate over time)

(Bitcoin inflation rate over time)

The process of halving bitcoin occurs every four years and uses this construction to simulate the scarcity of gold. This supply halving will last until 2140. Once the total circulation of Bitcoin reaches 21 million, it will be programmed to stop and no longer generate bitcoin.

So, we can see next year that bitcoin's SF will be close to gold (bitcoin 55, gold 50-60). But by the next halving, Bitcoin's SF will be as high as 100 or more and double every four years.

The conclusion is that after a few years, Bitcoin will be scarce than anything that human society once wanted to produce. This is very important. History tells us time and again that when multiple forms of currency are used simultaneously, each time the most difficult (or most reliable) currency wins.

Bitcoin is the most trusted currency we have created.

Value store

Well, in theory, bitcoin should be a good value storage method. But what is the reality? Considering that Bitcoin has been the best performing asset in the world for the past 10 years, I would like to say that the reality is also true.

People are concerned about the sharp rise and fall of bitcoin prices, saying that it is too unstable, not a good value storage means, but a bubble. But there are two problems with this view.

First, good value storage does not mean stability in the short term. Real estate and stock “bubbles” appear in striking regularity, but no one says they are a bad way to store value, and Bitcoin is no exception.

Bitcoin's price soars every time, but the subsequent plunge always ends at a higher low point than the previous cycle, which means that its value will continue to grow over time, even in this price fluctuation. In case.

Second, the speculative bubble will never swell again after it bursts. People like to compare the speculative tulip fanaticism of the 1730s with Bitcoin, but the tulip bubble has not regained it in a few years. The South China Sea bubble of the 1820s and any other speculative bubbles in history have not recovered again.

But bubbles that form around any fundamentally useful new technology will always recover. Think about the Internet bubble at the beginning of this century, the railway frenzy of the 19th century, or any stock market crash. These are mainly caused by the irrationality of human nature, and there are traces to follow.

And because the bitcoin market is relatively small, it is vulnerable to large fluctuations due to overly optimistic or pessimistic investors. A good form of value storage is long-term (for decades or centuries) to keep values stable or growing. On this time scale, short-term price fluctuations are completely irrelevant.

Other qualities of money

Ok, now it’s safe to say that Bitcoin is a good way to store long-term value. But does this mean that it is naturally a currency?

No.

As we said before, to function as a currency, you also need to play the role of the trading medium and the unit of account. Since Bitcoin has not been widely accepted by merchants or used to calculate the price of goods and services, we cannot say that Bitcoin implements all the functions of money.

This is where the opponents hold on. They think Bitcoin transfers are slow and volatile, and not many people use it to buy things, so they believe that Bitcoin will never have such an opportunity, and that this alternative should be used by other alternatives.

But the problem with this way of thinking is that it is completely reversed.

Like our ancestors, you can't promise me to use a stick as a reward, because we all know that sticks have no value, which is a bad deal for you. If I tell you that this stick is protected by a blockchain, it may be more confusing to make you think it is valuable, but in the end, it is still a worthless stick.

You may understand what I mean. It is claimed that the currency function of other cryptocurrencies is better than Bitcoin, completely ignoring the most important point of the currency: it first needs to be a means of value storage.

Items that exercise monetary functions in human history follow the same pattern:

First of all, it is a collection. People collect these things for some kind of interest—they are rare, usually either very beautiful, useful, or both.

Because they are difficult to produce, people see them as valuable, and then they become a value store that people still yearn for after a long time.

Because of the demand, these collections began to be traded between individuals and groups, eventually developing into a medium of exchange and accounting units.

This is an old and time-tested process, and it is not a few catchy buzzwords that can be subverted.

Therefore, although Bitcoin does not currently perform monetary functions well, it is working in this direction.

The more people see it as a means of value storage, the more people want to hold it. The more people hold it, the more stable its price will eventually be. The more stable it becomes, the more people can use it to trade. This is how it becomes a medium of exchange and a unit of account.

External functional layers, such as Lightning Networks, will support greater scalability than today, just as extra features allow the clumsy TCP/IP protocol to scale from a few kB capacity to high-speed streaming to billions of users in the early days of the Internet. .

These extra layers will facilitate the expansion of Bitcoin until one day the largest and most important transaction takes place at the base layer of Bitcoin. Daily payments will occur on the second level (such as lightning network) or even the third layer of technology.

This is the point.

The bitcoin we know today is not designed for thousands of transactions per second, and it is also cheap, stable, and secure.

No cryptocurrency can do this at the same time. There is a huge trade-off between security, price stability and speed. If you want a super-fast network, it may be more concentrated in design and therefore not safe. If its supply plan cannot be trusted, it will never become a value store.

You can't have a cryptocurrency that is both central and secure, while trading is super fast and cheap. Because you need verification from thousands of nodes and expensive miners to maintain network security.

But the history of money tells us that the most trustworthy form of value storage will eventually defeat inferior currencies.

Therefore, Bitcoin is not currently a good payment method, but it is not its original intention.

Bitcoin is not a better Paypal, it is better for the dollar.

Risk Warning: All articles in Blue Fox Notes can not be used as investment suggestions or recommendations. Investment is risky. Investment should consider individual risk tolerance. It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

Editor's Note: The original title is "The biggest misunderstanding of Bitcoin"

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Central Bank Digital Money Institute recruits and recruits! These graduate students have the opportunity

- Monthly News | September global blockchain private equity financing projects fell by 39% from the previous month, the Chinese and American markets cooled sharply

- Forbes: Libra is "better PayPal" but not a better cryptocurrency

- Is ETH changing from digital oil to digital currency, is this really feasible?

- Stable currency monthly report | USDC, DAI and other emerging stable currencies challenge USDT with DeFi scene?

- South Korea's blockchain company Iconloop receives $8 million in financing to build digital identity authentication services

- Decentralized communications startup New Vector received $8.5 million in financing, intended to replace WhatsApp, etc.