Monthly News | September global blockchain private equity financing projects fell by 39% from the previous month, the Chinese and American markets cooled sharply

In September 2019, the Sino-US blockchain private equity financing market “turned into the winter overnight”.

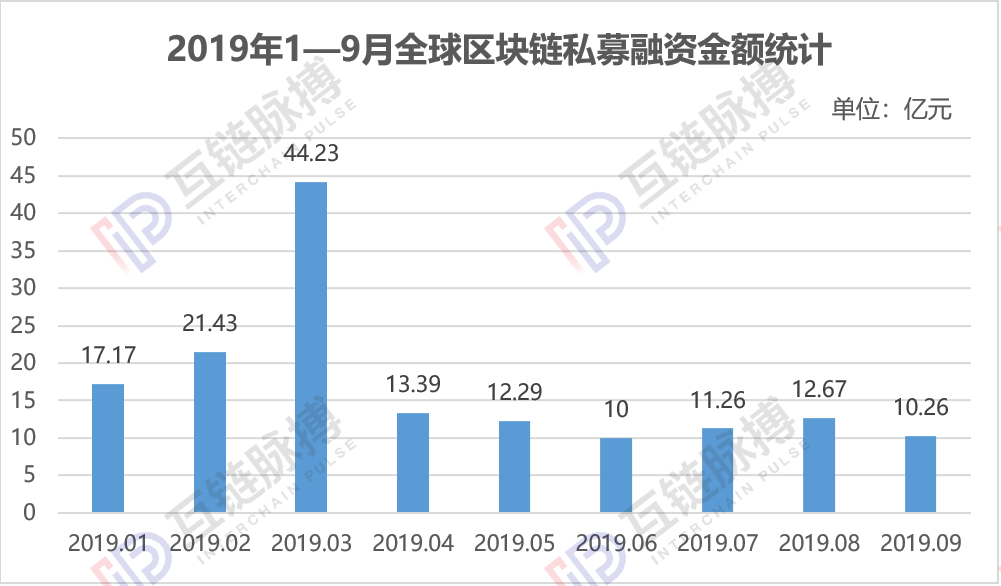

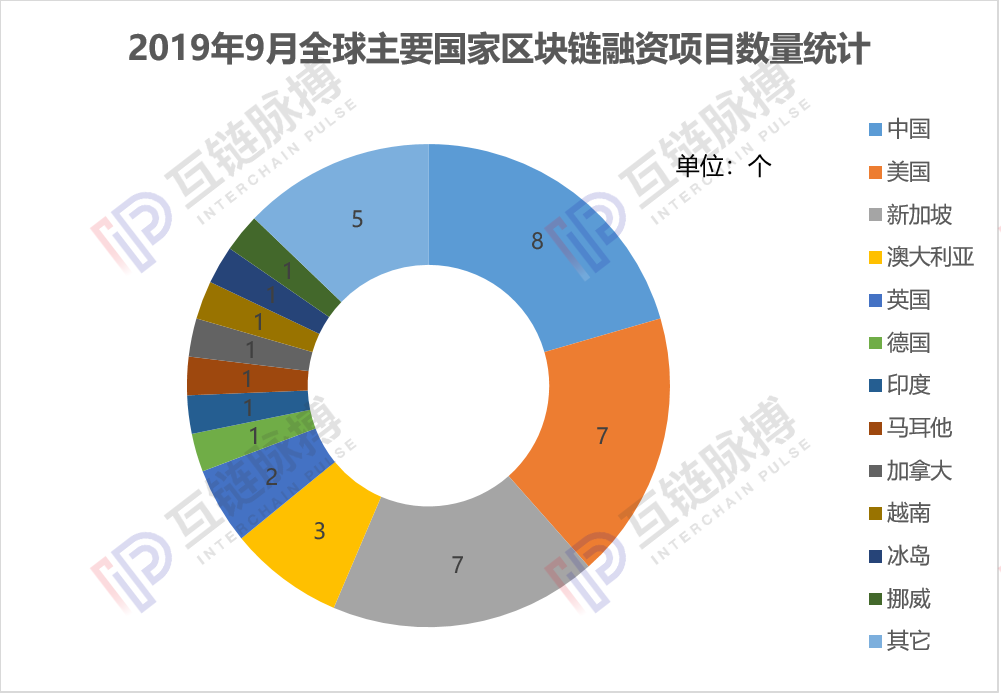

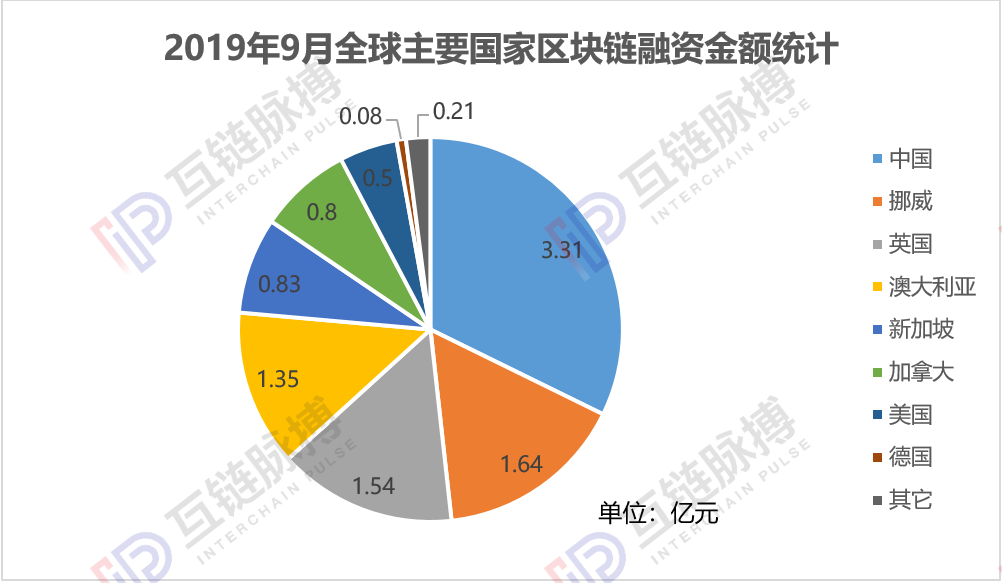

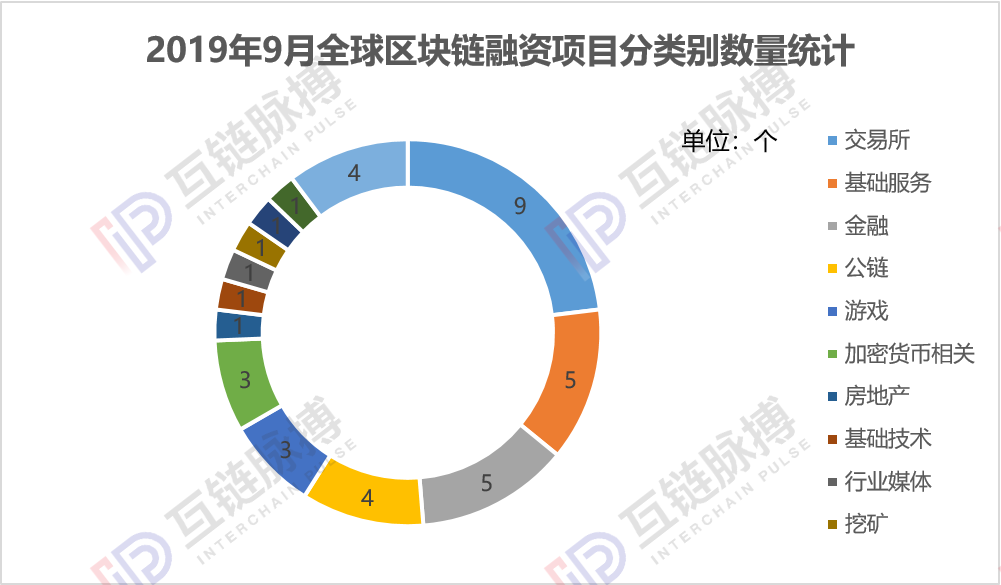

According to statistics from the Mutual Chain Pulse Institute, in September 2019, a total of 39 financings were obtained in the global blockchain sector, a decrease of 39.06% from the previous quarter. The total financing amounted to approximately 1.026 billion yuan, a decrease of 19.02% from the previous quarter. Of the 39 financing projects, 8 were in China, a decrease of 73.3% from the previous quarter, and 7 in the US, a decrease of 46.2% from the previous quarter.

(Source: Mutual Chain Pulse Institute)

- Forbes: Libra is "better PayPal" but not a better cryptocurrency

- Is ETH changing from digital oil to digital currency, is this really feasible?

- Stable currency monthly report | USDC, DAI and other emerging stable currencies challenge USDT with DeFi scene?

(Source: Mutual Chain Pulse Institute)

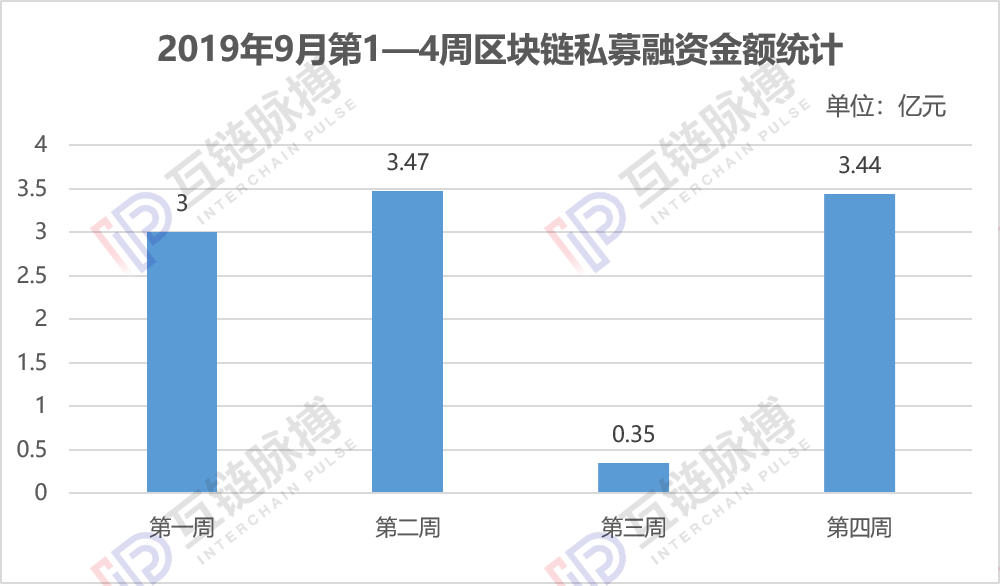

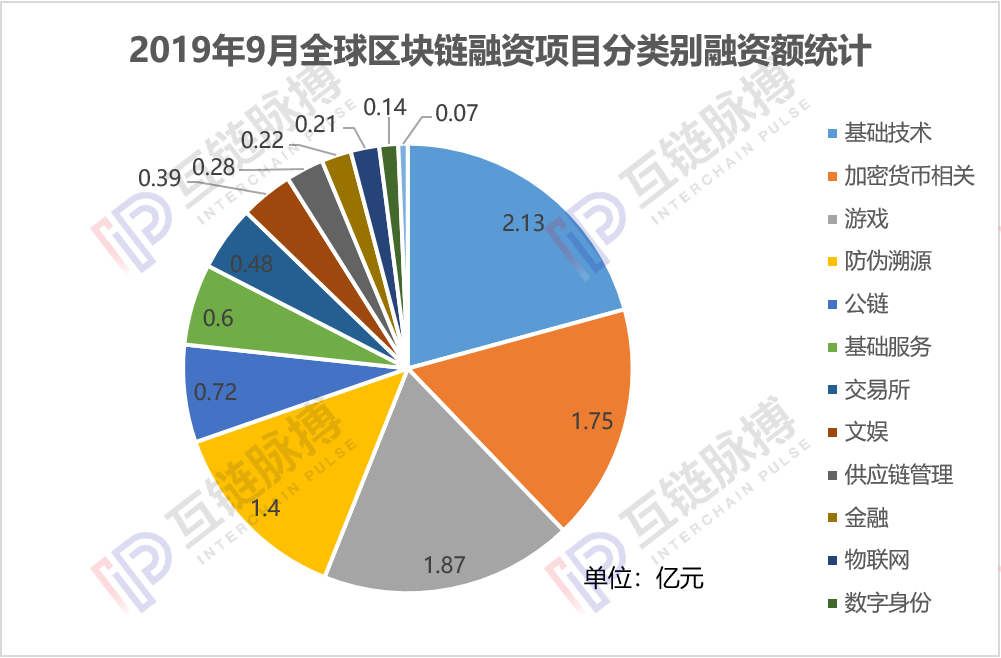

In terms of financing amount, the global blockchain investment and financing market also returned to the weak state of June this year, approaching the lowest point this year.

(Source: Mutual Chain Pulse Institute)

(Source: Mutual Chain Pulse Institute)

In September, the most popular item for capital remained the cryptocurrency exchange. According to statistics from the Mutual Chain Pulse Institute, in September 2019, a total of nine exchange projects in the world were financed, accounting for 23.07% of the total amount, and the financing amount was about RMB 48 million (excluding undisclosed financing amounts).

Among the exchange projects that have disclosed the specific financing amount, the financing amount is larger in Singapore's GCCX exchange, which has won 20 million yuan in financing, followed by Singapore's BJS currency and bitget exchanges. Millions of dollars and $1 million in financing.

(Source: Mutual Chain Pulse Institute)

Following the exchange is the blockchain basic services and financial sectors. In September, five projects in the blockchain basic services and financial sectors received financing, and the financing amounts were 0.6 billion yuan and 22 million yuan respectively.

(Source: Mutual Chain Pulse Institute)

In the basic services sector, September financing projects ranged from cryptocurrency data analysis to transaction monitoring to distributed application development. Among them, the large amount of financing includes Elementus, an illegal cryptocurrency transaction monitor in the United States, and Matter Labs, a blockchain research and development service provider, which received $3.5 million and $2 million in financing, respectively, from the UK's cryptocurrency data analyst Skew. Also got $ 2 million in financing.

In the financial sector, only two of the five projects that have been approved for public financing are the Singapore blockchain financial technology service provider Defi and the German encryption financial service provider Bitfineon, which received $2 million and 1.1 million respectively. Dollar financing.

In addition to the above three areas, public chains and games are also areas where more financing is available.

In the field of public chain, China's Hangzhou Yunxiang Network Technology Co., Ltd. received tens of millions of RMB financing, Bitmark in Taiwan and North Star Chain in Singapore also received $3 million and millions of dollars in financing.

In the gaming arena, Australia's Immutable project has won a large amount of financing of 15 million US dollars (about 107 million yuan), Canada's blockchain game service provider Dapper Labs also received 11.2 million US dollars (about 80 million yuan) .

In addition, in September, in the blockchain basic technology and cryptocurrency related services, there were also projects with large amounts of financing.

For example, in terms of basic technology, the secure distributed home storage technology research and development fun store has received tens of millions of dollars in financing, while in the cryptocurrency related service, Elliptic, a Norwegian cryptocurrency compliance company, received $23 million (about RMB). Large amount of financing of 1.64 billion yuan.

Text | Mutual Chain Pulse · Liang Shan Hua Rong

This article is [inter-chain pulse] original, reproduced please indicate the source!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- South Korea's blockchain company Iconloop receives $8 million in financing to build digital identity authentication services

- Decentralized communications startup New Vector received $8.5 million in financing, intended to replace WhatsApp, etc.

- Overview of blockchain application cases: health care and energy industry

- Internal and external, Libra can seek hope in the crack

- A text saying that IPFS: What is the expectation of Filecoin?

- The judge made a favorable Bitfinex ruling and rejected the file request filed by NYAG

- Monthly Report | September Domestic and Foreign Blockchain Policy: Virtual Currency Mining Supervision Strengthens Legal Digital Currency Multi-Country Support